MaxiTrade Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $500

- XCritical

- 2009

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $500

- XCritical

- 2009

Our Evaluation of MaxiTrade

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

MaxiTrade is a high-risk broker with the TU Overall Score of 2.19 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by MaxiTrade clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. MaxiTrade ranks 394 among 417 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

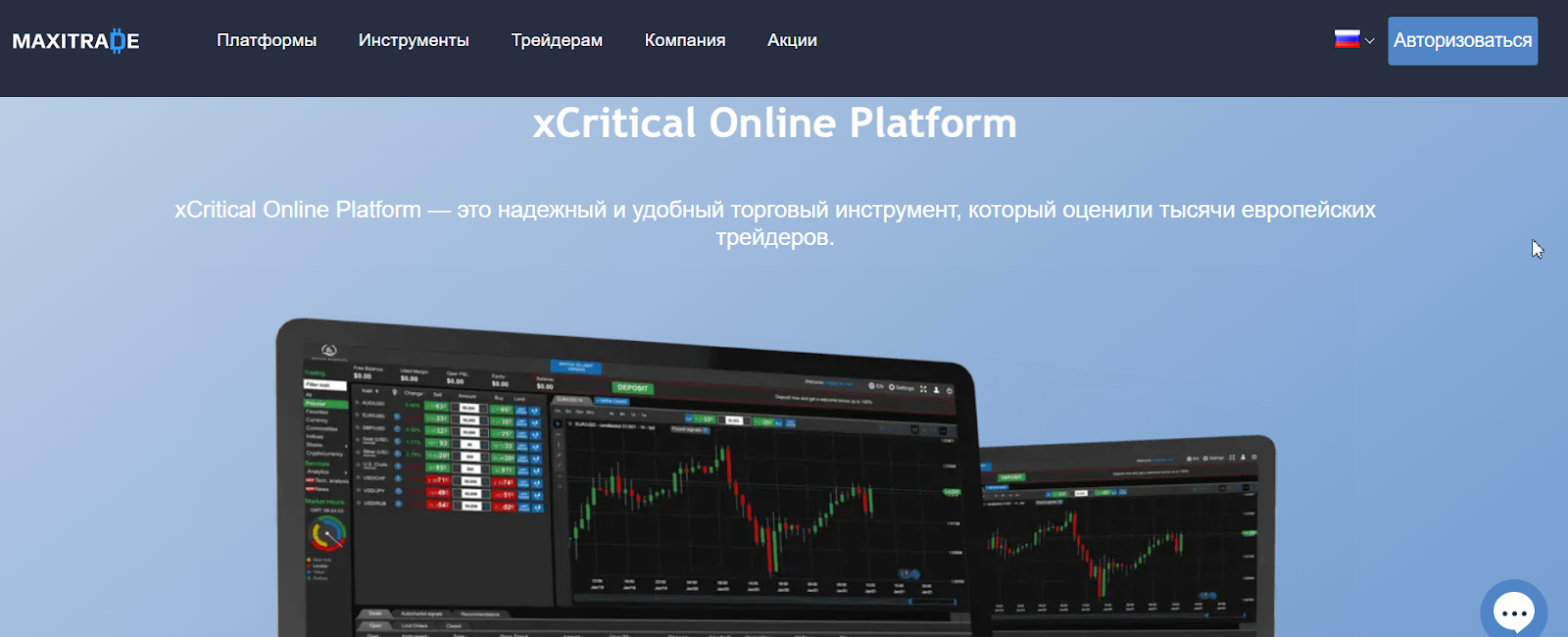

MaxiTrade is widely known in Europe for its favorable trading conditions. The main advantages of the broker are a large choice of assets, many useful instruments, low fees, and full transparency. As a special advantage, traders often mention the convenient XCritical trading platform, which has online and mobile versions. A welcome bonus allows the broker to actively attract users, making trading at the start more profitable. All MaxiTrade’s clients have access to deposit insurance when trading news. As a disadvantage, one can note the significant dependence of the available functions on the selected account.

