deposit:

- $1

Trading platform:

- Self Bank platform

- 0%

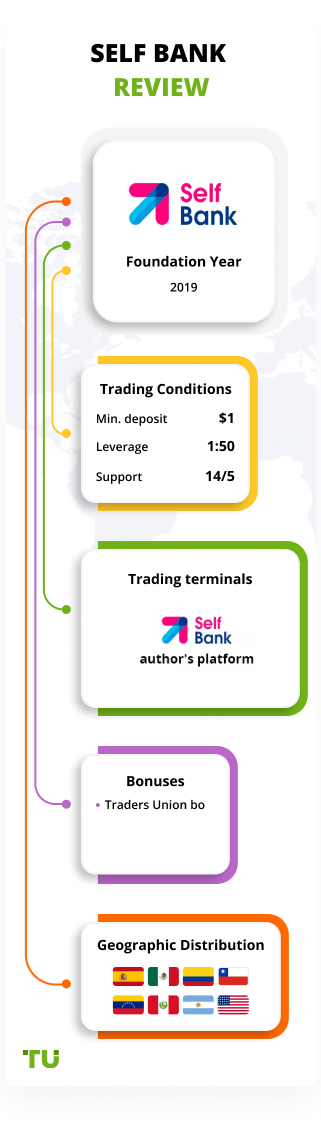

Self Bank (SelfBank) Review 2024

deposit:

- $1

Trading platform:

- Self Bank platform

- 0%

Note!

We’ve identified your country as US

Traders Union experts have analyzed all companies providing trading services in your country legally and compiled a rating of the best companies that offer the best working conditions, have reliable reputation and the highest number of positive reviews among traders on our website.

We’ve selected the Top 5 Best Brokers in US for you:

Summary of Self Bank Trading Company

Self Bank is a high-risk broker with the TU Overall Score of 2.57 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Self Bank clients on our website, Traders Union expert Anton Kharitonov does not recommend working with this broker, as, according to reviews, most clients are not satisfied with the broker. Self Bank ranks 358 among 413 companies featured in the TU Ranking, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Self Bank is an online bank specializing in banking rather than brokerage services.

Singular Bank, S.A. (formerly Self Trade Bank, S.A.) (Spain), hereafter referred to as “Self Bank, is a subsidiary of the Warburg Pincus, LLC investment holding and a lending institution that is regulated by the Central Bank of Spain. It has been providing a wide range of banking and financial services to clients of the European Union for almost 20 years. Self Bank provides banking services and offers financial planning, savings accounts, credit and debit cards, deposits, investment funds, pension plans, indices, payroll accounts and allows traders to invest in currencies, CFDs on stocks, indices, commodities, and ETFs. According to Rankia, a leading financial portal, Self Bank was ranked as the best multi-product broker in 2019.

| 💰 Account currency: | EUR, USD |

|---|---|

| 🚀 Minimum deposit: | From $0 |

| ⚖️ Leverage: | Up to 1:50 |

| 💱 Spread: | From 0,0002 pips |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, ETFs, indices, commodities, bonds |

| 💹 Margin Call / Stop Out: | Not indicated |

👍 Advantages of trading with Self Bank:

- Optimal trading conditions for traders who invest in the stock market.

- Tight market spreads for Forex trading accounts.

- The minimum deposit to enter the exchange starts at $0.

👎 Disadvantages of Self Bank:

- The company provides only proprietary terminals for trading Forex instruments. MetaTrader 4 and MetaTrader 5 are not on the list of available platforms.

- The maximum leverage does not exceed 1:50.

- There are no options for generating passive income, i.e., there are no PAMM accounts, a platform for copying transactions of successful traders, and affiliate programs.

- Trading bonuses are absent.

- The broker has only one Spanish version of the site.

Evaluation of the most influential parameters of Self Bank

Geographic Distribution of Self Bank Traders

Popularity in

Video Review of Self Bank i

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Self Bank

Self Bank is primarily a bank. Therefore its main priority is the provision of banking services. The company offers financial solutions for profitable placement and storage of funds, including savings and retirement accounts. Forex traders get a limited selection of trading tools, platforms, and analytics here.

Self Bank is focused on cooperation with residents of Spain and other European Union countries. So, to become its client, you need to have tax residency in the European Union, and you need to be a Spanish resident to apply for a Self Bank debit or credit card.

