How To Withdraw From Bybit To Bank Account In Pakistan

How to withdraw from Bybit to bank account in Pakistan:

With the increasing popularity of cryptocurrency trading platforms like Bybit, many traders in Pakistan are eager to know how to withdraw their earnings efficiently. Although Bybit does not support direct fiat withdrawals to Pakistani bank accounts, there are multiple methods you can use to transfer your crypto assets and convert them into fiat currency. We have prepared a comprehensive guide detailing the process, factoring in the nitty-gritties of the region and specific tools that can make the process easier.

How to withdraw from Bybit to bank account in Pakistan

Withdrawing funds from Bybit to a bank card or bank account in Pakistan requires a few steps. Below is a guide to help you perform this process smoothly.

Step 1: Convert crypto to USDT or another stablecoin

Before initiating any withdrawal, it’s important to first convert your cryptocurrency holdings (such as Bitcoin or Ethereum) into a stablecoin like USDT (Tether). This stablecoin provides liquidity and is widely accepted across various platforms for conversion into local currency.

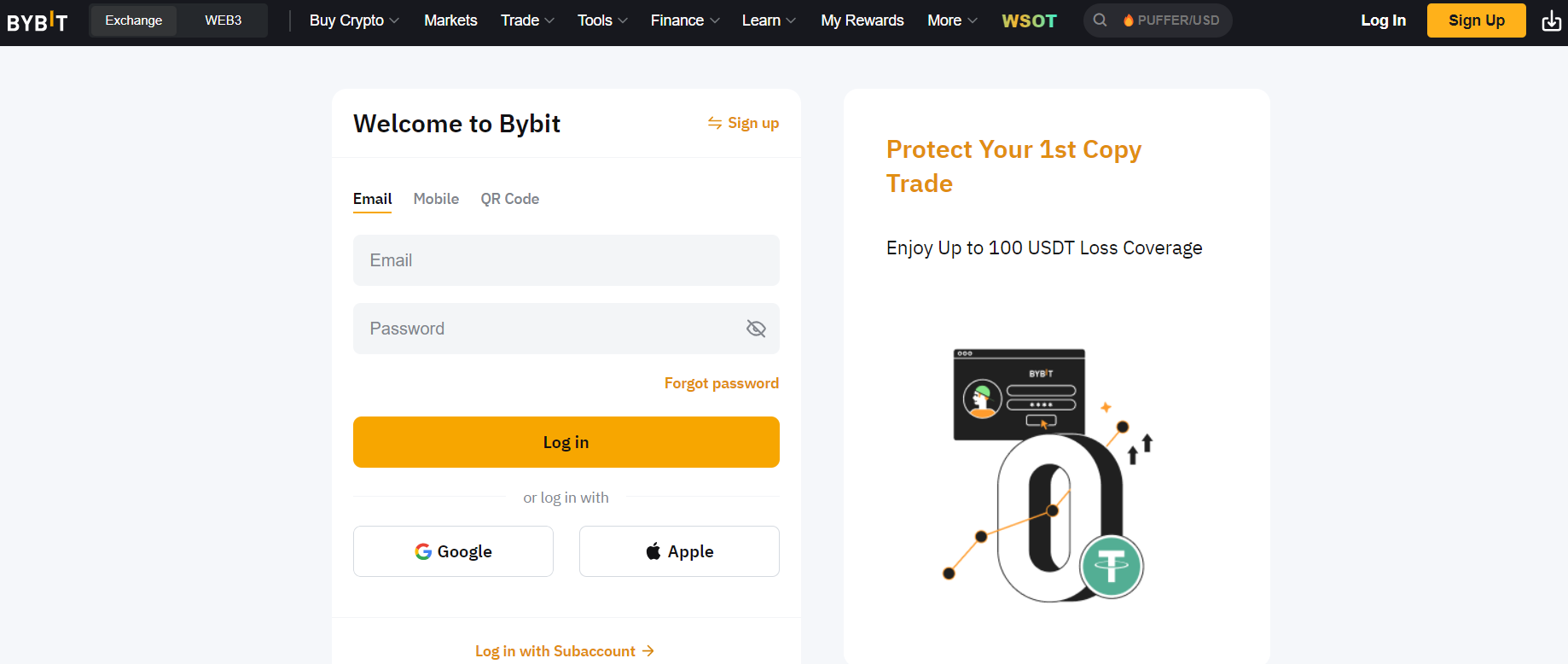

Log into your Bybit account.

Log in to your Bybit account.

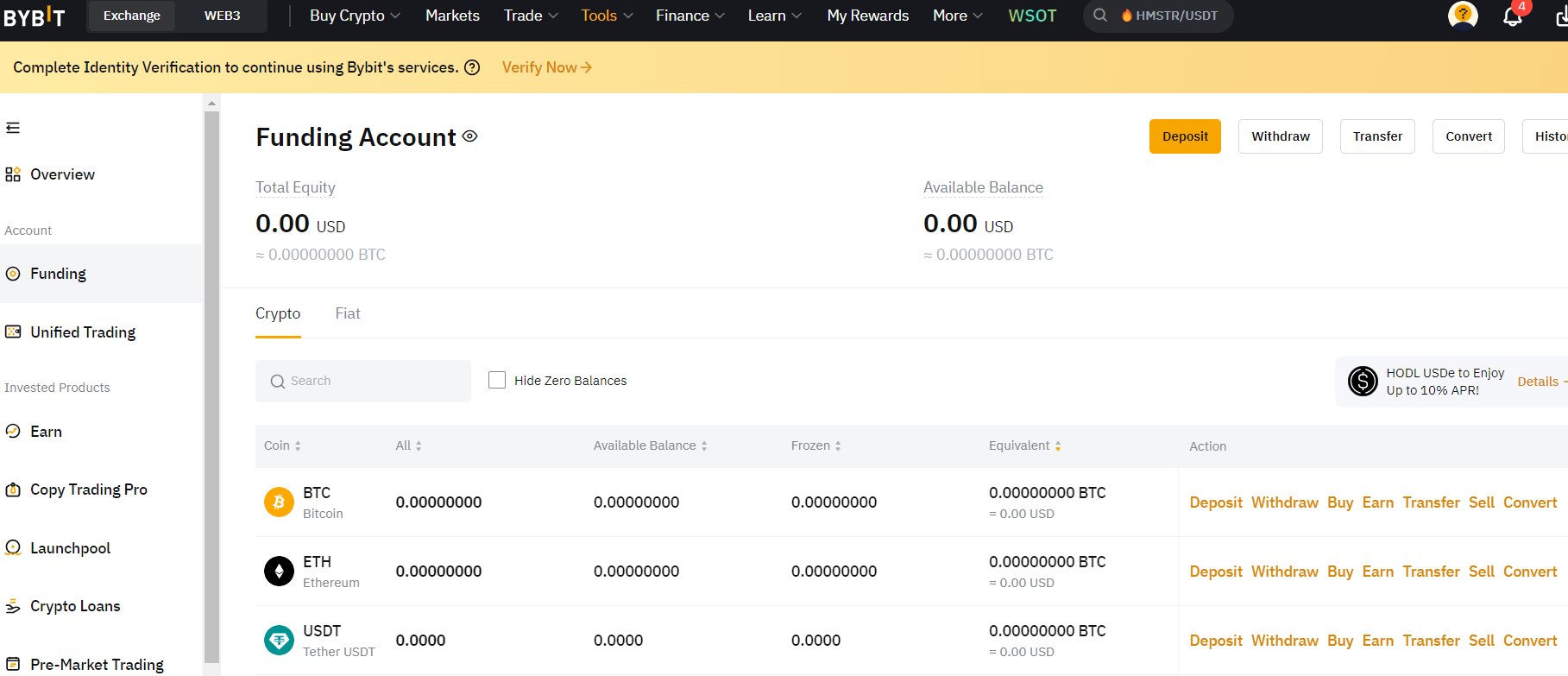

Go to the “Assets” section, then select “Convert”.