Brief Look at MaxiTrade

The MaxiTrade broker works with tier-1 liquidity providers such as HSBC, the largest bank in the European Union, which is one of the broker’s partners. The company offers a modern trading platform called XCritical, available both in a browser and as an app. There are six account types with different conditions. The minimum deposit is $500. Spread depends on the account and its average is 1.6 pips. There is no trading fee. The maximum leverage is 1:200. Assets available for trading include currency pairs, cryptocurrencies, stocks, indices, and commodities. Overall, there are 180 assets. MaxiTrade offers a 30% welcome bonus and joint funding of up to 150%. The broker provides expert analytics, educational materials, and such instruments for technical analysis as an economic calendar, table of reporting seasons, market signals, etc. The website also regularly hosts webinars for novice traders and professionals. Users’ funds are insured. There is a referral program, but no investment options.

- Traders can choose one of six accounts according to their trading preferences;

- The trading platform offered by the broker is assessed by experts as simple, reliable, and functional;

- A large pool of assets from different groups is available and traders work without any trading restrictions;

- Significant leverage increases profit potential while spreads are average or below average;

- The broker offers a welcome bonus as well as a joint funding program;

- There is no trading fee, but there is a competitive withdrawal fee, and the broker’s activity is 100% transparent;

- Client support is represented by a call center, email, live chat, and tickets. It is available 24/7.

- Spreads differ subject to the account type. On Starter accounts this indicator is quite high;

- The extended choice of instruments, including stocks and indices, is not available for all accounts;

- The broker does not offer passive income options, thus there is no copy trading or direct investment.

TU Expert Advice

Financial expert and analyst at Traders Union

MaxiTrade is registered in the Marshall Islands and has existed for more than a year. A retrospective analysis confirmed the transparency of its activity and showed the absence of open conflicts with its clients. According to user reviews, the company totally fulfills its stated obligations, including deposit insurance. This unique feature is available to every client who regularly trades news.

MaxiTrade attracts attention due to its large number of 180 assets that represent the most popular groups of financial instruments, such as currencies, cryptocurrencies, stocks, etc. The broker does not limit its clients in any way, so they can use any strategy. They can hedge, scalp, and employ advisors. Leverage is determined by the asset, the largest indicator for currency pairs is 1:200. This is quite competitive leverage.

Deposits start at $500 and are relevant only for Starter accounts. Spreads on a number of accounts are average for the market, and on premium accounts, they are much lower than those of most of the broker’s competitors. There are no trading fees, but withdrawal fees are charged. The broker uses innovative FinTech solutions, which allow it to quickly bring trades to the interbank market and process them at higher speeds. Also, there are unrivaled useful instruments, like Autochartist (which provides real-time market analysis for traders). Moreover, a personal analyst is available on all accounts, except for Starter.

The XCritical platform deserves special attention. Trader Union (TU) analysts have not found any disadvantages in it. It is convenient, functional, and at the level of traditional solutions like MetaTrader 4 and 5. There are online and mobile versions that can be downloaded for free from digital stores for Android and iOS. In conclusion, TU notes a 30% welcome bonus, as well as rebates from Traders Union, which gives new clients a significant financial advantage.

MaxiTrade Summary

| 💻 Trading platform: | XCritical |

|---|---|

| 📊 Accounts: | Starter, Bronze, Silver, Gold, Platinum, and VIP |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank transfer, Neteller, and Skrill |

| 🚀 Minimum deposit: | $500 |

| ⚖️ Leverage: | Up to 1:200 subject to the asset |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | 1.6 pips |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, stocks, indices, and commodities |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | HSBC and other tier-1 organizations |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: |

Demo account and six live accounts; Competitive spreads; No trading fees; Many assets; Useful financial instruments; Welcome bonus; Proprietary trading platform; Education section |

| 🎁 Contests and bonuses: | Yes |

MaxiTrade has several account types and each of them has its own minimum deposit. A $500 deposit is needed for Starter accounts; for Bronze, it starts from $4,001; for Silver, the deposit starts at $15,001, and increases incrementally. The largest minimum deposit is $500,000 for VIP accounts. Leverage is determined by the asset and does not depend on the account type. The highest trading leverage for currency pairs is 1:200, but you can use less leverage or trade without it. You can contact technical support 24/7 via a call center, email, live chat, Skype, and tickets in the Disputes section.

