What is Price action trading – a full guide for beginners

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The study of how an asset's price behaves over time is known as price action. When an asset's price rises or falls, price action traders usually don't care to explain the fundamental reasons behind such price movement; instead, they rely on price behavior to make trading decisions. So what traders do is look at the recent price history and patterns, and then combine that with some technical analysis.

If you’re looking to understand what price action trading is about and how you can take advantage of it to trade the markets, then we’ve got you covered.

In this guide, we'll go through some of the most prevalent price action trading methods which may inspire you to create your own trading strategy, try out new trading techniques, or even improve on an existing one.

What is Price action trading?

Candlestick patterns

Candlestick patternsIn basic terms, price action indicates significant market movements on the basis of which traders may make key trading decisions without needing any additional information from indicators or significant trading news.

Price action trading can be done in a variety of ways. Nonetheless, there are two that are quite popular with traders and have a high potential for profit.

Price action and Support/Resistance levels

Price action and price formation

Here is a list of the pros and cons of the price action trading strategy.

- Pros

- Cons

- Helps traders time the market using key levels

- Simulators can be used to test this.

- Freedom to develop your custom strategy

- In general, doesn’t have the support of indicators to validate trading decisions.

- Requires more effort and focus than regular investment.

- Every trader will read the candles differently

There is no such thing as an optimal trading strategy. Nonetheless, price action analysis gives data on which a huge number of genuine indicators are based, and at the same time, this is data on which key trade news is released.

Best Price Action Patterns

Knowing when to enter the market is one of the most important skills in Forex trading. You should aim to hop into emerging trends as early as possible in order to catch the maximum price swing. One of the best ways to do this is by predicting potential trend patterns on the chart.

Chart patterns can represent a specific attitude of the market participants towards a currency pair. For example, if major market players believe a level will hold and act to protect that level, we are likely to see a price reversal at that level. The different price action patterns include:

Reversal Patterns

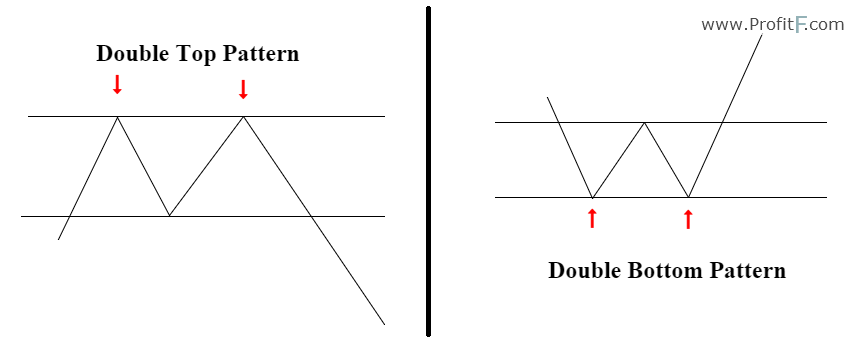

1. Double Tops and Double Bottoms

In this case, price moves in such a way that the candles form an M or W-shaped pattern by creating peaks and troughs that all have a neckline. Double tops (M) usually result in a reversal to the downside while double bottoms (W) result in a reversal to the upside. For these patterns, you’ll want to open a long position (in a double bottom) or short position (in a double top) just above/below the neckline when the second trough or peaked has formed.

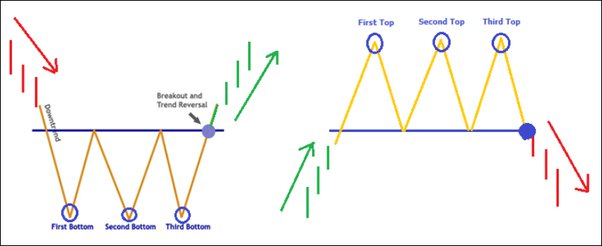

2. Triple Tops and Triple Bottoms

These are simply an extension of the double top and bottom patterns. Triple tops have three peaks while triple bottoms have three troughs, and they show that price has repeatedly failed to break above or below a key resistance or support region. Triple tops signal a reversal to the bearish side and triple bottoms give a bullish signal. For triple tops, you want to open a short position when the price breaks below the second neckline. While you want to open a long position in triple bottoms when the price breaks above the second neckline.

