How Much Do You Need To Invest In Forex?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Investing in Forex can start from $10-100. However, ideal amounts can go up to $10,000 or even higher based on your goals and risk tolerance. Long term investing typically requires less capital than short term trading while beginners should ideally start small and increase their investment gradually.

Forex trading, or foreign exchange trading, involves buying and selling currencies to profit from fluctuations in exchange rates. As the largest and most liquid market in the world, Forex trading offers numerous opportunities for traders of all levels. However, selecting the right amount to invest in often becomes a challenging consideration. This guide discusses how you can estimate the right investment amount, regardless of being a beginner or advanced trader.

The amount of capital needed to start Forex trading can vary significantly depending on the broker and the type of account you choose. Typically, brokers require a minimum deposit ranging from $100 to $500 for standard accounts. However, to effectively manage risk and withstand market fluctuations, starting with at least $1,000 to $2,000 is recommended.

This comparison will help you decide better when selecting a broker that best fits your trading goals and budget.

| Plus500 | Pepperstone | OANDA | FOREX.com | Interactive Brokers | IG Markets | |

|---|---|---|---|---|---|---|

|

Minimum deposit, $ |

$100 | $0 | No | $1000 | No | $1 |

|

Trading Platforms |

Mobile, Web, Desktop | MT4, MobileTrading, WebTrader, cTrader, MT5, TradingView | WebTrader, MetaTrader4, Mobile platforms, MetaTrader5 | FOREX.com, MT4, MT5 | Trader Workstation, IBKR Mobile, APIs | MetaTrader4, API, ProRealTime, IG Trading Platform |

|

Accounts |

Demo, User | Razor, Standard | Standard, Core, Swap-free, Premium, Premium Core | Standard account, Commission account, Direct Market Access account (DMA) | Real, Demo | Demo and CFD |

|

Leverage, 1: |

Up to 1:30 or up to 1:300 | Up to $400:1 retail, 500:1 Pro | Up to 1:200 | Up to 1:400 | Depending on the asset | Up to 1:200 |

|

Copy trading |

No | Yes | Yes | Yes | No | Yes |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

Study review |

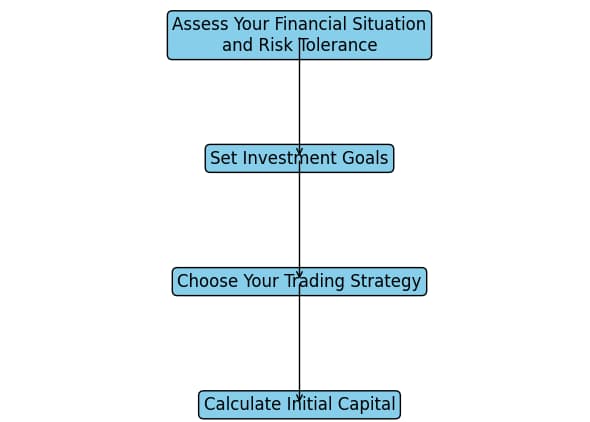

Step-by-step guide to determining your initial investment

Steps to Determine Your Initial Investment

Steps to Determine Your Initial InvestmentAssess your financial situation and risk tolerance. Determine how much capital you can afford to risk without affecting your financial stability.

Set investment goals. Decide whether your goal is short-term gains or long-term growth.

Calculate initial capital based on trading strategy. For example Scalping requires higher initial capital due to frequent trades and tight spreads, Day trading requires moderate capital for intra-day trades, Swing trading requires lower initial capital as suitable for trades held over several days.

Here's a tabular representation of how you can invest in Forex with different amounts of capital:

| Investment Amount | Strategy | Description |

|---|---|---|

0 dollars | Demo Trading | Use demo accounts provided by brokers to practice trading with virtual funds. Learn market basics, develop strategies, and build confidence without risking real money. |

1 dollar | Micro Accounts | Open a micro account with brokers offering low minimum deposits. Start trading with small positions, reducing overall risk. |

100 dollars | Standard Account | Open a standard trading account with $100 and use leverage to control larger positions. Manage expectations and use as a learning tool. Test and optimize trading strategies with real money, focusing on learning and improvement. |

150 dollars | Proprietary Trading Firms | Engage with proprietary trading firms to access leverage and trading capital beyond your initial deposit. Utilize the firm’s resources to trade larger positions and potentially increase profits. |

500 dollars | Copy Trading | Mimic the trades of experienced traders by allocating funds to copy their trades automatically. |

PAMM Accounts | Invest with skilled traders who manage multiple accounts, sharing profits and losses proportionally. | |

5,000 dollars | Independent Trading | Trade independently with a well-structured plan. A $5,000 investment allows for substantial trading while managing risk effectively. |

Professional Approach | Aim for a realistic return (e.g., 10% monthly) with disciplined trading and risk management. |

Factors influencing investment amount

Several factors come into play when deciding the investment amount:

Trading Goals and Objectives

Whether you aim for short-term gains or long-term growth will significantly impact your required investment amount.

