What Is Rich Mindset And How To Develop It

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

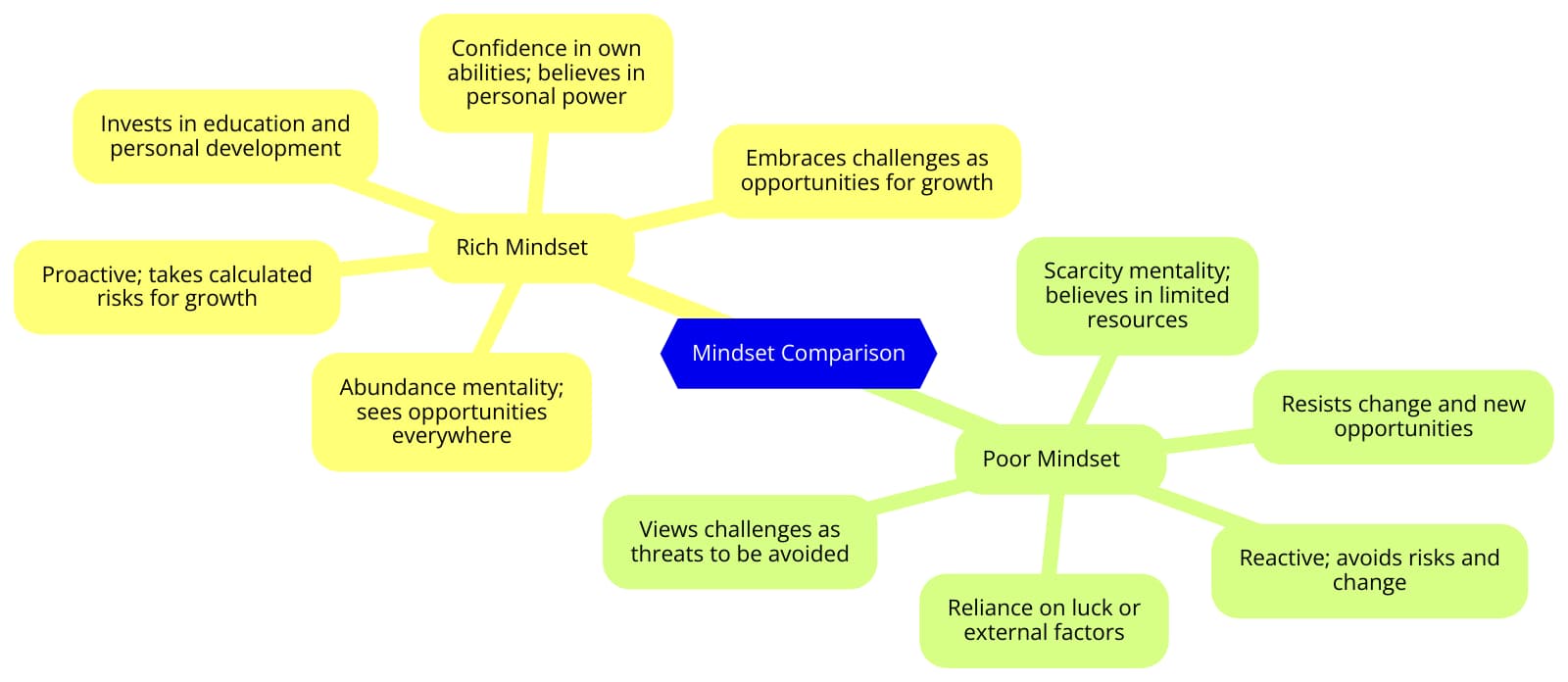

Rich Mindset and Poor Mindset represent two different ways of thinking that shape a person's approach to finances and life in general. People with a Rich Mindset see opportunities, learn from failures, and strive for continuous development, while a Poor Mindset is limited by fear of change and risk, as well as negative beliefs. Transitioning from a poor mindset to a rich one requires recognizing your limitations and adopting positive habits and beliefs, leading to financial success and personal growth.

In this article, we will explore the key differences between a Rich Mindset and a Poor Mindset and their impact on financial success and personal growth. Understanding these differences will help you realize how your thinking and beliefs can determine your wealth. We will also provide practical tips for developing a Rich Mindset.