Assets section of Bybit

Choose the cryptocurrency you want to convert, then select “Get a quote”.

Select the trading pair, such as BTC/USDT or ETH/USDT, and execute the trade to exchange your crypto for USDT.

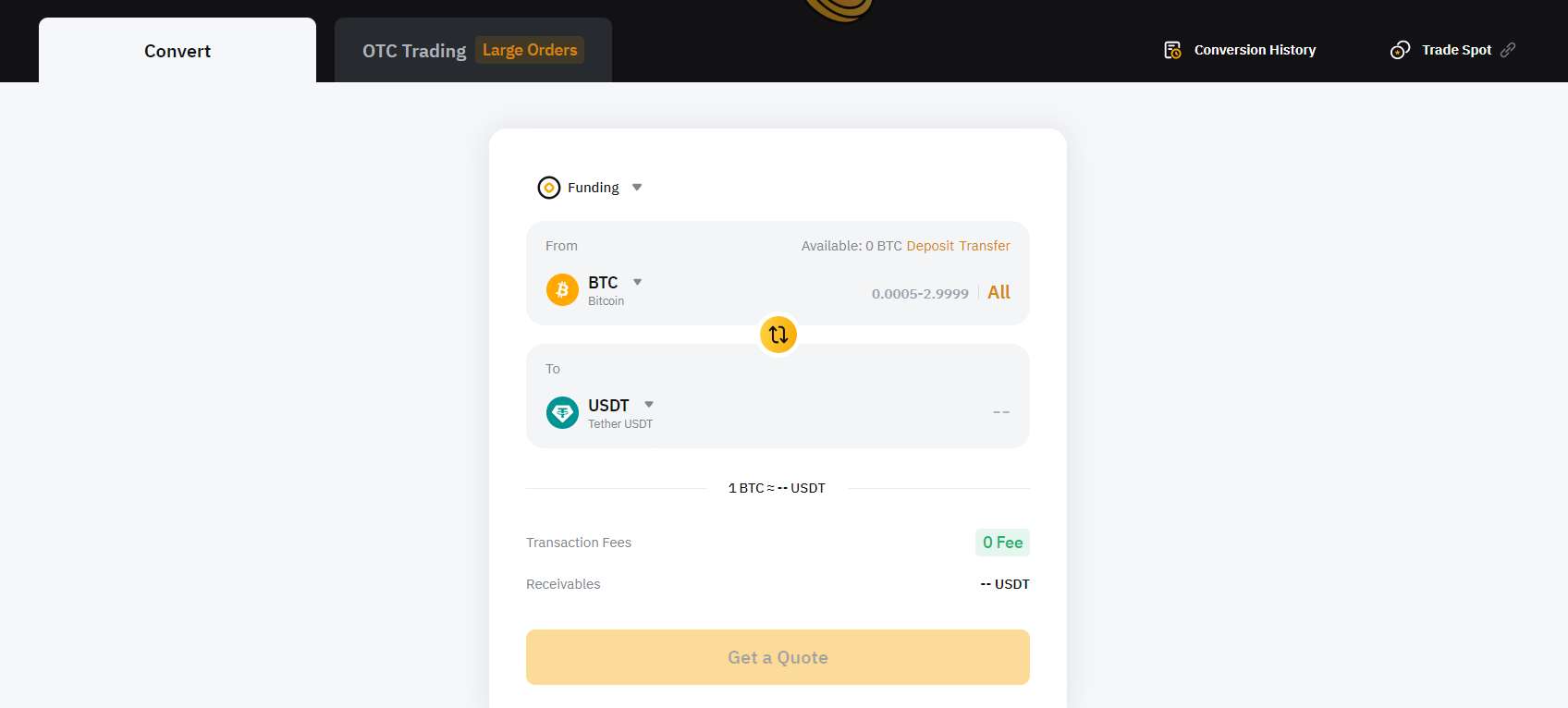

Select the trading pair, such as BTC/USDT or ETH/USDT