The Self Bank website is only available in Spanish. You can contact online chat specialists only after registration. The broker provides a demo account, but its validity period does not exceed 20 days. The trading web terminal and personal account are available in Russian.

Dynamics of Self Bank’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Digital Self Bank offers financial solutions for generating independent income in the financial markets. The company is not aimed at cooperating with passive investors. Ergo, social trading, investments in PAMM, MAM (Multi-Account Manager), and trust accounts are not available to its clients.

If you are a large investor and plan on investments over $ 10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Self Bank affiliate program

The Self Bank broker does not have an affiliate program. For this reason, his clients cannot receive passive income for attracting new users to the company.

Trading Conditions for Self Bank Users

Self Bank offers favorable conditions for investors who trade on the stock exchange. Conditions of the Forex instruments account cannot be considered the most optimal on the market. The maximum leverage does not exceed 1:50. There are no cryptocurrencies among the available assets. Self Bank does not deposit and withdraw funds through e-wallets; moreover, it charges a commission for withdrawing money from accounts. In addition to the spread, the company charges an additional fee if the trading volume's minimum requirements are not met.

$1

Minimum

deposit

1:50

Leverage

14/5

Support

| 💻 Trading platform: | Self Bank author's platform |

|---|---|

| 📊 Accounts: | Demo, currency account, and CFD trading |

| 💰 Account currency: | EUR, USD |

| 💵 Replenishment / Withdrawal: | Bank Transfer, Mastercard and Self Bank cards |

| 🚀 Minimum deposit: | From $0 |

| ⚖️ Leverage: | Up to 1:50 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 0,0002 pips |

| 🔧 Instruments: | Currency pairs, CFDs on stocks, ETFs, indices, commodities, bonds |

| 💹 Margin Call / Stop Out: | Not indicated |

| 🏛 Liquidity provider: | Saxo Bank |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | No cryptocurrencies, no access to MT4 and MT5 |

| 🎁 Contests and bonuses: | No |

Comparison of Self Bank with other Brokers

| Self Bank | RoboForex | Pocket Option | Exness | Vantage Markets | FreshForex | |

| Trading platform |

Self Bank platform | MT4, MT5, R MobileTrader, R StocksTrader, R WebTrader | Pocket Option, MT5, MT4 | Exness Trade App (mobile), Exness Terminal (web), MetaTrader5, MetaTrader4 | MT4, MT5, WebTrader, Mobile Apps | MT4, MobileTrading |

| Min deposit | $1 | $10 | $5 | $10 | $50 | No |

| Leverage |

From 1:1 to 1:50 |

From 1:1 to 1:2000 |

From 1:1 to 1:1000 |

From 1:1 to 1:2000 |

From 1:1 to 1:500 |

From 1:1 to 1:2000 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 1.2 point | From 1 point | From 0 points | From 0 points |

| Level of margin call / stop out |

1% / 1% | 60% / 40% | 30% / 50% | No / 60% | 100% / 50% | 40% / 20% |

| Execution of orders | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution | Market Execution | Market Execution, Instant Execution |

| No deposit bonus | No | No | No | No | No | $30 |

| Cent accounts | No | Yes | No | No | No | Yes |

Broker comparison table of trading instruments

| Self Bank | RoboForex | Pocket Option | Exness | Vantage Markets | FreshForex | |

| Forex | Yes | Yes | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes | No | No |

| CFD | Yes | Yes | Yes | Yes | Yes | Yes |

| Indexes | Yes | Yes | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | Yes | Yes | Yes |

| ETF | Yes | Yes | No | No | No | No |

| Options | No | No | No | No | No | No |

Self Bank Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| CFD and Currency Account | From €20 | Yes |

There are swaps (commission for moving a position to the next day). The Association's analysts also compared the average commissions charged by Self Bank with its competitors. For greater clarity, the test results are presented in the form of a comparative table.

| Broker | Average commission | Level |

| Self Bank | $20 | High |

| RoboForex | $1 | Low |

| Pocket Option | $8.5 | Medium |

Detailed Review of Self Bank

Self Bank is a Spanish bank that was the first to offer an innovative system for opening accounts with video identification, which allows you to become a client in a few minutes without providing documents. The company allows investing in 165 currency pairs, CFDs on stocks, ETFs, indices, commodities, and bonds. Provides favorable terms of cooperation for private traders and corporate companies. Self Bank focuses on the stock and commodity markets' trading assets: more than 3,500 investment funds are available to its clients.

