Two Key Habits You Must Develop To Become A Winning Trader

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Winning traders share certain common traits, or characteristics, that are key elements to their success. Two of these critical traits are the ability to accept the risk that is inherent in trading, and having a willingness to believe what the market’s price action is telling you. Developing these traits can help to significantly enhance your chances of enjoying consistent profitability in trading.

Today, I want to talk about two critical traits of winning traders. You might also call them habits, rules, or just guidelines. But whatever you call them, these are two things that you absolutely must have in your trading bag in order to be a winning trader in the financial markets. I can’t envision a winning trader anywhere in the world who lacks these two essential elements to trading success.

So, what are these two all-important traits of market wizards? Well, okay, since you asked nicely, I’ll tell you. Here we go:

The a bility to a ccept r isk.

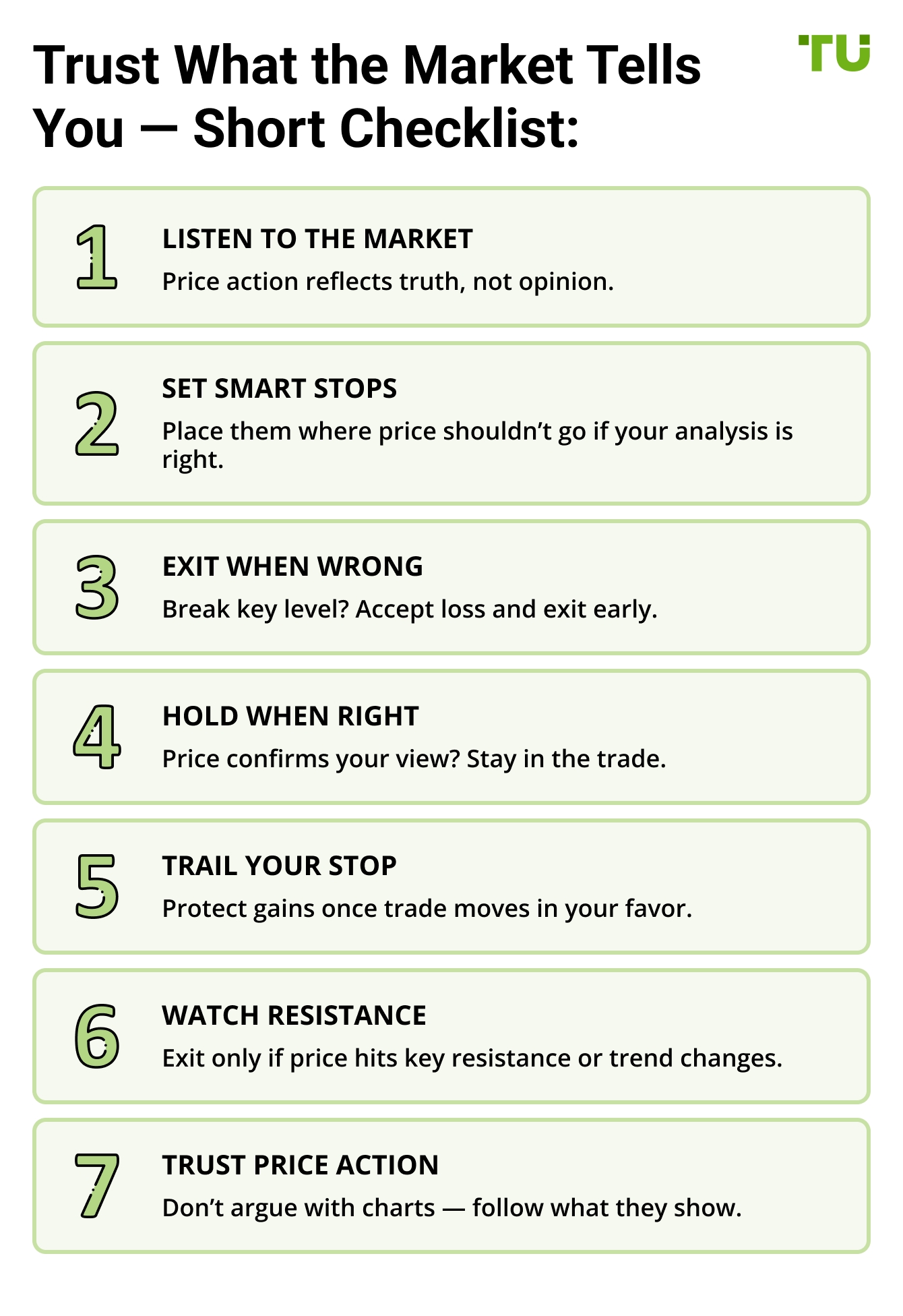

A w illingness to b elieve w hat the m arket is t elling y ou.

