deposit:

- $89

Trading platform:

- MT4

- MT5

Auto Prop Trader Review 2024

deposit:

- $89

Trading platform:

- MT4

- MT5

- Five plans

- balances of up to $200,000

- refundable enrollment fees

- cooperation with five brokers

- almost all types of financial instruments

- access to investing

- Up to 1:500

Summary of Auto Prop Trader Trading Company

Auto Prop Trader is a prop trading firm with higher-than-average risk and the TU Overall Score of 4.4 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by Auto Prop Trader clients on our website, Traders Union expert Anton Kharitonov recommends users to consider a more reliable partner with better conditions, as, according to reviews, many clients of this firm are not satisfied with the company’s work. Auto Prop Trader ranks 36 among 41 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria and a test on how to open an account.

Auto Prop Trader offers favorable conditions to clients at all levels. Conceptual advantages are a wide range of plans and balances, as well as almost complete freedom of trading: you only have to watch the drawdown and trade at least 3 days per month. Traders have access to all groups of financial instruments. Leverage depends on assets and may be up to 1:500. Investors can start from the minimum investment of $100 without additional conditions and receive up to 30% of the profits of clients that trade with their funds.

Auto Prop Trader combines traditional proprietary trading with an investment program for private individuals. Users can register with the company as traders or investors. Several plans with different conditions are available. The minimum enrollment fee is $89 and the maximum balance is $200,000. The profit share on most plans is 80%. Restrictions are minimal. News trading and advisors are allowed. Some plans offer scalable balances and no challenges. Enrollment fees are reimbursable and payouts are made once in two weeks. Trading is performed on МetaТrader 4 and МetaТrader 5. Investors can provide between $100 and $50,000 to the firm. Depending on the amount provided, investors receive up to 30% of the profits of traders that use their funds.

| 💰 Account currency: | USD |

|---|---|

| 🚀 Minimum deposit: | $89 |

| ⚖️ Leverage: | Up to 1:500 |

| 💱 Spread: | No data |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, stocks, indices, metals, energies, and commodities |

| 💹 Margin Call / Stop Out: | No data |

👍 Advantages of trading with Auto Prop Trader:

- Five plans with different conditions and balances, including plans with no challenges.

- Traders can get up to $200,000 in real accounts and trade with minimal restrictions.

- The firm allows using advisors and bots, trading news, and holding positions open overnight or over the weekend.

- Clients keep 80% of profits without additional conditions (except the “Simple” plan).

- The company cooperates with some of the top brokers such as Exness, FBS, FXTM, JustForex, and OctaFx;

- Users can trade currencies, cryptocurrencies, stocks, indices, metals, and energies with up to 1:500 leverage;

- Reasonable requirements. For example, traders can retry to pass challenges an unlimited number of times.

👎 Disadvantages of Auto Prop Trader:

- Although the firm offers several plans, balance scaling is somewhat inconvenient. For example, on the “Simple” plan, it is $50,000, $100,000, and $200,000;

- Tech support works promptly, but the call center may be overloaded during certain hours and clients may have to wait a long time for responses.

- Only MetaTrader 4 and MetaTrader 5 are presently available.

Evaluation of the most influential parameters of Auto Prop Trader

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of Auto Prop Trader

Auto Prop Trader differs from its competitors quite considerably. This firm is young, but it has already become reputable, largely due to its cooperation with Exness, JustForex, OctaFx, FBS, and FXTM. These are widely known and reliable brokers that hold licenses from international regulators. Partnership with five brokers is a big advantage of Auto Prop Trader. It means that traders get the most favorable spreads and trading fees and have access to a wide range of instruments. Importantly, when registering, a trader chooses a broker with which to open an account.

As far as proprietary trading goes, Auto Prop Trader offers many benefits. There are four account types with balances ranging between $5,000 and $200,000. The minimum enrollment fee is just $89, which is much lower than most of its competitors. On some plans, there are no challenges, but the enrollment fees are significantly higher and the limits are stricter. Nevertheless, irrespective of the account type, a trader has to watch only three parameters: daily drawdown, overall drawdown, and the number of active days per cycle. A day with at least one open trade is considered active.