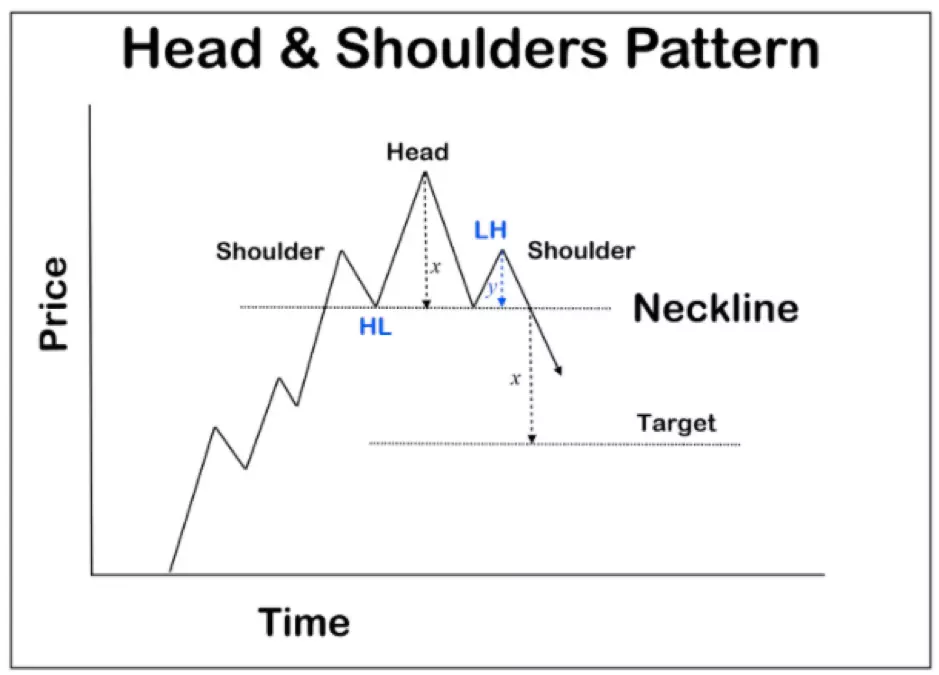

3. Head & Shoulders and Inverse Head & Shoulder

This pattern isn’t hard to detect because it forms an obvious baseline that has 3 peaks or troughs (in the inverse case) with the middle peak being the highest/lowest and the other two being similar in height or depth. The Head and shoulders is a bearish reversal pattern while the inverted scenario depicts a bullish reversal trend. To enter a long or short position, first, locate the neckline by connecting the lows formed after the left shoulder and after the head (do the reverse in the inverted case). Once the pattern has completely formed, wait for it to go lower than the neckline after the right shoulder’s peak. That’s where you place your short position entry. Of course, you’ll do the opposite in the inverted case.

Continuation Patterns

1. Triangular patterns

These are horizontal in nature, with the widest point being where the triangle starts to form. Triangles are created by drawing two trendlines in convergence. The symmetrical triangle is neutral and usually cannot give a hint of future price direction but it’s most likely to break out in the direction of the existing trend. The ascending triangle has a rising lower trendline and a flat upper trendline which indicates a bullish trend. For descending triangles, you’ll have a flat trendline below and a falling upper trendline, indicating a bearish trend. To trade ascending triangles, place your entry above the flat upper trendline so you catch some pips if the breakout happens. For descending triangles, place your entry below the flat lower trendline.

