How Prop Trading Differs From Other Trading Types

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Main differences between prop trading and other types of trading:

- Using company capital: Individuals utilize the capital provided by the company for trading ( up to $500,000)

- Risk and profit sharing: The company takes on the risk but keeps a portion of the profits if your trades are successful (a typical profit split might be 70/30)

- Trading freedom: Prop traders usually have more freedom to make their own trading decisions

- Less supervision: Prop traders often face less oversight compared to other types of traders

Prop trading, or proprietary trading, is a type of trading that is conducted with the firm's own capital . This is in contrast to other types of trading, such as retail trading or institutional trading, which are conducted with client funds.

In this article, we explore the benefits and drawbacks of prop trading. Additionally, we'll explore the individuals or entities for whom prop trading is well-suited, discuss the importance of having a solid understanding of trading strategies, effective risk management techniques, and the ability to handle the pressures and stress that come with prop trading.

Main differences between prop trading and other types of trading

You can find here the most relevant differences between prop trading and other kinds of trading:

| Aspect | Prop trading | Other types of trading |

|---|---|---|

| Capital | Firm's own capital | Client funds |

| Risk | Firm bears the risk | Client bears the risk |

| Reward | Profits generated from trading activities belong to the firm | Profits are retained by the client |

| Freedom | Prop traders typically have more freedom in their trading decisions | Traders may be subject to restrictions on their trading decisions |

| Supervision | Prop traders may have less oversight and supervision compared to other types of traders | Traders may be subject to more supervision from regulatory bodies or employers |

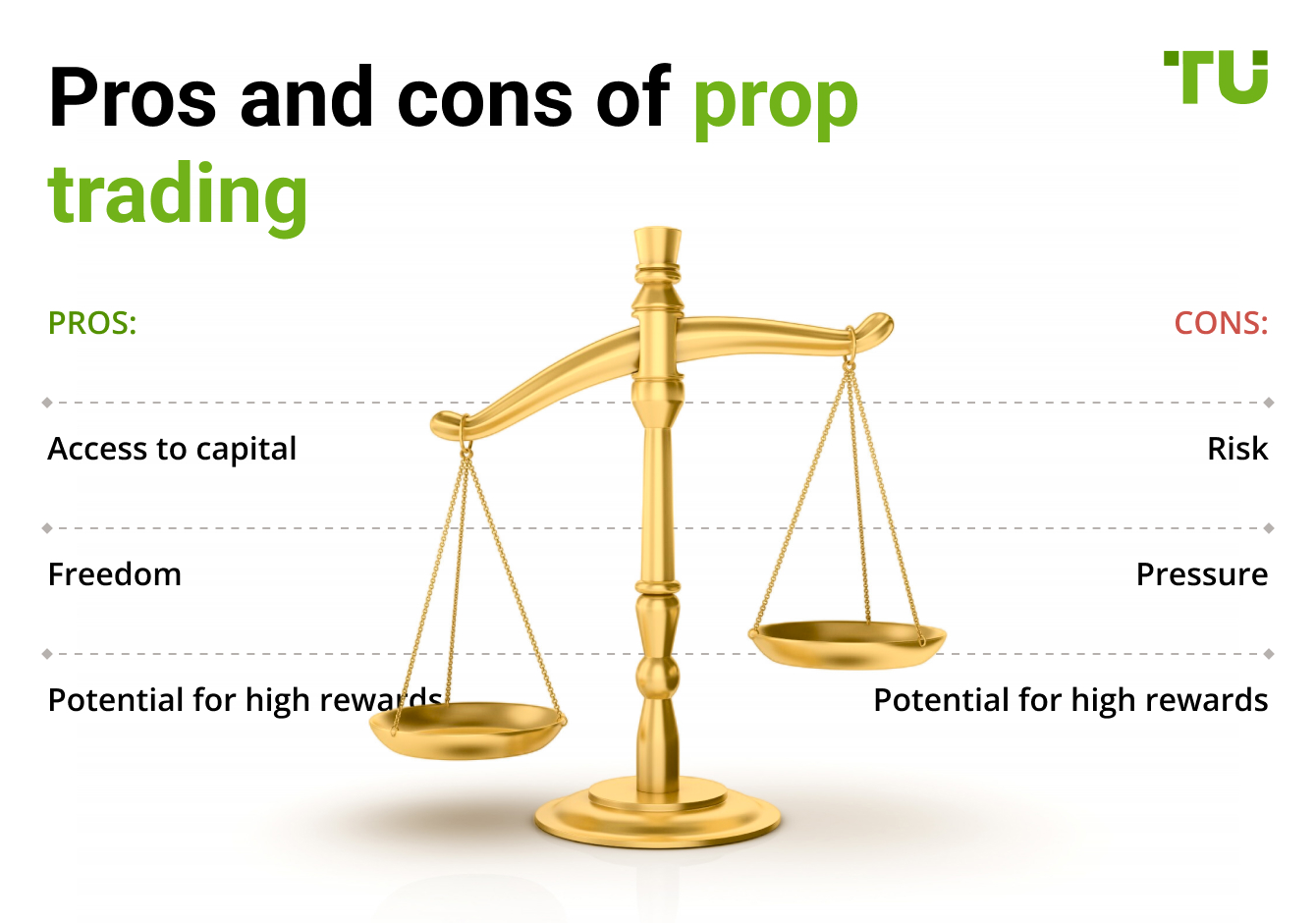

Pros and cons of prop trading

Pros and cons of prop trading- Pros:

- Cons:

- Access to capital : traders have access to significant capital provided by the firm, allowing them to take larger positions and potentially generate higher returns;

- Freedom : prop traders often enjoy a high degree of autonomy, making their own trading decisions and strategies;

- Potential for high rewards : successful traders can earn substantial profits, as they typically receive a percentage of the profits they generate.

