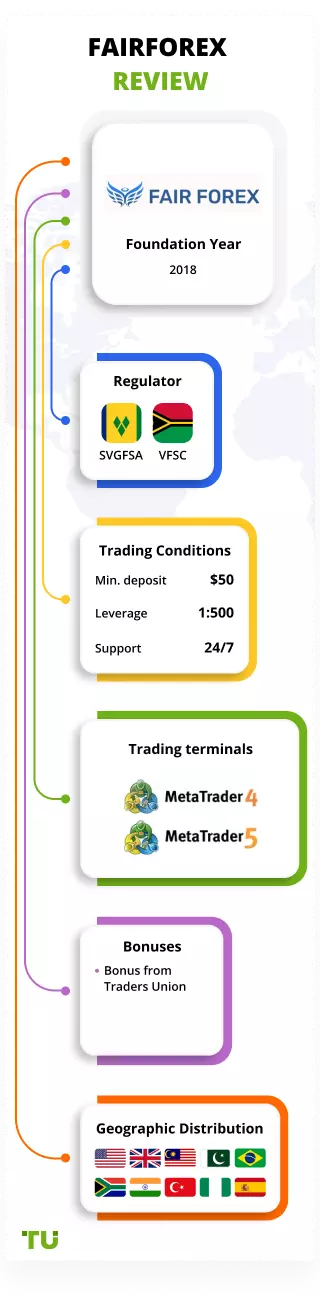

deposit:

- $50

Trading platform:

- MT4

- MT5

- SVGFSA

- VFSC

FairFx Review (FairForex) 2024

Attention!

This brokerage company is on the Blacklist. Working with companies on the Blacklist carries high risks of losing your money. We continuously monitor the Internet in order to identify new scams aimed at defrauding traders, and categorically do not recommend working with companies on the Blacklist.

We advise traders to choose reliable and trustworthy licensed companies from among top brokers of our rating:

Summary of FairForex Trading Company

“FairForex” broker has become a scammer. This company has ceased to fulfill its obligations to customers and partners, and has stopped making payouts.

👍 Advantages of trading with FairForex:

- Narrow spreads from 0.8 pips on Standard accounts and from 0.0 pips on accounts with an additional commission per lot.

- Available minimum deposit ($50) for the Standard account.

- A wide range of methods of replenishments and withdrawals of funds.

- The possibility to make transactions with more than 700 trading instruments using high leverage up to 1:500.

- ECN technology support.

- Clients’ funds are kept in segregated accounts.

- Fast and fully digitized account opening.

👎 Disadvantages of FairForex:

- Educational information on the official website is sparse.

- Regulation in an offshore jurisdiction and the inability to receive compensation in the event of bankruptcy by the company.

- There is a minimum withdrawal amount.

Geographic Distribution of FairForex Traders

Popularity in

Video Review of FairForex i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Investment Programs, Available Markets and Products of the Broker

The FairForex broker strives to maximize the trading opportunities of its clients; therefore, it does not limit them when choosing a trading strategy. Passive investors here can copy transactions of other clients of the company, invest in MAM accounts, and use expert advisors (bots) to automate trading processes. The referral program with commissions for attracting new users is also available.

Getting passive income from FairForex

All clients of the broker can earn money without actively trading and conducting market analyses. Currently, Fair Forex offers the following investment programs:

-

Expert Advisor uses automated (bots) that perform transactions according to a given algorithm. The company does not supply EAs, so the trader must find and install the necessary advisor on their own.

-

Signals is a proprietary service for copying transactions of successful traders who are also the company’s clients. Any interested trader can connect to it. To do this, you need to open an account with a broker and then make a deposit of $100. Access to the signal platform is opened in the personal account.

-

MAM — The Multi-Account Manager account is intended for fund and wealth managers who trade on behalf of several clients for a percentage of profits. The manager receives remuneration only for profitable trades. The MAM account is available on MT4 and MT5.

The investor selects his own account managers and traders, whose trades are copied to his account. Fair Forex does not guarantee passive income to its clients. Also, it is not responsible for the providers of trading signals to make such promises.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

FairForex’s affiliate programs:

-

Introducing Broker (IB) is a five-tier program whose participants receive compensation in the form of a rebates against the spread for attracted clients. IBs connect new traders and the broker charges him up to 25% of the amount of its own commissions.