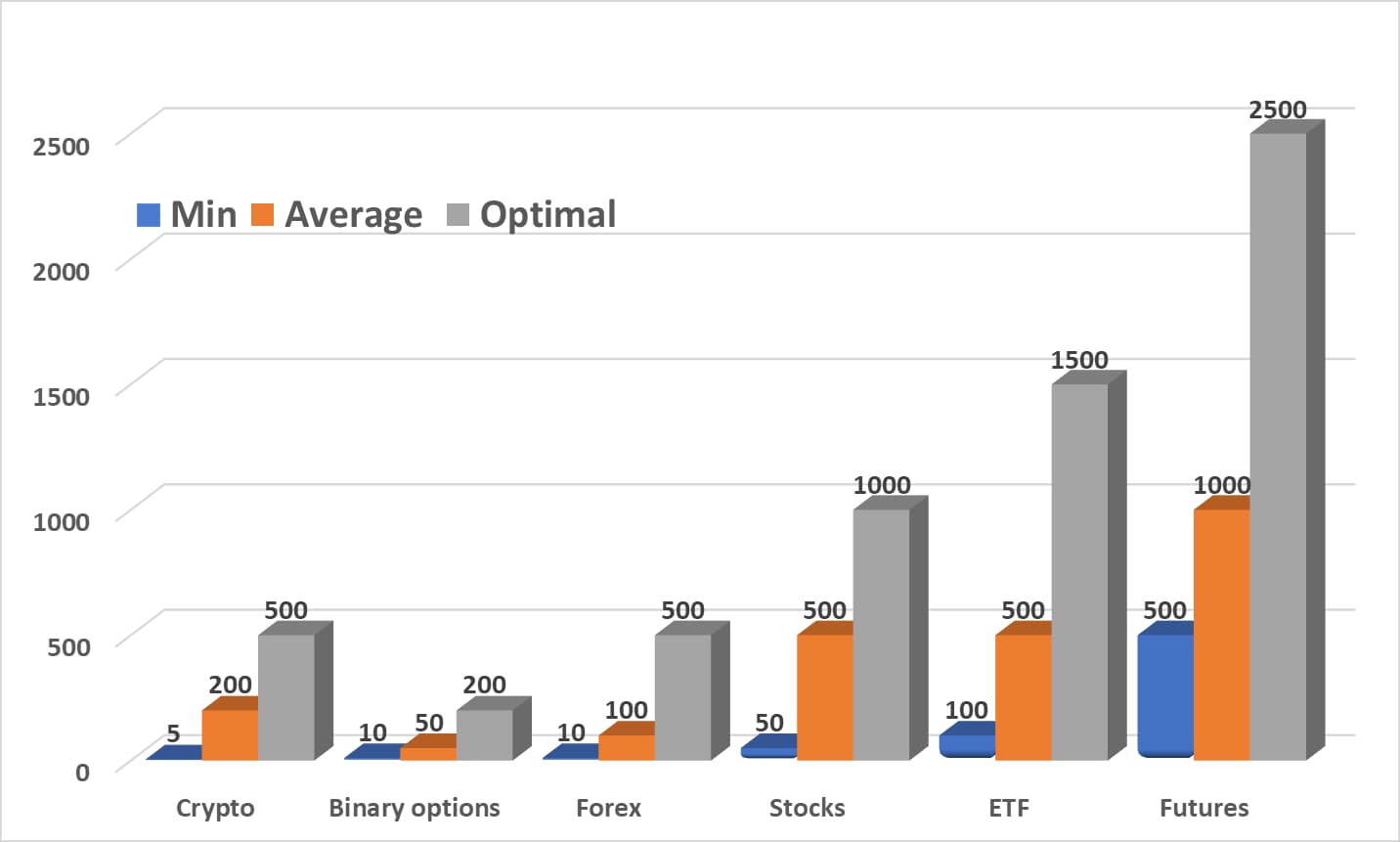

Comparison of minimum investment amounts

Comparison of minimum investment amountsShort-term trading

Short-term traders, such as day traders or scalpers, often require more capital to cover frequent trades and take advantage of smaller price movements. The high volume of trades and the need for quick execution mean that short-term traders need to ensure they have sufficient funds to manage multiple positions and margin requirements.Long-term trading