Let’s look at each of these traits in turn.

The ability to accept risk

The trading business is a risky business. You can’t make huge piles of money in the financial markets without being willing to risk losing some money. The very reason that it’s possible to earn a much higher return on investment through trading the markets, as opposed to, say, just putting your money in a bank savings account to earn a paltry 1-2% interest, is the presence of risk. Taking on a higher level of risk comes with a correspondingly higher level of potential reward.

If you can’t accept risk, then get out of the trading business. It’s just not for you. Because you will never be a consistently winning trader if you can’t accept the risk of losing. Every time you put on a trade – take a position in a financial market – you are taking the risk of losing money. That’s just the nature of trading. There’s no such thing as a “no risk” trade.

Fact: You will have losing trades. Some of your trades will lose money rather than make money. Every trader, even the very best of them, has losing trades. It is impossible to always accurately predict future market price action, without ever making an error, without ever being wrong.

Winning traders accept the fact that not all of their trades will work, and they’re okay with that fact of trading life. In contrast, losing traders trade as if they expect to be on the right side of the market 100% of the time. That expectation is not based in reality, and, therefore, is sure to lead to trading disasters. Winning traders simply accept losing trades as part of the cost of trading and develop trading strategies that can be profitable overall even if they’re not right 100% of the time.

Accepting the risk that’s inherent in trading will do two very important things for you, things that will help to both enhance your overall profitability and limit your losses. First, traders who accept the basic risk involved in trading aren’t usually hesitant to enter a trade when the market presents a favorable opportunity. Therefore, they are much less likely to miss out on such opportunities. On the other hand, traders who are crippled by a fear of risk often do miss out on very favorable trading opportunities, simply because they’re too afraid of entering the market and risking a loss.

Second, because of the fact that they are keenly aware of the risks inherent in trading, winning traders are commonly much better at keeping their losses small and at a minimum. They know that trading carries a risk of losing money. Because of that fact, they tend to be much better about things such as setting stop loss orders at a reasonable level, or abandoning a trade if the market’s price action begins to appear contrary to their market position or expectation

Traders who have trouble accepting the basic risk of trading often suffer larger losses. Why? – Because their aversion to risk makes them averse to closing out a losing trade, because they don’t want to be confronted once again with the fact that losing trades are part of the game. So, they tend to hang on, hoping against hope that the market will turn around and make their losing trade a profitable one. But, instead, that usually just leads to suffering a bigger loss when they finally give up hope two minutes before the market closes.

A willingness to believe what the market is telling you

The market is always telling us the truth. The only question is whether we recognize and believe the truth that it’s telling.

The market will tell you when you’re wrong. One of the questions I’m often asked is about how/where to put stop loss orders. And that’s a good question, because smart stop placement is essential to successful trading. Well, my standard answer to the question about stops is as follows:

Put your stop loss order at a price level that the market, logically, shouldn’t trade at if your market analysis is correct.

When you put on a trade…actually, even before you put on the trade…think about what the logical conclusions of your market analysis are. For example, based on GBP/USD having made a low at 1.3488 and then, after going up a bit, making a subsequent low at 1.3495 and then turning back to the upside and moving up to 1.3525, your market analysis might be something like, “I think that GBP/USD has made a double bottom around 1.3500, signaling a shift to a bull market and higher prices”. Okay, so if you then enter the market on the long side, it would be reasonable to put your stop loss either a bit below either 1.3495 or 1.3488.

You certainly wouldn’t want to see the market trading at, say, 1.3474. If you do, then the market is, in all likelihood, telling you that your market analysis is incorrect, that GBP/USD hasn’t made a trend change to the upside. Believe what the market is telling you, and get out of that trade while it’s still a relatively small loss.