The referral program is very beneficial for all participants. The brokerage company receives new active clients, partners receive cash rewards, and attracted traders receive liquidity and software from a broker larger than the IB itself.

Trading Conditions for FairForex Users

Traders who have opened an account with FairForex can trade currency pairs, cryptocurrencies, CFDs on stocks, indices, and commodities (including metals). The company offers retail clients 3 types of accounts, as well as their swap-free counterparts. An Enterprise Account with the tightest spreads and lowest commissions per lot is available to professional traders. The leverage depends on the asset class and customer status (retail or professional). The available methods of depositing and withdrawing funds depend on the country of residence of the trader.

$50

Minimum

deposit

1:500

Leverage

24/7

Support

| 💻 Trading platform: | МТ4 (desktop, mobile), МТ5 (desktop, mobile, web) |

|---|---|

| 📊 Accounts: | Demo МТ4, Demo МТ5, Raw Spread, Standard, Pro, Enterprise, and Islamic |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank wire, Visa, MasterCard, Zelle, Bitcoin, PayPal, and Cash App |

| 🚀 Minimum deposit: | from 50 USD |

| ⚖️ Leverage: | up to 1:500 (for retail trading) up to 1:100 (for professional traders) |

| 💼 PAMM-accounts: | Yes |

| 📈️ Min Order: | Raw Spread and Standard are 0.01;Pro is 0.1; andEnterprise is 1.0 |

| 💱 Spread: | Raw Spread, Pro, Enterprise are from 0.0 pips;Standard is from 0.8 pips |

| 🔧 Instruments: | Forex (47 pairs), CFDs on shares (564), indices (16), commodities (39), cryptocurrencies (36) |

| 💹 Margin Call / Stop Out: | 100% / 70% |

| 🏛 Liquidity provider: | major banks, including Bank of America, Saxo bank, HSBC, hedge funds, and significant brokerage firms |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | A Book |

| ⭐ Trading features: | The number of available assets depends on the selected terminal, there is a commission per lot |

| 🎁 Contests and bonuses: | Yes, including the Traders Union bonuses |

FairForex Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Raw Spread | from $0 | For bank transfer withdrawal |

| Standard | from $8 | For bank transfer withdrawal |

| Pro | from $0 | For bank transfer withdrawal |

| Enterprise | from $0 | For bank transfer withdrawal |

Swap commissions are for moving a position to the next day.

The analysts at the Traders Union compared the level of commissions of Fair Forex with fees of RoboForex and Forex4you. As a result of the comparison, each broker was assigned a low, medium, or high commission level.

| Broker | Average commission | Level |

| FairForex | $2 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed Review of FairForex

FairForex offers clients a wide range of ECN accounts, including swap-free Islamic accounts. Here you can start independent trading from $50, and social trading (copying transactions of another) from $100. The company guarantees no requotes, super-fast execution of trade orders, and zero deposit fees. Fair Forex allows not only active traders to earn money, but also investors who prefer passive strategies to do the same.

FairForex by the numbers:

-

The company has traded for over 3 years.

-

The order execution speed is less than 50 ms.

-

The number of assets available for trading is over 700.

-

The minimum deposit is $50.

-

Account types: 2 are educational, 4 allow swaps, and 3 are Islamic.

FairForex is a broker with a wide range of assets and A Book execution

FairForex is an ECN broker, so it guarantees its clients 100% confidential trading without any manipulation or restriction. The execution type is strictly A Book. The company provides an extensive and varied pool of liquidity from major providers, including banking institutions and other brokerage firms. Fair Forex allows you to trade cryptocurrencies 24/7. More than 1,000 traders have signed up to receive the broker’s quarterly newsletter.

Fair Forex clients can trade via the MetaTrader 4/5 desktops and mobile terminals. MT5 is also available on the web version. MT4 supports 33 graphic objects, 4 options for pending orders, trading in currency pairs, 10 indices, 9 cryptocurrencies, 20 shares, and 9 commodities. MT5 has more advanced functionality and supports 44 graphic objects, 6 types of pending orders (including buy stop limit and sell stop limit). The number of indices increased to 11, cryptocurrencies are up to 36, stocks are now up to 564, and goods are now up to 15.

