deposit:

- $200

Trading platform:

- MT4

- CySEC

- FSA (Seychelles)

- 0%

deposit:

- $200

Trading platform:

- MT4

- CySEC

- FSA (Seychelles)

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

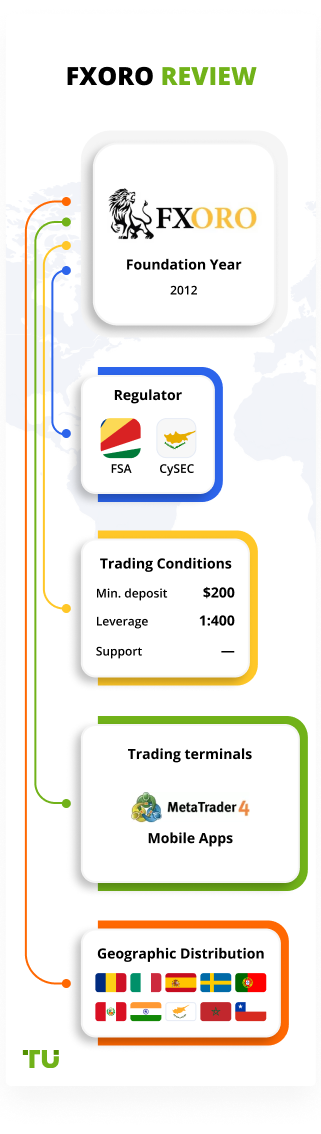

Summary of FXORO Trading Company

FXORO is a broker with higher-than-average risk and the TU Overall Score of 4.29 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by FXORO clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. FXORO ranks 186 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

FXORO is a CFD broker that offers standard conditions for its segment. Spreads are average to below average, and trading commissions on ECN accounts are on the same level as its competitors. The support of MetaTrader 4 serves as a universal advantage due to the platform’s flexibility and functionality. As the broker is regulated, there are no concerns about its reliability. Technical support is equally highly rated by users and experts. The constructive drawbacks include regional restrictions, the absence of typical passive income options, and other assets besides CFDs.

