deposit:

- €155

Trading platform:

- MT4

- MT5

- cTrader

- FTMO is a proprietary trading company that is partnered with multiple institutional liquidity providers to offer the best trading conditions.

- Up to 1:100

Summary of FTMO Trading Company

FTMO is one of the best proprietary trading firms in the financial market with the TU Overall Score of 9.02 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by FTMO clients on our website, Traders Union expert Anton Kharitonov believes he can recommend this company as the majority of reviews prove that the firm’s clients are fully satisfied with the company. FTMO ranks 2 among 40 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria and a test on how to open an account.

FTMO is a prop company for traders with trading experience, hard testing conditions, and attractive conditions for those who go into real trading. FTMO - Pros and Cons for Beginners.

FTMO is an international proprietary trading company created in the Czech Republic in 2014. The platform brings traders into its fold and after traders successfully pass a two-step testing regime, FTMO transfers 400 thousand dollars to the trader’s account. Transactions are monitored by FTMO to grow the deposit. There is a payment of 80% at the first stage of real trading. The 90% Profit Split is available only to those FTMO Traders that have reached Scaling Plan. The company works in full accordance with European financial legislation and is under the local regulator.

| 💰 Account currency: | USD, EUR, GBP, CZK, CAD, AUD, CHF |

|---|---|

| 🚀 Minimum deposit: | From €155 |

| ⚖️ Leverage: | Up to 1:100 |

| 💱 Spread: | No data |

| 🔧 Instruments: | Currency pairs, stocks, stock indices, commodities, cryptocurrencies |

| 💹 Margin Call / Stop Out: | No data |

👍 Advantages of trading with FTMO:

- Quite low testing cost is €155.

- Classic platforms such as MT4, MT5, and Ctrader are familiar to many traders. For these platforms, hundreds of indicators, scripts, and advisers have been developed.

- The starting reward is 80%.

- Diversification of tariff plans. Candidates can choose a demo deposit from 10 thousand to 200 thousand US dollars. There are tariff plans that span from standard to aggressive trading.

- Leverage is up to 1:100.

👎 Disadvantages of FTMO:

- Strict requirements for the test period. The allowable maximum loss is 10% of the deposit amount. The target profit is 10%, for which 1 month is provided.

- There is no information about how the company is funded.

Evaluation of the most influential parameters of FTMO

Trade with this prop-trading company, if:

- Asset variety is important to you. You can work with an extensive range of financial instruments — currency pairs, stocks, stock indices, commodities, cryptocurrencies.

- You're not ready to be limited by the starting account balance. Regardless of the account type, an FTMO client gains the right to scale up by 25% every 4 months if they pass a straightforward qualification.

Do not trade with this prop-trading company, if:

- You seek comfortable challenge conditions. The challenge lasts for 1 month on all accounts, and within that time, you must earn at least 10% of the provided amount.

Geographic Distribution of FTMO Traders

Popularity in

Video Review of FTMO i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Gibsone

Gibsone  TH Bangkok

TH Bangkok

Solid firm

Minor communication issues

Inderjeet

Inderjeet  IN Ludhiana

IN Ludhiana

Good support service and trading conditions

Spreads could be better for some pairs

Expert Review of FTMO

FTMO is a managing prop firm operating on the principle of a prop company. To receive money under management, a potential trader must successfully complete a two-stage active trading test. At each stage, requirements are set for the maximum allowable daily loss, total loss, and target profit level. The prop firm’s conditions are relatively loyal, but still, they can be difficult to successfully navigate. Regardless of the chosen testing package, the limits are 10% of the total loss. For comparison: other prop companies have allowable drawdowns of 15-20%.

Despite the strict requirements for the test period, FTMO has a relatively low test cost beginning at €155. By comparison, in most companies in this sector, the entrance fee for passing the test is from €400-500. Another advantage is the availability of standard MT4/MT5 platforms and mobile app. Most other prop companies have their own or adapted platforms, while FTMO has standard platforms. This allows you to work with any custom indicators and advisors previously honed in the MetaTrader tester.

