Where Do Rich People Keep Their Money?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Millionaires typically keep their funds diversified across various asset classes. Common investments include cash equivalents like money market funds and Treasury bills for liquidity, stocks and stock funds for growth, real estate for long-term stability, and private equity and hedge funds for high returns. They often employ multiple banking strategies, including offshore accounts and zero-balance accounts, to manage their wealth efficiently.

Understanding how millionaires allocate their funds offers key insights into effective wealth management. Wealthy individuals typically diversify their investments across various asset classes to balance risk and promote growth.

This article delves into these and other investment strategies of millionaires, including private equity, hedge funds, and offshore investments, offering a comprehensive look at how the wealthy manage and protect their wealth.

Where do millionaires keep their funds?

Understanding where millionaires keep their money reveals fascinating strategies that balance risk and maximize growth. These individuals diversify their investments across various asset classes, employing a mix of liquidity, long-term growth, and high-risk, high-reward opportunities.

Liquid assets

A significant portion of a millionaire’s portfolio—typically around 20-25%—is kept in liquid assets. This includes:

1. Money market funds

These mutual funds invest in short-term, high-quality debt securities like Treasury bills, commercial paper, and certificates of deposit. They offer high liquidity, allowing investors to convert holdings to cash easily with minimal risk. Typically, money market funds provide higher returns than regular savings accounts, making them attractive for millionaires looking to park cash temporarily.

For example, the Vanguard Prime Money Market Fund (VMRXX) has an average annual yield of 1.49% over the past five years, compared to an average savings account yield of around 0.05%. The Fidelity Government Money Market Fund also offers competitive yields and stability. As of December 2021, U.S. money market funds held over $4.5 trillion in assets, reflecting their popularity.

2. Treasury bills

Treasury bills (T-bills) are short-term government securities with maturities ranging from a few days to a year. They are issued at a discount and mature at face value, making the interest effectively the difference between the purchase price and the face value. T-bills are considered one of the safest investments because they are backed by the U.S. government.

The Chairman and CEO of Berkshire Hathaway Warren Buffett is known for keeping a substantial amount of Berkshire Hathaway's cash reserves in T-bills due to their security and liquidity, allowing the company to quickly capitalize on investment opportunities.

According to the data, provided by U.S. Department of the Treasury, The global financial market holds over $2 trillion in T-bills.

3. Certificates of deposit

Certificates of Deposit (CDs) are a favored investment among millionaires for their security and guaranteed returns. These time-deposit accounts offer a fixed interest rate over a specified term, making them a reliable component of a diversified portfolio. CDs are particularly appealing for their low risk and predictability, ensuring that a portion of a millionaire's wealth remains safe from market volatility. Notable investors like Mark Cuban have utilized CDs as part of their cash management strategy, emphasizing the importance of liquidity and security in preserving wealth.

Real estate

Real estate investments are a cornerstone of wealth preservation and growth for millionaires. They invest in residential properties, commercial buildings, and land. Real estate not only provides steady rental income but also appreciates over time. High-net-worth individuals often own multiple properties across various locations to diversify their real estate holdings.

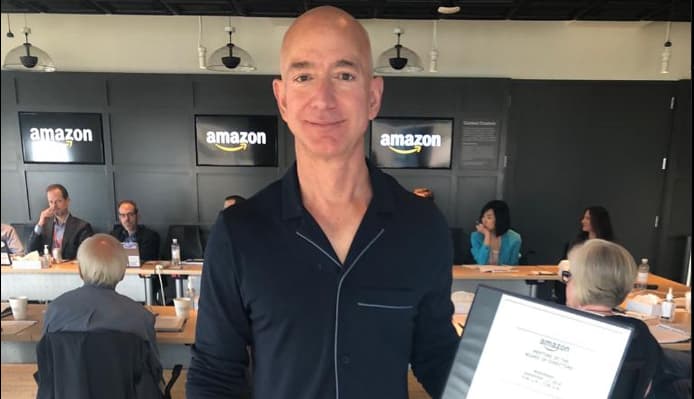

Jeff Bezos, founder of Amazon, owns multiple properties, including a $165 million Beverly Hills estate and a massive ranch in Texas (source:). According to the Federal Reserve, real estate accounts for about 25% of the assets of high-net-worth individuals in the U.S.

