Eightcap Demo Account Review

The Eightcap demo account provides a realistic trading environment for beginners and experienced traders. It offers access to real-time market data, advanced tools on MT4 and MT5, and diverse instruments like Forex, indices, and cryptocurrencies. Perfect for testing strategies risk-free before transitioning to live trading.

Unlike many brokers that provide restricted demo access, Eightcap delivers a comprehensive trading environment through MetaTrader 4 (MT4) and MetaTrader 5 (MT5). However, does the Eightcap demo account effectively prepare traders for real market conditions? This review delves into its key features, setup process, benefits, and potential drawbacks to help you decide.

Key features of Eightcap demo

The Eightcap demo account stands out with its user-friendly interface, advanced trading tools, and real-time market conditions, making it an ideal platform for strategy testing and skill development. Below are the key features of the Eightcap demo account.

Eightcap home page

User interface overview

The Eightcap new demo account provides an intuitive experience. It is available on MetaTrader 4 (MT4) and MetaTrader 5 (MT5). This makes it a solid choice for both beginners and advanced traders, as it ensures they get the best trading tools at their level and experience.

Trading tools and resources

Eightcap offers custom indicators, economic calendars, and algorithmic solutions. The Eightcap demo account allows users to explore an array of instruments, including forex, CFDs, and cryptocurrencies, in a risk-free environment.

