deposit:

- $250

Trading platform:

- MT5

- MT5 Webtrader

- MFSA

- 0%

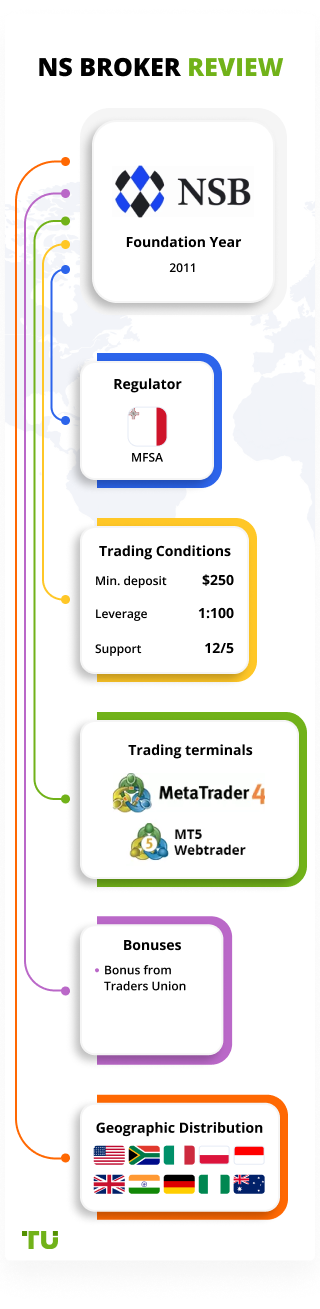

NS Broker Review 2024

deposit:

- $250

Trading platform:

- MT5

- MT5 Webtrader

- MFSA

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of NS Broker Trading Company

NS Broker is a broker with higher-than-average risk and the TU Overall Score of 3.76 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by NS Broker clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable broker with better conditions, as, according to reviews, many clients of this broker are not satisfied with the company’s work. NS Broker ranks 239 among 414 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

NS Broker is targeted at experienced and professional traders that prefer independent trading via ECN accounts on the MT5 platform.

NS Broker is an ECN broker incorporated in Malta, which has been operating under the license of MFSA IS/56519 (Malta Financial Services Authority) since 2011. The broker is a part of NSFX Ltd., an investment holding regulated by 5 European commissions. The company provides access to online trading of CFDs on currencies, stocks, indices, cryptocurrencies, energies and precious metals. NS Broker’s target audience are experienced market players and professional traders, who prefer active trading strategies.

| 💰 Account currency: | USD, EUR, GBP |

|---|---|

| 🚀 Minimum deposit: | USD 250 |

| ⚖️ Leverage: | Up to 1:30 (for retail trading), up to 1:100 (for professional traders) |

| 💱 Spread: | Floating, from 0.3 pips |

| 🔧 Instruments: | CFD on currencies, stocks, precious metals, indices, energies, cryptocurrencies |

| 💹 Margin Call / Stop Out: | 100%/50% |

👍 Advantages of trading with NS Broker:

- Execution of trades through the ECN network, which ensures high liquidity, order execution at best prices and absence of non-market quotes.

- Access to trading 6 types of CFDs: currency pairs, stocks, indices, precious metals, cryptocurrencies and energies.

- Control of the company’s operation by 6 international regulators.

- A possibility for each trader to open up to 100 trading accounts in euro, US dollars and British pounds.

- Quotes from the largest institutional liquidity providers, such as Currenex, Barclays, Dukascopy Bank, UBS.

- Absence of non-trading fees for deposit and withdrawal of funds on the part of the broker.

- Tight floating spreads – from 0.3 pips for EUR/USD.

👎 Disadvantages of NS Broker:

- The broker does not provide cent and standard accounts. The traders can trade only from ECN accounts, the work with which implies that a trader has certain experience and additional fixed commissions.

- The company does not offer investment programs. The broker’s priority is to work with active traders, not passive investors.

- The clients can trade only on the MetaTrader 5 platform. MetaTrader 4 is not provided.

Evaluation of the most influential parameters of NS Broker

Geographic Distribution of NS Broker Traders

Popularity in

Video Review of NS Broker i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of NS Broker

NS Broker is registered in Malta, but works with European traders, but from all over the world as well. The company’s website is available in 8 languages, and customer support – in 5 languages. At the moment, NS broker services over one million live MT5 accounts, from which its clients trade CFDs on currencies, cryptocurrencies, indices, stocks, oil and precious metals.

