Do I pay Forex trading taxes in Germany?

Yes, Forex trading in Germany is subject to taxation. Traders are liable for taxes on their trading income, and the rates vary based on the nature of the income, including capital gains. It is essential for traders to understand the tax laws, maintain accurate records, and be aware of specific regulations to optimize their tax obligations. The capital gains tax rate for financial investments is 25%, with an additional 5.5% solidarity surcharge, totaling 26.375%. Additionally, traders can benefit from an ”investor's allowance” to reduce taxable income. Consulting with tax professionals is advisable to ensure compliance and maximize available deductions.

Germany, with its rigorous tax system, subjects Forex traders to specific obligations. This article delves into the fundamentals of Forex trading taxes in Germany, shedding light on the regulations, tips, and essential information that traders need to navigate the tax landscape effectively.

-

Is Forex trading legal in Germany?

Yes, Forex trading is legal in Germany. The country provides a business-friendly environment, allowing investors to participate in the foreign exchange market. However, traders and brokers must adhere to strict legislation, requiring licensing from the Federal Financial Supervisory Authority (BaFin) for legal operation.

-

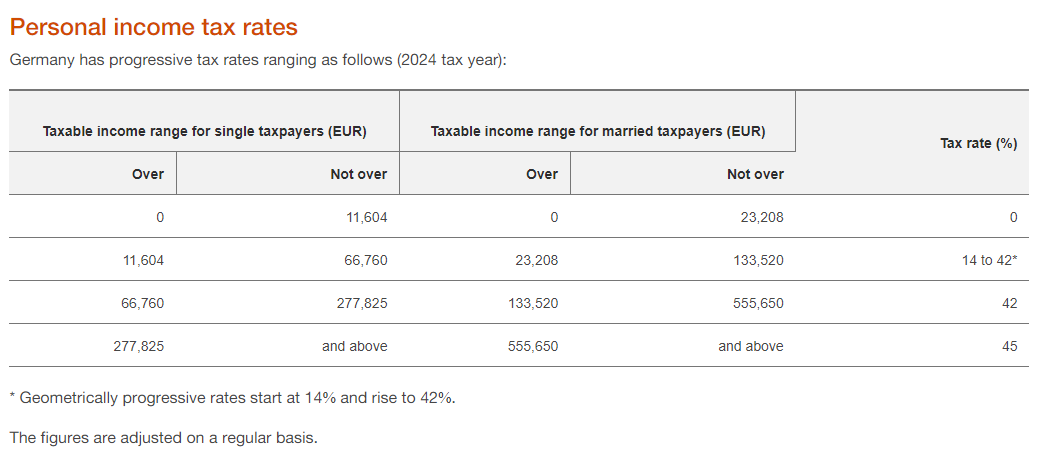

How much tax do you pay on trading income in Germany?

The tax on trading income in Germany varies. Capital gains from financial investments, including trading, are subject to a flat tax rate of 25%, with an additional 5.5% solidarity surcharge (totaling 26.375%). This tax is withheld at the source if the broker is based out of Germany; otherwise, it needs to be declared by the trader.

-

Is foreign income taxable in Germany?

For residents, worldwide income is taxable in Germany. However, non-residents are taxed only on income derived from German sources. Foreign-source income is subject to a credit for the foreign tax paid, limited to the corporation tax on net income.

-

Is Germany a free trade zone?

While Germany is part of the European Union (EU), which is a customs union promoting free trade among its members, it is not a free trade zone in the traditional sense. However, being in the EU facilitates trade relations, and Germany benefits from the free movement of goods within the EU.

Rules and Regulation

Forex regulation in Germany

BaFin is Germany’s financial regulator. This body issues licenses and monitors compliance by organizations. To obtain a license, there are requirements on the authorized capital, skills of employees, risk management, transparency, and funds storage.

Investor protection

The German Act WpHG protects investors. Germany is a member of MiFID II, which regulates all Forex brokers in the EU. Germany has an EdW Trader Insurance Compensation Fund, which compensates traders in case of broker’s bankruptcy for an amount up to €20,000.

Taxation

Profit from trade is taxed on a progressive scale. If the annual income is up to EUR 25,000, the rate is 15%. If the income is above EUR 25,000, the rate is 25%. Traders pay taxes themselves. Benefits and deductions are possible. Consulting with tax expert is recommended.

Best brokers for Forex trading in Germany

Forex trading taxation in Germany - How it works

Capital gains from financial investments, like the sale of shares or Forex gains, face a flat tax rate of 25%, plus a 5.5% solidarity surcharge. While related expenses cannot be deducted, there is an “investor's allowance” of EUR 801 (EUR 1,000 from the assessment period 2023) per taxpayer, providing relief for financial investment income. Specific rules and exemptions apply to capital gains from mutual funds units, and other capital gains are subject to progressive rates based on holding periods and total profits.

| Tax Type | Rate | Notes |

|---|---|---|

Capital Gains Tax |

25% |

Applied to all profits from Forex trading |

Solidarity Surcharge |

5.50% |

Added to the capital gains tax, bringing the total effective rate to 26.375% |

Church Tax (optional) |

Varies depending on region and religious affiliation |

Additional tax, typically between 8% and 9%, based on your income and church membership |

What are the tax rates for Forex trading income in Germany?

The tax rate for Forex trading income in Germany is 25%, effective from 2024. However, there is an investor's allowance of EUR 801 (EUR 1,000 from the assessment period 2023) per taxpayer for financial investment income. This allows for a tax-free threshold up to this amount.

How much trading income is tax-free in Germany?

In Germany, capital gains are taxable only if the overall gain over the year crosses the EUR 600 threshold.

