Forex scammer list in Malaysia

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Malaysia is a country with a developing economy that attracts financial companies to operate in this jurisdiction. Forex trading is legal and safe in the country. The Bank Negara Malaysia (BNM), the central bank and the financial regulatory authority of the country, permitted Forex trading back in 2012. However, it is important to avoid falling in the nets of scammers that actively operate in this market. They hunt novice traders, who are not aware of the key signs of a bucket shop and are prepared to give their money in return for a promise of fantastic profits. In our article, you will find the Forex Scammer List in Malaysia, learn about the main rules of choosing a broker and the best financial brokers providing services in this jurisdiction.

What Forex Brokers to Choose in Malaysia?

It is optimal to trade with brokers that have a stable international reputation, are regulated internationally, and accept clients from the Malaysia. We have compared three such brokers that hold the highest positions according to our methodology.

| Available in Malaysia | All regulations | Min Spread EUR/USD, pips | Max Spread EUR/USD, pips | Min. deposit, $ | Open account | |

|---|---|---|---|---|---|---|

| Yes | MISA, FSC (Mauritius) | 0,6 | 1 | 25 | Open an account Your capital is at risk. |

|

| Yes | ASIC, SCB, CySEC, FCA | 0,4 | 1,5 | 100 | Open an account Your capital is at risk. |

|

| Yes | VARA, AFSA, NBG, MiCAR | Not supported | Not supported | No | Open an account Your capital is at risk. |

Rules and Regulation

Licensing in Malaysia

Forex trading in Malaysia is regulated by the Securities Commission Malaysia (SC) under the Capital Markets and Services Act 2007. The regulatory framework aims to ensure market integrity, investor protection, and financial stability in the Forex market. Investors should trade with licensed brokers, conduct due diligence, and stay informed about their rights and protection to mitigate risks associated with Forex trading.

Investor protection in Malaysia

Forex investors in Malaysia are protected by the Securities Commission Malaysia (SC), which regulates the Forex market and ensures the integrity of the financial system.

Malaysia has policies to protect Forex investors:

licensing of Forex brokers;

Terestrictions on Forex trading.xt

Taxation in Malaysia

Forex taxation in Malaysia is governed by the Inland Revenue Board Malaysia (IRBM), which administers the country's tax laws. Forex traders are required to report their trading income to the IRBM and pay income tax on their profits at the applicable tax rates. Malaysia has progressive income tax rates, ranging from 0% to 30%, depending on the individual's total taxable income.

Forex Scam Broker Blacklist in Malaysia

The Forex Scammer List in Malaysia of the BNM, the country’s regulator, currently includes close to 400 companies. The list is regularly updated. Brokers, who have ceased to fulfill agreements and scam traders, leaving no chance of making money, are added to the list. Such scammers operate without a license, use manipulated software to drain deposits and find reasons to reject profit withdrawal requests. We invite you to check out companies, who have been added to the BNM’s blacklist relatively recently.

| Name | Date of establishment | Minimum losses |

|---|---|---|

| GOptions | 2009 | $5 |

| PTFX | 2006 | $10,000 |

| BFSforex | 2013 | $200 |

| ForexNova | 2005 | $10 |

| XIG Limited | 2017 | $50 |

| SunbirdFX | 2005 | $100 |

| TopproFX | 2014 | $10 |

| IGOFX | 2009 | $1 |

| Atlantic Global Asset Management (AGAM) | 2013 | EUR 90 |

| Axis Capital Corporation Ltd | 2002 | $1,000 |

| IFW | 2021 | n/a |

| Cronoscap | 2004 | $100 |

| ABX Trade | 2011 | $25 |

| Global Finance | 2014 | $10 |

GOptions

Goptions was established in 2009. The brand is operated by Go Marketing Technologies LTD based in Bulgaria. The broker provided services all around the world, including in Malaysia. The company attracted novice traders by offering them a wide range of financial instruments, no service fee and good trading conditions. However, it turned out that its promises meant nothing. The key signs of a scam are as follows:

Conducts hidden policy. There is no information on the website about top management and contacts;

Provides false recommendations (every new user is imposed the services of a fake analysts upon registration);

Rejects withdrawal requests. It is impossible to withdraw your own money from the platform;

There are many negative reviews about the platform of various websites.

