Are Government Bonds Halal Or Haram In Islam?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Government bonds are often seen as haram in traditional Islamic finance due to their fixed interest (riba) structure. However, Sharia-compliant alternatives like Sukuk have gained acceptance among scholars as halal investments.

The question of are government bonds halal is crucial for Muslim investors looking to stay aligned with Islamic principles. Bonds are common tools for income generation and public funding, but their structure often clashes with Sharia teachings. This article looks into whether they fit Islamic finance, discussing varying views and pointing out Sharia-compliant options like Sukuk.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

What are government bonds?

Government bonds are tools used by governments to borrow money and fund public spending. Investors lend money to the state for a set period and receive interest in return. This setup, while common in global finance, raises concerns under Islamic law due to the presence of riba. A key debate for Muslim investors today is: are national bonds halal or haram? To answer these, let’s first explore the main types of government securities:

Treasury bills (T-bills). These are short-term government debt instruments with maturities of less than a year. They are typically considered low-risk and are often used for quick liquidity needs.

Treasury notes (T-notes). These represent medium-term investments, usually with terms between one and ten years. They pay a fixed rate of interest every six months until maturity.

Treasury bonds (T-bonds). These are long-term securities with terms greater than ten years. They also pay semi-annual interest and are commonly used for stable, long-duration investments.

This interest (riba) makes traditional bonds problematic from a Sharia standpoint.

Why bonds are considered haram

Islam strictly prohibits riba (interest), as stated in several Quranic verses such as Al-Baqarah 2:275–279. Because most government bonds provide a guaranteed return above the principal, they fall under the category of riba-based contracts. This makes them incompatible with Islamic financial principles.

For a deeper understanding of the prohibition of interest and its implications for modern financial tools, explore our article on riba in Islam. The concept is particularly relevant when you are evaluating whether government bonds are halal or haram in Islam?, as the fixed return structure poses a clear conflict with Sharia principles.

Core reasons why conventional bonds are not aligned with Sharia guidelines include:

Fixed interest returns that contradict the concept of risk-sharing

Absence of tangible assets or involvement in productive economic activities

Bonds reflect debt trading, a practice generally discouraged in Islamic finance

Major Islamic scholars and institutions, including AAOIFI and AMJA, have consistently held the view that conventional bonds are impermissible due to their interest-based structure.

Are any types of bonds halal?

While traditional bonds are generally haram due to their reliance on interest (riba), Islamic finance has introduced several halal alternatives to meet the needs of Muslim investors. These include:

Sukuk bonds. Structured around tangible assets, sukuk avoid riba by promoting shared ownership and risk, rather than debt-based returns.

Green Sukuk. Designed to fund environmentally sustainable initiatives while remaining fully compliant with Shariah principles.

Premium bonds. Although resembling traditional prize-based products, they are typically considered haram due to their speculative nature, though scholarly opinions may vary depending on the structure.

Prize bonds. Often classified under maysir (gambling), making them impermissible in most Islamic rulings.

Each type of bond must be carefully evaluated on a case-by-case basis, taking into account its underlying structure, risk-sharing mechanism, and the true source of returns to determine Shariah compliance.