Subjects of taxation in Germany

In Germany, an individual's tax liability is significantly influenced by their fiscal residence status. The determination of tax residency is based on factors such as having a dwelling in Germany or a habitual abode with a physical presence exceeding six months in a tax year. Notably, nationality does not play a role in this determination. Residents in Germany are subject to taxation on their global income, including various categories like agriculture, forestry, trade, business, employment, capital investment, rents, royalties, and other income. In contrast, non-residents are taxed solely on their German source income, usually through withholding mechanisms. The tax status for legal entities hinges on fiscal residence, with companies either incorporated or managed and controlled in Germany deemed tax residents. Taxable income for resident companies extends globally, while non-resident companies are taxed solely on income from a German source.

Tax benefits and exemptions in Germany

pwc

The following are the most useful tax benefits and exemptions in Germany:

-

Income-related expenses lump sum

The German tax office allows a lump sum of €1,200 (increasing to €1,340 in 2023) for income-related expenses, covering work-related travel, stationery, and accountant services. Individuals exceeding this lump sum with additional expenses can deduct individual costs, provided they furnish proof or receipts -

Child allowance

Deductions are applicable for childcare expenses, allowing up to €4,194 a year per child -

Education expenses

Deductions are available for education expenses, allowing up to 30% of tuition fees -

Charitable contributions

Individuals can benefit from deductions for charitable contributions, with a limit of up to 20% of adjusted gross income. This applies to donations made to German charities and specific international charities -

Alimony payments

Deductions are applicable for alimony payments, with a cap at €13,805, subject to meeting the government's criteria

| Deduction/Allowance | Amount |

|---|---|

Income-related Expenses |

EUR 1,200 (2023: EUR 1,340) |

Child Allowance |

Up to EUR 4,194 per child |

Education Expenses |

Up to 30% of tuition fees |

Charitable Contributions |

Up to 20% of adjusted gross income |

Alimony Payments |

Up to EUR 13,805 |

For legal entities

-

Research and Development (R&D) allowance

The German Research Allowance Act introduces a tax-free subsidy of 25% of salaries and wages for certain R&D purposes, with a limited maximum amount per year -

Local authorities' incentives

Local authorities may provide facilities on favorable terms, such as inexpensive land on industrial estates and certain direct government aid -

Foreign tax credit

If foreign-source income is not exempt from German taxation, a credit is given for the foreign tax actually paid and not otherwise recoverable. However, the credit is limited to the corporation tax (including the solidarity surcharge) on the net income

| Benefit/Exemption | Details |

|---|---|

Research and Development Allowance |

25% tax-free subsidy for certain R&D purposes |

Local Authorities' Incentives |

Facilities and aid on favorable terms from local authorities |

Foreign Tax Credit |

Credit for foreign tax paid, limited to German corporation tax on net income |

Case studies

1 Case Study 1: Anna Müller

In the financial year 2023, Anna actively engaged in currency trading as a side gig, primarily dealing with Forex and Contracts for Difference (CFD) transactions. Anna made a total profit of EUR 150 from her Forex and CFD trading activities during the year. According to German tax regulations, capital gains from financial investments, including Forex gains, are tax exempt for gains up to EUR 600. Therefore, Anna would not be liable to pay any taxes.

2 Case Study 2: Stefan Schneider

Stefan Schneider, a resident of Hamburg, has been actively involved in professional Forex and CFD trading for several years. During the financial year 2023, Stefan executed a series of successful trades, resulting in a substantial profit of EUR 50,000. As per German tax regulations, Stefan would be subject to the flat tax rate of 25% on his capital gains from Forex and CFD trading. The solidarity surcharge of 5.5% would also be applicable.

-

Taxable amount = EUR 50,000 * 25% = EUR 12,500

-

Solidarity surcharge = EUR 12,500 * 5.5% = EUR 687.50

Stefan's tax liability would be EUR 13,187.50.

3 Case Study 3: Luisa Wagner

Luisa, a single taxpayer, engages in short-term trading activities, resulting in capital gains of EUR 900 within a year. As these gains fall below the EUR 1,000 yearly threshold (updated from EUR 801), Luisa's capital gains remain tax-exempt. Her approach to keeping profits within this limit ensures no tax liability on her short-term gains.

Taxation tips for Forex trading in Germany

Understanding the fundamentals of taxation is crucial for Forex traders in Germany. Here are essential tips to optimize tax obligations:

-

Familiarize with tax system

Stay updated on German tax laws and any amendments to ensure compliance with the evolving tax code impacting Forex trading activities -

Maintain detailed records

Keep comprehensive records, noting trade details, dates, amounts, and associated fees. Accurate documentation facilitates precise tax reporting -

Explore income-splitting

Consider income distribution among family members strategically. This approach may help alleviate the overall tax burden on your Forex trading gains. -

Consult tax professionals

Engage with tax professionals or accountants specializing in capital gains tax. Their expertise ensures you leverage all available tax deductions and credits. -

Trade tax awareness

Local municipalities levy trade tax in Germany, with rates varying. Be aware of the trade tax rates in your jurisdiction, as they contribute to the overall tax liability. -

Comply with annual summary requirement

Adhere to the new tax law mandating an annual summary of all trades, including spreads or multi-leg transactions treated as separate trades. This ensures adherence to regulatory requirements and accurate tax reporting.

Team that worked on the article

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Tobi Opeyemi Amure is an editor and expert writer with over 7 years of experience. In 2023, Tobi joined the Traders Union team as an editor and fact checker, making sure to deliver trustworthy and reliable content. The topics he covers include trading signals, cryptocurrencies, Forex brokers, stock brokers, expert advisors, binary options.

Tobi Opeyemi Amure motto: The journey of a thousand miles begins with a single step.