PTFX

PTFX is owned by Pruton Capital, an Indonesia company registered in 2006. The broker is not regulated, which is a big red flag in itself. However, the company succeeded in misleading many new traders. The broker offered services through MT4 and promised comfortable access to trading Forex pairs, stocks, commodities, indices and contracts for difference. PTFX was added to the BNM blacklist due to numerous complaints of traders. The following are the signs of a bucket shop:

No regulation;

Large number of revealing reviews;

Account blocking without a reason;

Manipulated platform for draining deposits of users;

Issues with money withdrawal.

BFSforex

BFSforex is a brand owned by BFS Markets Ltd. The company began its operation in 2013, actively developing its client base (providing services in 10+ Asian countries). The broker is regulated by the Ministry of Finance of the Republic of Mauritius. Particular interest of beginner traders in working with this organization was incited by low entry threshold, a demo account for risk-free training, and the universal MT4 as a trading platform. The list of available financial assets includes currency pairs, precious metals, futures and contracts for difference. However, in their reviews users write that BFSforex has turned into a scam and stopped allowing customers to withdraw their funds, which resulted in many traders losing large amounts. The key signs of a financial scam are:

Negative reputation online;

Promises of colossal gains;

No payment discipline;

Poor quality customer support;

Current issues don’t get resolved promptly;

Hidden fees (fake commissions, insurance).

ForexNova

ForexNova is an offshore broker from Vanuatu, although the contact details indicate that its office is located in the state of Delaware (Wilmington). It was established in 2005. The company does not have a brokerage license; it operates without authorization and provides services illegally. Novice traders fell for the empty promises of transparent and fair pricing, lightning-fast trade execution, and competitive spreads. Such gullibility led to the loss of deposits. The main signs of a financial scam:

No regulation;

Failure to perform trading obligations;

Regular technical failures of the platform, which leads to loss of money;

Made-up reasons for refusing withdrawals;

Absence of a demo account, which means that you have to risk your own money from the start;

Indifference of customer support, rude attitude.

XIG Limited

XIG Limited (also known as XIG Markets) was established in 2017. This is an offshore company from Vanuatu that does not provide information about its licenses and regulation. However, it does not target professional traders, who will pay attention to legal documents. This scam hunts beginners, who will take the bait of low entry threshold and leverage up to 400x. The company promises comfortable and secure trading with market execution, when it actually does not even have access to the real market. The broker is only putting on a cheap show to lure new investments from naive traders. The arguments against this organization are justified:

Illegal operation;

Does not allow users to withdraw money;

Extortion of funds from traders;

Covert policy;

Irresponsible attitude towards undertaken obligations;

Intentional technical failures;

Lots of reviews of scammed investors.

SunbirdFX

SunbirdFX is an Irish company founded in 2005. It offers access to trading major Forex currencies and CFDs on various products. The broker calls it its mission to ensure comfortable trading with strict adherence to the principles of business ethics and international standards. The minimum deposit is $100. As of today, the official website of SunbirdFX is blocked and the domain name is up for sale. As it turned out, the company operated without licensing and regulation and gave out promises just to attract people’s money. The key signs of a scam include:

Lack of legal framework;

Promises of outrageous profits;

Extortion of money;

Issues with payment discipline;

A large number of scammed customers.

TopproFX

TopproFX is a broker that offers access to trading Forex through the MT4 platform. The brand is operated by Too Pro Market Ltd located in Dominica. The company was established in 2014. The broker provides access to trading currency pairs, commodities, indices and contracts for difference. The company is not regulated, which means that traders register there at their own risk. Judging by reviews, this leads to nothing good. Although TopproFX offers a low entry threshold, in reality, it scams customers out of huge amounts. Key facts of a scam:

Negative reputation among traders;

The company is blacklisted by the regulator of Malaysia;

Issues with withdrawal of money (rejection of withdrawal requests for no reason, fake fees, etc.);

Manipulations with trading accounts;

Fake advice given by analysts.

IGOFX

The chances of making money with IGOFX are zero, as it is a scam broker. According to the information on the website, the brand is operated by IGO Global Limited based in Vanuatu. It was established in 2019 and was earlier licensed in New Zealand, although that license was revoked due to the failure of the broker to fulfill its obligations. At the moment, the company is not regulated. The broker offers comfortable and secure access to trading, but in reality does not perform undertaken obligations. The key signs of a scam are:

No regulation and unauthorized provision of services;

The broker is on the BNM blacklist due to non-compliance with the rules and regulations adopted in Malaysia;

Abundance of negative reviews due to the failure to fulfill obligations and financial fraud;

Issues with money withdrawals.

