How Quick Trading Works On Pocket Option: Complete Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Quick trading on Pocket Option lets users open positions with expiration times ranging from just 30 seconds up to 5 minutes. This mode is designed for those looking for short-term opportunities, with trades executing at high speed and outcomes.

Among all the tools available, Pocket Option's quick trading feature has become a go-to choice for many. It’s widely favored by both newcomers and seasoned traders due to its fast-paced nature and the broad range of strategies that can be applied. Understanding quick trading on Pocket Option is essential for anyone looking to make the most of fast market movements. With the right approach, it can be a powerful part of your trading routine, offering immediate feedback, fast decision-making, and the thrill of short-term market action. In this guide, we’ll walk you through how it works, how it compares to digital trading, and how to begin using it effectively.

What is quick trading on Pocket Option?

Quick trading on Pocket Option refers to binary options trading with very short expiration times, depending on the asset being traded and the approach used. It’s a style well-suited for users who prefer fast-paced decision-making and instant results. Many traders find that Pocket Option's quick trading strategy offers an ideal balance between speed and simplicity, especially for short-term market movements.

Key features:

Fast trade execution, with durations starting from just 30 seconds.

Available for both demo and real trading accounts.

Straightforward concept: predict whether the price will be higher or lower than the current value.

High trade frequency, allowing potential profit generation within minutes.

