Best Halal Investment Options In Pakistan

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

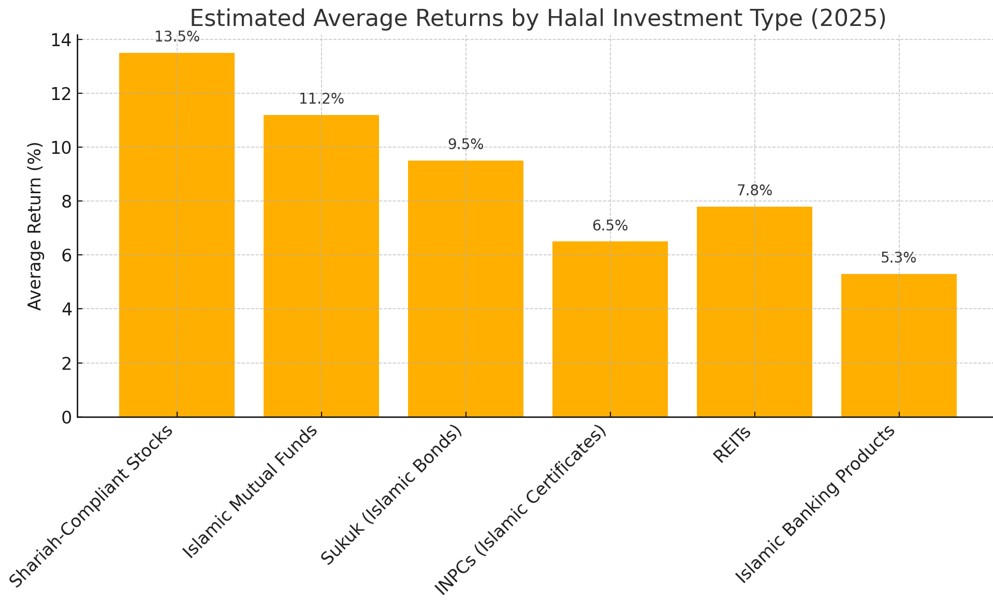

Halal investments in Pakistan cover a wide range of Shariah-compliant options, including stocks, sukuk, Islamic mutual funds, REITs, and government-backed savings schemes. KMI-30 index stocks have shown returns around 13.5%, sukuk average about 9.5%, while INPCs offer up to 6.5%. Investors can explore these opportunities through Islamic banks and licensed investment platforms, making it easier to invest ethically without compromising on returns.

With growing demand for value-driven finance, many individuals now look for halal investment opportunities in Pakistan that reflect both their financial goals and religious values. From Shariah-screened equities to sovereign sukuk offerings, the market offers a wide spectrum of avenues. Among them, the best halal investment options in Pakistan often depend on individual risk appetite, return expectations, and long-term financial planning. This guide explores some of the most dependable options available today.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Understanding halal investments in Pakistan

An investment qualifies as halal when it steers clear of interest (riba), high levels of uncertainty (gharar), and industries considered forbidden under Islamic law, such as gambling, alcohol, and pork-related businesses. These principles form the ethical base of Shariah-compliant investing and shape the way halal investment options in Pakistan are selected. The focus is always on ethical conduct, tangible assets, and fair risk-sharing arrangements.

In Pakistan, investments are reviewed by Shariah supervisory boards, which consist of Islamic finance scholars who assess whether a financial product or company meets Islamic standards. Regulatory bodies such as the State Bank of Pakistan (SBP) and the Securities and Exchange Commission of Pakistan (SECP) enforce compliance by applying specific benchmarks:

Interest-bearing debt must be less than 33% of total assets.

Non-compliant income should be under 5% of total revenue.

Liquidity and receivables must fall within approved thresholds.

These regulatory filters, combined with rigorous screening by Shariah boards, help investors navigate towards authentic Islamic finance options. Whether local or international, investors can confidently explore halal investment options in Pakistan knowing that these frameworks are in place to ensure Shariah investing compliance.