Atlantic Global Asset Management (AGAM)

AGAM is owned by Questra Holdings. The company was established in 2013 and four years later, negative reviews started to appear online testifying that the company stopped paying profits to traders. The broker focuses on investment portfolios, promising an annual return of 208-366%. The minimum loss is EUR 90. The company is officially registered in Cape Verde and does not hold a license. Following the AGAM scam, the company launched two more scam projects: QW Lianora Swiss and Five Winds Asset Management. The key signs of a scam are:

Unreasonably high return rate;

No license;

Many negatives reviews online;

Issues with withdrawals;

Irresponsible managers.

Axis Capital Corporation

Axis Capital Corporation is owned by Olympus Investment LLC, an offshore company registered in St. Vincent and the Grenadines (although there is mention of the company's British roots on the official website of the broker). The organization does not have a license. Many traders in Malaysia and other countries paid a steep price for working with this scam broker. The minimum loss from this scam amounts to USD 1,000. The key signs of a scam are:

False advice of a personal manager and analysts;

Made-up reasons for not allowing users to withdraw their funds;

Manipulated trading platform;

Reputation spoiled by negative reviews;

Promises of exorbitant returns;

No license;

Issues with customer support (disregard, bad attitude, slow responses).

IFW

IFW, a forex broker operating in Malaysia, has recently earned a notorious spot on the forex scammer list. The broker has raised significant concerns within the trading community, one of the most alarming being its lack of regulatory control. This absence of oversight raises doubts about the security and protection of traders' funds.

Additionally, numerous reports have emerged regarding withdrawal difficulties, leaving traders frustrated and uncertain about the broker's financial stability. Moreover, IFW's customer support has been disappointingly unresponsive, further adding to the growing list of concerns.

Cronoscap

Established in 2004, Cronoscap initially held promise as a forex broker. However, the tide has shifted, and this once-prominent firm is now on the scammers' list. The reason is that Cronoscap has been engaging in unauthorized capital market activities, including trading in securities without the necessary permissions and regulatory oversight.

Improper conduct is a significant source of concern for traders because it destroys the trust and confidence required for a transparent and safe trading atmosphere. By conducting unauthorized activities, Cronoscap has displayed a blatant disregard for regulatory compliance and investor protection. Traders who have dealt with Cronoscap have reported various issues, including difficulties with fund withdrawals, poor customer support, and an overall lack of transparency.

ABX Trade

Founded in 2011, ABX Trade presents itself as a player in the forex market, specializing in trading physical precious metals like silver, gold, and platinum. While the company may boast an Australian registration, it is important to note that ABX Trade is not regulated in Malaysia. The lack of regulatory oversight raises significant concerns for traders seeking a secure and trustworthy trading environment.

One of the glaring red flags associated with ABX Trade is its engagement in unlicensed capital market operations. Conducting business without the necessary licenses and regulatory approvals puts investors at great risk. Traders have left bad online reviews and reported poor customer service and an overall lack of transparency.

Global Finance

Global Finance, a company registered in Hong Kong, presents itself as a player in the market. However, it is crucial to note that Global Finance lacks valid regulatory status. The absence of proper regulation raises significant concerns and poses potential risks for traders.

Engaging in unauthorized capital market transactions, Global Finance operates in a gray area that undermines investor protection and regulatory compliance. Traders who have crossed paths with Global Finance have reported the lack of responsiveness from their customer support team has left many traders frustrated and questioning the company's integrity.

