deposit:

- £109

Trading platform:

- MetaTrader5

- FCA

deposit:

- £109

Trading platform:

- MetaTrader5

- Copy trading and arbitrage trading are prohibited

- Up to 1:33 (for intraday trading);up to 1:10 (for other strategies)

Summary of City Traders Imperium Trading Company

City Traders Imperium is a moderate-risk prop trading firm with the TU Overall Score of 5.45 out of 10. Having reviewed trading opportunities offered by the company and reviews posted by City Traders Imperium clients on our website, Traders Union expert Anton Kharitonov recommends users to thoroughly analyze pros and cons before opening an account with this firm as not all clients are satisfied with the company, according to reviews. City Traders Imperium ranks 21 among 40 companies featured in the TU Rating, which is based on the evaluation of 100+ criteria and a test on how to open an account.

City Traders Imperium is a prop firm for education and funding for professional Forex trading.

City Traders Imperium is an educational and prop (proprietary) firm established in 2018 in the UK by two professional traders. Clients who have completed the evaluation stage and are funded by City Traders Imperium can receive a profit split from 70% to 100% when they trade successfully. The firm gives its own capital only to active market participants who trade themselves and do not copy the trades of other traders. City Traders Imperium offers plans for intraday trading and long-term strategies. A direct funding program is also available.

| 💰 Account currency: | GBP, USD |

|---|---|

| 🚀 Minimum deposit: | £109 |

| ⚖️ Leverage: | Up to 1:33 (for intraday trading);up to 1:10 (for other strategies) |

| 💱 Spread: | From 1 pips |

| 🔧 Instruments: | CFDs on currency pairs (28), indices (9), gold, silver, and oil |

| 💹 Margin Call / Stop Out: | Not available |

👍 Advantages of trading with City Traders Imperium:

- the firm works with traders from more than 60 countries, including the USA;

- variety of financing plans with evaluation terms up to 12 months;

- one-time subscription fee for the selected tariff plan;

- MetaTrader platform for trading activity;

- payments up to 100% of the net profit for transactions;

- opportunity to trade with leverage;

- availability of high-quality training, such as full-fledged courses, individual lessons with a personal mentor, etc.

👎 Disadvantages of City Traders Imperium:

- There are restrictions on trading strategies and styles. Martingale, copy trading, high-frequency, and arbitrage trading are prohibited;

- The choice of assets is less than that of its competitors. Trading cryptocurrencies, CFDs on stocks, commodities, and exotic currency pairs are not available;

- No demo account. To test the trading conditions, you need to pay a subscription fee.

Evaluation of the most influential parameters of City Traders Imperium

Trade with this prop-trading company, if:

- You prefer flexibility and quick funding. With CTI, you have the flexibility to trade at your own pace, and if you meet their criteria, you could even get funded on the same day. This lack of a minimum trading requirement provides traders with more freedom and control over their trading activities.

Do not trade with this prop-trading company, if:

- You lack trading experience, as beginners with no prior trading experience might find it challenging to navigate the complexities of trading without foundational knowledge. It's advisable for novice traders to build their skills and understanding of the markets elsewhere before applying for a funded account with CTI.

Table of Contents

- Geographic Distribution

- Latest Comments

- Expert Review

- Latest City Traders Imperium News

- Analysis of City Traders Imperium

- Dynamics of the Popularity

- Investment Programs

- Trading Conditions

- Commissions & Fees

- Detailed Review

- Client Area of City Traders Imperium

- User Reviews of City Traders Imperium

- FAQs

- TU Recommends

Geographic Distribution of City Traders Imperium Traders

Popularity in

User Satisfaction i

Share your experience

- Best

- Last

- Oldest

Expert Review of City Traders Imperium

City Traders Imperium is a prop firm. It offers trading education and gives funds to traders in exchange for a share of the profits they make from trading on the financial markets. Prop trading is a mutually beneficial trading method for both parties. It gives traders the opportunity to use a larger amount of funds for transactions and to reduce risks, because if they complete the evaluation, they will be able to trade with the firm’s funds instead of their own. City Traders Imperium gives up to $4,000,000 to each trader.