MaxiTrade Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

To start trading with this broker, create a user account. Then open a trading account and make a deposit. Below TU provides a step-by-step guide on registration.

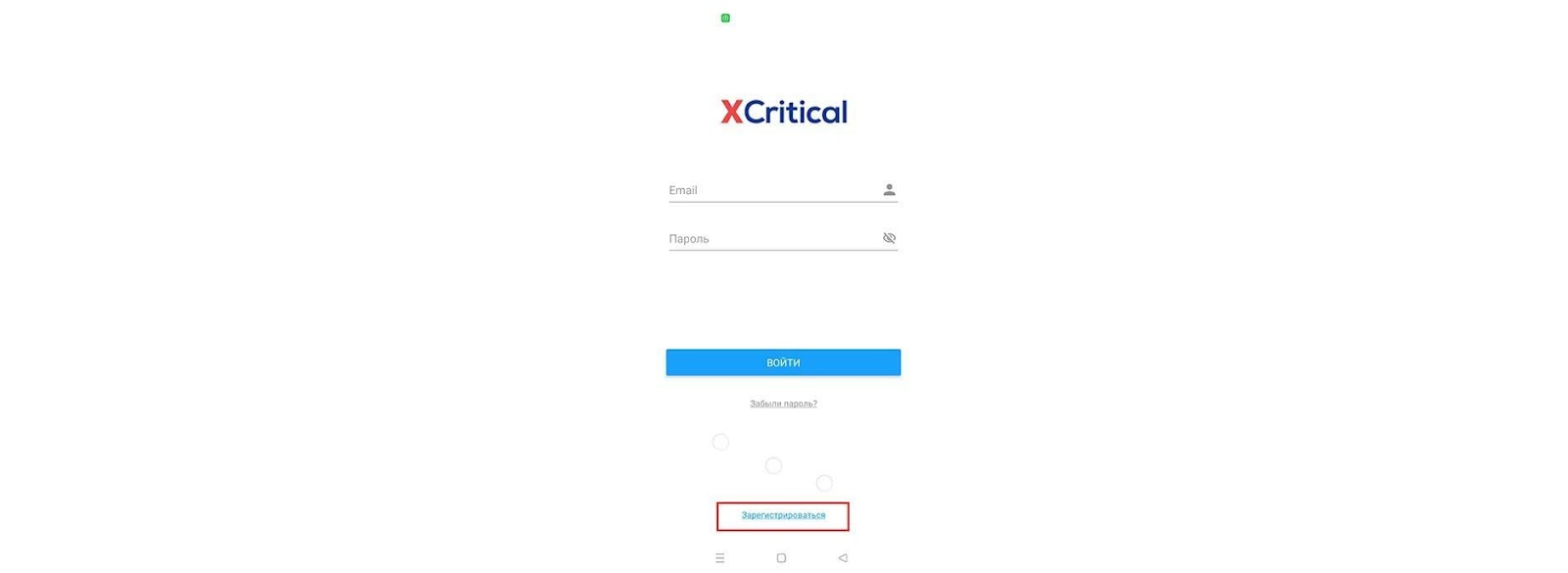

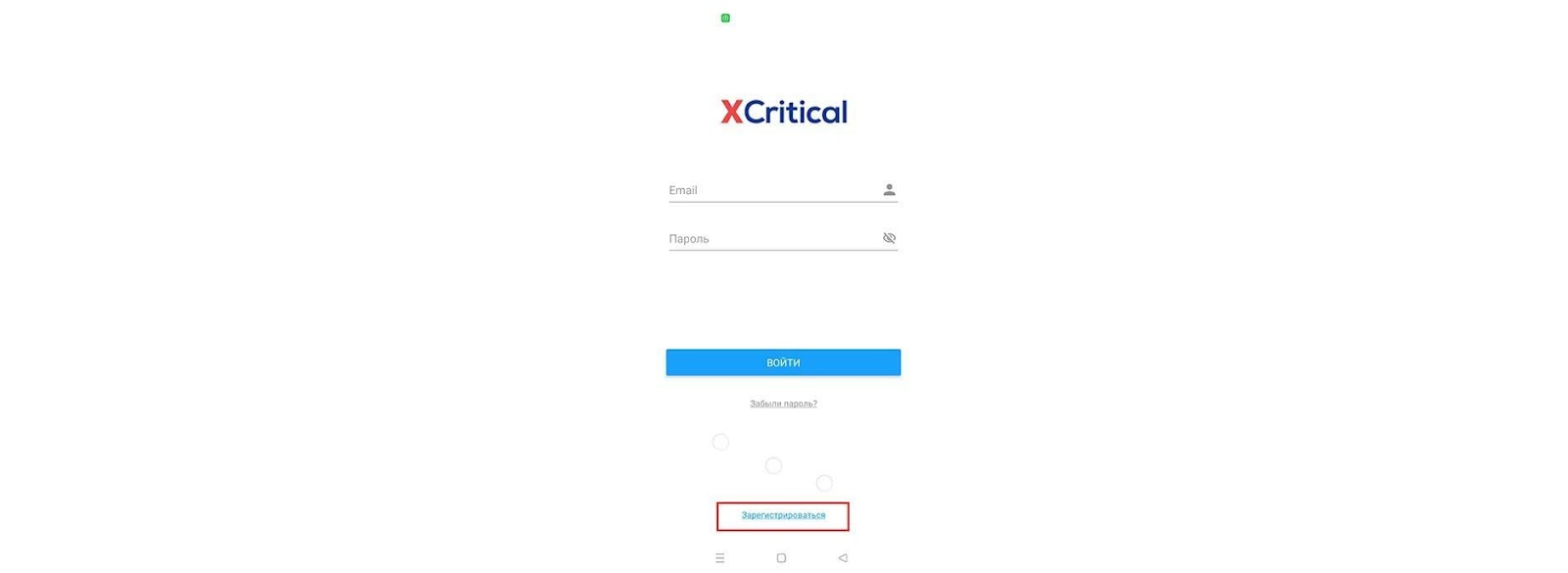

Go to your device's digital store, then to Google Play for Android or App Store for iOS. Enter "XCritical" in the search box and click the "Search" button. Open the application page and click the "Install" button. The application will automatically download and install on your smartphone.

After installing the application, launch it directly from the store or from a desktop shortcut. On the main screen, click the "Register" button (blue link at the bottom).

Enter your first and last names, email, and mobile phone number. Agree to the conditions of the broker by ticking the box and click the "Register" button. Log in and your new password will be sent to the specified email, which you can use to enter your user account through the application or on the broker's website.

In your user account, click the "Deposit" button or go to the "Account" tab and enter your payment details to deposit funds. Verification is not required. You can select the account type in the "Account" tab.

Services of MaxiTrade’s user account:

My trades. It displays open and closed trades, as well as limit orders with status details;

Account. In this tab, traders indicate their deposit and withdrawal details;

Instruments. This tab is a dashboard with information on assets available for trading;

Signals. The current signals are listed here, there is also a sub-tab with notifications;

More. This section contains account settings and additional instruments, technical support is also available here.

Regulation and safety

MaxiTrade is an officially registered organization. The company is headquartered in the Marshall Islands. The peculiarity of this region is that brokers’ activity is not regulated here. Usually, traders do not choose platforms that do not have regulators, however, MaxiTrade is an exception. The reason is that the broker has been operating for many years, and it always fulfills its obligations to its clients. At the same time, traders should understand that in case of disputes, it will be very difficult for them to defend themselves.