FairForex useful services:

-

Forex Trading Calendar. This is a calendar that displays economic events and news important for a trader in chronological order. It is available on the website and in the user’s personal account.

-

Forex Trading Calculators. On the website, there are 5 types of trading calculators: PIP, Margi, Fibonacci, Pivot, and Profit. They can only be used by traders registered with the broker.

-

Telegram channel. It helps the company’s clients receive free assistance in Forex trading (trading signals, indicators for the MT5 platform, and video instructions on how to use them), and also communicate with other traders, including professionals.

-

Help Center. Answers to frequently asked questions about Fair Forex conditions, accounts, deposits, withdrawals, and account management.

-

Blog. Articles with useful information for beginner traders about the Forex market.

-

Daily account statements. They display one’s history of trading, the size of the available margin, and the balance of free funds. The statements are sent by email.

Advantages:

High-speed order execution and no requotes.

The broker allows you to invest in managed MAM accounts.

Access to an extensive and varied pool of liquidity from major providers.

Services are provided through the popular terminals MetaTrader 4 and 5.

For Muslim clients, the broker offers swap-free Islamic accounts.

There are many assets available for trading, including cryptocurrencies.

The broker’s analytical tools are provided free of charge, regardless of the type of trading account.

The broker allows you to use any strategy: hedging, scalping, news trading, and algorithmic trading.

How to Start Making Profits — Guide for Traders

All accounts offered by Fair Forex use the ECN trading model and can be opened in both MT4 and MT5 terminals. The list of available assets is identical for all types of accounts but differs for different terminals.

Account types:

FairForex is an ECN broker that offers accounts with conditions adapted to different types of strategies.

Bonuses Paid by the Broker

Currently, the FairForex broker offers only one type of bonus, which is the $25 funding of the account. To receive this bonus, a trader must open a trading account, go through verification, and request a link to a resource with reviews by email. The company credits bonus money to the trading account. It cannot be withdrawn but can be used to make transactions.

Investment Education Online

There is no separate training section on the Fair Forex website. All useful information about the Forex market and the broker’s trading conditions can be found in the Help Center and Blog blocks.

A demo account is available to test trading systems and broker capabilities. It can be opened in both MT4 and MT5 terminals.

Security (Protection for Investors)

The holding company Fair Global Prime Group includes 3 brokerage companies. One of them is regulated by the SVGFSA (Financial Services Authority of St. Vincent and the Grenadines). At the time of preparation of this review, two more divisions were in the process of applying for licenses to operate as a Forex broker.

The company originally planned to obtain licenses from the Vanuatu Financial Services Commission (VFSC) and an unnamed UK regulator by the spring of 2021. However, due to the COVID-19 situation, the process of obtaining the licenses was delayed indefinitely.

👍 Advantages

- Client accounts are segregated

- Electronic systems and cryptocurrencies are available for deposit and withdrawal

👎 Disadvantages

- The company is not a member of an investor protection fund

- Financial audit results are not presented on the broker’s website

- No negative balance protection

Withdrawal Options and Fees

-

Withdrawals requested by 12:00 PM PST are processed on the same day during business hours - Monday through Friday from 7:00 AM to 7:00 PM PST. If the application is submitted after 12:00 noon, then the finance department will process it during the next business day.

-

Profits can only be withdrawn in US dollars using bank wire, Zelle, Bitcoin, PayPal, Cash App, as well as Visa and MasterCard.

-

Fair Forex charges a fee for bank transfer withdrawals. When credited to an account in the banks of Saint Vincent and the Grenadines and Vanuatu, the fee is $35, for an international transfer it is $45.

-

The minimum withdrawal amount by all methods is $50. Cash App and Zelle also have daily withdrawal limits of $100 and $200, respectively.

-

No-trade deposits and withdrawals are subject to a 20% payment processing fee.

-

Terms of crediting: Money is received on the cards within 2-5 days; with other methods, the money is deemed received on the day a proper application is confirmed.

Customer Support Service

The support service answers questions from users 24/7. However, sometimes the chat is closed due to a lack of staff or technical problems.