What is a rich mindset and a poor mindset?

Comparison of rich mindset and a poor mindset

Comparison of rich mindset and a poor mindsetA rich mindset is characterized by a focus on abundance, opportunity, and financial independence . Those with a rich mindset see challenges as opportunities for growth, invest in their education and personal development, and actively seek out ways to create wealth and achieve their goals. They are open-minded, proactive, and willing to take calculated risks to pursue financial success.

In contrast, a poor mindset is marked by a scarcity mentality, fear of failure, and a reliance on luck or external factors for financial success . People with a poor mindset may avoid taking risks, resist change, and harbor negative beliefs about money and their ability to achieve prosperity.

How to develop a rich mindset

Developing rich thinking involves changing your habits. Below are some practical tips and strategies to help you develop a mindset that promotes financial success and personal growth.

Practical tips and strategies

Set clear goals. Start by defining clear and achievable goals. Break them down into smaller, manageable steps and create a plan to achieve them. This provides direction and motivation. According to a study by Dominican University of California, people who write down their goals are 42% more likely to achieve them. This emphasizes the importance of clarity and specificity in goal-setting for financial success.

Continuous learning. Read books, take courses, and seek out mentors who can offer advice and ideas. Lifelong learning is the key to staying ahead and adapting to change.

Take calculated risks. See risk as an opportunity for growth. At the same time, carefully assess the risks to make informed decisions. Taking calculated risks can lead to significant rewards.

Networking. Surround yourself with like-minded people who inspire and challenge you. Connecting with successful people can provide valuable information and opportunities.

Invest wisely . Develop the habit of saving and investing. Learn about different investment options and seek professional advice if necessary. Investing helps to significantly increase your wealth over time. Data from Vanguard shows that the average annual return of a balanced portfolio (60% stocks, 40% bonds) over the past 20 years has been around 7%.

Changing habits

Predisposition to personal growth. Includes accepting challenges and failures as learning opportunities. A growth mindset encourages continuous improvement and adaptability.

Development of discipline. Set a daily routine and stick to it. Discipline in daily habits, such as saving regularly and studying consistently, creates a strong foundation for long-term success.

Focus on solutions. Shift your focus from problems to solutions. Instead of focusing on obstacles, think about how you can overcome them and what steps you can take to move forward.

Mindfulness practice. Mindfulness helps you stay in the present and reduces stress. Techniques such as meditation and deep breathing can improve mental clarity and concentration.

Characteristics of a poor mindset

Fear of risk and change: This is one of the main characteristics of a poor mindset. People with this mindset often avoid new opportunities and changes, preferring to stay in their comfort zone. They are afraid of losing what they have and do not believe that change can lead to better things. This fear paralyzes them, preventing them from making important decisions and taking steps to improve their lives.

Limiting beliefs and attitudes: People with a poverty mindset also have many limiting beliefs and attitudes. They believe that they do not deserve success or that wealth is only available to a select few. These attitudes are formed under the influence of the environment, upbringing and past failures. They act as a barrier that prevents a person from moving forward and achieving their goals.

How to recognize and overcome a poverty mindset

Overcoming a poverty mindset takes time and effort, but through self-reflection techniques and positive attitude changes, it is entirely possible.Scientific research supports the effectiveness of various methods to help identify and change limiting beliefs. Some of them are discussed below.

Cognitive behavioral therapy (CBT). It is one of the most effective methods of changing thinking. It focuses on identifying and changing negative thoughts and beliefs. Through CBT, a person learns to recognize irrational thoughts and replace them with more realistic and positive ones.

Metacognitive therapy. Aimed at changing metacognitive beliefs, that is, beliefs about one’s own thoughts. This approach helps people understand how their thoughts affect their emotions and behavior. With the help of metacognitive therapy, you can learn to control negative thoughts and reduce their influence.

Mindfulness and meditation. Proven to be effective in changing mindsets. Mindfulness practices help develop awareness and concentration, which helps you better understand your thoughts and emotions. Meditation reduces stress levels and improves emotional well-being.

Methods of self-analysis. Such as journaling are also effective in identifying and changing attitudes. Writing down your thoughts and emotions helps you better understand your inner beliefs and identify negative thinking patterns.

