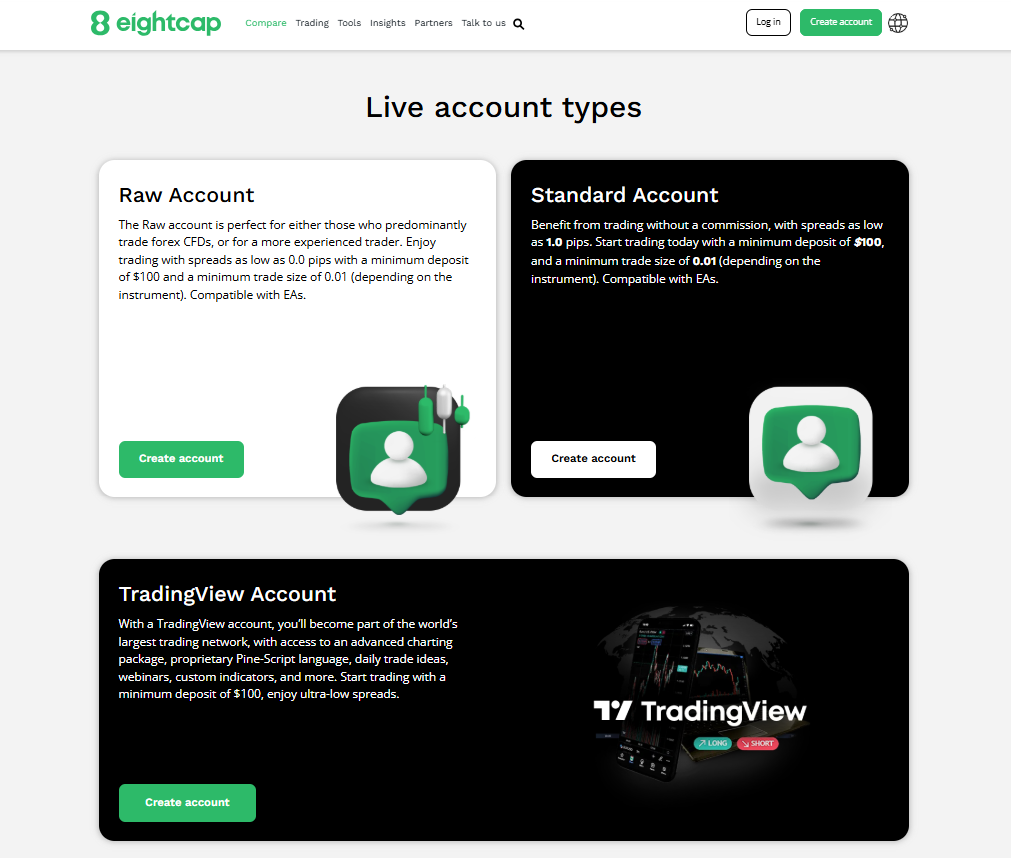

Eightcap Account Types

Eightcap offers two types of accounts: Raw and Standard. They have approximately the same trading conditions, minimal deposit requirements, and characteristics. However, by choosing a Raw Account, clients will get a narrower spread Eightcap, while a Normal or Standard Account allows them to trade without commissions.

The Raw plan will suit more experienced investors, while the Standard plan is ideal for beginners who want to try their hand at trading. Eightcap also has a demo plan, available to all traders and can be opened on MT4/MT5 platforms. Its validity period is limited to 30 days, but you can request an extension by contacting the intermediary's support team.

Eightcap account types

The demo account allows new investors to assess whether Eightcap's offerings meet their financial goals and needs. Read on to learn more about raw and standard accounts and their margin call level.

What are the features of an Eightcap standard account?

The Eightcap standard account is designed for newcomers who are starting to trade financial markets. It has a commission-free structure and variable spreads. Find out more about the Eightcap spread comparison and details.

The Eightcap Standard trading plan provides commission-free trading with variable spreads, making it a great choice for beginners and casual investors. It offers 3 platforms to choose from. MT4 and MT5 are considered the most versatile and user-friendly, while TradingView is ideal for comparing markets and instruments.

