How Forex Is Regulated In Israel: Key Rules & Licensing

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

In Israel, Forex trading is legal and regulated by the Israel Securities Authority (ISA). Brokers wishing to operate in the Israeli market must obtain a license from the ISA, demonstrating compliance with regulatory standards. The ISA enforces strict oversight to ensure fair trading practices and investor protection.

The Forex market in Israel is strictly regulated to protect investors and ensure transparency of financial transactions. The main regulatory body is the Israel Securities Authority (ISA), which sets requirements for brokers and supervises their activities. Licensing of Forex companies in the country is mandatory, and violation of regulations entails serious sanctions. There are also strict restrictions on providing services to retail clients, including a ban on high leverage. In this article, we have looked at the key regulations, the licensing process, and the tax obligations of traders in Israel.

Risk warning: Forex trading carries high risks, with potential losses including your entire deposit. Market fluctuations, economic instability, and geopolitical factors impact outcomes. Studies show that 70-80% of traders lose money. Consult a financial advisor before trading.

How Forex is regulated in Israel: key rules & licensing

In Israel, the Forex market is regulated by the Israel Securities Authority (ISA), which oversees Forex brokers' activities and ensures investor protection. Since 2015, strict regulations have been in place, requiring online brokers to obtain an ISA license to offer margin trading services to retail clients.

Forex broker licensing

To legally offer Forex trading services in Israel, brokers must secure a license from the ISA. This licensing process is rigorous, involving a detailed evaluation of the broker's financial stability, operational integrity, and adherence to regulatory standards. Key requirements include.

Minimum capital requirements. Brokers must maintain a minimum capital to ensure they can meet their financial obligations. For a limited license, a starting capital of approximately $200,000 is required, while a full market maker license necessitates about $380,000, contingent upon proper risk management.

Professional qualifications. Employees, especially those in advisory or managerial positions, must possess relevant qualifications and experience to ensure competent service delivery.

Transparency and reporting. Brokers are obligated to provide clear and accurate information about their services, fees, and the inherent risks associated with Forex trading.

Several brokers have successfully obtained ISA licenses, including Plus500IL Ltd., the Israeli subsidiary of Plus500, which received its trading arena license from the ISA in 2016.

Operational requirements for brokers

Licensed Forex brokers in Israel must adhere to several operational mandates designed to protect investors and maintain market integrity.

Leverage restrictions. To mitigate excessive risk, the ISA imposes leverage limits. These limits vary based on the volatility of the traded assets, ranging from conservative ratios like 20:1 for high-volatility assets to more liberal ratios up to 100:1 for lower-risk assets.

Disclosure requirements. Brokers are required to furnish clients with comprehensive information regarding the risks associated with Forex trading, details of their services, and any applicable fees.

Segregation of funds. To protect clients in the event of a broker's financial distress, client funds must be kept separate from the company's operational funds.

ISA's enforcement actions

The ISA actively monitors the Forex market and enforces compliance through various measures.

Prohibition of binary options. In 2016, the ISA banned licensed brokers from offering binary options to domestic traders, extending this prohibition to foreign traders in 2017 to curb fraudulent activities.

Action against unlicensed operations. The ISA has taken decisive actions against entities operating without proper licensing. For instance, in 2016, the regulator ordered Interactive Brokers to cease its Forex operations in Israel due to the lack of appropriate licensing.

Investor protection measures

The ISA's regulatory framework is designed with a strong emphasis on investor protection.

Educational initiatives. The ISA promotes investor education to ensure that traders are well-informed about the risks and dynamics of Forex trading.

Complaint resolution. A structured mechanism is in place for investors to lodge complaints against brokers, ensuring grievances are addressed promptly and fairly.

