Pacific Union Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $20

- MT4

- MT5

- WebTrader

- Pacific Union

- FSA

- 1975

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $20

- MT4

- MT5

- WebTrader

- Pacific Union

- FSA

- 1975

Our Evaluation of Pacific Union

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Pacific Union is a moderate-risk broker with the TU Overall Score of 6.28 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Pacific Union clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this broker as not all clients are satisfied with the company, according to reviews.

Pacific Union is a CFD broker, which means its pool of trading instruments consists solely of contracts for difference. There are many CFDs available, grouped into seven categories. Considering the high leverage, there is significant profit potential. Costs are reduced due to the absence of trading commissions on some accounts, and in most cases, there are no fees for fund withdrawals. The broker has a copy trading service. Beginners receive decent bonuses at the start, and there is a standard referral program that can provide additional income. The wide choice of accounts and trading platforms personalizes the broker's offerings and expands traders' opportunities. The drawbacks of Pacific Union are typical for most of the representatives in the segment.

Brief Look at Pacific Union

Pacific Union is a broker that allows trading in contracts for difference (CFDs) on hundreds of assets from the following categories: currencies, stocks, bonds, indices, commodities, metals, and exchange-traded funds (ETFs). New users receive a free demo account with a balance of 100,000 virtual dollars. Real accounts come in five types, differing in trading parameters and catering to traders of different levels. The minimum deposit is $20, and spreads are floating, starting from 0 or 1.3 pips depending on the chosen account. The maximum leverage is 1:1000. The broker's clients operate through MetaTrader 4, MetaTrader 5, and WebTrader trading platforms. The company also has a highly-rated mobile platform. In addition to active trading, traders can earn through a standard referral program and register in an integrated copy trading service. Pacific Union offers attractive bonuses through five active programs. The broker provides free technical and fundamental analysis tools and news analytics. It also has an extensive educational system.

- The minimum deposit is lower than the market average, and a free demo account and high-quality training ensure a low entry threshold.

- Traders can work with hundreds of assets with high leverage and no trading restrictions, resulting in high-profit potential.

- Narrow spreads combined with low commissions guarantee minimal trading costs.

- Traders can choose from five real account options, including an Islamic account with no swaps or interest charges.

- A wide selection of trading platforms, including mobile versions, allows traders to work comfortably in most conditions.

- The copy trading platform is transparent, fast, and features an intuitive interface.

- Customer support is available through the main communication channels, operates round the clock without interruptions, and has received numerous positive reviews.

- This broker only offers trading with CFDs.

- Apart from copy trading, the company does not provide other passive income options such as joint accounts, cryptocurrency staking, etc.

- Residents of Australia, Singapore, and some other countries cannot collaborate with this broker.

TU Expert Advice

Financial expert and analyst at Traders Union

The Pacific Union brokerage company was founded in 2015. The full name is Pacific Union (Seychelles) Ltd. As evident from the name, it is registered in Seychelles and regulated there as well. The broker has undergone several major rebranding efforts. There are no reported conflicts with clients, and experts have not found any confirmed cases of the company failing to fulfill its obligations. Also, the broker is considered reliable.

The trading conditions are at or better than the market average. There are several account types, some with spreads and commissions, while others have no commissions. The minimum spread starts from 0 or 1.3 pips, which is comparable to top competitors. The same can be said about the leverage of up to 1:1000 and the variety of base currencies. Only the Cent account is limited to U.S. dollars. The minimum position size starts from 0.01 lot, which is not particularly remarkable in this context.

One of the distinctive features is the proprietary copy trading service. It stands out for its intuitive interface and transparent functionality. The reviews also frequently mention the high-quality educational system. The materials are genuinely useful, presented in various formats, and regularly updated. The broker provides ongoing market analysis and offers free individual consultations. All of this is complemented by an economic calendar, Autochartist, and other tools for an independent analysis.

Another conceptual difference of the platform is its mobile application. It is not just a dashboard or a mobile version of the user account; it also allows for trading and activating advanced options. However, using the application is not mandatory since Pacific Union account holders can trade on MT4 and MT5 trading platforms. These are classic options that are suitable for most traders.

The broker's disadvantages are typical for many organizations in this segment. First, it is a CFD company, meaning all instruments are contracts for difference. Second, there are regional restrictions. The third aspect is the lack of PAMM and other types of joint accounts. However, Pacific Union offers the previously mentioned copy trading, which allows for potentially stable passive income based on individual preferences.

- You are looking for a broker with a low minimum deposit, below the market average, along with the provision of a free demo account. High-quality training is also available, ensuring a low entry threshold for traders.

