Finq.com Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- WebTrader

- MetaTrader4

- FSA

- 2018

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $100

- WebTrader

- MetaTrader4

- FSA

- 2018

Our Evaluation of Finq.com

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Finq.com is a broker with higher-than-average risk and the TU Overall Score of 3.85 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Finq.com clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

FINQ holds a strong position among CFD brokers, as it provides a lot of assets, high leverage, and reasonable trading fees, including tight spreads. Trader costs are on average lower than those of the broker’s competitors, which is also due to the absence of withdrawal fees. The company's clients work through top platforms that can be easily customized. There is neither full-fledged training nor alternative income options, except for the referral program with standard conditions. Based on a combination of factors, the broker can be recommended for review.

Brief Look at Finq.com

This broker offers CFDs (contracts for differences) on currencies, cryptocurrencies, stocks, indices, bonds, commodities, and ETFs (exchange-traded funds). There are more than 2,100 assets available to traders. The company offers 4 standard and 2 premium account types, plus a free demo account. The minimum deposit is $100, spreads are floating, from 0.14 pips, and the maximum leverage is 1:300. There are two trading platforms, namely MetaTrader 4 (MT4) and WebTrader. New clients can receive a welcome, deposit, or pending bonus subject to certain conditions. There is a standard referral program with payments for invited users. There are no other options for additional income, and the broker offers neither joint accounts nor copy trading. Deposits and withdrawals are possible using the most popular channels, including Visa/MasterCard bank cards, Skrill, Neteller, FasaPay, and others. Training includes only basic FAQs.

- This broker offers CFDs on seven groups of assets;

- Spreads are below market average and trading fees are comparable to the broker’s main competitors. For example, one fee is 0.08% for stocks on the Pro account);

- Moderate leverage increases the profit potential of a trader without a critical increase in risks;

- The most popular platforms are available for trading, including MT4 mobile version;

- Six live account types provide for getting the most individualized offer;

- There are no restrictions on trading, thus scalping, hedging, and the use of advisors are allowed;

- New clients can count on a number of bonuses that increase capital at the start.

- More than 2,000 assets are available to traders, but all of them are contracts for difference (CFDs);

- There are no options for additional income, except for the referral program;

- Residents of Germany, France, Australia, Japan, Israel, New Zealand, and a number of other countries cannot become clients of this broker.

TU Expert Advice

Financial expert and analyst at Traders Union

This broker started its work in 2017 and is controlled by Lead Capital Services Ltd. The company is officially registered and regulated by the Financial Services Authority of Seychelles (FSA, SD007) with a verified license. The company operates legally, transparently, and fulfills its obligations to its clients. The analysis of archived data did not reveal unresolved conflicts or situations when a trader had to apply to the regulator.

Trading conditions are generally standard for a CFD broker. Although in some ways FINQ outperforms its competitors. The first thing to note is the variety of account types. Clients can open a free demo account with virtual $10,000, as well as any of the six live accounts, which are quite different from each other in spreads, fees, and other trading elements. Two account types are positioned as premium and are designed for more experienced players. These are Classic and Professional accounts. They have extremely low costs: for example, on the Professional account spreads start from 0.14 pips, and the fee for stocks is only 0.08%.

There are over 2,100 CFDs on seven groups of assets, including currencies, cryptocurrencies, and securities. You can deposit and withdraw funds by bank transfers or cards and through popular electronic payment systems. The minimum deposit is only $100 for the Silver account and the minimum withdrawal limit is only for bank transfers. But this is a requirement of the banks, not the broker. Traders receive comfortable conditions and high-profit potential with leverage of up to 1:300 and the absence of trading restrictions.

There are very few analytical tools. The Trading Center, which includes professional analytics, is available in the user account after registration. The possibilities of the Trading Center are determined, among other things, by the account type, thus premium accounts receive more information about the markets. This can be defined as a disadvantage of the broker because it has competitors that provide equal opportunities for all account types. Another disadvantage is the absence of PAMM accounts and copy trading. The referral program is standard.

- You value transparency and clear communication with respect to fees. Information about their fees and spreads is readily available on their website, indicating a commitment to providing transparent details to traders.