Clients can trade on MetaTrader 4 or 5 and use a mobile app. In most cases, this is a plus, but some traders think that the unavailability of other platforms like cTrader, rTrader, or NinjaTrader is a negative. Technical support works 24/7, however, its call center is quite often overloaded because of a large number of calls. Such a problem never occurs with live chat or email, but responses by email are not that prompt.

Finally, there is a partnership for investors. You don’t have to be a legal entity to provide your capital to the company. Private individuals can do it as well. The minimum investment amount is $100, and the maximum amount is $50,000. Except for transferring funds to a specified account, Auto Prop Trader’s partner does not need to do anything. He just looks at the dashboard to see how traders use his funds and monitors the accrual of up to 30% of their profits in his account. Very few prop trading firms offer such a unique opportunity.

Dynamics of Auto Prop Trader’s popularity among

Traders Union’s traders, according to 2023 data

Investment Programs, Available Markets and Products of the Broker

Auto Prop Trader aims to raise additional funds so that more of its clients can trade various financial instruments. This is why the company offers a favorable solution, allowing investors to earn a good passive income.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Auto Prop Trader’s investment program:

When registering, choose an investing, not a trading account. Include the amount of funds with which you are ready to provide traders (later, you can add more funds). Transfer the specified amount to the company’s account and you don’t have to do anything else. On your user account’s dashboard, you can watch traders use your capital and your profit accrue. Investors get up to 30% of traders’ earnings. Withdrawals can be made once in two weeks through a channel that’s convenient for you.

Trading Conditions for Auto Prop Trader Users

The enrollment fee depends on the account type and balance. A trader selects them himself and therefore knows exactly what his expenses will be. Compared to prices at other prop firms, $89 for a standard account with a balance of $10,000 is objectively favorable. Leverage is available for all instrument types and varies depending on two factors: asset and broker, with which the firm’s client trades. The highest leverage is provided for currency pairs. Tech support can be contacted via phone, email, or live chat. All communication channels are available 24/7, which makes cooperation with the company a lot more comfortable.

$89

Minimum

deposit

1:500

Leverage

24/7

Support

| 💻 Trading platform: | МТ4, МТ5 |

|---|---|

| 📊 Accounts: | Simple, Instant, Evaluation, Factual, Investment |

| 💰 Account currency: | USD |

| 💵 Replenishment / Withdrawal: | Bank transfers, bank cards, or electronic wallets |

| 🚀 Minimum deposit: | $89 |

| ⚖️ Leverage: | Up to 1:500 |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | No data |

| 💱 Spread: | No data |

| 🔧 Instruments: | Currency pairs, cryptocurrencies, stocks, indices, metals, energies, and commodities |

| 💹 Margin Call / Stop Out: | No data |

| 🏛 Liquidity provider: | No data |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | No |

| 📋 Orders execution: | No data |

| ⭐ Trading features: | Five plans; balances of up to $200,000; refundable enrollment fees; cooperation with five brokers; almost all types of financial instruments; access to investing |

| 🎁 Contests and bonuses: | Yes |

Comparison of Auto Prop Trader to other prop firms

| Auto Prop Trader | Topstep | FTMO | Funded Trading Plus | The Funded Trader | The Trading Pit | |

| Trading platform |

MT4, MT5 | Deriv Trader, TSTrader, NinjaTrader, TradingView, Bookmap X-ray, Cunningham Trading Systems, DayTradr, InvestorRT, MotiveWave, MultiCharts, Rithmic R|TRADER Pro, Trade Navigator, Volfix.net | MetaTrader4, MetaTrader5, cTrader | MetaTrader4, MetaTrader5 | MetaTrader5, MetaTrader4, TradingView | MetaTrader4, MetaTrader5, BOOKMAP, R Trader, QUANTOWER |

| Min deposit | $80 | $1 | $155 | $119 | $189 | $99 |

| Leverage |

From 1:1 to 1:500 |

From 1:1 to 1:100 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:200 |

From 1:1 to 1:30 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | 1% / 1% | 50% / 50% | No | No | No |

| Execution of orders | N/a | ECN | Instant Execution | Market Execution | N/a | No |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Prop firms’ comparative table by trading instruments

| Auto Prop Trader | Topstep | FTMO | Funded Trading Plus | The Funded Trader | The Trading Pit | |

| Forex | Yes | No | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | Yes | No | Yes | Yes | Yes | Yes |