Stocks and stock funds

Equities are a crucial part of millionaire portfolios. They often invest in a blend of dividend-paying stocks, growth stocks, and index funds. Dividend stocks provide regular income, while index funds offer broad market exposure and diversification. For example, the co-founder of the Microsoft Corporation Bill Gates has significant holdings in dividend-paying stocks such as Berkshire Hathaway and Canadian National Railway.

Private equity and hedge funds

These exclusive investment options are favored for their potential high returns. Private equity involves investing in private companies, often with the aim of restructuring and selling at a profit. Hedge funds, on the other hand, use a variety of strategies to generate returns, such as long-short equity and global macro investing. These investments typically require significant capital and are accessible mainly to accredited investors. For example, Jim Simons who revolutionized the trading world by founding one of the most successful hedge funds in history, Renaissance Technologies. And Bruce Kovner founded Caxton Associates, a highly successful hedge fund, and earned his wealth through global macro trading. David Tepper founded the hedge fund Appaloosa Management, making it one of the most profitable hedge funds.

Offshore investments

To further diversify and protect their assets, many millionaires invest offshore. This can include foreign real estate, international stocks, and offshore funds. These investments offer benefits like tax advantages and protection against domestic economic fluctuations. However, they also come with legal and regulatory complexities that require expert navigation. For example, Shakira and other celebrities have been known to use offshore accounts to manage their wealth and reduce tax liabilities/ Another example is IKEA’s founder, Ingvar Kamprad, who utilized a complex web of offshore trusts to manage his vast fortune.

General trends and habits

Millionaires typically focus on a few key trends in managing their wealth:

Diversification: Spreading investments across different asset classes and geographies to minimize risk. For instance, Ray Dalio, founder of Bridgewater Associates, advocates for diversification as a key strategy in his "All Weather" portfolio;

Liquidity: Maintaining accessible funds to capitalize on investment opportunities or handle emergencies. According to a UBS study, the average high-net-worth individual keeps about 30% of their portfolio in cash or cash equivalents;

Long-term Growth: Prioritizing investments that offer steady appreciation over time;

Professional Management: Utilizing financial advisors and wealth managers to optimize investment strategies and navigate complex financial landscapes. For example, many ultra-high-net-worth individuals employ family offices to manage their investments and personal affairs, providing comprehensive financial services.

These strategies collectively help millionaires build resilient portfolios that withstand market volatility and ensure sustained wealth growth.

Philanthropy and charitable trusts

Philanthropy allows wealthy individuals to reduce their taxable income while making a social impact. According to IRS, donations to qualified charities can be deducted up to 60% of adjusted gross income, which also helps in estate planning by reducing estate taxes. Thus, Bill and Melinda Gates have used their foundation to donate billions, impacting global health and education and benefiting from tax deductions.

Charitable trusts and foundations provide systematic ways to manage philanthropy and enjoy tax benefits. Charitable remainder trusts (CRTs) offer income to donors before transferring the remaining assets to charity. Foundations allow for controlled, long-term charitable giving and significant tax advantages, like income tax deductions and estate tax reductions.

Wealth protection and safety

FDIC coverage

To protect large sums of money, millionaires often use FDIC-insured accounts.

Note: There is no minimum deposit level for FDIC (Federal Deposit Insurance Corporation) insurance in the United States. The FDIC automatically insures all deposits up to a set limit, which is currently $250,000 per depositor per bank. This means that if you have a deposit at a bank that is an FDIC member, your funds will be insured up to $250,000. Even very small deposits are protected and this ensures protection against bank failure.

To insure amounts exceeding this limit, they can use the Certificate of Deposit Account Registry Service (CDARS). CDARS spreads deposits across multiple banks while still maintaining FDIC coverage, ensuring that large sums remain protected.

Physical safety measures

Beyond financial instruments, millionaires also take physical measures to protect their assets. This includes using high-security vaults and secure storage facilities for valuables such as gold, jewelry, and important documents. These facilities offer advanced security features, including biometric access, surveillance systems, and private security personnel, ensuring that physical assets are safeguarded against theft and damage.

