deposit:

- €89

Trading platform:

- MT4

- MT5

- cTrader

deposit:

- €89

Trading platform:

- MT4

- MT5

- cTrader

- Forex only

- challenges can be restarted

- initial fees are returned

- profits split 80/20

- transparent payouts

- Individual

Summary of True Forex Funds Trading Company

True Forex Funds is a moderate-risk prop trading firm with the TU Overall Score of 5.73 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by True Forex Funds clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this firm as not all clients are satisfied with the company, according to reviews. True Forex Funds ranks 17 among 41 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria and a test on how to open an account.

True Forex Funds offers favorable conditions for partners with any experience and goals. The available plans and account currencies, access to growing your balance through successful trading, and the absence of limits on strategies enable you to put almost any solution into action and achieve your most ambitious goals. Initial fees may be returned, no monthly fees are charged, and the profit split is 80/20. These are beneficial, competitive terms that few prop trading firms offer.

The True Forex Funds proprietary (prop) trader provides its partners with funds for trading in the currency market. Balances are available in USD, EUR, or GBP, ranging from $10,000 to $200,000 or the equivalents in the other two currencies. Later on, the balance can be increased to $400,000. The challenge has 2 phases comprised of 8% and 5% profit targets. After the completion of the challenge, no limits apply on strategies or the number of trading days. You only need to monitor the daily and overall drawdowns. The 80/20 profit split is in favor of the trader. True Forex Funds does not charge monthly fees. Only initial fees apply and they are fully reimbursed if you pass the challenge. The prop trading firm offers a typical referral program with payouts of 15% of the invited partners’ initial fees. The company’s operation is completely transparent. The payouts register is constantly updated. Clients can trade on МТ4, МТ5, or cTrader.

| 💰 Account currency: | USD, EUR, GBP |

|---|---|

| 🚀 Minimum deposit: | €89 |

| ⚖️ Leverage: | Individual |

| 💱 Spread: | Unavailable |

| 🔧 Instruments: | Currency pairs only |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with True Forex Funds:

- the firm offers five plans that differ in the initial fee, balance, and acceptable drawdown;

- traders can choose USD, EUR, or GBP as an account currency;

- the initial fee is reimbursed if a trader passes the challenge;

- if you exceed a time or drawdown limit, you can try again for free;

- trading partners take 80% of their net profits;

- spreads are lower than if you trade directly with a broker;

- socially active traders can make good money through the affiliate program.

👎 Disadvantages of True Forex Funds:

- the firm offers only one type of trading instrument: currency pairs;

- you can only use three trading platforms. Other solutions are unavailable;

- tech support can be contacted through tickets on the website, live chat, or email. There is no call center.

Evaluation of the most influential parameters of True Forex Funds

Table of Contents

Geographic Distribution of True Forex Funds Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of True Forex Funds

True Forex Funds is headquartered in Hungary and operates in over 110 countries without regional restrictions. The company is unique in that it lets you select your account currency (USD, EUR, or GBP), whereas other proprietary trading firms usually offer only one currency. You can also choose your account size from $10,000 to $200,000, which can later be increased to $400,000 or the equivalent in another currency.

