Is Car Insurance Halal Or Haram In Islam?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

In Islam, conventional car insurance is generally regarded as haram because it contains elements of uncertainty, called gharar, along with components of maysir and riba. These features do not align with the moral and contractual clarity expected in Islamic finance. However, when purchasing car insurance is mandated by law and no acceptable alternatives exist, scholars allow it as an exception based on necessity. A more ethically sound approach is takaful car insurance, which operates on mutual support and shared risk, following principles that fit within Islamic ethical boundaries.

In many countries, car insurance is a legal requirement. This leads to a common concern among Muslims: is car insurance halal or haram in Islam? The challenge lies in the fact that standard insurance contracts often involve interest and speculative risk, which go against the teachings of Islamic finance. Because of this, there’s a growing demand for financial models that stay true to Shariah. One such model is Shariah-compliant car insurance, which avoids unethical elements by focusing on collective responsibility and fairness. At the same time, many scholars ask whether car insurance is haram, especially in settings where individuals have no choice but to opt for conventional plans. These discussions highlight the need for accessible alternatives grounded in Islamic principles.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Is car insurance haram?

The requirement to purchase conventional vehicle insurance is, in many Islamic scholarly opinions, considered incompatible with Islamic legal principles. This is because such policies often involve riba (interest), gharar (excessive uncertainty), and compensation based on chance. These elements go against the framework of ethical contracts in Islamic teachings. As a result, many scholars continue to examine whether car insurance is haram, especially when these contracts contain conditions that contradict key aspects of Islamic law.

Many jurists who have issued public guidance approach the matter by clarifying “is car insurance halal or haram in Islam?” through structured analysis. Their rulings highlight concerns such as fixed financial gains, unequal sharing of obligations, and payments that depend on unpredictable accidents. These concerns directly challenge the Islamic values of fairness, mutual consent, and legitimate risk-taking, which are essential in Sharia-based commercial dealings. That’s why the call for alternatives like Shariah-compliant car insurance has steadily grown.

What does Islam say about car insurance: halal or haram?

Many scholars ask whether car insurance is haram, and the answer really comes down to how the policy is set up and what the user intends. Most regular car insurance is considered haram due to uncertainty and gambling. But what many people don’t realize is that scholars sometimes allow basic coverage if it’s required by law and doesn’t involve profit or interest.

A big part of this debate focuses on the type of insurance. Third-party coverage is often allowed when driving without insurance is illegal, since it protects others. On the other hand, full or comprehensive plans might involve risk and speculation, making them harder to justify. That’s why scholars continue to discuss whether car insurance is halal or haram in Islam, especially in places where insurance is unavoidable.

Some scholars have looked into how car insurance might change to fit Islamic ethics. Instead of profit-driven policies, they imagine a system where people cover each other, like in takaful. Everyone contributes to a shared pool, and leftover funds can go back to the group or to charity. The challenge is building a halal-friendly option that can still work in today’s legal systems and serve drivers everywhere.

Another issue is hidden interest charges. Many people pay for car insurance through auto-debit or monthly payments, and small delays can trigger interest without them knowing. This spoils what might look like a clean policy. For Muslims who avoid riba completely, it’s important to check how the payment is made and if it’s tied to any interest-based services.

Finally, while Islamic car insurance is available in some countries, many regions still don’t offer it. In those cases, scholars may allow conventional insurance under strict conditions, like sticking to third-party coverage and avoiding interest, if there's no halal option yet. It shows that Islamic law can adapt when needed, but it also reminds believers to stay conscious of their choices.

What is Islamic car insurance?

The takaful car insurance model functions through a system of mutual financial cooperation, where participants voluntarily contribute to a shared fund rather than paying for a commercial service. This collective pool is then used to support members who face losses, based on terms agreed upon beforehand. The managing organization takes a fixed administrative fee, without earning profit from the pooled contributions. This structure helps maintain alignment with the principles expected in Shariah-compliant car insurance.

Unlike traditional insurance, Islamic car insurance removes the direct transaction between the company and the insured individual. Instead, every participant becomes a co-owner of the fund and may receive a share of any surplus if overall claims are low. There are no promised profits or guaranteed returns. The foundation of halal car insurance rests on fairness, the absence of interest, and full financial transparency in how contributions and payouts are managed.

