Is Insurance Halal? A Complete Guide For Muslim Traders And Investors (2025)

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Many scholars consider conventional insurance haram because it involves elements like interest (riba), excessive uncertainty (gharar), and gambling (maisir). Takaful, a cooperative insurance system that complies with Shariah law, is viewed as halal and has received widespread approval from Islamic scholars and financial bodies. However, in certain situations, such as when the law requires it or in cases of necessity (darura), conventional health and car insurance might be allowed, especially if no Takaful options are available. As of 2025, the global Takaful market is valued at $55.78 billion, with projections estimating growth to over $75 billion by 2033.

Insurance plays a key role in both personal and commercial financial planning, yet many Muslims continue to ask: is insurance halal (permissible) or haram (forbidden)? Scholars have debated this question for years, primarily due to the presence of gharar, riba, and maisir in many conventional models. Still, Takaful has emerged as a Shariah-based solution, providing the benefits of risk-sharing without compromising Islamic principles — and its adoption has accelerated notably over the past decade. In this article, we bring together the most recent scholarly opinions, up-to-date industry figures, and practical tips to help both new and experienced Muslim investors and traders make sound, faith-aligned financial choices.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

What is insurance and how does it work?

Insurance is a way to transfer the financial risk of unexpected events to someone else, in exchange for a fee, so you're not left footing the entire bill when life goes sideways.

Here are its key features:

It’s a promise backed by probability. Insurance companies use massive data sets to predict the odds of certain events and pool money from many people to cover the few who actually face a loss.

You're not buying protection, you’re buying shared risk. When you pay for insurance, you’re joining a group of people who all chip in so no one person bears the full cost of a disaster.

Claims aren’t payouts, they’re contracts being fulfilled. When you “get money from insurance,” you're not receiving generosity; you're executing a clause you already paid for in advance.

Underwriting is the real engine behind insurance. Before a policy is approved, a behind-the-scenes process called underwriting calculates how likely you are to file a claim, and that affects everything from your premium to your coverage limits.

Insurance depends on uncertainty to function. If everyone knew exactly when and what bad thing would happen, insurance wouldn’t work — its entire model relies on unpredictability.

Why conventional insurance may be haram

1. Gharar (Uncertainty)

The outcome of the policy is unclear. You might pay regular premiums and never make a claim, or you could suddenly claim a large sum due to an unexpected event.

This level of ambiguity goes against the principles of transparency and certainty required in Islamic contracts.

2. Riba (Interest)

Insurance companies typically invest collected premiums in interest-bearing financial products.

In Islamic law, both earning and paying interest are clearly prohibited, making this a major concern.

3. Maisir (Gambling)

The insurance contract involves risk-taking and imbalance. You’re essentially “betting” on an uncertain event, which closely resembles gambling.

Because of this speculative nature, it is seen as a form of maisir, which is not allowed in Islamic finance.

These three elements — gharar, riba, and maisir — are the primary reasons many scholars deem conventional insurance impermissible.

Scholarly opinions: Latest Islamic rulings

Majority view: Insurance is haram

Most prominent Islamic scholars and fatwa councils — such as those from Al-Azhar University and the Islamic Fiqh Academy — consider conventional insurance to be haram.

They base this position on the contract’s speculative elements and its reliance on interest-based investments, both of which conflict with Sharia principles.

Minority view: Conditional permissibility

A minority of scholars allow insurance under specific conditions:

When it is legally required (e.g., vehicle insurance by state mandate).

When it serves an essential need, such as access to healthcare.

This view treats insurance as darura (necessity), where avoiding harm overrides the prohibition.

| Scholar/Institution | Stance on Conventional Insurance | Notes |

|---|---|---|

| Al-Azhar University | Haram | Strongly against interest-based and speculative insurance |

| Islamic Fiqh Academy (OIC) | Haram | Proposes Takaful as the only compliant alternative |

| Dar al-Ifta (Egypt) | Haram | Emphasizes riba and gharar concerns |

| ECFR (Europe) | Conditionally Halal | Permissible when mandatory or no Takaful available |

| Dr. Yusuf al-Qaradawi (late scholar) | Permissible in certain conditions | Focused on necessity and social welfare |

| Mufti Taqi Usmani | Haram (Conventional) – Halal (Takaful) | Strong advocate of Takaful model |

Types of insurance: Permissible or not?