Top shariah-compliant investments 2025

In 2025, Pakistan’s Islamic finance sector is demonstrating solid maturity, offering a range of Shariah-compliant investment channels tailored for ethical capital growth. This guide provides verified insights into the most effective halal investment opportunities in Pakistan, covering stocks, sukuk, REITs, funds, and savings plans, all structured under Islamic financial law.

Shariah-compliant stocks

The Pakistan Stock Exchange (PSX) hosts a range of companies that align with Islamic finance principles by meeting strict criteria on debt ratios, interest exposure, and core business compliance. This makes them a strong component for Shariah compliant investment options in Pakistan. Some of the halal stocks in Pakistan include:

| Company | Sector | YTD Return (%) | Market Cap (PKR bn) | P/E (TTM) | Dividend Yield (%) |

|---|---|---|---|---|---|

| Meezan Bank (MEBL) | Islamic Banking | 33.90% | 574.68 | 5.79 | 8.74 |

| Mari Energies (MARI) | Energy | 102.40% | 754.1 | 10.45 | 23.07 |

| Fauji Fertilizer (FFC) | Fertilizer | 3.70% | 538.12 | 6.18 | 10.05 |

For many investors focused on ethical returns, these companies offer a compelling balance of stability and growth, often considered among the best Islamic investments in Pakistan for diversified equity exposure.

Halal ETFs and index funds

While investing in individual Shariah-compliant stocks is a popular method for halal investing, there are two other options that are also directly tied to the stock market — and potentially more accessible or diversified for Muslim investors:

Halal ETFs (Exchange-Traded Funds). These are investment funds that hold a basket of halal-compliant assets. They are traded on the stock exchange just like individual stocks, meaning you can buy or sell shares in real-time. ETFs are an efficient way to gain exposure to a diversified portfolio while maintaining Shariah compliance.

Halal index funds. These are mutual funds that track a Shariah-compliant index. Unlike ETFs, index funds are typically purchased directly through asset management firms and priced once per day. Their portfolios mirror halal stock indices 1:1, providing strict compliance and long-term stability.

For more details on how these work and what makes them halal, you can read: Halal ETFs and index funds in Pakistan.

Currently, Pakistan offers two actively listed Shariah-compliant ETFs:

| ETF Name | Description | Shariah Compliance | Listed On |

|---|---|---|---|

| Meezan Pakistan ETF | A diversified ETF tracking top Shariah-compliant stocks on the Pakistan Stock Exchange (PSX), launched by Al Meezan. | Certified by Shariah Board | Pakistan Stock Exchange (PSX) |

| Mahaana Islamic Index ETF | Tracks the Mahaana Islamic Index, comprising strictly Shariah-compliant companies based on screening criteria. | Based on Islamic screening methodology | Pakistan Stock Exchange (PSX) |

These ETFs offer a halal-compliant, diversified, and accessible alternative to direct stock picking, especially for Muslim investors in Pakistan or those interested in regional Islamic markets.

Islamic mutual funds

In contrast to ETFs and index funds, which are directly tied to the stock market and primarily invest in equities, Islamic mutual funds offer a more flexible and diversified halal investment vehicle. Shares in mutual funds are purchased directly from asset management companies, not through a stock exchange. These funds can include a broader range of Shariah-compliant assets — not just stocks, but also Islamic income instruments, sukuk (Islamic bonds), and cash equivalents, making them suitable for different investor profiles and risk appetites.

Islamic mutual funds are structured to align with Islamic finance principles and are available in various categories such as equity, income, and balanced funds. Below are some of the leading Shariah-compliant mutual funds in Pakistan:

Meezan Sovereign Fund, which focuses on government securities under Al Meezan Investment Management.

Atlas Islamic Income Fund, offering steady returns through Islamic income instruments.

