Your capital is at risk.

Bernstein Bank Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- €1,000

- MT4

- TradingView

- German Central Bank

- BaFin

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- €1,000

- MT4

- TradingView

- German Central Bank

- BaFin

Our Evaluation of Bernstein Bank

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Bernstein Bank is a broker with higher-than-average risk and the TU Overall Score of 3.3 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Bernstein Bank clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

Bernstein Bank works with both individual traders and legal entities, offering a single universal account with low trading costs and comfortable working conditions. The diverse range of assets in its pool and sufficient leverage provide the potential for a significant profit in successful trades. Trading is conducted through the popular MT4 trading platform, with the addition of the online TradingView platform. The broker publishes extensive analytics, educational, and specialized materials for traders of varying expertise. Unfortunately, aside from MAM accounts, there are no other additional earning options for individual traders.

Brief Look at Bernstein Bank

Bernstein Bank is an FX and CFD broker offering a pool of over 100 financial instruments traded with flexible leverage up to 1:100. To get to know the platform, traders can open a Demo account. There is one live account with universal conditions, featuring typical floating spreads that are dependent on the asset and market situation. For instance, spreads start at 1 pips for FX EUR/USD and DAX CFDs. No commission is charged. Funding and withdrawals can be made through bank transfers, credit cards, or cryptocurrency wallets, with reasonable withdrawal fees. Traders use the MT4 trading platform, and the user account provides access to TradingView. The broker does not restrict clients’ trading strategies. The website features newsfeeds, analytics, and educational materials.

- The Demo account allows traders to explore the platform and experiment with trading strategies.

- The broker offers one live account with comfortable trading conditions and no strategy limitations.

- Over 100 financial instruments enable the formation of a diversified investment portfolio.

- The broker provides a moderate leverage of 1:100, allowing potential profit increases even with small capital.

- The user-friendly MetaTrader 4 trading platform is easily customizable, and TradingView is available online.

- Both beginners and professionals can find valuable information on the broker's website, which is presented in various formats, including webinars and podcasts.

- Institutional clients can work with the company on individual terms, receiving attractive offers.

- All assets in the broker's pool, except currency pairs, are represented by contracts for difference (CFDs).

- The only alternative earning option is a jointly managed account (MAM), as there are no copy trading or partnerships for individuals.

- Technical support is active 24/5, and managers are not available on weekends.

TU Expert Advice

Financial expert and analyst at Traders Union

The Bernstein Bank brand is owned by the German company Bernstein Bank GMBH, regulated by the Federal Financial Supervisory Authority of Germany (BaFin) and the Central Bank of Germany (Deutsche Bundesbank). Therefore, there are no questions about the broker's legitimacy, reliability, and transparency. A retrospective analysis has not revealed any confirmed cases of the broker failing to fulfill its obligations to its clients.

Like most competitors, Bernstein Bank offers new clients the opportunity to personally explore the platform under conditions that closely resemble real trading. A Demo account is provided for this purpose. There is only one live type account, with universal conditions suitable for traders of all levels. Institutional clients open accounts based on individual requests.

The broker’s asset pool includes currency pairs and CFDs on stocks, indices, commodities, metals, and cryptocurrencies. Spreads are typical or floating, starting from 1 pips. There are no additional costs. The broker imposes no restrictions on clients, they can scalp, hedge, trade on news events, and use expert advisors. The only thing they need to consider is the market operating hours, which are indicated on the company's website.

In general, the broker provides a lot of useful information. There is financial news with analytics, educational podcasts, and an economic calendar, and the company regularly conducts informative webinars. Although most of the information is geared toward beginners, webinars often cover topics of interest to professionals. Thus, in terms of secondary infrastructure and support, Bernstein Bank surpasses many competitors in its segment.

The 1:100 leverage is average for the market. The MT4 platform is also supported, as with most brokers. However, the inclusion of TradingView in the trader's user account is a functional advantage, as it is less common. It's also worth noting that the broker has a well-developed B2B segment, offering many special deals for legal entities. However, for external earning options, only joint MAM accounts are available. The introducing broker (IB) program is exclusively designed for legal entities. Considering all factors, the platform can be recommended for collaboration.