👍 Advantages

- Operators are quick to respond

- Most of the time the chat is available 24/7

👎 Disadvantages

- Chat crashes

- Can’t be contacted by phone

- To get a specific answer, you need to ask leading questions

- No access to a personal manager by phone or email

To contact support, you can use:

-

chat on the website or in the personal account;

-

email;

-

Telegram;

-

a ready-made feedback form;

-

the broker’s messenger app on Twitter, Facebook, LinkedIn, and Instagram.

Contacts

| Registration address | Fair Forex Limited, Suite 305, Griffith Corporate Centre, Beachmont, Box 1510, Kingstown, St Vincent and the Grenadines |

| Regulation |

SVGFSA, VFSC Licence number: support@fairforexfx.com |

| Official site | https://www.fairforexfx.com/ |

Review of the Personal Cabinet of FairForex

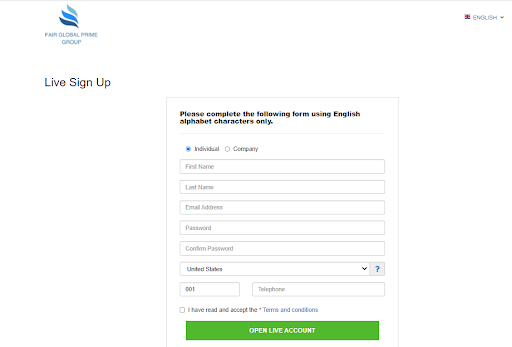

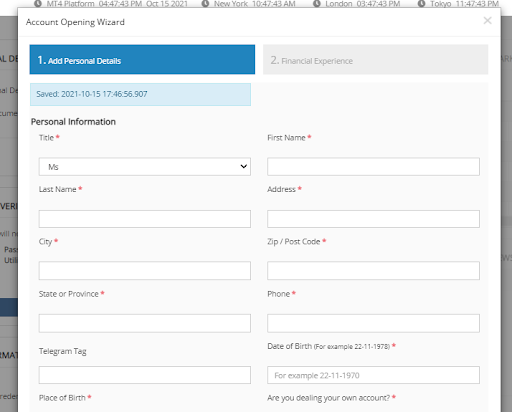

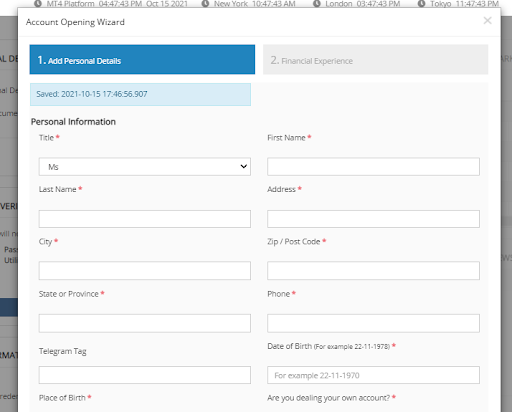

To become a FairForex client and open a brokerage account, follow the instructions below:

At the top of any page on the company’s website, click Sign Up.

A standard form will open where you need to enter your first name, last name (as in your passport), email, and phone number. You also need to come up with a password and select the country of residence from the drop-down list.

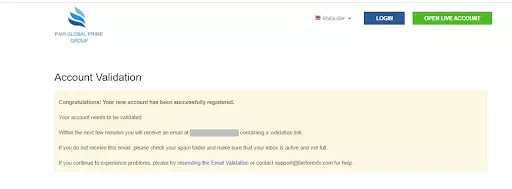

Then, the company will ask you to validate the created account. To do this, you need to follow the link that can be found in the letter sent by Fair Forex to the email specified during registration.

Upon the first visit to your personal account, the company notifies the user that he needs to go through verification and make a deposit of at least $50.