- Regulation is a top priority for you. Finq.com's regulatory status is unclear, and being registered in St. Vincent and the Grenadines raises concerns due to the less stringent regulations prevalent there compared to top-tier authorities.

- Limited information with respect to the broker is a red flag for you. Finq.com's website lacks detailed information about the company, team, and trading platform features.

Finq.com Summary

| 💻 Trading platform: | MetaTrader 4 and WebTrader |

|---|---|

| 📊 Accounts: | Classic, Silver, Gold, Platinum, Professional and Exclusive |

| 💰 Account currency: | USD, EUR, and GBP |

| 💵 Replenishment / Withdrawal: | Visa, MasterCard, Diners Club International, Skrill, Neteller, FasaPay, and Discover |

| 🚀 Minimum deposit: | $100 |

| ⚖️ Leverage: | Up to 1:300 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating, from 0.14 pips |

| 🔧 Instruments: | CFDs on currencies, cryptocurrencies, stocks, indices, bonds, commodities, and ETFs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: |

Virtual $10,000 on a demo account; Six live account types; Low entry threshold; Over 2,100 assets; Flexible conditions for spreads and fees; Several bonuses for new clients; Two trading platforms; No options for passive income. |

| 🎁 Contests and bonuses: | Yes, including bonuses from Traders Union |

If a broker offers multiple account types, the minimum deposit usually depends on the chosen type. The minimum deposits with FINQ totally depend on the account type. For example, the Silver account requires a minimum deposit of $100, the Gold account requires a minimum of $10,000, and to open the Exclusive account it is necessary to deposit from $100,000. Account types also differ in trading costs and conditions. Although leverage for all accounts is the same, as it depends only on the asset. Like other brokers, FINQ offers the highest trading leverage of 1:300 for trading currency pairs. Client support can be contacted via WhatsApp, email, and live chat, and is available 24/5.