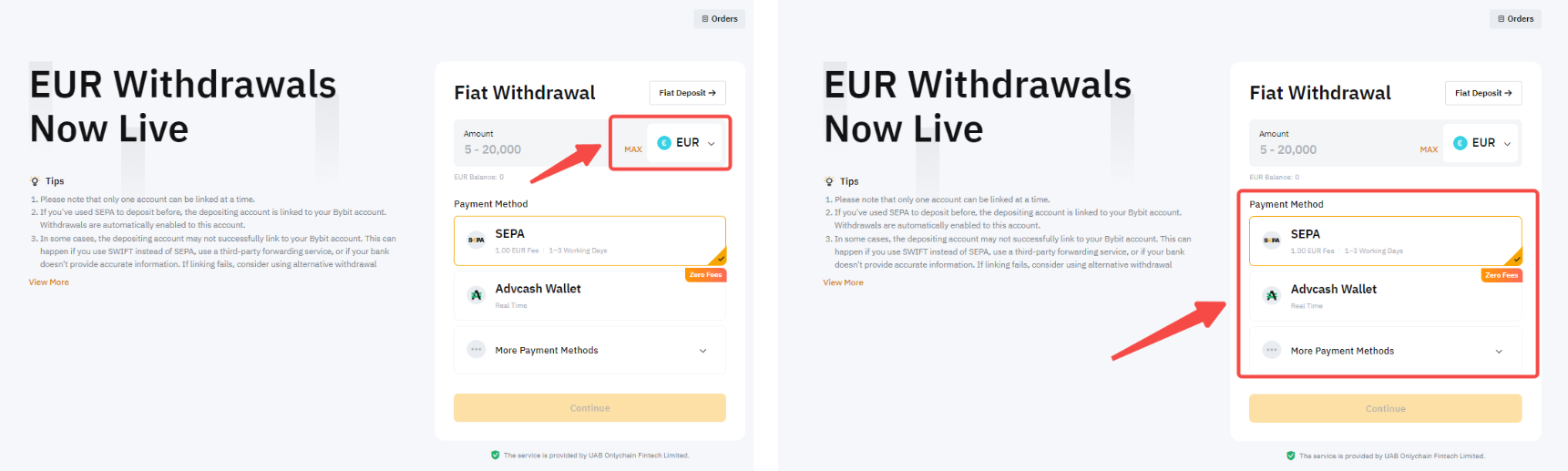

Step 2: Transfer USDT to another exchange

Since Bybit doesn’t allow direct fiat withdrawals to Pakistani bank accounts, you need to transfer your USDT to another exchange, such as Binance, which supports Pakistani bank transfers via peer-to-peer (P2P) trading.

