Windsor Brokers Review 2024

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MT4

- CySEC

- FSC (Belize)

- FSA (Seychelles)

- JSC

- CMA

- 2010

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

- $50

- MT4

- CySEC

- FSC (Belize)

- FSA (Seychelles)

- JSC

- CMA

- 2010

Our Evaluation of Windsor Brokers

According to our idea, the TU Overall Score indicator should answer the biggest question of all: “Can I trust this broker with my money?”. The scores range within 0.01 – 9.99 (the higher the indicator the more trust the broker has). More details

Windsor Brokers is a broker with higher-than-average risk and the TU Overall Score of 4.69 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Windsor Brokers clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work.

Windsor Brokers is a broker that offers limited options for active and passive trading and is suited mainly for professionals.

Brief Look at Windsor Brokers

Windsor Brokers is a trading intermediary that is part of the Windsor Brokers Ltd corporation. The above group of companies, which has been operating since 1988, holds licenses from the CySEC 030/04 (Cyprus Securities and Exchange Commission), FSC 000153/391 (Belize International Financial Services Commission), JSC 1265 (Jordan Securities Commission), and FSA SD072 (Seychelles). Windsor Brokers offers high-quality services and has won more than 20 awards. According to the UK Forex Awards, the company was named the most reliable Forex broker in 2017, and International Business Magazine named it the “Best service provider for Forex Clients” in 2018.

- narrow spreads of 0.0 pips on professional Zero and VIP Zero accounts;

- no restriction on the use of trading advisors, scalping, and hedging;

- the ability to connect trading signals from the MQL5.community platform.

- the client cannot invest in trust management accounts or ready-made diversified portfolios;

- MT4 is the only trading platform;

- the lack of Russian on its website;

- no client support;

- no educational materials.

TU Expert Advice

Financial expert and analyst at Traders Union

Windsor Brokers provides professional brokerage services that are particularly popular among traders from Asia and Africa. The broker does not allow the registration of clients from the EU and the USA, but it is available for traders from the CIS countries. For trading, the company provides 44 currency pairs, indexes, commodities, energies, bonds, stocks, and metals. There is no cryptocurrency in the list of available assets.

As for other aspects, Windsor Brokers offers access to free webinars. The website contains the topics, dates, names of speakers, language, and duration of the event. Traders can also watch 70 video tutorials on trading, analysis, and various assets. Unfortunately, all information is provided in English. The videos are intended for beginners, so watching them will not turn a novice trader into a professional.

The company’s website is uninformative because much data is only available after a long registration process that consists of six stages. The website is available in ten languages, but there is no Russian version. Client support specialists provide answers to traders from CIS countries only in English.

- You value narrow spreads of 0. 0 pips on professional Zero and VIP Zero accounts. Low spreads can contribute to reduced trading costs, especially for active traders.

- You appreciate no restrictions on the use of trading advisors, scalping, and hedging. This flexibility allows you to implement various trading strategies based on your preferences and goals.

- You prefer brokers with low minimum deposit requirements. A high minimum deposit of $50 might be a deterrent if you are seeking a broker with lower entry requirements. Consider whether this aligns with your budget and trading preferences.

- If trading cryptocurrency is an essential part of your trading strategy. The absence of this option with the broker may limit your choices.

Windsor Brokers Summary

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

| 💻 Trading platform: | MT4 |

|---|---|

| 📊 Accounts: | Demo, Prime, Zero, VIP Zero |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank Transfer, Credit/Debit Card, WebMoney, Skrill, Neteller, Union Pay, ZixiPay & various regional e-wallets |

