Developing a Trading Mindset: The Key to Successful Trading

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Steps to developing a trading mindset:

- Self-awareness;

- Positive affirmations;

- Visualization techniques;

- Setting realistic goals;

- Embrace learning opportunities;

- Continuous education;

- Learn from mentors and experts.

This article explores the importance of a trading mindset, and provides a step-by-step guide for developing it.

Developing a trading mindset

Self-awareness. Identify personal strengths, weaknesses, and emotional triggers. Understanding your psychological makeup can help in mitigating negative behaviors that affect trading.

Positive affirmations. Use affirmations to build confidence and reinforce positive beliefs. Statements like “I am a successful trader” can help in developing a positive outlook.

Visualization techniques. Mentally rehearse successful trading scenarios. Visualization helps in preparing mentally for actual trading situations, thereby reducing anxiety and increasing confidence.

Setting realistic goals. Break down long-term goals into manageable milestones. Achievable goals provide direction and purpose, enhancing motivation and focus.

Embrace learning opportunities. View mistakes and losses as opportunities for growth. Analyzing errors and learning from them is crucial for continuous improvement.

Continuous education. Stay updated with market trends and strategies. Regular learning through courses, webinars, and reading helps in adapting to market changes.

Learn from mentors and experts. Seek guidance from experienced traders. Mentorship provides valuable insights and helps in developing a robust trading mindset.

Importance of mindset in trading

Impact of emotions on trading decisions

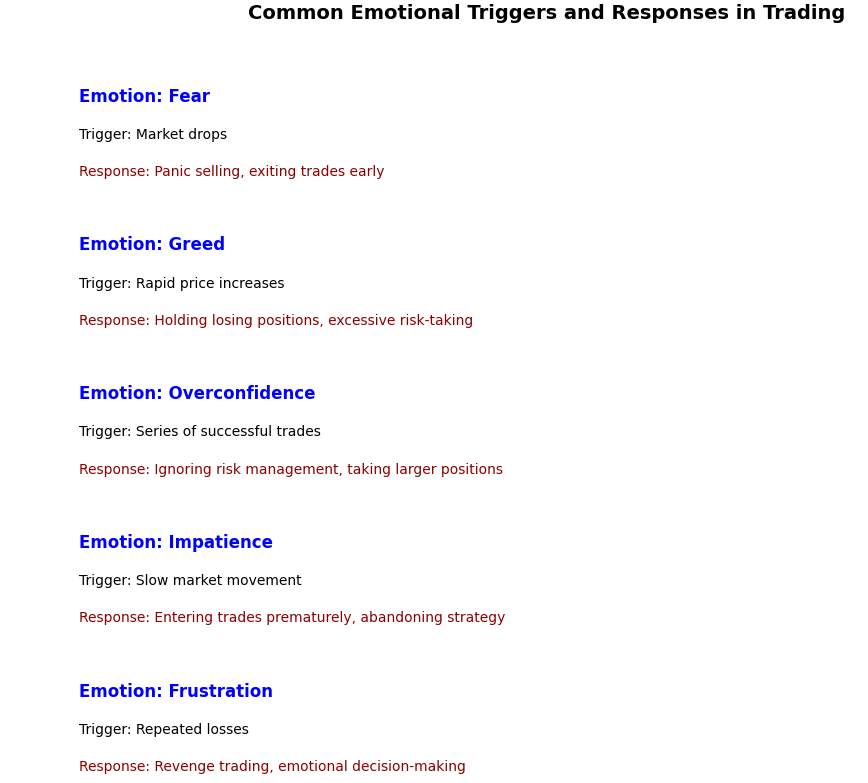

Emotions like fear, greed, and overconfidence can heavily influence trading decisions. Fear might cause a trader to exit a profitable trade too early, while greed could lead to holding onto a losing position for too long, hoping for a market reversal. Understanding these emotional triggers is essential for making rational trading decisions.

Need for discipline and regularity

Discipline is the cornerstone of successful trading. It involves sticking to a well-defined trading plan, adhering to risk management rules, and maintaining consistency in trading actions. Regularity in following these practices helps in avoiding impulsive and emotionally driven trades.

Risk control

Effective risk control is vital for long-term trading success. Psychological factors, such as fear of loss and overconfidence, can lead to poor risk management decisions. Traders must develop the ability to manage these emotions to protect their capital.

Navigating losses and market dips

Losses are an inevitable part of trading. The ability to navigate these losses without letting emotions take over is what separates successful traders from the rest. Developing strategies to handle market dips and losses calmly can prevent reactionary decisions that often lead to further losses.

Ensuring long-term viability

A strong trading mindset supports sustainable success. It involves setting realistic expectations, maintaining emotional stability, and continuously improving trading strategies. This long-term approach helps in avoiding the pitfalls of short-term, emotion-driven trading.

