Understanding Ijarah In Islamic Finance

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Ijarah is a concept in Islamic finance that functions similarly to leasing, where one party (the lessor) allows another party (the lessee) to use an asset for an agreed period in exchange for rental payments. What makes Ijarah distinct is its strict alignment with Shariah law, it avoids interest (Riba), and the ownership of the asset remains with the lessor during the entire lease duration.

Ijarah in Islamic finance provides a faith-based alternative to traditional leasing. The arrangement allows individuals and businesses to benefit from the use of assets without transferring ownership, which fits within the moral and legal framework of Islamic finance. It reflects the broader values of responsibility and shared risk that are central to the system. In this guide, we’ll explore what Ijarah means in practice, walk through how it operates, and look at the types of Ijarah in Islamic banking, including both operational and financial variations. Alongside that, we’ll also highlight real-world use cases that show how this model supports both ethical halal investing and practical business needs.

Mufti Muhammad Taqi Usmani, a prominent Islamic finance scholar, states:

“In an Ijarah contract, the lessor must retain ownership of the asset throughout the lease period, bearing all liabilities arising from ownership.”

This highlights the principle that the financier bears the risks associated with ownership, distinguishing Ijarah from conventional leasing.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

What is Ijarah in Islamic finance?

Ijarah's meaning lies in its purpose: a lease that follows Islamic principles, where the bank or financier owns the asset and rents it out for a set period. Unlike a typical loan or sale, the person using the asset never owns it unless specified later. What makes Ijarah unique is that the owner handles damage or repairs, not the user. This small but crucial detail shifts how Islamic banks manage their risks, especially when dealing with big-ticket items like planes or factories.

Ijarah leasing isn’t just a rental agreement, it’s also a way for banks and clients to access assets without paying upfront. Instead of giving a loan, the bank buys the asset and leases it, sometimes handing over ownership at the end as a gift. This is common in Sukuk investments, where real assets back the financial product. Businesses also use Ijarah to lower taxes and avoid interest, making it a smart, faith-friendly way to manage capital.

People often ask “what Ijarah is in Islamic finance?”, expecting a simple answer. But real-world Ijarah contracts are complex and highly detailed. They include who pays for maintenance, what happens if the asset breaks, and even what type of insurance must be used. That’s because unclear terms can make the deal invalid under Islamic law. So banks make sure every small detail is written down, making the contract clear and fair for both sides.

Key features

Shariah-compliant financing.

Asset ownership remains with the lessor.

Fixed rental payments.

Transparent terms and conditions.

How does an Ijarah work?

Step-by-step process

The lessor (financier) purchases the asset that the lessee needs.

Both parties agree on the lease period and rental amount.

The lessee uses the asset for the agreed duration, paying regular rental installments.

At the end of the term, based on how the agreement is structured, the asset is either returned to the lessor or transferred to the lessee through a nominal payment.

Basic rules of Ijarah

The leased asset must have economic value.

Rental payments are clearly stated and locked in the lease agreement.

Maintenance responsibilities should be defined without ambiguity.

The lessor is responsible for major repairs and risks tied to ownership.

Ijarah contract example

A useful Ijarah example can be seen when an Islamic bank helps a customer finance a vehicle using the Ijarah Muntahia Bittamleek model. In this arrangement, the bank first purchases the car on behalf of the customer, then leases it to them over a five-year period. Throughout this term, the customer pays agreed rental installments, following the terms of the Ijarah contract signed at the outset. At the end of the lease, the customer is given the choice to acquire ownership of the vehicle by paying a nominal, pre-agreed amount. This structure reflects how Ijarah in Islamic banking provides asset-based financing while complying with Shariah principles.