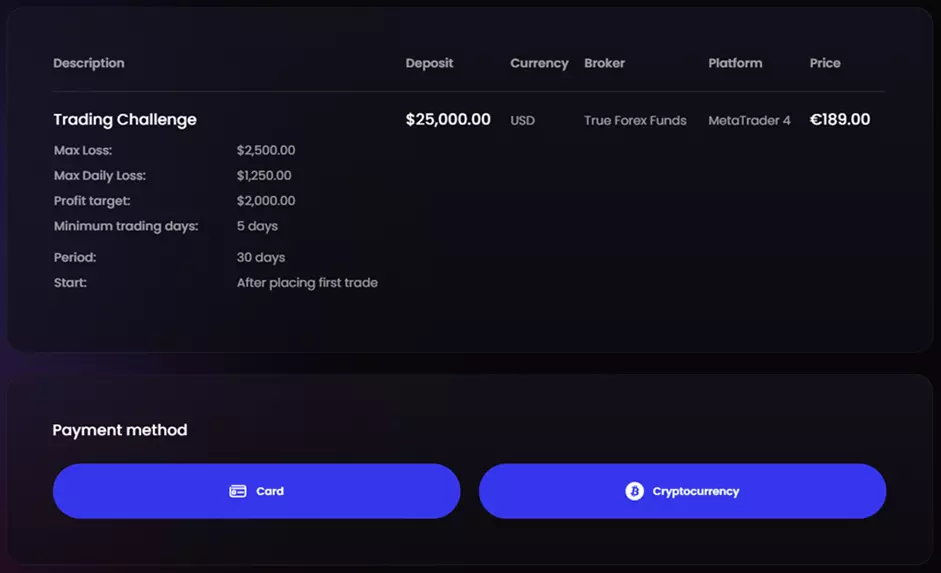

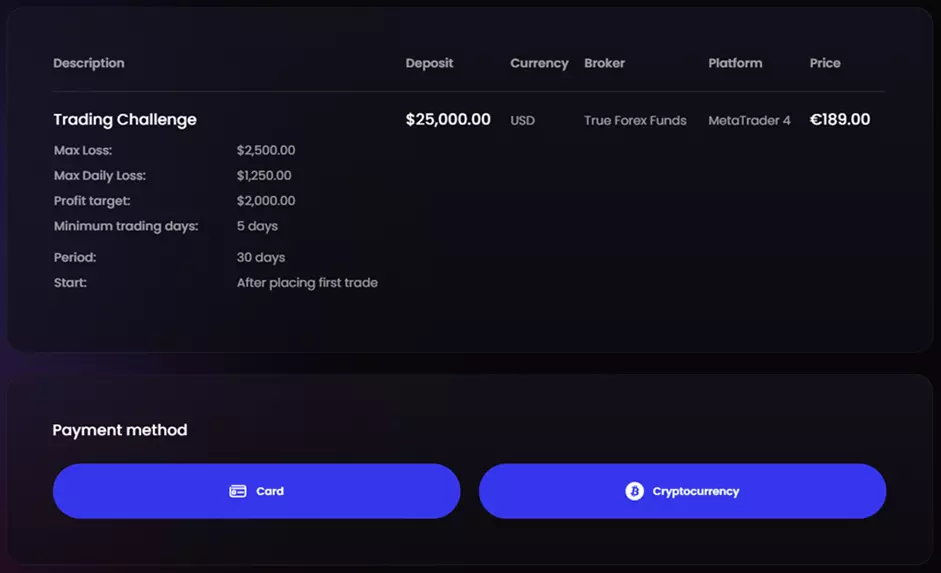

The challenge conditions are standard. There are two phases. The first one lasts for 30 days and its profit target is 8% of the balance. The second one lasts for 60 days and its profit target is 5%. These objectives are quite realistic for experienced traders who use leverage. Beginners may have difficulties, but if they fail to pass the first or second phase, they can retry for free. The initial fee amount depends on the balance and is reimbursed after the successful completion of the challenge. It means that becoming the firm’s partner doesn’t actually cost you anything. You only pay the broker fees for spreads and leave 20% of your net profit to the platform.

Restrictions on the number of trading days only concern the challenge and don’t apply after you pass it. You can trade intraday, hold trades overnight or through the weekend, or open long positions for any term. These are rather lenient conditions. Comparative analysis shows that very few prop trading firms offer similar trading parameters. It’s important to mention that the company’s activity is 100% transparent. It even publishes lists of the leaders and information about all payouts. The same goes for the liquidity providers: these are proven reliable organizations.

Based on the above factors, True Forex Funds can be recommended to traders with any experience and ambitions. The possibility to get a balance of up to $400,000 or the equivalent in another currency is a good incentive. Naturally, leverage is available, but it is determined individually. The relative downsides are the limited number of available instruments and trading platforms and that the support service does not have a call center.

Dynamics of True Forex Funds’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Proprietary trading firms do not provide typical investment solutions like buying dividend stocks or investing funds in cryptocurrency staking. Referral programs are almost always the only option for passive earning with prop firms. Partners get rewards for inviting users through affiliate links or codes. Thus, platforms develop by increasing the influx of users.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

True Forex Funds’ affiliate program:

Every partner of this prop trading firm gets a referral link that can be posted on any website. Users who follow the link and register on the True Forex Funds website bring the link’s owner 15% of their initial fees. The number of users that can be invited to the platform is unlimited. Rewards accrue in the partner’s user account and can be withdrawn along with profits from Forex trading.

Trading Conditions for True Forex Funds Users

Although partners can select account currencies, initial fees are always paid in euros. The range is from €89 to €998, depending on the required balance. True Forex Funds does not charge monthly or additional fees, or trading or withdrawal fees. Leverage is available for all trading instruments, but is determined individually and on what assets are traded, plus external factors. Client support responds to tickets, emails, and live chat messages. You can submit requests around the clock, but if you do it after hours, you will have to wait for a response.

€89

Minimum

deposit

| 💻 Trading platform: | MT4, MT5, cTrader |

|---|---|

| 📊 Accounts: | $10,000, $25,000, $50,000, $100,000, and $200,000 (or equivalents in another currency) |

| 💰 Account currency: | USD, EUR, GBP |

| 💵 Replenishment / Withdrawal: | Bank transfer, bank card, cryptocurrency wallet |

| 🚀 Minimum deposit: | €89 |

| ⚖️ Leverage: | Individual |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No |

| 💱 Spread: | Unavailable |

| 🔧 Instruments: | Currency pairs only |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Unavailable |

| ⭐ Trading features: | Forex only; challenges can be restarted; initial fees are returned; profits split 80/20; transparent payouts |

| 🎁 Contests and bonuses: | No |

Comparison of True Forex Funds to other prop firms

| True Forex Funds | Topstep | FTMO | Funded Trading Plus | FTUK | Earn2Trade | |