The market will also tell you when you’re right. Let’s stay with the same scenario on GBP/USD – lows at 1.3488 and 1.3495 – with a bounce back up as high as 1.3525. Now, let’s say that you’re able to buy in on a retrace to 1.3515, and that the market then moves on up to 1.3535. Now, let’s say that it then falls back to 1.3528. Should you close your trade with just a 13-pip profit? – Probably not.

You want to cut your losses short, not your profits. Since you entered the trade, the market’s price action has only served to confirm your market analysis – the market has made a new near-term high, and it hasn’t dropped back to anywhere close to your trade entry price, much less anywhere below it. Be willing to accept the fact that you were right! You might want to move your stop up to around breakeven or a little better but, based on the current price action, the market isn’t signaling a downtrend, it’s signaling an uptrend – the very uptrend that you correctly forecasted.

Therefore, the smart move is more likely to stay in the trade at least until (a) the market encounters some recognized price resistance level, or (b) the market price action changes significantly.

Be willing to believe what you see in market price action. Trust that the market is telling you the truth.

As someone who's spent years analyzing markets and coaching traders, I’ve learned that most aspiring traders don’t fail because they lack technical knowledge — they fail because they cling too tightly to control.

Focus on response over prediction

Let me explain. Markets are dynamic ecosystems, not machines with fixed outputs. The moment you try to impose rigid expectations — expecting a trade must work out because your analysis says so, or refusing to exit because you need to be right — you put yourself on a collision course with volatility.

What has helped me, and what I always tell others, is to focus onresponse over prediction. That means I come into the day prepared with scenarios, yes, but not fixed outcomes. If the market proves me wrong, I don’t see it as a betrayal — I see it as information. I’d rather be wrong and free than “right” and stuck in a losing trade if I didn't exit.

A practical exercise I recommend: at the end of each trading day, don’t just log P&L — rate your flexibility. Did you adjust when new data came in? Did you exit when the evidence turned? Did you let a winner breathe instead of snatching profit out of fear?

When you let go of the illusion of control, you become far more attuned to the truth the market is offering you. And ultimately, that’s what trading is about: truth, not certainty.

Conclusion

One of the best ways to become a consistently profitable, winning trader, is to cultivate the same characteristics that other winning traders have in common. First, accept occasional losing trades as simply a natural part of trading. This will help you relax and make more rational – rather than emotional – trading decisions, thereby contributing to higher earnings in the financial markets. Second, don’t let someone – not even yourself – trick you by yelling at you, “Don’t believe your lying eyes!” Instead, simply see what the market is telling you by its price action, because it’s telling you the truth.

FAQs

Why is understanding and accepting risk so important in trading?

Understanding and accepting risk is critical to trading success because of the basic fact that trading is inherently a risky endeavor. Traders who fail to accept the basic truth about risk in trading are not likely to make the wisest trading decisions.

What are the advantages that come from a clear understanding of market risk?

Having a clear understanding of the nature of risk in trading can endow traders with several important advantages. A proper understanding of market risk can help traders get more favorable trade entry prices, minimize their losses, and maximize their wins.

How can a trader know where to place stop loss orders?

A good rule of thumb in placing initial stop loss orders is to place your stop loss at a price level that the market, logically, shouldn’t trade at if your market analysis is correct. For example, if your market analysis that Aud/Usd has made a bottom at.6750 is correct, then you wouldn’t expect to see it trading below .6730.

Why is market price action so important?

It’s important to closely monitor market price action because the price action in a market reveals the truth about current buying and selling pressure in the market, and about the most probable future price movement. Seeing the truth that price action is telling you will help you more quickly determine if your current market analysis is correct.

Related Articles

Team that worked on the article

Johnathan M. is a U.S.-based writer and investor, a contributor to the Traders Union website. His two primary areas of expertise include finance and investing (specifically, forex and commodity trading) and religion/spirituality/meditation.

His experience includes writing articles for Investopedia.com, being the head writer for the Steve Pomeranz Show, a personal finance radio program on NPR. Johnathan is also an active currency (forex) trader, with over 20 years of investing experience.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Price action trading is a trading strategy that relies primarily on the analysis of historical price movements and patterns in financial markets, such as stocks, currencies, or commodities. Traders who use this approach focus on studying price charts, candlestick patterns, support and resistance levels, and other price-related data to make trading decisions.

Take-Profit order is a type of trading order that instructs a broker to close a position once the market reaches a specified profit level.

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.