Bernstein Bank Summary

Your capital is at risk. Your capital is at risk. 79.43% of retail investor accounts lose money when trading CFDs with this provider. Bernstein Bank and its affiliates do not target EU/EEA/UK clients. It is the user's responsibility to ensure that any use of the website or services adhere to local laws or regulations. Please be aware that you are able to receive investment services at your own exclusive initiative only, ensuring you fully understand all the risks involved.

| 💻 Trading platform: | MT4 and TradingView |

|---|---|

| 📊 Accounts: | Demo, Standard, Institutional |

| 💰 Account currency: | USD, EUR, GBP |

| 💵 Replenishment / Withdrawal: | Bank transfer, bank card, cryptocurrency wallet |

| 🚀 Minimum deposit: | €1,000 |

| ⚖️ Leverage: | Up to 1:100 |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating from 1 pips |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, indices, commodities, metals, cryptocurrencies |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market |

| ⭐ Trading features: |

The Demo account is free of charge, One real account with universal conditions, A rather large minimum deposit, More than 100 assets of different types, Moderate leverage, A lot of analytics and training materials on the website, Available online trading in the browser, 24- hour support on workdays |

| 🎁 Contests and bonuses: | Yes (rebates from TU) |

Typically, the minimum deposit depends on the account type, if there are multiple account types. At Bernstein Bank, there is only one live account, and to open it, a minimum deposit of at least €1,000 is required. Leverage is the same for all users and is determined solely by the asset. The highest ratio for currency pairs is 1:100. However, traders are not obligated to trade with leverage as they can also opt for none or lower ratios. Technical support is provided through a call center and email. It operates 24/5 on weekdays, meaning you can reach the managers even at night. However, client support is not available on weekends, leaving the traders to deal with any issues on their own.