| Aspect | Ijarah (Islamic) | Conventional Leasing |

|---|---|---|

| Compliance | Shariah-compliant | Interest-based |

| Ownership | Lessor retains | Lessor retains |

| Interest (Riba) | Prohibited | Included |

| Contract Terms | Transparent | May include hidden fees |

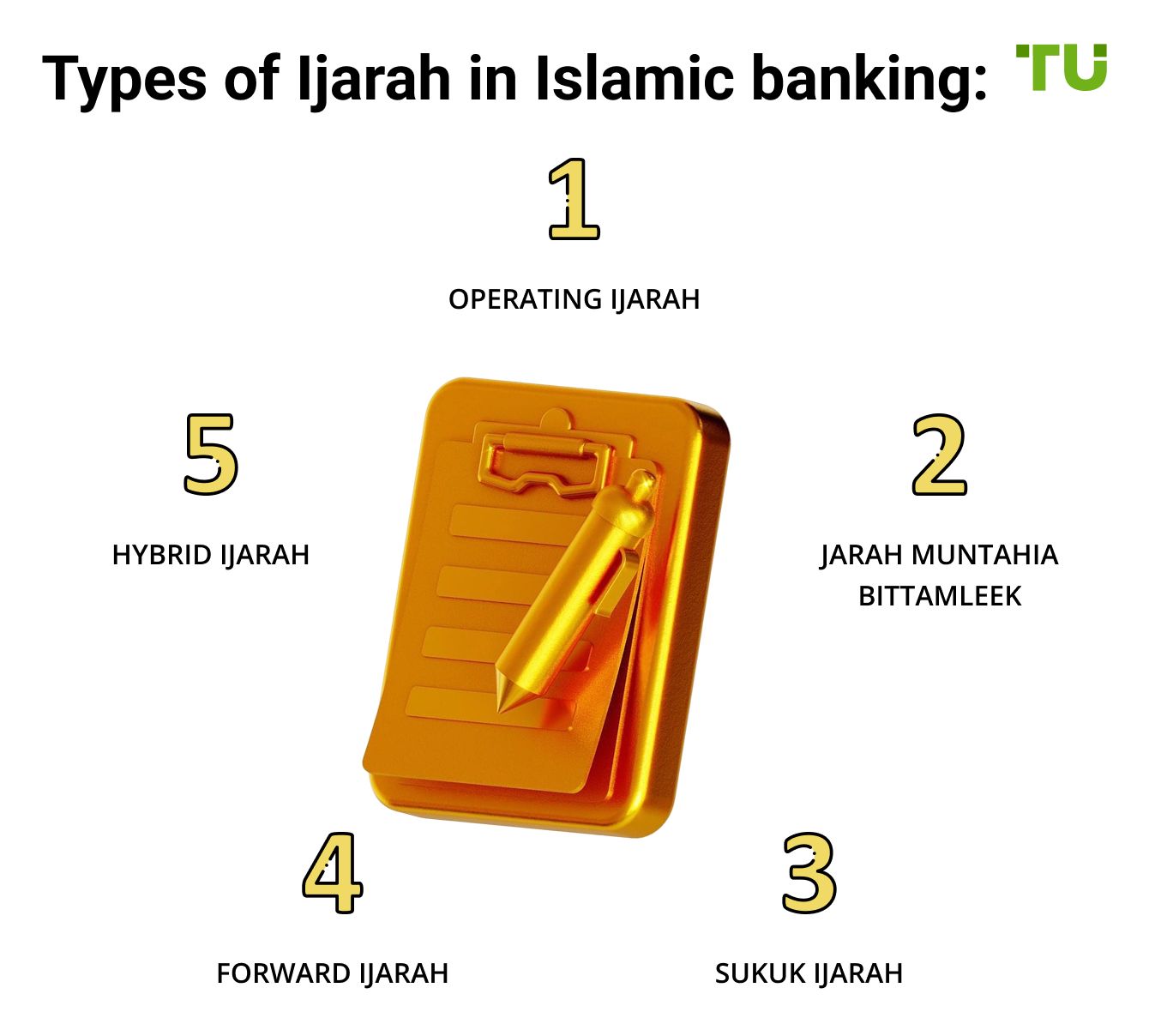

Types of Ijarah in Islamic banking

There are multiple Ijarah types in Islamic banking, each with its own purpose and structure depending on how the asset is used and who takes on the risk.

Operating Ijarah. This is a straightforward lease where the asset is returned after the term ends, with no ownership transfer. It’s often used for short-term rentals like machinery or office space. This Ijarah type does not involve any promise to sell.

Ijarah Muntahia Bittamleek. This type of Ijarah ends with the lessee gaining ownership. Either the asset is gifted at the end, or sold at a token price. This structure is common in home financing and is a classic Ijarah contract example where leasing leads to eventual ownership.

Sukuk Ijarah. In this structure, physical assets are leased out and the right to receive rent is securitized and sold to investors. Ijarah Sukuk allows for Shariah-compliant investments and creates steady income streams without involving riba, making it popular in global Islamic capital markets.

Forward Ijarah. This involves leasing an asset that is still under construction. Once built, the lease begins. It is often paired with Istisna contracts and used in real estate or infrastructure development. It's especially useful when the end asset is expensive and long-term.

Hybrid Ijarah. A mix of Ijarah and other contracts like Murabaha or Musharakah. For example, part of the payment may be rental while another part gradually purchases a share in the asset. This is ideal for complex financing needs.

