Best EV ETFs To Invest In 2025

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Best EV ETFs to invest in 2025 are:

Global X Autonomous & Electric Vehicles ETF (DRIV)

KraneShares Electric Vehicles and Future Mobility ETF (KARS)

SPDR S&P Kensho Smart Mobility ETF (HAIL)

First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN)

ARK Autonomous Technology & Robotics ETF (ARKQ)

First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN)

Global X Lithium & Battery Tech ETF (LIT)

Invesco WilderHill Clean Energy ETF (PBW)

This article provides an in-depth look at the top 8 EV ETFs to consider in 2025, helping both beginner and advanced traders make informed investment decisions.

Best Electric Vehicles (EV) ETFs To Invest In 2025

The following list highlights the top EV ETFs based on performance, expense ratio, and asset allocation. Comparing EV ETFs based on specific metrics helps investors make informed decisions by understanding the strengths and weaknesses of each option.

| ETF Name | Asset allocation | Expense ratio | Assets Under management | Performance metrics |

|---|---|---|---|---|

Global X Autonomous & Electric Vehicles ETF (DRIV) | Diversified across leading EV companies | 0.68% | $1.5 billion | Consistent annual returns |

iShares Self-Driving EV and Tech ETF (IDRV) | Broad exposure to EV and tech firms | 0.47% | $800 million | Strong performance with moderate risk |

KraneShares Electric Vehicles and Future Mobility ETF (KARS) | Focus on high-growth EV and mobility companies | 0.70% | $500 million | High growth potential |

SPDR S&P Kensho Smart Mobility ETF (HAIL) | Innovative transportation technologies | 0.45% | $600 million | Balanced performance |

First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) | Emphasis on clean energy and EV sectors | 0.60% | $1 billion | Strong long-term returns |

ARK Autonomous Technology & Robotics ETF (ARKQ) | High-growth autonomous technology companies | 0.75% | $2 billion | High volatility but high returns |

Global X Lithium & Battery Tech ETF (LIT) | Key battery producers for EVs | 0.75% | $1.2 billion | Essential for EV supply chain |

Invesco WilderHill Clean Energy ETF (PBW) | Clean energy and EV technologies | 0.70% | $900 million | Diverse clean energy investments |

Global X Autonomous & Electric Vehicles ETF (DRIV)

Focuses on companies involved in the development of autonomous vehicle technology, electric vehicles, and related components.

Assets Under Management (AUM): $1.5 billion

Expense ratio: 0.68%

Performance: Annualized return of 23.45% over the past three years.

Holdings: Includes major companies like Tesla, NVIDIA, and Alphabet.

Key features: Low expense ratio, diverse asset allocation, and significant exposure to leading EV companies.

iShares Self-Driving EV and Tech ETF (IDRV)

Invests in companies driving innovation in autonomous and electric vehicle technologies.

Assets Under Management (AUM): $800 million

Expense ratio: 0.47%

Performance: Annualized return of 22.50% over the past three years.

Key features: Broad exposure to global EV and tech firms, moderate expense ratio.

KraneShares Electric Vehicles and Future Mobility ETF (KARS)

Targets companies engaged in the production of electric vehicles, autonomous driving, and shared mobility.

Assets Under Management (AUM): $500 million

Expense ratio: 0.70%

Performance: Annualized return of 28.15% over the past three years.

Holdings: Includes companies like NIO, BYD, and Tesla.

Key features: High-growth potential, global reach, and a focus on future mobility trends.

SPDR S&P Kensho Smart Mobility ETF (HAIL)

Invests in companies focused on smart transportation and mobility solutions.

Assets Under Management (AUM): $600 million

Expense ratio: 0.45%

Performance: Annualized return of 21.80% over the past three years.

Holdings: Includes companies like Aptiv, Garmin, and Uber Technologies.

Key features: Balanced portfolio, exposure to innovative transportation technologies, competitive expense ratio.

First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN)

Includes companies in the clean energy and EV sectors, emphasizing green energy solutions.

Assets Under Management (AUM): $1 billion

Expense ratio: 0.60%

Performance: Annualized return of 30.55% over the past three years.

Holdings: Includes companies like Tesla, ON Semiconductor, and Enphase Energy.

Key features: Strong performance record, diversified holdings, and focus on sustainability.