| Trading platform |

cTrader, MT4, MT5 | Deriv Trader, TSTrader, NinjaTrader, TradingView, Bookmap X-ray, Cunningham Trading Systems, DayTradr, InvestorRT, MotiveWave, MultiCharts, Rithmic R|TRADER Pro, Trade Navigator, Volfix.net | MetaTrader4, MetaTrader5, cTrader | MetaTrader4, MetaTrader5 | MT4, MT5 | NinjaTrader, R Trader Pro, Finamark |

| Min deposit | $89 | $1 | $155 | $119 | $119 | $90 |

| Leverage |

From 1:1 to 1:1 |

From 1:1 to 1:100 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

From 1:1 to 1:1 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | 1% / 1% | 50% / 50% | No | No | 10% / 10% |

| Execution of orders | N/a | ECN | Instant Execution | Market Execution | No | Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Prop firms’ comparative table by trading instruments

| True Forex Funds | Topstep | FTMO | Funded Trading Plus | FTUK | Earn2Trade | |

| Forex | Yes | No | Yes | Yes | Yes | No |

| Metalls | No | Yes | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes | Yes | No |

| CFD | No | No | Yes | Yes | No | No |

| Indexes | No | No | Yes | Yes | Yes | Yes |

| Stock | No | Yes | Yes | No | No | Yes |

| ETF | No | No | No | No | No | No |

| Options | No | No | No | No | No | No |

True Forex Funds Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| $10,000 | No (determined by liquidity providers) | No |

| $25,000 | No (determined by liquidity providers) | No |

| $50,000 | No (determined by liquidity providers) | No |

| $100,000 | No (determined by liquidity providers) | No |

| $200,000 | No (determined by liquidity providers) | No |

In any case, traders that use a prop firm’s funds pay spreads and/or trading fees set by brokers. The nuance is that prop trading firms conclude their own agreements with brokers, which enables them to offer their partners more favorable terms than if they trade with brokers directly. True Forex Funds ensures some of the tightest spreads in the market.

Detailed review of True Forex Funds

True Forex Funds was founded by currency market professionals who know exactly what their partners need. The company has a physical office in Györ, Hungary, but operates worldwide. Verification requirements and challenge objectives are reasonable. Earning 8% of the balance within 30 days and then 5% within 60 days is not very difficult. The challenge has general time limits and requires you to trade at least 5 days per trading cycle. After the challenge, no such limits apply and partners of the prop firm can trade at their own pace. They only need to monitor the maximum daily and overall drawdowns that are rather high: up to 5% and 10% of the balance respectively. Therefore, cooperation with this prop trading firm is equally convenient for novice and veteran traders with a plethora of strategic preferences.

True Forex Funds by the numbers:

-

$400,000 maximum balance;

-

110 countries;

-

80% profit share goes to a trader;

-

$14 million paid out;

-

24 hours average payout time.

The True Forex Funds proprietary trading firm is focused on Forex

Some prop firms offer several groups of financial instruments, while others prefer to focus on one particular asset group. There is no right or wrong approach here. Everything depends on the platform’s vision and goals. Since its establishment, True Forex Funds has only been providing currency pairs to its clients because the company’s founders are Forex professionals. The advantage of its focus on currencies is that the firm carefully selects brokers that offer the most favorable terms in this segment. As a result, traders get lower spreads and faster execution of transactions compared to directly trading with brokers. But certainly, the main advantage is access to trading with serious capital that a trader cannot afford on his own.

Useful features of True Forex Funds:

-

a trader can select his desired balance from $10,000-$200,000, and the preferred currency of his account from among the USD, EUR, or GBP;

-

if for some reason a trader fails to pass the challenge, they can try again for free and the number of attempts is unlimited;

-

after the completion of the challenge, the minimum activity limits are removed and you can trade any number of days (initially, set for at least 5);

-

the affiliate program lets you earn passively by getting 15% of the initial fees of the users who followed your referral link;

-

traders can hold positions and trade at night or during weekends. They only have to see to it that the daily and overall drawdowns do not exceed the limits.

Advantages:

traders can choose one of the five plans in accordance with the required balance. The plans determine the challenge objectives, including drawdown limits;

besides the balance, you can choose one of the three account currencies: USD, EUR, or GBP. Your choice only affects the withdrawal currency, not the trading conditions or available instruments;

the challenge has two stages that are fairly easy: 8% in 30 days and 5% in 60 days. If a trader fails one of the stages, a free retrial is always available;

you can get from $10,000 to $200,000 from the start and if you trade well, the firm grants you additional funding up to $400,000;

a trader’s profit share is 80% with 20% going to the platform, which is one of the highest values in the segment. Many prop firms offer a 50/50 split.