Islamic rulings on insurance are not always one-size-fits-all — different types of insurance may be judged differently depending on their structure, purpose, and necessity. While traditional models often include elements prohibited in Islam, such as riba (interest) and gharar (excessive uncertainty), not all insurance is treated the same under Shariah. In certain situations — particularly where the need is urgent or where coverage is legally mandated — some forms of insurance may be allowed with conditions.

Below is a breakdown of the most common insurance types and their permissibility from a Shariah perspective.

| Insurance Type | Halal or Haram? | Scholar Consensus | Key Notes |

|---|---|---|---|

| Life Insurance | Generally Haram | Majority opinion | Long-term uncertainty and riba involved |

| Health Insurance | Conditionally Halal | Divided | Permitted by many scholars for essential care |

| Car Insurance | Conditionally Halal | Widely accepted | Required by law in many countries |

| Business/Property | Mixed Opinions | Depends on contract terms | Takaful preferred |

| Travel Insurance | Conditionally Halal | Divided | Often permitted for necessity, especially for medical or trip-related emergencies |

| Pet Insurance | Mixed Opinions | Limited discussion | Depends on contract type; Takaful preferred if available |

What is takaful? The halal insurance alternative

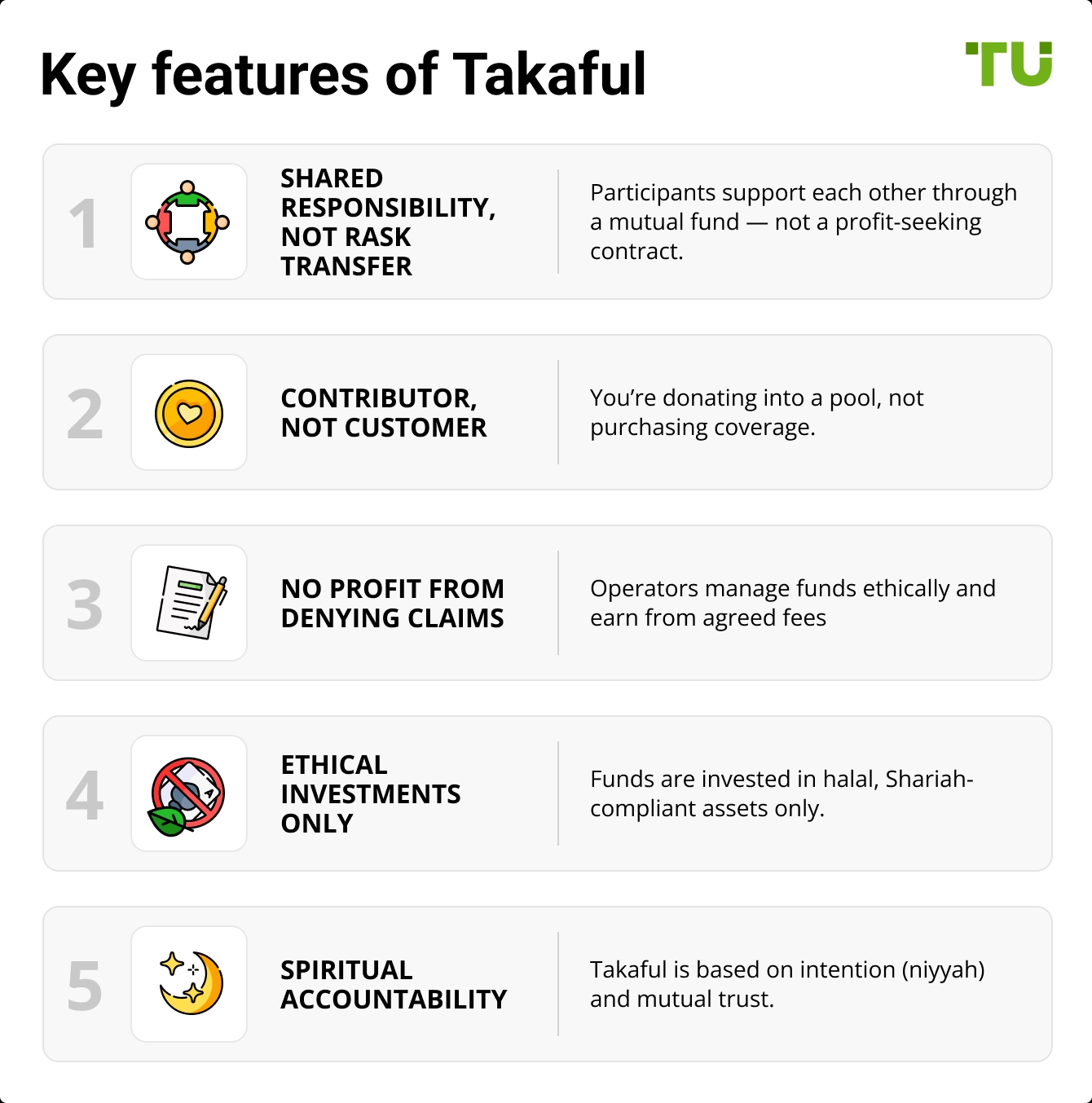

Takaful is a Sharia-compliant mutual insurance system. It avoids riba, gharar, and maisir by using a cooperative model.

Takaful is built on the concept of shared responsibility, not risk transfer. Unlike conventional insurance where the company absorbs your risk for profit, Takaful participants agree to help each other using a communal pool of funds.

You're a contributor, not a customer. When you pay into a Takaful plan, you’re not buying a service — you’re donating into a mutual fund that you might need someday, or might never touch at all.

Profit comes second to purpose. Takaful operators don’t own the money; they manage it. Their income comes from pre-agreed fees, not from holding onto surplus or denying claims.