My impression of FTMO remains positive. But after studying the conditions, it is clear that without trading experience, it makes no sense to try your hand at the test. Testing conditions are favorable for those who have worked previously with a demo account and are good at risk management. However, you can also gain experience on the company’s platform itself. There is a free version of the test that fully corresponds to the paid test.

Dynamics of FTMO’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

The FTMO offer is itself an investment program, the essence of which is as follows: each trader can get 400 thousand USD at his disposal, but before that, you need to go through two test steps. Before testing, there is an opportunity to practice on a demo account.

Invest in yourself | How to become a professional trader with almost no investment

The path to becoming an FTMO trader and earning real money consists of 2 steps:

-

Evaluation stage. At this stage, the trader chooses the amount of the initial deposit from 10 thousand to 200 thousand US dollars. The test fee, respectively, will be €155 euros for a deposit of 10 thousand US dollars. The higher the deposit, the larger the fee. Requirements: target achieving a profit of 10% of the deposit, which must be received within a maximum of 30 days when trading at least 10 days. It is not necessary to trade all 30 days. Permissible losses are allowed up to 10% of the total deposit or up to 5% daily.

-

Verification stage. At this stage, the trader is given up to 60 days to meet the requirements for the maximum daily and total drawdown, but the requirements for the target profit are reduced by 2 times. Conditions are simplified to work on more conservative strategies.

Testing is paid and depends on several factors such as the type of account chosen (regular trading or aggressive) and on the initial deposit amount. The fee is paid only once, so at the second stage, you do not need to pay. If the test is passed, the trader receives real money under management of about 400 thousand dollars. In case of a violation, the test must be re-taken. The number of "retakes" is not limited, but discounts are not provided.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

FTMO’s affiliate program:

The FTMO affiliate program involves attracting traders who would like to unleash their potential, but do not have start-up capital. The company offers each affiliate 8% of the fee amount paid by the referral. Each affiliate receives a referral link and marketing materials.

Trading Conditions for FTMO Users

FTMO offers a classic set of trading instruments: from currency pairs and stock assets to cryptocurrencies. Trading platforms are MetaTrader4, MetaTrader5, and cTrader. Trading conditions during testing and on a real account are the same.

€155

Minimum

deposit

1:100

Leverage

24/7

Support

| 💻 Trading platform: | МТ4, МТ5, and cTrader |

|---|---|

| 📊 Accounts: | Demo, main account, Swing account |

| 💰 Account currency: | USD, EUR, GBP, CZK, CAD, AUD, CHF |

| 💵 Replenishment / Withdrawal: | Credit cards, bank transfers, Skrill, Confirmo, Nuvei, and other fee payment methods |

| 🚀 Minimum deposit: | From €155 |

| ⚖️ Leverage: | Up to 1:100 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | No data |

| 🔧 Instruments: | Currency pairs, stocks, stock indices, commodities, cryptocurrencies |

| 💹 Margin Call / Stop Out: | No data |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Instant execution |

| ⭐ Trading features: | FTMO is a proprietary trading company that is partnered with multiple institutional liquidity providers to offer the best trading conditions. |

| 🎁 Contests and bonuses: | No |

Comparison of FTMO to other prop firms

| FTMO | Topstep | Funded Trading Plus | The5ers | Traddoo | |

| Trading platform |

MetaTrader4, MetaTrader5, cTrader | Deriv Trader, TSTrader, NinjaTrader, TradingView, Bookmap X-ray, Cunningham Trading Systems, DayTradr, InvestorRT, MotiveWave, MultiCharts, Rithmic R|TRADER Pro, Trade Navigator, Volfix.net | MetaTrader4, MetaTrader5 | MetaTrader5 | MetaTrader4, MetaTrader5 |

| Min deposit | $155 | $1 | $119 | $85 | $99 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:100 |

From 1:1 to 1:30 |

From 1:1 to 1:30 |

From 1:1 to 1:30 |

| Trust management | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

50% / 50% | 1% / 1% | No | No | No |

| Execution of orders | Instant Execution | ECN | Market Execution | N/a | No |

| No deposit bonus | No | No | No | No | No |

| Cent accounts | No | No | No | No | No |

Prop firms’ comparative table by trading instruments

| FTMO | Topstep | Funded Trading Plus | The5ers | Traddoo | |

| Forex | Yes | No | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | No | Yes |

| CFD | Yes | No | Yes | No | Yes |

| Indexes | Yes | No | Yes | Yes | Yes |

| Stock | Yes | Yes | No | Yes | Yes |

| ETF | No | No | No | No | No |

| Options | No | No | No | No | No |

FTMO Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard/Swing | From $6 | No |

Check the information about other commissions with the company's support service.