- You seek a copy trading platform that is transparent, fast, and features an intuitive interface. Additionally, the broker offers leverage up to 1:1000.

- You are looking for a broker that provides trading options beyond CFDs, offering a more diversified range of instruments.

- You prefer a broker that is regulated by more than one authority, such as the FCA, ASIC, or CySEC, ensuring a higher level of regulatory oversight and security for your trades.

Pacific Union Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MT4, MT5, WebTrader, Pacific Union |

|---|---|

| 📊 Accounts: | Cent, Standard, Pro, Prime, Islamic, demo |

| 💰 Account currency: | USD, GBP, CAD, AUD, EUR, SGD, NZD, HKD, JPY |

| 💵 Replenishment / Withdrawal: | Visa, MasterCard, Bank Transfer, Neteller, Skrill, Faspay; in some regions additional money transfer methods are available |

| 🚀 Minimum deposit: | $20 |

| ⚖️ Leverage: | Up to 1:1000 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating, from 0 or 1.3 pips depending on the account type |

| 🔧 Instruments: | CFDs on currencies, shares, bonds, indices, commodities, metals, ETFs |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | No |

| ⭐ Trading features: | Free demo account, five real accounts including a swap-free account, narrow spreads and low commissions, a wide range of CFDs, high leverage, and a proprietary copy trading service. |

| 🎁 Contests and bonuses: | Yes |

In most cases, if a broker offers multiple account types, each account determines its own minimum deposit. This is exactly the case with Pacific Union. To open a Cent account, $20 is sufficient. For a Standard, Islamic, or Pro account, a minimum deposit of at least $50 is required. However, for the Prime account, the minimum deposit is $1000. Trading leverage also varies depending on the account type. On all accounts except the Pro account, the leverage is 1:500. On the Pro account, it can be increased to 1:1000. The broker's customer support is the same for all accounts. It can be contacted via phone, email, or LiveChat. The support operates day and night, without breaks, but only on weekdays.