Finq.com Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

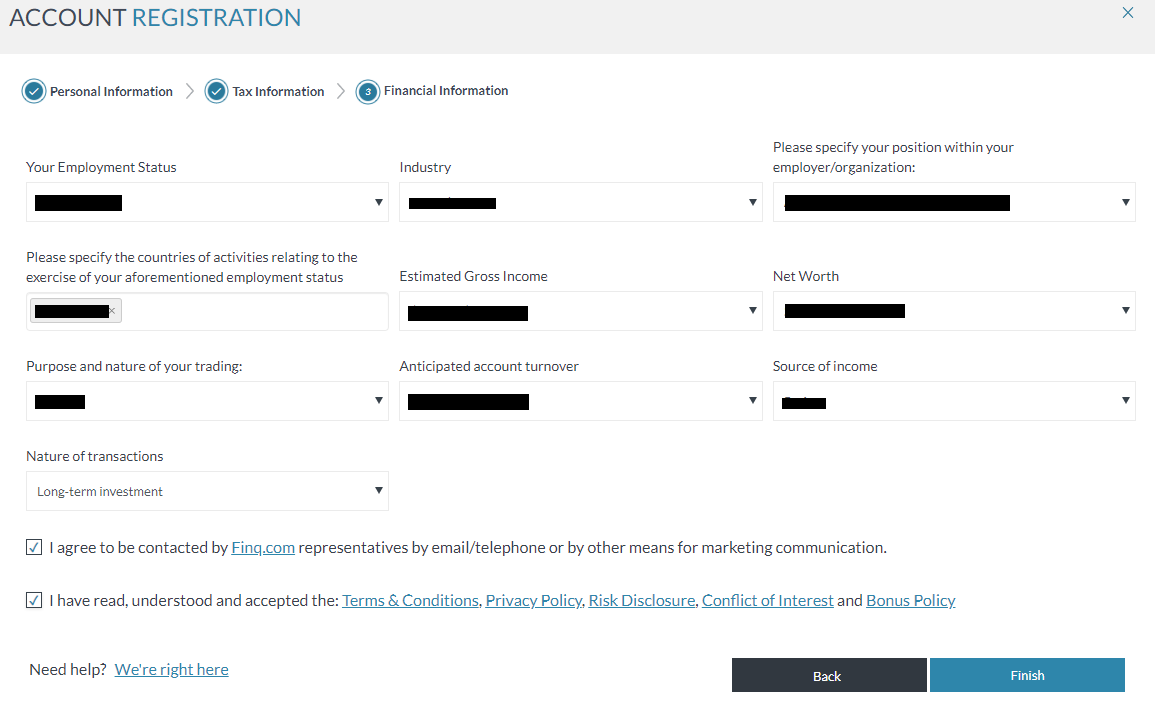

Trading Account Opening

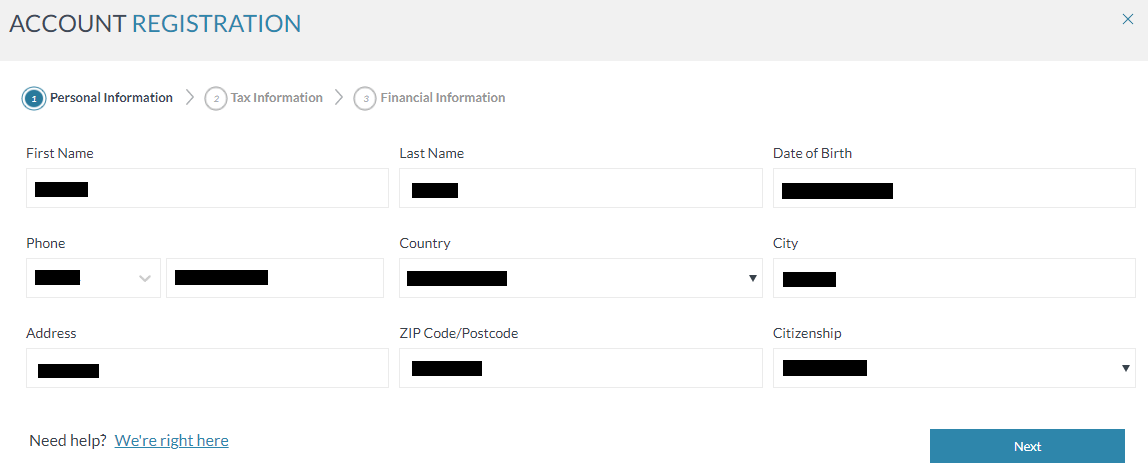

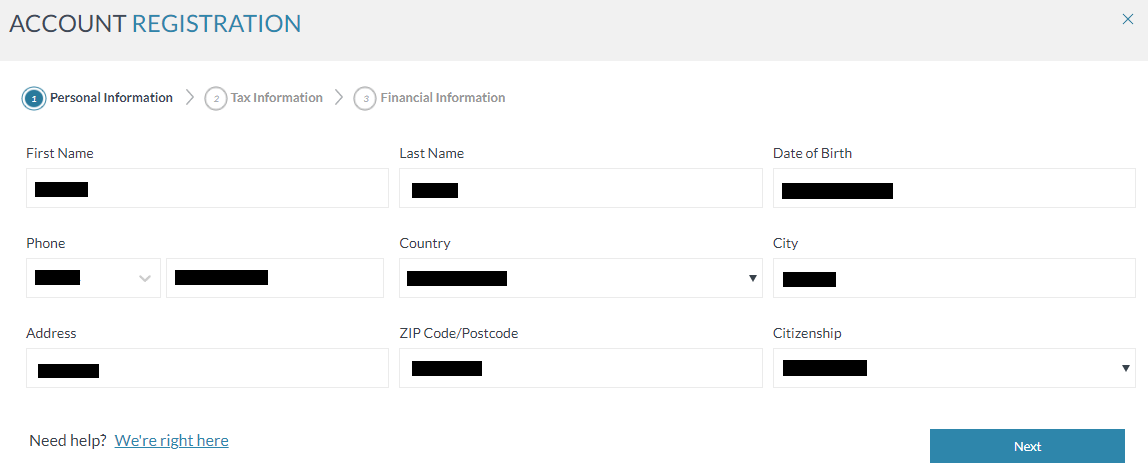

To start working with this broker, register on its official website and make a deposit. In the future, account management will be carried out through the user account. TU experts have prepared the below step-by-step guide on registration and features of the FINQ’s user account.