A comparative analysis of FTMO commissions with its competitors' commissions was also made. Since there is not much information about the FTMO conditions, the 6 pips spread for the EUR/USD pair, which was received from the support service, was taken as the basis.

Detailed Review of FTMO

FTMO presents itself as a company that provides traders with money management based on the technology of a subsidiary structure. FTMO is not a broker in the strict sense of the word, as indicated on the website. Its task is to find professional traders and transfer investors' money to them to use instead of their own during managed trading of Forex assets.

FTMO's success by the numbers:

-

Services clients in more than 180 countries.

-

More than 6 million trades per month are made by traders on real investment accounts.

-

More than 27 million US dollars have been paid out to traders from real accounts.

FTMO is a prop company where professional traders excel

The general structure of the FTMO proposal has been described above. The company has a standard account and a swing account. The difference is that the standard account has restrictions on fundamental trading. There are two types of strategy on the standard account normal and aggressive (i.e., high risk) trading. The aggressive type provides for a larger allowable loss of up to 20%, but the target profit is also increased to 20%. The cost of the budget package itself with a deposit of $10,000 for a moderate risk is €155, for an aggressive stratagem, the deposit fee is €250.

After successfully passing the test, the initial real amount of the managed deposit is 400 thousand US dollars with the condition of 80% of the trader's profit. Twenty percent of the profit is received by the company and investors. Next, the scaling program starts. The limit of money under management can be reviewed upwards every 4 months. If a trader has increased the deposit by at least 10% during this time (20% for an account with aggressive trading), the deposit amount is increased by 100 thousand US dollars. The maximum allowable limit for an aggressive trading account is USD 2 million, and for an account with moderate risk, it’s USD 2 million. Also, with scaling, the trader's reward increases up to 90% of the profit.

Useful services of the FTMO firm:

-

Economic calendar. It can be useful for trading, but here it is necessary to bear in mind the restrictions on trading at the time of the important news release.

-

Statistical application. Shows significant and numerical probabilities of market behavior.

-

Mentor Application. Helps traders achieve better results by strengthening their discipline.

-

Trade magazine. Saves trading results with the ability to analyze trades.

-

Account MetriX. An innovative and unique web application where you can track your progress towards becoming an FTMO trader.

-

Account analysis. An objective trade analysis tool that provides an “outside point of view”.

-

Performance Coach. Psychological help.

-

Equity Simulator. A tool for improving the risk management system and calculating the probability of chances of a positive result based on current trading conditions. It is available in your MetriX account.

Advantages:

Inexpensive test that can be taken any number of times.

No restrictions on applied strategies. Allowed trading advisors. Restrictions on fundamental trading are introduced to reduce the risk of losing money during an increase in volatility.

Leverage is up to 1:100. This is high for such companies.

There is a shorter Free Trial version of the FTMO Challenge with the same trading conditions.