Key features:

Minimum deposit. $100

Spreads. From 1.0 pip

Commissions. None

Leverage. Up to 1:500 for non-Australian clients

Trading platforms. MT4, MT5, and TradingView

Markets available. Forex, commodities, indices, stocks, and cryptocurrencies

Minimum trade size. 0.01 lot

This account is ideal for beginners who prefer simple pricing without commission fees. With access to over 800 financial instruments, traders can diversify their strategies with ease. You can start by completing the Eightcap account registration, where you’ll find a step-by-step guide on setting up a live trading account.

What are the features of an Eightcap raw account?

This type of Eightcap account is designed for advanced traders who require tight spreads and low-cost execution. It’s perfect for those who focus on CFD trading across different markets. It allows investors to exchange all assets and utilize a full range of educational materials and analytical tools.

Eightcap offers speculators an economic calendar based on artificial intelligence, the Capitalise.ai platform for automating trading by creating and running strategies without the need for programming, the FlashTrader automated Expert Advisor, and much more.

Key features:

Minimum deposit. $100

Spreads. From 0.0 pips

Commissions: $3.50 per side per lot

Leverage: Up to 1:500

Platforms: MetaTrader 4, MetaTrader 5, and TradingView

Markets available: Forex, indices, commodities, stocks, cryptocurrencies

Minimum trade size: 0.01 lot

The low spread and ECN-like execution make this account an excellent option for scalpers and traders who execute high-volume trades. To learn more about the ECN-like execution and tighter spreads, check out the Eightcap Raw account comparison.

What are the features of an Eightcap demo account?

According to Eightcap types review, in addition to real accounts, Eightcap provides dealers with a free demo account for test trading. It is active for 30 days, but it can be extended by contacting the support team. The size of the virtual balance ranges from $3,000 to $500,000, and the leverage can be 1:500. A demo account allows the investor to deal on real quotes and takes into account the current market peculiarities.

Key features:

Available for 30 days (extendable upon request)

Virtual funds: $3,000 - $500,000

Leverage: Up to 1:500

Trading platforms: MT4, MT5

Markets available: Forex, indices, stocks, cryptocurrencies

To get started with a risk-free trading experience, register for an Eightcap demo account and gain first-hand exposure to the trading environment.