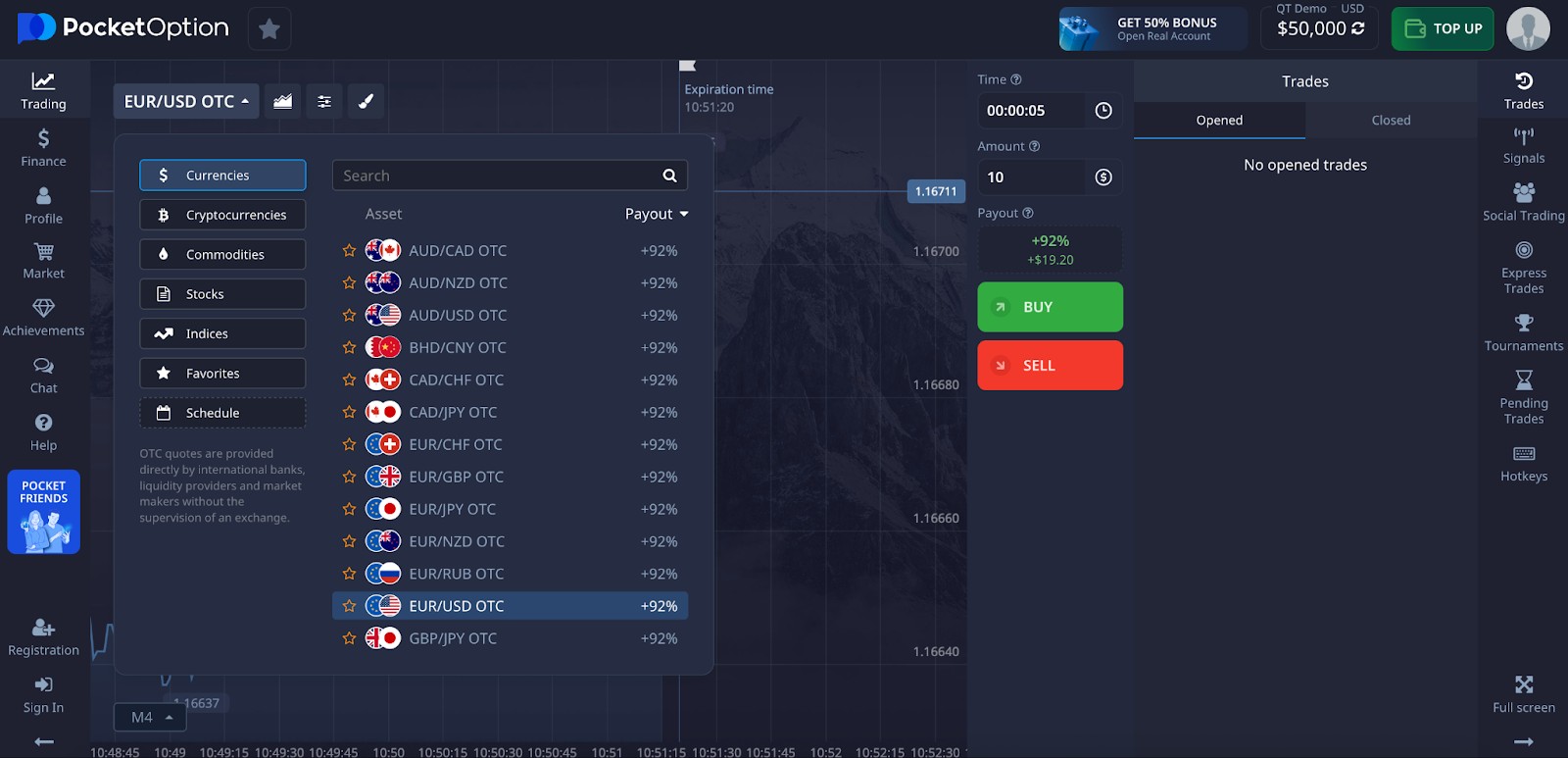

Available assets

You can trade the following assets in quick trading mode:

Currency pairs (e.g., EUR/USD, GBP/USD)

Cryptocurrencies

Stocks

Indices

Commodities

Why traders choose quick trading

Quick trading on Pocket Option isn’t just about speed, it’s about mastering momentum, reaction time, and control.

The 5-second expiry trick. Traders use the shortest timeframes to test price sensitivity and scalp micro-movements with precision.

Real-time news syncing. Some pros pair Pocket Option with mobile alerts from macroeconomic calendars to place lightning-fast trades during volatility spikes.

Dual-screen practice method. One screen runs a live trade and the other runs the quick trading and demo account Pocket Option side-by-side for instant comparison and reaction training.

Price action batching. Traders group similar candlestick patterns into “action batches” to create mini playbooks for each market session.

Quick trading vs digital trading on Pocket Option: what’s the difference?

Traders often find themselves wondering about the difference between the two main trade types on the platform: quick trading vs digital trading on Pocket Option, and which one might be the better choice for their strategy.

Here’s a clear comparison:

| Parameter | Quick trading | Digital trading |

|---|---|---|

| Expiration time | 30 seconds to 5 minutes | From 5 minutes and up |

| Execution mechanism | Fixed payout at expiration | Flexible settings available |

| Commissions and payouts | Fixed | May vary |

| Risk level | High | Medium |

| Best for | Scalping, trading on news | Strategic trading |

Which mode is better for beginners?

We recommend beginning with a demo account to safely test your strategies and get comfortable with how Pocket Option works. Practicing in this risk-free environment allows you to understand order execution and asset behavior before moving on to real funds. Many traders start with quick trading on a demo account in Pocket Option as a way to build confidence while exploring different techniques.

Risks and execution features

Quick trading requires strict money management.

Do not risk more than 1-2% of your deposit per trade.

Pay attention to spreads and potential execution delays.