Go to the broker's official website. Select the interface language in the upper right corner and click the “Start Trading” button.

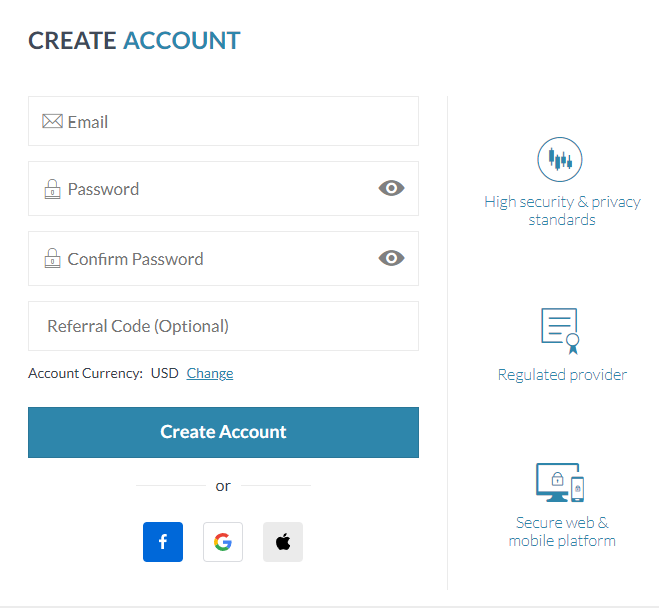

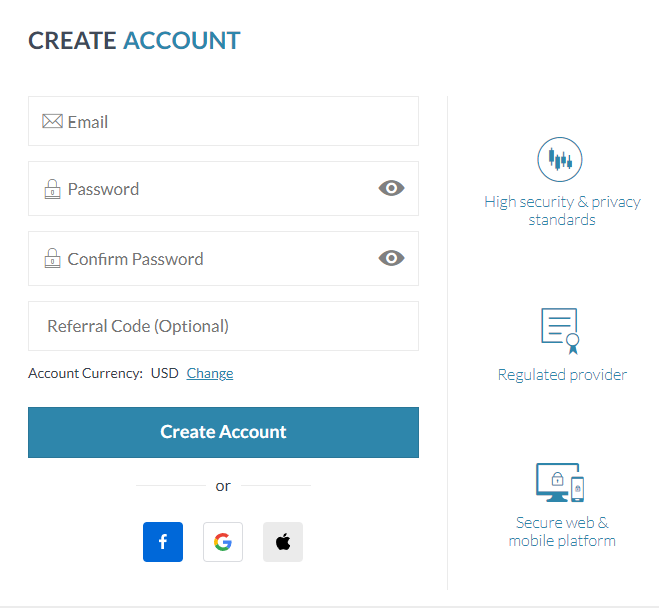

Enter your email as your login, then make a password and enter it twice. Enter your referral code if you have one. Specify the basic currency of the account and click the “Create Account” button.

Enter your first and last names, date of birth, and nationality. Enter your registration address with a post code and mobile phone number. Then click the “Next” button.