| 🚀 Minimum deposit: | From $50 |

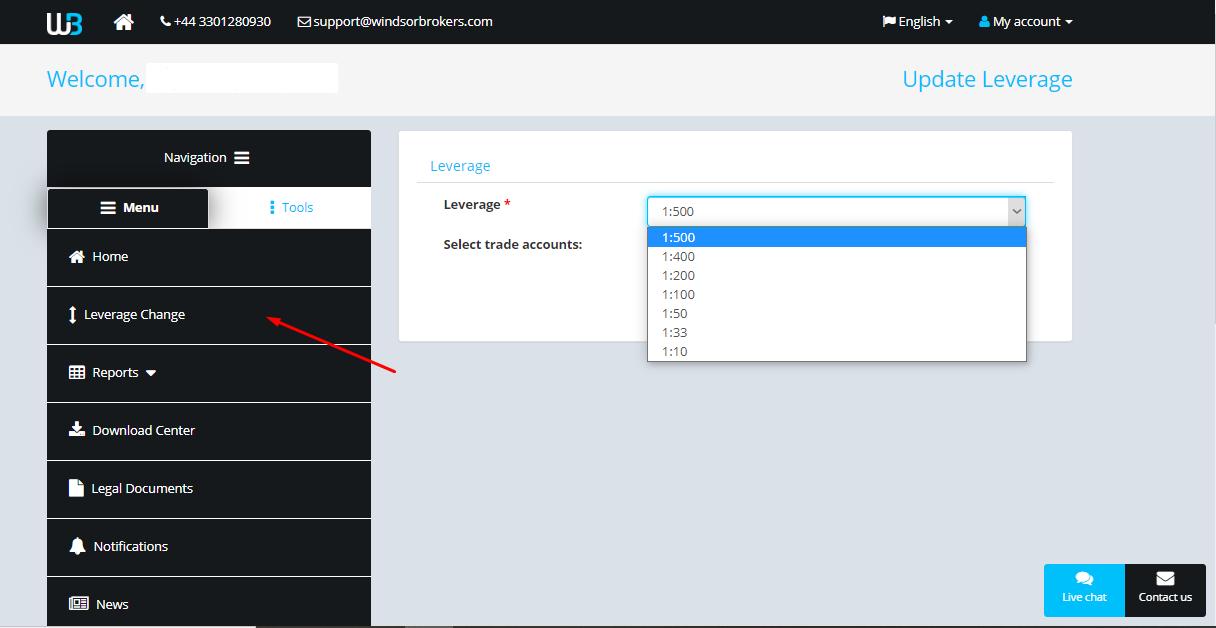

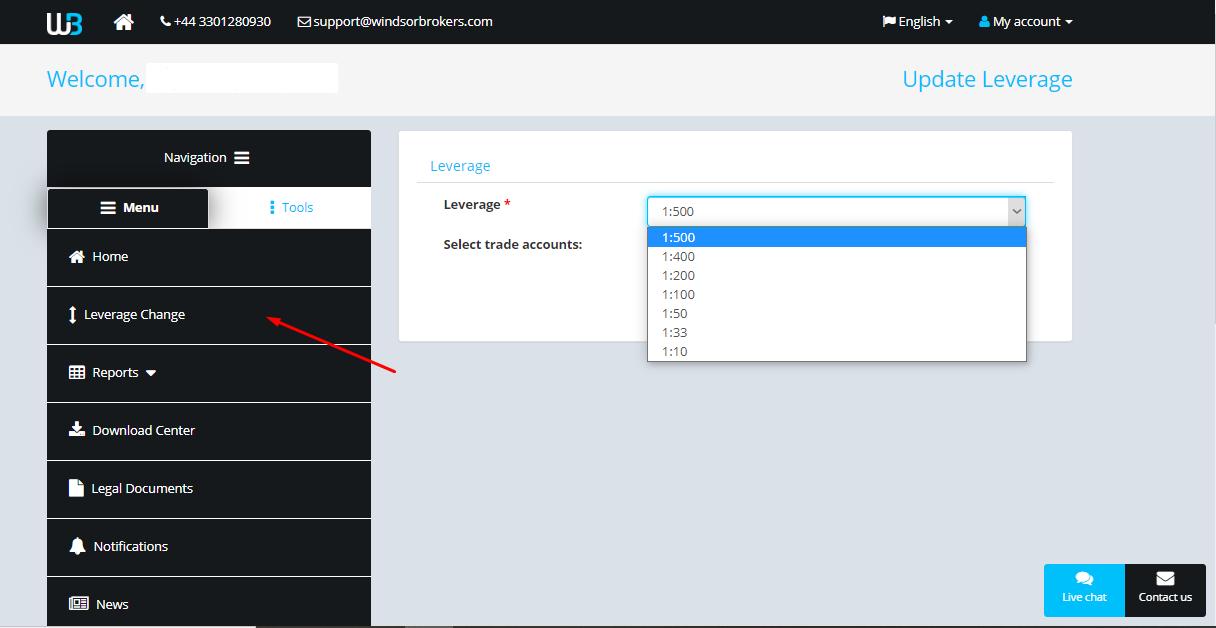

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | from 0 pips |

| 🔧 Instruments: | Currencies, spot metals, CFDs on stocks, indexes, commodities, energies, cryptocurrencies |

| 💹 Margin Call / Stop Out: | 100/20% |

| 🏛 Liquidity provider: | Confidential information |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | Cryptocurrencies are not available |

| 🎁 Contests and bonuses: | A trading bonus of $30 for new clients, a trading bonus of 20% of the deposit amount (ended August 31, 2020) |

Windsor Brokers provides two types of accounts that, according to the company statement, are designed with its clients’ trading experiences in mind. However, the terms of the accounts are still not suitable for novice traders. The minimum deposit of $50 is too high for many Forex beginners. In addition, typical spreads on currency pairs range from 1.5-3.6 pips, which is a fairly high value.

Windsor Brokers Key Parameters Evaluation

Share your experience

- Best

- Last

- Oldest

Trading Account Opening

If you want to trade with Windsor Brokers and receive a refund of the spread from the Traders Union, you need to open a real account with the broker. To do this, follow the instructions below:

Register on the Traders Union website and follow the referral link to the broker’s website. On the main page, click the “Open account” button.

Fill out the registration form with the following information: country of residence, surname and first name, phone number, email address, and communication language (Russian is not supported). Come up with a strong password and choose “Live account”. After that, confirm the e-mail by following the link that came to your specified e-mail, and click on “Login.” In the window that appears, specify the e-mail and password used during registration. Complete the profile by answering financial questions. Before adding funds to your account, be sure to pass verification.