In order to get funded by the prop firm, traders must first choose a plan and pay for it, and then prove their expertise on a virtual deposit account. After completing the qualification stage, that is, confirming the ability to trade in compliance with the conditions of City Traders Imperium, the firm provides traders with capital for trading in the real market.

City Traders Imperium has an important feature: traders must place a stop loss on every trade in MT5. Trades closed without a stop loss are considered a violation of the trading terms. So these trades are not taken into account when calculating profit and the number of active trading days. If traders could not achieve the required target profit and drawdown indicators for the first time, they can start the evaluation stage again.

Dynamics of City Traders Imperium’s popularity among

Traders Union’s traders, according to 2023 data

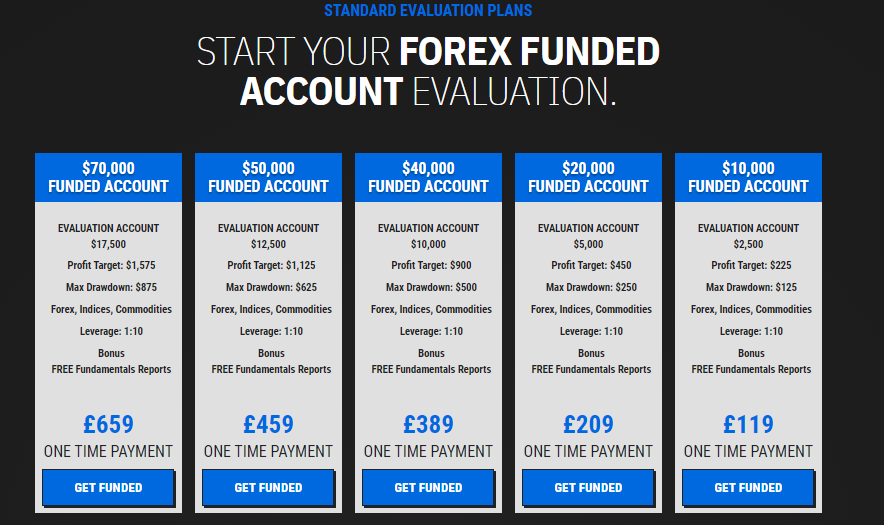

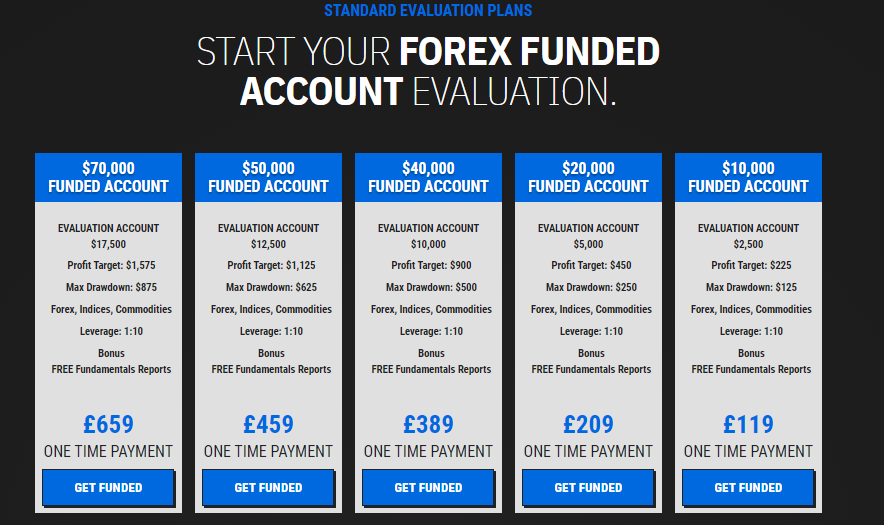

Investment Programs, Available Markets and Products of the Broker

City Traders Imperium is a prop trading firm that provides capital for trading, not for investing. A client who gets funded must trade on Forex independently. It is possible to earn additional passive income by inviting referrals.