Setting up a demo account

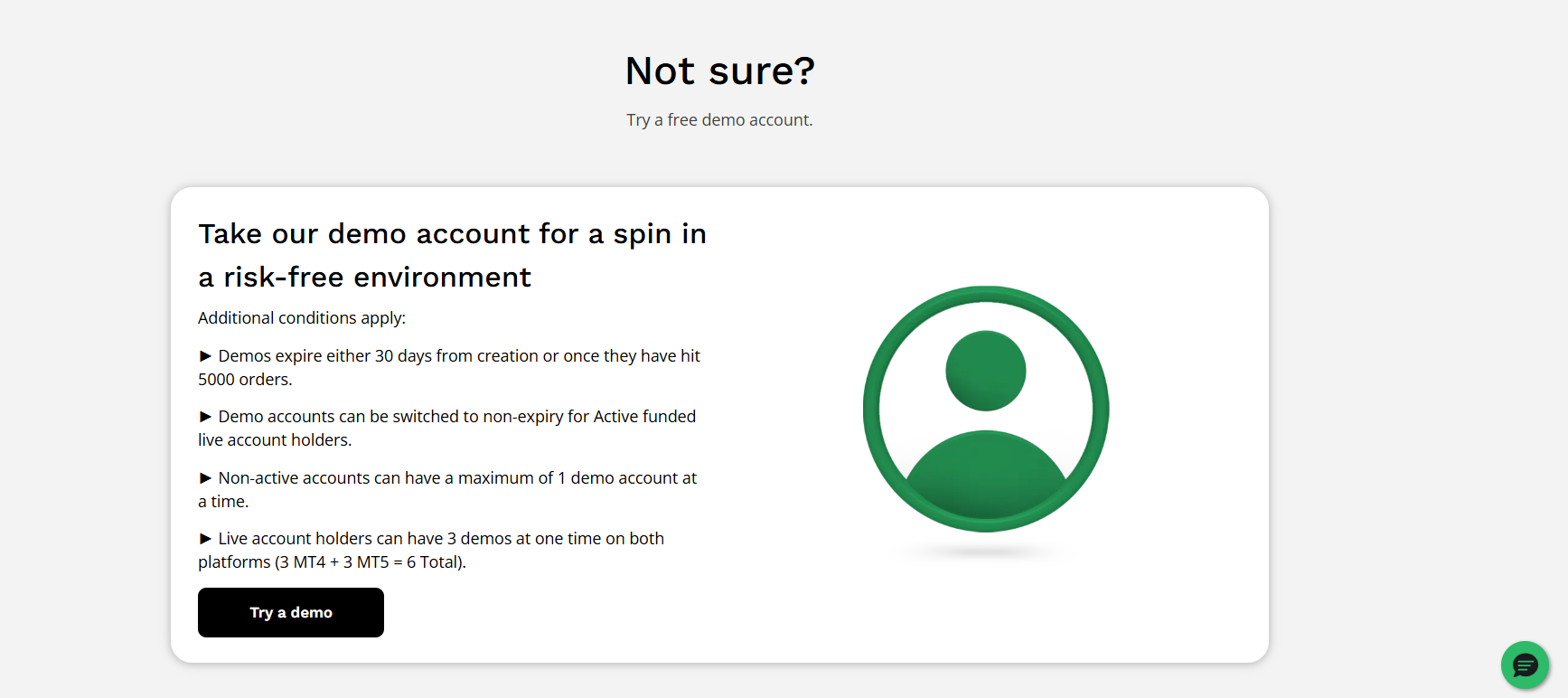

Eightcap demo account

Setting up a demo account with Eightcap is simple and lets you practice trading in a risk-free environment. Follow these steps to get started:

Step 1: Download MetaTrader 4 (MT4) or MetaTrader 5 (MT5)

Visit Eightcap’s official website and download your preferred trading platform—MT4 or MT5. These platforms are available for desktop and mobile devices.

Step 2: Install and open the platform

Install the platform on your device. Once installed, open the application to proceed with the account setup.

Step 3: Open a new account

On the platform, go to the “File” menu and select “Open an Account.” A window will appear with a list of available servers. If “Eightcap-Demo” isn’t listed, type “Eightcap” in the search bar and click “Scan” to find it.

Step 4: Configure account details

Choose “Eightcap-Demo” as your server and click “Next.” Select “New demo account” and provide your details. Then, customize the account settings:

Account Type: Standard or Raw.

Base Currency: Options include USD, AUD, EUR, and NZD.

Leverage: Choose between 1:25 and 1:500 based on your preferences.

Initial Deposit: Set an amount ranging from $3,000 to $5,000,000.

Tick the agreement box and click “Next.”

Step 5: Save your credentials

Your demo account details will be generated automatically. Save this information securely, as you’ll need it to log in. After saving, click “Finish.”

Step 6: Log in and start trading

The platform will log you into your demo account. Check the “Navigator” window to ensure your account is listed. You’re now ready to explore the platform and trade with virtual funds.

Additional information

Demo accounts are active for 30 days. You can request an extension by contacting Eightcap’s customer support.

Account customization options

The Eightcap demo account allows full customization, including setting preferred trading features, adjusting leverage, and modifying order execution speeds for better demo trading experience. Learn can US residents trade with Eightcap?

Is the Eightcap demo good for beginners?

The Eightcap demo profile is an excellent starting point for beginners, offering zero financial risk, full market access that simulates live conditions, and a safe space to test strategies before transitioning to a live account. This extensive range of instruments enables traders to diversify their portfolios and capitalize on various market opportunities.

However, while the demo account offers real-time pricing and execution speeds, it does not replicate the emotional intensity of actual trading.

Trading instruments available

Eightcap offers a diverse range of trading instruments, allowing traders to access various global markets through Contracts for Difference (CFDs). The available instruments include:

Forex. Over 45 currency pairs, encompassing major, minor, and exotic pairs. Users benefit from high-leverage options, up to 1:500.

Major pairs (EUR/USD, GBP/USD, USD/JPY).

Minor pairs (AUD/NZD, CAD/CHF, EUR/GBP).

Exotic pairs (USD/SGD, EUR/TRY, GBP/ZAR).

Indices. You get link to major global stock indices, such as the US30 (Dow Jones), ASX200 (Australia 200), UK100 (FTSE 100), GER40 (DAX 40), and NDX100 (Nasdaq 100). You can trade with competitive spreads, for example, as low as 1 pip on the ASX200 on Eightcap.

Commodities. Availability of precious metals like Gold and Silver, as well as energy commodities such as Crude Oil. You can utilize leverage up to 1:500 for commodities trading. Read Eightcap leverage explained for traders.

Shares. Speculate on the price movements of leading Australian and US company shares through CFDs. You get access to over 660 stock CFDs with leverage up to 1:20.

Cryptocurrencies. Trade a selection of popular cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. You can benefit from leverage up to 1:20 on crypto assets.

Eightcap provides a robust trading platform for Forex and CFD traders, but those seeking funded trading can explore alternative prop trading firms - join Eightcap prop firm.

Exploring effective trading strategies

Day trading strategy

Day trading focuses on taking advantage of short-term price fluctuations. Traders execute multiple trades within a single trading day, targeting small profits that can accumulate over time. With the demo account, beginners can practice executing trades quickly, analyzing charts, and developing a disciplined approach to managing risk.