How to Start Making Profits — Guide for Traders

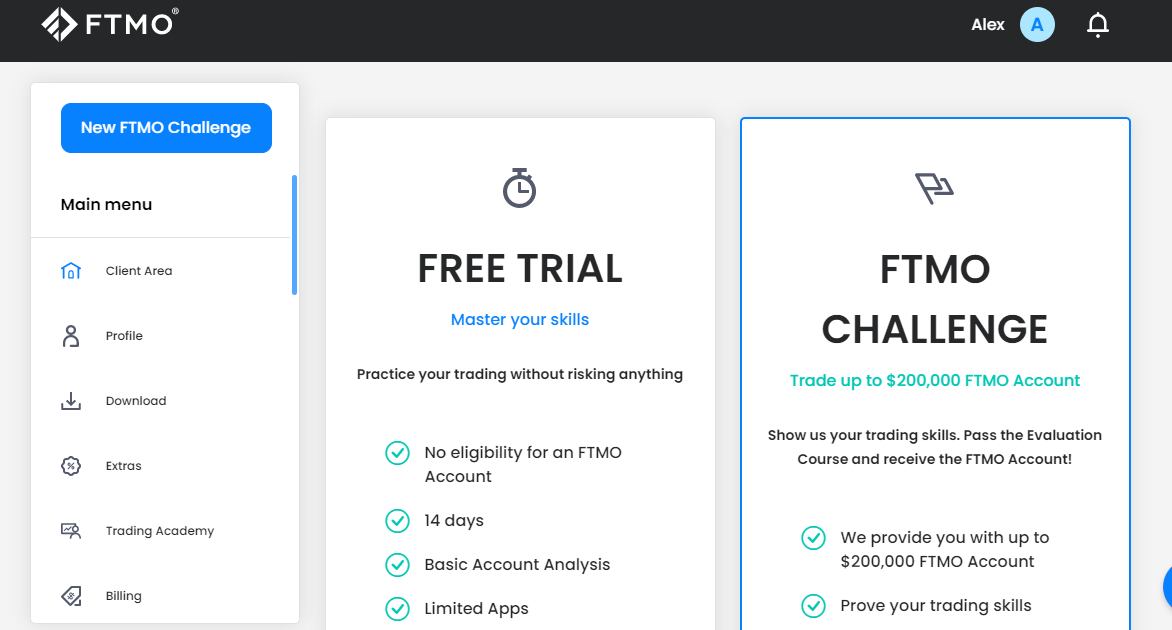

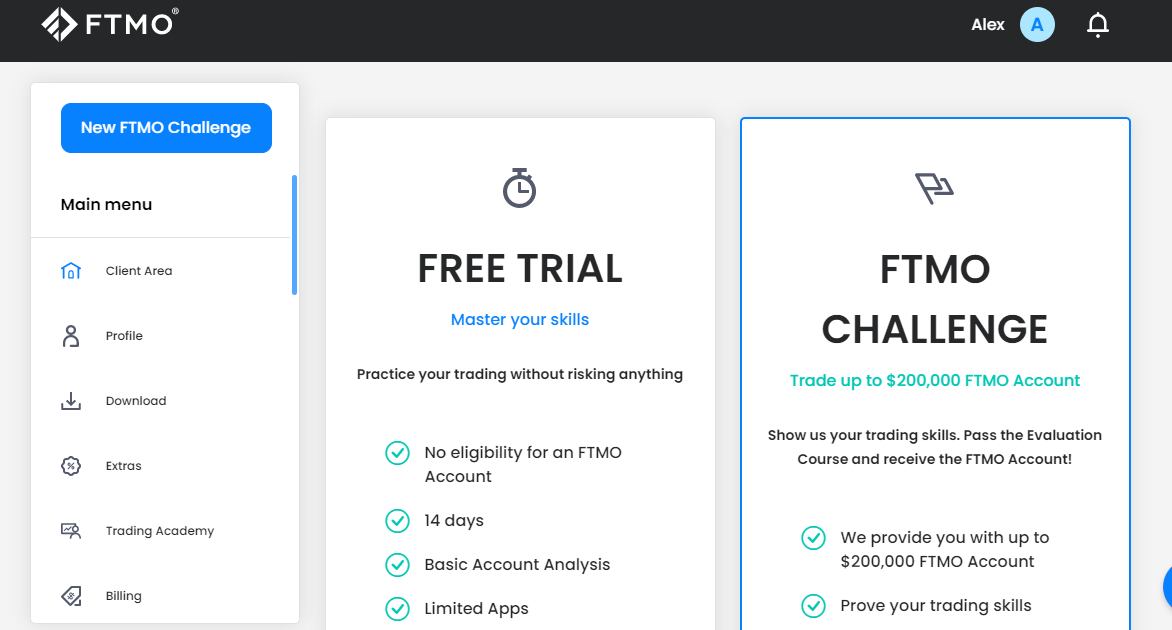

The FTMO Challenge is a test that provides for several types of accounts. First, there are two test types — moderate risk and aggressive risk. Limits on loss and target profit depend on the type of risk you choose. The second is the ability to activate an FTMO Swing account.