Guide on how traders can start earning profits

Whatever prop firm you cooperate with, the right choice of a plan is key. True Forex Funds offers five accounts that only differ in the balance and acceptable drawdown. Traders can also select account currencies. It is reasonable to select a currency based on your region. In Europe, it will be easier to get payouts in euros and, in the UK, pounds sterling will be a better choice. In other regions, U.S. dollars are mostly chosen. The more experience and ambitions you have, the larger balance you need from the start. Even with $10,000, you can move all the way up to $400,000, although it will take more time than if you get $200,000 at the start.

Account types:

Note that the initial fee is fully reimbursed if you pass the challenge. If for some reason a trader cannot complete the challenge, they lose the right to the fee reimbursement.

Investment Education Online

Proprietary trading firms want their partners to trade successfully, as the firms’ profits rise along with traders’ profits. For this reason, such platforms provide educational content, guides, and instructions. True Forex Funds does not focus on teaching, but its official website features a useful blog and support center that cover Forex-related topics.

Presently, the company’s blog is under development and there are not many articles on it. But the already published ones were written by experts and have practical value, especially for novice traders. The main source of knowledge is the support center that focuses on presenting the platform and explaining the basics of Forex.

Security (Protection for Investors)

As a proprietary trading firm, True Forex Funds does not route its clients’ trades to the market. This is done by brokers that are required to be licensed and regulated. All brokers that cooperate with True Forex Funds are proven and reliable. They are regulated by state and international agencies.

👍 Advantages

- Traders can always turn to the company’s tech support

- Traders can contact the legal department of the primary broker

👎 Disadvantages

- The company is not responsible for the execution of trading orders

Withdrawal Options and Fees

-

After passing the challenge, a client starts trading on a real account and gets 80% of his net profit.

-

If a trader uses the affiliate program, all referral payouts are made to his user account.

-

Withdrawal requests are processed by tech support and delivered in minimal time.

-

Payouts are available once a week.

-

Withdrawals can be made through primary channels, including bank cards and cryptocurrency wallets.

-

After a withdrawal request is approved, it takes an average of 24 hours for the funds to arrive in your account.

Customer Support Service

True Forex Funds does not have a call center but has a physical office that clients can visit to get expert help. In most cases, however, it is easier to request help through tickets on the website, live chat, or email. Support works Monday through Saturday, 08:00-13:00 GMT.

👍 Advantages

- You can get advice even if you are not the firm’s partner

- During business hours, the managers respond very promptly

👎 Disadvantages

- No call center

Client support can be contacted via the following channels:

-

tickets in the Contacts section;

-

tab with messages in your user account;

-

email;

-

live chat link, which is at the bottom right corner of the website.

You can send a ticket or email even during off hours and weekends. But your request will be processed on the next regular business day.

Contacts

| Foundation date | 2020 |

| Registration address | Bajcsy-Zsilinszky út 27, 3rd floor office. 9021, Győr, Hungary |

| Official site | https://trueforexfunds.com/ |

| Contacts |

Email:

support@trueforexfunds.com,

|

Review of the Personal Cabinet of True Forex Funds

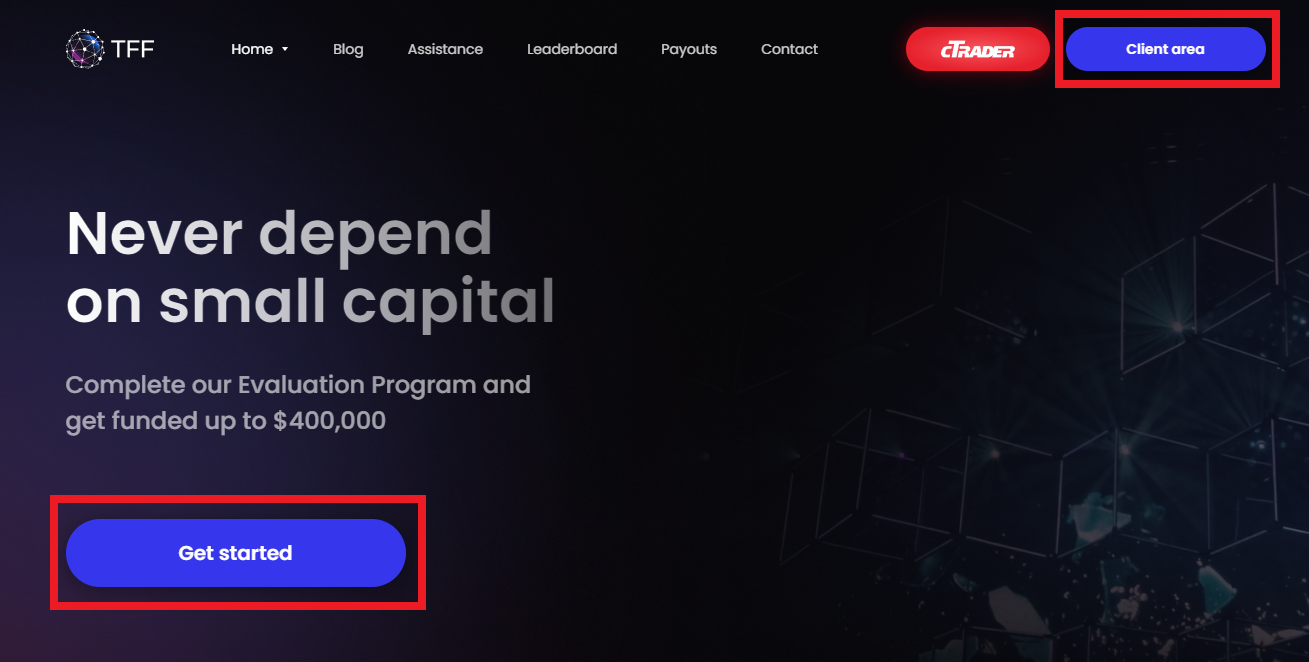

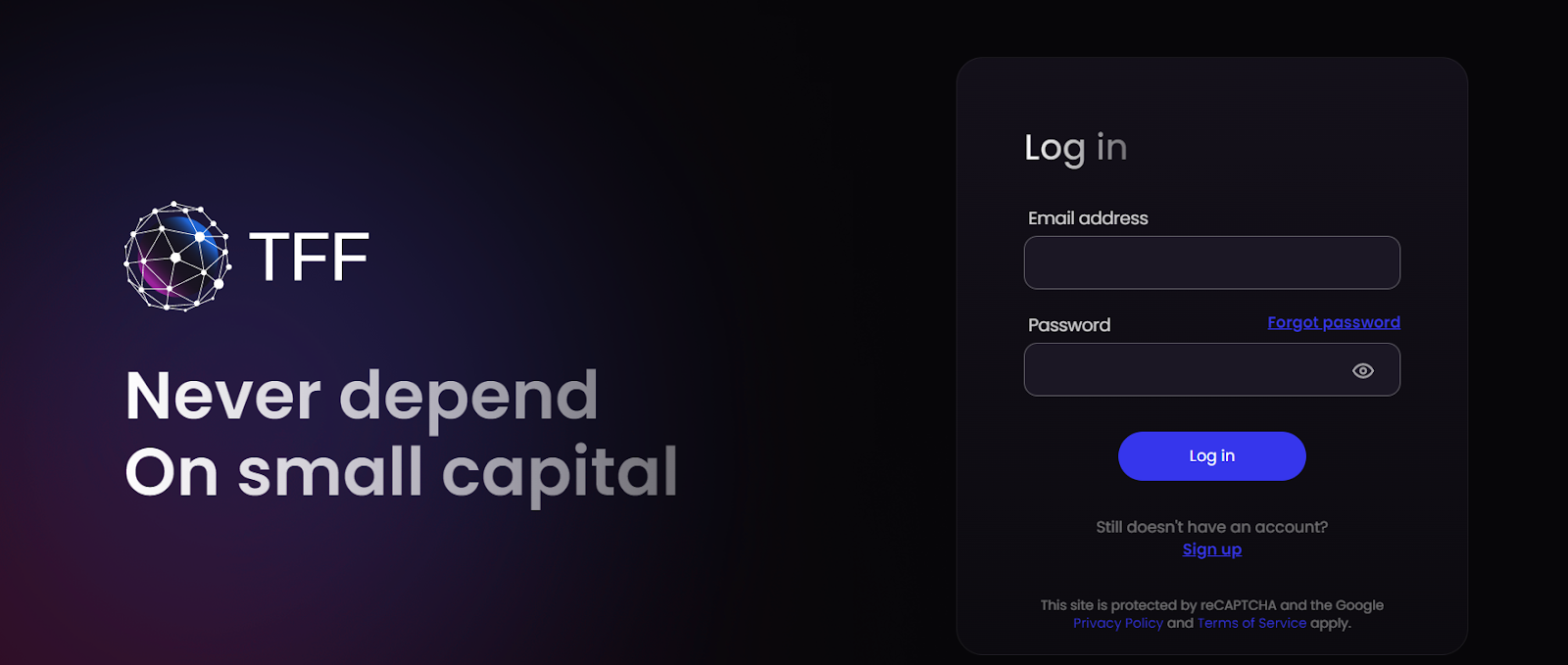

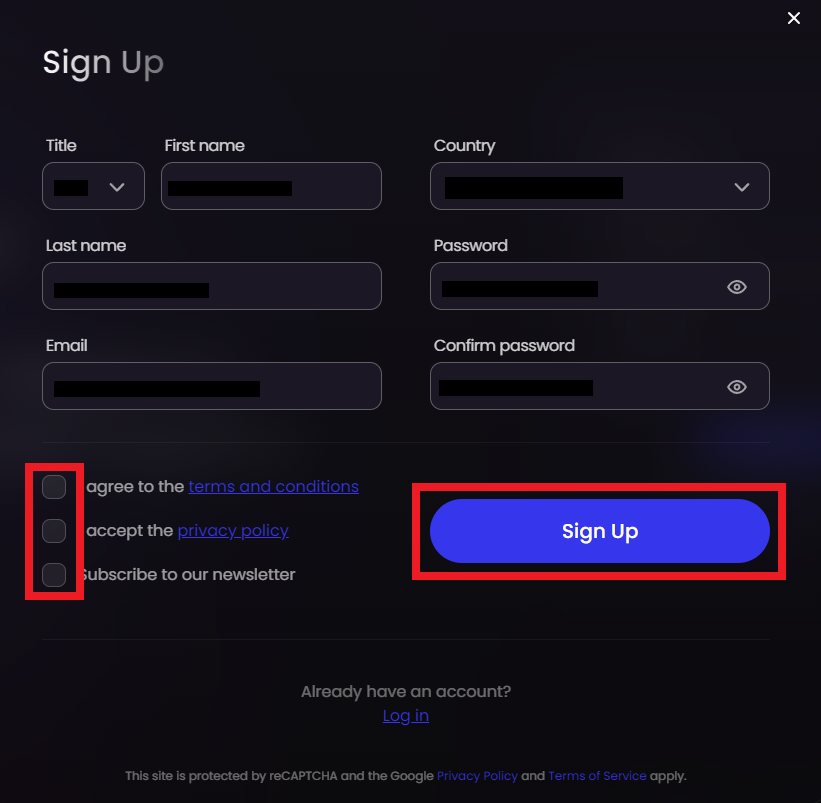

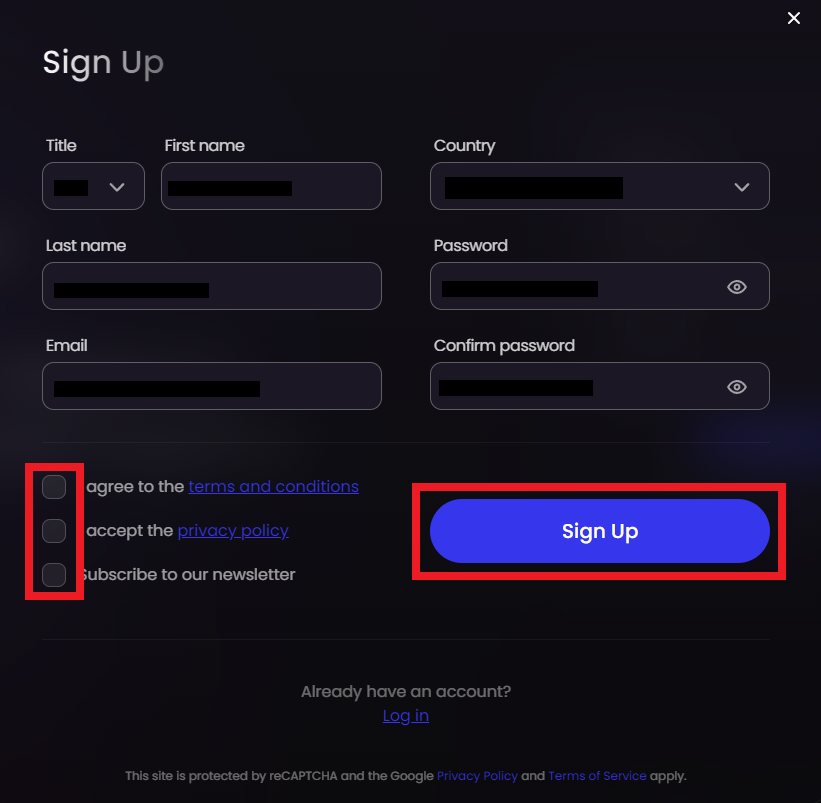

To start cooperating with this proprietary trading firm, register on its official website.

Click the “Client area” button in the top right corner or the “Get started” tab on the same page. Both actions will lead to the same result.

If you already have a user account, log in to it. If you don’t, click “Sign up”. Remember that if questions come up at some point, you can always turn to tech support even if you are not a partner of the firm. The easiest way to do it is via the live chat in the bottom right corner of the screen.

Select a title (Mr., Mrs., etc.) and enter your first and last names, email address, and country of residence. Generate a password and confirm it. Accept the terms of service by ticking the boxes. A subscription to the newsletter is not necessary but is recommended. Next, click “Sign Up”.