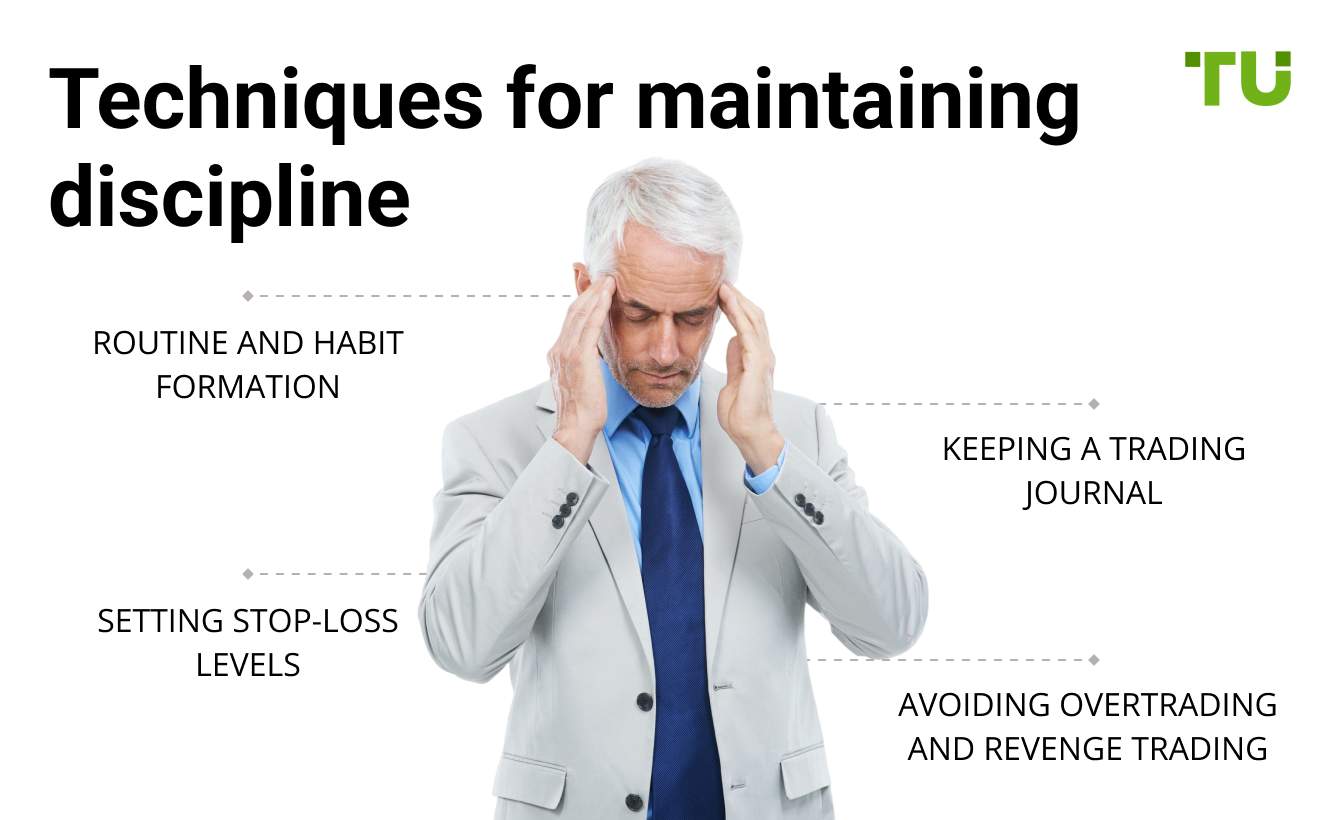

Routine and habit formation

Establishing daily routines and habits reinforces discipline. Regular practices like reviewing the trading plan and analyzing past trades can help in maintaining focus.

Keeping a trading journal

Tracking trades in a journal helps in identifying areas for improvement and reinforces discipline. A well-maintained trading journal provides insights into trading patterns and behaviors.

Setting stop-loss levels

Implementing stop-loss orders is crucial for managing risk. A chart showing how stop-loss levels protect against large losses can illustrate this concept effectively.

Avoiding overtrading and revenge trading

Recognizing and mitigating impulsive behaviors like overtrading and revenge trading is essential. Techniques to control these impulses help in maintaining trading discipline.

Handling emotional trading

Managing fear and greed

Strategies for controlling powerful emotions like fear and greed are vital for trading success.

Detaching emotionally from trades

Maintaining objectivity in trading decisions by detaching emotionally from trades is crucial. Techniques for achieving this detachment can help in making rational decisions.

Coping with losses

Approaches for handling losing trades and minimizing emotional impact are essential for psychological resilience.

Maintaining a growth mindset

Continuously learning and adapting to market changes is key to trading success. A growth mindset encourages traders to view challenges as opportunities for improvement.

Building a positive trading mindset

Positive affirmations and visualization. Using positive affirmations and mental rehearsals can build a positive mindset. These techniques reinforce confidence and help in maintaining a positive outlook.

Setting realistic and achievable goals. Realistic goal setting is important for motivation and focus. Breaking down long-term goals into achievable milestones helps in maintaining direction.