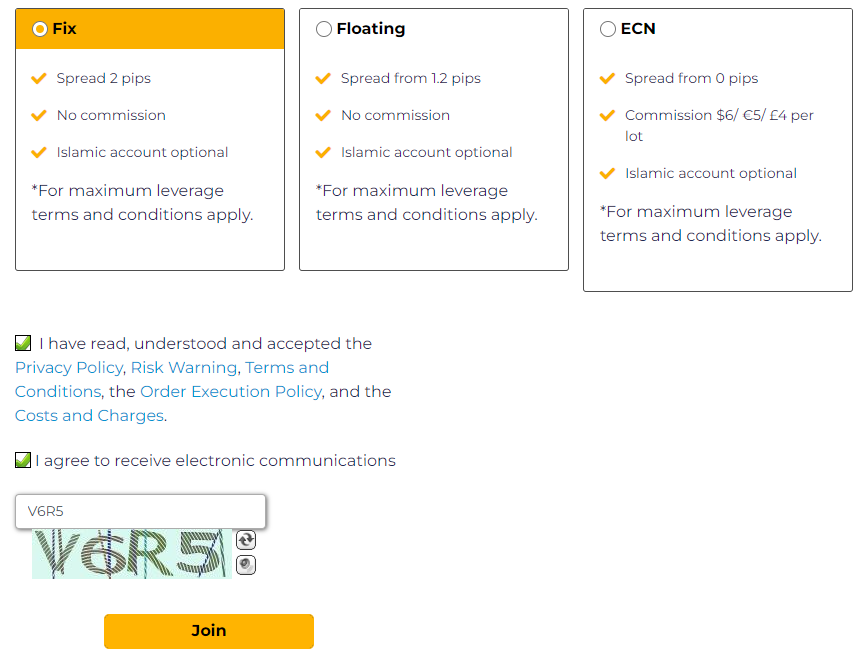

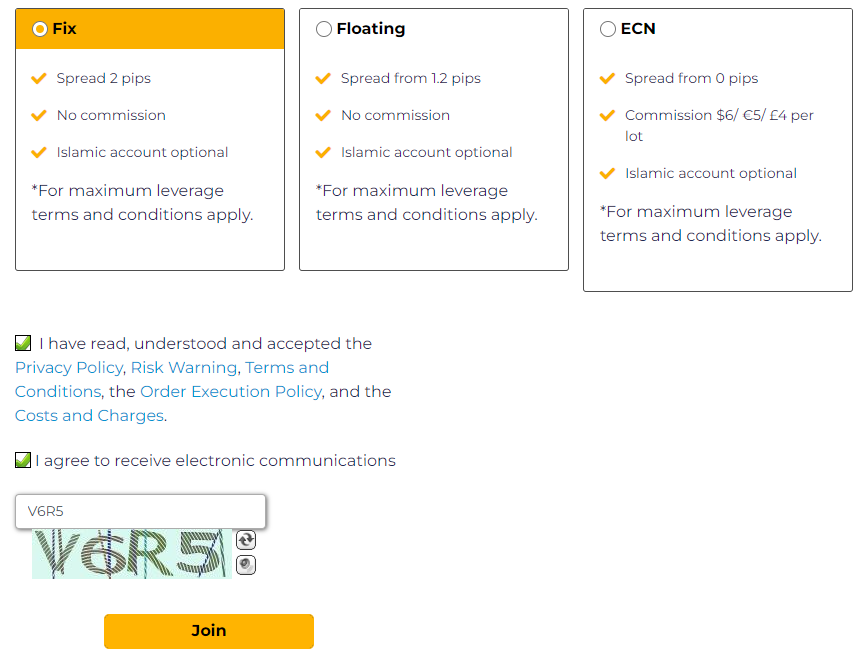

The FXORO broker provides access to hundreds of contracts for difference (CFDs) on the following asset groups: currency pairs, cryptocurrencies, stocks, indices, commodities, and exchange-traded funds (ETFs). Additionally, its clients have the opportunity to invest in physical shares of American companies. They are offered a free demo account and three real accounts using fixed, floating, and ECN spreads. Any real account can be converted to a swap-free (Islamic) account. The spread is either fixed (2 pips) or floating (from 1.2 pips), and a commission is only charged on ECN accounts, amounting to $6 per standard lot. Professional accounts with higher leverage and minimum trade size are available to large investors. Trading is conducted through the MetaTrader 4 platform. Trading is limited to purchasing physical shares.

| 💰 Account currency: | USD, EUR, GBP, CHF |

|---|---|

| 🚀 Minimum deposit: | $200 |

| ⚖️ Leverage: | 1:30; 1:400 |

| 💱 Spread: | Floating (from 1.2 pips) or fixed (2 pips) |

| 🔧 Instruments: | CFDs on currency pairs, cryptocurrencies, stocks, indices, commodities, and exchange-traded funds |

| 💹 Margin Call / Stop Out: | No |

👍 Advantages of trading with FXORO:

- There are three real accounts and the ability to convert either to an Islamic account, and transfer to a professional account, allowing for customized trading conditions.

- A demo account is available; the minimum deposit is $200; and no commissions are charged on fix and floating accounts; all of which provides comfortable conditions for beginners.

- Increased leverage combined with an extended educational course, analysis, and signals, simplify trading for experienced players.

- The platform offers a wide range of fundamental and technical analysis tools for more accurate forecasting.

- Traders work through the MT4 trading platform, which stands out for its extensive customization potential through plugins.

- This broker does not charge a commission for the first three withdrawals per month regardless of the channel, which reduces traders' overall costs.

- Technical support operates round the clock on weekdays, with a call center, email, LiveChat, and ticket system on the broker's website.

👎 Disadvantages of FXORO:

- This broker only offers contracts for difference (CFDs).

- This company does not work with residents of the Islamic Republic of Iran, Canada, and some other countries.

- FXORO clients can earn solely through active trading and purchasing physical shares.

Evaluation of the most influential parameters of FXORO

Trade with this broker, if:

- You are not comfortable without CySEC regulation (or regulation from an authority of similar competence). FXORO is regulated by the Cyprus Securities and Exchange Commission (CySEC), providing a considerable level of oversight and protection.

- You value a user-friendly platform. FXORO offers their own web and mobile platforms known for their ease of use, making them potentially suitable for beginners or traders who prioritize simplicity.

Do not trade with this broker, if:

- You prioritize advanced charting and technical analysis tools. If you are a demanding trader who requires sophisticated tools for in-depth analysis, FXORO's platforms, which offer basic tools, may not meet your requirements.

