Trading 212 Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- 1 £ or 1 €

- Web platform

- Mobile application

- FCA

- CySEC

- 2006

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- 1 £ or 1 €

- Web platform

- Mobile application

- FCA

- CySEC

- 2006

Our Evaluation of Trading 212

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Trading 212 is a broker with higher-than-average risk and the TU Overall Score of 4.89 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Trading 212 clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

The broker is focused on cooperation with novice and experienced traders, but pays more attention to the development of service and trading conditions, rather than educational programs.

Brief Look at Trading 212

The Trading 212 brokerage company (trading212.com) is registered to do business in London in 2006. Its specialization is the provision of services for investment and active trading in the foreign exchange and stock markets. The company is regulated and licensed by the UK Financial Conduct Authority (FCA, 609146) and by CySEC (398/21) in Europe. The broker does not provide data on awards received during the work.

- low level of the minimum deposit;

- a large selection of trading assets;

- multilingual site interface.

- lack of investment programs;

- a small number of ways to contact support;

- the company does not hold contests for traders;

TU Expert Advice

Financial expert and analyst at Traders Union

Trading 212 has been cooperating with the Traders Union for more than a year and during this period it has established itself as a reliable partner who regularly fulfills its obligations. Traders may choose from two types of accounts. One allows you to invest in stocks; the other one involves active trading. Both accounts have a demo version, which permits traders to test the trading conditions before moving on to real trading. There is also an ISA account for UK clients.

The broker is ready to cooperate with traders and investors, regardless of their level of experience, but upon registration, it warns potential clients about the increased risks associated with trading. During its activity, the company has received many positive and negative reviews. The Trading 212 support team distinguished themselves by providing qualified assistance to resolve pressing questions and problems. However, before opening an account with a broker, we strongly recommend that you read the reviews by the company's clients.

The broker's website is not visually overloaded and at the same time, it allows traders to learn all the information related to trading conditions and additional opportunities. The site interface has been translated into 11 languages, which is an advantage for the company's clients.

Trading 212 Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 83% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | Web platform, a mobile app for iOS and Android |

|---|---|

| 📊 Accounts: | Trading 212 Invest, Trading 212 CFD, ISA (available for UK clients only) |

| 💰 Account currency: | GBP, EUR or a supported local currency |

| 💵 Replenishment / Withdrawal: | Bank cards: Visa, Visa Electron, MasterCard, Maestro; electronic payment systems: PayPal, ApplePay, GooglePay, Skrill; bank transfer via wire transfer |

| 🚀 Minimum deposit: | 1 £,€ |

| ⚖️ Leverage: | 1:30 (retail clients), 1:500 (Pro clients) |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.1 |

| 💱 Spread: | From 0 pips |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, indices, futures, commodities, ETFs |

| 💹 Margin Call / Stop Out: | 45%/25% |

| 🏛 Liquidity provider: | n/a |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market Execution |

| ⭐ Trading features: | Trading stocks, CFDs and ETFs |

| 🎁 Contests and bonuses: | No |

The broker aims to provide optimal conditions for both investing and trading. The company offers traders a low minimum deposit level - GBP/EUR 1 at Trading 212 Invest and GBP/EUR 10 at Trading 212 CFDs. Available leverage on CFD accounts is 1:30 (retail clients) and 1:500 (Pro clients). There is some information about each of them in the personal account.