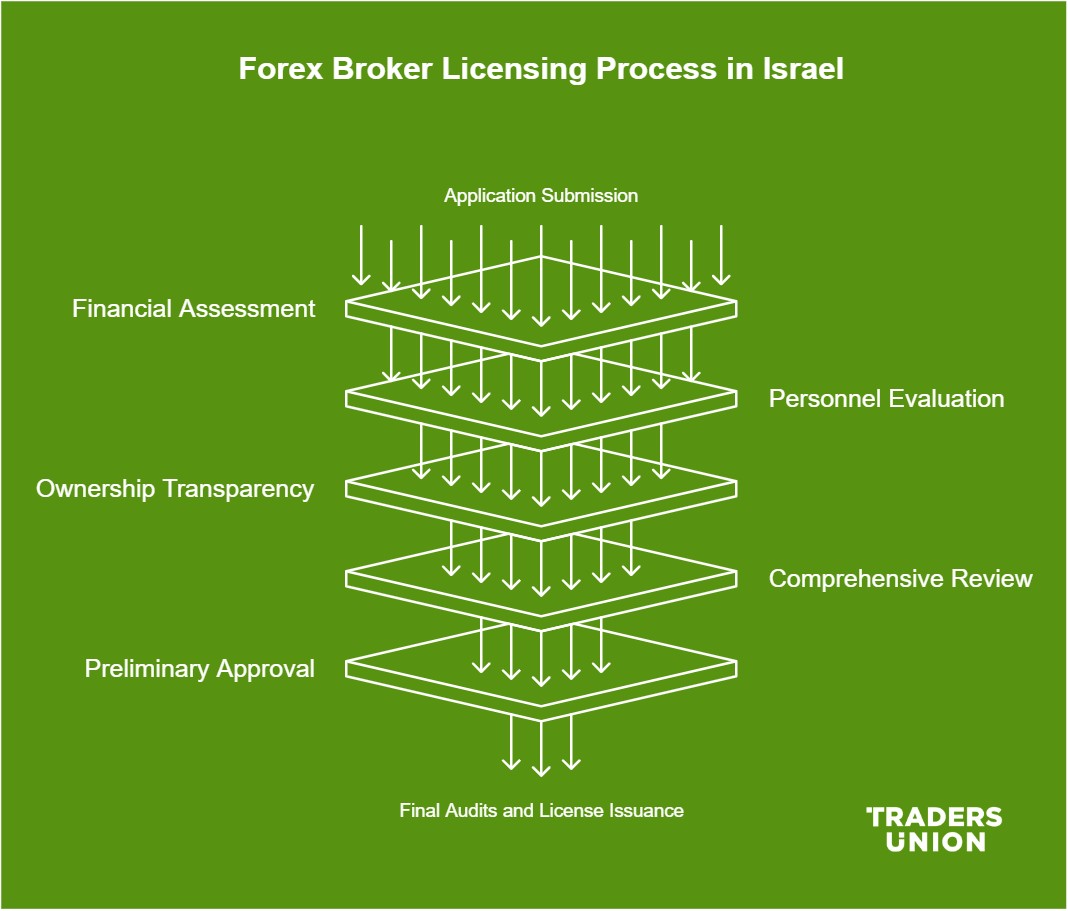

Forex brokers licensing process in Israel

In Israel, the foreign exchange (Forex) market operates under the stringent oversight of the Israel Securities Authority (ISA), established to ensure transparency and integrity within the financial markets. The ISA mandates that all Forex brokers obtain a license to operate legally, enforcing strict compliance standards to protect investors and maintain market stability.

Licensing process

The process of obtaining a Forex broker license in Israel is comprehensive, involving several critical stages.

Application submission. Prospective brokers must submit a detailed application to the ISA, including essential corporate documents such as the company's articles of incorporation and a comprehensive business plan outlining key operational aspects, market strategies, financial projections, and risk management measures.

Financial assessment. The ISA evaluates the financial stability of the applicant to ensure they possess the required minimum capital. For a limited license, a starting capital of approximately $200,000 is necessary, while a full market maker license requires about $380,000, contingent upon proper risk management.

Personnel evaluation. The qualifications and experience of key personnel, particularly senior management, are scrutinized to ensure they meet the professional standards required to operate a Forex brokerage.

Ownership and transparency. The ownership structure is examined to ensure transparency and compliance with regulatory standards, preventing any potential conflicts of interest.

Comprehensive review. The ISA conducts an in-depth review of the submitted documents, verifies funding sources, and assesses the company's risk management framework. This stage ensures that the applicant can operate within the regulatory guidelines and maintain financial stability.

Preliminary approval and final audits. Upon passing the initial assessments, the applicant receives preliminary approval. Subsequently, additional audits are conducted to confirm compliance with transparency and client protection standards. Only after successfully completing this rigorous process does the ISA issue a license, authorizing the company to operate legally in Israel.

Consequences of operating without a license

Operating as a Forex broker in Israel without an ISA license carries severe penalties.

Financial penalties. Unlicensed brokers are subject to substantial fines. For instance, in 2016, the ISA fined D.G.I Media NIS 500,000 for operating a binary options brokerage without proper authorization.

Operational bans. The ISA actively monitors the market and can impose bans on unlicensed entities, effectively prohibiting them from operating within Israel.

Legal actions. Severe violations can lead to criminal charges against company executives, including potential imprisonment, especially in cases involving fraudulent activities.

Forex trading taxation in Israel

In Israel, income derived from foreign exchange (Forex) trading is subject to taxation, with the applicable tax rates and obligations varying based on the trader's status and the nature of their trading activities.

General taxation principles for Forex trading income

Profits from Forex trading are considered taxable income in Israel. The classification of this income depends on the trader's engagement level:

Capital gains. For individuals who engage in Forex trading occasionally and do not consider it their primary source of income, profits are typically classified as capital gains. These gains are taxed at a flat rate of 25%.

Business income. If Forex trading is conducted systematically and recognized as a professional activity, the income may be classified as business income. Such income is subject to progressive income tax rates, which can reach up to 50%, depending on total earnings.

Tax rates for individuals and corporations

Individuals. Private investors whose Forex trading is not considered a professional activity are subject to a 25% capital gains tax. However, if the tax authorities determine that trading constitutes a business activity, the income is subject to progressive income tax rates, ranging from 10% to 50%, depending on total earnings.

Corporations. Companies engaged in Forex trading are subject to corporate tax, with a standard rate of 23% applied to taxable profits.

Reporting obligations for traders and brokers

Traders using foreign brokers. Individuals trading through foreign brokers must self-report their Forex income and pay the appropriate taxes, as foreign brokers do not withhold taxes for the Israeli tax system. Annual tax returns must be filed, detailing all trading income and expenses.

Traders using Israeli brokers. When trading through an Israeli broker, the broker is responsible for withholding tax on the client's profits and remitting it to the tax authorities. However, the trader remains ultimately responsible for ensuring correct tax payments.

Possible tax deductions and benefits

Israeli tax laws allow traders to offset losses against future profits, reducing the taxable base. Losses can be carried forward and deducted from future gains to lower tax liabilities. Additionally, traders may deduct expenses directly related to trading activities, including brokerage commissions, fees for access to trading platforms, and other relevant costs.

It's important to note that tax regulations can change, and individual circumstances may vary. Therefore, it's advisable for Forex traders in Israel to consult with tax professionals or the Israeli Tax Authority to ensure compliance with current laws and to optimize their tax strategies.

How to choose a reliable Forex broker in Israel

Selecting a reliable Forex broker in Israel requires a thorough approach and consideration of several key factors.

Checking for an ISA license

The first step is verifying whether the broker holds a license issued by the Israel Securities Authority (ISA). A valid ISA license confirms that the company complies with regulatory standards and operates under the supervision of the authority. The official list of licensed brokers is available on the ISA website.

Evaluating trading conditions, transparency, and reputation

Once the broker’s license is confirmed, it is essential to review trading conditions, including spreads, commissions, leverage, and available trading instruments. A transparent broker provides clear information about its services, trading terms, and associated risks.

It is also advisable to check trader reviews and ratings on specialized platforms to gain insight into the broker’s reputation.

Compliance with regulations and client protection

A trustworthy broker must strictly adhere to regulatory requirements, including segregation of client funds and providing negative balance protection mechanisms. These measures ensure the safety of client investments and help mitigate trading risks.

By carefully analyzing these aspects, traders can choose a reliable Forex broker in Israel that meets their needs and provides a secure trading environment.

| Available in Israel | Demo | Min. deposit, $ | Standard EUR/USD spread, avg pips | Investor protection | ISA regulation | Regulation level | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|---|

| Yes | Yes | 100 | 0,7 | €20,000 £85,000 SGD 75,000 | No | Tier-1 | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | No | 0,6 | £85,000 €20,000 €100,000 (DE) | No | Tier-1 | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | No | 0,3 | £85,000 SGD 75,000 $500,000 | No | Tier-1 | 6.8 | Open an account Your capital is at risk. |

|

| Yes | Yes | 100 | 1,0 | £85,000 | No | Tier-1 | 6.95 | Study review | |

| Yes | Yes | No | 0,5 | $500,000 £85,000 | No | Tier-1 | 6.9 | Open an account Your capital is at risk. |

Why trust us

We at Traders Union have analyzed financial markets for over 14 years, evaluating brokers based on 250+ transparent criteria, including security, regulation, and trading conditions. Our expert team of over 50 professionals regularly updates a Watch List of 500+ brokers to provide users with data-driven insights. While our research is based on objective data, we encourage users to perform independent due diligence and consult official regulatory sources before making any financial decisions.

Learn more about our methodology and editorial policies.

Try setting up a simple alert system for geopolitical news affecting the shekel

Most beginners in Israel don’t realize how much regional politics impact Forex volatility. The Israeli economy reacts sharply to shifts in oil prices, military tensions, and global alliances. If you’re just looking at price charts and technical indicators, you’re missing half the picture. Try setting up a simple alert system for geopolitical news affecting the shekel — spikes in crude oil, central bank statements, or unexpected policy changes can all impact your trades.

A smart way to hedge sudden swings is by holding some funds in assets that move opposite to the shekel, like gold or U.S. Treasury bonds. This way, if the market turns against you overnight, you’re not completely wiped out.

Another thing people don’t think about is how Israel’s strict Forex regulations can actually protect you. The ISA has clear rules about leverage, fund safety, and trade transparency, which means any broker offering sky-high leverage outside of these limits is probably operating in a shady way. Stick with regulated brokers that guarantee you won’t lose more than your deposit — this is called negative balance protection, and it can save you from a total disaster if a trade goes south. Before choosing a broker, check their execution reports — if your trades always get filled at worse prices than expected, they might be messing with your orders.

Conclusion

The regulation of the Forex market in Israel is aimed at creating a safe and transparent environment for traders. Mandatory licensing of brokers, leverage restrictions and strict control by the ISA help reduce risks and protect the interests of investors. Trading without a license entails serious sanctions, including fines and legal action. Traders working in this market are required to declare income and comply with tax requirements. When choosing a broker, it is necessary to check for a license, analyze trading conditions and take into account the company's reputation. Compliance with these principles will help avoid financial risks and operate in accordance with the law.

FAQs

Can you trade Forex in Israel without opening an account with a licensed broker?

Retail investors can use foreign brokers, but without an ISA license, such companies are not required to comply with local customer protection laws. In the event of disputes or financial problems, traders will not have the support of the regulator.

What are the restrictions for professional traders in Israel?

Professional traders can access higher levels of leverage and work with international brokers. However, to obtain the status of a professional investor, you must meet certain criteria, such as capital size or experience in the financial markets.

How does the ISA monitor the activities of licensed brokers?

The regulator conducts regular inspections, requests financial reports, and monitors compliance with customer protection requirements. In the event of violations, fines, temporary restrictions, or license revocation may be imposed.

What are the risks associated with trading illiquid currency pairs?

Illiquid currency pairs are characterized by low trading volume, which leads to high spreads and possible sharp price fluctuations. Such conditions may increase transaction costs and increase the likelihood of slippage when executing orders.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).