Takaful funds are ethically invested. Unlike conventional insurers who may invest in anything profitable, Takaful funds must be placed in Shariah-compliant avenues — no alcohol, gambling, or interest-based investments.

Every policy includes spiritual accountability. Participants enter with the niyyah (intention) of mutual aid, and misuse of the system isn’t just unethical — it’s religiously discouraged.

Takaful is endorsed by Islamic scholars worldwide and is a preferred halal solution.

Global takaful market: Latest data (2024–2025)

Market size. Valued at USD 49.79 billion in 2025; projected to reach USD 111.89 billion by 2034, reflecting a compound annual growth rate (CAGR) of 9.41% during the forecast period.

Regional leaders. Gulf Cooperation Council (GCC) countries dominate with 85% of the global Takaful market share in 2024.

Saudi Arabia's market share. Holds 100% of the local insurance market as Takaful, similar to Iran and Sudan, as of Q3 2023.

Product segment. Medical Takaful leads with over 50% market share in 2023; projected to grow to USD 45.4 billion by 2032.

Traders and investors: What you need to know

For Muslim traders and investors, dealing with insurance can feel like navigating a gray zone — here’s how to handle it with both financial clarity and spiritual confidence.

Conventional insurance can raise red flags in Shariah. The mix of interest (riba), uncertainty (gharar), and gambling-like risk (maysir) in most insurance structures can conflict with Islamic finance principles.

Takaful is more than “Islamic insurance” — it’s a co-op of mutual care. Instead of a profit-seeking insurer, participants contribute to a shared pool that supports anyone in need, aligning with the concept of brotherhood and collective responsibility.

You can’t just “go without” — some insurance is legally required. In cases like auto or professional liability, scholars often allow conventional policies out of necessity, as long as you don’t go beyond basic coverage.