Bernstein Bank Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

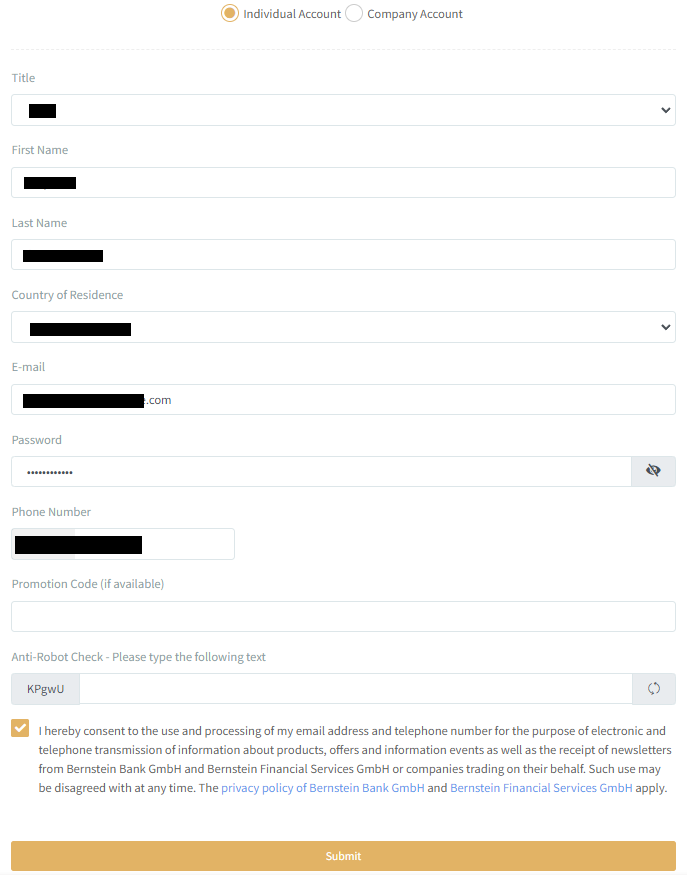

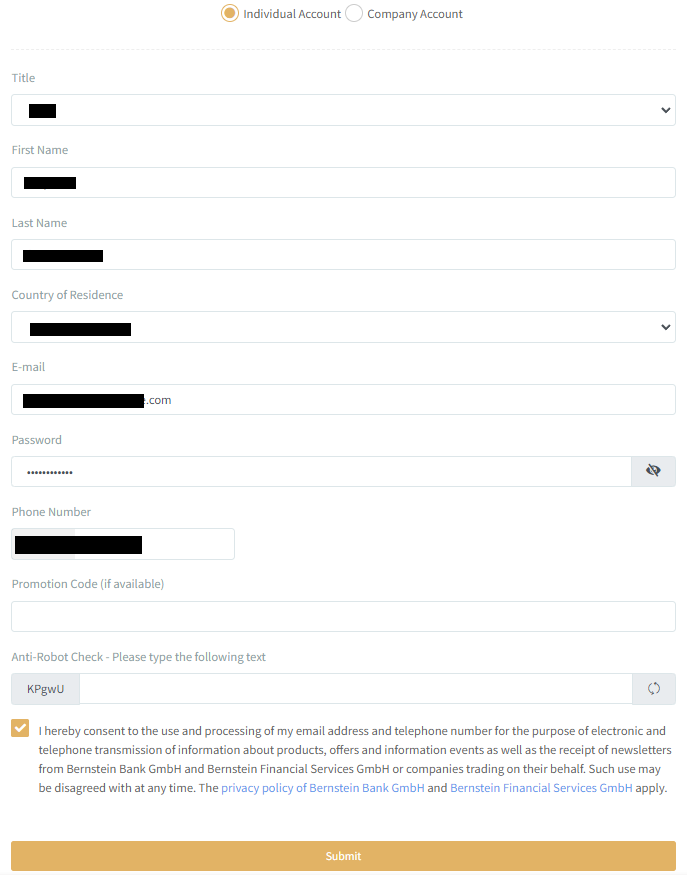

If you plan to work with the broker, first register on their website, go through the verification process, and then open an account. After that, you can make a deposit, set up a trading platform, or operate from the user account. TU experts have prepared a step-by-step guide to minimize questions at each stage. They have also provided a detailed overview of the user account.

Go to the broker's website. In the top menu, choose your preferred interface language. Click on "Live Account" or "Open Account."

Select the account type – Standard or Institutional. Specify how you'd like to be addressed. Enter your first and last name and your country of residence. Enter your email address in the corresponding field, then create a password and provide a contact phone number. If you have a promo code, use it. Enter the captcha. Agree to the data processing terms by ticking the box at the bottom. Click the "Confirm" button.