UBL Islamic Savings Fund, designed for capital preservation with competitive returns.

| Fund Name | Fund Type | NAV (PKR) | YTD Return (%) | Risk Profile |

|---|---|---|---|---|

| Meezan Sovereign Fund | Sovereign Income | 52.46 | ~8.7% | Medium |

| UBL Islamic Cash Fund | Islamic Money Market | 114.85 | ~13.9% | Low |

| Atlas Islamic Stock Fund | Islamic Equity | 1,276.10 | ~61.7% | High |

These funds allow retail investors to participate in ethical markets with professional fund management and regulatory oversight. We have covered a more detailed list of such funds in our guide: Best halal mutual funds in Pakistan.

Sukuk (Islamic bonds)

Sukuk serve as asset-backed financial instruments that generate returns without breaching Islamic prohibitions on interest. In 2024, the Government of Pakistan issued over PKR 1 trillion in sukuk, aimed primarily at infrastructure development. Sukuk bonds in Pakistan continue to attract interest from investors seeking transparency and risk-sharing in their portfolios, further strengthening the country’s ecosystem for Islamic finance.

| Sukuk Name | Type | Return | Issuer | Tenor | Shariah Certification | Structure | How to Invest |

|---|---|---|---|---|---|---|---|

| Pakistan Global Sukuk 2029 | Sovereign (Intl.) | 7.95% | Pakistan Global Sukuk Co. Ltd | Matures Jan 31, 2029 | International Shariah Boards (AAOIFI, etc.) | Ijarah | Through Euroclear, Nasdaq Dubai, brokers |

| Government Ijarah Sukuk (GIS) | Sovereign | Fixed/Variable | Government of Pakistan (via SBP) | 3–10 years | SBP Shariah Advisory Committee | Ijarah | SBP auctions, PSX, Islamic banks |

| Green Sukuk (Pakistan) | Sovereign | Fixed Return | Government of Pakistan | 3 years | SBP Shariah Advisory Committee | Ijarah | SBP auction, PSX-listed |

| PIA Sukuk-I | Corporate | Fixed Return | Pakistan International Airlines (Govt. backed) | 3–5 years (est.) | SECP & Public Sector SLR Eligible | Ijarah | PSX, licensed brokerage accounts |

Islamic Naya Pakistan Certificates (INPCs)

INPCs are Shariah-compliant sovereign investment instruments offered by the Government of Pakistan. Available in both local (PKR) and foreign currencies (USD, GBP, EUR), they provide fixed returns and are structured to align with Islamic financial principles. Backed by state guarantees, they are a trusted income-generating option for both local and overseas investors.

INPCs follow the Mudarabah model, where investors entrust funds to the government via designated Islamic banks. Returns are generated from halal (permissible) revenue sources, without riba (interest), excessive uncertainty (gharar), or speculation. Each issuance is reviewed and certified by the Shariah Board of the State Bank of Pakistan.

Returns and terms (as of Q2 2025):

Minimum investment: $500 (USD/GBP/EUR) or PKR 100,000 (varies by bank and tenure).

USD INPCs (12-month term): 6.5% annual return.

PKR INPCs (12-month term): 14.2% annual return.

Available tenures: 3 months, 6 months, 12 months, and up to 3 years.

Profit payouts: quarterly or at maturity.

Real Estate Investment Trusts (REITs)

Halal REITs allow investors to pool money into real estate ventures without direct property ownership. By 2025, four Shariah-compliant REITs are regulated under SECP, offering exposure to commercial and residential sectors. These trusts serve as a flexible and regulated avenue for investing in real assets, making them a solid part of the halal investment landscape in Pakistan.