Account types:

There is a demo platform for training.

FTMO - How to open, deposit and verify a trading account | Firsthand experience of TU

Bonuses Paid by the Broker

The company does not provide bonuses and does not hold contests. Promotional offers are not covered by FTMO's marketing policy.

Investment Education Online

There is no training provided on the FTMO website. Access to the Trading Academy can be obtained only after registration from the user account. The Academy has video courses, trading recommendations, and discounts on paid courses for company affiliates. Separate practical information is presented in the blog.

There is a Free Trial account, the conditions for which correspond to the conditions of testing.

Security (Protection for Investors)

There is no detailed information. It is known that the company does not belong to investment or age companies, as required by law. Brokerage services are provided by the Forex prop platform.

FTMO safety and regulation👍 Advantages

- The trader risks only the amount of the fee for passing the test. Further on, the trader’s own money is never used.

👎 Disadvantages

- Lack of transparency

Withdrawal Options and Fees

-

The information presented on the site refers to FTMO only. The trader does not make any investment other than testing fees.

-

Fee payment options include credit cards, bank transfers, Skrill, Confirmo, Nuvei, Discover, Unlimint, etc.

-

Withdrawal of money from a real account after passing the test is possible under the following conditions: the first request is 14 days after the opening of the first trade; the profit allocation system includes a 60-day period during which a withdrawal can be requested 3 times. The system is described in more detail in the FAQs section.

-

There is no commission for withdrawing money.

-

The withdrawal request processing time is 1-2 business days. Cryptocurrency payments are possible.

Customer Support Service

Customer Service is available 24/7 in several languages

👍 Advantages

- Responds quickly

- Support available in 17 languages

👎 Disadvantages

- Sees trading issues in a superficial manner

The prop firm can be contacted as follows:

-

Chat.

-

Email.

-

Messengers.

-

Telephone.

Registration is not required to communicate with the support service.

Contacts

| Foundation date | 2014 |

| Registration address | Purkyňova 2121/3 110 00 Prague, Czech Republic |

| Official site | https://ftmo.com/ |

| Contacts |

Email:

support@ftmo.com,

Phone: +442 033 222 983 |

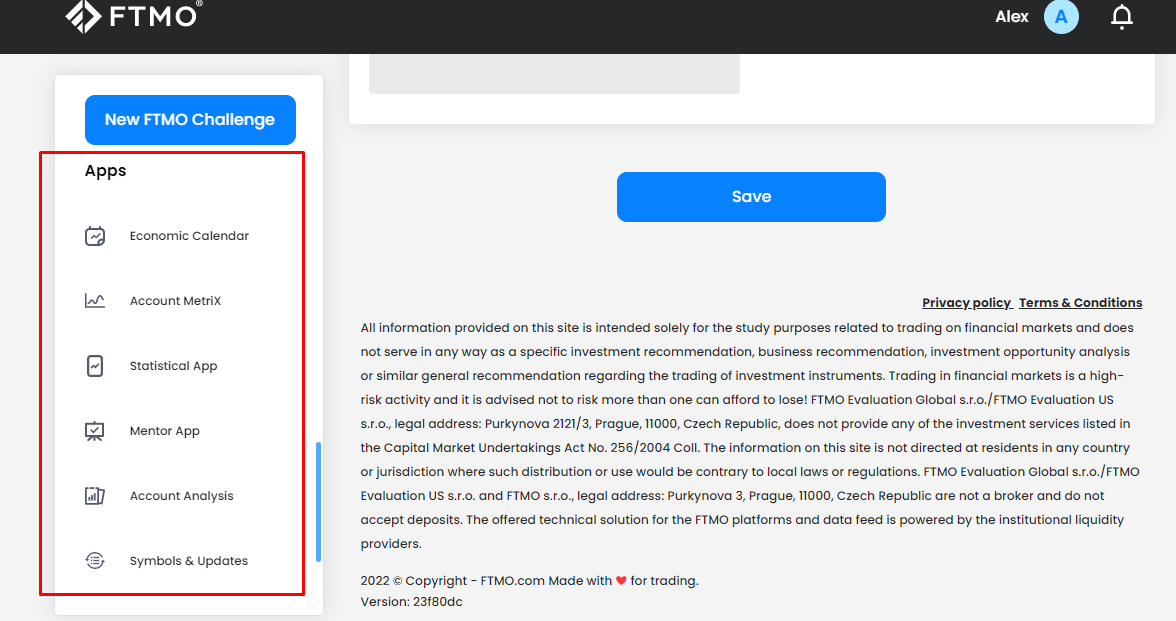

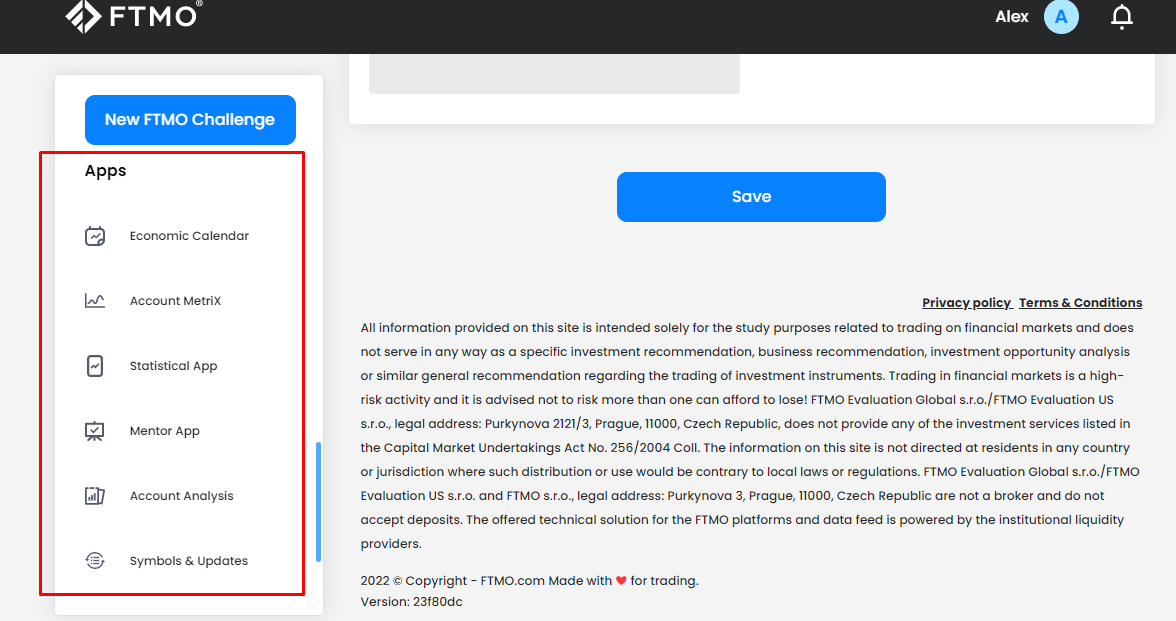

Review of the Personal Cabinet of FTMO (FTMO Challenge)

To gain access to the user account, you need to go through a quick registration. After registration, the company provides a free trial in which you can test the platform and the supporting applications. Then you need to pay for the test, after which FTMO will provide account settings for taking the test.

On the main page, select the type of registration, which is either passing the test or the free trial version. You can also find links to opening an account in the FAQs section.

Enter your email address which will be linked to the account. Confirm your registration via the email address you provided.

The following functions are available in the user account:

1. Managing applications.

2. Select a test type.

1. Managing applications.

2. Select a test type.

Other useful functions of the user account:

-

Trading academy.

-

Access to autochartist tools.

-

Access to client support services.

-

Payment management.

-

Profile details management.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Find out how FTMO stacks up against other brokers.

Articles that may help you

FAQs

How do client reviews impact FTMO rating?

Any review can raise or lower the rating of any company in the Forex prop firms rating. To read reviews about FTMO you need to go to the company's profile.

How can I leave a review about FTMO on the Traders Union website?

To leave a review about FTMO , you need to register on the Traders Union website.

Can I leave a comment about FTMO if I am not a Traders Union client?

Anyone can post a comment about FTMO in any review about the company.

Traders Union Recommends: Choose the Best!