Breakout strategies

This strategy involves entering a trade when an asset’s price moves beyond a significant support or resistance level. Breakouts often signal increased volatility, offering potential opportunities for significant price movements. Using tools like the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) platform, traders can set alerts to monitor breakout levels and refine their timing.

Trend-following strategies

Trend-following involves identifying and capitalizing on strong market trends. Traders use technical indicators such as moving averages and the Relative Strength Index (RSI) to confirm momentum. Practicing on the Eightcap demo account helps traders recognize trends early and determine the best points to enter or exit a trade.

Advanced trading techniques

Scalping techniques

Scalping is a high-frequency trading method where traders execute numerous trades within minutes or seconds to profit from small price changes. The demo account allows users to practice precision timing and quick decision-making without financial risk, perfect for mastering this fast-paced strategy.

Swing trading strategy

Swing trading is ideal for traders who aim to capture medium-term price movements. Positions are typically held for days or weeks, making it suitable for those who prefer a less intensive approach than day trading. Using the Eightcap demo platform, traders can test swing trading setups and analyze the performance of technical indicators like Fibonacci retracements or Bollinger Bands.

Algorithmic trading

Algorithmic trading uses automated strategies to execute trades based on predefined criteria. With Eightcap’s support for MT4 and MT5, traders can create, test, and optimize their algorithms. Backtesting strategies against historical data is a powerful way to refine them for live markets.

The Eightcap demo account enables users to test and optimize these strategies without financial risk. It serves as a powerful tool for developing and refining risk management strategies before trading with real capital. It allows traders to practice controlling losses, optimizing trade sizes, and managing leverage in a risk-free environment.

Importance of risk management

RIsk management is the foundation of long-term success in the financial markets. The Eightcap demo account provides a safe environment to identify and mitigate risks before transitioning to live trading.

Key trading risks to manage

Overleveraging. Excessive use of leverage magnifies both gains and losses, increasing capital exposure beyond safe limits.

Emotional trading. Impulsive decisions driven by fear or greed often lead to poor trade execution and unnecessary losses.

Ignoring stop-loss orders. Failing to set protective stops can result in small losses escalating into significant drawdowns.

Essential risk management tools with Eightcap

You can use risk management tools in Eightcap demo trading environment to develop risk-aware strategies. Some of these tools include:

Stop-loss & take-profit orders. Automatically close trades at pre-set price levels, preventing uncontrolled losses.

Risk/reward ratio optimization. Helps traders structure trades with a favorable profit-to-loss balance.

Real-time market simulation. The demo account mirrors live conditions, allowing traders to refine risk mitigation strategies before trading with real capital.

Performance tracking

Performance tracking is the process of analyzing and measuring trading results to assess strategy effectiveness and improve decision-making on Eightcap. It helps traders identify strengths, weaknesses, and areas for optimization before committing to real capital.

Key metrics in performance tracking on Eightcap:

Win/loss ratio. Measures the percentage of successful trades versus losing trades.

Drawdown levels. Evaluates the largest decline in trading capital to manage risk exposure.

Slippage effects. Assesses the difference between expected and actual execution prices, crucial for live trading accuracy.

Transitioning from demo to live trading account on Eightcap

Moving from a demo account to a live trading account on Eightcap is a crucial step in a trader's journey. While demo accounts provide a safe environment to practice, live accounts involve real money, introducing new challenges like emotional discipline, market risks, and execution differences.

Key differences between demo and live accounts

Execution and market conditions

Demo accounts simulate trading without involving real market conditions. Orders are executed instantly, with no slippage or liquidity issues.

Live accounts reflect real market dynamics. Trades can face slippage, variable spreads, and execution delays during high volatility.

Psychological factors

Trading with virtual funds in a demo account carries no emotional stress.

Live trading, however, can evoke strong emotions such as fear and greed, affecting decision-making and risk tolerance.

Risk exposure

Demo trading allows risk-free experimentation, whereas live trading involves real financial risk. Traders must carefully manage their capital to avoid losses.