| REIT Name | Market Cap (PKR bn) | P/E Ratio | Dividend Yield (%) | EPS (TTM) | Net Income (TTM, PKR bn) | Revenue (TTM, PKR bn) |

|---|---|---|---|---|---|---|

| Dolmen City REIT | 60.06 | 6.04 | 8.15 | 3.66 | 8.14 | 5.63 |

| Globe Residency REIT | 2.42 | 8.41 | 10.14 | 2.05 | 0.29 | 2.58 |

Islamic banking products

For those focused on capital preservation with minimal risk, Islamic banks in Pakistan provide a wide range of investment banking products structured under Shariah principles. These include:

| Product Type | Structure | Purpose / Use Case | Risk Level | Typical Return (Q2 2025) |

|---|---|---|---|---|

| Savings Accounts (Mudarabah) | Profit-sharing | Daily banking with profit instead of interest | Low | ~3.5%–5.5% annually |

| Term Deposit (Mudharabah) | Fixed tenure pool | Capital preservation with predefined tenure | Low | ~6%–7% for 1-year term |

| Islamic Home Financing | Diminishing Musharakah | Structured joint ownership model | Medium | Variable |

| Auto & SME Finance | Ijarah / Murabaha | Asset-backed loans without riba | Medium | Fixed profit margins |

These offerings reflect the growing demand for ethical banking and are often cited among the best Islamic investments in Pakistan for conservative investors.

Halal entrepreneurship

Halal entrepreneurship is one of the most dynamic and impactful forms of Shariah-compliant investing in Pakistan. It offers investors the opportunity to participate in ethical business models that align with Islamic principles while supporting the real economy.

| Sector | Profit Potential | Risk Level | Notes |

|---|---|---|---|

| Halal Restaurants & Food Trucks | High | Medium | Strong and growing demand in urban and expat communities |

| Islamic Education & EdTech | High | Medium | Rapidly expanding among youth and families |

| Halal Logistics & E-commerce | High | High | Requires capital and tech infrastructure |

| Green & Ethical Startups | Medium–High | Medium | ESG-aligned businesses are gaining traction |

Most halal ventures operate under one of two common Islamic finance models:

Musharakah (Partnership). Both investor and entrepreneur contribute capital and share profits/losses based on agreement.

Mudarabah (Profit-sharing). The investor provides capital; the entrepreneur manages the venture. Profits are shared, but losses are borne by the investor alone.

These contracts must be verified by a Shariah board or Islamic finance authority.

International perspective

Pakistan’s Shariah-compliant assets compete with regional leaders:

Malaysia. Dominates sukuk issuance (~60% global market share).

UAE. Strong in REITs and Islamic fintech.

Pakistan. Emerging hub with retail-oriented growth, increasing inclusion in global Islamic indices (e.g., MSCI Islamic).

This regional positioning enhances the Islamic investment in Pakistan narrative on a global stage.

| Country | Key strengths | Market position |

|---|---|---|

| Malaysia | Dominant in global sukuk issuance, accounting for approximately 60% of the market. Islamic finance assets exceeding USD 600 billion as of 2024. Robust regulatory framework supporting Islamic finance growth. | Recognized as a global leader in Islamic finance. Continues to innovate and expand its Islamic finance offerings. |

| UAE | Rapid growth in Islamic fintech, with the market projected to reach USD 35.1 billion by 2031. Strong government support and a tech-savvy population driving fintech adoption. | Emerging as a hub for Islamic fintech innovation. Significant investments in digital financial services. |

| Pakistan | Islamic banking assets exceeding PKR 8.6 trillion (~USD 30 billion) as of mid-2024. Government initiatives aiming for a fully Islamic banking system by 2027. | Growing presence in global Islamic finance indices. Increasing demand for Shariah-compliant financial products. |

If you’ve been focusing on halal investment opportunities within Pakistan and are considering expanding your reach globally, there is an entire world of Shariah-compliant options waiting to be explored. Beyond local stocks and mutual funds, investors can now access global markets through Islamic trading platforms that offer halal-compliant services in stocks, Forex, commodities, and even digital assets like crypto.