How to check if a Forex Broker is legit in 5 steps

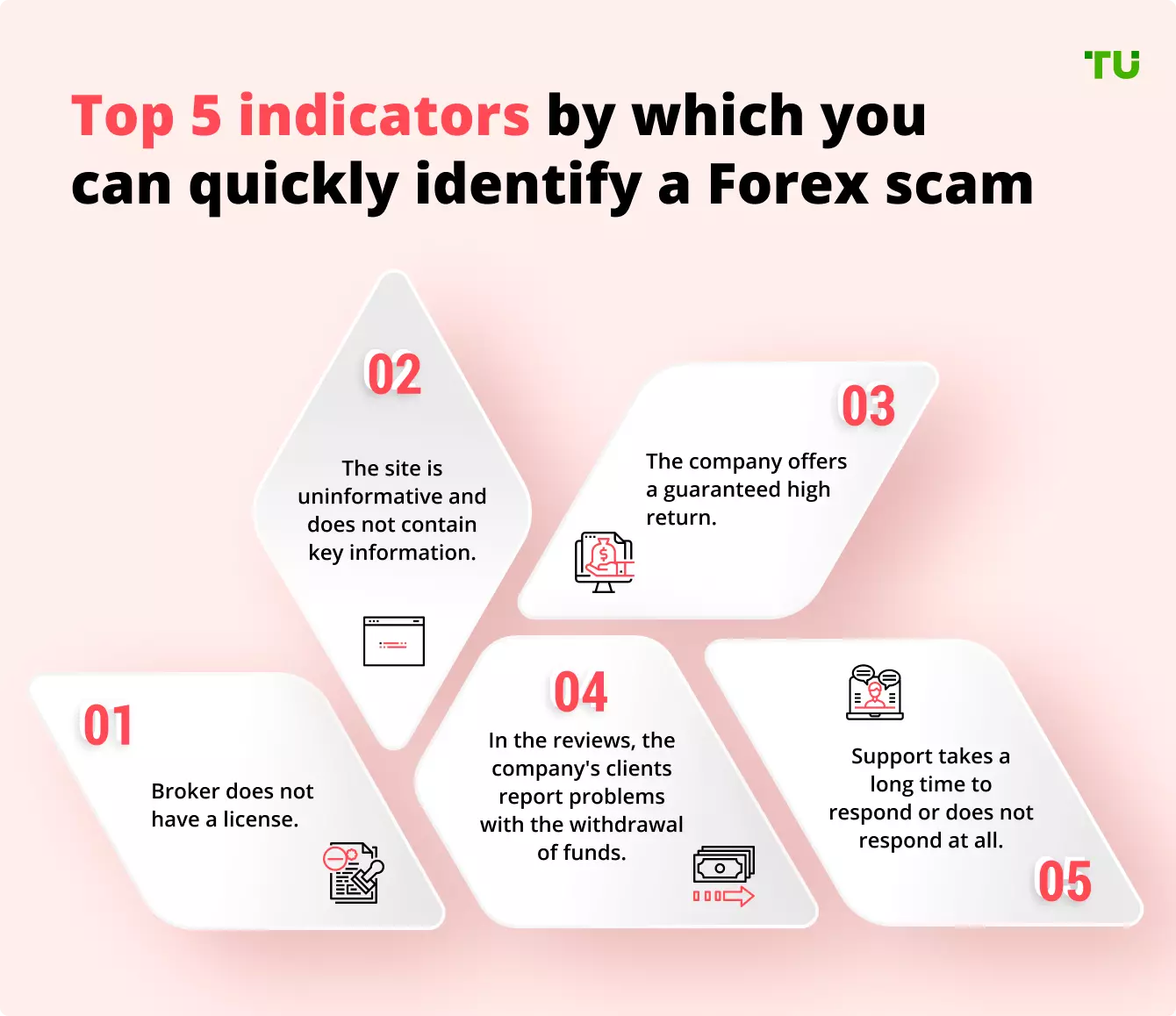

The International Forex market attracts traders, but also scammers, who will not miss an opportunity to empty your wallet. The majority of scammers lure naïve investors with promises of exorbitant income, ‘assistance’ in trading, and good trading conditions.

Forex scams are increasing each year, with scammers coming up with new schemes to trick as many people as possible out of all their money, before a large number of revealing reviews appears on the Internet.

That is why before registering on a trading platform and entrusting a broker with your money, you need to perform a full analysis and evaluate all risk factors. This will help you avoid losing your money and find a truly worthy financial partner. Let’s discuss the key factors you need to consider when choosing a broker.

1. Check regulatory information about your broker

First, you need to check whether the company you are interested in operates legally in Malaysia. This is a guarantee that your broker will provide services in good faith and be held accountable in case of some illegal actions. A potential financial partner providing services in the RSA may also have licenses of reputable regulatory authorities from other jurisdictions (FCA, ASIC, BaFin, etc.).

Brokers operating legally do not try to conceal their legal documents, providing scanned copies of the certificate of incorporation, licenses. In the very least, a company should list the numbers of licenses on its website, so that traders could verify this information. Information about licenses can usually be found in the footer of a broker’s website or in a separate tab or section.

NOTE! Do not believe the provided information right away; always verify it!

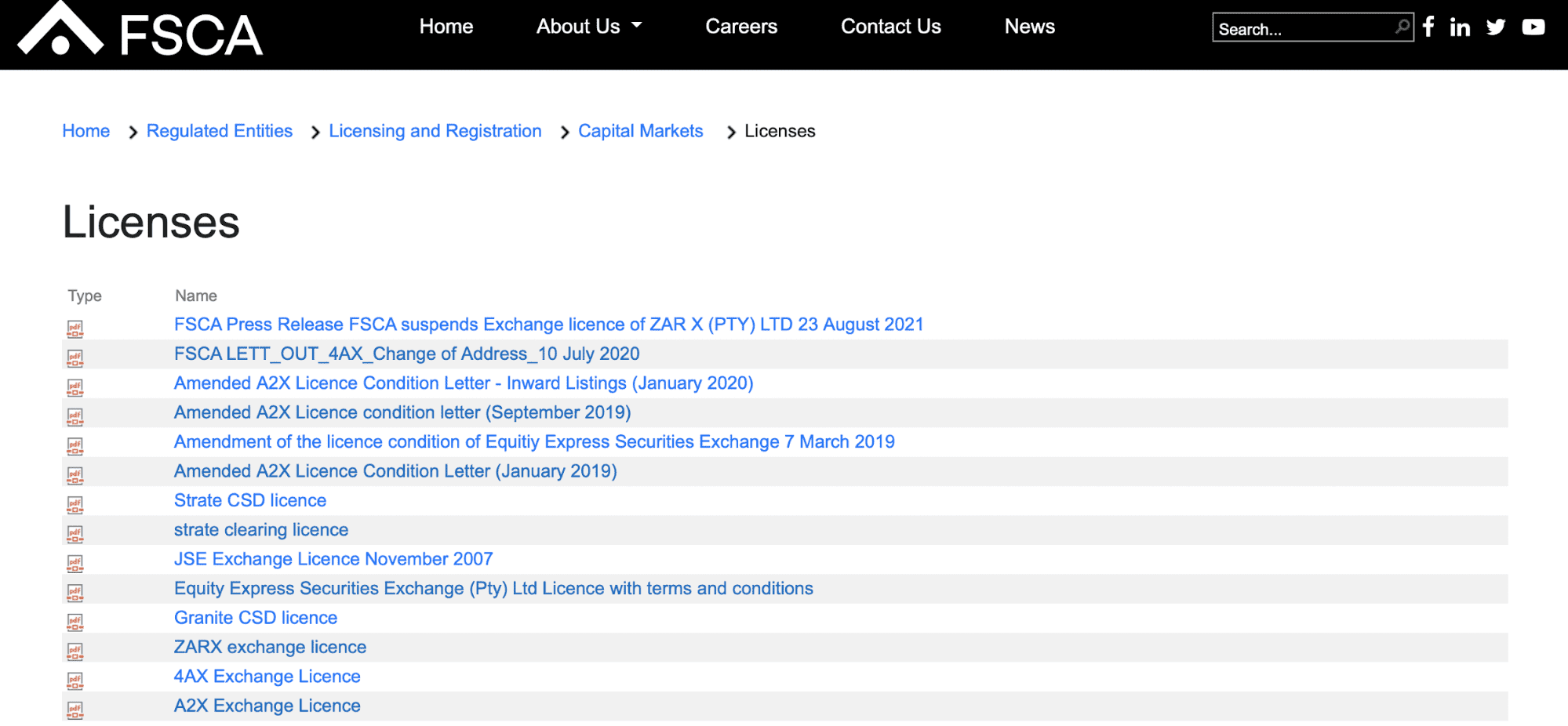

2. Check the database on the regulatory authority’s website

You can check the broker's license directly on the website of the regulatory authority. You can search by the document number or company name. This will allow you to learn whether the company is regulated or not. Here’s how the licensing section looks like on the FSCA’s website:

Information about Licenses

Information about Licenses3. Get to know broker’s website

The next important step involves assessment of the broker’s website. Financial companies that are serious about working successfully with traders will provide the following information:

Project’s roadmap and strategic development plans;

Legal information and internal documents with clearly specified details of cooperation, and key rules;

Risk disclosure;

Specifications of contracts, indicating the minimum deposit, spreads, etc.;

Diversity of payment methods with specification of payment procedures and fees;

A good choice of channels to contact customer support: phone support, live chat, pages on social media, etc.).