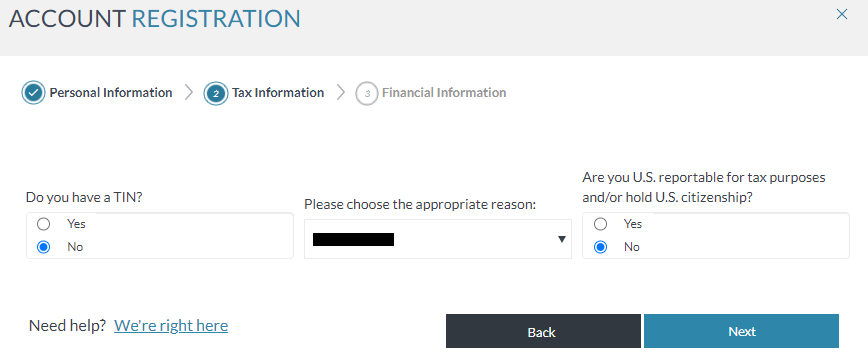

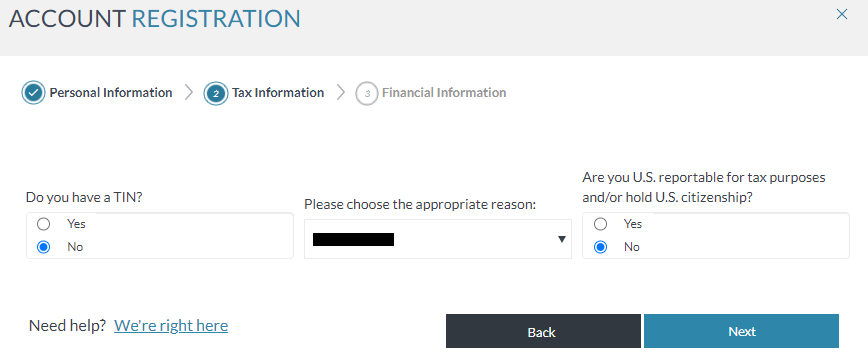

Answer a few questions, provide the required information, and click the “Next” button.

Tell the broker about yourself by answering a few simple questions. Agree to the terms of service by ticking the two appropriate boxes. Click the “Finish” button.

Next, choose a bonus or you can refuse them. Select your deposit channel and follow the on-screen instructions to make your first deposit.

As soon as the funds are credited to the account, you can start trading through the selected trading platform (WebTrader is integrated with the user account, and MT4 must be downloaded on the broker's website in the appropriate section).

Features of the user account:

Since WebTrader is integrated into the user account, the broker's client can execute trades in it directly. You can switch between groups of assets in the menu on the left, and in the center of the screen there are charts, an archive of trades, and all the necessary information;

“Watchlist” and “Featured” tabs provide for keeping track of assets that interest you. Each asset can be detailed and filtered by the selected parameters. Charts are modified by time frames, also there is a basic set of tools for technical analyses;

Opened trades are displayed in the “Positions” block. The “Orders” block, respectively, provides access to active orders. In the “Alerts” block, traders can set personal alerts for events that will be activated in accordance with the specified triggers;

At the top right, there is a button to enter the profile settings. There, you can correct your personal data, change deposit/withdrawal options, set leverage, and set security parameters. There are also reports and technical support.

Regulation and safety

If a broker does not have official registration, don’t trade with it, as it is a scam. Registration confirms that the company operates within the laws of the country where it is headquartered. It also requires regulation by a competent organization at the international level. Lead Capital Services Ltd, which owns the FINQ trademark, is registered in Seychelles and regulated by FSA with a verified license.

Advantages

- Traders can contact client support of Lead Capital Services Ltd

- This broker’s clients can apply to FSA

- Contact Traders Union’s legal department for free consultation and representation. It protects its members’ rights without charge.

Disadvantages

- No opportunity to address any financial authority outside Seychelles

- No opportunity to contact international regulators that do not control FINQ’s activities

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Silver | $6, fee for stocks is 0.20% | No |

| Gold | $5, fee for stocks is 0.16% | No |

| Platinum | $4, fee for stocks is 0.12% | No |

| Exclusive | $3, fee for stocks is 0.08% | No |

| Classic | $4, fee for stocks is 0.16%, for currency pairs and metals it is $0.03 | No |

| Professional | $1.4, fee for stocks is 0.08%, for currency pairs and metals it is $0.04 | No |

FINQ does not charge withdrawal fees, regardless of the withdrawal channel used by a trader. This is an important advantage, because many brokers have this fee, and it can be quite high, especially when it comes to a fixed fee. In general, the performance of the broker looks attractive, its fees are close to the market average, while there are many brokers whose spreads and fees are much more significant. The comparative table below provides information on the fees of FINQ and two of its competitors.

| Broker | Average commission | Level |

|---|---|---|

|

$3.9 | |

|

$1 | |

|

$8.5 |

Account types

The most important moment at the start is the choice of the best account type for you. There are brokers whose accounts do not have a conceptual difference, but FINQ implements a standard practice, so the account types are very different from each other. First of all, they differ in the minimum deposit, spread, and fee. Note that ECN accounts are positioned by the broker as expert. These accounts are called Classic and Professional. They have tighter spreads and lower fees, but the minimum deposit is higher. However, the most significant minimum deposit of $100,000 is on the Exclusive account. But there is an extremely low spread from 0.3 pips and the smallest fees start at 0.08% for stocks. Thus, a trader needs to scrupulously approach the choice of the account type, focusing on available capital, real trading experience, and ambitions.