Advantages

- Traders can contact the legal department of the broker or lawyers at Traders Union

Disadvantages

- No possibility to address international regulators and regional financial control authorities

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Starter | $2.5 | Yes |

| Bronze | $1.9 | Yes |

| Silver | $1.7 | Yes |

| Gold | $1 | Yes |

| Platinum | $0.4 | Yes |

| VIP | $0.15 | Yes |

The transparency of the broker's activity attracts many traders, even though some other nuances may not satisfy them. When you know exactly what the costs of a particular trade will be, it is much easier for you to trade. In addition, there will be no situation when you withdraw profit and receive an amount less than expected. Below TU provides average fees for MaxiTrade and its two closest competitors.

| Broker | Average commission | Level |

|---|---|---|

|

$1.5 | |

|

$1 | |

|

$8.5 |

Account types

If a broker offers several account types, the correct choice by a trader and how he uses it determines how the platform will develop in the future. This is because spreads, available financial instruments, and the priority of technical support depend on the account selected. MaxiTrade’s accounts also affect the extension of the trade duration, saving the user account program, and the ability to trade on the U.S. quarterly reports.

Accounts also differ in the availability of webinars, trading focus groups, and SMS notifications. Finally, the work of the analytical service and the availability of financial services are also determined by each account. For example, technical support on Starter accounts only helps on how to start trading, while on Gold accounts, experts select investment portfolios for you; and on VIP accounts, free monitoring of trading accounts is available.

Read the conditions carefully before making your choice. It is not necessary to aim for Gold or more expensive accounts if you do not know how to properly use the opportunities they offer.

Account types:

Note that in addition to live accounts, the broker also offers a demo account. It does not require a deposit. Trading is carried out with real quotes, but with virtual funds. A demo account is required to get acquainted with the platform and work out strategies.

Deposit and Withdrawal

-

If clients trade on a demo account, they do not make a profit, because they work with virtual funds;

-

On live accounts, each successful trade brings traders money that replenishes their internal balance;

-

Traders can submit withdrawal requests in their user accounts;

-

All questions (for example, the minimum withdrawal amount and fee) can be clarified with technical support;

-

Withdrawal of funds takes several business days;

-

Withdrawals to bank cards, as well as by Neteller and Skrill are available.

Investment Options

Many brokers offer their clients the opportunity to buy dividend stocks or invest in cryptocurrency staking. These types of investment do not provide a 100% guarantee of profitability, but may be attractive to some traders. However, most brokers focus on active trading. In addition, there is an opinion among experts that brokers who do not deal with passive income provide better services in the trading segment because all their resources are aimed at the development of a particular direction. Anyway, MaxiTrade does not provide any investment solutions. The company only has a referral program, but traders should understand that this is not quite a source of passive income. To make good money on referrals, it is necessary to communicate a lot with colleagues on the internet.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Referral program from MaxiTrade:

Traders must apply for a referral link. Then they place it on the internet without restrictions. Everyone who clicks this link and registers on the broker’s website will become a referee of its owner. Referrals bring the link’s owner 15% of the first and each subsequent deposit. If deposits exceed $10,000, the bonus is fixed at the level of $1,500. Traders can have an unlimited number of referees. The program is single-level, that is, traders do not receive bonuses for clients who were invited by their referees. Traders can withdraw profit from this program only after their referrals make a certain number of trades, while the trading volume must be 50% of the volume specified in the Terms of Service.

The referral program is open to all traders. To receive bonuses for invited clients, you do not need to meet any specific requirements. The program is available to owners of Starter accounts as well.

Customer support

Technical (client) support is an important part of the activity of any organization. Brokers may offer the best FAQs and the simplest website interface, but traders will still have questions that they cannot answer on their own. Therefore, it is necessary that the company's clients receive competent assistance at any time. Thus, MaxiTrade offers 24/7 technical support, which is represented by many communication channels, such as a call center, email, live chat, Skype, and tickets on the website.

Advantages

- Non-registered users can contact technical support

- Managers are available for communication 24/7

- All communication channels respond quickly

Disadvantages

- There are accounts with priority support

It is difficult to single out the disadvantages of MaxiTrade’s client support team. However, there is one moment, that the priority level of your application depends on the account type. On Starter accounts you will be served in order of receipt, while on Gold accounts you will be one of the first to receive an answer.

Below is the list of communication channels relevant for all account types:

-

call center;

-

email;

-

email for claims;

-

Skype;

-

live chat on the broker's website and in the user account;

-

tickets.

Keep in mind that responses by phone and live chat are always faster than by email. If you create a ticket on the website, the answer will come to your email.