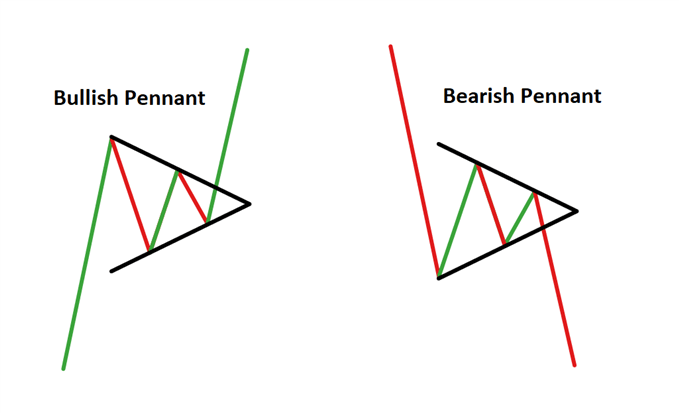

2. Pennants

Similar to triangles, pennants can be bullish or bearish and mostly form a small symmetrical triangle. Bearish pennants show up in steep downward trends where the price consolidates for a bit before continuing downward. The reverse occurs in bullish pennants where the price consolidates before continuing upwards. To trade bearish pennants, open a short position just at the pennant’s bottom while bullish pennants will require you to place your long position just above the pennant.

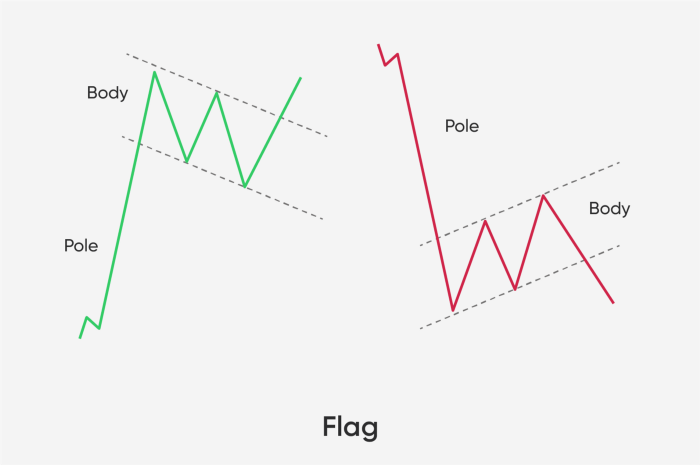

3. Flags

Flags look like a small rectangle that forms immediately after a sharp move, serving as the point where the market consolidates in a channel. Flags may either be bullish or bearish. Bullish flags have a rising pole and then a consolidating channel that declines, while bearish flags have a descending pole and then a rising consolidation channel. To trade flags, draw the channel using two parallel trendlines and then open a buy position when the price breaks out of the upper trendline in a bullish flag pattern. Do the opposite for a bearish flag pattern by opening a short position when the price breaks below the lower trendline.

How to Build a Trading System

As your knowledge, personality, and risk tolerance grow, you may want to create your own system. A trading strategy is essential for you as a price action trader because it will decrease your trading mistakes and losses. It will keep you from making irrational decisions while you're in a hurry. Instead, you'll be able to trade with less tension and emotion.

A trading system is only as good as the people that use it. You must stick to it, and in order to do so, you must exercise extreme self-control. Even though it appears to be straightforward, most traders are nonetheless unable to do so. You must put out your trading system rules and adhere to them at all times. Here's our checklist for putting together a trading strategy:

Step 1: Define your time frame

Your trading time frame should be a good fit for your personality. You're a natural long-term trader if you don't have time to watch the markets all day and need more time to analyze each trade. Your charts will therefore use a daily or even weekly time frame. You will make fewer transactions and pay the spread less frequently this way. You'll have to be patient because your system will only send out a few signals per month or year. Long-term trades necessitate larger stops, so if you don't want to receive margin calls, you'll need a larger account.

A higher timeframe, on the other hand, is not for you if you are impatient, spend most of your time staring at the screen, and feel compelled to hit the button. Instead, become an intraday trader who works with 15-minute or even 1-minute charts. This way, you'll have a lot of trading possibilities every day and won't have to worry about overnight dangers.

Step 2: Identify the position of the market

In the timeframe you wish to trade, it's critical to recognize the trend and the wave. Always trade in the direction of the current trend. So you BUY long when the trend goes upward and SELL short when the trend moves downward. It's always better to enter trades near the support or resistance levels because you can better manage your risk.