Features of the user account include:

The user account includes the following sections:

-

technical analysis of EUR/USD, GBP/USD, USD/JPY, GBP/JPY, AUD/USD, EUR/JPY, gold, silver, crude oil, and Dow Jones assets;

-

education with video tutorials, e-books, and a glossary of terms;

-

economic calendar and Forex calculators;

-

Download Center for downloading the trading platform;

-

an online chat where clients can ask a client service expert a question in real time and a form for sending a letter to the broker’s e-mail.

Regulation and Safety

Windsor Brokers is a group of companies that have received licenses from three regulators: CySEC (Cyprus Securities and Exchange Commission), FSC (Belize International Financial Services Commission), and JSC (Jordan Securities Commission).

International regulators closely monitor the capital market to maintain a healthy investment environment and protect the interests of traders. They are the guarantors of the development of the financial market, following international standards, and ensuring the safety of domestic and foreign investors.

Advantages

- Client funds are stored in accounts separate from the broker’s capital

- Protection against negative balance

- Safety of personal data and payment details of traders

Disadvantages

- Regulators do not review the claims of private traders who hold insignificant amounts

- Regulators do not participate in compensation schemes for individuals

- Depositing and withdrawing funds from accounts is impossible without verification.

Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

|---|---|---|

| Prime | From $1 | Yes |

| Zero | From $8 | Yes |

| VIP Zero | From $8 | Yes |

All types of accounts (except Islamic ones) have swaps, which is a fee for transferring a position to the next day.