To start trading with Fair Forex, a trader in the personal account should do the following:

1. Enter personal data:

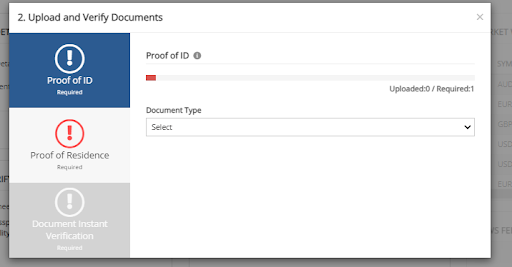

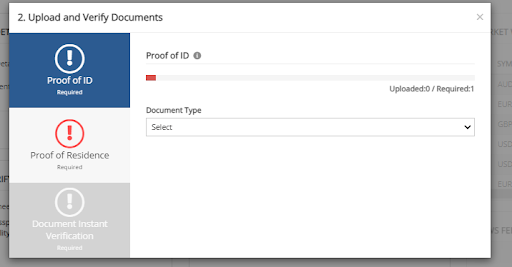

2. Upload documents for verification:

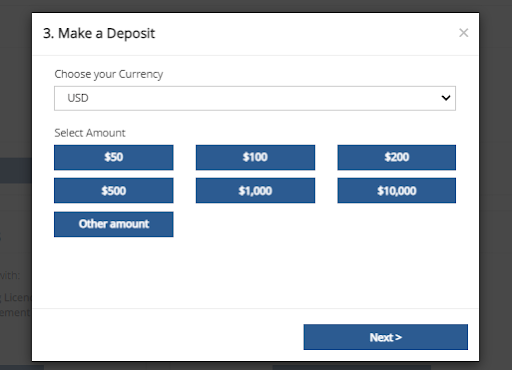

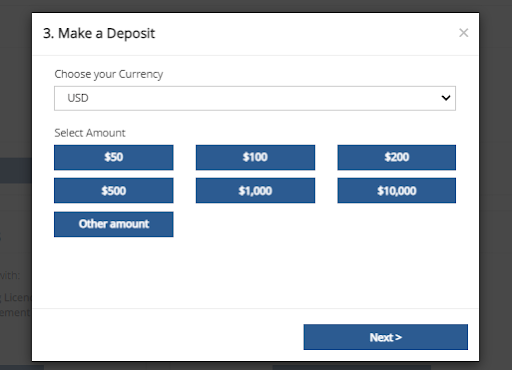

3. Making deposit in EUR or USD:

1. Enter personal data:

2. Upload documents for verification:

3. Making deposit in EUR or USD:

The Fair Forex personal account, also includes:

-

Economic calendar.

-

Leverage button.

-

Download Center.

-

Referral links.

-

IB daily commission summaries.

-

Company’s news.

-

Helpful instruments.

-

Button for connecting the copy trade services.

-

Help Center.

We constantly monitor the Internet for the emergence of new fraudulent schemes to deceive traders. We have been collecting data about scam brokers for more than 10 years and we think we know every dishonest company in the market. Below we have collected for you the information about the scammers from the List of SCAM Brokers.

Articles that may help you

FAQs

Why has FairForex been placed on the Forex Broker Blacklist?

Possible reasons:

• multiple complaints have been filed against FairForex by traders claiming the broker failed to fulfil its obligations, including process withdrawals;

• the website of FairForex is down, not updated or operates with clear errors and some features are not available;

• FairForex has been blacklisted by the regulatory authority, and a warning has been published on the regulator’s website.

What should I do if FairForex got blacklisted and I still have money in my account?

Don’t panic right away. First, try to find out the reason why FairForex got blacklisted. The situation may be temporary. Contact Traders Union client service for details. If the situation is critical, try to withdraw money. The best way to do it in parts, so that the broker does not suspect that you want to withdraw your entire balance and close the account.

What should I do if I cannot withdraw my money from FairForex?

If your broker refuses to process withdrawals under various pretexts, your algorithm of actions is as follows:

• Get a clear response from the broker’s Support Service with reference to the clauses of the Terms of Use (User Agreement). Save your correspondence and download the transaction history from your account.

• With a full package of documents, appeal to the following organizations: the broker’s regulator or corresponding law enforcement agencies. If you make your deposit with a bank transfer, try to initiate a chargeback request.

• Share your situation on traders’ forums, add the broker to blacklists of various websites, as it will help others avoid the mistake.

Is there any chance to recover my money if FairForex is a scam?

On rare occasions, yes, for example, if the broker was a member of a compensation fund, or upon a court’s ruling.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.