Is Systematic Investment Plan Halal In Islam?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

A Systematic Investment Plan (SIP) can be considered permissible when the investments it involves follow Islamic principles. Rather than the method itself, what matters is where the funds are placed and whether those assets meet Shariah guidelines. Many scholars today discuss whether a systematic investment plan is halal, especially when it comes to investing in mutual funds or stocks that may not always be Shariah-compliant.

Systematic Investment Plans have become a widely accepted strategy for building wealth over the long term. Yet, for practicing Muslims, there remains some confusion. Some investors are uncertain and ask whether an SIP is halal or haram in Islam, since the answer depends on what companies or instruments the plan is linked to. If the SIP invests in industries that are free from interest, alcohol, gambling, or other prohibited sectors, then it is more likely to be in line with Islamic investing ethics. In this article, we look into how SIPs work from an Islamic viewpoint and share insights on selecting ethical options that comply with faith-based investing.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

What is a SIP and how does it work?

A Systematic Investment Plan (SIP) is a way to invest the same amount regularly, usually every month, in mutual funds or ETFs. It lets you buy at different prices, which can lower your average cost and build steady habits. What most people don’t talk about is that SIPs can be built to follow Islamic rules if you choose the right funds. This raises the question of whether SIPs are halal or haram in Islam, and the answer depends on where your money actually goes. If the SIP invests only in shariah compliant stocks or Islamic-style bonds, it could be considered halal. But if you go with regular mutual funds without checking, you might end up with things Islam doesn’t allow. So checking the details isn’t just smart, it’s necessary.

Is SIP halal or haram according to Islamic finance?

Many scholars debate whether SIP investment is halal or haram in Islam, and it really comes down to where your money ends up. A Systematic Investment Plan (SIP) is simply a way to invest small amounts regularly. It’s not good or bad on its own, the issue is what kind of companies that money goes into.

A lot of regular funds include businesses tied to interest-based banks, alcohol, or gambling. What most Muslims don’t realize is that even so-called “ethical” funds can make money in ways Islam doesn’t allow, so it needs to be cleaned up. Some dedicated Islamic SIPs use careful checks to avoid such sectors, keep debt levels low, and give away any unclean profits to charity. For anyone serious about halal investing, just checking the fund name isn’t enough. You’ve got to look into what industries it includes, how they handle un-Islamic earnings, and who the scholars making the rules are.

To support the permissibility of Systematic Investment Plans (SIPs) in Islam, it's essential to reference Islamic teachings that emphasize the importance of ethical earnings and investments.

The Qur'an underscores the significance of lawful earnings:

“O you who have believed, eat from the good things which We have provided for you and be grateful to Allah if it is [indeed] Him that you worship.”

— Surah Al-Baqarah (2:172)

Islamic scholars have elaborated on the principles of halal investing. For instance, Mufti Muhammad Taqi Usmani, a renowned Islamic jurist, states:

“The term ‘Islamic Investment Fund’ means a joint pool wherein the investors contribute their surplus money for the purpose of its investment to earn halal profits in strict conformity with the precepts of Islamic Shariah.”