City Traders Imperium prohibits copy trading, but duplication of trades from other accounts is allowed. The firm may request a trading account statement to confirm that no third-party signals are used for social trading. City Traders Imperium encourages its clients to trade with different strategies and prohibits copy trading in order to diversify their risks.

Algorithms and advisers are allowed, but there are nuances. Traders can use the trading applications developed by themselves without restrictions. If EAs (expert advisors) were bought or downloaded online, they should not be used here. In this case mirror trading or copy trading become possible on two or more accounts. A client of City Traders Imperium can purchase a ready-made expert advisor (bot) on their website at the price of £109-£449.

If you are a large investor and plan on investments over $10,000, contact us at vip-invest@tradersunion.com or by the feedback form on our website. Our professional team will take you through all the intricacies of the deal and all the steps from signing up to withdrawal of profits.

Partnership program from City Traders Imperium:

Affiliate program. If a referral has paid for any of the Evaluation plans, then 5% of its cost will be received by a trader who invited this referral. If the referral link was used to join the Direct Funding plan, the affiliate is credited with £50 for each active paid registration.

A client of the firm can participate in the referral program at any stage, such as during evaluation, confirmation of qualification, or trading with live money. City Traders Imperium currently uses PayPal as the payment method for affiliate fees.

Trading Conditions for City Traders Imperium Users

City Traders Imperium clients can trade on Forex market with floating spreads starting from 1 pips. The amount of leverage depends on the type of asset and the paid financing plan. To start trading, a trader must make a one-time payment of at least £109. Money can be credited only from bank cards with your name on them. Cryptocurrencies, bank transfers, and online systems are available for withdrawal.

£109

Minimum

deposit

1:33

Leverage

24/5

Support

| 💻 Trading platform: | MetaTrader 5 |

|---|---|

| 📊 Accounts: | Standard, Portfolio Manager |

| 💰 Account currency: | GBP, USD |

| 💵 Replenishment / Withdrawal: | Bank cards, bank transfers, Wise, PayPal, Revolut, Crypto (USDT, Tron, Solana, BNB Smart Chain, and Polygon) |

| 🚀 Minimum deposit: | £109 |

| ⚖️ Leverage: | Up to 1:33 (for intraday trading);up to 1:10 (for other strategies) |

| 💼 PAMM-accounts: | No |

| 📈️ Min Order: | 0.01 |

| 💱 Spread: | From 1 pips |

| 🔧 Instruments: | CFDs on currency pairs (28), indices (9), gold, silver, and oil |

| 💹 Margin Call / Stop Out: | Not available |

| 🏛 Liquidity provider: | Own sources |

| 📱 Mobile trading: | Yes |

| ➕ Affiliate program: | Yes |

| 📋 Orders execution: | Market execution |

| ⭐ Trading features: | Copy trading and arbitrage trading are prohibited |

| 🎁 Contests and bonuses: | Discount coupon |

Comparison of City Traders Imperium to other prop firms

| City Traders Imperium | Topstep | FTMO | Funded Trading Plus | Traddoo | E8 Funding | |

| Trading platform |

MetaTrader5 | Deriv Trader, TSTrader, NinjaTrader, TradingView, Bookmap X-ray, Cunningham Trading Systems, DayTradr, InvestorRT, MotiveWave, MultiCharts, Rithmic R|TRADER Pro, Trade Navigator, Volfix.net | MetaTrader4, MetaTrader5, cTrader | MetaTrader4, MetaTrader5 | MetaTrader4, MetaTrader5 | MT4, MT5 |