How to start trading in quick trading mode

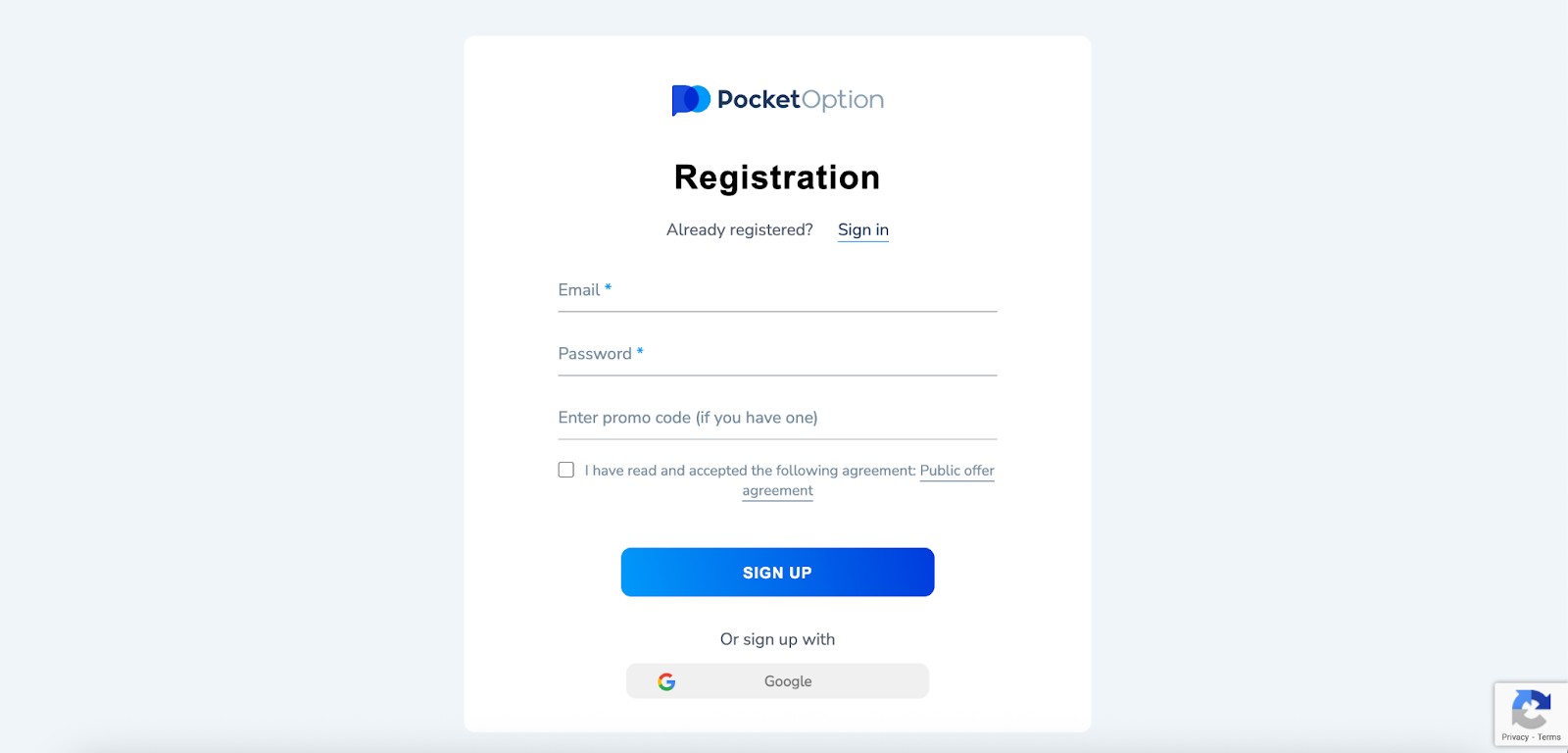

Step 1. Register and open an account

Go to the official Pocket Option website.

Register quickly using your email or social media accounts.

Step 2. Choose between demo and real accounts

Once your account is set up, you can pick between a practice account and a live trading account.

If you're just starting out, using the demo version is a safer way to experiment without risking capital.

When you're ready to move forward, quick trading on a real account in Pocket Option provides the opportunity to earn real profits using your own funds.

We recommend starting with the demo version to minimize risks.