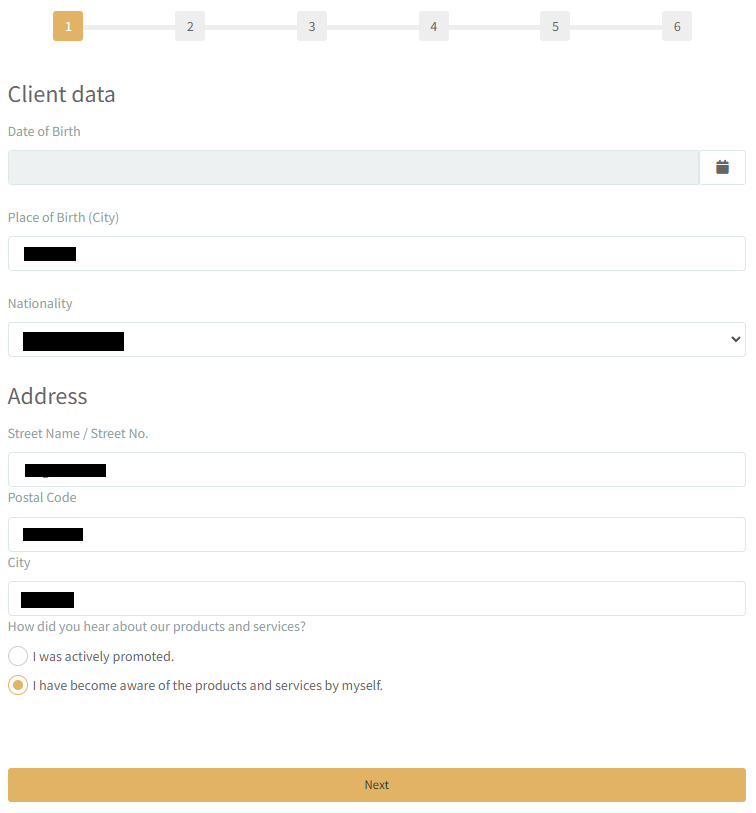

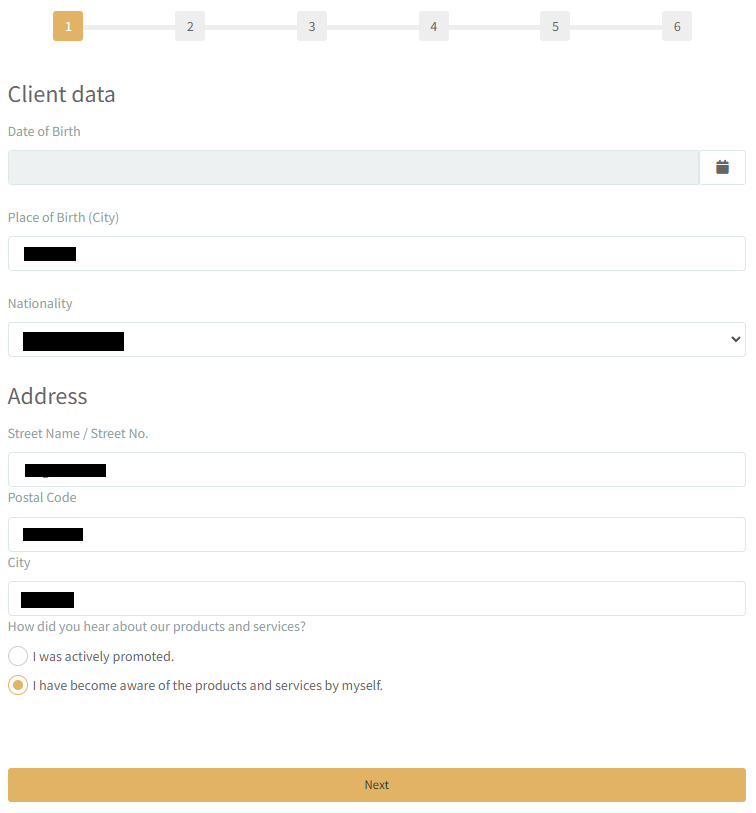

Insert your date of birth. Specify your birthplace, nationality, and full address with postal code. Answer how you learned about the broker. Click "Next."

