IBKR Pro vs IBKR Lite – Which Is Right for You?

IBKR Lite is a good choice if you're new to trading or just want something simple — it's free of commission fees on U.S. stocks and ETFs and has no inactivity charges, which is great for anyone who trades occasionally and wants to keep costs low. If you’re more serious about trading, IBKR Pro might fit better. It has advanced tools and global market access, but also some fees and a more complex setup.

Interactive Brokers is a global brokerage platform that offers access to a wide range of financial markets. Whether you're an active day trader, an advanced algorithmic trader, or a casual investor, IBKR has two distinct account options tailored to different needs: IBKR Pro and IBKR Lite. Each plan has specific features, benefits, and pricing structures, making it vital to choose the right one based on your trading style.

In this article, we'll guide you through the detailed comparison of IBKR Pro and IBKR Lite to help you make an informed decision.

IBKR Pro vs IBKR Lite: a comprehensive comparison

Key differences: IBKR Lite vs. IBKR Pro

Here are the major differences between IBKR Lite and IBKR Pro across various aspects:

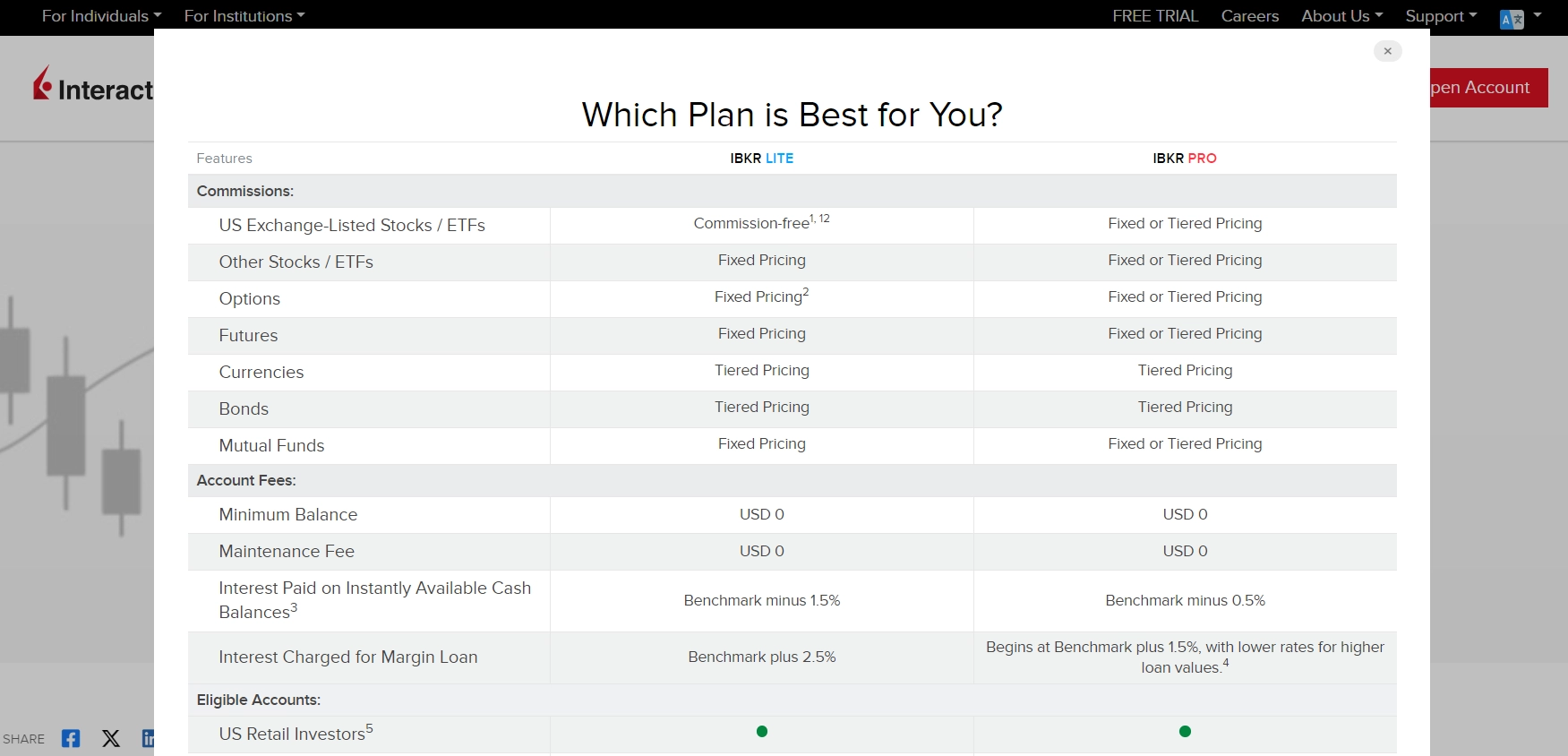

IBKR Pro vs IBKR Lite

| Features | IBKR Lite | IBKR Pro |

|---|---|---|

|

Commissions (US-listed Stocks/ETFs) |

Commission-free |

Fixed or tiered pricing |

|

Options & futures pricing |

Fixed pricing |

Fixed or tiered pricing |

|

Interest on cash balances |

Benchmark minus 1.5% |

Benchmark minus 0.5% |

|

Margin loan interest |

Benchmark plus 2.5% |

Benchmark plus 1.5% (better rates for larger loans) |

|

Market data |

Complimentary real-time data for U.S. stocks |

Access to premium, global market data packages |

|

Trading technology |

Client Portal, IBKR Mobile |

TWS, Algos, APIs, and SmartRouting |

Choosing between IBKR Pro and IBKR Lite largely depends on how frequently you trade, the assets you focus on, and your need for advanced trading tools. Let’s break it down step by step:

-

Understand your trading style

-

Active trader: if you’re placing multiple trades a day and need access to advanced tools, IBKR Pro is your best choice.

-

Long-term investor: if you’re a buy-and-hold investor, IBKR Lite is likely better suited for you.

-

-

Compare the fee structures

-

IBKR Lite: commission-free trading for U.S. exchange-listed stocks and ETFs. Fixed pricing for options and futures.

-

IBKR Pro: offers both fixed and tiered pricing. Tiered pricing is advantageous for high-volume traders as fees decrease with more trades.

-

-

Evaluate trading tools and technology needs

-

IBKR Pro provides access to more sophisticated trading tools such as the Trader Workstation (TWS), which is appropriate for professionals.

-

IBKR Lite users can access the simpler Client Portal and IBKR Mobile platforms, making it ideal for retail investors.