Trading 212 Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

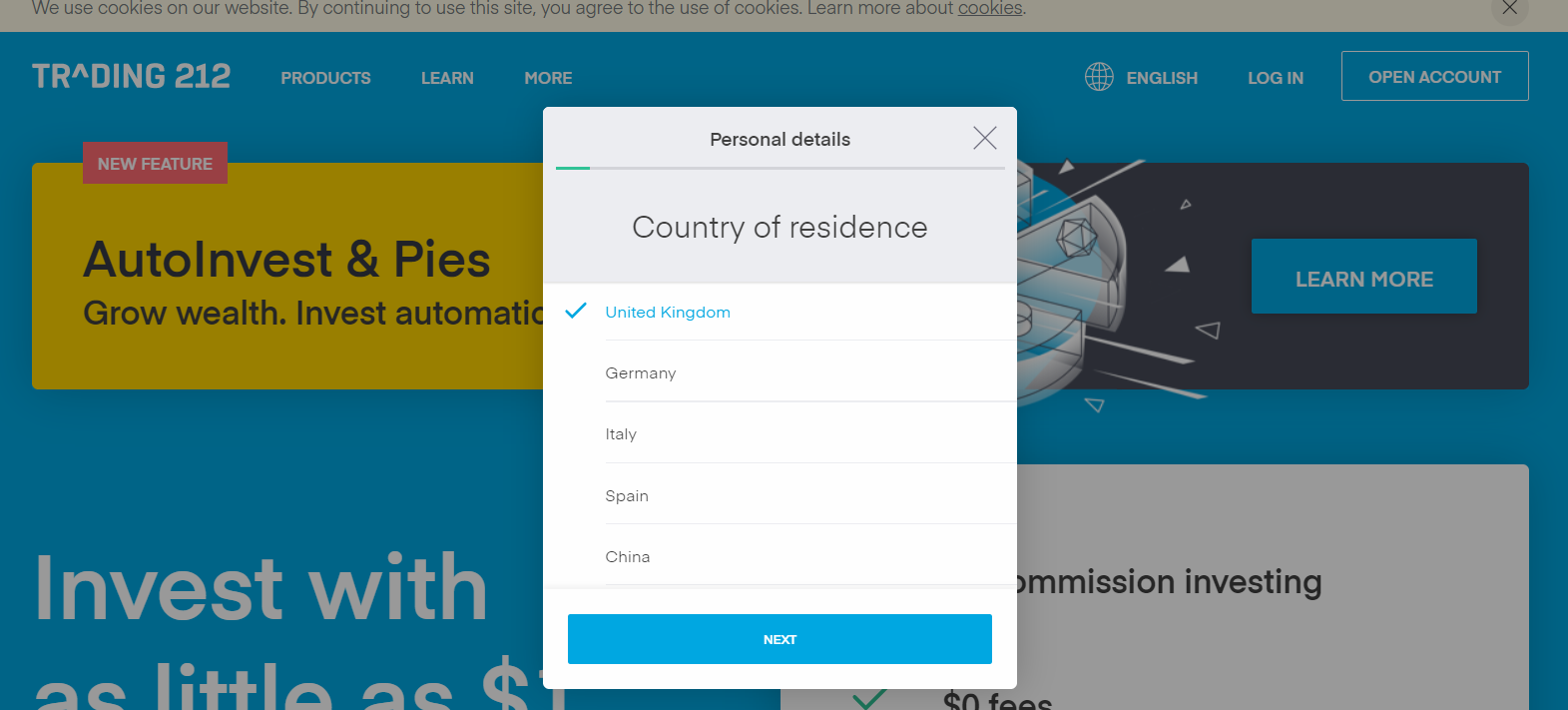

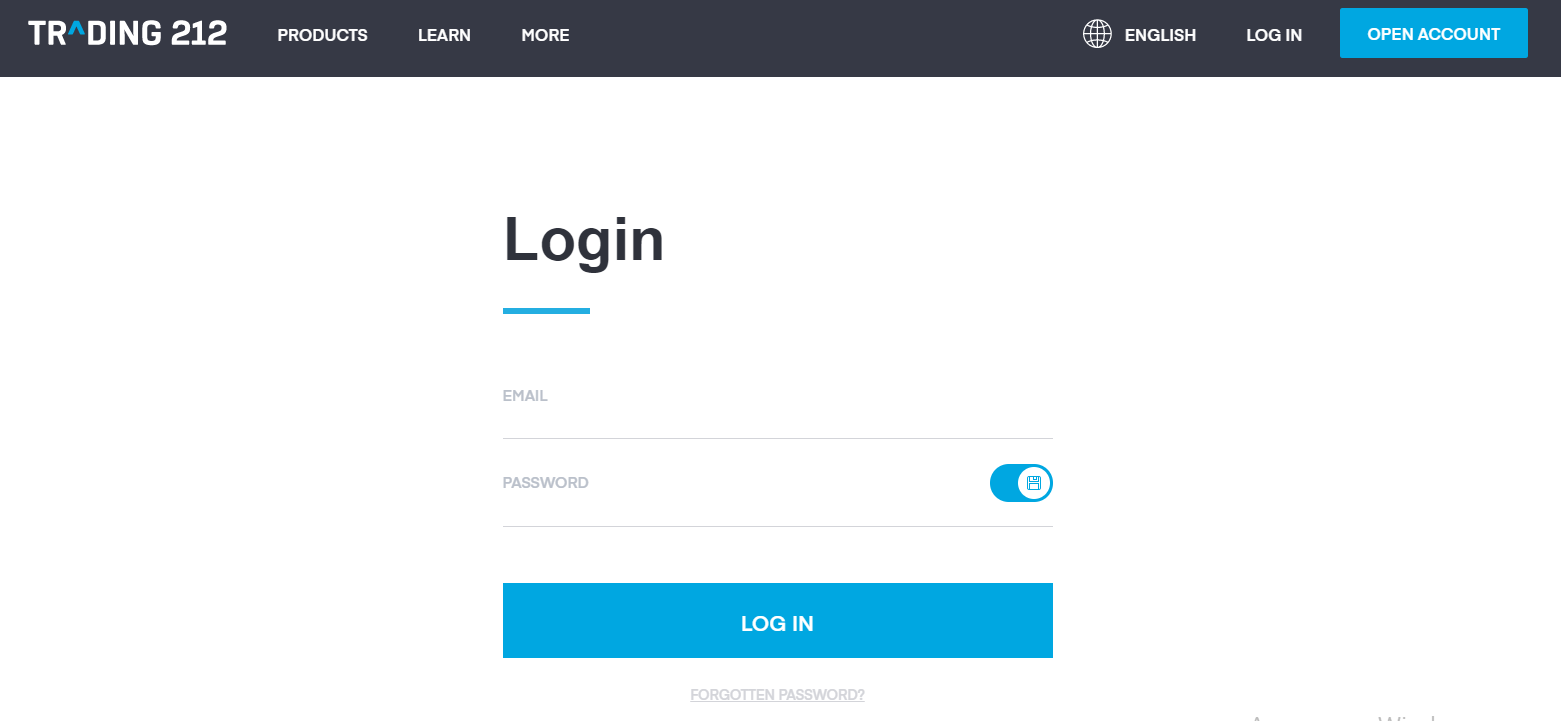

To start investing or actively trading with the Trading 212 broker, you need to register and open your personal account. To learn how to do this and what functions are in the trader's personal account, read the detailed instructions below.

To receive a rebate from the Traders Union, you need to log into your account on the Union’s website and link your Trading 212 account to the TU. If you are not registered yet, use the referral link, go to the broker's main page and click on the "Open an account" button.

In the dialog window, select the account you need — real or demo

To open a demo account, enter your email address and a password. Then you can start virtual trading. For a real account, you must indicate the country of residence, citizenship, phone number and date of birth. The broker also requests information about the country you pay taxes to, identification code, internal passport number, residence address, desired account type (Invest or CFD), account currency, information about income, work and trading experience.

After filling out the form with all the necessary data, enter your email address and a password.

The last step is to verify the account with document data (passport, identification code, and others).

After opening an account, you will automatically be taken to your personal account and the broker’s web platform. The following functions are available in the Personal Account:

-

funds management;

-

reports;

-

training;

-

client agreement;

-

help center;

-

switching a real account to a demo version.

Regulation and safety

Trading 212 UK Ltd is registered in England and Wales, authorised and regulated by the Financial Conduct Authority, FCA (Firm reference number 609146).

Trading212 Markets Ltd. is registered in Cyprus, authorised and regulated by the Cyprus Securities and Exchange Commission, CySEC (Lisence number 398/21).

Clients registered under Trading 212 UK entity are insured for up to 85,000 GBP as per FSCS, and for clients registered under Trading 212 EU entity - their funds are insured for up to 20,000 EUR plus an additional up to 1M EUR per client underwritten by Lloyds of London.

