Altcoins and their types

The cryptocurrency market is actively developing. Today it is possible to make money and not just on Bitcoin (₿). Altcoins are a great opportunity to multiply capital and you can invest in them for passive income, or actively trade them on cryptocurrency exchanges. But to do so, you need to understand what altcoins are, how they differ from Bitcoin, how they are mined, and the laws under which they exist.

Altcoins are actively traded on exchanges, and while they were initially regarded with suspicion, many countries have now passed laws legalizing their use in everyday life. Today altcoins are an organic part of the global financial market, which is characterized by high volatility, but also by high-profit potential. In this article, the Traders Union will detail the prospects of altcoins in 2023 and explain how to make money with them.

Start trading cryptocurrencies now with Binance!What are altcoins?

In 2009, Bitcoin appeared, and for a short time, it was the only cryptocurrency in the world. Two years later, its first fork, Namecoin, appeared. To simplify, a fork is a certain software project that uses the code of another product as a basis. Later in 2011, Litecoin (Ł), another fork of Bitcoin, was launched. In 2014, independent projects appeared such as Ripple, Stellar, Monero, etc. All of these cryptocurrencies are altcoins.

An altcoin is any cryptocurrency that appeared after Bitcoin. And only Bitcoin itself is not an altcoin. The word altcoin is a portmanteau of "alternative coin".

The first altcoin was Namecoin. Today there are over 2,000 altcoins. Altcoins don’t even have a comprehensive list because they appear and disappear every day. However, segment leaders such as Ethereum, Bitcoin Cash, Cardano, and some others are now firmly established. That is why investing in altcoins is quite realistic and promising. They have high market capitalization and liquidity. Find out what altcoin season is, its impact, and how to navigate it in the TU article.

What problems do altcoins solve?

Before discussing what altcoins are, it is important to understand why alternative coins emerged in the first place. After all, it was the reason for their emergence that determined the popularity of altcoin cryptocurrencies and their development potential. All coins globally solve the same problem that Satoshi Nakamoto wanted to solve by launching Bitcoin.

The idea of a "bitcoin" was to create a convenient alternative to traditional money for remote payment. That is, it was referred to as a fully electronic currency. But there was a problem — e-systems have the inherent property of "double spending". You cannot spend the same paper bill twice, and in the case of e-transfers, the problem is solved by an authorized intermediary, such as a bank.

Without going into technical details, suffice it to say that Bitcoin circumvents the problem of "double spending" without an intermediary (trusted node) by deliberately complicating transactions. Transactions in such a system are combined into blocks and blocks into a continuous chain (blockchain), where each successive block includes each previous one.

Banks, tax authorities, judicial, and other state agencies cannot influence altcoins, track transactions or control them in any way. This is how all altcoin cryptocurrencies work. These systems are completely autonomous and anonymous. On the other hand, they are completely transparent, because every transaction is publicly available on the blockchain. But it is impossible to know the source and destination of a transfer.

Altcoins are the direct descendants of Bitcoin, so they solve the same problems. They have a high transaction speed compared to any other payment option. And this is because the process is not controlled by anyone, there are no intermediaries and no delays associated with them. The same factor ensures the absolute security of payments since no one can get access to the list of transactions without knowing the user's personal data.

To understand how to make money from altcoins, it's important to consider how they differ from Bitcoin. Many altcoins here are unique, they can be created in a different programming language, each has its complexity and extraction speed, distribution methods, working algorithms, etc. For example, while Litecoin is almost identical to Bitcoin, Ethereum is a fundamentally different type of altcoin, which is a one-of-a-kind virtual machine based on smart contracts.

Examples of altcoins

Below, the Traders Union explains what altcoins are. It is impossible to classify them, except to divide them into Bitcoin forks and independent projects. But this division has no practical value because each altcoin is a completely independent and autonomous system. If Bitcoin disappears tomorrow for some reason, nothing will happen to its forks. Here, it is higgledy-piggledy.