A typical Ijarah agreement outlines the roles of both parties, rental terms, maintenance responsibilities, and what happens in case of asset damage. It avoids ambiguity, making it valid under Shariah. Understanding what an Ijarah contract is helps avoid disguised interest-based deals.

Related principles behind Ijarah: Salam, Wakalah, and Mudarabah

To fully understand how Ijarah fits within the broader framework of Islamic finance, it’s helpful to explore related contract types that often complement or influence its structure. For instance, in large-scale asset projects or development-based leasing, Ijarah is frequently paired with forward contracts like the Salam contract in Islamic finance, where payment is made in advance for assets delivered later. This setup works particularly well in industries like agriculture or construction, where delivery and leasing timelines intersect.

Additionally, when Ijarah transactions involve delegated authority or third-party management, they may incorporate Wakalah. Under this structure, an agent is appointed to act on behalf of the financier or client, handling asset acquisition or lease administration while ensuring all actions remain Shariah-compliant.

Lastly, for joint investment models where the financier and client share profits and losses, a hybrid approach using Mudarabah may be used alongside Ijarah. Here, Ijarah provides asset access while Mudarabah ensures profit-sharing, creating a flexible solution for both individual investors and institutional portfolios. These supporting principles help shape how Ijarah is applied in real-world contracts and underscore its place in a wider ethical finance system.

Beyond traditional banking, if you're exploring halal investment options, whether it's in stocks, crypto, or the FX market, it’s a good idea to use an Islamic account that aligns with your faith. This way, you can trade confidently without compromising on your beliefs. Below, you’ll find a curated list of trusted brokers that offer Shariah-compliant accounts. Take a look, compare what they offer, and choose the one that fits your trading goals best.

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.8 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | No | Yes | 50 | 200 | No | 1.97 | Study review | |

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review |

Unlock higher returns in Ijarah by timing lease structures and understanding asset risks

If you’re just starting out with Ijarah contracts, here’s something most people don’t tell you: the rental structure in Ijarah isn’t just about fixed returns. You can legally structure escalating rent clauses based on expected inflation or asset depreciation, especially in long-term leases. This way, the lessor can hedge against economic shifts without violating Shariah. Beginners usually assume the rent is static, but understanding how to build flexibility into the contract upfront can protect both parties and offer long-term stability.

Another overlooked area is asset-specific risk management. In Ijarah, ownership and risk of the asset remain with the lessor. But smart investors build in stipulations where the lessee handles minor maintenance and operational costs, while the lessor insures only the capital asset. This clear split avoids disputes, improves compliance, and can even attract better lessees. So don’t just copy-paste contract templates, tailor your clauses around the nature and wear of the asset to boost efficiency.

Conclusion

Ijarah serves as a meaningful financial approach that blends today’s economic demands with time-honored Islamic values. By steering clear of Riba (interest), Gharar (excessive uncertainty), and Maysir (gambling), it helps keep financial dealings grounded in ethics, fairness, and shared benefit for all parties. This framework not only supports personal and commercial financial stability but also encourages a more balanced and fair economic landscape.

For individuals, Ijarah offers a way to access key assets like homes, cars, and equipment without turning to traditional interest-based loans. Businesses, in turn, make use of adaptable financing to secure assets, manage their cash cycles smoothly, and stay strong in competitive markets. In a time when financial markets are often questioned for volatility and speculation, Ijarah offers a more grounded and thoughtful model. It promotes openness, shared risk, and fairness in transactions, values that are essential for lasting economic health.

FAQs

Can an Ijarah contract be canceled before the lease period ends?

Yes, it can, but only if both parties agree. Early termination terms must be clearly stated in the contract. Depending on the situation, the lessee may need to pay a penalty or cover remaining rental dues.

Is it possible to renegotiate rent in an Ijarah agreement?

Only if it's structured as a variable rental contract. Fixed-rent Ijarah terms are locked, but some contracts allow periodic reviews where rent can be revised based on mutual consent and specific conditions.

What happens if the leased asset becomes unusable due to no fault of the lessee?

In that case, the lessor (as the asset owner) bears the responsibility. The lessee is not liable to continue rent if the asset can’t be used unless otherwise stated in the contract.

Are Ijarah contracts available in non-Muslim countries?

Yes, many global Islamic banks and financial institutions offer Ijarah options, even in non-Muslim majority countries, especially where there’s demand for Shariah-compliant financing.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Risk management is a risk management model that involves controlling potential losses while maximizing profits. The main risk management tools are stop loss, take profit, calculation of position volume taking into account leverage and pip value.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.