- You reside in restricted countries. This broker does not work with residents of the Islamic Republic of Iran, Canada, and some other countries. If you are located in these regions, you may need to explore alternative brokers that accommodate residents from your country.

- You are looking for lower minimum deposits. With a minimum deposit of $200, FXORO's entry requirement may be higher compared to brokers with lower minimum deposit options.

Geographic Distribution of FXORO Traders

Popularity in

Video Review of FXORO i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of FXORO

The broker is owned by MCA Intelifunds Ltd, registered in Cyprus, and regulated by CySEC 126/10 (The Cyprus Securities and Exchange Commission) and FSA SD046 (Seychelles). This broker is well-known worldwide, and traders consider it reliable and transparent. A retrospective analysis has not revealed any unresolved conflicts with clients. Personal fund and data protection are implemented at a modern level, complying with the prevailing standards.

In terms of the offered conditions, FXORO is focused on a single direction – trading contracts for difference. However, there are many contracts available for various assets, including currencies and cryptocurrencies. This allows for implementing diverse strategies and forming diversified portfolios. The leverage on regular accounts is up to 1:30, while on professional accounts it goes up to 1:400. The fixed spread is 2 pips while floating spreads start from 1.2 pips, which correspond to the average market. This broker's minimum trade size is not different from its competitors. It is worth mentioning that any of the three real accounts can be converted from standard to professional or Islamic (swap-free) trading.

Traditional options for additional earnings, such as copy trading, joint accounts, and referral programs, are not available. There are no special promotions or bonuses. This broker doesn't offer options that could distract traders from their work while providing questionable benefits. As an alternative earning opportunity, you can only purchase physical shares of American companies.

FXORO stands out among its competitors in two aspects. First, its education and training program. It has one of the most comprehensive educational programs, including basic and advanced courses. This company regularly conducts webinars with experts. The second point is the abundance of genuinely useful analytical tools, they comprise much more than just an economic calendar and margin calculator. This broker offers sentiment analysis, strategic bulletins, newsfeeds, and concise reviews. All of this helps one to trade more successfully. Of course, there are drawbacks, such as regional restrictions and the absence of support on weekends. However, these disadvantages are common among many brokers and don't classify FXORO as inferior.

Dynamics of FXORO’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Additional earning options can be an advantage for a broker, but such opportunities are not mandatory. After all, most traders come to the broker to trade independently. Joint accounts and copy trading are useful because they allow for passive earnings with reduced risks, plus they provide relevant experience. The referral program can also generate some income, but it is not passive at all, as it requires a lot of online communication and preferably having a popular blog. FXORO does not offer any of the mentioned investment options, but they have an option that is quite rare.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Investing in physical stocks

The program is designed for long-term investment. This broker's clients can buy stocks of American companies and then sell them at a more favorable price. Despite FXORO acting as an intermediary, the trader is the actual owner of the security and can dispose of it at their discretion. And of course, if the stock pays dividends, the owner receives them according to the company's established schedule. In reality, this is one of the simplest forms of passive investing. As for its effectiveness, the broker provides sufficient analytical information for diligent traders to make successful forecasts.

Trading Conditions for FXORO Users

The minimum deposit is often determined by the account type, but FXORO clients must deposit at least $200, regardless of which account they plan to trade on. As for leverage, it depends on the trader's level. If a user trades on standard accounts, the trading leverage cannot exceed 1:30. But if he has confirmed his professional qualifications and is trading on the corresponding accounts, the leverage increases to 1:400. The leverage also depends on the asset, with the highest leverage applicable to currency pairs. Finally, the broker's technical support is available around the clock without breaks, but only on weekdays. All standard communication channels are available.

$200

Minimum

deposit

1:400

Leverage

24/5

Support

| 💻 Trading platform: | MT4 |

|---|---|

| 📊 Accounts: | Fixed, Floating, ECN (each in standard and professional versions); Each account can be converted to swap-free |

| 💰 Account currency: | USD, EUR, GBP, CHF |

| 💵 Replenishment / Withdrawal: | Visa, MasterCard, Maestro, Skrill, Neteller, Wire2pay, bank transfer |

| 🚀 Minimum deposit: | $200 |

| ⚖️ Leverage: | 1:30; 1:400 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating (from 1.2 pips) or fixed (2 pips) |