| CFD | Yes | No | Yes | Yes | No | Yes |

| Indexes | Yes | No | Yes | Yes | Yes | Yes |

| Stock | Yes | Yes | Yes | No | No | Yes |

| ETF | No | No | No | No | No | No |

| Options | No | No | No | No | No | No |

Auto Prop Trader Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Simple | Set by brokers | No |

| Instant | Set by brokers | No |

| Evaluation | Set by brokers | No |

| Factual | Set by brokers | No |

The fees don’t depend on account types or balances. It means, for example, that for users who trade currency pairs on the Evaluation and Factual accounts using the Exness broker, the fees are equal in the same situations.

Detailed review of Auto Prop Trader

Experts often state that it is better to trade with companies that have been in the market for many years. However, proprietary trading is going through another wave of popularity, and new firms now successfully compete with old-timers, despite their youth. Auto Prop Trader is one such firm. From the start, it managed to garner the support of five of the top brokers, including the legendary Exness and FBS. Besides that, the company decided to provide users with its own capital and implemented its Investment account that lets everyone invest from $100 in successful traders. Presently, Auto Prop Trader’s trading conditions are entirely competitive.

Auto Prop Trader by the numbers:

-

346 confirmed active accounts;

-

46 funded professional traders;

-

up to 80% of profit is kept by clients;

-

$200,000 can be provided from the start;

-

up to 30% of traders’ profits go to investors.

Auto Prop Trader provides funds for trading currencies, cryptocurrencies, stocks, and other instruments

Proprietary trading firms often focus on a particular group of financial instruments. Usually, it's currency pairs to which a limited number of stocks and cryptocurrencies is sometimes added. Auto Prop Trader cooperates with five brokers at once ꟷ Exness, FBS, FXTM, JustForex, and OctaFx ꟷ and they provide access to the most popular assets, namely currency pairs, cryptocurrencies, stocks, indices, metals, commodities, and energies. Why is it an advantage? First, a trader gets all instruments he is used to trading and doesn’t need to limit himself. Second, the more assets are available, the easier it is to diversify risks. The latter is necessary, as the company provides up to 1:500 leverage that carries not only a higher profit potential but also a greater danger.

Useful features of Auto Prop Trader:

-

Users can get maximally individualized accounts by selecting one of four trading accounts with various balance options.

-

Users can select an investment account. The minimum investment is $100, all data about funds are displayed on the dashboard, and investors earn up to 30% monthly.

-

There are almost no restrictions on trading. You have to trade at least three days per month and monitor overall and daily drawdowns.

Advantages:

the minimum enrollment fee is just $89 (for a balance of $10,000). There are plans with monthly fees;

traders can get balances of up to $200,000 right away, and there are plans without challenges;

if a trader fails a challenge, he can retry for free any number of times;

you can hold trades open overnight or over the weekend, trade news, and apply to hedge;

the company’s tech support is deemed one of the best and is available via phone, email, and live chat.

Guide on how traders can start earning profits

For those who are beginning to cooperate with the firm, the most important thing is to choose the right account type and balance. The Simple account is suitable for novice traders or more experienced players who want to test the company. The Instant account is different in that it offers higher enrollment fees and no challenge. Factual and Evaluation accounts are optimal in most cases. The Investment account, as is clear from its name, is meant for those who want to invest their funds in other users’ trading. This option is offered by very few prop firms. Note that you can have several accounts and connect them all to one dashboard.

Account types:

Auto Prop Trader offers many account types and balance options, so don’t hurry to make a choice. On the company’s website, you can learn all the details about each account and compare them.

Investment Education Online

Proprietary trading firms want their clients to improve their skills because the more proficient traders can trade, the more income the firm gets. For this reason, many companies provide educational content and conduct webinars to improve their traders’ qualifications. However, Auto Prop Trader has a different approach.

The prop firm supposes that its clients are quite experienced market participants and don’t need to be educated. Nevertheless, the blog on the website regularly publishes articles that can be useful for traders with any experience.

Security (Protection for Investors)

Proprietary trading firms do not route their traders’ transactions to the market. Brokers do. Therefore, Auto Prop Trader only needs an official registration, and obtaining a special license is not necessary. Exness, FBS, FXTM, JustForex, and OctaFx brokers are Auto Prop Trader’s partners. These are large and well-known market participants, and all of them are licensed (information about their licenses is on their websites, usually in the footers or special sections).