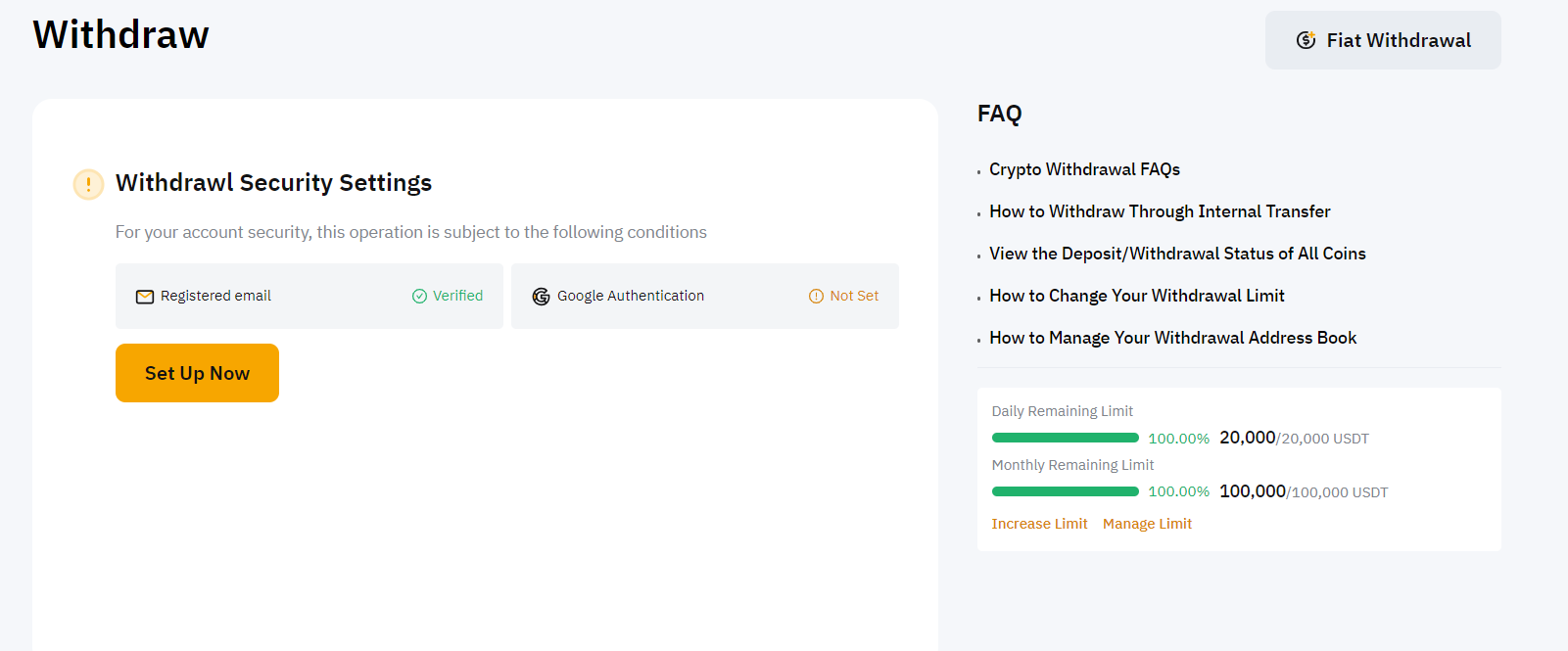

Go to the “Withdraw” section in your Bybit account.

Go to the “Withdraw” section in your Bybit account

Select USDT as the withdrawal asset.

Enter the Binance deposit address for USDT. Make sure to select the TRC20 network to minimize transfer fees.

Confirm the withdrawal, and your USDT will be transferred to Binance.

Confirm the withdrawal, and your USDT will be transferred to Binance

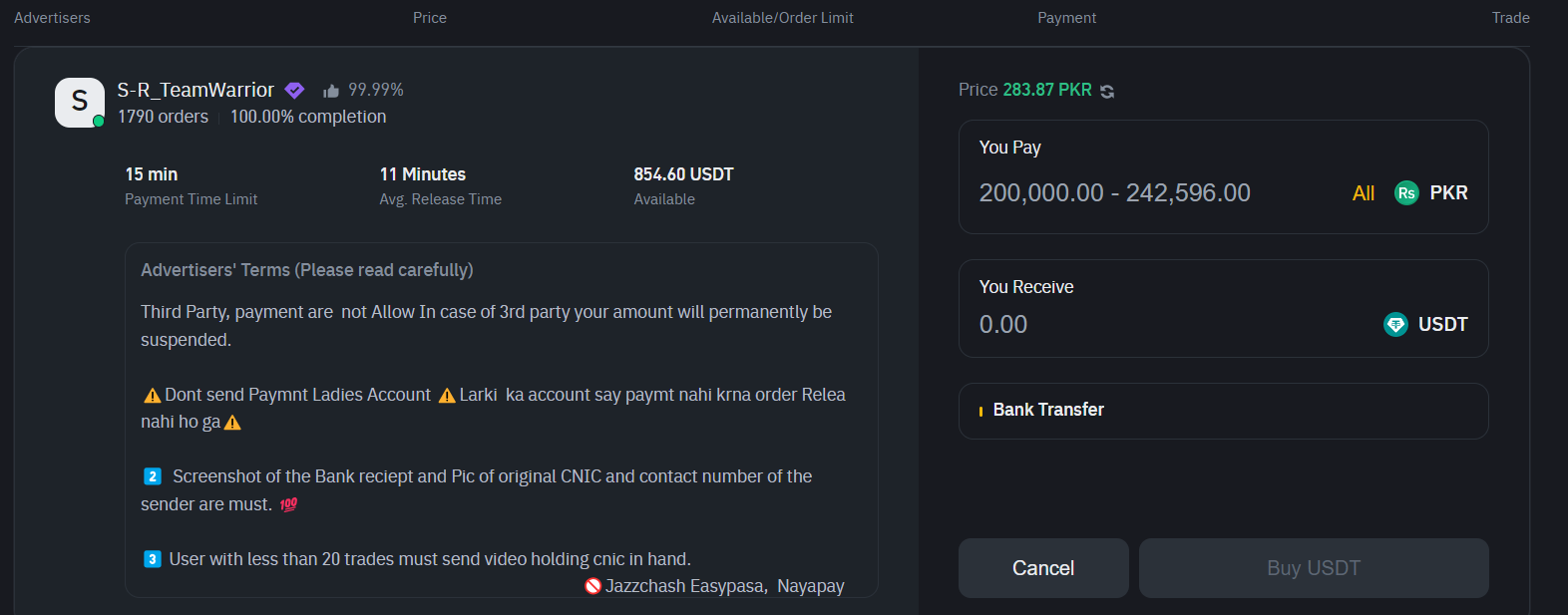

Step 3: Sell USDT for PKR on Binance

Once your USDT is in your Binance account, you can sell it for Pakistani Rupees (PKR) via Binance P2P.

Open your Binance account and navigate to the P2P trading platform.

Open your Binance account

Choose USDT/PKR as the trading pair.

Review the available offers from buyers who can transfer PKR directly to your bank account.

Choose a buyer with a good reputation and initiate the trade.

Once the buyer confirms the transfer of PKR to your bank account, release the USDT to complete the transaction.

Release the USDT

Step 4: Withdraw PKR to your bank account

After selling your USDT for PKR on Binance P2P, the buyer will transfer the equivalent amount of PKR to your bank account in Pakistan. Ensure that you verify the transfer before releasing the USDT to the buyer. The funds should be reflected in your bank account typically within a few minutes, depending on your bank’s processing times.

When might you need to withdraw funds from Bybit to a bank account?

Withdrawing funds to a card is a common procedure for all traders. You might need to do this in several situations, such as:

Cashing out profits from short-term trades.

Withdrawing gains for long-term investors following a "buy and hold" strategy.

Utilizing earnings from Bybit Earn.

Withdrawing profits from Tap-2-Earn games like Hamster Kombat, Catizen, X Empire and more.

Withdrawal time and limits

Withdrawals from Bybit to Binance are typically processed within an hour. However, P2P trades on Binance may take slightly longer depending on the buyer’s promptness in completing the transaction. Bybit imposes a daily withdrawal limit of 2 BTC for non-KYC accounts, while fully verified accounts can withdraw much larger amounts.