A few figures about Self Bank that will be of interest to traders choosing a broker:

-

Self Bank is part of the Warburg Pincus holding conglomeration with more than 50 years of experience.

-

It provides access to over 3500 investment funds.

-

It has been operating in the European market for over 19 years.

Self Bank is a broker that guarantees safety to clients.

Self Bank is a financial holding company that provides banking and investment services. For Forex trading, foreign exchange accounts are operated by Saxo Bank, a company regulated by the Danish Financial Supervision Authority (DFSA). Self Bank provides its clients high-security:

-

Uses the leading (anti phishing and malware).

-

Encryption software.

-

Provides the Self Protect service to protect debit and credit card transactions.

-

Uses multi-level operational access codes.

-

The company works with digital documentation to eliminate the risks of sending personal data by mail.

The professional web platform Self bank allows you to access trading without installing any software on your computer or Android device. Owners of iPhone and iPad can use the author's mobile applications for trading.

Useful services of Self Bank:

-

Infomarkets Service. A fundamental and technical analysis tool allows you to determine the volatility of trading instruments.

-

Trading Central. Customizable web platform with 80 indicators and oscillators.

-

Economic calendar. Displays the leading financial news and events online.

Advantages:

Tight market spreads for popular currency pairs in a calm market.

No minimum deposit requirements.

Supervision by the Central Bank of Spain with reports according to the unified reporting standards CRS (Common Reporting Standard).

Membership in the Deposit Guarantee Fund with insurance up to 100,000 euros per client.

A convenient personal account that provides access to trading through the web platform.

Traders are allowed to hedge positions and use signals to improve trading efficiency.

How to Start Making Profits — Guide for Traders

Self Bank is a digital bank that offers a wide range of accounts for private and corporate clients. The broker provides only one type of account for trading currency pairs and CFDs.

Account types:

A demo account is available with a validity period of up to 20 days. The Self Bank broker aims to cooperate with European traders who prefer to invest in the stock market.

Bonuses Paid by the Broker

Self Bank does not provide bonuses to traders who have opened a Forex trading account. A limited selection of bonus offers for banking services is only available to Self Bank customers from Spain.

Investment Education Online

All educational information about financial markets is available in the Help section of the official website. The company is focused on traders who invest in the stock market, so most of the training is devoted to this issue.

Self Bank has a demo account with which a potential client can practice applying the theoretical knowledge gained during study.

Security (Protection for Investors)

Self Bank or Singular Bank SAU is a credit institution controlled by the Central Bank of Spain (Banco de España).

Self Bank is listed in the register of national credit institutions of the Bank of Spain and has a Deposit Guarantee Fund (DGF). In case of a Self Bank bankruptcy, each depositor of the company can receive compensation up to 100,000 euros.

👍 Advantages

- The broker provides services following the legislation of the European Union

- Active negative balance protection

- All account holders are eligible for compensation if the company is declared bankrupt

👎 Disadvantages

- Complicated procedure for opening an account for foreign citizens

- Verification is a mandatory procedure when opening an account

- No high leverage under the regulator’s requirements

Withdrawal Options and Fees

Available withdrawal methods: bank transfer (domestic and international), Self Bank cards (Spain residents only), Mastercard (Eurozone residents).

-

Self Bank charges a withdrawal fee from all account types. Commission size: regular transfers from SEPA (Single Euro Payments Area) accounts of individuals: 0.25% (min €2), urgent transfers and non-SEPA transactions: 0.30% (min €20).

-

The timing of crediting money depends on the client's jurisdiction, the exact time of the request for withdrawal of funds, and the currency specified in the application.

-

National transfers SNCE and international SEPA, withdrawn before 17.00 hours, are made on the day of request; after 17.00 hours, on the next business day.

-

International systems (except SEPA) credit money on the day of application for withdrawals in euros and dollars, the next day for withdrawals in pounds and Swiss francs.

Customer Support Service

The broker's support service answers customer questions from 8:00 to 22:00 hours from Monday through Friday local time.