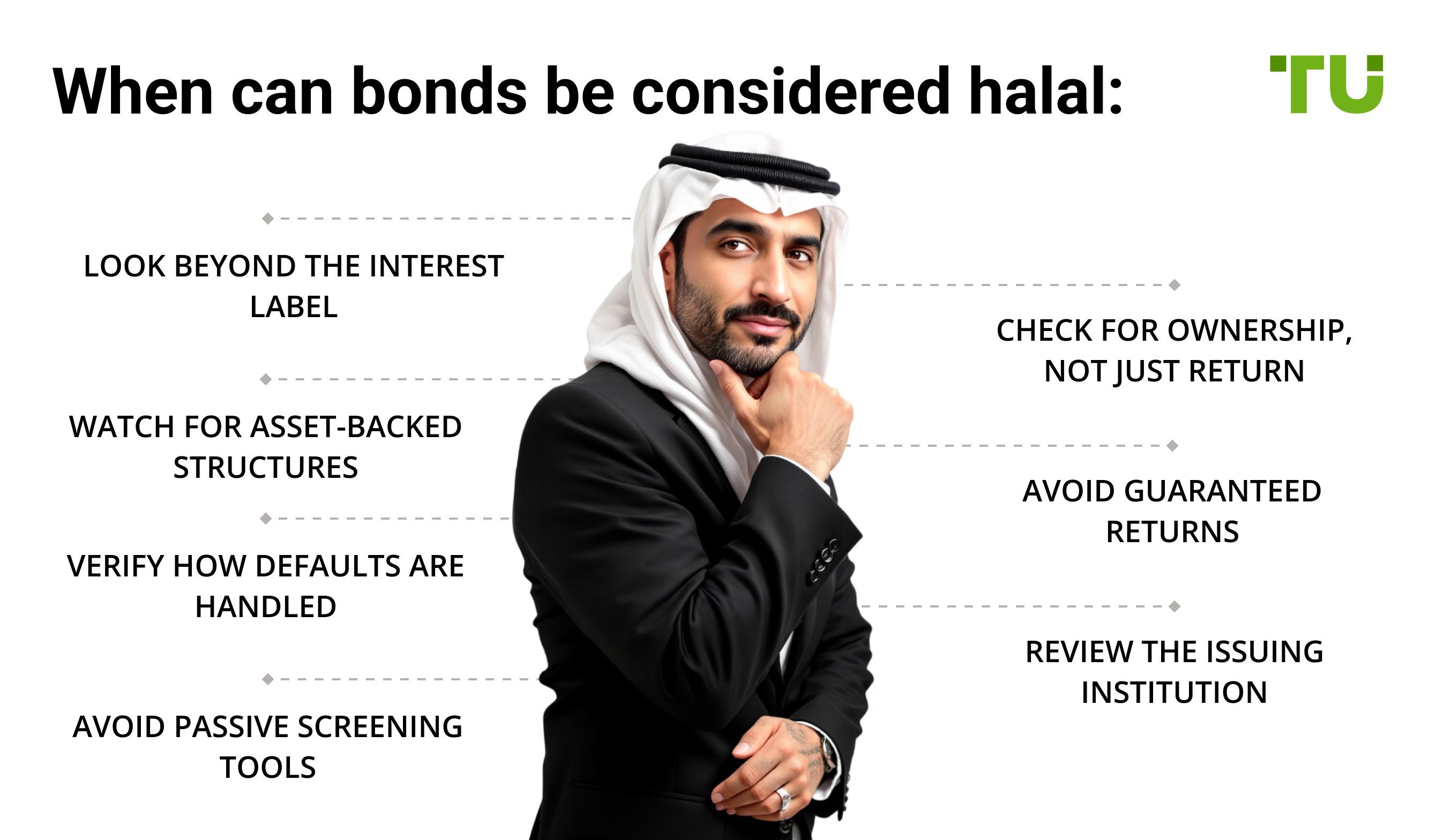

When can bonds be considered halal?

Most people assume all bonds are haram, but in specific cases, bonds can fit within Islamic principles but you have to dig into the details.

Look beyond the interest label. Not all fixed-income returns are interest-based. Some Islamic bonds (sukuk) pay you using profits made from actual business activity.

Check for ownership, not just return. Halal bonds should give you partial ownership in the asset or project, not just a promise of repayment with interest.

Watch for asset-backed structures. Sukuk that involve leasing (ijarah) or joint ventures (musharakah) create income through trade or rent, making them far more acceptable than conventional bonds.

Avoid guaranteed returns. Islamic finance encourages risk-sharing. Any bond promising a fixed return regardless of asset performance often ends up involving riba.

Verify how defaults are handled. Halal structures don’t penalize delays with interest. They solve delays by taking back assets or adjusting deals, not charging more money.

Review the issuing institution. Some governments issue sukuk alongside conventional bonds. Understand how the money will be used. It affects whether it’s really Shariah-friendly.

Avoid passive screening tools. Online tools sometimes label things the wrong way. Double-check yourself if the structure includes real trade or asset use if you are serious about knowing whether treasury bonds are halal or haram.

Before considering exceptions, it's important to distinguish between instruments structured around riba and those that rely on speculation or uncertainty, which are also prohibited in Islam.

Halal alternatives to government bonds

Here are some halal investment alternatives to government bonds for investors seeking to grow their capital in accordance with Islamic principles:

Sukuk (Islamic bonds)

Sukuk are the most direct Shariah-compliant alternative to conventional bonds. Instead of earning interest, investors in sukuk receive a share of profits from an underlying asset or project.

How it works: sukuk holders own a portion of a tangible asset or venture, such as infrastructure or real estate, and earn income from its use (e.g., lease or profit-sharing).

Why it’s halal: it avoids riba (interest) by being asset-backed and based on actual economic activity.

Halal mutual funds

Some Islamic mutual funds focus on income-generating equities or sukuk portfolios.