Also, TU experts conduct a comparison of trading fees at Windsor Brokers with similar terms at competitors. Based on the results, each of the brokers was assigned a level such as low, medium, or high.

| Broker | Average commission | Level |

|---|---|---|

|

$5.3 | |

|

$1 | |

|

$8.5 |

Account Types

Windsor Brokers offers several types of accounts from which to choose. They differ in terms of the minimum deposit amount, spread, fees, and the availability of swap-free accounts.

Account types:

A demo account allows the client to test the broker’s trading terms without putting his money at risk.

Windsor Brokers’ terms are developed primarily for professional traders who want to trade with narrow spreads and are ready to make a deposit starting at $2,500.

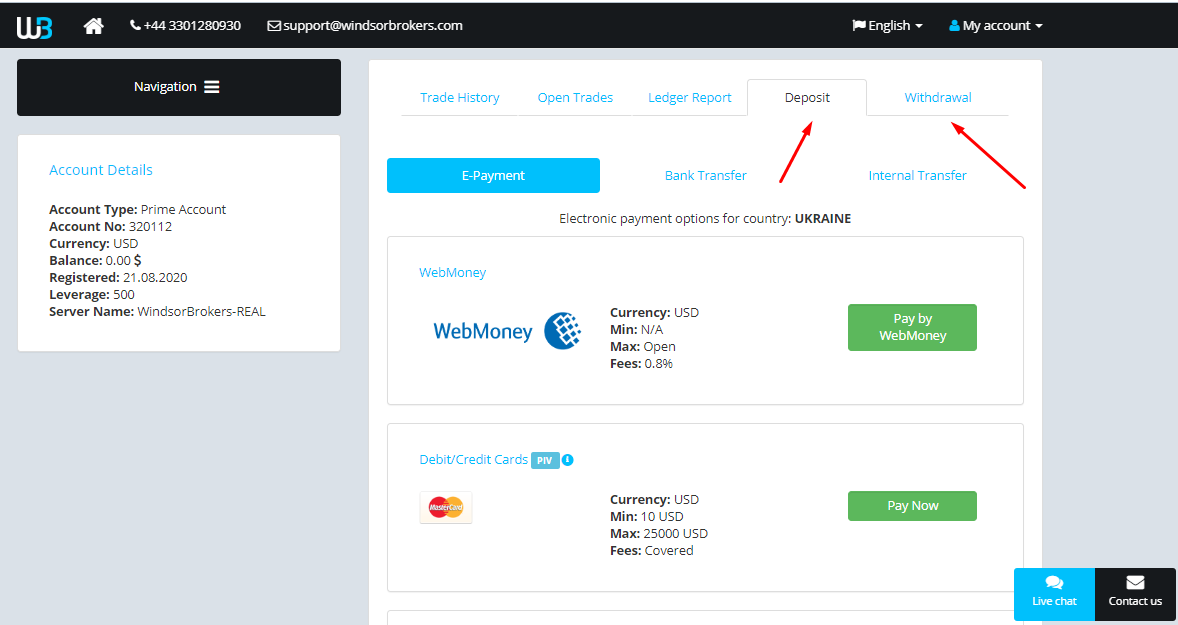

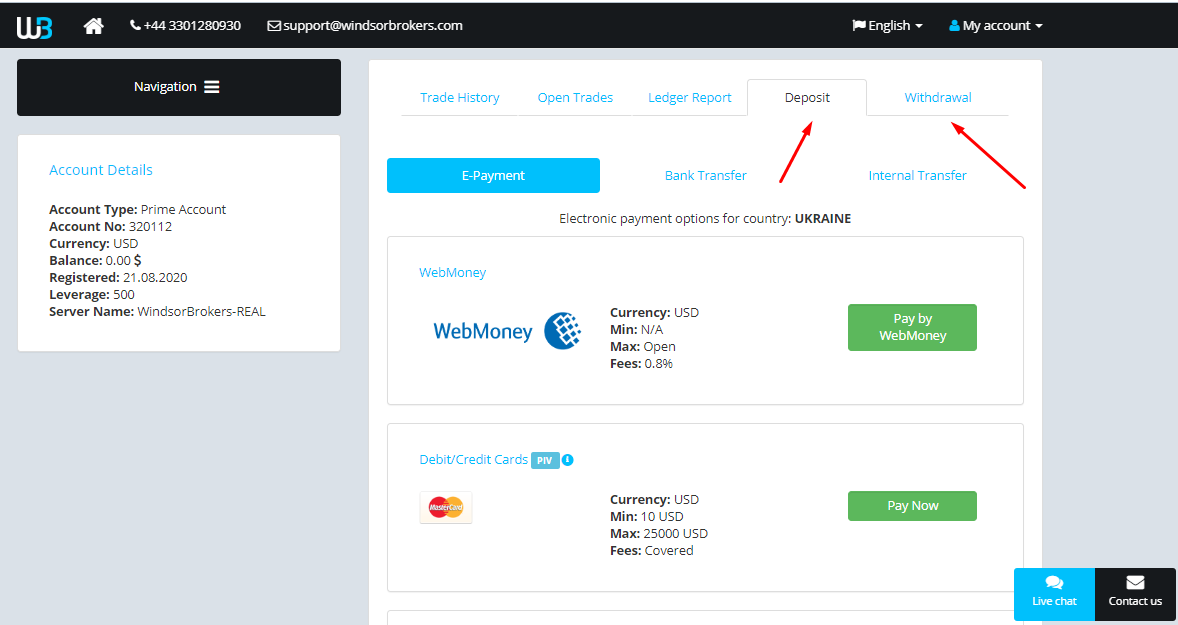

Deposit and Withdrawal

-

Windsor Brokers provides free withdrawals. However, the payment system fees are: bank cards and Neteller — $3, €3, £3 (per transaction); WebMoney — 0.8%, Skrill — 3%, and UnionPay — 0%.

-

Withdrawal methods include bank transfers, MasterCard and Visa cards, WebMoney, Neteller, Skrill, UnionPay, and e-wallets. The withdrawal methods are the same as for the deposit.

-

When transferring money from the bank card, the money must be withdrawn within 6 months. If the deposit is not withdrawn during this time, the trader must provide a bank statement for money to be transferred to the bank account.

-

Crediting to electronic wallets and bank cards takes 24 hours. The speed of bank transfers varies and depends on the bank.

-

Currencies that are available for withdrawal and deposit include: USD, EUR, GBP, COP, INR, KWD, and CNY.

-

Before depositing funds into the account, the client must pass verification.

Investment Options

The goal of Windsor Brokers is to offer favorable terms for independent trading. The broker offers only two options for obtaining passive income — a referral program and access to a trade copying service. Clients of the company are unable to invest in trust management accounts (such as PAMM accounts) or ready-made portfolios with varying levels of risk.