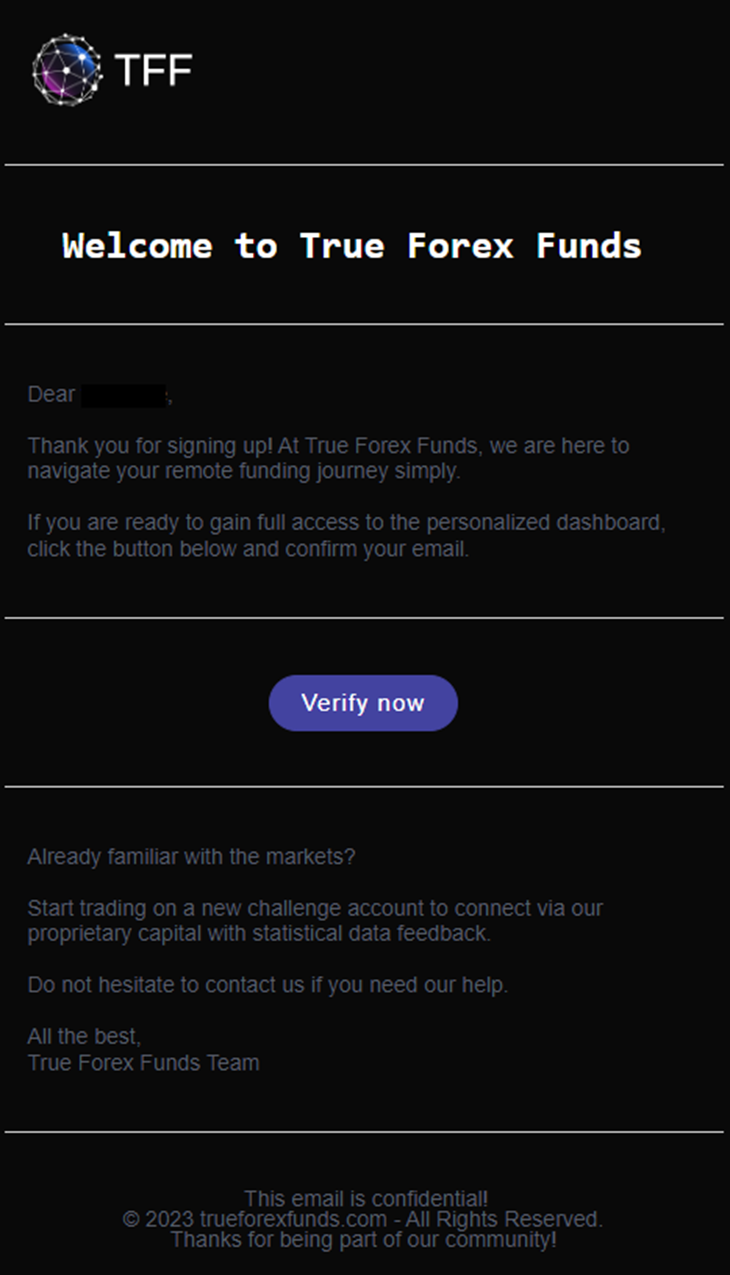

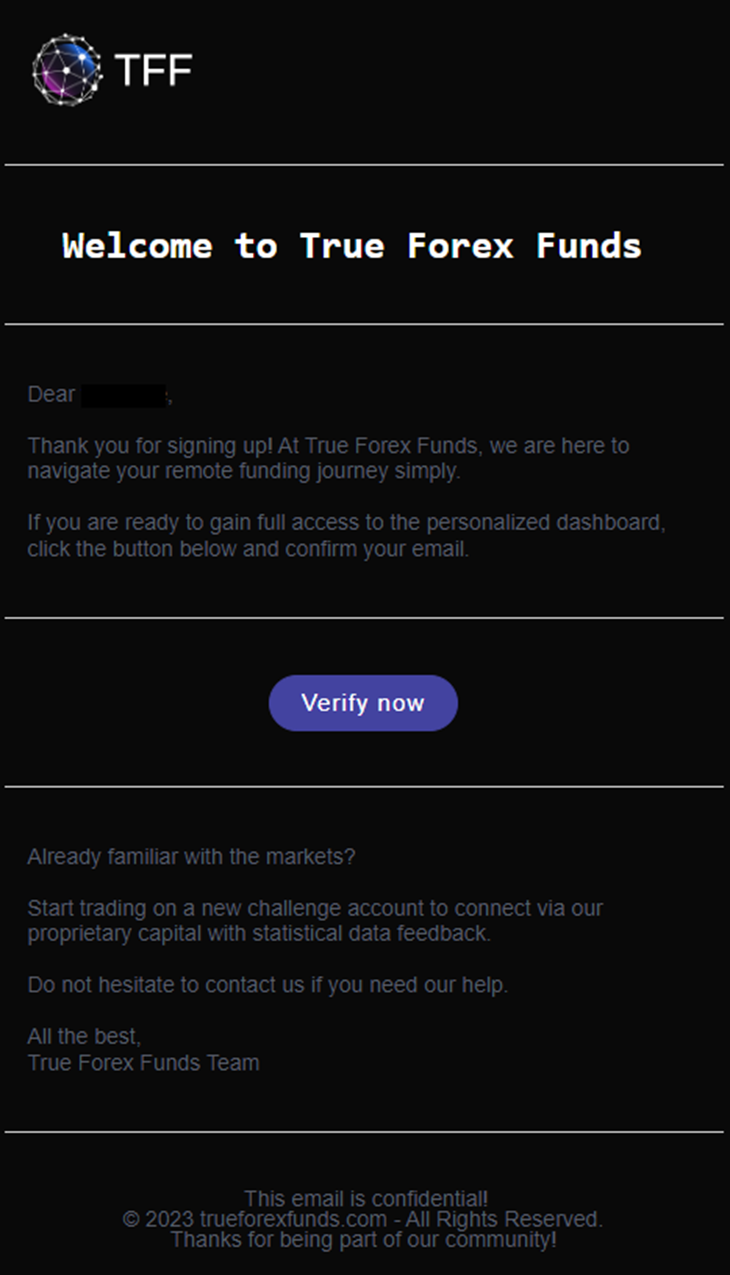

A message with a link will arrive at the email address you included. Follow the link and confirm the registration. Enter your email and password to finish registering and log in to your user account.