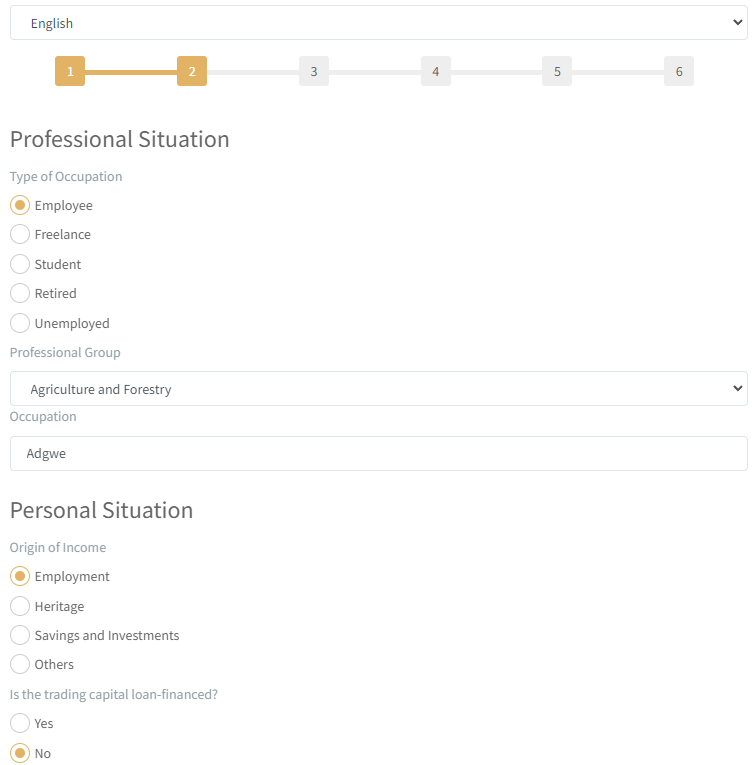

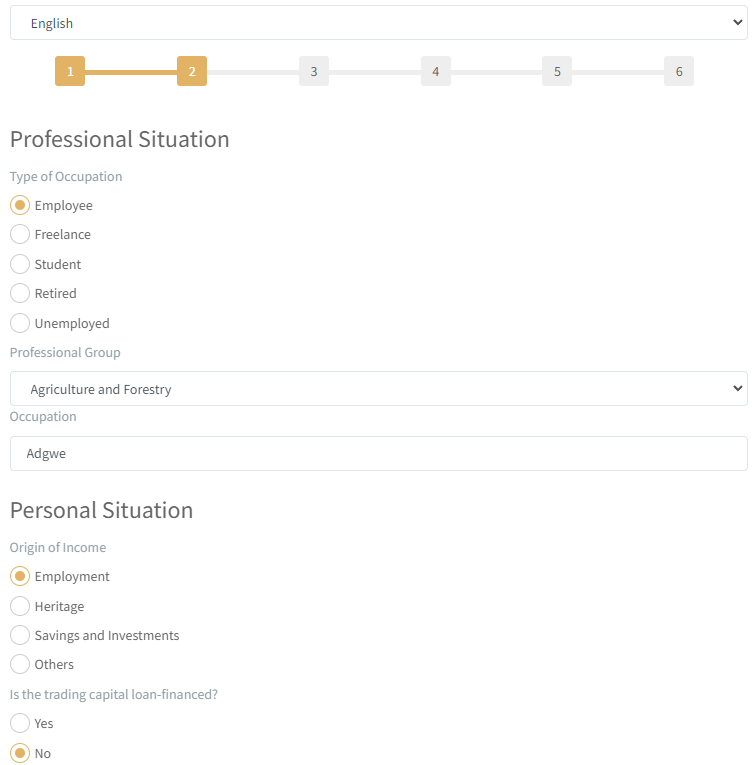

Several blocks of questions will follow. They relate to your financial status, employment, and trading experience. Answer honestly. Your responses may influence the conditions offered by the broker. After completing each block, click "Next."

After completing the registration, verification will be required, simply a confirmation of the trader's personal data by providing a photo/scan of an identification document (passport, ID card). Simply follow the on-screen instructions. Once you have access to the user account, make a deposit using the corresponding option and wait for the funds to be credited to your account.

When you open a live account, verify it, and make a deposit, you can start trading. The first option is to work in the user account through TradingView. The second option is to download the MetaTrader 4 trading platform from the solution's website, install it, launch it, and enter your registration details.

Your Bernstein Bank user account also provides access to:

-

Monitor information about their accounts, receive summaries and reports, and close and open accounts.

-

View current trades and trade history, as well as all transactions, including deposits and withdrawals.

-

Make deposits to the account, create withdrawal requests, and track the status and execution of orders.

-

Execute trades on available financial markets using the integrated TradingView platform.

-

Contact technical support, change personal data in your profile, and adjust account security settings.

Regulation and Safety

If a trader has never dealt with a broker before, it's natural for them to want to ensure its reliability. How can this be done? First, check the registration, as its presence confirms the legality and official status of the platform. Second, all top brokers are subject to regulation, meaning they operate under the control of authorized organizations overseeing brokers' compliance with their obligations. The company Bernstein Bank GMBH, which owns the Bernstein Bank brand, is registered in Germany. Its activities are monitored by the Federal Financial Supervisory Authority of Germany and the Central Bank of its country.