| Min deposit | $109 | $1 | $155 | $119 | $99 | $138 |

| Leverage |

From 1:1 to 1:33 |

From 1:1 to 1:100 |

From 1:1 to 1:500 |

From 1:1 to 1:30 |

From 1:1 to 1:30 |

From 1:1 to 1:100 |

| Trust management | No | No | No | No | No | No |

| Accrual of % on the balance | No | No | No | No | No | No |

| Spread | From 1 point | From 0 points | From 0 points | From 0 points | From 0 points | From 0 points |

| Level of margin call / stop out |

No | 1% / 1% | 50% / 50% | No | No | No |

| Execution of orders | Market Execution | ECN | Instant Execution | Market Execution | No | No |

| No deposit bonus | No | No | No | No | No | No |

| Cent accounts | No | No | No | No | No | No |

Prop firms’ comparative table by trading instruments

| City Traders Imperium | Topstep | FTMO | Funded Trading Plus | Traddoo | E8 Funding | |

| Forex | Yes | No | Yes | Yes | Yes | Yes |

| Metalls | Yes | Yes | Yes | Yes | Yes | Yes |

| Crypto | No | No | Yes | Yes | Yes | Yes |

| CFD | Yes | No | Yes | Yes | Yes | Yes |

| Indexes | Yes | No | Yes | Yes | Yes | Yes |

| Stock | No | Yes | Yes | No | Yes | Yes |

| ETF | No | No | No | No | No | No |

| Options | No | No | No | No | No | No |

City Traders Imperium Commissions & Fees

| Account type | Spread (minimum value) | Withdrawal commission |

| Standard | From $10 | Withheld by banks and payment systems |

| Portfolio Manager | From $10 | Withheld by banks and payment systems |

When transferring a transaction to the next trading day, a swap (overnight) fee is charged.

Detailed review of City Traders Imperium

City Traders Imperium aims to make professional trading accessible to anyone. The firm offers full training in Forex trading, as well as inexpensive tariff plans for beginning CFDs traders. City Traders Imperium is registered in the UK but provides services to traders from many jurisdictions that allow CFD trading.

City Traders Imperium by the numbers:

-

Over 8,000 members in the Discord community;

-

Each trader is funded with up to $4,000,000;

-

4 tariff plans with varying conditions are available;

-

Offers 33 successful strategies developed by the firm’s experts.

City Traders Imperium is a prop firm that provides funds for Forex trading

Traders funded by City Traders Imperium can trade all major currency pairs and more than 20 minor currency pairs. Trading commodities such as oil, gold, and silver is available. You can also earn on the price movement of stock indices such as S&P 500, DAX, AUS200, US100, and UK100. Clients of City Traders Imperium can use VPS (Virtual Private Server) for their expert advisors. The firm’s server is located in Amsterdam, so traders are advised to choose a VPS location in this region in order to trade with minimal delay.

At the moment, clients of City Traders Imperium can trade exclusively in MetaTrader 5. Versions for Windows and macOS are available. It is allowed to use EAs and algorithmic programs, but only those that are not intended to copy someone else's trades.

Useful services of City Traders Imperium:

-

Blog. It presents useful articles for Forex traders. A section with technical analysis is also available;

-

Community on Discord. Its participants can exchange instant messages and have voice and video conferences;

-

Helpful tips. On the firm's website, you can find information about brokers with the lowest spreads and fees, as well as the best VPS for advisors and software for backtesting;

-

Fundamental analysis. This includes weekly market reviews, reports with financial performance of firms, and trading ideas for currencies, commodities, and indices. The monthly fee for this information is £19, but a free 14-day trial period is available.

Advantages:

Any retail trader who has proven the ability to trade within the required drawdown and profit levels is eligible to get funded by the firm;

Financing programs are available for different categories of traders, including professionals in CFD trading;

Positions hedging, algorithmic trading using expert advisors, and news trading are allowed;

Clients have access to fresh analytics, recommendations from trading professionals, and communication with other City Traders Imperium members;

The subscription fee for joining the programs is charged once, and not monthly, as with other prop firms.