In places where religious finance laws are part of the system, Sharia car insurance is offered through providers that follow approved Islamic standards. These firms are overseen by certified Shariah boards and monitored by Islamic regulatory bodies or central banks. Well-known providers such as, Takaful Malaysia, Qatar Islamic Insurance Company, and offer plans that follow industry standards and uphold the values expected in these markets. Many scholars also explore whether car insurance is haram, particularly when comparing conventional and faith-based models. These discussions lead to the broader question of is car insurance halal or haram in Islam, which often depends on the contract’s design and the ethical integrity of the provider.

Halal insurance market: regulators, companies, practice

Institutions such as IFSB and AAOIFI provide guidance for how risk, contract terms, and compliance should be structured in products identified as Shariah-compliant car insurance. While IFSB focuses on broader policy and regulation within the financial system, AAOIFI is more involved with setting contract templates, financial reporting practices, and certification procedures.

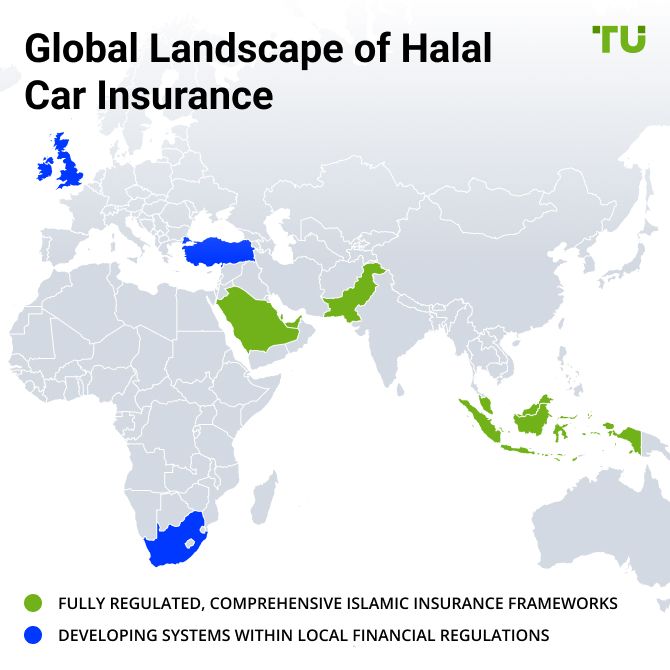

The use of takaful car insurance is seen mainly in countries that have well-developed Islamic financial regulation in place. Nations such as Malaysia, Saudi Arabia, the United Arab Emirates, Indonesia, Bahrain, and Pakistan have insurance sectors supervised by both central financial authorities and Shariah boards. Meanwhile, countries like the United Kingdom, South Africa, and Türkiye are developing systems to support similar models within their regulatory frameworks.

In terms of operations, Islamic car insurance is provided by companies that meet recognized Shariah standards. Some of the major names include Takaful Malaysia, Salaam Takaful, Noor Takaful, Qatar Islamic Insurance Company, Abu Dhabi National Takaful, and FWU Takaful. These providers are members of Islamic finance associations, subject to ongoing review by Shariah advisors, and maintain transparent compliance reporting for the public.

In places where car insurance is legally required, halal car insurance is developed to follow both national laws and Islamic guidelines. For example, countries like the UAE and Malaysia require insurers to be licensed by financial authorities and approved by Shariah boards. In the United Kingdom, takaful car insurance is offered as an optional product and regulated by the Financial Conduct Authority, with oversight from local Shariah scholars to ensure it meets religious standards.

Scholarly, trader, and institutional opinions

Many scholars continue to debate whether car insurance is haram, and the discussion goes beyond just the general idea of contracts. Some argue that conventional car insurance violates Islamic principles due to gharar (excessive uncertainty) and maysir (speculation), especially when premiums are paid with no guarantee of return unless an accident occurs. But others highlight a key difference: in many countries, car insurance is mandatory by law. In such cases, scholars from Dar al-Ifta and similar institutions have stated that necessity makes it permissible, though not ideal.

A lesser-known viewpoint comes from Muslim traders and logistics operators, especially those in high-risk areas or commercial fleets. For them, car insurance isn’t just legal compliance, it's about risk offset in supply chains. In a 2020 case in Indonesia, several halal-certified logistics companies were fined for not holding valid insurance after an accident caused cargo damage. These traders then shifted to takaful car insurance, not out of religious sentiment, but because cooperative models provided clearer legal cover in Shariah courts.

Interestingly, modern fatwas from financial Shariah boards often discuss the idea of indirect riba in insurance contracts. For instance, some contracts invest surplus premiums in interest-bearing instruments. Scholars from Bahrain and Pakistan have issued warnings about this, urging Muslims to verify where their premium money goes. That’s why many now prefer Shariah-compliant car insurance, which gives full disclosure on where funds are parked and how claims are managed.