Advantages

- Broker has been in the market for a long time

- Registered in Germany

- Regulated by the German Central Bank

- Regulated by BaFin, also

Disadvantages

- Traders outside Germany do not have regional protection

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Standard | From $10, and no commission | Yes |

An important point is that institutional clients have special conditions discussed individually. These conditions will undoubtedly be more favorable in terms of trading costs but will require a significantly larger deposit. As for withdrawal fees, they exist and depend on the withdrawal channel. The exact amount is not specified on the website, but before each transaction, traders will receive precise information on the commission to be charged.

TU experts have prepared another table, indicating the average trading costs for Bernstein Bank clients, and two other brokers. This will help you to understand how advantageous the platform's offering is.

| Broker | Average commission | Level |

|---|---|---|

|

$10 | |

|

$1 | |

|

$8.5 |

Account Types

If the broker offers several live accounts, choosing the appropriate account may pose some difficulties. However, Bernstein Bank has only one account for individuals, and legal entities operate under special conditions. In this case, the trader only has to initiate the registration process, and later, they will receive detailed consultation from a manager and can determine their optimal trading conditions. Bernstein Bank clients operate through the MetaTrader 4 platform, which has desktop and mobile versions and can be customized with plugins. However, traders also have the option to trade in their account on the company's website, as TradingView is integrated in the browser-based platform.

Account types:

If a trader has never worked with this broker before, it is recommended to first open a demo account. This will allow exploring the platform's capabilities in real conditions, and the user can experiment with strategies without risk. Afterward, they open a live account and start making full-fledged trades.

Deposit and Withdrawal

-

In case of successful trading on a live account, the trader replenishes their balance.

-

Profits can be fully or partially withdrawn at any time by submitting a request in the user account on the website.

-

Currently, the trader has the option to withdraw funds via bank transfer, to a credit/debit card, or a cryptocurrency wallet.

-

Applications are typically processed within one day, but card transfers may take up to 3-5 days.

-

The broker charges a withdrawal fee, and there may also be a commission from the third party involved in the transaction, such as a bank.

Investment Options

Some brokerage companies offer their clients alternative methods of earning. This can be strictly passive income from participating in copy trading or compensation for inviting others through a typical partner program to the traders' platform. At Bernstein Bank, the partnership is available only to legal entities. However, all company clients can join managed accounts.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

MAM accounts

A trader can open such an account and become a manager or join an existing account as an investor. The manager uses joint capital in trades, it is either their own or that of the investors. Investors can set a limit on the amount from their account that is available in a particular trade. In the case of a successful trade, everyone profits based on their trades, plus the manager charges a small percentage from investors for its services. If the trade is unsuccessful, everyone, including the manager, loses their funds. For investors, this is a 100% passive income, while the manager earns additional profit based on their successes.

Customer Support

Can funds be deposited using a Visa card issued by a Canadian bank? What are the current spreads on currency pairs with EUR? Is scalping allowed? Traders' questions may arise from their inattention or insufficient information or a lack of transparency on the broker's website. Moreover, there is always the possibility that a user will encounter an atypical situation, a real problem during trading, deposit, or withdrawal. In such a case, they need to contact Bernstein Bank's client support by calling the hotline or sending an email. There is no live chat or ticket system. Managers are available 24/5.

Advantages

- Multiple communication channels

- Support is accessible even to traders who are not yet clients of the broker

- Managers respond during the night on weekdays

Disadvantages

- No communication channels with technical support are operational on weekends

Are you already collaborating with Bernstein Bank? Or are you planning to become a client of this brokerage company? It doesn't matter because client support managers are always ready to help you with relevant questions.

Here are the current contact methods:

-

Phone;

-

Email.

The company has official accounts on the following social platforms: LinkedIn, Twitter, Facebook, and YouTube. You can also communicate with managers there. It's advisable to subscribe to the broker so as not to miss its important updates.