It is impossible to tell you about all the altcoins on the exchange because there are too many of them. But it’s not necessary to understand each one to make money. About fifty altcoins have real value for investors today. Ethereum, Litecoin, and Dogecoin are used here as examples. Each of these coins is original and unique, and each can be chosen to invest profitably in altcoins. Discover the necessary steps to finding a 100x altcoin in the TU article.

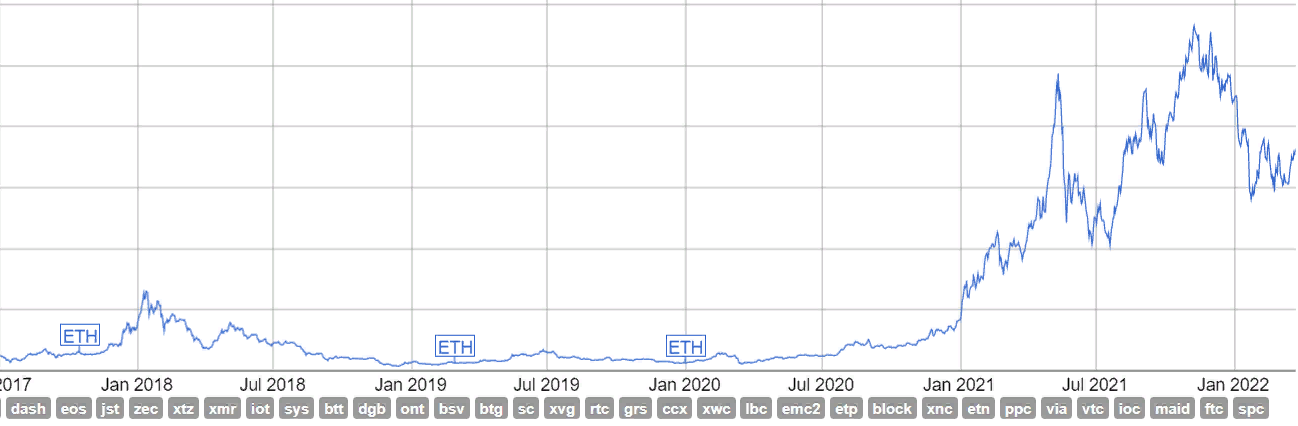

Ethereum

This altcoin was launched in 2015 by billionaire programmer Vitalik Buterin, the founder of Bitcoin Magazine. Unlike Bitcoin, Ethereum was not created as a payment system, but as a platform for integrating blockchain technology into third-party projects. That is why giants like Microsoft, IBM, and S7 were interested in Ethereum from the start.

The peculiarity of Ethereum is that the technology can be used to register any transaction with any asset — not just make payments. Ethereum is used to buy and sell securities, exchange resources, etc. At the same time, Ethereum bypasses traditional legal procedures, like other altcoin cryptocurrencies, which makes transactions relatively fast.

The market capitalization of Ethereum is currently valued at as much as $29 trillion. In 2023, the indicator is projected to grow intensely. It is quite easy to make money on Ethereum, given its popularity and volatility. The altcoin is traded on almost every major cryptocurrency exchange.

Market capitalization of Ethereum

Litecoin

This altcoin was launched in 2011 by its creator, a little-known programmer Charles Lee. Again, it is a fork of Bitcoin, so this altcoin cryptocurrency acts only as a payment system. Chains in the blockchain of all Bitcoin forks are created using the same algorithm. The difference is in the function of finding the hash in the chain: Bitcoin uses the SHA-256 algorithm, Litecoin uses the scrypt (pronounced "ess crypt") function.

Scrypt uses SHA-256 as a subprogram, so Litecoin mining is more complicated than Bitcoin mining due to higher memory requirements. This is not a problem for modern GPUs, and LTC has a conceptual advantage such as new blocks that are created every 2.5 minutes, which is four times faster than in the case of Bitcoin. Accordingly, the confirmation of the transaction is also four times faster. Finally, the number of blocks in the system is four times higher than in Bitcoin.

Of all the altcoins on the exchange that are forks of Bitcoin (and there are hundreds of them), Litecoin is the most promising because it is more technologically advanced and has higher profit potential. Litecoin currently has a market capitalization of $727 billion.

Litecoin market capitalization

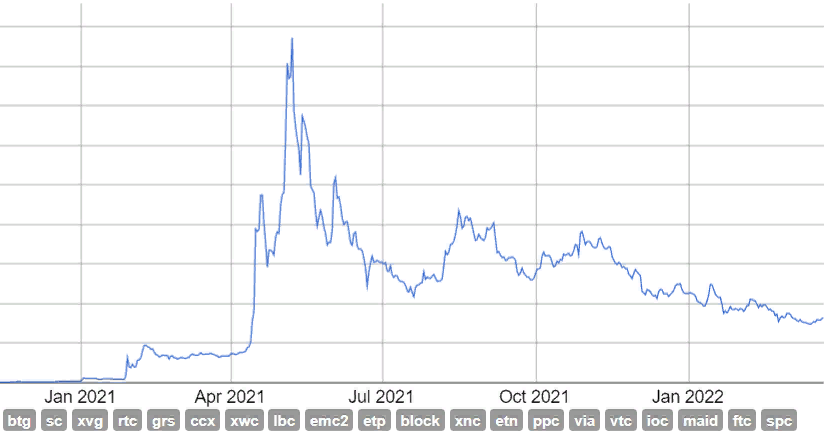

Dogecoin

Dogecoin was launched in 2013, it was created by programmers Billy Marcus and Jackson Palmer as a “joke”. At the start, this cryptocurrency altcoin gained the widest popularity, because a popular meme with a Shiba Inu dog was chosen as its official symbol. It is curious that the price of one DOGE still doesn’t exceed $0.5. Nevertheless, during 2023 the value of the coin has grown by 20,000%. Much of the reason was the interest of Elon Musk in it, and seriously, the upcoming mission to the moon, planned by SpaceX, is fully paid for in Dogecoin.

The DOGE altcoin is actively traded on exchanges, and it is extremely volatile. This is due to the peculiarities of DOGE mining since a new block in the chain is built in exactly one minute, which is even faster than in the case of Litecoin. In 2013, DOGE set a historical record for the number of transactions, exceeding the total number of transactions with other cryptocurrencies by 2.scripts. So if you intend to invest in altcoins, be sure to consider Dogecoin. Its market capitalization is currently $1.7 billion. It is one of the most popular and potentially promising cryptocurrencies.

Dogecoin market capitalization

Why are altcoins popular for investment?

Investing in altcoins is a common method of making money. And you can invest in them in different ways. For example, you can use stacking, which is discussed below. In stacking, you give some of your capital to a blockchain project in exchange for a reward after an agreed period. Alternatively, you can simply trade altcoins as part of regular currency pairs on the Forex market.

The advantages of altcoins compared to their "ancestor" are often individual. The example of Litecoin was given above, which is almost the same as Bitcoin, but it is mined many times faster, and much easier on modern equipment. As for Ethereum, there are hundreds of projects that are not related to the financial sector at all, and it is possible to invest in them successfully. In the case of Bitcoin, its functionality is strictly limited because it is purely a payment system, and that's all.

General advantages of altcoin cryptocurrencies:

-

they are cheaper than Bitcoin, so they are much more accessible to novice traders and investors;

-

investing in altcoins doesn’t require large initial capital or special knowledge of financial markets;

-

to understand how to make money from altcoins and start doing it, it is enough to study a couple of basic guides;

-

most altcoins can be used to make money passively through stacking, lending, and similar solutions;

-

many altcoins have exceptional growth potential (Dogecoin is a great example);

-

Great volatility makes active trading in crypto-to-crypto and crypto-to-fiat pairs extremely promising.

The main problem with Bitcoin is its conservatism. As well as its high price. Investing in altcoins has no such obstacles, which makes it much easier as an investment.

Is passive income from altcoins possible?

Investing in altcoins for passive income is quite realistic. There are several popular methods, such as the aforementioned stacking. Stacking is only suitable for altcoins on the Proof of Stake (PoS) algorithm. They are EOS, Tron, Stratis, NEO, Lisk, VeChain, and many others. In addition, some coins use several algorithms at once, including PoS. Examples are EmerCoin, NovaCoin, and YaCoin.