4. Does a broker guarantee profit?

A broker cannot guarantee that you will earn a profit, as it acts solely as an intermediary between the Forex market and traders. Brokers are responsible for prompt execution of client orders, stable operation of the platform, quality analytical instruments and good advice from a personal manager, or customer support. The following should not be on a broker’s website:

Guarantees that you will earn a profit;

Promises of colossal profit in a short time and without specialized knowledge;

Stories about ‘unique’ earning algorithms and secret schemes.

5. Read customer reviews

Reviews of real clients can tell you a lot about a broker. If a company has many negative reviews (traders point to extortion, manipulation of trading process, issues with withdrawals and failure to perform obligations), it is best not to go with such a broker. You can find reviews of real clients on the Traders Union website, where users actively share their personal opinions and tell the truth about financial companies.

Types of Forex Scams in Malaysia

Forex trading in Malaysia presents lucrative opportunities, but it's essential to be aware of the prevalent scams in this dynamic market. By understanding these scams, you can protect yourself and your investments. Let's explore the main types of forex scams in Malaysia.

Ponzi and Pyramid Schemes

Ponzi Schemes and pyramid schemes are among the most prevalent scams targeting unsuspecting forex traders. In these schemes, fraudsters promise high returns or guaranteed profits by pooling funds from new investors to pay off earlier ones. Eventually, the scheme collapses, leaving investors with significant financial losses.

Fake Signal Providers

Another common scam involves fake signal providers who claim to offer accurate and profitable trading signals for a fee. These fraudulent providers may lure traders with promises of easy money, but their signals are often unreliable, leading to poor trading decisions and financial losses.

Unregulated Forex Brokers

Unregulated forex brokers operate outside the boundaries of regulatory oversight. While some may offer attractive trading conditions, bonuses, or leverage, they lack the necessary licenses and oversight to ensure fair and secure trading practices. Dealing with unregulated brokers puts your funds at risk and may make it challenging to seek legal recourse in case of disputes.

Fly-by-Night Traders

Illegitimate individuals or entities, known as fly-by-night traders, appear suddenly, promising quick riches and high returns. However, they lack credibility, experience, and regulatory compliance.

These fraudulent traders employ enticing marketing tactics and false claims to attract investors before disappearing with their funds. Traders should exercise caution when dealing with unknown entities offering extravagant promises without a verifiable track record.

Forex Bucket Shops

Bucket shops are unscrupulous brokerage firms that manipulate trades to deceive traders. They create a simulated trading environment where trades do not reach the actual market. Instead, trades are handled internally, and outcomes are artificially manipulated to ensure losses for traders.

Bucket shops profit from their client's losses, making it impossible for traders to achieve genuine success. Such establishments lack regulation, transparency, and fair trading practices.

Phishing

Phishing is a cybercrime tactic that tricks individuals into sharing personal and financial information. Scammers create fake websites and deceptive emails to steal data for identity theft and fraud. Traders should verify legitimacy before sharing sensitive information.

Forex Robot Sales

Scammers sell automated trading robots with claims of incredible profits. The bots generate losses not profits.

Advance Fee

Scammers offer loans, IPO allotments, or investment opportunities for upfront fees that are pocketed without providing services.

Forex Course Scams

Companies sell overpriced courses with exaggerated earnings claims targeting new traders. Information is often basic or duplicated.

To safeguard your investments in the forex market, conduct thorough research and choose regulated brokers with a proven track record. Be cautious of promises that sound too good to be true, and verify the credibility and regulatory status of any entity you engage with. Remember that knowledge and vigilance are crucial to protect yourself from forex scams.

FAQs

What are the key signs of a scam broker?

Scam brokers make unrealistic promises, lack transparency about licensing, and use high-pressure sales tactics to get your money quickly. They often have shady websites with fake addresses, no audits, and no regulatory registrations or reviews.

How do I check the existence and authenticity of legal documents?

Scam brokers may claim they are regulated, even providing the license number. This information needs to be checked on the official website of the regulatory authority. Such authorities provide information about licensed companies in the public domain.

Is Forex trading legal in Malaysia?

Forex trading is fully legal in Malaysia. A number of laws and regulations were adopted by the country to regulate this activity. The key regulators are BNM, FAA, MIDA, and SAC.

What shouldn’t be on a broker’s website?

A company cannot guarantee that you will earn a profit. A broker is only an intermediary that must ensure fair and quick transaction execution and withdrawal of earned money.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).