Steps to transition smoothly to a live trading account

Open a live account

Visit the Eightcap website and complete the account application process. Verify your identity by submitting the required documents. Once approved, you can deposit funds and start trading. The minimum deposit is $100, making it accessible for beginners.Start with small capital

Begin trading with a small initial deposit to reduce exposure to losses while familiarizing yourself with live market conditions.Implement risk management strategies

Use stop-loss and take-profit orders to manage your trades. Adjust your position sizes and leverage based on your risk tolerance to protect your capital.Understand slippage

Be prepared for slippage in live markets, where trades may execute at a different price than expected due to rapid price movements. This is common during high volatility or low liquidity.Maintain emotional discipline

Develop a trading plan and stick to it. Avoid impulsive decisions driven by fear or greed. Practicing discipline is essential to long-term success in live trading.

Pros and cons of using the Eightcap demo account

Before you create a demo profile, learning about the pros and cons is among the best practices for beginners. Below are the top pros and cons of an Eightcap demo account.

👍 Pros

• No financial risk. Practice trading strategies using virtual funds, eliminating the risk of real monetary loss.

• Full functionality. Experience real-time market conditions with accurate price feeds and execution speeds, mirroring live trading environments.

• Skill development. Enhance technical and analytical abilities, building confidence before transitioning to a live trading account.

• Risk management practice. Refine techniques like setting stop-loss and take-profit orders, and determine optimal position sizes without financial consequences.

• Testing trading tools. Explore various indicators, automated strategies, and platform features to identify what works best for your trading style.

👎 Cons

• Limited emotional engagement. Trading with virtual funds does not replicate the psychological pressures of live trading, which can affect decision-making.

• Time restriction. The demo account is active for 30 days by default. However, extensions can be requested through customer support.

A lesser-known benefit of the Eightcap demo is its compatibility with algorithmic trading tools

Setting up your Eightcap demo account is more than just practicing trades. Take this time to explore unique techniques, such as focusing on trading during specific hours when market volatility peaks, like the overlap between the London and New York sessions. Instead of copying generic strategies, create your own approach by observing patterns in price movements around news releases. Use the demo account to analyze how these movements vary across currency pairs and refine your timing for entering and exiting trades. This hands-on approach ensures you’re learning practical skills for real market conditions.

A lesser-known benefit of the Eightcap demo is its compatibility with algorithmic trading tools. Even if you aren’t into coding, experiment with ready-made strategies or adjust settings like trailing stop-loss levels to match your risk tolerance. Test these strategies using past market data available on MetaTrader 4 or 5, and observe how they perform in different scenarios. By treating the demo account as a testing lab, you’ll gain deeper insights into what works best for your trading goals while building a solid foundation for live trading.

Conclusion

The Eightcap demo account is a powerful platform for traders of all levels to refine their skills and test strategies without risking real money. With access to real-time market data, diverse trading instruments, and advanced tools, it offers a realistic trading environment that mirrors live market conditions. Beginners can build confidence by mastering risk management, while experienced traders can experiment with algorithmic strategies and scalping techniques.

Although transitioning to live trading introduces emotional and financial challenges, the experience gained from the demo account helps traders prepare for success. Use this tool as a stepping stone to optimize your trading strategies and achieve long-term growth in the financial markets.

FAQs

How long can I use the Eightcap demo account?

The Eightcap demo account is available for 30 days by default. However, traders can request an extension by contacting customer support.

Can I withdraw funds from my demo account?

No, all virtual assets in the Eightcap demo account are for practice purposes only. Since it is a simulated environment, withdrawals are not possible.

Is the Eightcap demo account free?

The Eightcap demo account is completely free for all users. Traders can access real-time market data and trading tools without any cost.

Does the demo account reflect real market conditions?

The Eightcap demo account offers live spreads and execution speeds similar to a real account. It helps traders experience actual market conditions without financial risk.

Team that worked on the article

Peter Emmanuel Chijioke is a professional personal finance, Forex, crypto, blockchain, NFT, and Web3 writer and a contributor to the Traders Union website. As a computer science graduate with a robust background in programming, machine learning, and blockchain technology, he possesses a comprehensive understanding of software, technologies, cryptocurrency, and Forex trading.

Having skills in blockchain technology and over 7 years of experience in crafting technical articles on trading, software, and personal finance, he brings a unique blend of theoretical knowledge and practical expertise to the table. His skill set encompasses a diverse range of personal finance technologies and industries, making him a valuable asset to any team or project focused on innovative solutions, personal finance, and investing technologies.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).