To earn money safely, beginners should choose a reliable broker, which will allow them to invest in stocks, funds and other assets. We compared the conditions of top brokers and suggest you familiarize yourself with their offers:

| Plus500 | Pepperstone | OANDA | FOREX.com | Interactive Brokers | |

|---|---|---|---|---|---|

|

Min. deposit, $ |

100 | No | No | 100 | No |

|

Demo |

Yes | Yes | Yes | Yes | Yes |

|

Max. leverage |

1:300 | 1:500 | 1:200 | 1:50 | 1:30 |

|

Instruments |

CFDs on stocks, Forex, cryptocurrencies, indices and commodities, real stocks, options, ETFs (not available for all countries), futures (for U.S. residents only) | CFDs on Forex, Index, Stocks, Currency Indices, Commodities, ETFs, Crypto | FX, Indices, Bullion, Commodities, Crypto | Forex, cryptocurrencies, indices, commodities, stocks | Stocks, options, futures, currency, metals, bonds, ETF, mutual funds, CFD, EPF, Robo-portfolios, hedge funds, forecast contracts (Product availability is dependent on IBKR affiliate and client country of residence) |

|

Investor protection |

€20,000 £85,000 SGD 75,000 | £85,000 €20,000 €100,000 (DE) | £85,000 SGD 75,000 $500,000 | £85,000 | $500,000 £85,000 |

|

Forex Regulation |

FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | SEC, FINRA, SIPC, FCA, NSE, BSE, SEBI, SEHK, HKFE, IIROC, ASIC, CFTC, NFA |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

From real estate to hedge funds: My insights on millionaire investments

From my perspective, understanding the financial habits of millionaires offers valuable lessons for traders and investors. Millionaires typically diversify their investments across various asset classes to balance risk and maximize growth.

Liquid assets like money market funds and Treasury bills often make up 20-25% of their portfolios, ensuring liquidity. Real estate investments provide long-term growth and passive income, with properties ranging from residential rentals to commercial buildings. Stocks, especially dividend-paying ones, are favored for income and growth. Private equity and hedge funds offer high returns through sophisticated strategies, though they come with higher risks. Offshore investments help diversify and protect wealth. Investment choices should be made based on your personal financial goals.

Final thoughts

Millionaires typically diversify their investments across various asset classes to balance risk and promote growth. They invest in liquid assets like money market funds, Treasury bills, and certificates of deposit for stability and liquidity. Real estate is a cornerstone for long-term growth and income. Stocks, including dividend-paying and growth stocks, form a significant part of their portfolios, while private equity and hedge funds offer high returns through sophisticated strategies. Offshore investments provide additional diversification and protection. Understanding these strategies offers valuable insights into effective wealth management and can help enhance your own financial practices.

FAQs

What types of liquid assets do millionaires prefer?

Millionaires prefer liquid assets like money market mutual funds, CDs, commercial paper, and Treasury bills for their liquidity and low risk. These typically make up 20-25% of their portfolio, providing flexibility for emergencies and opportunities.

How do millionaires use real estate as part of their investment strategy?

Real estate is key for long-term growth and passive income. Millionaires invest in both residential rentals and commercial properties, balancing their portfolios and generating steady cash flow.

Why do millionaires invest in private equity and hedge funds?

Private equity and hedge funds offer high returns through sophisticated strategies, accessible only to accredited investors. These investments diversify portfolios and can outperform traditional markets despite higher risks.

What role does diversification play in a millionaire’s investment strategy?

Diversification mitigates risk and ensures financial stability. Millionaires spread investments across stocks, bonds, real estate, private equity, and cash equivalents, protecting against market volatility and economic downturns.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Jim Simons is a highly successful hedge fund manager and mathematician known for his quantitative trading strategies. He founded Renaissance Technologies, a quantitative hedge fund firm, in 1982. Simons and his team developed sophisticated mathematical and statistical models to identify profitable trading opportunities in various financial markets, including stocks, futures, and options

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Yield refers to the earnings or income derived from an investment. It mirrors the returns generated by owning assets such as stocks, bonds, or other financial instruments.

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.