Example: funds that invest in dividend-paying halal companies or Shariah-compliant fixed-income instruments.

Screened for: riba, maysir (gambling), and haram industries like alcohol, gambling, or conventional banks.

Islamic REITs (real estate investment trusts)

These funds invest in rental-generating real estate portfolios that comply with Islamic guidelines.

Income model: earnings come from rent, not interest.

Shariah-compliant if: properties avoid leases to businesses involved in non-halal activities.

Profit-sharing investments (mudarabah / musharakah)

These are partnership-based investment contracts where profit is shared and loss is borne based on capital contribution.

Where to find them: offered by Islamic banks or fintech platforms.

Used in: business financing, infrastructure, or Islamic development projects.

Islamic saving certificates & accounts (non-interest based)

Some Islamic banks offer saving plans that mimic fixed-income returns without involving interest.

Structure: based on contracts like mudarabah or wakalah.

Returns: generated from real economic activity and shared with depositors.

If you want to explore other halal alternatives to government bonds (stock, Forex, сrypto etc), we suggest you do so through brokers that offer Islamic accounts. We have presented the top options below. You may compare and choose one for yourself:

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.8 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | Yes | 50 | 200 | No | 1.97 | Study review |

Risks and warnings

Now that we’ve answered your question: “are government bonds halal?”, here are some under-the-radar risks that most beginners miss but matter big time.

Check the source of returns. Most government bonds are built on guaranteed interest you earn no matter what, which goes against Shariah principles.

Beware of sukuk imitations. Some bonds sound Islamic but aren’t built like real sukuk with asset backing and shared risk.

Don’t rely on labels. Just because it says “halal” doesn’t mean it is. Read the fatwa closely instead of just trusting the label.

Don’t assume geography equals compliance. A bond issued in a Muslim country doesn’t automatically follow Islamic rules. Many still pay you interest, just under a different name.

Watch for disguised interest. Some structures avoid saying “interest” but still promise fixed profits. It’s just another way of packaging interest.

Understand bond duration. Short-term bonds can shift structures more often, making them more vulnerable to non-compliant practices.

Check for true risk-sharing. Halal investing means you share in the ups and downs, not just take a payout no matter what happens.

Most government bonds are quietly failing Shariah standards in 2025

While many beginners assume government bonds are “safe” or “neutral” from an Islamic finance perspective, the reality is more complicated. Bonds backed by central banks often rely on tools like interest rate swaps, repo markets, and fiat-based guarantees. These seem fine at first glance, but they sneak in riba beneath the surface.

What makes it worse is some “Shariah-compliant” funds even include government sukuk that behave almost exactly like bonds, just wrapped differently. This can make it feel halal, but it’s not. Something most beginners miss unless they dig into the fine print.

Another red flag? These bonds usually have zero connection to anything real. In many cases, you’re just giving the government a loan and hoping they pay you back with interest, not profits from actual businesses or projects that make money.

In Islamic finance, that’s a problem. Instead of buying into paper promises backed by tax hikes or money printing, look for asset-linked sukuk, the kind backed by airports, toll roads, or energy projects. At least then, your profit comes from something tangible, not just a cycle of debt.

Conclusion

The question are government bonds halal has a clear answer in most Islamic finance rulings: they are not. Due to the fixed interest nature of these instruments, they fall under the category of riba-based transactions, which are prohibited in Islam. Major Islamic institutions such as AAOIFI and AMJA consistently rule against their permissibility.

While exceptions exist under extreme necessity, Sharia-compliant alternatives like sukuk offer a valid path forward.

FAQs

Can I hold a government bond temporarily until I find a halal investment?

Even temporary holding of interest-based bonds is discouraged in Islam, unless you're in a situation of extreme necessity. Instead, consider keeping funds in a non-interest-bearing account while researching halal options like sukuk or Sharia-compliant funds.

What if my employer offers government bonds as part of a retirement plan?

If participation is mandatory and you can’t opt out, many scholars advise donating the interest portion to charity without the intention of reward, while actively seeking alternatives for future contributions.

Do national savings bonds in Muslim countries follow Islamic principles by default?

No. The country’s religious identity doesn't guarantee Sharia compliance. Many national bonds still involve interest, so always review the structure, fatwa backing, and asset linkage before investing.

How can I verify if a bond labeled 'Islamic' is truly halal?

Check for an independent Sharia board endorsement and transparency around how returns are generated. Halal bonds must involve asset ownership, risk-sharing, and income from real economic activity, not just relabeled interest.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.