The broker provides exclusively ECBN accounts, which is why the traders are forced to pay additional trading fees in addition to spread. NS Broker’s spreads are tight floating and start from 0.3 pips. However, the broker also charges commission per lot, which means that this company cannot be recommended to novice traders. The broker is more suitable for professionals, for whom using ECN technology is a priority.

The website of NS Broker features a lot of analytics and instruments for increasing trading effectiveness. There is also quality education and extensive newsfeed of economic and financial news. However, potential clients cannot test the broker’s conditions and service on cent accounts, which is particularly relevant for novice traders. Also, the minimum deposit is $250, which is rather high for the majority of the Forex beginners.

Dynamics of NS Broker’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

The services of NS Broker are designed exclusively for active traders, who manage their funds and trade financial instruments independently. The broker does not offer its clients its own investment programs or Multi Account Manager (MAM), a popular passive income service. At the same time, the company does not prohibit the use of expert advisors for automation of trading and copying signals from the MQL5 Community platform.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

NS Broker’s affiliate program

-

Affiliate program. A partner is paid based on the CPA model, i.e. for a certain action of the clients referred by him/her. The company awards the referrer up to 50% of the spread and trading commissions the new clients are charged with.

Partners can withdraw the awarded funds via a Bank Transfer, Neteller, Skrill, Paypal, WebMoney. In order to participate in the Affiliate program, you need to become a client of NS Broker and then fill out an application in order to register as a partner.

Trading Conditions for NS Broker Users

NS Broker offers its clients access to trading over 100 financial instruments from ECN accounts. The minimum deposit for retail and professional traders is $250. Leverage depends on the class of asset and client’s experience. The broker provides the MT5 platform for trading, allows to deposit and withdraw funds via electronic payment systems and allows to connect Expert Advisors. Cent accounts are not available, but there is a demo account without the expiry date.

$250

Minimum

deposit

1:100

Leverage

12/5

Support

| 💻 Trading platform: | МТ5 Desktop, МТ5 Mobile, МТ5 WebTrader |

|---|---|

| 📊 Accounts: | Demo Account, Real Account, Islamic Account |

| 💰 Account currency: | USD, EUR, GBP |

| 💵 Replenishment / Withdrawal: | Visa and Mastercard cards, Skrill, Neteller, Bank Transfer |

| 🚀 Minimum deposit: | USD 250 |

| ⚖️ Leverage: | Up to 1:30 (for retail trading), up to 1:100 (for professional traders) |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | Floating, from 0.3 pips |

| 🔧 Instruments: | CFD on currencies, stocks, precious metals, indices, energies, cryptocurrencies |

| 💹 Margin Call / Stop Out: | 100%/50% |

| 🏛 Liquidity provider: | Dukascopy Bank, Prime XM, Barclays, UBS, Currenex, City Bank, Credit Suisse, LMAX Group |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market, Limit, Stop Loss, Trailing Stop, Good till Cancelled (GTC), One Cancels the Other (OCO) |

| ⭐ Trading features: | In addition to spread, there are additional trading fees, EAs are allowed, each client can open up to 100 live accounts |

| 🎁 Contests and bonuses: | No |

Comparison of NS Broker with other Brokers

| NS Broker | RoboForex | Pocket Option | Exness | Octa | FxGlory | |

| Trading platform |

MT5, MT5 Webtrader, MT5 IOS, MT5 Android | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MetaTrader4, MetaTrader5 | MT4, MobileTrading, MT5 |

| Min deposit | $250 | $10 | $5 | $10 | $25 | $1 |

| Leverage |

From 1:1 to 1:100 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:3000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | 8.00% |

| Spread | From 0.3 points | From 0 points | From 1.2 point | From 1 point | From 0.6 points | From 2 points |

| Level of margin call / stop out |

100% / 50% | 60% / 40% | 30% / 50% | No / 60% | 25% / 15% | 20% / 10% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Instant Execution, Market Execution |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | Yes | No | No | No | No |

Broker comparison table of trading instruments

| NS Broker | RoboForex | Pocket Option | Exness | Octa | FxGlory | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | No |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | No |

| Stock | Yes | Yes | Yes | Yes | Yes | No |

| ETF | No | Yes | No | No | No | No |

| Options | No | No | No | No | No | No |

NS Broker Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Real Account | From $3 | No |

There are swaps (commission for position rollover to the following day).