MQL5 Signals is a trade copying service from MQL5.community

After registering on the MQL5.community platform, Windsor Brokers clients can choose a suitable trading strategy and subscribe to it. This requires having an amount on the account that can cover the subscription price. The fee for connecting to the service is automatically deducted from the investor’s account in advance at the time of registration of the request. In the event of a profitable trade, the signal provider will be paid 20% of the profit. The terms and conditions are as follows:

While each user is allowed to copy multiple signals, a single trading account can only be used to subscribe to a single provider.

The investor sets up the subscription parameters on his own. He authorizes the copying of the stop loss and take profit levels and specifies the acceptable spread between the execution price and the copied trade’s price, within which trading signals will be executed.

The subscriber independently determines the percentage of funds on the trading account that will be used for the purchase or sale of answer asset.

The investor specifies the minimum amount of his own funds on the trading account, at which the execution of trading signals will be stopped and all positions will be closed.

Any broker’s client can be both an investor and a trader. Trading results are provided in visual form as reports and charts. The subscriber can choose a signal provider based on maximum profit, reliability, and monthly income. It is also possible to sort by leverage, intraday trading effectiveness, and subscriber reviews.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Windsor Brokers referral program

These are the terms of the referral program:

The referral program pays the client for newly connected traders (referrals), the amount of which is determined by the trader’s trading activity.