Account types:

As a rule, if traders have not previously traded with the broker, they first open a demo account to explore its conditions. Further, in accordance with their own capabilities and preferences, users select one of the live account types and proceed to full-fledged trading.

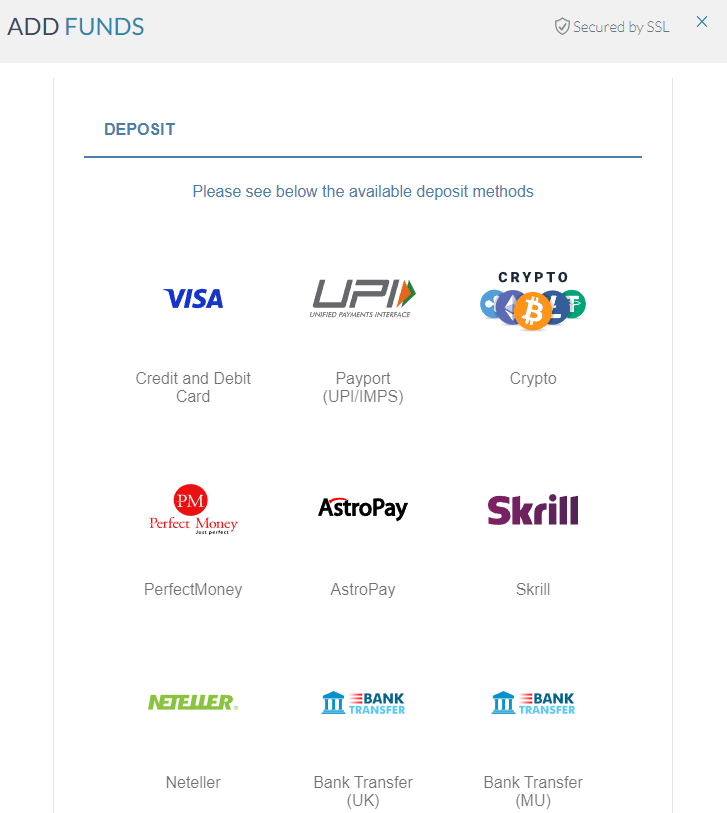

Deposit and Withdrawal

-

While traders are working on a demo account, they are trading virtual currency, so they do not receive profit that can be withdrawn;

-

As soon as they start trading on a live account, make a deposit, and start opening trades, their balance increases subject to successful trading;

-

At any time, traders can submit withdrawal requests through the appropriate option in their user accounts on the broker's website;

-

When withdrawing money by bank transfers, the minimum allowable amount is $100, while there are no minimum and the maximum limits when using other withdrawal channels;

-

This broker does not charge a withdrawal fee, but it may be charged by third parties involved in the process, such as banks or online transfer systems;

-

All requests are processed in the shortest possible time, any questions about withdrawals can be clarified via technical support.

Investment Options

Some brokers offer alternative options for income, in addition to active trading. These can be the purchase of physical stocks with dividends, copying trades, participating in MAM and PAMM accounts, or investing in cryptocurrency staking. The availability of such solutions is an absolute advantage, but it is not a priority, because most traders come to brokers to trade and earn money on their own. FINQ is one of the brokers focused exclusively on providing standard brokerage services. The only alternative income option is the referral program.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Refer a Friend program

This broker’s clients receive a special link in their user accounts and can place it online at their own discretion. Everyone who clicks this link becomes a referral of its owner. Referrals bring the link’s owner a cash bonus, which depends on the amount of their first deposit. If they deposit up to $499, the link’s owner receives 20% of the amount; if the deposit is up to $1,999, traders receive a fixed amount of $150. When referrals deposit up to $9,999, traders who invited them receive $250, while for deposits up to $20,000, the broker will provide a $400 reward. There are no additional conditions, except that referrals need to register and replenish their accounts. You can only receive one payout per referral. After inviting five referrals, the bonus is irrelevant.