There's also a legal distinction between risk-pooling and risk-transfer. Traditional car insurance works on the principle of risk-transfer, where your risk becomes someone else's responsibility for a price. In contrast, Islamic car insurance based on takaful promotes mutual responsibility. Each member contributes to a shared fund and agrees to help anyone who faces a loss. This model is increasingly being adopted not just in Muslim countries, but in Europe as well, particularly in Germany and the UK where Muslim-friendly financial services are expanding fast.

Other types of Islamic insurance and how to invest ethically

When discussing halal and haram insurance, it’s important to consider the various types available. While car insurance often sparks debate in Islamic finance, other forms of coverage also raise ethical questions. For instance, life insurance is generally viewed as haram due to fixed payouts, interest-based reserves, and speculative elements. In contrast, takaful-based life plans avoid these issues by using shared risk structures and profit-sharing models.

Similarly, health insurance can be problematic when based on risk transfer and interest. Conventional policies may include speculative underwriting, making them non-compliant. However, takaful health insurance follows a model of community contribution, aligning with Islamic principles.

The same logic applies to travel insurance. While conventional travel policies may involve interest and risk transfer, takaful versions focus on mutual assistance and ethical fund management, making them more acceptable.

One innovative solution is investment-linked takaful, which combines insurance coverage with Shariah-compliant investment growth. Unlike conventional insurance, it does not involve fixed payouts or interest-based reserves. Instead, participants contribute to a pooled fund, and any surplus is shared or reinvested ethically. This hybrid model offers both security and potential financial growth, making it a balanced choice for Muslims looking to manage risk while building wealth responsibly.

Also, if you're looking to grow your wealth without stepping outside Islamic principles, it's important to be mindful of where and how you invest. One practical way to stay on the right path is by choosing a dedicated Islamic account, built to support halal trading in markets such as stocks, crypto, and Forex. We've taken the time to review the best platforms offering these accounts and outlined their standout features to help you get started. You can check them out below.

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.8 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | Yes | 50 | 200 | No | 1.97 | Study review |

Structured pooling in takaful makes car insurance halal for Muslims

A lot of people think insurance is automatically haram because it usually involves interest or uncertainty. But in reality, Islamic alternatives like takaful work very differently. It’s more of a community-based setup where everyone chips in to help each other in case of accidents, not for profits. What’s rarely mentioned is that if fewer claims are made, you might actually get part of your money back. That flips the usual idea of insurance on its head, it’s ethical, and it can be financially rewarding too.

If you come across a provider saying their car insurance is halal, don’t just trust the label. Ask whether they follow a wakalah model or a mudarabah model. In the wakalah setup, the company just takes a fixed fee to manage the fund. But in mudarabah, they share profits with policyholders. This changes how your money is used and shows whether the model sticks to Islamic values or not. It’s small details like these that tell you whether your insurance is truly Shariah-compliant or just marketed that way.

Conclusion

Islamic regulation of car insurance lies at the intersection of legal obligations and Shariah principles. The conventional car insurance model is often deemed non-compliant, though limited use may be permitted under legal compulsion. The growth of the takaful car insurance sector offers options aligned with mutual risk-sharing and transparent fund governance. Certified providers operating under shariah compliant car insurance standards are already active in both Islamic and secular jurisdictions. Where such products are unavailable, alternative approaches, such as basic legal coverage combined with charitable redirection, may be considered. Making an informed choice requires reviewing contract structures and verifying compliance with Islamic financial standards.

FAQs

Can the same driver use both conventional insurance and takaful in different countries?

Yes, as long as it complies with local laws, a driver may use takaful in one country and conventional insurance in another. However, legal interpretations differ, and use of non-compliant contracts should be limited to cases where no halal alternative exists.

How can a driver verify that an insurance product is Shariah-compliant?

Check for a certified Shariah board opinion, a clear fund model such as wakalah or mudharabah, and rules for surplus distribution. Also confirm that the contract excludes any form of fixed or guaranteed returns.

Is it permissible to use a payout from a non-halal insurance policy taken under legal compulsion?

Yes, if the policy was obtained due to legal enforcement, it is generally permissible to use payouts to cover actual damages. Fatwas support this under the condition that the policyholder does not voluntarily seek profit from the scheme.

Can car insurance be combined with other Islamic insurance products?

Yes, some frameworks allow combined coverage that includes car, health, and property under a unified takaful fund. This is acceptable as long as each component adheres to Shariah rules and terms are clearly separated.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.