Contacts

| Registration address | Bernstein Bank GmbH Sonnenstrasse 1, 80331 Munich Germany |

|---|---|

| Regulation | German Central Bank, BaFin |

| Official site | https://bernstein-bank.com/ |

| Contacts |

+49 (0)89 2154 310-36

+49 (0)89 2154 310-99 +49 (0)89 2154 310-34 +49 (0)89 2154 310-32 |

Education

Often, brokers attract clients who have little to no experience in financial markets, and some may have minimal experience in this field. Some platforms offer educational materials, typically including short articles, FAQs, and glossaries, but occasionally education materials may encompass full educational courses. On the Bernstein Bank website, alongside newsfeeds, analytics, and special tools, there is a section dedicated to education. It contains a considerable amount of materials that can be beneficial not only for beginners. In addition to textual guides, there are videos and podcasts. The broker also hosts regular webinars, addressing questions often of interest to professionals.

The educational section on the website is indeed excellent. Importantly, while the broker focuses on educating beginners, it also doesn't overlook experienced market participants, providing them with valuable information.

Comparison of Bernstein Bank with other Brokers

| Bernstein Bank | RoboForex | Pocket Option | Exness | Octa | XM Group | |

| Trading platform |

MT4, TradingView | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5 | MT4, MT5, MobileTrading, XM App |

| Min deposit | $1000 | $10 | $5 | $10 | $25 | $5 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1 point | From 0 points | From 1.2 point | From 1 point | From 0.6 points | From 0.6 points |

| Level of margin call / stop out |

No | 60% / 40% | 30% / 50% | No / 60% | 25% / 15% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed review of Bernstein Bank

The Bernstein Bank broker has been in the market for quite some time. It's important to note that the organization initially operated as a large private bank, well-known in Germany. However, over time, its range of capabilities expanded, acquiring the necessary licenses from local regulators and entering the global Forex market. The broker has already implemented numerous innovative solutions, using virtual dedicated servers, and liquidity is sourced from first-tier providers. There are no questions regarding security, as Bernstein Bank employs SSL protocols and authentication tokens. Client funds are kept segregated from the company's funds. Thus, in terms of speed and security, the broker adheres to advanced standards and easily competes with other top players in the segment.

Bernstein Bank by the numbers:

-

The minimum deposit is €1,000.

-

There are 100+ financial instruments available.

-

Market spreads are from 1 pips.

-

Leverage is up to 1:100.

-

There are 2 trading platforms from which to choose.

Bernstein Bank is a Forex and CFD broker for traders of any experience level

A universal advantage for any platform is an extensive asset pool. In the case of Bernstein Bank, that includes currency pairs, as well as CFDs on stocks, indices, commodities, metals, and cryptocurrencies. A multitude of diverse assets allows forming a diversified portfolio to mitigate trading risks. Moreover, the variety of financial instruments enables the implementation of various trading strategies. The broker does not impose restrictions. Continuing the conversation about universality, it's essential to highlight the 1:100 leverage, considered optimal by most experienced traders. Finally, the platform features newsfeeds, analytics, an economic calendar, plus TradingView in the user account with a choice of indicators. While basic articles and podcasts are aimed at beginners, webinars will also be useful for experienced market participants.

Bernstein Bank’s analytical services:

-

Economic calendar. A standard tool for technical analysis. It's an interactive, updated table displaying all events from the political and economic world affecting quotes. Next to each event is the affected asset, its current indicator, and forecast.

-

Newsfeeds with analytics. The broker has a general feed containing short messages with the most significant news, accompanied by expert opinions. Traders can subscribe to the free newsfeeds.

-

TradingView in the user account. This is a popular trading platform that is implemented in a way that allows trading directly from the browser. It's not as customizable as, for example, MT4, but it has built-in charts and indicators.

Advantages:

The broker offers comfortable trading conditions with many assets, tight spreads, and moderate leverage.

The MT4 trading platform is considered one of the best, and easy to master, with the option to customize it for the user.

The company has been in the market for a long time, is well-known, and is officially registered, with reliable regulators.

Institutional accounts receive unique conditions, and the platform has many special B2B products.

Technical support is highly rated by users and praised for its responsiveness and competence.

User Satisfaction