-

-

Assess market data requirements

-

IBKR Pro users receive a more comprehensive range of real-time market data, essential for active traders.

-

IBKR Lite provides complimentary real-time data for U.S. stocks and ETFs, sufficient for most casual investors.

-

-

Consider your need for margin trading

-

IBKR Pro offers better margin rates (starting at benchmark plus 1.5%) compared to IBKR Lite (benchmark plus 2.5%), making it more appealing for traders who use leverage.

-

-

Determine customer support expectations

-

Both accounts offer excellent customer support, but IBKR Pro users may experience faster, more specialized assistance.

-

IBKR Pro vs IBKR Lite

Trading technology and platforms

Both IBKR Lite and IBKR Pro provide access to a range of trading platforms, but the main differences lie in the level of sophistication and flexibility offered.

-

IBKR Pro. You gain access to Trader Workstation (TWS), a powerful platform equipped with charting tools, customizable algorithms, and APIs. TWS is designed for professional traders who need a complete set of trading tools.

-

IBKR Lite. Offers a simpler, user-friendly experience through the Client Portal and IBKR Mobile, making it ideal for retail investors who need a more straightforward interface for casual investing.

Fees and pricing structure

In both accounts, there are no maintenance fees or minimum balance requirements, making it accessible for traders of all levels.

-

IBKR Lite is best for those who want commission-free trading on U.S. stocks and ETFs with fixed pricing on options and futures.

-

IBKR Pro offers both fixed and tiered pricing, which can lead to lower overall costs for high-volume traders. This flexibility is particularly useful for those trading multiple asset classes globally.

Account features: margin trading, interest rates, and SmartRouting

IBKR Pro allows users to take advantage of SmartRouting, a tool that improves trade execution by seeking the best prices across multiple exchanges. Margin traders will also find more competitive interest rates with IBKR Pro, where larger loans qualify for even better terms.

Educational and research resources

-

IBKR Pro offers access to extensive research tools, including analyst reports, fundamental data, and educational content tailored to advanced traders.

-

IBKR Lite provides basic resources, which are sufficient for long-term investors or those new to the market.

What should be considered for beginners?

-

IBKR Lite is designed for retail investors who prioritize commission-free trades and ease of use. The platform is intuitive, and the resources provided are enough to help beginners learn the ropes.

-

Margin trading limitations. Beginners should be cautious when using margin, as IBKR Lite imposes restrictions to help prevent excessive risk.