| 🔧 Instruments: | CFDs on currency pairs, cryptocurrencies, stocks, indices, commodities, and exchange-traded funds |

| 💹 Margin Call / Stop Out: | No |

| 🏛 Liquidity provider: | No |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Market |

| ⭐ Trading features: |

Free demo account Three real accounts in two variations each Live accounts can be converted to Islamic Average market spreads and commissions Only CFD assets The possibility to invest in physical shares of US companies No copy trading or joint accounts. |

| 🎁 Contests and bonuses: | Yes (rebates from TU) |

Comparison of FXORO with other Brokers

| FXORO | RoboForex | Pocket Option | Exness | FreshForex | NPBFX | |

| Trading platform |

MT4 | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MobileTrading | MT4 |

| Min deposit | $200 | $10 | $5 | $10 | No | $10 |

| Leverage |

From 1:2 to 1:400 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0.4 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 40% / 20% | No / 30% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution, Instant Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | $30 | No |

| Cent accounts | No | Yes | No | No | Yes | No |

Broker comparison table of trading instruments

| FXORO | RoboForex | Pocket Option | Exness | FreshForex | NPBFX | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | No | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | No | Yes |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | Yes | Yes | No | No | No | Yes |

| Options | No | No | No | No | No | No |

FXORO Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Fix | $2, fixed, and without commission | No |

| Floating | From $12, floating, and without commission | No |

| ECN | From $0, floating, and commission is $6 per lot | No |

FXORO does not charge fees for the first three withdrawals per month. The withdrawal channel does not matter. Since most traders do not withdraw funds more frequently, they do not incur additional costs when working with the platform. However, if for some reason a broker's client needs to withdraw funds four or more times within a calendar month, they will be charged a fixed commission of $10 (or the equivalent in another base currency of the account) for each withdrawal after the third. This fee is also independent of the channel used to withdraw profits. The table below shows the average trading fees for FXORO and two industry leaders, allowing you to visually assess the convenience of cooperation with this company.

| Broker | Average commission | Level |

| FXORO | $4 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed review of FXORO

Platform testing has shown high order execution speeds and the absence of bugs, indicating the use of advanced technological solutions such as virtual servers and optimized architecture. Since the broker has never been hacked, this points to the application of modern security protocols. Thus, FXORO clients operate on a platform that is in line with top representatives of the industry. The trading account options are either at or above the average market level. This broker's conceptual differences lie in a well-thought-out and well-structured educational system, as well as a large number of tools for technical and fundamental analyses that clients can use without limitations. Add to this the universal MetaTrader 4 trading platform and the option to invest in physical stocks, and you get a progressive broker providing a comfortable working environment.

FXORO by the numbers:

-

The minimum deposit is $200.

-

There are 3 accounts available, 2 variations of each, plus an Islamic account.

-

The maximum leverage is 1:400.

-

The lowest spread is 0 pips.

-

Trading commission on the ECN account is $6.

FXORO is a CFD broker with versatile trading conditions

Many brokers offer only contracts for difference. When trading CFDs, a trader can also use leverage, open short and long positions, and work with hundreds or even thousands of positions. However, there are some differences between trading an asset and trading a contract on an asset. The main one is that CFDs generally have higher costs. A platform that specializes in contracts needs to offer as many assets from different groups as possible, and FXORO fully satisfies this criterion. Why is this important? Because the deeper the pool, the lower the trading risks due to the diversification of the investment portfolio. Moreover, this allows traders to expand their strategic potential. High leverage is an undeniable advantage, as well as FXORO clients are able to trade through MetaTrader 4, the simplest, most functional, and most convenient platform.

FXORO’s analytical services:

-

TC Alpha Generation. The Trading Central Alpha Generation service is designed at the intersection of automated analysis and independent analysts' opinions. It provides trend forecasts taking into account the current market situation.

-

TC Market Buzz. Trading Central Market Buzz is a unique service aimed at simplifying the lives of traders who cannot or do not want to sift through the newsfeeds. The widget filters financial news and highlights the most resonant topics.

-

Strategy Newsletter. A powerful strategic aggregator that collects news and checks market trends against specified parameters, and provides an information summary for subsequent analysis.

Advantages:

This broker is officially registered, and its activities are regulated by a recognized supervisory authority.

This company's policy guarantees full transparency, with all fees known in advance and no hidden payments.

A wide selection of assets combined with high leverage and a universal trading platform.

An impressive set of professional tools to speed up and simplify analysis and forecasting.

Responsive and competent technical support is available through several communication channels.

Guide on how traders can start earning profits

At the start, it is most important to choose an account with conditions that best suit you. FXORO offers three account types, plus a demo. The fixed account has a fixed spread of 2 pips, while the floating account has a floating spread starting from 1.2 pips. Since there are no trading commissions on either account, analyzing the markets of the assets you intend to trade makes sense. A fixed spread may be more advantageous in certain situations. As for the ECN account, it has the lowest spread (starting from 0 pips), but there is a commission of $6 per lot. Here too, you need to assess your preferred markets and strategies. Another point to consider is that any account can be opened on professional terms. To do this, you need to undergo qualification. Additional details can be found in the corresponding section on the broker's website. Professional accounts have higher leverage and larger trades, so they are geared toward experienced market participants with substantial capital. If you practice Islam, any account can be converted to a swap-free account upon request.

Account types:

Typically, traders planning to work with FXORO first register a demo account. This allows them to familiarize themselves with the platform's conditions and test their strategies without the risk of financial losses. Then, if the trader is satisfied, he opens a real account. At this point, he needs to make a choice based on his experience, capital, ambitions, and preferences.

FXORO’s bonuses

Promotions are designed to attract users' attention to the platform. Typically, these are financial bonuses that reduce the entry threshold. The most common type is deposit or welcome bonuses, where traders receive an additional amount from the broker on top of their deposited funds. However, these bonuses cannot be easily withdrawn. Some bonuses cannot be withdrawn at all, while others require a certain, often significant, trading volume. Additionally, profits made using bonus funds may also have withdrawal conditions. FXORO aims to maintain a transparent policy, and the company does not have any conditions hidden in the fine print. Experts believe this is the main reason for the absence of bonus payments. However, through a unique offer from an international traders' association, traders can still benefit from it.

Investment Education Online

The nature of trading determines a simple truth: a player cannot be successful if they do not improve their skills. Practice is only one side of the coin. The market evolves, old methods of analyses become outdated, losing their effectiveness, and new conceptual solutions emerge. That's why some brokers offer educational materials to their clients. Sometimes, it includes FAQs and trading glossaries. However, some platforms have comprehensive educational courses, as does FXORO. The website provides a basic program for beginners and an advanced one for professionals. They also offer an analytical blog, a standard glossary, articles, and a FAQs section. This broker regularly conducts webinars that many users consider a primary source of genuinely useful and up-to-date information.

Security (Protection for Investors)

With a broker, a single registration is not enough, even if it claims to comply with local regulatory legislation. Reliability and security can only be guaranteed through regulation. FXORO is owned by MCA Intelifunds Ltd, which is registered in Cyprus and regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 126/10 and FSA (Seychelles). If traders want a comprehensive assessment for greater confidence, they should read reviews. It is important to look for reviews only on trusted platforms, such as the TU website. On this platform, moderators filter out fake and promotional reviews, leaving only those belonging to traders who have genuinely worked or are working with the broker.

👍 Where can you get help?

- From the broker’s client support team

- From the CySEC regulator

- Contact Traders Union’s legal department for free consultation and representation. It protects its members’ rights without charge.

👎 There is no point in contacting

- Any financial regulatory body outside Cyprus.

- Regulators that do not monitor the broker's activities.

Withdrawal Options and Fees

-

If a trader has opened a demo account, they trade with virtual funds and cannot receive or withdraw real profits.

-

After registering a real account and making a deposit, the trader gains access to withdrawing their earnings if they have traded successfully and have a positive balance.

-

Withdrawal of funds is done through the corresponding function in the user account on the broker's official website.

-

Traders can withdraw funds using the following channels: Visa and MasterCard cards, Skrill, Neteller, Wire2pay, and bank transfer.

-

Submitting a withdrawal request is available at any time. The first three requests per month are not subject to a commission fee.

-

For the fourth and subsequent withdrawals within one month, the trader must pay $10 or the equivalent in another account currency.

-

It should be noted that third parties involved in the withdrawal process, such as banks or e-wallets, may charge their fees.

-

This broker's prompt technical support is available to assist with any questions related to fund withdrawals.

Customer Support Service

Technical support is essential for any organization. For a broker, it is a critically important infrastructure component because traders often encounter complex situations. One trader may need urgent consultation regarding the use of a particular trading instrument, another may encounter a bug while trading, and a third may want to withdraw funds in a non-standard way. FAQs may not always provide the necessary help, and communication with a live representative usually leads to a more targeted and effective resolution of the issue. If a trader experiences incompetence or dissatisfaction with the speed of response from customer support, they may become greatly disappointed and switch to a competitor. FXORO eliminates this situation by providing professional-level customer service. The platform's managers work round the clock without breaks, but only on weekdays. They can be reached online through any of the available channels.

👍 Advantages

- You can call/write to support even if you are not a client of the broker. It is not possible to reach specialists on weekends.

- Managers will respond to you on weekdays at any time of the day.

- There is a call center, email, LiveChat, and tickets on the website.

👎 Disadvantages

- It is not possible to reach specialists on weekends.

Whether you are already a client of the broker or planning to become one, feel free to contact its technical support, using one of the methods listed below:

-

Call center;

-

General email;

-

Email for corporate clients;

-

LiveChat on the website and in the user account;

-

Tickets.

This broker has official accounts on Instagram, Twitter, Facebook, Telegram, and LinkedIn. It is also possible to contact the customer service managers through these channels. It is recommended to follow at least one of the broker's social media pages to stay updated on FXORO’s latest news.

Contacts

| Foundation date | 2012 |

| Registration address | Petrou Tsirou 82, Mesa Geitonia, 3076, Limassol, Cyprus. |

| Regulation |

CySEC, FSA (Seychelles) |

| Official site | fxoro.com |

| Contacts |

Email:

info@fxoro.com,

cs@fxoro.com,

partnership@fxoro.com,

Phone: +35725205555 |

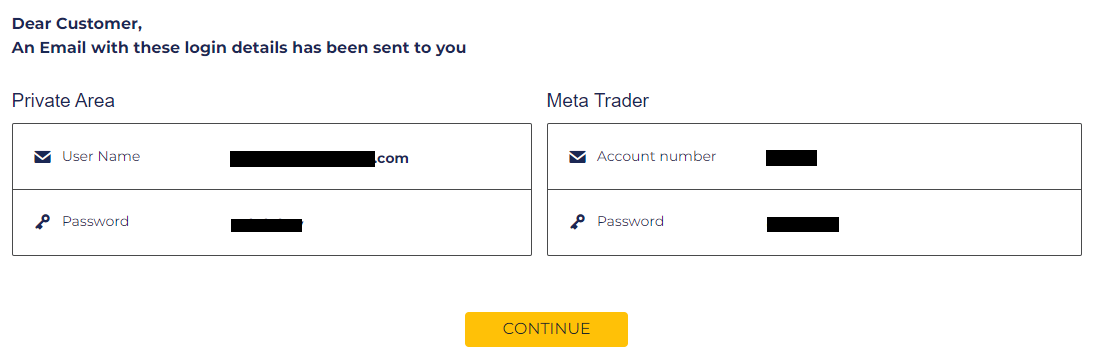

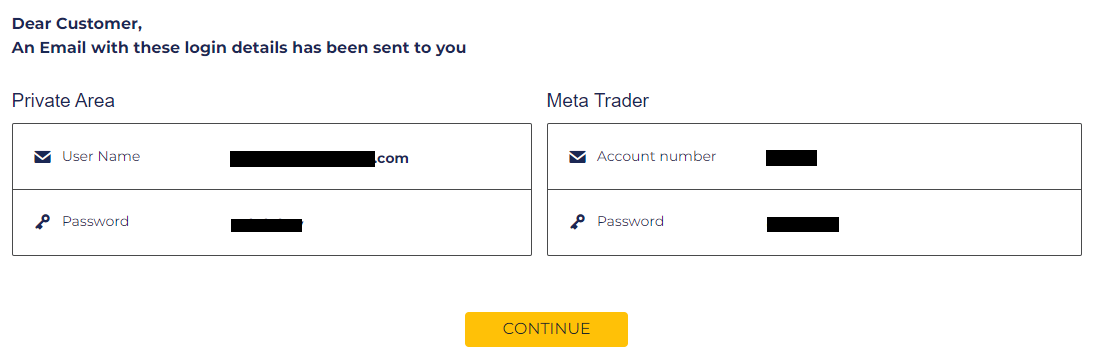

Review of the Personal Cabinet of FXORO

To start collaborating with a broker, register on their website and verify your identity. After that, make a deposit and start trading on a real account through the MT4 trading platform. TU experts have prepared the below step-by-step guide on how to register and what options are available in the FXORO user account.