Clients can leave positions open over the weekend as there are no time limits to hold positions in all City Traders Imperium funding programs.

Guide on how traders can start earning profits

To get funded by City Traders Imperium, you need to select and pay for one of the tariff plans. They differ in the cost of subscription, the profit split, requirements for drawdown and profitability, and the amount of available leverage.

Financing program types:

City Traders Imperium does not offer free trials. However, you can pay for the cheapest plan and test the trading conditions on it. In this case, a trader risks only the deposited subscription fee, because trading is carried out on a demo account at the first stage.

City Traders Imperium is a prop firm that offers a wide range of financing programs with various conditions.

Investment Education Online

City Traders Imperium is interested in attracting experienced market participants, which is why its website provides training in professional trading. In addition to an introductory course on Forex trading, the firm’s clients get access to paid courses, seminars, and webinars, as well as to the analysis of unique profitable strategies.

Clients can request personal mentoring from the firm. The price of the service is £2,499. Help from the mentors is not limited in time, so traders can access them throughout their trading activities.

Security (Protection for Investors)

The firm’s legal name is City Traders Imperium Limited. Its registration number in the UK is 11463147. It is not licensed by any financial regulator, as well as the British FCA (the Financial Conduct Authority).

Brokers accept and keep deposits of traders. City Traders Imperium is a prop firm, its clients do not deposit their own funds, therefore, they cannot lose them.

👍 Advantages

- Clients do not use their own funds, there is no risk of loss

- Brokers recommended by City Traders Imperium are licensed

- Simple account opening and confirmation of new user accounts

👎 Disadvantages

- The prop firm is not responsible for traders’ funds. It’s the broker’s responsibility

- Traders can pay the subscription fee only from their personal bank card

- Financial regulators do not track the activity of City Traders Imperium

Withdrawal Options and Fees

-

Traders cannot withdraw money they used to pay the subscription fee. They can only withdraw profits earned after they complete the (i) evaluation and (ii) qualification stages and start trading with live funds provided by the firm;

-

To submit a withdrawal request, send an email to funding@citytradersimperium.com stating your account number and the withdrawal amount. All positions must be closed;

-

Withdrawal conditions depend on the financing plan. Withdrawal of profits under Standard and Classic Evaluation plans is possible only when a target profit of 50% is achieved. Money is credited in one payment to the card which was used to pay the subscription fee;

-

Portfolio managers and traders who have chosen Direct Funding can withdraw money after the net profit exceeds the initial payment amount. Available withdrawal methods are bank transfers, Wise, Revolut, and PayPal;

-

New participants of the Day Trading Challenge can withdraw profit after a month of trading on a live account, but if the target profit of 15% is achieved, the profit can be withdrawn earlier. Also, after achieving the target profit of 15%, withdrawal becomes available every two weeks, and not once a month. After 4 months of successful trading without violations of the requirements and submitting four withdrawals, a trader can withdraw profits every Friday;

-

Withdrawal in USDC cryptocurrency is available on the Polygon/Matic network. Money is credited to the wallet within 24-48 hours from of the moment the withdrawal request is submitted.

Customer Support Service

The firm’s support is available 24/5.

👍 Advantages

- Live chat is available

👎 Disadvantages

- Responses via email take up to 2 days

- No telephone communication

Means of communication between funded traders and City Traders Imperium are:

-

online chat;

-

email;

-

Discord.

Live chat is not available on Saturday, Sunday, and public holidays, however, a trader can leave a request for an email response. Operators respond within the business hours of the firm.