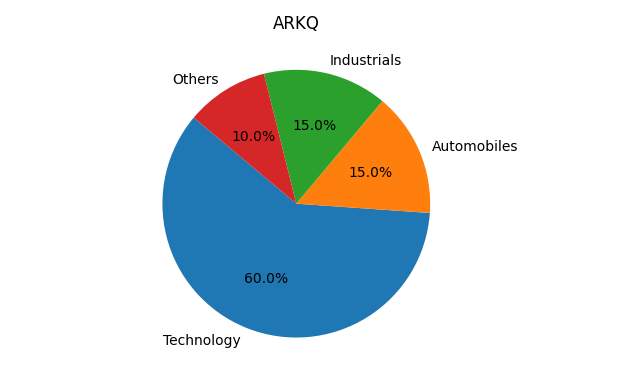

ARK Autonomous Technology & Robotics ETF (ARKQ)

Concentrates on companies developing autonomous technologies and robotics, including EVs.

Assets Under Management (AUM): $2 billion

Expense ratio: 0.75%

Performance: Annualized return of 37.12% over the past three years.

Holdings: Includes companies like Tesla, Trimble, and Baidu.

Key features: Active management, high-growth companies, innovative investment approach.

Global X Lithium & Battery Tech ETF (LIT)

Focuses on the lithium and battery technology industry, essential for EV production.

Assets Under Management (AUM): $1.2 billion

Expense ratio: 0.75%

Performance: Annualized return of 32.40% over the past three years.

Holdings: Includes companies like Albemarle, BYD, and Panasonic.

Key features: Exposure to key battery producers, crucial component of the EV supply chain.

Invesco WilderHill Clean Energy ETF (PBW)

Invests in companies advancing clean energy and EV technologies.

Assets Under Management (AUM): $900 million

Expense ratio: 0.70%

Performance: Annualized return of 25.67% over the past three years.

Holdings: Includes companies like Plug Power, Enphase Energy, and Tesla.

Key Features: Diverse clean energy investments, focus on renewable energy sources.

Key factors reviewers consider when evaluating EV ETFs

Expense ratios. Low expense ratios are critical in maximizing returns, as they represent the annual fees charged by the ETF. For example, the iShares Self-Driving EV and Tech ETF (IDRV) has a relatively low expense ratio of 0.47%, making it an attractive option for cost-conscious investors.

Assets under management (AUM). AUM indicates an ETF's popularity and stability. ETFs like ARK Autonomous Technology & Robotics ETF (ARKQ) with $2 billion in AUM suggest a high level of investor confidence and liquidity.

Performance metrics. Historical performance, volatility, and risk-adjusted returns are essential metrics. For instance, the Global X Lithium & Battery Tech ETF (LIT) has shown consistent growth due to its focus on the essential battery technology sector.

Asset allocation. Understanding the ETF's asset allocation is crucial. Diversification across sectors and companies can reduce risk and improve stability. Pie charts can visually represent how each ETF allocates its investments.

Liquidity. Liquidity measures the ease of buying and selling ETF shares. Highly liquid ETFs like the Global X Autonomous & Electric Vehicles ETF (DRIV) ensure that investors can quickly enter and exit positions without significant price changes.

Risk and warnings

Investors should consider these factors when making investment decisions to better manage potential downsides and enhance their overall investment strategy.

| Risk Type | Description |

|---|---|

Market Risks | Market volatility can significantly impact EV ETFs. Investors should be prepared for fluctuations and consider using risk management strategies to mitigate these risks. |

Regulatory Risks | Changes in government policies and regulations can affect the EV industry. Staying informed about regulatory developments is essential for investors. |

Technology Risks | Technological advancements and competition within the EV sector pose risks. Investors should consider the potential impact of these factors on their investments. |

Investment Risks | General risks associated with ETF investing, such as liquidity risk and tracking errors, should be taken into account. Diversification and careful selection of ETFs can help manage these risks. |

Trader’s costs

Understanding the costs associated with trading EV ETFs is crucial for maximizing your returns. Here are the primary costs you should consider:

Trading fees. Trading fees, which include brokerage fees and management fees, can significantly impact your overall returns. Each time you buy or sell an ETF, you may incur a commission fee from your broker. Additionally, some brokers charge management fees for maintaining your account.