Cultivating patience and persistence. Patience and persistence are crucial for long-term trading success. Emphasizing these qualities helps in developing a resilient trading mindset.

Regular self-reflection and review. Periodic self-reflection and review of trading performance are essential for continuous improvement. A template for a self-reflection checklist can assist in this process:

| Self-reflection Aspect | Questions to ask yourself |

|---|---|

Emotional response to trades | How did I feel after each trade? Did I let emotions affect my decisions? |

Adherence to trading plan | Did I follow my trading plan strictly or deviate from it? Why? |

Risk management practices | Was my risk management strategy effective? What can I improve? |

Identification of biases | Did I notice any cognitive biases in my decision-making process? |

Learning from mistakes | What mistakes did I make, and what can I learn from them? |

Consistency in trading | Was I consistent in my trading actions and decisions? |

Continuous education | What new knowledge or skills did I acquire recently? |

Review of trading journal | Did I regularly review my trading journal? What patterns did I notice? |

Setting and achieving goals | Were my trading goals realistic and achievable? Did I meet them? |

Feedback from mentors or peers | Did I seek feedback from mentors or peers? How did it help me improve? |

Resources for improving trading psychology

Online courses and webinars. Educational resources such as online courses and webinars offer continuous learning opportunities for traders.

Trading communities and forums. Engaging with other traders in communities and forums provides support and insights, helping traders improve their psychological resilience.

Professional mentorship. Learning from experienced traders through mentorship can accelerate the development of a robust trading mindset.

Books and articles. Recommended readings on trading psychology provide valuable insights and knowledge. A list of top books will help improve your trading psychology:

| Title & Author | Description |

|---|---|

The Disciplined Trader by Mark Douglas | Focuses on the psychological aspects of trading, offering practical advice for developing discipline and emotional control. |

Trading in the Zone by Mark Douglas | Emphasizes the importance of consistency and probabilistic thinking in trading success. |

The Psychology of Trading by Brett Steenbarger | Explores the intersection of psychology and trading, providing insights into improving traders' mental approach. |

Enhancing Trader Performance by Brett Steenbarger | Offers practical strategies for improving trading performance through better psychological practices and self-awareness. |

Market Wizards by Jack D. Schwager | A collection of interviews with successful traders, offering valuable insights into their mindsets and strategies. |

Thinking, Fast and Slow by Daniel Kahneman | Explores cognitive biases and decision-making processes relevant to traders, though not exclusively about trading. |

Developing a trading mindset involves a combination of self-awareness, discipline

Developing the right trading mindset is not just beneficial — it’s essential. Trading is a psychological battle as much as it is a technical one. Here are some insights from my experience that I believe can help both new and experienced traders.

One of the most valuable lessons I’ve learned is the importance of self-awareness. Knowing your strengths and weaknesses can significantly impact your trading performance. For instance, if you know that you tend to get anxious during high volatility, you can prepare yourself mentally or adjust your trading strategy to mitigate this weakness. I recommend keeping a trading journal to document your trades, thoughts, and emotions.

In conclusion, developing a trading mindset involves a combination of self-awareness, discipline, continuous learning, and community engagement. It’s a continuous journey of self-improvement and adaptation. By focusing on these areas, you can enhance your trading performance and navigate the complexities of the market with confidence and resilience. Remember, your mindset is your most powerful tool in trading. Use it wisely.

Conclusion

Developing a trading mindset is essential for achieving long-term success in the financial markets. Your mindset influences every decision, from entering and exiting trades to managing risks and coping with losses. By focusing on self-awareness, positive affirmations, visualization techniques, and continuous education, traders can cultivate a resilient and disciplined approach.

By continuously working on psychological resilience and discipline, traders can navigate the complexities of the market with confidence and achieve sustainable success. Remember, a strong trading mindset is as crucial as technical skills and market knowledge, making it a fundamental aspect of your trading journey.

FAQs

How can I develop a trading mindset?

Developing a trading mindset involves self-awareness, positive affirmations, visualization techniques, setting realistic goals, embracing learning opportunities, continuous education, and learning from mentors and experts.

Why is mindset important in trading?

Mindset is crucial in trading because it impacts decision-making, helps manage emotions, enforces discipline, and supports long-term viability. A strong mindset allows traders to handle losses and market volatility effectively.

What should beginners focus on when developing a trading mindset?

Beginners should focus on understanding behavioral biases, developing patience and discipline, implementing basic risk management techniques, and starting with a simple trading plan to build confidence and experience.

How can advanced traders improve their trading mindset?

Advanced traders can improve their mindset by utilizing advanced emotional control techniques, leveraging technology for psychological resilience, maintaining consistency and discipline, and adopting a probabilistic mindset.

Related Articles

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

The informal term "Forex Gods" refers to highly successful and renowned forex traders such as George Soros, Bruce Kovner, and Paul Tudor Jones, who have demonstrated exceptional skills and profitability in the forex markets.

Overtrading is a phenomenon where a trader executes too many transactions in the market, surpassing their strategy and trading more frequently than planned. It's a common mistake that can lead to financial losses.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.