When using Bybit to withdraw funds to a bank account in Pakistan, especially via a secondary exchange like Binance, traders should weigh the benefits and challenges of the process. Here's a breakdown:

👍 Pros:

• Widely accepted method. Using Binance P2P for converting USDT to PKR is a popular and proven method among traders in Pakistan. It provides a reliable option when Bybit lacks direct support.

• Low fees with TRC20. By choosing the TRC20 network for USDT transfers, traders can significantly reduce transaction fees when moving assets between Bybit and Binance.

• Access to P2P market. Binance’s P2P platform offers a wide range of local buyers and sellers, ensuring traders can easily find someone to exchange USDT for PKR at a competitive rate.

• Secure transactions. Binance P2P uses an escrow system, which adds an extra layer of security by holding the crypto until the fiat payment is confirmed.

👎 Cons:

• No direct withdrawal on Bybit. Bybit does not offer direct fiat withdrawals to Pakistani bank accounts, requiring an additional step of transferring funds to another exchange.

• P2P trust issues. While Binance P2P provides an escrow system, there is still a need to carefully vet the reputation of buyers to avoid potential scams or delays.

• Network fees. Although TRC20 offers lower fees, traders still need to account for the minor costs of transferring between exchanges, which can add up, especially for smaller withdrawals.

• Processing time. Depending on the buyer’s response time and bank processing speeds, the entire process may take longer than expected, especially if network congestion or verification steps delay the transaction.

Tips for a successful withdrawal

Withdrawing funds from Bybit to your bank account in Pakistan requires a few specific steps that might not be obvious at first. While Bybit doesn’t support direct transfers to banks, you can make the most of their peer-to-peer (P2P) marketplace. What you should focus on is finding a trusted P2P seller with a solid reputation in the Pakistani market. Rather than going straight for the best price, pick traders who complete transactions fast and have plenty of good reviews, especially for local banks like Meezan Bank or HBL. These banks tend to work better with P2P platforms, so you’ll deal with fewer delays.

Also, keep an eye on exchange rates. Since the last quarter of 2024 could see big shifts in crypto prices, locking in the exchange rate when you start the transaction is a smart move. This protects you from sudden changes in the value of the rupee. Make sure you’re also aware of any changes in regulations from the State Bank of Pakistan regarding crypto transfers, so you avoid any unexpected hiccups.

Conclusion

While Bybit doesn’t currently offer direct bank withdrawals in Pakistan, the process of withdrawing your funds through a secondary exchange like Binance is relatively straightforward. By following steps detailed in this guide, you can easily convert your crypto assets into PKR and have the funds deposited into your local bank account. Be sure to stay updated on any changes in regulations or fees, as the cryptocurrency landscape is continually evolving.

FAQs

Is it possible to withdraw USDT from Bybit without paying high fees?

Yes, choosing the TRC20 network when withdrawing USDT minimizes fees. It's a cost-effective option widely used for transferring between exchanges.

What happens if the P2P buyer doesn’t send the payment to my bank account?

Binance’s P2P platform has an escrow system that holds your USDT until the payment is confirmed. If the buyer fails to pay, you can open a dispute and Binance will resolve the issue.

Do I need to complete KYC on Binance to withdraw PKR?

Yes, completing KYC on Binance is required to fully access the P2P trading and fiat withdrawal features. This helps increase your withdrawal limits and ensures smooth transactions.

Can I use a debit card to withdraw PKR from Binance after selling USDT?

No, Binance P2P generally involves bank transfers or Easypaisa/JazzCash for fiat withdrawals in Pakistan. Debit card withdrawals are not typically offered.

Team that worked on the article

Igor is an experienced finance professional with expertise across various domains, including banking, financial analysis, trading, marketing, and business development. Over the course of his career spanning more than 18 years, he has acquired a diverse skill set that encompasses a wide range of responsibilities. As an author at Traders Union, he leverages his extensive knowledge and experience to create valuable content for the trading community.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.