Expense ratios. These fees are expressed as a percentage of your total investment in the ETF. Lower expense ratios mean more of your money stays invested, which can lead to higher returns over time. For example, if an ETF has an expense ratio of 0.50%, you will pay $5 annually for every $1,000 invested.

Hidden costs. These include bid-ask spreads, which are the differences between the buying and selling prices of ETF shares, and other transaction fees. Bid-ask spreads can vary significantly depending on the liquidity of the ETF; more liquid ETFs typically have narrower spreads. Other hidden costs might include fees for currency conversion if you're investing in international ETFs.

| ETFs | Demo | Min. deposit, $ | ECN Commission | Investor protection | Open account | |

|---|---|---|---|---|---|---|

| Yes | Yes | 100 | No | €20,000 £85,000 SGD 75,000 | Open an account Your capital is at risk. |

|

| Yes | Yes | No | 3 | £85,000 €20,000 €100,000 (DE) | Open an account Your capital is at risk.

|

|

| Yes | Yes | 100 | 5 | £85,000 | Study review | |

| Yes | Yes | No | 2 | $500,000 £85,000 | Open an account Your capital is at risk. |

|

| Yes | Yes | 1 | 2,3 | £85,000 €100,000 SGD 75,000 | Study review |

Always look at the historical performance of an ETF

As a professional trader with years of experience in the market, I've seen firsthand the impact of making well-informed investment decisions. As for my practice, you should always look at the historical performance of an ETF. While it's true that past performance doesn't guarantee future results, it can give you a good sense of how the ETF has navigated market ups and downs.

It's also important to understand the underlying holdings of an ETF. Take the time to review what companies and sectors the ETF invests in. For instance, the Global X Lithium & Battery Tech ETF (LIT) focuses on battery producers, a critical component of the EV supply chain. Knowing this helps you understand the ETF’s strategy and potential growth areas.

Remember, the goal is to balance potential returns with an acceptable level of risk, positioning yourself to take full advantage of the growth opportunities in the EV market.

Conclusion

It is crucial for investors to stay informed about market conditions, regulatory changes, and technological advancements in the EV sector. By carefully evaluating these factors and utilizing the provided guidance, investors can position themselves to take advantage of the growth opportunities in the EV market while managing potential risks.

As you consider investing in EV ETFs, remember to balance potential returns with your risk tolerance and investment goals. With the right approach, EV ETFs can be a valuable addition to your investment portfolio, capitalizing on the ongoing transition to clean energy and sustainable transportation.

FAQs

What are EV ETFs?

EV ETFs (Electric Vehicle Exchange-Traded Funds) are investment funds that hold a diversified portfolio of stocks from companies involved in the production and development of electric vehicles and related technologies.

How do EV ETFs work?

EV ETFs work by pooling money from multiple investors to buy a diversified portfolio of EV-related stocks. The ETF shares are traded on stock exchanges, and their prices fluctuate based on the underlying asset value and market demand. Investors can buy and sell ETF shares just like regular stocks.

What are the benefits of investing in EV ETFs?

Investing in EV ETFs offers several benefits, including diversification, professional management, and exposure to the growing EV industry. They also provide a convenient way to invest in multiple EV companies without needing to research and buy individual stocks.

Can I invest in EV ETFs with a small budget?

Yes, many brokers allow you to buy fractional shares of ETFs, enabling you to invest in EV ETFs with a small budget. This makes it accessible for investors with varying levels of capital to gain exposure to the EV market.

Related Articles

Team that worked on the article

Parshwa is a content expert and finance professional possessing deep knowledge of stock and options trading, technical and fundamental analysis, and equity research. As a Chartered Accountant Finalist, Parshwa also has expertise in Forex, crypto trading, and personal taxation. His experience is showcased by a prolific body of over 100 articles on Forex, crypto, equity, and personal finance, alongside personalized advisory roles in tax consultation.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Options trading is a financial derivative strategy that involves the buying and selling of options contracts, which give traders the right (but not the obligation) to buy or sell an underlying asset at a specified price, known as the strike price, before or on a predetermined expiration date. There are two main types of options: call options, which allow the holder to buy the underlying asset, and put options, which allow the holder to sell the underlying asset.

A brokerage fee, also known as a commission, is a fee charged by a brokerage or financial institution for facilitating and executing financial transactions on behalf of clients. Brokerage fees are typically associated with services related to buying or selling assets such as stocks, bonds, commodities, or mutual funds.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.