A Step-By-Step Guide On Using ChatGPT To Create A MT4 Trading Bot

Yes, ChatGPT can assist in creating a Forex trading bot. By providing clear and specific prompts, users can leverage ChatGPT to generate code for their trading strategies. However, careful testing and potential manual adjustments may be required to ensure the bot functions effectively in real market conditions.

A Forex trading bot is like a digital assistant that helps traders by executing buy or sell orders on their behalf in the foreign exchange market. It operates based on predefined strategies and can analyze market conditions swiftly. In this step-by-step guide, the experts at TU will explore how to use the power of ChatGPT to create a MetaTrader 4 (MT4) trading bot.

Can ChatGPT write code for a trading bot?

Yes, but it requires clear and specific prompts. Start by instructing ChatGPT with a straightforward and detailed description of your trading strategy.

How do you make a bot on MT4?

First, use ChatGPT to generate the trading bot code. Then, copy the code and paste it into MetaEditor. Finally, compile the code in MetaEditor to create an Expert Advisor (EA) ready for deployment on MetaTrader 4 (MT4).

Do trading bots make profit?

Trading bots have the potential to make a profit, but success depends on various factors, including the effectiveness of the trading strategy, market conditions, and continuous monitoring and adjustment.

How difficult is it to build a trading bot?

Building a trading bot involves multiple steps. While ChatGPT can simplify the code-writing process, challenges may arise during testing. The difficulty depends on factors such as the complexity of the strategy, the need for adjustments, and the thoroughness of the testing process.

Can you use ChatGPT to create a trading bot?

Creating a trading bot with ChatGPT involves several essential steps. Initially, one must gather extensive historical market data relevant to the specific trading assets or strategies being targeted. This data is pivotal in training the model, enabling it to recognize patterns and trends in the market. The model requires fine-tuning to align with specific trading goals and preferences.

Following the training phase, the subsequent step involves coding the trading robot. This code should include the fundamental logic and algorithms necessary for real-time trade execution, market data analysis, and seamless integration with ChatGPT. It is crucial to design the code for efficiency and reliability. If required, integration with external services, such as databases or third-party APIs, is essential for efficient market data retrieval and real-time trade execution.

Once the bot's code is developed, it undergoes testing before deployment. This testing phase ensures the bot's performance is satisfactory. Users can choose from various types of trading bots, including arbitrage bots, market-making bots, trend-following bots, and algorithmic crypto trading bots.

For detailed insights and recommendations, it is highly recommended to explore this article; AI Trading Bot in ChatGPT. Here’s a brief overview in the form of a step-by-step guide on utilizing ChatGPT for coding a trading bot.

Using ChatGPT to write code for a trading bot

Using ChatGPT to write code for a trading bot

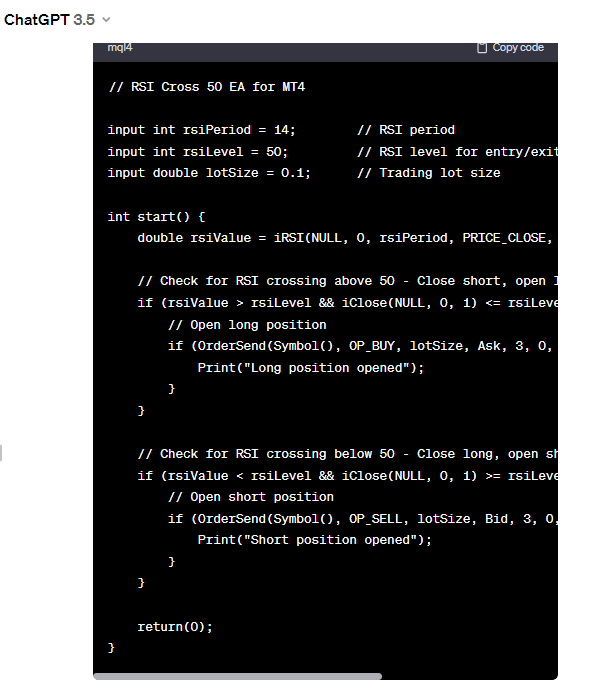

In this initial step, the process begins with utilizing ChatGPT to generate the code for a trading bot. The strategy employed involves instructing the bot to execute a buy order when the Relative Strength Index (RSI) exceeds 50 and to initiate a sell order when the RSI falls below 50.