Pacific Union Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

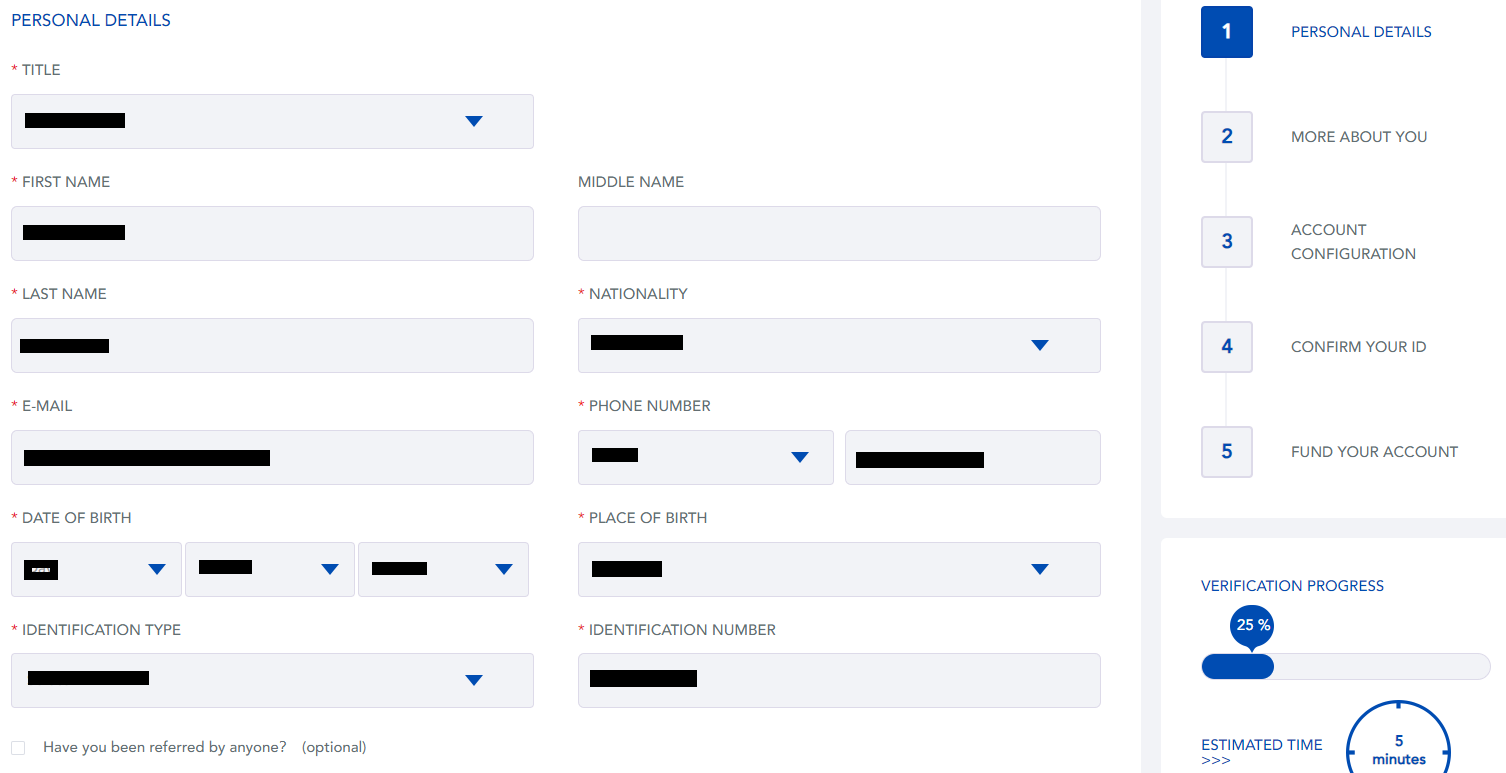

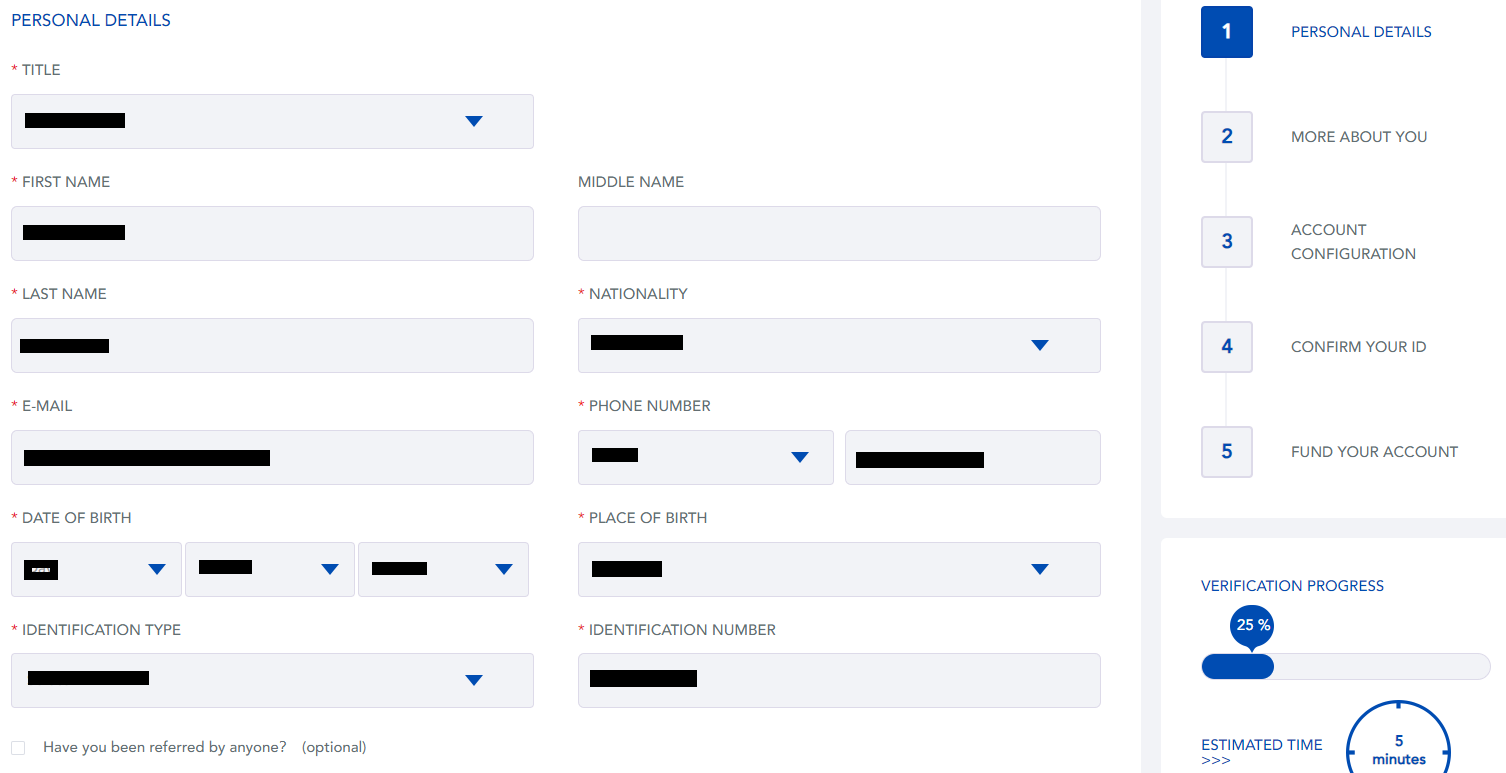

Trading Account Opening

To start collaborating with this broker, you need to visit its website and register. Verification of your personal data will also be required. After that, you can open a real account, deposit funds, download the preferred trading platform, and start trading. The experts at TU have prepared a step-by-step guide to registration and a detailed description of the features of the Pacific Union user account.

Go to the broker's website at puprime.com. In the upper left corner, select “Personal”. In the upper right corner, choose your preferred language for the interface. Click on "Join Now".