Step 3: Find support and resistance levels

Peaks and troughs

Support and resistance levels from a previous time frame

Fibonacci levels

Trend lines

Step 4: Find your entry levels

Trading the Bounce

Trading the Breakout

Trading the Trend Reversal (Failure Swing)

Step 5: Find your exit levels

Beginners look for good entry points, believing that if they find them, they will be rewarded financially. Professionals, on the other hand, devote a significant amount of effort to managing their transactions and seeking exits. Stop Loss and Take Profit should be considered if you actually want to trade with more profits than losses.

Step 6: Use multiple time frame analysis

A currency pair can exist on many time periods, including daily, hourly, 15-minute, and even 1-minute! When trading, you can employ a technique known as multiple time frame analysis. This implies that you do not trade using just one time frame. You'll need to look at the next higher time period to have a better sense of the overall trend before making your entry on the lower time frame.

This is due to the fact that the trend's direction may fluctuate depending on the time range. The EURUSD, for example, may be in an uptrend on the daily chart but a decline on the 4-hour chart. You will be able to recognize where you are in reference to the broader picture if you employ several time frame analyses.

This will help you minimize losing trades. There could be a new trend coming from a different time frame than the one you're trading in, and if you don't check it out, it could be detrimental to your trade.

Is Price Action Trading Good For Me?

As technical traders, it's critical that you don't get too caught up in the why of things. A daily EURUSD chart appears the same to you as it does to every other trader on the planet. According to statistics, the Forex market transacts over $6 trillion every day. Consider how many eyes it translates to when everyone is staring at the same graphic. Quite a lot!

You get the idea; the possibilities are unlimited. Because the possibilities are limitless, so are the results. In other words, the outcomes aren't as consistent as if you used price action levels, which are universal.

The same rule applies to trading Forex or any other liquid market. If a significant number of traders have the same (or similar) levels on their charts, the chances of price movement respecting those levels (traders following other traders) increase exponentially.

Those traders are simply following in the footsteps of the herd. And that's perfectly fine! The Forex market is one place where being a follower rather than a leader pays well.

It's worth noting that price action levels are most effective in markets with a lot of liquidity. That's why it's so effective in the Forex market. The Forex market offers some of the best price action levels of any financial market due to its huge liquidity (the highest in the world).

The best strategy for Price action trading

Get started with price action trading by looking into these different strategies that are currently in use by some of the most seasoned traders.

Strategy 1 - trade trend reversals

Every trend has specific principles to validate it. For instance, a downtrend is characterized by the candlesticks making consistent lower highs and lower lows while an uptrend will have the candles making consistent higher highs and higher lows.

As soon as those events no longer happen, the trend will become invalid and a reversal will most likely occur. At that point, you can trade the reversal by opening a position and making an entry.

Strategy 2 - trade trend continuations

Whenever a trend forms either to the upside or downside, you're most likely to see a slight reversal from that trend, before it eventually gets back in line and continues in the same direction. Whenever that reversal happens, the candlesticks take different shapes to form a triangle. So, you'll need a lot of patience to confirm what trend it is. Then wait for the reversal which leads to the formation of the triangle. As soon as the price breaks that triangle and starts to head back in the direction of the trend, you can pick an entry point and open a trade.

Strategy 3 - trade rejections

Every chart has key levels which could be supply and demand zones, or breakouts. And two things will happen once such levels are approached. The price action either pushes through such levels or becomes rejected because of a lack of sufficient trading volume to get through those levels. You can watch out for these key levels and then trade in the direction of the rejection.

Which brokers are best for Price action trading?

With so many Forex brokers to choose from, finding the perfect one can be difficult and time-consuming. The essential criteria for selecting a broker are straightforward. Without a doubt, maintaining the protection of your cash should be your first priority. Here are some factors to consider when looking for a good price action trading broker:

Regulatory Compliance

A reputable broker's activities should always be regulated by a government agency dedicated to safeguarding and promoting the integrity of brokerage operations. Traders should be protected against fraud and manipulation, hence any abusive practices related to the sale of futures and options should be prohibited. These credentials are frequently listed in the broker's About Us section.

Safety of Funds

Regulated brokers must follow a set of rules designed to protect investor assets. This is the major reason for the importance of regulation. A "Net Capital Rule" applies to every registered broker, requiring a minimum amount of capital to be retained in liquid form. This provides a safety net for investors in the event that a broker is forced to close.