- Risk : the potential for significant financial losses is high, as traders are dealing with the firm's capital;

- Pressure : the environment can be highly stressful, with the constant need to make profitable trades and meet performance targets;

- Potential for high rewards : while high rewards are possible, the flip side is that high losses are also a real possibility, adding to the financial pressure.

To learn more advantages and disadvantages of proprietary trading companies, and how their work is organized - read the article Proprietary Trading Explained.

How to choose a prop firm?

An important step in choosing a prop firm is to compare several of them . We have studied the conditions of prop trading firms specializing in providing funding to traders and invite you to review the comparative table:

| Firm Name | Capital Access | Trader Autonomy | Profit-Sharing Structure | Training & Support | Overall Reputation | Open an account |

|---|---|---|---|---|---|---|

| FTMO | Up to $400,000 | High | Up to 90% profit split | Moderate support | Excellent | Open an account Your capital is at risk. |

| Funded Trading Plus | Up to $200,000 | High | Up to 80% profit split | Moderate support | Very Good | Open an account Your capital is at risk. |

| The5ers | Up to $1,280,000 | High | Up to 50% profit split | Comprehensive training | Excellent | Open an account Your capital is at risk. |

| TopStepTrader | Up to $500,000 | High | Up to 80% profit split | Good support | Very Good | Study review |

| Lux Trading Firm | Up to $2,500,000 | High | Up to 75% profit split | Comprehensive training | Excellent | Open an account Your capital is at risk. |

Success demands a comprehensive understanding of the markets

Based on my extensive experience in proprietary trading, I can attest to its inherently high-risk nature. However, it is well-suited for traders with a strong track record, a high risk tolerance, and the ability to operate independently under pressure. Proprietary trading strategies are designed to capitalize on short-term market fluctuations, allowing for quick profit realization without the need for increased market liquidity.

Success in proprietary trading demands a comprehensive understanding of the markets we operate in. Risk management is a critical component of proprietary trading. You must be acutely aware of the risks we undertake and be prepared to accept losses when necessary.

To increase your chances of joining a proprietary trading firm, thorough preparation is crucial. Mastering the intricacies of the role and developing the necessary skills can significantly enhance your prospects. To aid in this preparation, I recommend reading my article " Top 9 Tips for Successful Prop Trading Interviews", which offers valuable insights into how to position yourself for success in this competitive field.

Summary

Though prop trading carries greater risks than other types of trading, it also offers traders the potential to capitalize on short-term opportunities and reap significant rewards. For traders who are willing to take on these risks, prop trading can be a great way to increase their income.

The key to success is to carefully analyze the performance of the trades and understand the risks associated with each trade. It is also important to have a good risk management strategy in place. By taking the time to understand the complexities of prop trading and properly analyze performance, traders can potentially maximize their returns.

FAQs

What is the difference between a prop trader and a retail trader?

A prop trader uses a trading firm's money to trade financial instruments, aiming to make profits for the firm. On the other hand, a retail trader uses their own money to trade, primarily seeking personal profit.

How prop trading differs from retail Forex trading?

Prop trading involves trading with a firm's capital on behalf of a financial institution. In contrast, retail forex trading is done by individuals using their own money to trade currencies. Prop traders generally have access to more resources, tools, and leverage compared to retail forex traders.

Why do traders use prop firms?

Traders use prop firms to access larger amounts of capital, enabling them to make bigger trades and potentially earn higher profits. Additionally, they benefit from better trading infrastructure, educational resources, and lower costs associated with prop trading.

Related Articles

Team that worked on the article

Anastasiia has 17 years of experience in finance and content marketing. She believes that the support of information and expert opinion is very important for the success of investors and new traders. She is ready to share her knowledge of forex, stock and cryptocurrency trading, as well as help choose the right investment products and strategies to achieve active or passive income.

Dr. BJ Johnson is a PhD in English Language and an editor with over 15 years of experience. He earned his degree in English Language in the U.S and the UK. In 2020, Dr. Johnson joined the Traders Union team. Since then, he has created over 100 exclusive articles and edited over 300 articles of other authors.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Proprietary trading (prop trading) is a financial trading strategy where a financial firm or institution uses its own capital to trade in various financial markets, such as stocks, bonds, commodities, or derivatives, with the aim of generating profits for the company itself. Prop traders typically do not trade on behalf of clients but instead trade with the firm's money, taking on the associated risks and rewards.