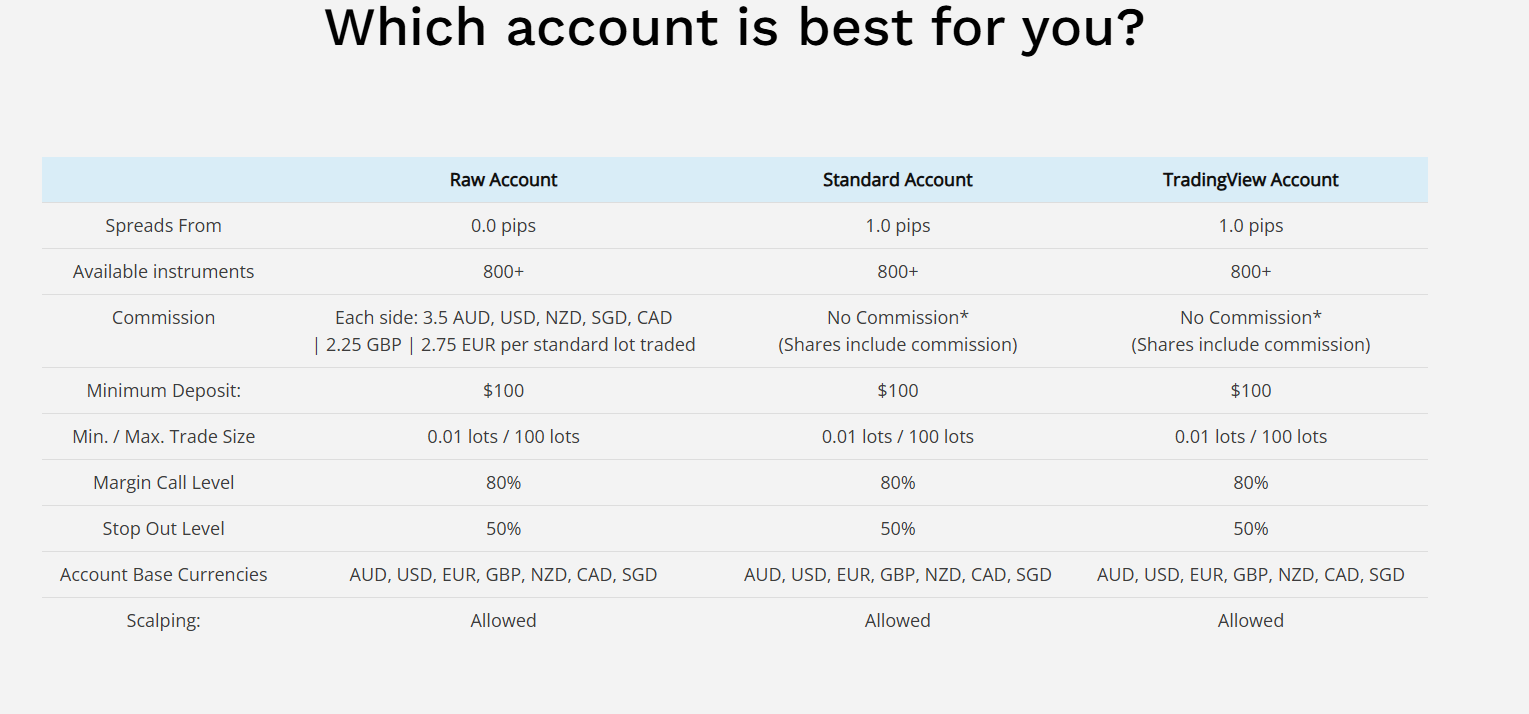

How to choose? Eightcap account types comparison

Eightcap account permission

Choosing the right Eightcap account type depends on your trading experience and goals. Beginners may start with demo accounts, while intermediate traders might prefer standard accounts. Professionals often opt for raw accounts for specific features.

With access to MT4, MT5, and TradingView, traders can access narrow spreads and competitive costs. Below is a comparison of Eightcap account types.

Comparison of Eightcap account types

| Feature | Standard Account | Raw Account | Demo Account |

|---|---|---|---|

| Minimum Deposit | $100 | $100 | Free |

| Platforms | MT4, MT5, TradingView | MT4, MT5, TradingView | MT4, MT5 |

| Markets | Forex, indices, stocks, commodities, cryptocurrencies | Forex, indices, stocks, commodities, cryptocurrencies | Same as live accounts |

| Spreads | From 1.0 pip | From 0.0 pips | Simulated |

| Commission | None | $3.50 per lot per side | None |

| Best For | Beginners & casual traders | Advanced & high-volume traders | Testing strategies |

Note:

The margin call level on Eightcap's Raw and Standard trading plans is set at 80%, ensuring traders manage risk effectively. Those using the Eightcap Raw plan benefit from tighter variable spreads, making it ideal for scalping and high-frequency trading. Learn more about "how forex spreads work and their impact on trading costs."

How to open an Eightcap trading account?

Opening an Eightcap trading account is a straightforward process, whether you’re a beginner or an experienced trader. With competitive spreads, low spreads, and spreads from 0.0 pips, this platform offers traders a friendly sign-up process. Here is a guide to getting started with Eightcap:

Step 1: Register for an Eightcap live trading account

Visit the website and click the "Create Account" button. Choose from the available account types—Eightcap standard account, Eightcap raw account, or Eightcap demo account—depending on your trading needs. The platform provides an easy-to-follow Eightcap registration guide.

Step 2: Confirm your email and login details

Once you've submitted your registration, the platform will send a verification email to your registered address. Click the link inside to confirm your email and proceed with setting up your live account.

Step 3: Complete the Eightcap verification

To fully activate your Eightcap trading account, you must complete the verification process. This includes uploading:

A valid government-issued ID (passport, driver’s licence).

