Saxo Bank withdrawal guide

Saxo is a licensed bank and online broker, running its business continuously for over five years. Commissions under different assets and ultra-competitive spreaders of Saxo Bank have drawn the attention of several traders, and beginners are looking forward to the steps to withdraw from their Saxo Bank accounts.

So, a brief Saxo bank withdrawal guide on How to withdraw from Saxo Bank will be helpful to them. The review also includes details on withdrawal currencies and methods.

Saxo Bank withdrawal methods and fees

Saxo Bank accepts only bank transfers as the withdrawal method. There is no need to pay a fee through this method. But, your bank may charge some transactional fees. Remember that fund transfer from third-party accounts is not acceptable.

| Method | Speed | Fee | |

|---|---|---|---|

Bank transfer |

Yes |

Varies with currency |

Zero |

Electronic wallet |

No |

- |

- |

Bank cards |

No |

- |

- |

Payment services (list available, if any) |

No |

- |

- |

Crypto (list available, if any) |

No |

- |

- |

For non-UK users who have chosen card-based transactions, Saxo Bank has imposed some transaction limits. The maximum limit for a single transaction is 5000 USD. Again, the maximum 1-month transaction acceptable is 50,000 USD.

There may be a delay in the withdrawal process for some reasons-

Before releasing the amount, it is essential to ensure enough amount available in the account.

Checks on interest charges are made for full fund withdrawal.

Accrued charges of the previous month have to be processed.

Some more checks are needed to prevent fraudulence and money-laundering cases

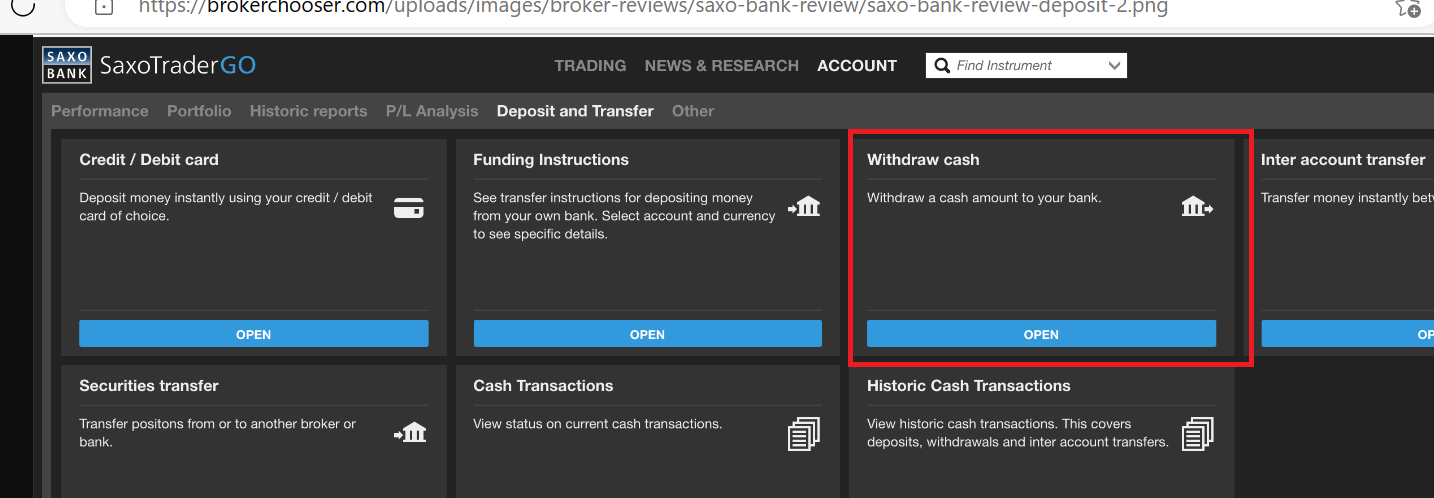

How to withdraw money from Saxo Bank?

How to withdraw money from Saxo Bank

Withdrawing your money from a Saxo brokerage account is slightly different from a standard bank account withdrawal method. You will not find instant withdrawal opportunities. Remember that if you have invested your funds, you should close some positions first to access the cash to be withdrawn. The broker takes some time to make the amount available for withdrawal.

Novices at the Saxo Bank’s platform will find it easy to withdraw funds from their accounts. Check the steps to find all the answers for your how to withdraw profit from Saxo Bank related queries.

Access the dashboard to reach the menu.

Click on Deposits and Transfers

Hit the option - Withdraw Funds

Choose the Saxo account from where the money will be withdrawn.

Select the preferred withdrawal currency.

Enter the amount you like to withdraw.

Choose the external account from the menu. However, if you have no external accounts, you can register a new one for withdrawal.

Hit the option- ‘Transfer’. Now, you are down.

You will receive a code to your registered mobile number. A confirmation window will display some instructions if you have not received the code. Enter the code to click Confirm.

So, these are some steps for withdrawing your funds online. However, if the online withdrawal module is not accessible, you must download the Withdrawal Form from the site and deliver it to Saxo Bank.

Make sure that you have verified your account to get the withdrawal facility.

It is to be noted that Corporate Clients cannot take advantage of the online withdrawal module. But they can send a request through SaxoGroup Cash Module Form.

Those who have used the Saxo bank withdrawal cash module do not need to pay an extra charge. But, if you have submitted a withdrawal request using a manual withdrawal form should pay SGD 50 as a processing charge.

What is Saxo Bank’s minimum withdrawal amount?

The minimum amount to be withdrawn from your Saxo Bank account is 1000 USD/Euro/Pounds. So, before making your withdrawal request, you should ensure that your account has this amount.

Is Saxo Bank Regulated? Is it safe?What are Saxo Bank withdrawal currencies?

Saxo bank accepts different currencies for withdrawal:

AUD

USD

HKD

AED

CAD

CHN

CHF

EUR

GBP

JPY

NZD

SGD

If your bank account’s currency and the base currency of your Saxo Bank account are different from each other, you have to pay a conversion fee. You can talk to the bank representative to know the conversion charge. However, the best way to avoid conversion fees is to open a multi-currency account at a virtual bank.

FAQ

Is Saxo Bank a reliable and safe online broker?

Saxo is a highly reliable broker. The UK regulator, Financial Conduct Authority, and other top-tier financial authorities regulate the Danish investment bank Saxo.

How long should investors wait to withdraw funds from the Saxo account?

It usually takes a day to execute the withdrawal process at Saxo bank.

Does Saxo Bank offer any bonus?

There is a loyalty program for Saxo Bank customers. Classic level refers to 0 points, while the Platinum level means 120000 points. VIP members have to gain 500000 points.

Can the money be transferred between sub-accounts?

Yes. You can quickly transfer from the sub-account transfer option in the menu. You need to select the account and enter the amount to be transferred.

Team that worked on the article

Andrey Mastykin is an experienced author, editor, and content strategist who has been with Traders Union since 2020. As an editor, he is meticulous about fact-checking and ensuring the accuracy of all information published on the Traders Union platform. Andrey focuses on educating readers about the potential rewards and risks involved in trading financial markets.

He firmly believes that passive investing is a more suitable strategy for most individuals. Andrey's conservative approach and focus on risk management resonate with many readers, making him a trusted source of financial information.

Also, Andrey is a member of the National Union of Journalists of Ukraine (membership card No. 4574, international certificate UKR4492).

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.