The Relative Strength Index, commonly known as RSI, is a measure used in financial markets to assess the magnitude of recent price changes. It helps traders identify potential overbought or oversold conditions in an asset. When RSI surpasses the 50 mark, it signifies that the asset might be in an upward trend, prompting the bot to execute a buy order. Conversely, if the RSI drops below 50, it suggests a potential downward trend, prompting the bot to initiate a sell order.

To instruct ChatGPT to create the necessary code for this strategy, one can use a straightforward prompt such as, "Develop a trading bot code that executes a buy order when the RSI is greater than 50 and a sell order when the RSI is less than 50." As shown in the image below, this clear and concise prompt guides ChatGPT to generate code that aligns with the specified buy and sell conditions based on the RSI indicator.

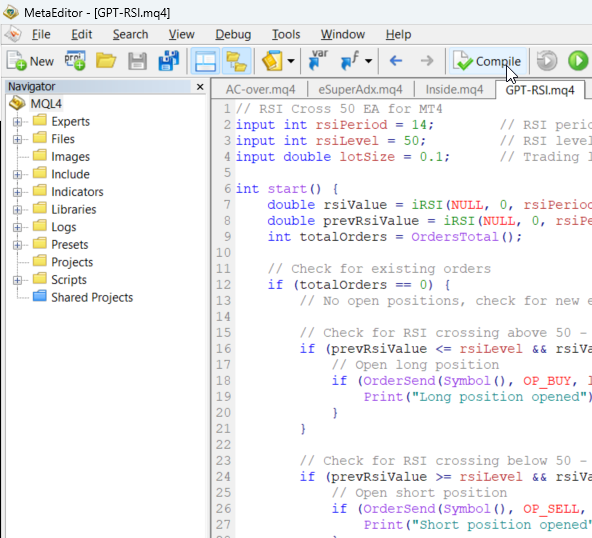

Compiling in MetaEditor

Compiling in MetaEditor

To bring the trading bot to life, the next critical step is compiling the code using MetaEditor. This involves a simple yet pivotal process of copying the generated code and pasting it into MetaEditor, a specialized environment for coding trading strategies. After pasting the code, a click on the compile button (refer the image below) and it will transform the code into an Expert Advisor (EA), making it ready for deployment in MetaTrader 4 (MT4).

With MetaEditor seamlessly integrated into the MT4 platform, traders can effortlessly compile their trading bot's code. This compilation process is essential as it transforms the written code into a functional Expert Advisor that can autonomously execute trades based on the predefined strategy. The simplicity and effectiveness of this compilation procedure within MetaEditor contribute to the accessibility and usability of automated trading strategies in the Forex market.