👍 Advantages

- Traders can always contact the firm’s legal department

- Traders can send direct messages to the brokers with whom they have accounts

- Traders can send requests to international regulators of the brokers

👎 Disadvantages

- If a trader is not from Singapore where the prop firm is registered, there are no local protection mechanisms for him

Withdrawal Options and Fees

-

Withdrawal requests cannot be submitted more often than once in 14 days.

-

Making requests requires traders to contact tech support.

-

Funds can be withdrawn through all primary channels, including bank cards and crypto or electronic wallets.

Customer Support Service

Auto Prop Trader’s tech support is deemed one of the promptest and the most competent. It is available 24/7, including holidays, and can be contacted through all primary channels.

👍 Advantages

- You don’t need to be a registered user of the firm to contact its tech support

- Responses from the call center and live chat are almost always quick

👎 Disadvantages

- At peak hours, you sometimes have to wait a long time for a response by phone

You can contact Auto Prop Trader’s technical support via the following channels:

-

call center;

-

email;

-

live chat on the company’s website.

TU also recommends subscribing to the firm’s official Twitter to always know the latest news.

Contacts

| Foundation date | 2022 |

| Registration address | 168 Robinson Road, Singapore 068912 |

| Official site | https://autoproptrader.com/ |

| Contacts |

Email:

support@autoproptrader.com,

|

Review of the Personal Cabinet of Auto Prop Trader

To start cooperating with Auto Prop Trader, you need to register on its official website, choose a plan and pay an enrollment or monthly fee. TU has prepared the below step-by-step guide for your convenience.

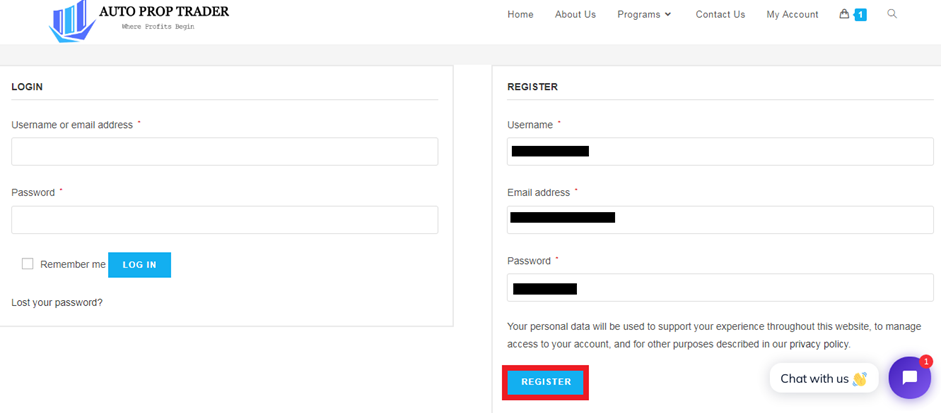

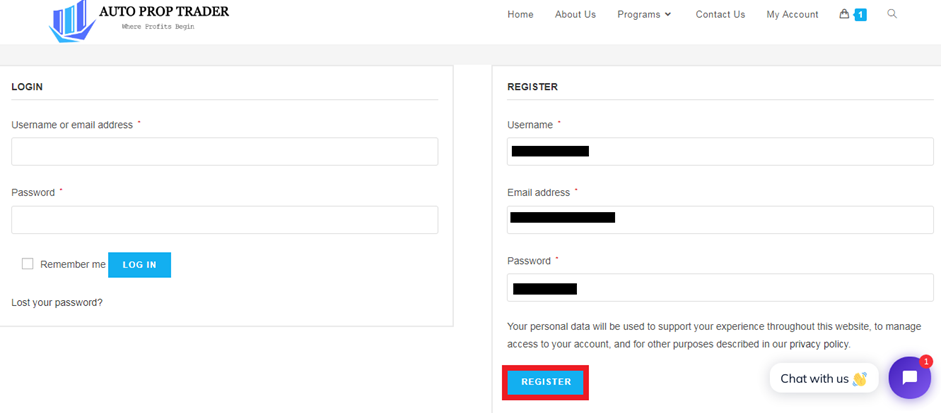

Go to the Auto Prop Trader website and click “My Account” in the top right corner of the screen.