An important part of the analysis of NS Broker trading conditions is their comparison with those offered by other Forex brokers. TU analysts compared the average commission of the Maltese company with more popular competitors RoboForex and FxPro.

| Broker | Average commission | Level |

| NS Broker | $3 | Medium |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | High |

Detailed Review of NS Broker

NS Broker is an ECN broker, which has been operating under the regulation of MFSA since 2011. At the moment, traders from more than 20 countries of the European Union use the services of the broker. NS Broker has established partnerships with major investment banks, such as Barclays, CitiFX Pro, UBS and Deutsche Bank. This guarantees the clients high liquidity as they trade and safety of their funds, which are kept in segregated accounts.

NS Broker in figures:

-

Over 10 years of operation in the field of brokerage services.

-

100+ trading instruments.

-

Official website in 8 languages.

-

Customer support in 5 languages.

-

99.9% orders of the clients are executed within 11.06 ms.

NS Broker is a broker for retail and professional CFD trading

The company specializes in CFD trading. The broker offers its clients access to trading 40 currency pairs, precious metals (gold and silver), stocks of 35 international companies, and cryptocurrencies Bitcoin, Ethereum, Litecoin. The choice of commodities is not big: traders can only trade Brent and WTI oil. Also stock indices of Europe, America and Asia are available, and not only major ones, such as AUS200, FRA40, JPN225, UK100, but also minor ones.

NS Broker offers only one platform for trading – MetaTrader 5. The clients can use different versions of it: desktop, mobile or web trader. The platform supports 21 timeframes of charts, over 50 adjustable indicators, and 40 drawing elements. It also features MQL4 and MQL5 programming languages, which enable experienced users to create their own indicators, strategies and advisors.

Useful services:

-

Analytics from Trading Central. This is a newsletter with news, trading ideas, fundamental and technical research, which is sent daily to users’ email. It is available only to the traders registered with the broker.

-

Crypto Info. This section of the website features useful information for crypto traders.

-

Economic calendar. It shows the dates of important global events in the financial industry that could have an impact on the prices of specific assets or markets in general.

-

Technical analysts. Weekly forecasts about possible change of the price of the asset based on the past market data from NS Broker’s analysts.

-

Section of the website features financial news. It shows the most significant events, which are important for the traders, who prefer fundamental analysis.

-

Live quotes from TradingView. It is a newsfeed with prices for currencies, bonds, indices and commodities published on the website’s home page. The data changes in real time mode.

-

Trading instruments. The broker provides traders with currency converter, margin and pip cost calculators.

Advantages:

Partners can earn passive income for referring new clients to the company.

Muslim traders can open Islamic accounts for trading Swap free.

The broker keeps the funds of the clients in reliable global banks on segregated accounts.

The company holds a brokerage license from MFSA, a highly respected EU regulator.

The clients can use advisors for automated trading.

Not only wire transfers and debit/credit cards, but also electronic payment systems Neteller and Skrill are available for deposit and withdrawal of funds.

Any trader can open a demo account and test the conditions of the broker without any financial investment and risks.

NS Broker’s website features a great amount of useful information: news, analytics, quotes in real time mode, educational materials.

How to Start Making Profits — Guide for Traders

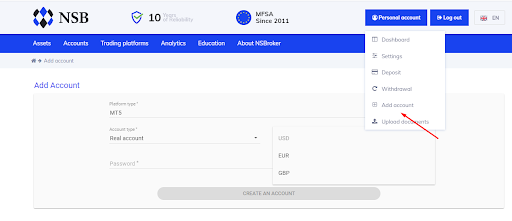

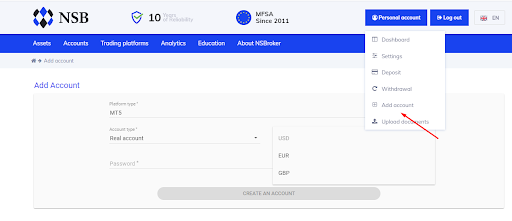

NS Broker offers only one type of real account for MT5. However, each client can open up to 100 trading accounts in three currencies — USD, EUR, GBP.