Contacts

| Foundation date | 2018 |

| Registration address | City Traders Imperium Limited, 124 City Rd, EC1V 2NX, London, UK |

| Regulation |

FCA |

| Official site | https://citytradersimperium.com/ |

| Contacts |

Email:

ctisupport@citytradersimperium.com,

|

Review of the Personal Cabinet of City Traders Imperium

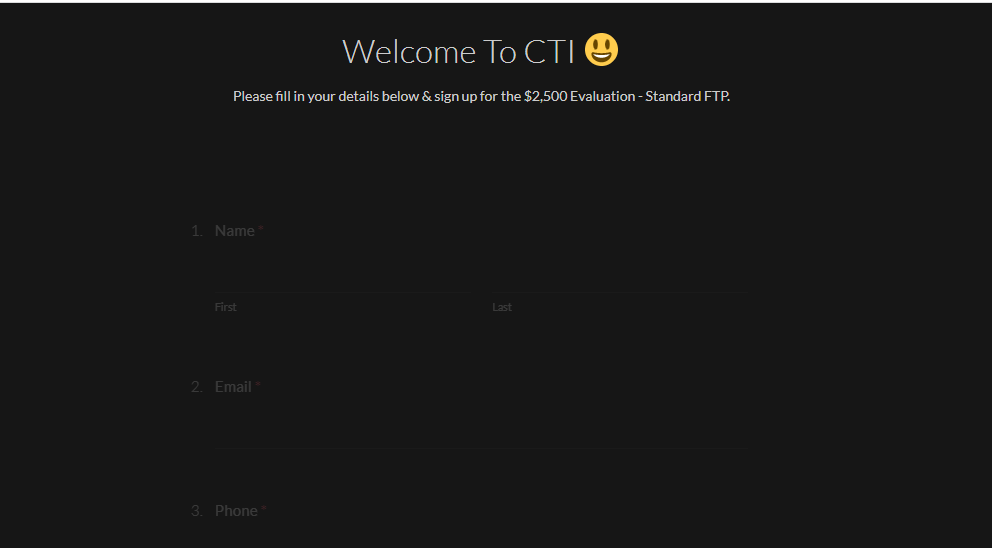

User accounts are created when clients register on the firm’s official website as they follow the procedure below:

Go to the website and click the “Funding Programs” button.

After the desired funding program has been selected, click “Get Funded”.

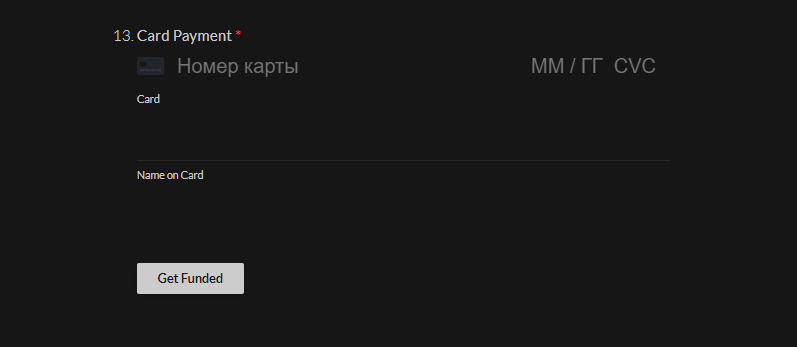

The first step of registration is to enter your first and last names, email address, and phone number. Also indicate your experience of trading on financial markets, your address, and country of residence, and then agree to the terms of service.

The final stage is payment for the selected tariff plan. After that, the firm sends a username and password for authorization in the user account to the email specified during registration.

Articles that may help you

FAQs

How do client reviews impact City Traders Imperium rating?

Any review can raise or lower the rating of any company in the Forex prop firms rating. To read reviews about City Traders Imperium you need to go to the company's profile.

How can I leave a review about City Traders Imperium on the Traders Union website?

To leave a review about City Traders Imperium , you need to register on the Traders Union website.

Can I leave a comment about City Traders Imperium if I am not a Traders Union client?

Anyone can post a comment about City Traders Imperium in any review about the company.

Traders Union Recommends: Choose the Best!