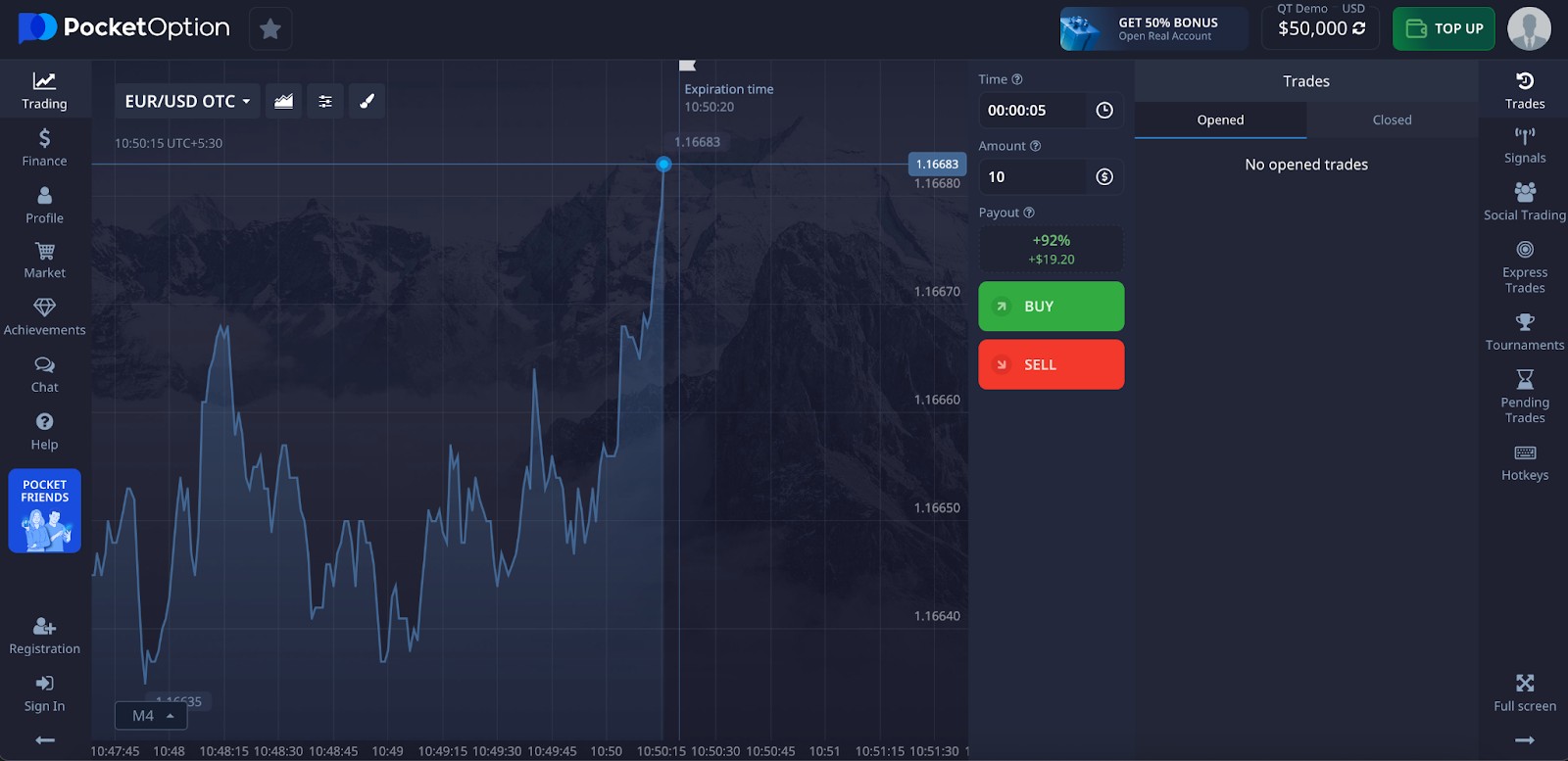

Step 3. Set up the trading interface and select an asset

From the trading terminal, enable the Quick Trading mode.

Adjust the expiration time and trade size based on your strategy.

Make sure to choose assets that show consistent volatility and fit your trading plan.

If you're unsure about the differences between trading types, it helps to understand Pocket Option's quick trading vs digital trading. Quick trading offers ultra-fast trade execution with shorter expiry times, ideal for scalping and fast decision-making. On the other hand, digital trading allows for longer analysis windows and more strategic entries.

New users often ask, what is the difference between quick trading and digital trading in Pocket Option, especially when deciding how to allocate time and capital. The answer lies in your trading style: quick trading suits fast-paced, high-frequency strategies, while digital trading caters to longer-term planning and analysis.

We also recommend watching a short video guide "Pocket Option 1 Minute Trading Strategy":

Best strategies for quick trading on Pocket Option

Quick trades on Pocket Option can be powerful, but only if you use sharp strategies built for speed and precision.

Use 5-second chart confirmations. Before entering a 30-second trade, check the last few candles on a 5-second chart for trend flips or wick rejections.