Contacts

| Foundation date | 2009 |

|---|---|

| Registration address | Trust Company Complex, Ajeltake Road, Ajeltake Island, Majuro, Republic of the Marshall Islands |

| Official site | https://maxitrade.com/ |

| Contacts |

+48 221 530 624

|

Education

Traders must improve by exploring new trading methods and learning from the experience of their colleagues. Otherwise, they stagnate, fail to keep up with the market, and the number of unsuccessful transactions increases. Brokers are well aware of this, which is why many platforms provide their clients with educational programs. These programs range from basic FAQs to full-fledged academies. MaxiTrade also offers its traders a training system, which is considered one of the best.

In fact, MaxiTrade provides comprehensive training for every level, ranging from the Forex market novice traders to professionals who work with large investment portfolios. But it all depends on the chosen account. Starter accounts offer only the basics, thus work with other assets, except for currency pairs, is not described. But Gold accounts and all subsequent ones offer more in-depth and comprehensive education.

Comparison of MaxiTrade with other Brokers

| MaxiTrade | RoboForex | Pocket Option | Exness | Vantage Markets | Forex4you | |

| Trading platform |

XCritical | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5, WebTrader, Mobile Apps | MT4, MobileTrading, MT5 |

| Min deposit | $500 | $10 | $5 | $10 | $50 | No |

| Leverage |

From 1:1 to 1:200 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:10 to 1:2000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1.6 point | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0.1 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 100% / 20% |

| Execution of orders | Instant Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | Yes |

Detailed review of MaxiTrade

MaxiTrade is officially registered and has been offering its services to traders worldwide (with a few exceptions) for many years. The company meets modern standards from a technical point of view. A special advantage is the trading platform, which is considered one of the fastest and most innovative. The company offers everything you need for comfortable work, namely an economic calendar, a table of reporting seasons, a table of spreads, and a calendar of futures contract expirations. The trading platform can display a variety of charts; also, there is a wide choice of timeframes. It is possible to insure the deposit while trading news, this function has no analogs. All accounts, except for Starter, offer a personal manager who provides up-to-date analytics. The amount of information and its customization are determined by the account type.

MaxiTrade by the numbers:

-

The minimum deposit is $500;

-

30% welcome bonus;

-

180 financial instruments;

-

The maximum leverage is 1:200;

-

Deposit insurance is 100%.

MaxiTrade is a convenient broker for trading on popular markets

There are platforms that focus on a specific group of financial instruments, but most offer several groups. Usually, these are currencies, stocks, and indices. Cryptocurrencies have recently been often included in the list of assets available for trading. Of particular note are brokers who work strictly with contracts for difference (CFDs). One way or another, most traders prefer to have access to as many markets as possible. MaxiTrade is one of the leaders in this sense, as currencies, cryptocurrencies, indices, stocks, and commodities are all available to its clients. Of course, there are platforms that also offer commodities, precious metals, etc. However, 180 assets from 5 different groups are more than enough to make a diversified investment portfolio. In addition, the wider the pool of instruments available to traders is, the less they limit themselves, and the more strategies they can apply.

Useful services offered by MaxiTrade:

-

Economic calendar. Many brokers have this service. It is a list of the most important political and economic events for the current year that could potentially affect the quotes of certain assets;

-

Reporting season. This is an interesting addition to the economic calendar. The service is presented in the form of a table adjusted by timeframes, which displays the positions of large companies for the previous reporting season with a forecast for the current season;

-

Spread table. This is an extremely useful service with real-time data changes. Traders can select any asset from the list and find out what spread they are currently trading on the selected live account.

Advantages:

A wide range of accounts, each of which offers its own trading conditions and is designed for certain groups of traders;

Full transparency of the platform, thus all fees are known in advance and you can consult your manager at any time;

Leverage of up to 1:200, 180 assets from 5 groups, no restrictions on trading strategies, and many useful instruments are available;

The broker has a welcome bonus, 100% deposit insurance, and a profitable referral program;

The broker's XCritical trading platform is rated by users and experts with the highest score due to its simplicity and functionality.

User Satisfaction