The introducing broker (IB) provides discounts or the trader pays part of his fee to the introducing broker.

Web Affiliates are paid a reward from website owners for each trading account created from directed traffic.

The White Label program rewards a fee to the partner company that sells Windsor Brokers services under its own brand.

Windsor Brokers offer individual remuneration schemes for partners, multilingual client support service, easy setup, and free access to the Windsor Partners portal.

Customer Support

The broker’s client support service is available 24/5.

Advantages

- The quick response of operators in online chat

Disadvantages

- The support service is not available on weekends

- The support service does not provide answers in Russian

- The client can make a call only to the of Belize and Jordan numbers

- No callback option

Ways to reach client’s support service:

-

by phone via the numbers listed on the website;

-

by email;

-

in an online chat on the broker’s website;

-

via the client’s user account.

The company has pages on Facebook, Twitter, YouTube, and LinkedIn.

Contacts

| Foundation date | 2010 |

|---|---|

| Registration address | 35 Barrack Road, 2nd Floor, Unit 204, Belize City, Belize |

| Regulation |

CySEC, FSC (Belize), FSA (Seychelles), JSC, CMA

Licence number: CYSEC - 030/04 |

| Official site | windsorbrokers.com |

| Contacts |

+44 1145519650 ,+44 3301280930, +962 6 550 9090, +254 205029240

|

Education

The company’s website has a dedicated Education section. In this section, traders can find theoretical courses as well as sign up for upcoming webinars from Windsor Brokers experts.

Clients can use a free demo account to assess their level of knowledge.

Comparison of Windsor Brokers with other Brokers

| Windsor Brokers | RoboForex | Pocket Option | Exness | TeleTrade | Vantage Markets | |

| Trading platform |

MT4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5 | MT4, MT5, WebTrader, Mobile Apps |

| Min deposit | $50 | $10 | $5 | $10 | $1 | $50 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:10 |

From 1:1 to 1:500 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0.8 points | From 0 points |

| Level of margin call / stop out |

100% / 20% | 60% / 40% | 30% / 50% | No / 60% | 70% / 20% | 100% / 50% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Detailed review of Windsor Brokers

Windsor Brokers is an international broker with more than 30 years of experience that strives to make investing accessible to everyone. The company offers its clients narrow spreads, a diverse range of trading assets, and high-quality educational materials for beginners who know English. After registering with a broker, traders gain access to useful tools and services for optimizing trading, as well as several methods for depositing and withdrawing funds at reasonable fees.

Windsor Brokers by the numbers:

-

more than 30 years of work in the global financial market;

-

insurance for each client up to 5,000,000 euros;

-

more than 20 international awards.

Windsor Brokers is a broker for active and passive trading

The management of Windsor Brokers believes that everyone should be able to trade on financial markets under fair, efficient, and safe terms. The broker offers several types of accounts, including one with a $50 deposit and professional education for novice traders, and one with a floating spread of 0.0 pips for professionals. The company’s clients get access to market analysis, expert analytical materials, trading ideas, and technical reviews. The broker offers to connect to signals from the MQL5.com website and take part in the referral program for passive income without independent trading.

The broker’s clients trade on MetaTrader 4, the most popular platform among traders. In addition to the desktop trading platform, there is a web version and mobile applications for Android smartphones and tablets, iPhones, and iPads. The broker also provides a multiplatform which serves as an online service for the simultaneous management of multiple accounts.

Useful Windsor Brokers services:

-

analytics, which is a section with in-depth market analysis and a daily technical review from the industry’s leading financial analysts;

-

the economic calendar shows world news and events in real time that may influence the results of trading;

-

calculators for determining profit, margin, spread, reversal point, and Fibonacci levels.

Advantages:

licenses from international regulators, including CySEC, FSC, and JSC;

fast order execution speeds;

free access to market analysis and educational materials.

Although the broker does not forbid scalping or hedging, it does establish a restriction of 50 lots per ticket for Forex.

User Satisfaction