These platforms are designed to operate within the boundaries of Islamic finance, eliminating interest-based transactions and avoiding non-permissible industries. If you're ready to diversify while maintaining your ethical and faith-based principles, the following selection of global halal investment platforms can serve as a valuable starting point.

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.8 | Open an account Your capital is at risk. |

|

| Yes | No | Yes | 50 | 200 | No | 1.97 | Study review | |

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review |

Halal investment options for overseas Pakistanis

Shariah-compliant investment options in Pakistan for overseas Pakistanis often blend faith and performance with compelling returns.

Sukuk funds offering 6–8 % returns. These Islamic bonds pay stable quarterly yields in PKR or USD that beat regular bank savings.

Islamic equity platforms averaging 12 % annual growth. Funds like Meezan Tahaffuz and MCB-Arif Habib pick stocks that follow Islamic rules and usually do better than 8 % T‑bills.

Dedicated real estate REITs with 9–11 % yields. Options like Dolmen Malls REIT give you rental income in USD and protect you when rupee prices bounce around.

Halal gold-backed certificates around 4–5 % annual returns. These follow the actual gold market and act like a safety net for your portfolio.

Risks and limitations

Even the best halal investment in Pakistan comes with limitations that new investors often miss. Here's what you really need to watch for.

Limited sector exposure. Most Shariah-compliant funds avoid banking and conventional finance, which limits diversification and may reduce returns in bullish sectors.

Inconsistent screening standards. Different scholars and institutions have different filters for what qualifies as halal, which can confuse investors looking into Shariah-compliant investment options in Pakistan.

High fund turnover. To stay compliant, funds often rebalance frequently, which increases transaction costs and can eat into overall profits.

Illiquid sukuk products. Many retail-focused sukuk don’t trade actively, making it hard to exit positions when markets turn volatile.

Hidden riba exposure. Some supposedly halal investment in Pakistan options still hold small percentages of interest-based income, which can be overlooked by casual investors.

Missed high-growth IPOs. Many IPOs in Pakistan include companies with mixed income sources, causing them to be excluded from Shariah-compliant indexes.

Fatwa dependency risk. Some funds rely on fatwas from a single scholar or board, and a change in opinion can shift compliance status overnight.

Earn halal returns by using dividend reinvestment in Shariah stocks and sukuk cycling

A smart halal move many beginners miss is reinvesting dividends from Shariah-compliant stocks. Instead of cashing them out or letting them sit idle, put those returns right back into buying more of the same stock or a similar one that’s still halal. Over time, this creates a steady snowball effect that builds your portfolio without breaking any Islamic rules. It’s a slow but reliable way to grow your money while keeping things clean and compliant.

Here’s another trick: don’t just buy one sukuk and forget about it. Spread your money across sukuk that mature at different times. When one matures, you can reinvest that into whatever’s offering the best halal return at the moment. This keeps your money moving and gives you more flexibility when the market shifts. It’s a simple way to stay liquid and responsive, all while keeping things within Islamic boundaries.

Conclusion

Pakistan presents a range of documented and well-regulated halal investment options in Pakistan, from mutual funds and sukuk to real estate and certified banking products. Each avenue follows clearly defined compliance standards under the State Bank of Pakistan or the Securities and Exchange Commission of Pakistan. By choosing vetted and transparent models, individuals can participate confidently in halal investment opportunities in Pakistan while aligning with Islamic ethics.

FAQs

Can non-resident Pakistanis invest in halal options?

Yes, through Islamic Naya Pakistan Certificates (INPCs), available in multiple currencies via Islamic banks.

Are halal stocks in Pakistan less profitable?

Not necessarily. Some Shariah-compliant stocks like Meezan Bank and MARI show competitive annual yields above 13%.

How is Shariah compliance verified?

Compliance is overseen by Shariah boards and regulators like SECP and SBP using specific financial ratios and business filters.

Do halal investments protect against inflation?

Investments like REITs and equity-based mutual funds often provide inflation-adjusted returns better than fixed-income models.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).