Advantages

- Availability of licenses and regulators

- Documents confirming the existence of a license are provided on the broker's website in the open access

- Customer funds are protected using segregated accounts

- In case of liquidation of the company, clients receive financial compensation in the amount of up to 90%, but not more than EUR 20,000

- The regulations governing the relationship between the broker and clients

- Disputes between the company and the investor are resolved by independent experts

Disadvantages

- Consideration of a claim from a private client may take more than one month

- The regulator does not consider small claims

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Trading 212 Invest | From $1.5 | No |

| Trading 212 CFD | From $1.5 | No |

The transfer fee for the next day is only charged on the Trading 212 CFD accounts. The Trading 212 invest account allows you to transfer orders without fees. Trading 212 was also compared with leading companies in the market. According to the results of the analysis, brokers were divided according to the levels of commission they charge: from low to high.

| Broker | Average commission | Level |

|---|---|---|

|

$1.5 | |

|

$1 | |

|

$8.5 |

Account types

The Trading 212 broker offers only three types of real accounts, which provide optimal conditions for active trading and investing, as well as two virtual accounts. Their differences are in the form of trading instruments, the amount of the minimum deposit, and the commission for currency conversion.

Account types:

Each of the presented accounts is available in a demo version, which allows you to test their trading conditions without financial risks.

Trading 212 is a broker aimed at cooperating with traders regardless of their trading experience, and with investors who prefer to work with stocks.

Deposit and Withdrawal

-

Trading 212 broker withdraws funds to the user's personal account on-demand and reserves the right to set limits on the minimum withdrawal amount. There is no commission for replenishing a trading account and for withdrawing funds.