Set RSI alerts at extremes. Instead of watching RSI manually, set alerts at 80 or 20. This helps catch overbought or oversold zones without staring at the screen.

Trade in sync with OTC liquidity shifts. On weekends or off-market hours, OTC charts behave differently. Study volatility bursts at session start or end before jumping in.

Reverse trade after fake breakouts. Many quick traders get trapped on breakouts. Use a 3-candle test. If the breakout fails to hold, enter in the opposite direction.

Exploit psychological price levels. Watch round numbers like 1.1000 or 80.000. Price often stalls or reverses here, especially in short timeframes.

Use Pocket Option’s trade expiry timer. Beginners often overlook this. Enter 2–3 seconds before a candle closes to better align with price action shifts.

Track trader sentiment but fade the herd. Pocket Option shows % of traders going up or down. When it’s 90% in one direction and stalling, fade the crowd on reversals.

Typical profitability and win rates

Expert traders combining multi‑timeframe confluence, volume analysis, and psychological triggers report win rates of 67–73%, sustaining risk‑reward ratios above 1:1.8. Higher-frequency setups, like the “5-second strategy,” can yield profits up to ~92% per successful trade — but this requires precision and emotional control.

Experienced traders may average 8–16% monthly ROI, depending on market conditions and capital management.

Average monthly profits for seasoned users hover around $1,500, often achieved through disciplined trade execution and consistent strategy improvement.

One Pocket Option user reported $1,200 in Forex profits (8% ROI) in Q1, rising to $3,000 with diversified crypto positions in Q4 — demonstrating how scaling across assets and adapting strategies can boost returns.

Boost Pocket Option wins using trade layering and custom expiry cycles

If you’re just clicking call or put based on candle color, you’re missing the real edge. One underrated tactic is trade layering within micro timeframes. Instead of entering one trade, stagger 2–3 entries within 10–15 seconds of each other, slightly above or below your first strike. This cushions your risk and creates a layered zone where at least one trade typically lands in the money. It’s like giving yourself a built-in buffer, and on choppy charts, this method often outperforms single-entry trades.

Another sharp tactic? Custom expiry manipulation. Most traders stick to default expiry times like 1 minute or 5 minutes, but Pocket Option lets you tweak expiry to the second. If you analyze when volume spikes (like right before a news candle), setting expiry to end just before or after the volatile spike can make or break your position. Precision here lets you dodge fakeouts and close right at your target. It’s surgical timing, and it gives you an edge over traders who simply press and pray.

Conclusion

Quick trading on Pocket Option is an excellent choice for those who want fast trades and immediate results. It is important to understand how it differs from digital trading, start with the demo version, test various strategies, and manage your risks carefully. Use our recommendations to improve your trading performance.

FAQs

Can I trade quick trades on Pocket Option during weekends?

Yes, you can, but only using OTC (over-the-counter) assets. These mimic real markets and remain available even when traditional markets are closed. Just keep in mind: OTC price movements can behave differently, so test your strategy carefully.

Is it possible to cancel a quick trade after placing it?

No, once a quick trade is placed on Pocket Option, it cannot be canceled or reversed. Always double-check your trade settings and expiry time before confirming.

Do quick trades on Pocket Option work on mobile devices?

Absolutely. Pocket Option's mobile app supports full quick trading functionality, allowing you to place and manage trades on the go with real-time execution and charts.

How many quick trades can I place at the same time?

You can open multiple trades simultaneously on Pocket Option, but doing so increases your risk exposure. Stick to your risk management rules even when stacking positions.

Related Articles

Team that worked on the article

Oleg Tkachenko is an economic analyst and risk manager having more than 14 years of experience in working with systemically important banks, investment companies, and analytical platforms. He has been a Traders Union analyst since 2018. His primary specialties are analysis and prediction of price tendencies in the Forex, stock, commodity, and cryptocurrency markets, as well as the development of trading strategies and individual risk management systems. He also analyzes nonstandard investing markets and studies trading psychology.

Also, Oleg became a member of the National Union of Journalists of Ukraine (membership card No. 4575, international certificate UKR4494).

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).