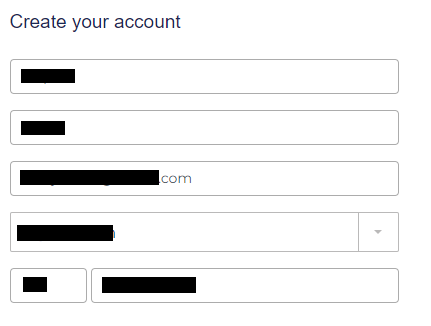

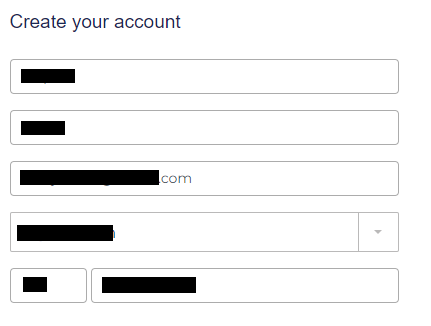

Go to the broker's website. In the top menu, select the language of the interface. Click on the “Register” button.

Enter your first and last names, as well as your country of residence. Provide your email address and contact phone number.

Choose the account type. Agree to the terms of cooperation by checking the two boxes. Enter the captcha and click “Join”.

Your email will be used as the login, and the system will generate a password automatically and which you can change later. Additionally, you will be provided with the login details for accessing the MT4 trading platform immediately. These details will also be duplicated in an email sent to your email address. Use the login and password to log in to your user account on the website.

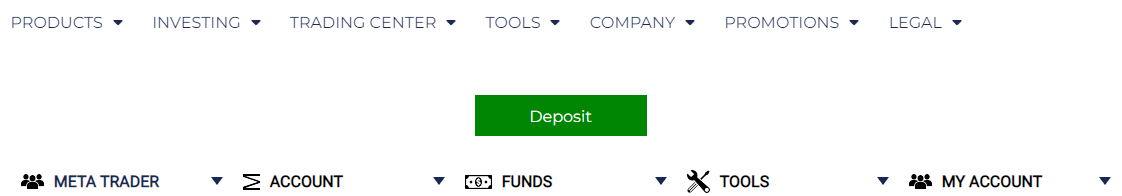

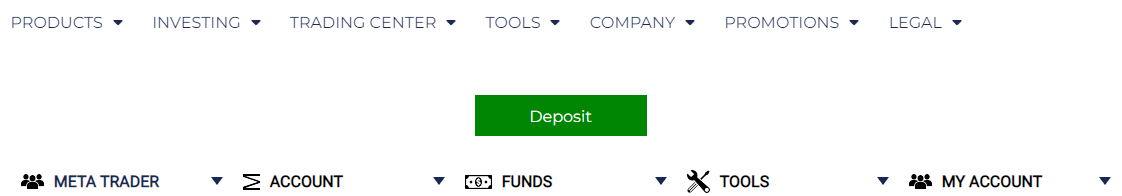

Follow the instructions on the screen to verify your information. Next, provide photos/scans of documents confirming your identity. After successful verification, the system will guide you on how to make a deposit by a corresponding button that will appear on the screen. You can download the MT4 trading platform from the broker's website or the official MetaTrader portal. Once logged into the platform, you can start trading under the selected conditions, which are determined by the type of account you opened.

Your FXORO user account also provides access to:

Meta Trader 4. This section allows you to configure the operation with the corresponding trading platform.

Accounts. Here, all the trader's active accounts are listed along with detailed information.

Deposits. This section contains a set of options for making deposits and withdrawing profits from the platform.

Settings. In this section, the broker's client can customize trading parameters according to their needs.

My Profile. This section is necessary for the verification and adjustment of personal data.

Additionally, from the user account, you can navigate to any section on the website or contact support.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Find out how FXORO stacks up against other brokers.

Articles that may help you

FAQs

Do reviews by traders influence the FXORO rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about FXORO you need to go to the broker's profile.

How to leave a review about FXORO on the Traders Union website?

To leave a review about FXORO, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about FXORO on a non-Traders Union client?

Anyone can leave feedback about FXORO on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.