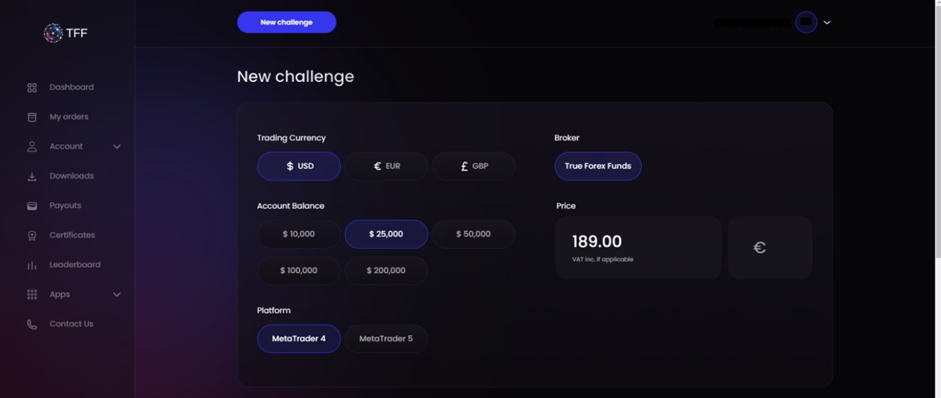

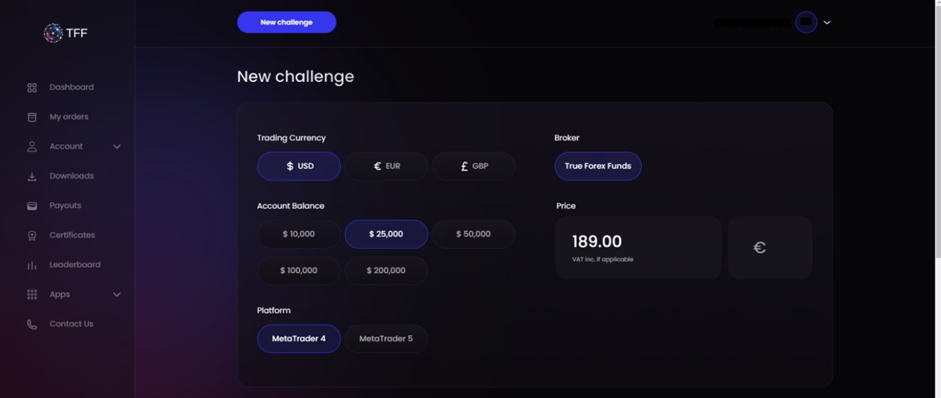

On the dashboard, click “Challenge” and select account parameters and a trading platform. In the lower part of the page, include your personal information: phone number and residential address with a zip code. Accept the terms of service by ticking the boxes. Click “Place an order”.

Review the challenge conditions and price. Choose a payment method: bank card or cryptocurrency wallet. If these channels are not suitable for you, contact tech support and find out how else you can pay the initial fee. Follow the on-screen instructions. After your payment is processed, you will be able to start the challenge. As soon as you complete it, you will get access to a real account.

Features of the True Forex Funds user account:

-

The dashboard displays your progress in the challenge and aggregates data on your account balance.

-

My Orders show a list of paid fees and reimbursements.

-

The user account contains settings that enable you to change personal and corporate information, as well as combine multiple accounts.

-

The Downloads store allows the download of files that can be used to install trading platforms.

-

Payouts store contains data on all withdrawal requests, including archived ones.

-

Certificates show a trader’s personal achievements such as completed challenges and payout receipts.

-

The leaderboard is a list of the platform’s best partners that earned the highest profits in a trading cycle.

-

Apps. Here, a trader can launch the capital curve simulator and the time zone converter.

-

Contact Us. Here, a partner can find the prop firm’s contacts and form tickets with requests.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

How do client reviews impact True Forex Funds rating?

Any review can raise or lower the rating of any company in the Forex prop firms rating. To read reviews about True Forex Funds you need to go to the company's profile.

How can I leave a review about True Forex Funds on the Traders Union website?

To leave a review about True Forex Funds , you need to register on the Traders Union website.

Can I leave a comment about True Forex Funds if I am not a Traders Union client?

Anyone can post a comment about True Forex Funds in any review about the company.

Traders Union Recommends: Choose the Best!