Customer support

Client (technical) support is necessary for every broker, and it must provide prompt assistance at a high-quality level. After all, all traders sooner or later face difficult situations that they cannot solve on their own. And if they address support, but receive an insufficiently prompt or satisfactory answer, they may become disappointed with the broker and go to its competitor. FINQ’s client support works 24/5, that is, it’s not available on weekends. It is quite competent and can be contacted via email, WhatsApp, and live chat.

Advantages

- Technical support can be contacted via several communication channels

- Managers are 24/5

Disadvantages

- Support is not available on weekends

Whether you are the broker’s client or just intend to register, you can clarify all controversial and confusing questions with managers by the following communication channels:

-

WhatsApp;

-

email;

-

live chat.

Note that FINQ has offices in Cyprus and Seychelles. You can also apply here for advice, but first check the website for working hours of the selected office.

Contacts

| Foundation date | 2018 |

|---|---|

| Registration address | Suite 3, Global Village Jivan’s Complex, Mont Fleuri Mahé, Seychelles |

| Regulation | FSA |

| Official site | https://www.finq.com/en |

| Contacts |

+35722008069

|

Education

Traders are successful only if, in addition to active trading, they regularly improve their theoretical background through eBooks, specialized forums, and webinars. Some brokers provide their clients with training courses to improve their skills. FINQ is not among such companies, so traders will not find full-fledged educational programs there. Nevertheless, the website provides FAQs on working with the company and trading platforms, plus there is a blog in the Trading Center with news and analytics.

Since the broker does not offer comprehensive training, novice traders can only learn the basics on the website. There is no educational information for professionals. However, the information regularly published by experts in the Trading Center will be useful to all clients regardless of their experience.

Comparison of Finq.com with other Brokers

| Finq.com | RoboForex | Pocket Option | Exness | IC Markets | Tickmill | |

| Trading platform |

MetaTrader4, WebTrader | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, cTrader, MT5, TradingView | MT4, MT5, Tickmill Mobile App |

| Min deposit | $100 | $10 | $5 | $10 | $200 | $100 |

| Leverage |

From 1:1 to 1:300 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0.4 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 100% / 30% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | $30 |

| Cent accounts | No | Yes | No | No | No | No |

Detailed review of Finq.com

The company has been on the market for 6 years, and its technological stack meets modern requirements. The execution of orders is at the level of 30-50 ms. FINQ works with tier-1 liquidity providers, including well-known banks. User funds and data are protected by SSL protocols and advanced architecture that minimizes the risk of system hacking. This broker takes full responsibility for the provided services. As a result, traders work on a fast, convenient, and secure platform that is as protected as possible.

FINQ by the numbers:

-

The minimum deposit is $100;

-

6 live account types;

-

2 trading platforms;

-

Over 2,100 assets in the pool;

-

Up to $4,000 deposit bonus.

FINQ is a CFD broker for active trading

The number and variety of assets largely determine the range of opportunities for traders. FINQ provides excellent conditions, namely over 2,100 CFDs on 7 asset groups. This means that traders can trade CFDs on currencies, cryptocurrencies, stocks, indices, etc. That is, they easily collect diversified portfolios in which the negative trend of one asset is compensated by the stable and developing positions of others. Moreover, the wider the pool of financial instruments, the more diverse strategies can be used. FINQ does not limit its clients, allowing them to apply any styles and methods. Given the acceptable trading costs, such conditions will be attractive to traders of any level.

Useful services offered by FINQ:

-

Economic calendar. This is a basic tool for fundamental analysis. The calendar displays the most significant events from the world of politics and economics that may affect quotes;

-

Trading Center. It is a comprehensive service of fundamental analytics. This broker's experts filter information from various sources and provide traders with concise conclusions.

Advantages:

This broker has a low entry threshold, so there is a free demo account, the minimum deposit is only $100, and three bonus types for novice traders;

Traders get comfortable conditions, such as a wide pool of assets, moderate leverage, and fast order execution;

Socially active users have access to additional income through the referral program with simple and understandable conditions;

Trading costs of clients are average or below average, and there is no withdrawal fee;

Technical support is highly rated by traders and experts and is available 24/5.

User Satisfaction