👍 Advantages

- Not only clients but also traders without registration can contact Self Bank representatives by phone and email

👎 Disadvantages

- Not available on weekends

- Only the company's clients can get advice in the online chat

- Support is provided in Spanish only

There are several ways to contact support:

-

by phone numbers indicated on the website;

-

by fax;

-

by email;

-

by using the feedback form;

-

via online chat on the website (registered customers only).

Support is available from the broker's website and your personal account.

Contacts

| Foundation date | 1995 |

| Registration address | Singular Bank, S.A.U. (Self Trade Bank S.A.U.) Calle de Goya, 11.28001 Madrid |

| Official site | selfbank.es |

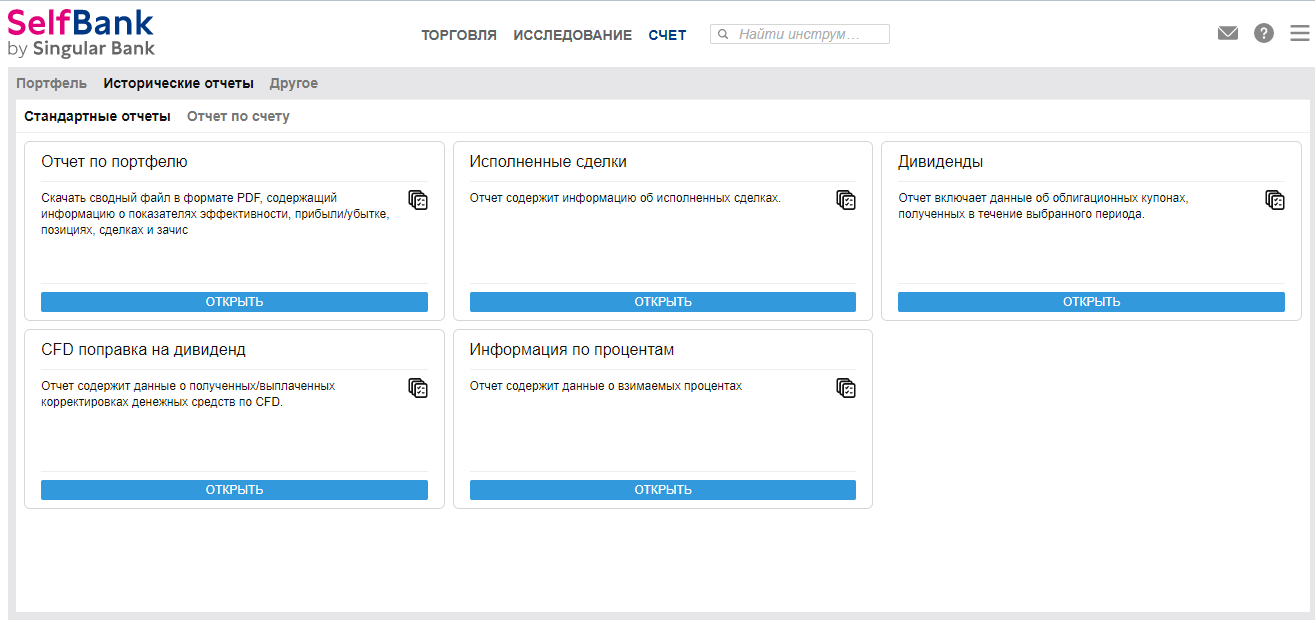

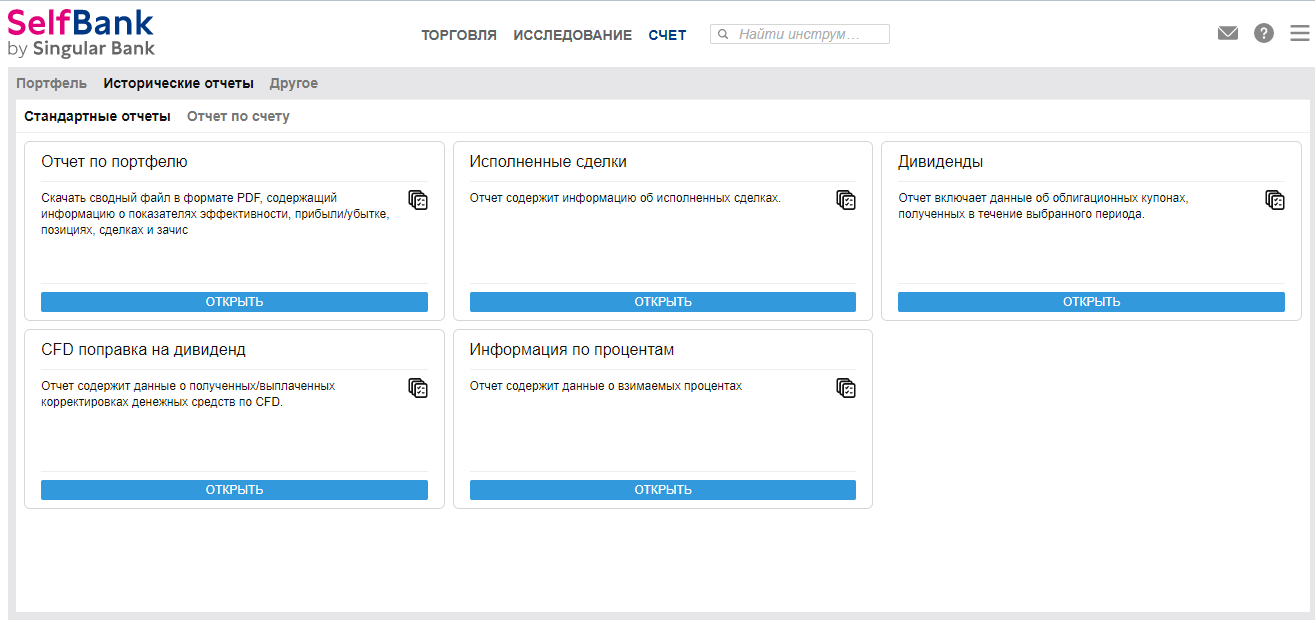

Review of the Personal Cabinet of Self Bank

You need to open a trading account to start making money with Self Bank. To do this, you need to visit the official website of the company and follow these steps:

Click “Become a client” and choose the appropriate type of account from the line offered by the company.

The account “Cuenta de CFDs y Divisas” (“CFD and foreign exchange account”) is intended for trading currency pairs and CFDs.

Choose to open a digital or regular account. If the digital method (Self Now) is selected, you must enter personal data, confirm your identity using digital video identification and receive an electronic key to enter your personal account. After entering personal data, the customer receives by email all product information and a temporary security password when opening an account without Self Now. Further, you need to send identity documents via email.

The following tabs are available in the Self Bank personal account:

1. “Personal account” – your personal account is for performing financial transactions and generating trading reports:

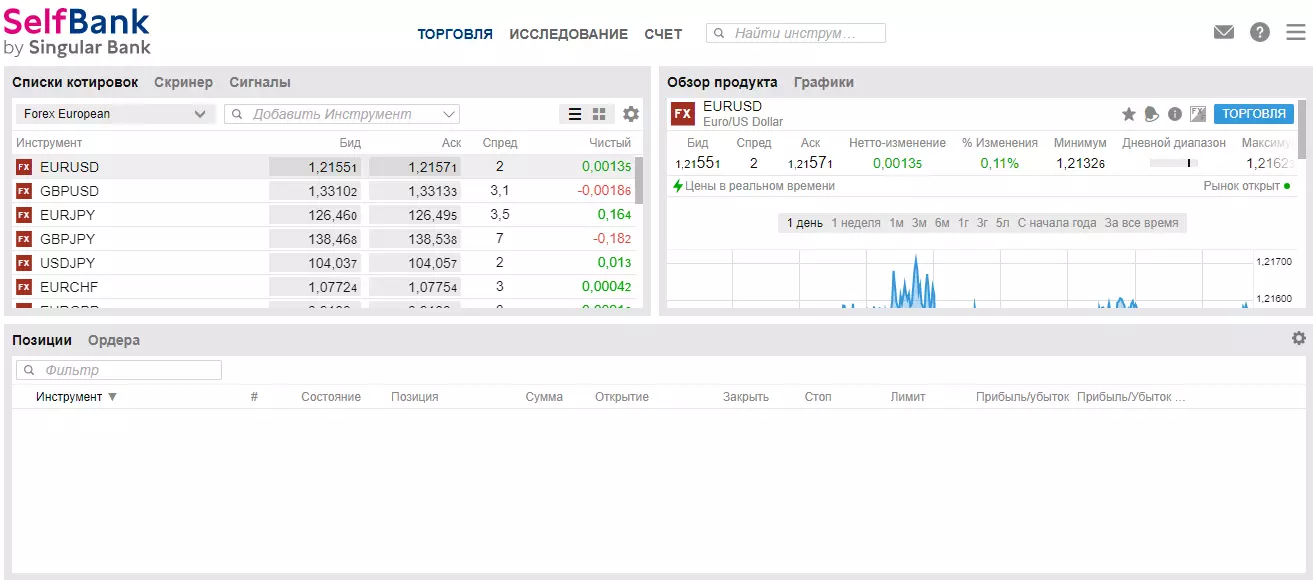

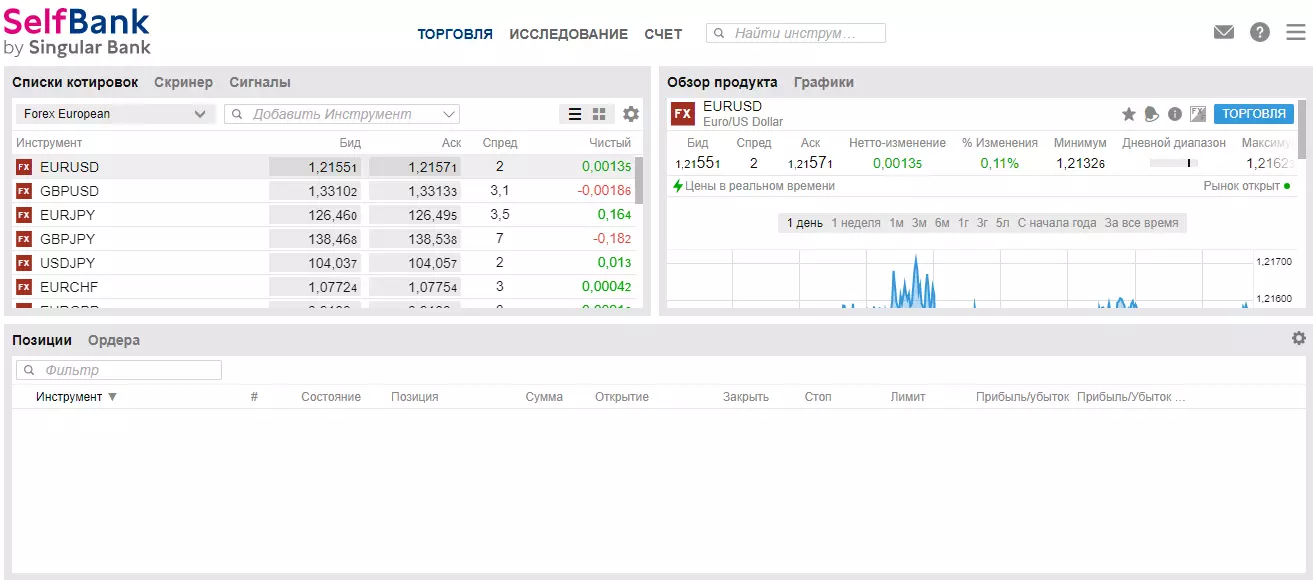

2. The “Trade” tab takes you to the web terminal and so you can start trading:

1. “Personal account” – your personal account is for performing financial transactions and generating trading reports:

2. The “Trade” tab takes you to the web terminal and so you can start trading:

There are also many other useful functions and features, such as:

-

the “Research” section contains an economic calendar and the latest news from the financial markets.

-

Real-time currency quotes.

-

Active operations log with information on all actions in the trading terminal.

-

A window for communication with specialists using online chat.

Articles that may help you

FAQs

Do reviews by traders influence the Self Bank rating?

Any review can raise or lower the rating of any broker in the general list of brokers. To read reviews about Self Bank you need to go to the broker's profile.

How to leave a review about Self Bank on the Traders Union website?

To leave a review about Self Bank, register on the Traders Union website or you can also leave a review through Facebook.

Is it possible to leave a comment about Self Bank on a non-Traders Union client?

Anyone can leave feedback about Self Bank on multiple participating clients; however, Traders Union clients also receive additional payments later for working with any broker listed at the Forex market.

Traders Union Recommends: Choose the Best!

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest.