Who Owns Webull? Is Webull A U.S. Or Chinese Company?

Webull is a U.S.-based trading platform headquartered in New York, but its parent company, Fumi Technology, is based in China. While Webull operates under U.S. regulations, its ownership links to Chinese investors, including Xiaomi and Shunwei Capital, which has raised some privacy and regulatory concerns.

Webull has quickly risen as a popular choice for traders looking for commission-free access to stocks, ETFs, and cryptocurrencies. This article explores Webull’s origins, ownership structure, leadership, regulatory adherence, data security, and recent plans for a public listing.

Who owns Webull?

Webull, founded in 2017, is a U.S.-based trading platform that operates under Webull Financial LLC. Headquartered in New York, it offers a broad range of trading services while being regulated within the U.S. financial system. However, the company is owned by Hunan Fumi Information Technology Co., a Chinese-based holding company with financial backing from prominent Chinese investors, including Xiaomi and Shunwei Capital. Webull’s founder, Wang Anquan, previously held roles at major Chinese tech firms, including Alibaba and Xiaomi, establishing connections that influenced the company’s funding and technological foundation.

Is Webull a U.S. or Chinese Company?

While Webull’s parent company is Chinese, Webull itself is a U.S.-registered company operating under American laws. Its regulatory compliance and headquarters in New York position it firmly within the U.S. financial system.

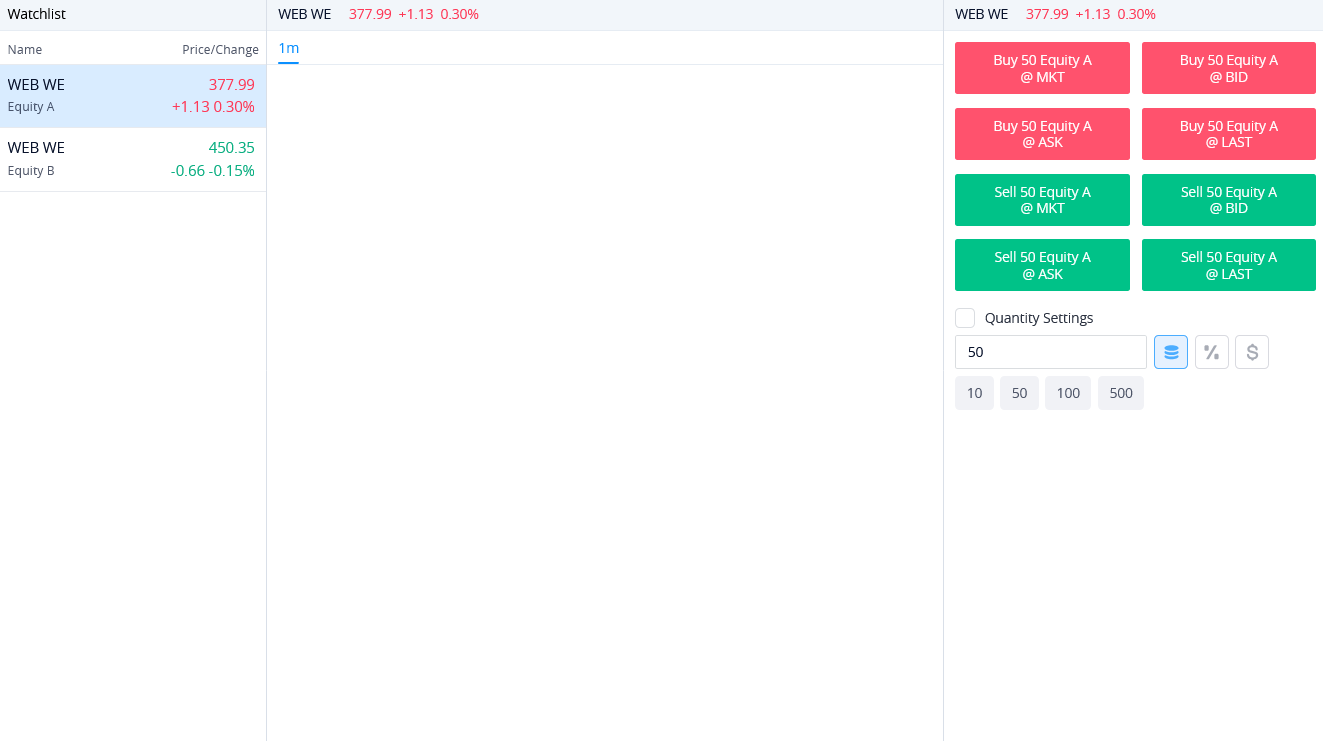

How to use Webull

-

Get started. Download the Webull app or access the platform via the website, then sign up and complete the verification process.

-

Fund your account. Fund your Webull account through a bank transfer or other supported funding methods.

-

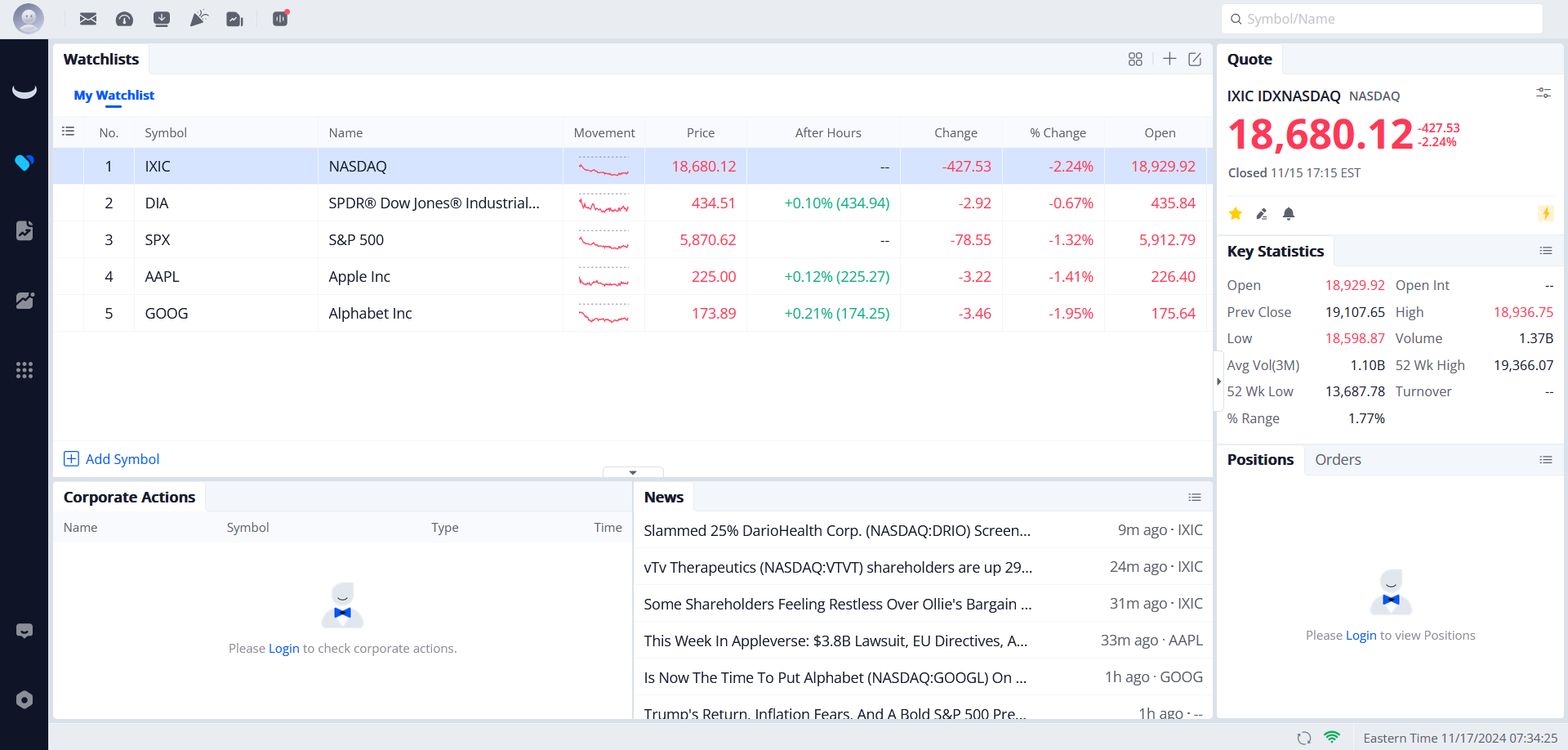

User-friendly interface. Webull provides a customizable interface with advanced charting tools and real-time data, making it easy to analyze stocks, ETFs, and cryptocurrency trends.

-

Practice with paper trading. New traders can practice using Webull’s paper trading feature to gain experience without financial risk.

-

Margin trading for advanced users. For experienced users, Webull offers margin trading, which can increase both potential gains and risks.

-

Research and alerts. Utilize Webull’s built-in research tools and set customized alerts to enhance your trading strategy and stay informed.

Webull website

Webull website

Webull website

Leadership and regulatory compliance

Webull’s U.S. operations are led by CEO Anthony Denier, who looks after regulatory adherence and data security in the American market. The platform is registered with the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), ensuring that it abides by stringent regulatory standards to protect investors. Additionally, customer assets on Webull are protected by the Securities Investor Protection Corporation (SIPC) up to $500,000, and its clearing firm, Apex Clearing Corporation, provides further insurance.

Denier and Webull’s U.S. leadership team have highlighted the company’s separation from Chinese influence, stating that customer data is stored and managed within the U.S. This structure aims to reassure users about Webull’s commitment to U.S. regulations and standards, even with its foreign ownership.

Data security and privacy concerns

Despite assurances from Webull’s management, concerns have been raised in the U.S. regarding data security, particularly given Webull’s parent company’s Chinese roots. Recent regulatory developments have heightened scrutiny around Webull’s operations. In 2024, a coalition of state attorneys general launched an investigation into Webull, examining issues surrounding data privacy and its potential affiliations with Chinese government interests. This led to a notable development when the state of Tennessee banned Webull from all government-issued devices due to security risks, emphasizing the growing unease in the U.S. over Chinese-owned platforms in sensitive areas of finance and data.

Webull has responded by reinforcing that American user data is strictly managed under U.S. regulations, with no sensitive information transferred to its parent company or other entities in China. This separation is part of Webull’s broader efforts to protect its reputation and reassure U.S. users of its independence in data management.

Public listing plans and transparency goals

In early 2024, Webull announced its intention to go public through a merger with SK Growth Opportunities Corporation (SKGR), a special-purpose acquisition company (SPAC). This move is projected to value Webull at approximately $7.3 billion. By becoming a publicly traded entity, Webull hopes to enhance its transparency and align itself more closely with other prominent American trading platforms.

The public listing is expected to bring about additional financial and operational disclosures, which may help address ongoing concerns regarding Webull’s ownership and data security policies. It also reflects Webull’s aim to solidify its position in the competitive U.S. market, demonstrating a commitment to adhering to the highest regulatory standards in order to gain investor and user trust.

Technological advantages and user experience

Webull leverages a data-driven approach to enhance its platform, delivering intuitive analytics, charting tools, and streamlined trading features. This focus on technology has been a significant factor in Webull’s rapid growth, attracting a diverse range of investors from novice traders to experienced professionals. The platform’s data-centric model also benefits from artificial intelligence and big data insights to improve user engagement and offer tailored investment advice.

Webull’s mobile app stands out with its easy-to-use design and rich features, putting essential trading tools right in your hand, perfect for trading on the go. The desktop version offers similar features, including advanced charting tools, real-time market data, and layouts you can customize to fit your trading style. In 2024, Webull made bond trading more accessible by allowing investments with as little as $100, compared to the usual $1,000 minimum at other brokerages. This change opens up bond trading to more people. Additionally, Webull's paper trading feature lets you practice trading strategies without risking real money, helping you build your skills.

The broader impact of Chinese ownership in U.S. finance

Webull is not alone in facing scrutiny over its Chinese ownership; other Chinese-affiliated companies operating in the U.S. have similarly encountered heightened regulatory attention. The platform’s ownership structure highlights broader concerns about the role of foreign investment in the U.S. financial system, particularly from countries with differing regulatory standards.

As Webull prepares for its public listing, its strategy of aligning closely with U.S. regulations and maintaining data integrity under the oversight of American management may help it address these geopolitical concerns.

Risks and warnings

While Webull provides a good platform to work with, there are some risks to consider:

-

Market volatility. As with any trading platform, investments on Webull are subject to market fluctuations. This can lead to gains but also losses, especially with high-risk assets like cryptocurrencies.

-

Margin trading risk. Webull offers margin trading, which can amplify both profits and losses. Trading on margin should be approached cautiously, as it increases the potential for financial risk.

-

Data security concerns. Given Webull’s Chinese parent company, data privacy has been a subject of scrutiny in the U.S. Though Webull assures users that data remains under U.S. regulations, the potential for regulatory changes or additional scrutiny is a consideration for users focused on privacy.

-

Limited support for certain accounts. Webull currently does not offer some account types, such as retirement accounts, which might limit options for long-term investors.

-

Withdrawal fees and timing. Users have reported potential fees and longer processing times for withdrawals, which might be inconvenient for those needing quick access to funds.

Things to look at when dealing with platforms like Webull

When choosing a trading app, it’s important to think beyond its appearance and flashy ads. Make sure to check who owns the platform and where it’s based, as this can tell you a lot about how it operates, handles user data, and follows rules. Apps with mixed ownership may have to follow different sets of regulations, which could affect your experience. Don’t just rely on popularity to assume a platform is safe — take the time to see who runs it and how it’s structured.

Also, pick platforms that are open about how they work. Look for apps that explain their safety measures, financial health, and how they meet local rules. Check if they’re linked to well-known financial groups or part of a bigger company, as this can affect how they handle your funds and your overall experience. While reading user reviews can be helpful, go a step further by finding regulatory reports or expert opinions on the app’s security. This kind of careful approach can help you avoid surprises and choose a platform that fits your needs.

Conclusion

Webull presents a unique case in the U.S. financial market: a Chinese-owned trading platform that operates independently under strict American regulations. Despite its connections to China through Fumi Technology, Webull has positioned itself as a U.S.-based platform with a strong focus on data security, transparency, and regulatory compliance. The upcoming public listing via a SPAC merger could further validate Webull’s standing as a reliable platform for U.S. investors by increasing operational transparency and reducing concerns over foreign influence.

FAQs

Is it safe to trade on the Webull?

Yes, Webull operates under U.S. regulations, and user data is stored and managed within the U.S. They also ensure data privacy with compliance to local data protection laws.

If Webull goes public, will there be any changes to the platform or user experience?

Going public is primarily aimed at increasing transparency and enhancing trust. For users, this shouldn’t change the platform's functionality or experience.

Could Webull be banned because of its Chinese ownership?

Webull complies with U.S. regulations, which makes a ban unlikely. However, continued compliance will be essential for their operations.

I want to use Webull for long-term investments. Is this platform suitable for that purpose?

Yes, Webull offers comprehensive tools for long-term investing, though it’s also popular among active traders for its features and low costs.

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).