If you already have an account, log in to it. If you don’t, enter the required details in the right-hand window. By clicking the “Register” button, you automatically accept Auto Prop Trader’s terms of service.

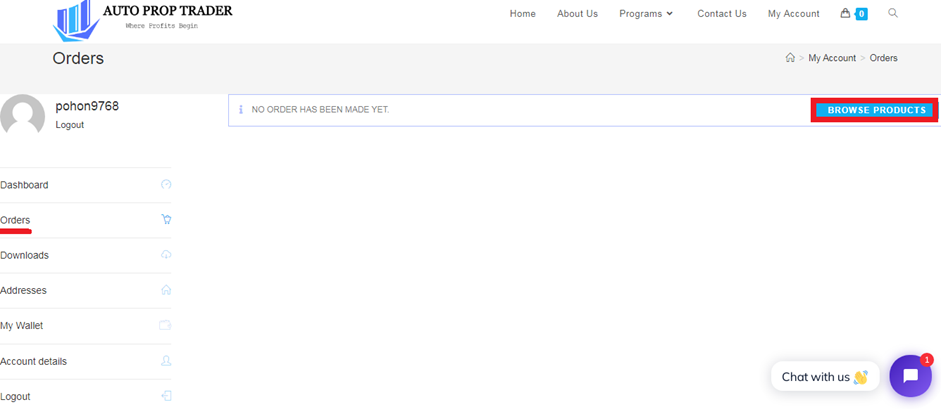

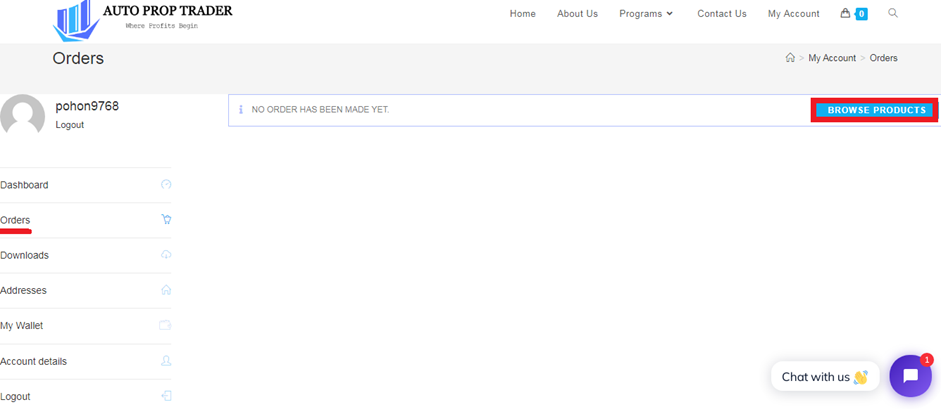

You have logged in to your Auto Prop Trader user account. Go to “Orders”, then click the “Browse Products” button. Review the account types offered, choose a suitable one, and pay for it as per the on-screen instructions. As soon as the firm gets your payment, you will be able to start the challenge or trade on a real account if the plan you chose does not include a challenge.

Features of Auto Prop Trader’s user account:

-

Dashboard displays primary data on active accounts.

-

Orders. Here a trader can choose new accounts and pay for them.

-

Downloads display a list of active accounts with progress in challenges.

-

Addresses. In this section, you include your billing address and delivery address.

-

My wallet. Here you can set up e-wallets and monitor transactions.

-

Account details. Edit the details of your profile.

Disclaimer:

Your capital is at risk. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. A high percentage of retail investor accounts lose money when trading CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Articles that may help you

FAQs

How do client reviews impact Auto Prop Trader rating?

Any review can raise or lower the rating of any company in the Forex prop firms rating. To read reviews about Auto Prop Trader you need to go to the company's profile.

How can I leave a review about Auto Prop Trader on the Traders Union website?

To leave a review about Auto Prop Trader , you need to register on the Traders Union website.

Can I leave a comment about Auto Prop Trader if I am not a Traders Union client?

Anyone can post a comment about Auto Prop Trader in any review about the company.

Traders Union Recommends: Choose the Best!