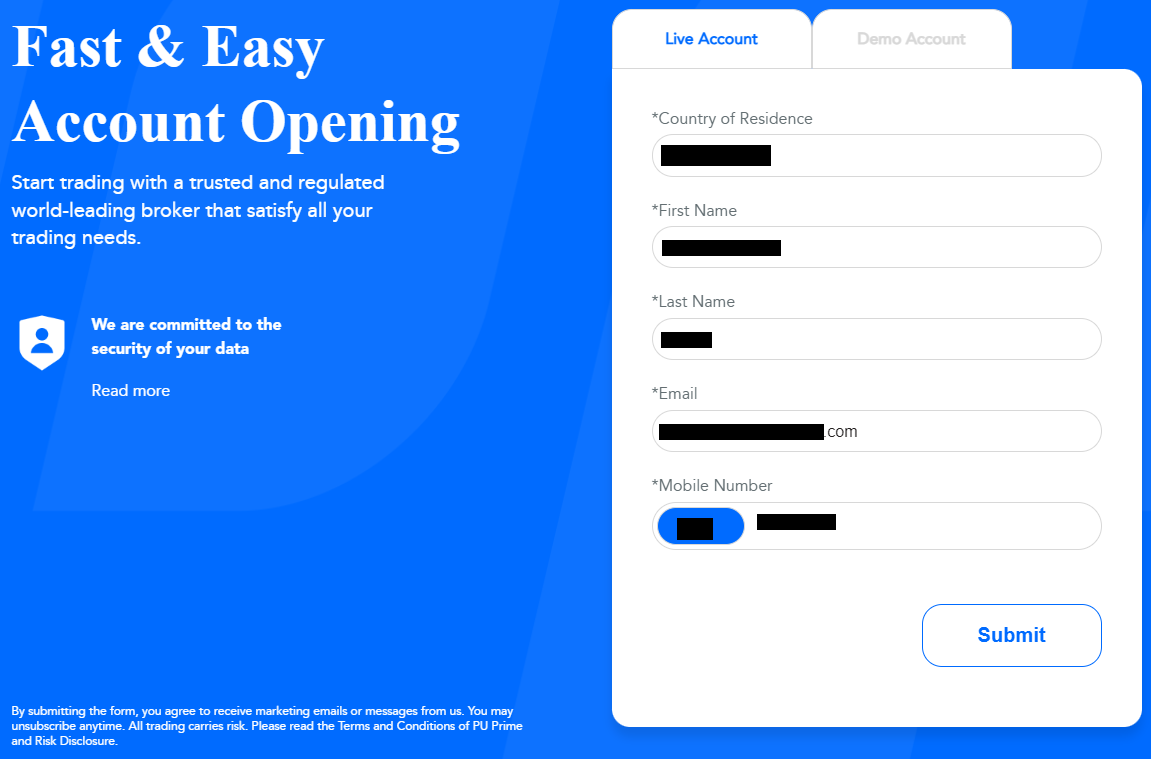

Select “Live Account” (the demo account is opened similarly). Specify the country of your residence. Enter your first name, last name, email address, and phone number. Click “Submit”.

Choose the salutation option, then enter your first name, last name, email address, and phone number again. Specify your nationality, date of birth, and place of birth. You will also need to indicate the type and number of the document that can confirm your identity. Click "Next" and follow the on-screen instructions. Answer the questions and upload scans/photos of your supporting documents.

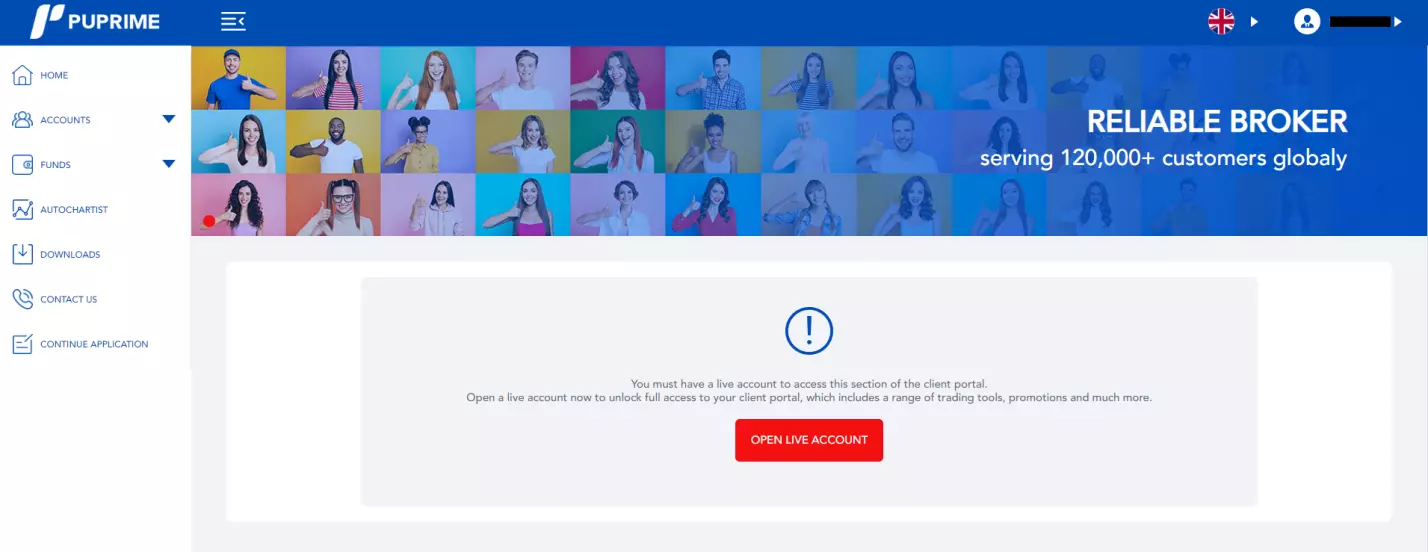

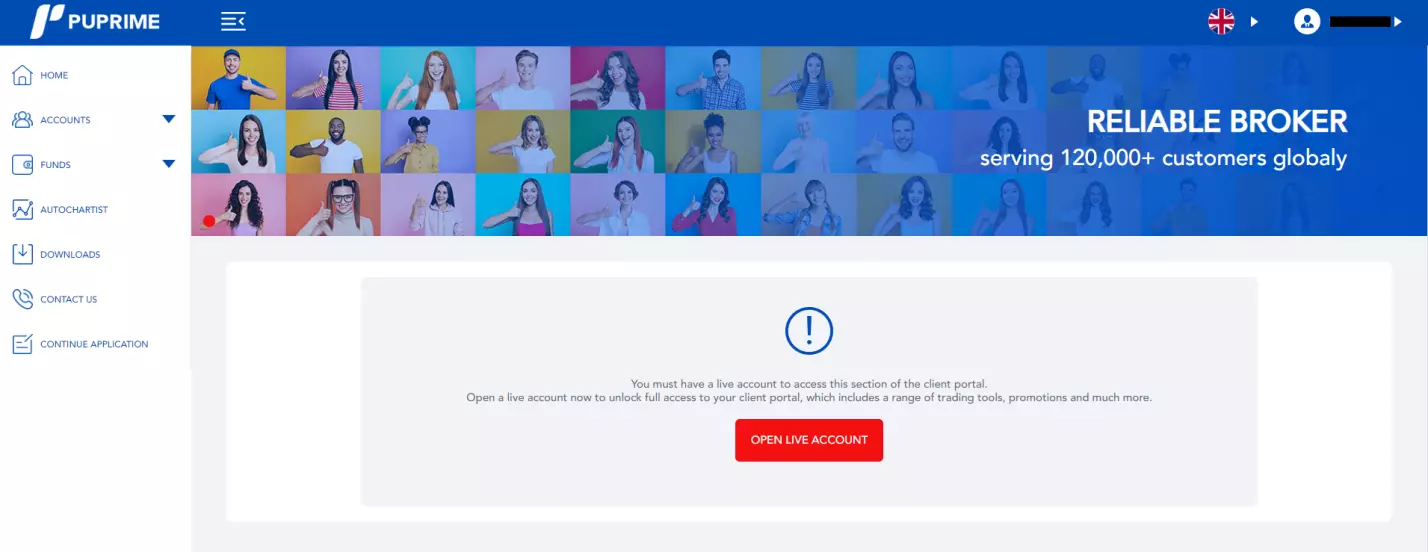

If for some reason you have interrupted your registration, there is a "Continue Application” button in the left menu. Click on it. Wait for the verification of the submitted documents to be completed. After that, you will gain full access to the user account. You can open/close accounts in the “Accounts” section, and there is a “Deposit Funds” button in the "Funds" section to add funds to your balance. Once you select the account conditions and deposit funds, download the trading platform and you can start trading. The distributions of all the trading platforms supported by Pacific Union are available in the “Downloads” section.

Your Pacific Union user account also provides access to:

The dashboard serves as the main menu and displays basic information about active accounts and trades, which can be further detailed. Frequently used features are also located here.

In the “Accounts” section, traders can open/close real and demo accounts. Detailed statistics and basic options are available for each account.

The “Funds” section is intended for depositing and withdrawing funds, as well as internal transfers. It also includes a transaction archive with the status of all operations.

The “Autochartist” section provides access to the corresponding features. Here, traders can explore selected markets using advanced analytical tools.

The “Downloads” section contains distributions of the MetaTrader 4 and MetaTrader 5 trading platforms. The broker's mobile platform can be downloaded from any digital store.

The “Contact Us” section lists all the relevant company contacts, as well as an office map. Tickets cannot be generated from the user account, only on the website itself.

There is also a “Profile” section. It displays the user’s statistics, and below it, there are buttons to change the password and log out.

Regulation and safety

When it comes to a company providing brokerage services, three aspects confirm its compliance with reliability and security requirements. The first aspect is official registration, which indicates that the broker operates within the proper legal framework. The second aspect is regulation, which signifies that the broker conducts its activities transparently and strives to fulfill obligations to its clients. The third aspect is positive user reviews. However, it is important to be cautious with reviews since many platforms publish fake or even promotional posts. In the case of Pacific Union, it is a company officially registered in Seychelles. It is regulated by the local Financial Services Authority (FSA) pursuant to license number SD050. According to feedback from traders on reputable and established platforms, Pacific Union predominantly receives positive reviews. Clients highlight the variety of assets, low costs, the convenience of the trading platform, and the competence of customer support.

Where can you go for help?

- To the customer support of Pacific Union (Seychelles) Ltd

- To the FSA regulator

There is no point in contacting

- A government regulatory authority outside of Seychelles

- A regional or international regulator, except FSA

Commissions and fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Cent | From $1.3, no commission | No, for most withdrawal methods |

| Standard | From $13, no commission | No, for most withdrawal methods |

| Pro | From $13, no commission | No, for most withdrawal methods |

| Prime | From $0, the commission is $3.50 per lot | No, for most withdrawal methods |

| Islamic | From $13, the commission is $0-3.50 per lot | No, for most withdrawal methods |

The exact numbers provided above give an overview of the broker's collaboration conditions but do not indicate their profitability. That's why traders prefer to compare the data by personally examining each platform. TU experts have saved you time by conducting a comparison and presenting the data in the below table.

| Broker | Average commission | Level |

|---|---|---|

|

$8.06 | |

|

$1 | |

|

$8.5 |

Account types

The account type opened by the trader is of paramount importance. Pacific Union accounts differ primarily in their minimum deposit requirements. In this regard, the Prime account is the most demanding, requiring a minimum of $1000 to start. The easiest account to open is the Cent account, which only requires $20. Zero spreads are only available on the Prime account, and it also incurs commissions. Islamic accounts also have fees, and their spreads start at 1.3 pips, just like on other accounts. Only USD can be held in the Cent account, while all base currencies are available on other accounts (see the table above). Thus, for beginners, it is easiest to open a Cent or Standard account. The Pro account has universal characteristics and is chosen by traders with different levels of expertise. As the name suggests, the Islamic account is swap-free and is designed for users who adhere to Islamic principles. It is also worth noting that trading gold, crude oil, and some other assets is only possible on a Pro account.

Account types:

Usually, traders first open a demo account. On a demo account, they can trade without risk but also without profit. This allows them to explore the platform's capabilities and refine their strategies. Then, based on their preferences, the broker's client can switch to one of the real accounts and can open additional accounts as needed.

Deposit and Withdrawal

-

Traders have the option to open a demo account and trade with virtual funds without any risk, but they won't receive real profits.

-

Once a trader opens a real account and makes a deposit, they can expect to earn profits if their trades are successful.

-

Profits can be withdrawn at any time, and there is no limit on the number of withdrawals. Withdrawal requests can be submitted through the user account.

-

The broker does not charge a commission for the first withdrawal in a month. For the second and subsequent withdrawals via bank transfer, a fee of $20 applies.

-

The minimum withdrawal amount is $40. Withdrawal requests for amounts below this threshold cannot be processed.

-

Withdrawal requests are processed within one business day. Requests submitted on weekends will be processed on Monday.

-

Traders can withdraw funds through the following channels: Visa and MasterCard cards, bank transfer, Neteller, Skrill, and Faspay.

-

Please note that there may be other withdrawal channels available, but they depend on the region in which the trader is located.

Investment Options

Investment solutions are advantageous because additional earning options interest many traders, even though they come to the broker primarily for independent trading. In this regard, some brokers offer cryptocurrency staking, investments in startups, and dividend stocks. Joint accounts, particularly MAM and PAMM, long ago became traditional options. Auto trading can also be considered a form of passive income. In the case of Pacific Union, the company's clients have two opportunities to earn additional income, and below is a brief description of these options.

Copy trading

Copy trading services are offered by most top brokers and operate on a common principle. A trader can register as a signals provider or an investor. Signal providers trade in their usual mode while simultaneously transmitting their trades to interested users. Providers are ranked based on trade volume, win rate, and other indicators. Investors select the best providers and connect to them. The providers' trades are automatically duplicated in the investors' accounts. Investors can set limitations, such as the amount of the trade. For example, if a provider places a $500 trade, but an investor only wants to risk $50. The profits are distributed proportionally according to their respective trades. Additionally, each investor pays a small commission to the provider for their services. If a trade is unsuccessful, everyone, including the signals provider, loses their trade. The Pacific Union service is intuitive and easy to learn. It is an optimal form of passive income that also allows beginners to learn from the real trades of experienced colleagues.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Referral program

Brokers often implement referral programs to attract more clients. The general conditions of Pacific Union do not conceptually differ from those offered by other platforms. After registration, a trader receives a unique referral link that they can share on the internet or send to friends and colleagues through any communication channel. When a user clicks on the link and registers on the broker's website, they become a referral of the link’s owner. The referral brings a $150 bonus to the link’s owner when they deposit $500 or more into their account. The referral also receives an additional $100 bonus from the broker. Since both benefit, the referral program seems very attractive. A trader can receive only one bonus per referral, but they can invite an unlimited number of referrals to the platform. An important note is that the $150 and $100 bonuses apply to most regions, but they may be higher or lower for certain regions. All details regarding the referral program can be clarified in the trader's user account.

Customer support

Technical support is essential for any company that works with an active client base. In the case of brokers, having such a structure is particularly critical because most traders sooner or later encounter challenges where they need help. The cause of the problem may be user inattention or a system glitch, even by the most powerful and reliable systems. In any case, a trader will seek qualified assistance. If the help provided is not prompt or sufficiently competent, the client may become disappointed with the platform and switch to a competitor. To prevent this from happening, Pacific Union has established a strong technical support department that operates in multiple languages and provides consultations around the clock but only on weekdays. The communication channels are standard: telephone, email, and LiveChat. The chat is available on the website, in the user account, as well as in the broker's mobile application.

Advantages

- Users can contact support without being a broker's client

- Specialists are ready to respond 24/5

- The support team is multilingual and provides consultations on trading matters

Disadvantages

- Traders will not receive assistance on weekends

If you need consultation, want to clarify a trade related question, or have encountered a sudden issue, Pacific Union support is ready to help you. To contact them, you can use the following options:

-

For general inquiries, contact the call center;

-

Legal inquiries call center;

-

Email;

-

LiveChat - on the website, user account, and broker's app;

-

Tickets on the website.

The broker is present on the following social platforms: Facebook, Twitter, LinkedIn, Instagram, YouTube, and TikTok, where you can also reach out to the support team. Subscribing to Pacific Union's profile on at least one of these social networks is recommended to stay updated on analytical news and beneficial promotions.

Contacts

| Foundation date | 1975 |

|---|---|

| Registration address | 9A, CT House, Providence, Mahé, Seychelles |

| Regulation |

FSA

Licence number: SD050 |

| Official site | https://www.puprime.com/ |

| Contacts |

+248 4671 948, +248 4373 668

|

Education

A trader is successful when they earn profits. And to do that, it is necessary to accumulate practical experience and improve theoretical knowledge. This can be achieved by studying e-books and specialized articles, attending seminars and webinars, and working with current market analysis. Some brokers strive to assist their clients in this regard and offer educational materials. These materials can come in various formats, volumes, and usefulness, ranging from basic FAQs to comprehensive courses and even physical training centers. Pacific Union does not have such centers, but the broker's educational system is characterized as one of the most comprehensive and extensive. The website includes a trader's glossary, e-books for users of different levels, basic and advanced video lessons, a trading blog with articles from experts, and current market analysis. Importantly, the education is not focused solely on beginners, and the provided information is equally beneficial for traders of all levels.

Overall. Pacific Union offers everything a beginner trader needs. Before engaging in trading, it is recommended to familiarize oneself with the materials in the “Education” section. Experts particularly highlight the e-books published on the website, as the information in them is not only useful but also relevant to today's markets. Experienced traders can also explore the offered materials as they will undoubtedly find something valuable.

Comparison of Pacific Union with other Brokers

| Pacific Union | RoboForex | Pocket Option | Exness | XM Group | InstaForex | |

| Trading platform |

MT4, MT5, WebTrader, Pacific Union | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5, MobileTrading, XM App | MT4, MultiTerminal, MobileTrading, MT5, WebTrader |

| Min deposit | $50 | $10 | $5 | $10 | $5 | $1 |

| Leverage |

From 1:500 to 1:1 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:30 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | Yes |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0.6 points | From 0 points |

| Level of margin call / stop out |

120% / 50% | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 30% / 10% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | Yes | Yes |

Detailed review of Pacific Union

The broker applies a proprietary technological stack and has a copy trading service and a proprietary mobile platform. Both solutions are actively supported and modified, have never been hacked, and demonstrate high stability. Pacific Union uses virtual servers to ensure the platform’s performance and uninterrupted operation. Additionally, some standard solutions have unique options. For example, while the economic calendar is quite typical, the Autochartist tool possesses an expanded set of visualization tools, and the notification system is integrated into the broker's application. Thus, Pacific Union lacks technical deficiencies, targets both novice and experienced traders, and strives to maintain a balance between different earning paths. However, there is a clear emphasis on active trading since passive earning options are essentially limited to copy trading. The referral program cannot be considered a solution for generating passive income because it requires a lot of work.

Pacific Union by the numbers:

-

There are 6 account types, including a demo account.

-

There are 7 asset groups and hundreds of CFDs.

-

Minimum deposit is $20.

-

Minimum spread is 0 pips.

-

Maximum leverage is 1:1000.

Pacific Union is a universal CFD broker

All traders aim to work with platforms that provide the most attractive conditions. In addition to technical capabilities and trading costs, the assets pool also plays a significant role. Only CFD trading. There should be plenty of them so that traders can build a diversified portfolio and not limit themselves to strategic opportunities. Pacific Union has hundreds of positions grouped into seven categories: currency pairs, stocks, indices, commodities, metals, ETFs, and bonds. This provides sufficient diversity for traders to earn freely using various trading methods. Considering the capabilities of the trading platforms offered and special tools for technical and fundamental analysis, the company's clients have everything they need for successful trading.

Pacific Union’s analytical services:

-

Copy trading. Traders can register on the service as a signals provider and additionally earn commissions from users who duplicate their trades, or as an investor to profit from the successful trading of more experienced colleagues.

-

Autochartist. This comprehensive service is offered by only a few brokers. It includes an integrated system of market analysis tools and the resulting visualization. It supports various charts, indicators, and timeframes. However, it should be noted that Autochartist is only integrated into the MT4 trading platform.

-

Economic calendar. A typical solution that visually displays events from the worlds of politics and economics that can affect the quotes of various assets. The calendar is available on the broker's website, it is free and can be used even without being a client of Pacific Union.

Advantages:

The broker guarantees transparent operations, and all commissions and fees are known in advance. This means that traders always know exactly how much a specific trade or transaction will cost them.

The platform offers a wide range of additional tools, including various charts, analytical tools, and updated newsfeeds with expert commentary.

Traders have access to a pool of hundreds of CFDs. Traders can trade on their terms, hedge positions, scalp, transfer trades, and use bots.

The broker's mobile application is comparable in convenience and functionality to MT applications. Traders can use MT4, MT5, or WebTrader if they want more convenience.

The company's technical support is available through all major communication channels: call center, email, LiveChat on the website, and in the client's user account. Specialists work 24/5.

User Satisfaction