Long-term traders, such as swing traders or position traders, can often start with less capital. These traders focus on larger price movements over extended periods, reducing the frequency of trades and, consequently, the need for a high initial investment.

Risk tolerance

Risk tolerance reflects your willingness and ability to bear potential losses in your trading activities. It is inversely related to your capital requirement as having high risk tolerance means you’re comfortable risking a bigger portion of your capital each trade, effectively being comfortable with low initial capital.

Now, let's look at the table with techniques for managing risk and their description.

| Technique | Description |

|---|---|

Position sizing | Determine the size of each trade based on total capital and risk tolerance. |

Leverage control | Use leverage cautiously to enhance gains while minimizing potential losses. |

Stop-loss orders | Set predetermined levels to exit trades and limit potential losses. |

Diversification | Spread investments across various assets to reduce risk exposure. |

Hedging | Use financial instruments to offset potential losses in other investments. |

Market conditions and volatility

Volatile markets can present both opportunities and risks, affecting how much capital you should allocate.

Higher volatility: During periods of high market volatility, prices can swing dramatically in short periods. While this can create profit opportunities, it also increases the risk of significant losses. A larger capital buffer can help manage these fluctuations and provide the necessary margin to keep positions open;

Lower volatility: In stable market conditions, price movements are generally more predictable and less extreme. This environment allows traders to operate with a smaller capital base while still managing risk effectively.

Tips for beginners

For beginners, taking certain steps can put them ahead of others in terms of learning and knowledge. We have discussed some of these steps below:

Starting small - begin with a small investment amount to gain practical experience without significant financial risk. Using a demo account is an excellent way to practice;

Learning and education - the more you know, the better your trading decisions will be. Use educational resources and training programs to build a strong foundation. You may also read books like "Forex for Beginners" by Anna Coulling to deepen your understanding;

Building confidence - confidence in trading comes with experience and consistent practice. Start with small trades and gradually increase your investment size as you become more comfortable. Gradually increase your investment size as you gain experience.

Forex trading can be highly rewarding, but it also comes with significant risks. Understanding these risks and taking appropriate measures to mitigate them is crucial for long-term success.

A solid trading plan is key

Forex trading involves many different factors that can affect your earnings. From my experience, I would advise you to keep the following things in mind:

A solid trading plan is key. This includes setting clear goals, knowing how much risk you can handle, and having specific strategies for starting and ending trades.

Managing risk well is also very important. Use stop-loss orders, choose the right trade sizes, and spread your trades out to manage risks better.

Successful traders also regularly check market movements, economic signs, and world events.

Finally, improving your strategies by regularly testing and fine-tuning them using past data can enhance your results by the day.

Conclusion

Deciding the amount to invest in Forex trading requires careful consideration of your financial situation, trading goals, risk tolerance, and market conditions. Starting with a minimum of $10 to $500 is possible, but a more substantial initial capital of $1,000 to $2,000 is recommended for effective risk management and to handle market fluctuations. Your financial stability and risk comfort are key factors in deciding how much to invest, ensuring that your investment does not raise a question on your financial health. Additionally, market conditions must also be considered when making this decision; volatile markets may require a larger capital buffer, while stable conditions might allow for smaller investments.

FAQs

What are the main risks of investing in Forex?

Forex trading involves various risks, including market volatility, leverage risk, and liquidity risk.

How can beginners start investing in Forex?

Beginners should start with a demo account, learn trading basics, and gradually invest small amounts.

What factors affect the required investment in Forex trading?

Investment requirements are influenced by trading goals, risk tolerance, and market conditions.

How much can I realistically earn as a Forex trader?

Earnings vary based on capital size, trading strategy, and market conditions. Setting realistic expectations is crucial.

Related Articles

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.

A day trader is an individual who engages in buying and selling financial assets within the same trading day, seeking to profit from short-term price movements.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.