A proof of residence (utility bill or bank statement from the last 3 months).

In some cases, additional documents may be required to meet compliance regulations.

More details on this process can be found in the Eightcap verification guide.

Step 4: Fund your Eightcap account

After verification, deposit at least $100 to your Eightcap live trading account. The platform accepts multiple funding options, including bank transfers, credit/debit cards, and e-wallets.

Step 5: Commence trading on Eightcap

Once you are credited, you can open positions on an MT4, MT5, or TradingView account. Eightcap offers traders access to a wide range of markets, including forex, indices, stocks, cryptocurrencies, etc.

What leverage does Eightcap offer? With maximum leverage up to 1:500, narrow spreads, and advanced trading platforms, Eightcap provides an ideal environment for all types of traders.

Another trick to up your trading game is using Capitalise.ai with Eightcap’s Standard account

When starting with Eightcap’s Standard account, explore the TradingView platform to connect with its social trading features. Instead of relying solely on charts, follow expert traders’ shared strategies within the TradingView community. This is an underrated way to learn—studying how experienced traders make decisions can offer insights that books or guides often miss. Try mirroring their strategies in steady currency pairs like EUR/USD, which generally have predictable trends. This careful entry into trading minimizes risk and helps you pick up advanced techniques as you go.

Another trick to up your trading game is using Capitalise.ai with Eightcap’s Standard account. This tool allows you to set up automated trading rules without needing coding skills. For example, you can create simple rules like “If EUR/USD reaches today’s high and RSI exceeds 70, sell.” This approach takes the pressure off constant monitoring and lets you learn market behavior as trades execute in real time. Pairing this with manual analysis on TradingView can build your skills quickly, giving you both hands-on and automated experience.

Final thoughts

Eightcap has established itself as a reliable trading platform, delivering innovative solutions for over a decade. With access to competitive spreads, advanced trading platforms, and a wide range of financial instruments, it caters to traders at every level. For beginners, the Eightcap Standard account stands out as the ideal choice. It offers a simple, commission-free structure with reasonable spreads, ensuring a cost-effective way to explore trading without complexity.

Additionally, the competitive margin call level provides alerts when available funds are insufficient to maintain open positions, enabling better risk management.

For experienced traders, the Eightcap Raw account is a game-changer. With ultra-tight spreads starting from 0.0 pips and low commission costs, it’s perfectly designed for scalpers and high-volume traders who prioritize efficient trade execution. Moreover, the demo account acts as a stepping stone for traders at all levels, providing a risk-free environment to refine strategies. Compatible with MT4, MT5, and TradingView platforms, the demo account offers a seamless transition to live trading by simulating real-market conditions.

Whether you are a beginner looking to explore the basics or a seasoned trader seeking advanced features, Eightcap’s tailored account types ensure that there’s a perfect fit for every trading style. Start your trading journey today and experience the competitive edge Eightcap offers.

FAQs

Which Eightcap account type is best for beginners?

For newbies who only want to try their hand at trading, a demo account is suitable. With its help, they will be able to improve their skills without any financial risks. Beginners should also take a closer look at the standard account, which includes all the necessary functions for a start, including zero commissions.

In a nutshell, the free demo account or normal account, which offers zero commissions and low-cost spreads is ideal for beginners.

Does Eightcap offer swap-free accounts?

No, Eightcap does not offer Islamic (swap-free) trading accounts. Swap-free accounts are typically designed for traders who follow Sharia law, which prohibits earning or paying interest on overnight positions.

Since Eightcap does not have a swap-free trading account option, Muslim traders seeking a Sharia-compliant trading environment may need to consider other brokers that offer Islamic accounts with no overnight interest fees.

How to open an Eightcap trading account?

To open a live account with Eightcap, you need to go to the broker's website, click on the "Create account" button, and fill in the form with the requested data. Next, you need to confirm your email address and verify your account by uploading a scanned copy of your identity document and proof of residence.

What’s the Eightcap minimum deposit for an account?

Eightcap’s lowest deposit for both Standard and Raw accounts starts at $100 or its currency equivalent, depending on your region.

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).