Assess “need vs. excess” through a Shariah lens. If you're buying insurance for luxury assets (like a second home or speculative business ventures), that might cross into questionable territory versus insuring your main livelihood.

Your safest bet for remaining following Shariah principles when trading or investing is by using Shariah-compliant brokers. And luckily, you don’t need to do the hard work here. We have already researched the market and presented the top Shariah-compliant brokers offering Islamic accounts in the table below. You can compare them and make a choice for yourself:

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.82 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.77 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | Yes | No | 70 | 10 | No | 1.96 | Open an account Your capital is at risk.

|

Pros and cons of insurance in Islam

- Pros

- Cons

Risk protection and legal compliance. Insurance provides coverage for property, life, health, and business, shielding against unexpected losses. In many countries, it's legally required (e.g., car insurance).

Financial support during emergencies. Health insurance helps cover hospital expenses, and property insurance replaces damages after disasters — making it essential during crises.

Takaful as a Halal alternative. This cooperative, donation-based model eliminates riba, gharar, and maisir, aligning with Islamic law and gaining scholarly approval.

Global regulation and stability. Insurance industries, especially Takaful, are usually regulated by financial authorities — ensuring transparency, claim fairness, and capital security.

Growing access to Halal insurance. The Takaful market is rapidly expanding, offering Shariah-compliant options for life, medical, vehicle, and business insurance.

Conventional insurance is often deemed haram. Without a Shariah framework, most insurance types are not permissible unless in cases of necessity.

Lack of Takaful availability in some regions. In non-Muslim countries or remote areas, access to halal alternatives may be limited or nonexistent.

Lack of awareness among Muslims. Many Muslims unknowingly engage in non-compliant policies due to limited knowledge about Takaful.

Higher costs in some Takaful plans. Ethical investment models may lead to slightly higher premiums or lower returns than conventional options.

Conventional insurance becomes halal and why Takaful isn’t always what it claims to be

A common mistake among beginners is assuming all insurance is either fully halal or haram, when in fact, it depends on the policy’s structure. Conventional models often involve riba, gharar, and maysir — prohibited in Islam — while cooperative models like Takaful aim to align with Shariah by focusing on mutual aid over profit.

In cases of necessity, such as mandatory or urgent medical coverage, limited use of conventional insurance may be allowed. However, choosing a policy is only the beginning — Muslims should also ensure their premiums aren’t being invested in non-compliant sectors. Always ask for a fatwa or governance report to verify Shariah oversight; aligning finances with faith means knowing where your money goes and what it supports.

Conclusion

Takaful offers a modern, ethical solution for Muslims seeking Shariah-compliant risk protection. While conventional insurance is largely considered haram, Takaful has become a trusted global alternative with a rapidly expanding market. As a trader or investor, choosing Takaful ensures both compliance and protection — helping you grow your wealth with peace of mind.

FAQs

Can you mix Takaful and conventional insurance in your portfolio?

Yes, but it’s not ideal. Mixing halal and non-halal models can dilute your intention of staying fully Shariah-compliant. If you must use conventional insurance temporarily, keep it minimal and for essentials only — then slowly transition your entire coverage to Takaful as options become available.

Is employer-provided insurance automatically halal if you didn’t choose it?

If enrollment is automatic and you have no control over the policy type, most scholars say you're not accountable for it. But if you're given options, choose the Takaful or lowest-risk plan.

Do all Takaful providers follow the same Islamic standards?

Not necessarily. Some operate with stricter Shariah oversight than others. Always check who’s on their advisory board and ask to see their fatwas. A provider using vague religious language without proof might be more “Islamic-branded” than truly Shariah-compliant.

Is microinsurance halal if it helps low-income Muslims?

Microinsurance can be halal if structured like Takaful — with clear contracts, no interest, and mutual support. When used to protect basic needs like health or farming tools, many scholars see it as a permissible and even recommended form of community care.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.