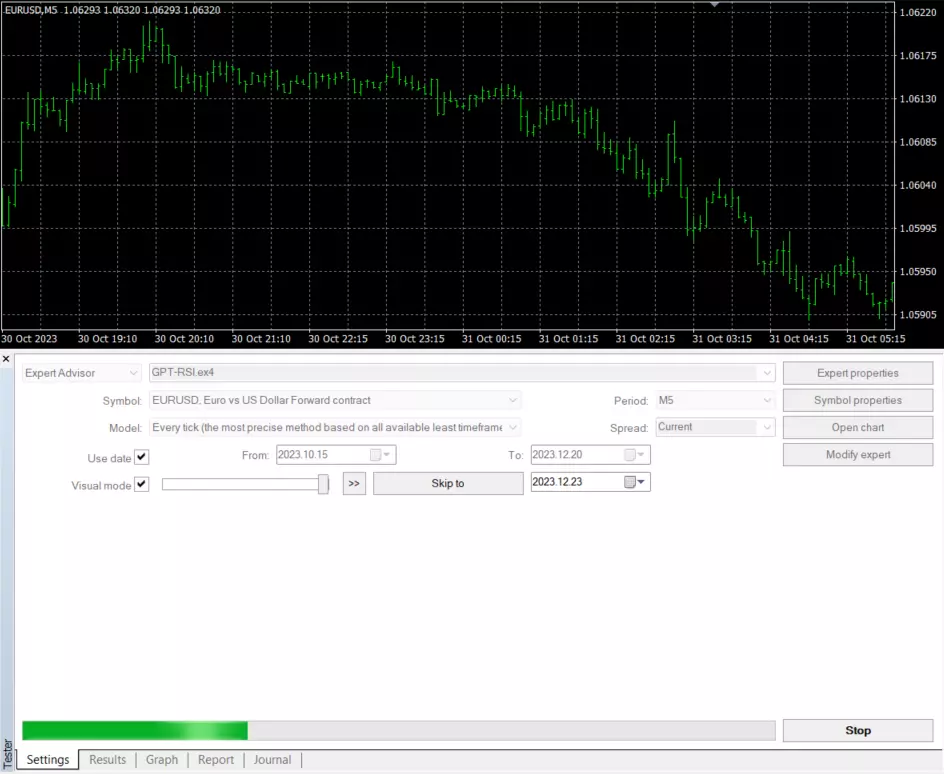

Running the tester

Rnuning the tester

The subsequent phase in deploying a Forex trading bot involves running the tester, a crucial component that allows traders to assess the bot's performance under simulated market conditions. The tester includes various parameters, including the chosen trading symbol, such as EUR/USD, the model type defining the bot's behavior, the timeframe for data analysis, the spread indicating the difference between bid and ask prices, and specific historical dates to conduct backtesting.

Within the tester, users can fine-tune and evaluate their trading bot's strategy by adjusting these parameters. For instance, choosing a different trading symbol might expose the bot to varied market dynamics, while adjusting the timeframe enables users to analyze performance across different time intervals. The spread parameter influences the cost of executing trades, and testing on historical dates provides insights into the bot's historical performance.

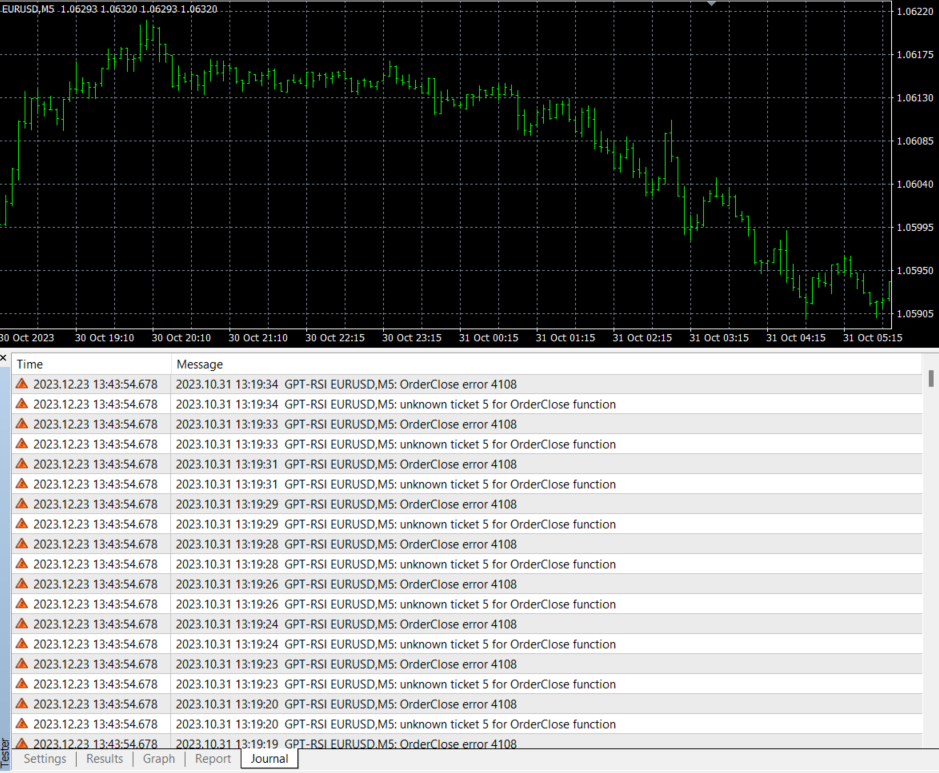

However, despite the initial success of the bot in the tester, it was seen that persistent errors were found after the first trade is executed. These errors could potentially hinder the bot's continued operation, highlighting the importance of thorough testing and debugging before deploying the trading bot in live market conditions.

Errors witnessed in code

For further insights into effective Forex robot backtesting, it is highly recommended to explore this detailed article: How to Backtest Forex Expert Advisor in MT4.

Results of the experiment on creating a trading bot with ChatGPT

Upon conducting the experiment to develop a trading bot using ChatGPT, several notable outcomes emerged, shedding light on both positive and challenging aspects of the process.