Advanced Charting Tools

Price action trading relies on a series of information that can only be obtained from the charts. So make sure your preferred broker offers advanced tools for graphical analysis as well as autochartist tools to make your analysis easier.

We have highlighted the following brokers as top recommendations.

Interactive Brokers

For day traders, Interactive Brokers offers a well-regarded trading platform as well as the possibility of volume reductions if you use the broker's Pro service. If you do a lot of business, the broker will even reduce your basic commission by up to 90%. This broker may not be the best at providing stellar research tools but it excels when it comes to equipping traders with live news and a wide range of charting tools. That's all thanks to the Workstation. You'll also get no-commission stock and ETF trades, as well as several of the broker's other popular features if you choose the broker's newer Lite service tier. Commissions are $0.005 per share (stocks and ETFs) for the Pro tier (minimum $1) and $0 for the Lite tier; $0.65 per contract (options) for the Lite tier; and volume discounts are available.

eToro

eToro takes home the prize for its user-friendly copy-trading platform, which allows traders to imitate the trades of experienced investors – or earn unique rewards for sharing their own trading techniques. eToro offers a complete – albeit rather pricey – trading experience with over 3,000 tradeable symbols, including CFDs, FX, exchange-traded securities, and major cryptocurrencies. With a Trust Score of 91 out of 99, eToro is rated low-risk. eToro is not publicly listed, does not operate a bank, and is regulated by two tier-1 (high trust) regulators, one tier-2 (medium trust), and no tier-3 regulators (low trust). The Australian Securities and Investment Commission (ASIC) and the Financial Conduct Authority (FCA) are eToro's tier-1 regulators (FCA).

Summary

Price action trading is beneficial to all beginner traders. Learning to read and analyze price chart movements is in and of itself a trading system. If you chose to use other analysis methods, such as statistics, indicators, or seasonality, it can help. Although price action trading does not guarantee profits, it is an effective trading method that may be developed with time and effort. If you're new to trading, you only need to be familiar with one method to get started. Before attempting to learn more, make money with the technique you've picked.

FAQs

Does price action trading work?

Yes, it does work for understanding what the market situation is using candlesticks and other on-chart patterns

Should I trade using indicators or price action?

First and foremost, recognize that there is no need to pick between indications and price action. Both can be used. Second, you must investigate both options and make your own decision.

What is the ideal timeframe for trading price action?

The short answer is that it depends on how much risk you're willing to take. Determine what kind of trader you are. Long-term traders should stick to higher timeframes, while short-term traders should use lower timeframes.

What is the best trading method for price action?

In general, the ideal price action trading technique is one that you can execute profitably with your talents and expertise. The best strategy for one trader may differ from yours.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Olga Shendetskaya has been a part of the Traders Union team as an author, editor and proofreader since 2017. Since 2020, Shendetskaya has been the assistant chief editor of the website of Traders Union, an international association of traders. She has over 10 years of experience of working with economic and financial texts. In the period of 2017-2020, Olga has worked as a journalist and editor of laftNews news agency, economic and financial news sections. At the moment, Olga is a part of the team of top industry experts involved in creation of educational articles in finance and investment, overseeing their writing and publication on the Traders Union website.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

A trading system is a set of rules and algorithms that a trader uses to make trading decisions. It can be based on fundamental analysis, technical analysis, or a combination of both.

Price action trading is a trading strategy that relies primarily on the analysis of historical price movements and patterns in financial markets, such as stocks, currencies, or commodities. Traders who use this approach focus on studying price charts, candlestick patterns, support and resistance levels, and other price-related data to make trading decisions.

In trading, a supply and demand zone refers to specific price levels on a chart where there is an imbalance between buyers (demand) and sellers (supply). A demand zone represents a price area where buying interest is strong, potentially leading to price increases, while a supply zone indicates an area where selling interest is significant, possibly resulting in price declines.

A long position in Forex, represents a positive outlook on the future value of a currency pair. When a trader assumes a long position, they are essentially placing a bet that the base currency in the pair will appreciate in value compared to the quote currency.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.