The essence of stacking is as follows. The owner of an altcoin lends it to a blockchain to keep the system running, and is rewarded for it. Stacking is an alternative to mining in which no computing power is needed to form new blocks in the blockchain, only existing blocks.

Of course, the more coins an investor provides to a blockchain, the higher his reward will be. It is possible to invest in several projects at once. Altcoins on cryptocurrency exchanges are actively used for stacking. All top cryptocurrency exchanges offer such a possibility. A potential investor simply goes to the corresponding page of the site or goes to a specialized service, chooses a project, and invests in it.

The most popular altcoins for stacking are:

-

Ethereum (ETH);

-

-

Tezos (XTZ).

Stacking has two risks. First, the altcoin can suddenly depreciate and you will incur losses. Second, the funds invested in the project will be frozen and you will not be able to use them until the expiration of the contract (the exception is flexible stacking, but it is less common and has specific terms). There’s another nuance which is funds are usually withdrawn from the project for several days.

How to buy altcoins?

Now you know what cryptocurrencies are and how to make money on them. Here is an illustrative hypothetical using Binance as an example. There is a detailed algorithm of actions from the moment of registration on a cryptocurrency exchange to entering the trading terminal to actively buy and sell. Binance is one of the top exchanges. For other cryptocurrency exchanges, the steps are given here may differ only slightly, but in general, the sequence of actions remains the same.

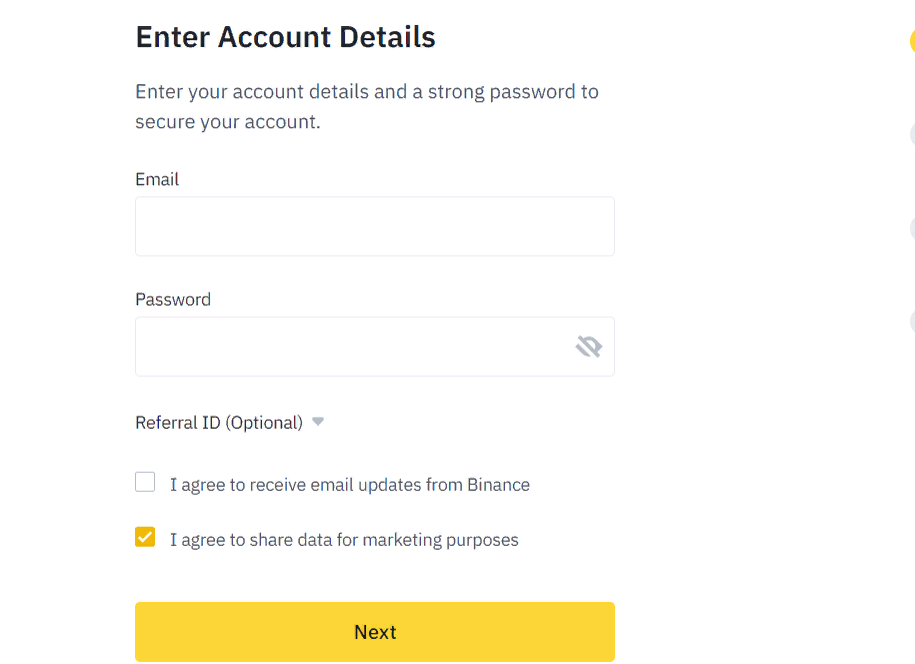

Registration

Visit the official Binance website and click the "Register" button in the upper right corner. Usually, the region is determined automatically, but sometimes you need to select it manually from the drop-down menu. Click the "Create a personal account" button, enter your email address and password. A verification code will be sent to your mail. Enter it in the appropriate field. In the next window, enter your phone number. Another verification code will be sent by SMS, enter it. After that, the system will ask you to pass a simple anti-bot check and you will get to your personal account.

Binance registration

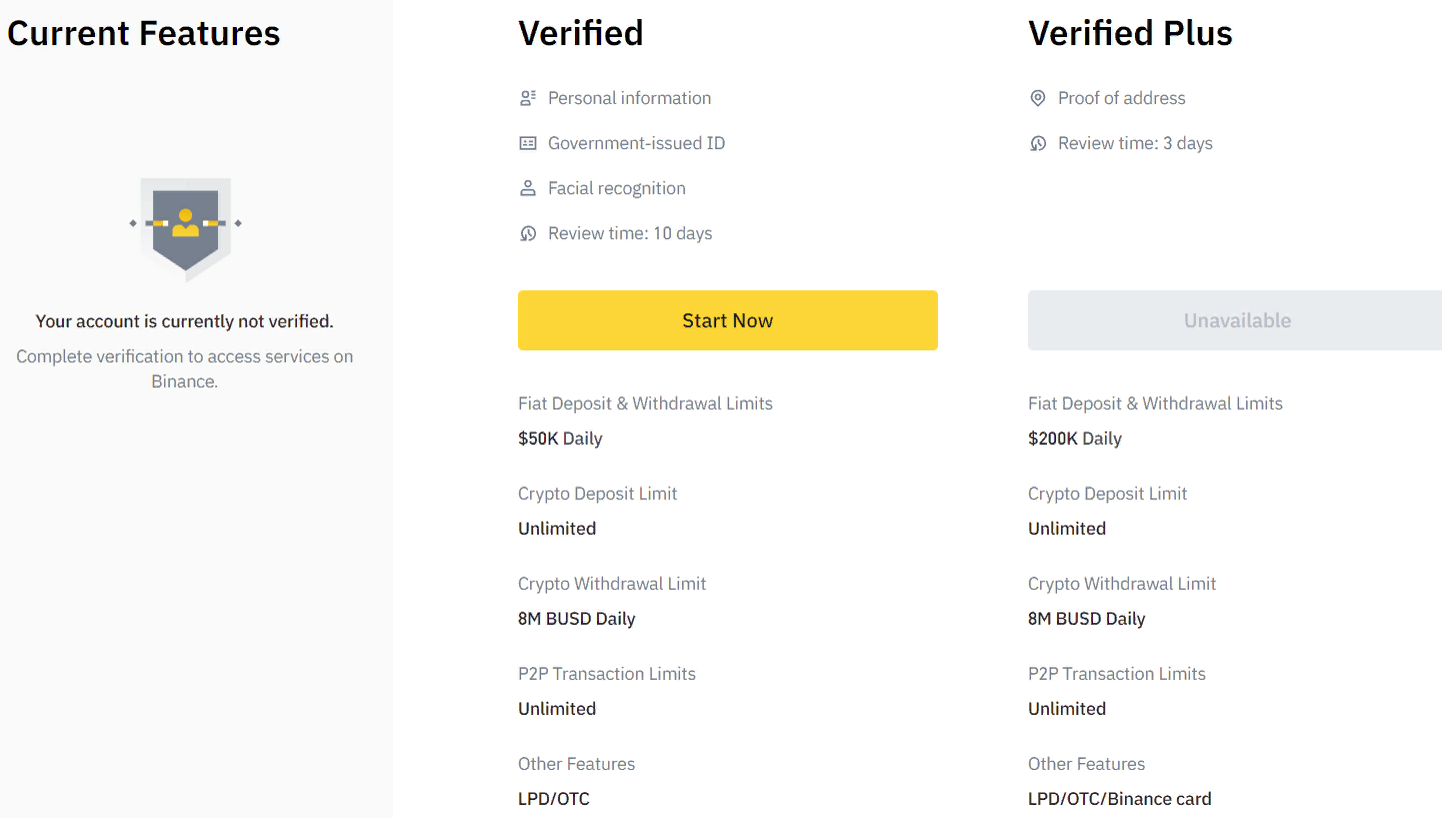

Verification

Now you need to verify your account, i.e., confirm your personal data. This is necessary for the cryptocurrency exchange to make sure that you are not a scammer and really intend to invest in altcoins. Click on the account icon in the upper right corner, select "Security", then "Verification". A page will open, presenting you with two verification options, indicating the differences between them. Choose the appropriate option and click on "Verify Now". Then follow the instructions of the system. You will need to provide scans of documents confirming your identity.

Verification on Binance

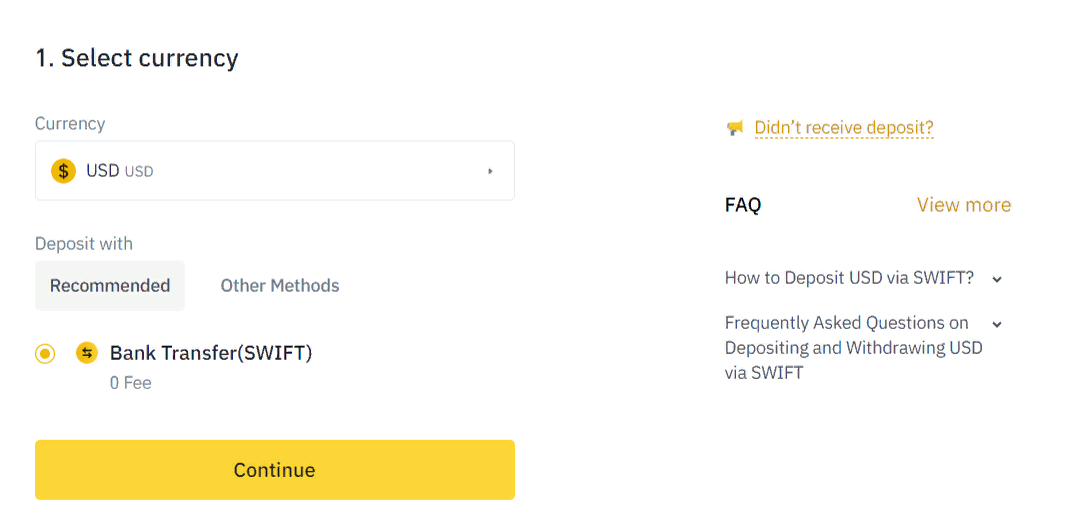

Account replenishment

To trade and invest in passive income projects, you must first buy an altcoin cryptocurrency. To do this, fund your account on the exchange. Click on the "Wallet" button in the upper right corner of the screen, then go to the "Wallet Overview" section. You can also click on the "Fiat and Spot" button. After that, if you have an option, click on the "Deposit" button. The system will offer you to choose the deposit channel and currency. For example, you can deposit funds from a VISA card. When you make a choice, click "Continue" and you will get to the secure site of the payment system. Then follow the instructions.

Depositing account on Binance

How to purchase altcoins

You can buy the desired altcoin on the Binance exchange in several ways. For example, you can do it through the trading terminal by opening the corresponding transaction. To do this, go to the terminal (main menu item "Trade"), select the asset pair you are interested in and enter the amount, click the "Buy" button.

Purchasing altcoins on Binance

A simpler option is in the main menu (shown above), hover over "Buy cryptocurrency" and in this submenu click on the "Deposit with card" button. Select the currency with which you will pay for the purchase and the card type. Then enter the amount and follow the instructions on the screen. You will be redirected to the payment service.

10 Best Altcoins to Buy During The Crypto WinterAre Altcoins profitable and how much can I earn?

Investments in altcoins are not limited in terms of profit potential. Experienced traders who actively trade crypto-to-crypto and crypto-to-fiat pairs frequently earn $1,000 to $10,000 per month. In this sense, cryptocurrency trading doesn’t differ from trading using any other instrument.

Factors that affect the profitability of altcoin trading:

-

the theoretical background of the trader, level of proficiency in trading methods of technical and fundamental analysis;

-

stress resistance, the ability to make informed decisions, and a trading strategy that is constantly adapted to the market;

-

the ability to reduce risk through diversification, strict compliance with the rules of money management;

-

trading conditions of the cryptocurrency exchange where the trader trades (number of instruments, commissions, limits, withdrawal conditions);

-

the current situation on the global cryptocurrency market, the state of altcoins, which the trader actively trades.

As was said earlier, the promising altcoins of 2023 are extremely volatile; but in general, all cryptocurrencies are volatile. However, that is an advantage that allows earning from fluctuating quotes in any timeframe. Alternatively, it is a huge disadvantage because often it is impossible to take into account all the factors and it is simply impossible to predict the price movement. That is why to trade successfully you need to practice all the time and follow the money management rules.

The same risks are relevant for investing in altcoins from a passive income perspective (e.g., stacking). But there are a couple of other things. For example, it may happen that the blockchain project you invest in simply leaves the market. The reasons don't matter, it can be a fraudster or just the developers giving up on the idea. In this case, there is a serious chance of losing your deposit completely. But this situation is relevant only for little-known altcoins, with TRON or Monero this is possible only in a very conditional theory.

In the case of stacking, the yield can be different. Some projects give about 2-4% per annum, while others give 40-60%. As the interest rises, so does the risk. For example, ADA altcoin on Binance is available for investment at 7.75% per annum. This is a well-known stable altcoin cryptocurrency. And you can invest right now at 42.25% in a fairly young coin CAKE. The income potential is 5.4 times higher. However, there is no 100% guarantee that CAKE will survive the current quarter.

Top 5 tips for traders who want to invest in altcoins

First, don't jump into the deep end. It is technically easy investing in altcoins, so you don't need financial education, in-depth knowledge of the currency markets, or much experience in trading. But you will need to learn the basics of technical and fundamental analysis to earn a steady income. For this purpose, you can use the guides and training courses offered by your cryptocurrency exchange.

Second, the choice of a cryptocurrency exchange is conceptually important. Different exchanges have different conditions in terms of the available altcoins list, passive income options, trading commissions, and deposit/withdrawal channels. All these things determine the profit potential of investing in altcoins. Always choose only top cryptocurrency exchanges with low fees and as solid a list of trading instruments as possible.

Third, reduce risk in every way possible. When thinking about how to make money from altcoins, try different passive income options, not only stacking but also, for example, lending and cloud mining. When using stacking, invest in several projects at once. Then, if one of them turns out to be unprofitable, you will remain in the black at the expense of the success of the others. This is called investment portfolio diversification.

Fourth, don't ignore the money management rules. Do not bet more than 1-2% of your capital on trading. Do not risk funds, the loss of which will critically affect your financial situation. Eliminate emotionalism and don't take actions of which you are not sure. You know that altcoins are highly volatile. Be aware of the risk, be prepared for it.

Fifth, use your broker's entire arsenal of tools. For example, there is margin trading to increase the profitability of altcoin trading. The risk is higher, but the profit increases many times over. As an option, consider P2P exchange, as well as comprehensive solutions for investing in altcoins. For example, Binance has a unique service called Binance Earn, which offers a lot of opportunities.

Best cryptocurrency exchange to buy altcoins

What altcoins are and the factors that affect the potential return on investing in them were explained above. Choosing a broker is one of the key steps. Experts and traders themselves consider Binance the best option for both novice traders and experienced participants in the cryptocurrency market. The exchange was launched in 2017, it was founded by Changpeng Zhao. It is the world's largest blockchain ecosystem, which provides a full list of modern methods of earning altcoin cryptocurrencies.

Cryptocurrency exchanges operate officially and transparently. The company offers spot, futures, and margin trading. There is a P2P exchanger, many options for passive income, including stacking, farming, and auto investment. The exchange has its own plastic card that can be used to pay for items in stores almost all over the world.

Binance even has its own NFT-marketplace, the first and largest in the world. At the moment, the State Hermitage Museum is cooperating with the crypto exchange to release tokenized works of art from the museum's collections.

Binance offers 411 cryptocurrency altcoins for trading, with spot commissions of no more than 0.1%, which is below the market average. The website is ranked #1 in the cryptocurrency market with a market dominance of 39.80%. Daily trading volume is over $5.3 trillion. According to the sum of factors, it is undoubtedly the best platform for investing in altcoins.

Top 10 most promising altcoins in 2024

What crypto altcoins are better to invest in right now?