Account types:

Traders can test the broker’s trading conditions using demo accounts. The company provides virtual USD 100,000 for use without the expiry date.

NS Broker is an ECN broker that offers one universal account for clients with different levels of expertise. At the same time, novice traders do not have the possibility to trade from cent accounts and without paying additional trading fees.

Bonuses Paid by the Broker

The broker does not offer bonuses to registered traders and does not hold any contests with money as a reward. NS Broker’s policy aims to provide truly beneficial conditions that will allow traders to receive maximum opportunities in real trading.

Investment Education Online

NS Broker has a separate Education section on its website, where novice traders can find a lot of useful educational information. The company offers different formats of education: video tutorials, texts (articles), guides and electronic books.

Demo account is the most effective educational instrument. It can be used for testing your trading skills in real market conditions, but without the risk of losing money.

Security (Protection for Investors)

NS Broker is a Forex broker managed by NSFX Ltd., which obtained the license No. IS/56519 from the Malta Financial Services Authority (MFSA). The regulator strictly monitors the broker’s operation and demands transparency of monetary and accounting reporting.

NS Broker holds the MFSA license, and therefore it is a member of the Investor Compensation Scheme. Under its conditions, every client will be compensated for up to 90% of his/her loss (but no more than EUR 20,000) in case the broker goes bankrupt or becomes insolvent. Outside Malta, the operation of the subsidiaries of NSFX Ltd. is controlled by international supervisory authorities: BaFin (Germany), Finanstilsynet or NFSA (Norway), DFSA (Denmark), CONSOB (Italy), ACPR (France), CNMV (Spain).

👍 Advantages

- As per requirements of the regulators, all funds of the traders are isolated from the company’s equity and are kept in independent bank accounts

- Negative balance protection

- The broker complies with the Markets in Financial Instruments Directive (MiFID)

- The broker is a member of a compensation fund

👎 Disadvantages

- Limited leverage for retail and professional traders

- You cannot deposit funds without passing verification

Withdrawal Options and Fees

-

Specialists of the financial department of NS Broker process withdrawal requests within one working day.

-

Traders can withdraw money to Visa and Mastercard debit/credit cards, to a bank account or Neteller and Skrill electronic wallets.

-

Timeframe for crediting the funds: wire transfer – up to 2 working days, cards and EPS – within one working day.

-

The company does not charge a withdrawal fee. Skrill and Neteller charge 2.9% fee. The size of the wire transfer fee and withdrawal to a card depends on the financial institution.

-

Money can be withdrawn in US dollars, Euro and British pounds.

Customer Support Service

A trader can ask a question in the chat at any time of day and night, but the operator will respond during the working hours of the company. Operating hours of customer support: Monday to Friday, from 08:00 till 20:00 (GMT+3).

👍 Advantages

- Live chat operators respond within 1-2 minutes.

- Customer support answers the questions of the broker’s clients and unregistered users

- Regional phone numbers are specified on the website

- Support is provided in 5 languages

👎 Disadvantages

- The company does not have social media accounts

- Operates 12/5

- You cannot order a call back

There are several ways to contact customer support:

-

Call the numbers specified in the Contact Us section;

-

Write a message to the operators of the online chat;

-

Ask a question by filling out the feedback form;

-

Send an inquiry via email: help@nsbroker.com.

The online chat button is active both on the website and in the Personal Account.

Contacts

| Foundation date | 2012 |

| Registration address | Suite 124, Signature Portomaso, Vjal Portomaso, San Giljan, PTM01, Malta |

| Regulation |

MFSA |

| Official site | https://nsbroker.com/ |

| Contacts |

Email:

help@nsbroker.com,

Phone: +44 (203) 936-07-21 |

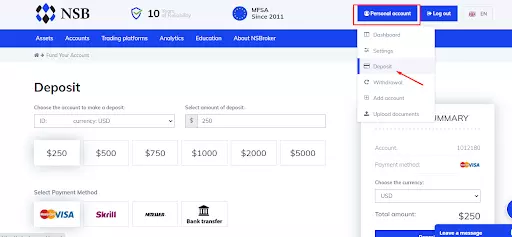

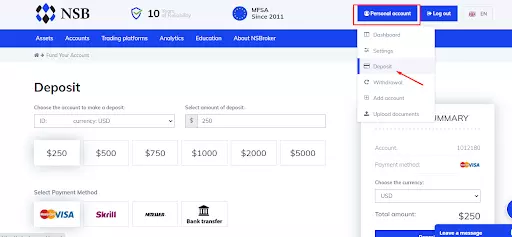

Review of the Personal Cabinet of NS Broker

Opening a Personal Account on the NS Broker’s website takes no more than five minutes. The standard procedure consists of several steps:

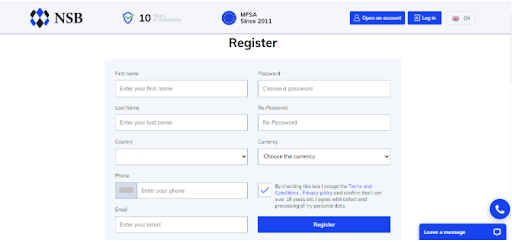

First you need to visit the broker’s official website. In the upper right part of any page, you will see the Open an Account button. Click on it to start the registration process.

Next you will see a special form, which you need to fill out. Provide your first name, last name, country, phone number and email. Also here you will need to come up with or generate a reliable password and choose the account currency: USD, EUR, GBP. After you enter the information you will need to tick the box confirming that you have reviewed and accept the official conditions. Next, you click on the Register button.

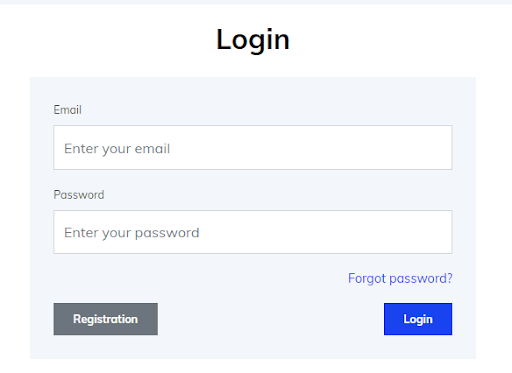

After you complete registration, you need to access your Personal Account. It is all pretty standard: enter your email and the password you’ve chosen during your registration.

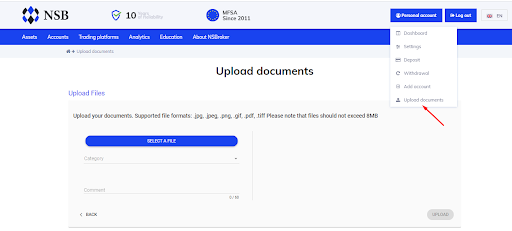

You can take the following actions in your Personal Account on NS Broker:

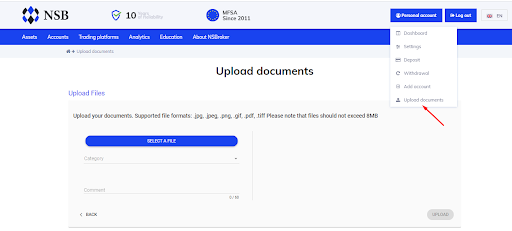

1. Upload verification documents:

2. Open a new trading account:

3. Make a deposit:

1. Upload verification documents:

2. Open a new trading account:

3. Make a deposit:

In the Personal Account, the traders can also:

-

Download the trading platform.

-

View all open and closed trades for the chosen period.

-

Submit a withdrawal request.

-

Change personal data.

-

Contact customer support via the live chat.

Disclaimer:

Your capital is at risk. Trading in Forex and Contracts for Difference (CFDs), which are leveraged products, is highly speculative and involves substantial risk of loss. It is possible to lose all your capital. Your capital is not guaranteed and may go down as well as up. Therefore, Forex and CFDs may not be suitable for all investors. Only invest with money you can afford to lose. So please ensure that you fully understand the risks involved. Seek independent advice if necessary.

Articles that may help you

FAQs

Do reviews by traders influence the NS Broker rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about NS Broker you need to go to the broker's profile.

How to leave a review about NS Broker on the Traders Union website?

To leave a review about NS Broker, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about NS Broker on a non-Traders Union client?

Anyone can leave feedback about NS Broker on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.