-

To deposit and withdraw funds to a trading account, the company's client can use Visa, Visa Electron, MasterCard, Maestro bank cards, PayPal, Apple Pay, Google Play, Skrill, and bank wire transfers.

-

When withdrawing funds, the broker does not provide data on the time when funds are credited to a deposit account or a client's personal account. However, transactions using electronic payment systems are faster, while bank transfers take up to 5 business days.

-

You can withdraw funds in the following fiat currencies: GBP and EUR.

-

To withdraw funds, the user needs to verify his account by providing the broker with the relevant documents in the personal account.

Investment Options

Trading 212 positions itself as a company that cooperates not only with active traders but also with investors. Popular investment programs are not presented here. The only way to invest involves buying shares of various companies and receiving dividends or remuneration for the subsequent resale of shares. Another way to get a passive income is to partner with a broker. In this case, it is not necessary to actively trade yourself.

If you are a large investor and plan on investments over $ 10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Trading 212 affiliate program:

-

Trading 212 provides a tiered referral program that rewards every client and friend they refer with a free share (or a share of the whole share) up to €100/GBP.

To become a participant in the promo offer, a trader must meet several requirements, which are described in detail in the relevant section on the broker's website.

Customer support

In case of questions or problems during the workflow, a trader may contact the support service, which works around the clock, 7 days a week.

Advantages

- 24/7 support

- Prompt answers from specialists

Disadvantages

- Few communication methods

You can contact Trading 212 specialists in the following ways:

-

fill out the feedback form on the broker's website;

-

send an email;

-

send a message to the online chat in your personal account.

Online chat is available exclusively to registered clients of the broker.

Contacts

| Foundation date | 2006 |

|---|---|

| Registration address | 107 Cheapside, London EC2V 6DN |

| Regulation |

FCA, CySEC

Licence number: 609146, 398/21 |

| Official site | trading212.com |

| Contacts |

Education

The brokerage company is focused not only on providing quality services but also on developing its clients. Therefore, Trading 212 offers traders of all levels training materials that will help novice traders to understand the basics and nuances of trading, and professionals to improve their skills.

We recommend testing the acquired knowledge without financial risk using a demo account.

Comparison of Trading 212 with other Brokers

| Trading 212 | RoboForex | Pocket Option | Exness | Octa | XM Group | |

| Trading platform |

Web Trading platform, Mobile platforms | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5 | MT4, MT5, MobileTrading, XM App |

| Min deposit | 1 £,€ | $10 | $5 | $10 | $25 | $5 |

| Leverage |

From 1:30 (retail clients) to 1:500 (Pro clients) |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0.6 points | From 0.6 points |

| Level of margin call / stop out |

45% / 25% | 60% / 40% | 30% / 50% | No / 60% | 25% / 15% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed Review of Trading 212

Trading 212 is known as an investment company that gives traders the ability to trade and invest comfortably. The broker focuses on the use of new technologies in its work to make trading conditions optimal for both inexperienced market participants and professionals. Thus, this company sets a minimum deposit level, which opens up access to the stock markets for a larger number of customers. The development of its mobile application has made the broker popular in the UK and elsewhere.

A few numbers about the Trading 212 broker which will help a trader to choose a reliable broker:

-

The company offers over 12,000 stocks and ETFs available in Invest/ISA accounts which is the highest number among competitors, as well as over 5,000 leveraged instruments in the CFD account;

-

Trading 212 has over 1,5 million active clients;

-

the company's mobile app has been downloaded over 15 million times;

-

qualified support service is available 7 days a week, 24 hours a day.

Trading 212 has optimal trading conditions for investors and traders

The broker prioritizes the use of new technologies that make the trading process even faster, more comfortable, and more accessible. There are three types of accounts offered by Trading 212: account for investment, account for active trading, and ISA (available for UK clients) In the first case, trading is carried out exclusively on the stock market; in the second, the trader has access to the foreign exchange and other markets.

Trading is carried out in two modes: through a browser and a mobile application for iOS and Android. Therefore, the user does not need to install additional programs. You only need a gadget with access to the internet.

Useful services of Trading 212:

-

News. The service allows traders to stay up to date with the latest news on the global economic arena;

-

Economic calendar. It gives traders more detailed information about the current market situation;

-

Analysis. These are daily analytical materials on the most popular trading instruments;

-

Help Center. It allows you to find answers to the most frequently asked questions from customers using the built-in search engine;

-

Autoinvest. An automated system simplifies the investment process.

Advantages:

having your own mobile application for comfortable trading;

support service provides professional assistance to clients at any time;

client funds are reliably protected by segregated accounts;

use of convenient payment systems available all over the world;

low level of the minimum deposit for investment and active trading.

User Satisfaction