The Traders Union has analyzed the cryptocurrency market and identified the coins with the highest profitability potential. The table below shows the top 10 altcoins and their main indicators.

| Cryptocurrency | Industry | Current price | 1y return | 1m Return | Total score | |

|---|---|---|---|---|---|---|

Cryptocurrency exchange |

603.20$ |

96.93% |

85.77% |

9.5 |

Invest | |

Blockchain platform |

0.75$ |

131.69% |

37.81% |

9.2 |

Invest | |

Payments |

0.00$ |

NaN% |

NaN% |

9 |

Invest | |

Payments |

0.00$ |

NaN% |

NaN% |

8 |

Invest | |

Blockchain platform |

0.00$ |

NaN% |

NaN% |

8 |

Invest | |

Payments |

0.00$ |

NaN% |

NaN% |

7.6 |

Invest | |

Payments |

0.00$ |

NaN% |

NaN% |

7.5 |

Invest | |

Decentralized exchange |

0.00$ |

NaN% |

NaN% |

7.4 |

Invest | |

Blockchain platform/Media |

0.00$ |

NaN% |

NaN% |

7 |

Invest | |

Internet of Things |

0.39$ |

90.86% |

50.15% |

6.9 |

Invest |

Summary

From this article, you learned what altcoins are and their types. The definition is elementary: Altcoins include all coins that are not Bitcoin. Some are forks of Bitcoin, but most are standalone blockchain systems. There are more and less popular altcoin cryptocurrencies, each coin has its own characteristics and advantages in terms of active trading and passive earning.

They have one thing in common. They allow one to multiply capital using a wide range of exchange trading methods and instruments. Of course, there are also risks and significant ones. The cryptocurrency market is highly volatile, so there is always a chance that the price will move in the wrong direction or that some system will simply leave the market. With the right approach, the risk can be diversified and reduced, protecting the investor from critical losses.

This article is Part 1 of a two-part article. This part lists the most promising altcoins for 2023 and reviews some of them in detail. Part 2 outlines a step-by-step guide on how to register on a top cryptocurrency exchange and buy altcoins. Combined with the expert advice presented in the material, the information obtained is enough for you to buy your first asset right now and start investing.

FAQs

What are altcoins?

This is the name of all cryptocurrency coins, except Bitcoin. The first altcoins appeared as forks of Bitcoin, that is, they were “based” on Bitcoin. Today there are over 2,000 altcoins, but not all of them are actively traded and objectively promising for investment.

Which altcoin is best to invest in?

Litecoin, Ripple, Cardano, Binance Coin, etc. The list of promising altcoins for 2024 is quite impressive. The history of a coin's development, its market capitalization, and liquidity matter. Read the information above to get a better understanding of altcoin parameters.

How to make money on altcoins?

You can trade them in for other cryptocurrencies and for crypto-fiat pairs. Or invest in blockchain projects to earn interest on the deposit, for example, through stacking. Top cryptocurrency exchanges offer many opportunities for active and passive income from altcoins.

Is it important to choose a good cryptocurrency broker?

This is a conceptually significant step for profitable investing in altcoins. A cryptocurrency broker determines trading and deposit terms – the list of available coins, commission fees, risk mitigation mechanisms, and deposit and withdrawal channels. That is why the Traders Union recommends working with Binance, the undisputed leader in this segment.

Glossary for novice traders

-

1

Cryptocurrency

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

-

2

Bitcoin

Bitcoin is a decentralized digital cryptocurrency that was created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. It operates on a technology called blockchain, which is a distributed ledger that records all transactions across a network of computers.

-

3

Broker

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

-

4

Trading

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

-

5

Ethereum

Ethereum is a decentralized blockchain platform and cryptocurrency that was proposed by Vitalik Buterin in late 2013 and development began in early 2014. It was designed as a versatile platform for creating decentralized applications (DApps) and smart contracts.

Team that worked on the article

Ivan is a financial expert and analyst specializing in Forex, crypto, and stock trading. He prefers conservative trading strategies with low and medium risks, as well as medium-term and long-term investments. He has been working with financial markets for 8 years. Ivan prepares text materials for novice traders. He specializes in reviews and assessment of brokers, analyzing their reliability, trading conditions, and features.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).