We have selected several brokers so that you can test your Rich Mindset skills to increase your capital. These companies offer a wide range of assets for the most discerning traders, including stocks, bonds and currency pairs, low minimum deposit and spreads.

| Plus500 | Pepperstone | OANDA | FOREX.com | Interactive Brokers | |

|---|---|---|---|---|---|

|

Min. deposit, $ |

100 | No | No | 100 | No |

|

Max. leverage |

1:300 | 1:500 | 1:200 | 1:50 | 1:30 |

|

Min Spread EUR/USD, pips |

0,5 | 0,5 | 0,1 | 0,7 | 0,2 |

|

Spread by account type ECN, ECN Spread EUR/USD, avg, pips |

No | 0,1 | 0,15 | 0,2 | 0,2 |

|

Spread by account type Raw, Raw Spread EUR/USD avg, pips |

No | No | No | 0,1 | No |

|

Scalping |

Yes | Yes | Yes | Yes | Yes |

|

Trading bots (EAs) |

Yes | Yes | Yes | Yes | Yes |

|

Open account |

Open an account Your capital is at risk. |

Open an account Your capital is at risk.

|

Open an account Your capital is at risk. |

Study review | Open an account Your capital is at risk. |

Change your beliefs and attitude towards money and success

Rich Mindset, or the mindset of a rich person, is a set of beliefs and habits aimed at achieving financial success and personal growth. I see that people with this mindset see opportunities where others see problems. They strive for continuous learning, are not afraid of risks, and perceive failures as lessons rather than defeats. This mindset contributes to the active development and realization of potential, allowing you to achieve significant success both in the financial sphere and in other aspects of life.

Developing a Rich Mindset requires systematic work on yourself. I recommend first changing your beliefs and attitude towards money and success. This can be done through cognitive behavioral therapy, metacognitive therapy and mindfulness practices. These techniques help you recognize and change limiting beliefs, develop positive thinking, and learn to cope with negative thoughts. It is also important to implement habits that promote personal and professional growth, such as continuous learning, effective time and resource management, and strategic planning.

To develop a Rich Mindset, I recommend starting by setting clear and achievable goals, breaking them down into small steps. Incorporate reading, learning and self-reflection into your daily routine. Gradually, you will notice how your thinking changes, becoming more flexible and open to new opportunities, which will lead to an improved quality of life and financial success.

Conclusion

Developing a Rich Mindset is a crucial step toward financial success and personal growth. This type of mindset allows individuals to see opportunities instead of limitations, view failures as temporary obstacles, and use them for further development. People with a Rich Mindset exhibit determination, perseverance, and a willingness to engage in continuous learning, ultimately leading them to achieve their goals.

To develop a Rich Mindset, it is essential to actively work on changing your beliefs and habits. Key elements of this process include cognitive-behavioral therapy, metacognitive therapy, and mindfulness practices. Regular application of these methods helps cultivate positive thinking, overcome fears and limiting beliefs, and build self-confidence.

In conclusion, the path to developing a Rich Mindset requires time, effort, and dedication. However, by making the necessary efforts and following the outlined methods and strategies, you can significantly change your thinking and behavior.

FAQs

Is it possible to develop a rich mindset later in life, or is it only for the young?

Rich mindset development is possible at any age. It's never too late to start cultivating positive beliefs and habits to achieve financial success.

Can a rich mindset be inherited or is it solely based on personal effort?

While environment and upbringing play a role, a rich mindset is primarily shaped by personal attitudes and efforts towards learning, growth, and risk-taking.

Does developing a rich mindset require significant financial resources upfront?

No, developing a rich mindset is more about adopting the right mindset and habits than having substantial financial resources. It's about making the most of what you have and being resourceful.

How can a rich mindset impact other areas of life beyond finances?

A rich mindset can positively influence various aspects of life, including relationships, health, and personal fulfillment. It fosters a proactive approach to challenges and encourages continuous self-improvement.

Related Articles

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

The informal term "Forex Gods" refers to highly successful and renowned forex traders such as George Soros, Bruce Kovner, and Paul Tudor Jones, who have demonstrated exceptional skills and profitability in the forex markets.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

An ECN, or Electronic Communication Network, is a technology that connects traders directly to market participants, facilitating transparent and direct access to financial markets.