What should be considered for advanced traders?

For more sophisticated traders, IBKR Pro is the clear choice. It offers:

-

Access to TWS, APIs, and algorithmic trading features.

-

Competitive interest rates on margin loans.

-

Charting tools and market data, all of which are critical for executing complex trading strategies.

Risks and warnings

-

Market volatility. Margin trading can amplify both gains and losses, making it essential to understand the risks involved, especially for traders using IBKR Pro.

-

Hidden costs. While IBKR Lite may seem fee-free, there can be additional costs for market data or advanced order types that users need to be aware of.

Pros and cons of IBKR Pro vs IBKR Lite

IBKR Pro

👍 Pros

• Advanced tools. Access to powerful trading platforms like Trader Workstation (TWS) and SmartRouting, ideal for active or professional traders who need real-time data and analytical tools.

• Flexible pricing. Offers tiered or fixed pricing, which can be cost-effective for high-volume traders.

• Lower margin rates. Competitive rates starting at benchmark plus 1.5%, which is favorable for those who use margin frequently.

👎 Cons

• Inactivity fees. Charges inactivity fees that can impact users who trade infrequently.

• Platform complexity. More complex tools and active management requirements can make it challenging for beginners to navigate effectively.

IBKR Lite

👍 Pros

• Simple and commission-free. Commission-free trading for U.S.-listed stocks and ETFs, making it accessible for occasional investors or beginners.

• No inactivity fees. Avoids inactivity charges and offers a more user-friendly interface.

• Straightforward pricing. No commissions for U.S.-listed stocks and ETFs, ideal for long-term or less active traders.

👎 Cons

• Limited access to advanced tools. Does not include access to TWS or SmartRouting, which may be limiting for traders who need sophisticated tools.

• Higher interest rates on margin. Offers higher margin rates than Pro, which can increase costs for users who trade on margin.

Think about how often you plan to trade

If you’re new to investing and stuck choosing between IBKR Pro and IBKR Lite, think about how often you plan to trade and whether you care about getting the best possible prices. IBKR Pro is designed for those who might trade more frequently or want access to a broader range of investment options. A big plus with Pro is its SmartRouting feature, which automatically seeks out the best prices for each trade by linking you directly to more markets. Many beginners overlook this, but better prices on trades can make a noticeable difference, especially if you’re planning on being active in the market.

IBKR Lite, by contrast, is great for those who don’t want to worry about paying commissions on U.S. stocks and ETFs. But here’s the trade-off — Lite routes your orders through third-party platforms, which can sometimes mean you’re not getting the absolute best price. So, if your strategy leans more toward buying and holding or trading infrequently, Lite’s simplicity and no-commission setup might be a good fit. But if you’re looking to grow in trading and want that added advantage in execution quality, Pro might quietly boost your results over time.

Conclusion

When deciding between IBKR Pro and IBKR Lite, the choice ultimately depends on your trading style and objectives. If you're an active trader looking for advanced tools and competitive margin rates, IBKR Pro is the way to go. If you're an occasional investor looking for a simple, commission-free experience, IBKR Lite will suit you better. Choose wisely based on your trading habits and financial goals.

FAQs

Is it possible to switch between IBKR Pro and IBKR Lite?

Yes, it's possible to switch between IBKR Pro and IBKR Lite at any time. Your first three reclassifications are processed daily, while subsequent changes occur quarterly.

Is there a fee to transition from IBKR Lite to IBKR Pro?

No, there is no fee to switch between IBKR Lite and IBKR Pro. You can switch based on your changing needs without any cost.

Does IBKR Lite offer margin trading?

Yes, IBKR Lite offers margin trading, but the interest rates are higher compared to IBKR Pro. Lite users will pay benchmark plus 2.5%, while Pro users enjoy lower rates starting at benchmark plus 1.5%.

What happens if I trade frequently using IBKR Lite?

If your trading activity appears non-retail (such as high-frequency or algorithmic trading), IBKR reserves the right to reject your orders or switch your account to IBKR Pro, which is more suited for professional trading behavior.

Team that worked on the article

Mikhail Vnuchkov joined Traders Union as an author in 2020. He began his professional career as a journalist-observer at a small online financial publication, where he covered global economic events and discussed their impact on the segment of financial investment, including investor income. With five years of experience in finance, Mikhail joined Traders Union team, where he is in charge of forming the pool of latest news for traders, who trade stocks, cryptocurrencies, Forex instruments and fixed income.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).