Firstly, ChatGPT demonstrated its capability to generate code in accordance with the trading strategy in plain language. This positive outcome signifies the potential of leveraging natural language prompts to instruct the model in creating functional code for automated trading systems.

The next positive aspect was the successful compilation of the generated code. The code, once produced by ChatGPT, proved compatible with the MetaEditor environment, enabling traders to move forward in the bot development process.

However, a setback was faced as the compiled code failed to operate as intended. It became evident that manual intervention or additional instructions to ChatGPT were necessary to rectify the errors. This realization introduces a challenge, as addressing these issues might demand considerable effort and time, and success is not guaranteed.

In conclusion, while ChatGPT exhibits promise in code generation and compilation for trading bots, theexperiment underscores the importance of thorough testing and potential manual revisions to ensure the bot functions accurately and reliably. This dual nature of positive advancements and challenges emphasizes the need for a cautious and iterative approach when integrating ChatGPT into the creation of automated trading systems.

Best Forex brokers

Tips for using ChatGPT when creating trading robots

When using ChatGPT to develop trading robots, using the following tips can significantly enhance the effectiveness of the process:

Clarity and specificity

Ensure clarity and specificity in your prompts to ChatGPT. Clearly articulate your trading strategy and objectives to receive an accurate and relevant code. The more precise your instructions, the better ChatGPT can comprehend and generate suitable code for your trading bot.

Test and refine

After obtaining the generated code, it's crucial to backtest it using historical data. Simulate trading scenarios to evaluate the bot's performance. This step allows you to identify any potential shortcomings and refine the code accordingly. Iterative testing ensures the bot is well-prepared for live market conditions.

Integrate with a trading platform

Choose a trading platform that seamlessly supports the integration of trading bots. Platforms like TradingView or Pine Script provide a conducive environment for deploying and managing your trading strategies. This integration facilitates a smoother transition from code generation to real-world trading.

Monitor and adjust

Keep a vigilant eye on your bot's activities once deployed. Regularly monitor its performance and be prepared to make adjustments to the strategy or parameters based on evolving market conditions. This approach ensures that your trading bot remains adaptive and responsive to dynamic market trends.

Leverage multiple indicators

Enhance the effectiveness of your trading strategy by combining the RSI approach with other technical indicators. Integration with indicators like moving averages or Bollinger Bands can contribute to a more comprehensive and robust trading strategy, increasing the likelihood of successful trades.

Consider market sentiment

In the volatile nature of cryptocurrencies, incorporating market sentiment analysis into your bot's strategy is essential. This analysis helps manage risk and enables more informed decision-making. Understanding broader market sentiment enhances the bot's ability to navigate unpredictable market dynamics effectively.

Summary

If it is to determine whether ChatGPT can create a Forex trading bot, three key steps emerge as crucial. First, you start by using ChatGPT to write the code for your trading bot. This involves instructing ChatGPT with clear and specific prompts about your trading strategy. Once the code is generated, the next step is compiling it in MetaEditor. This simple process involves copying the code and pasting it into MetaEditor, making your Expert Advisor ready for action in MetaTrader 4 (MT4).

The third and final step involves using MT4 Tester to ensure your trading bot is up to the task. The tester allows you to fine-tune your strategy by adjusting parameters like trading symbols, model types, timeframes, spreads, and historical dates for backtesting. While this process may initially show promise, it's essential to be cautious. Even though the bot may compile successfully, it might not function as intended. In such cases, manual revisions or additional instructions to ChatGPT might be needed, demanding careful testing and potential adjustments for a reliable and effective trading bot.

In summary, from coding with ChatGPT to compiling in MetaEditor and testing with MT4 Tester, these steps represent a systematic approach to creating a Forex trading bot. Remember, while ChatGPT offers a promising start, careful monitoring and potential adjustments are crucial to ensure your trading bot operates successfully.

Glossary for novice traders

-

1

Index

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

-

2

Upward Trend

Uptrend is a market condition in which prices are generally rising. Uptrends can be identified by using moving averages, trendlines, and support and resistance levels.

-

3

BaFin

BaFin is the Federal Financial Supervisory Authority of Germany. Along with the German Federal Bank and the Ministry of Finance, this government regulator ensures that licensees abide by eurozone laws.

-

4

Options trading

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

-

5

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.