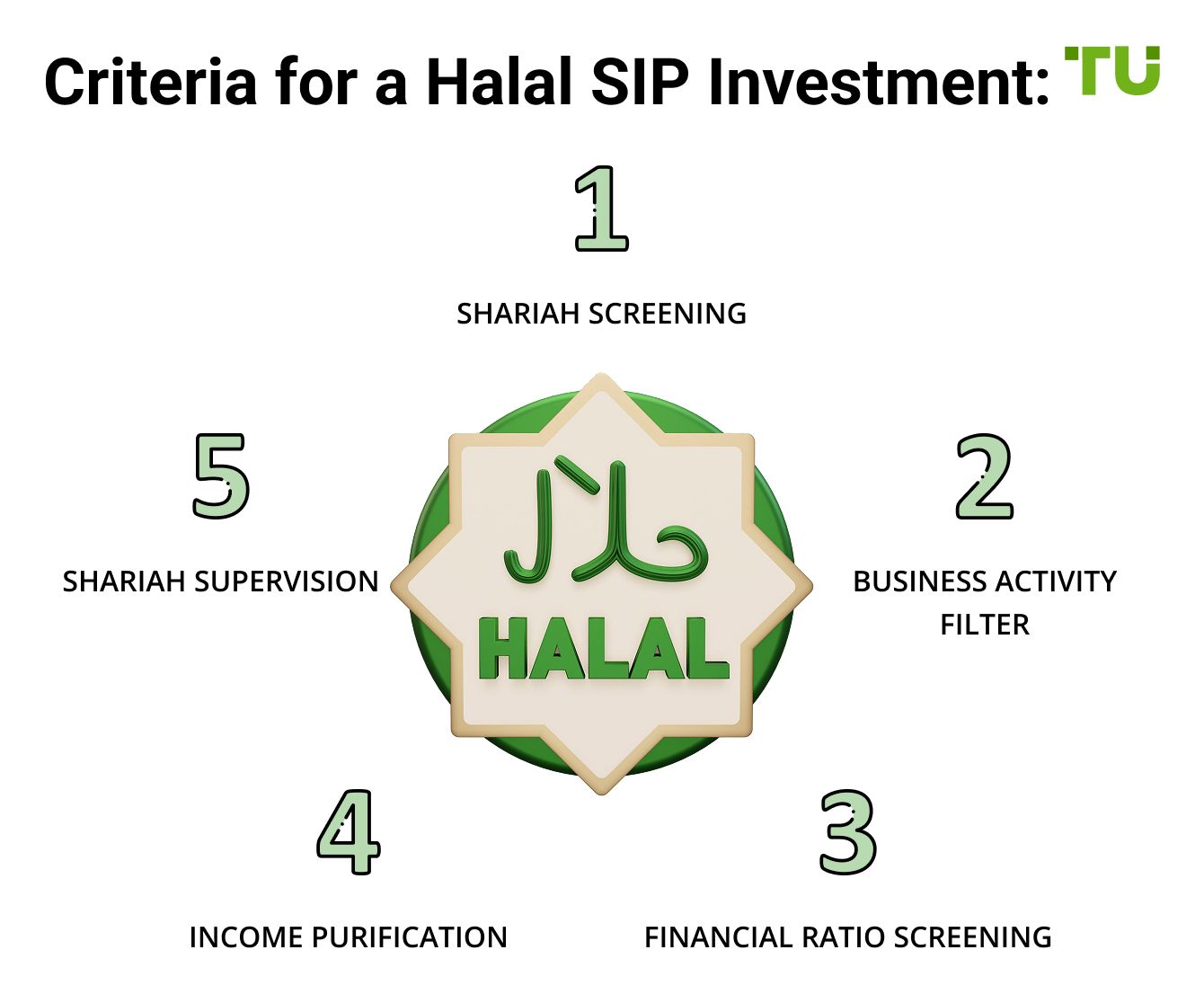

To confirm a SIP’s Shariah compliance, consider the following guidelines.

Shariah screening

The fund should be reviewed by scholars familiar with Islamic finance. This review focuses on what kinds of businesses are involved, how much debt they hold, and where their earnings come from. Investors often consult a halal SIPs list to identify funds that follow these ethical filters.

Business activity filter

The companies included in the portfolio must not earn a major part of their income from sources considered haram, such as traditional banking, insurance, gambling, alcohol, pork products, or adult entertainment. Ensuring the businesses operate in acceptable sectors is a core requirement.

Financial ratio screening

Islamic finance may allow a small amount of interest-related exposure, but only within strict boundaries. For example, a company’s total debt should usually stay below one-third of its total market value. These rules help structure Shariah-compliant SIPs while keeping them grounded in Islamic ethics.

Income purification

If a company earns a minor portion of income through non-permissible means, that part must be cleansed. This involves giving away the same amount to charity, with no personal gain, to remove any impurity from the investment earnings.

Shariah supervision

Ideally, the fund should have a dedicated Shariah board that regularly checks and reviews the fund’s operations. These ongoing audits help ensure the SIP stays within the limits set by Islamic financial laws and continues to remain suitable for faith-based investors.

Examples of Shariah-compliant SIPs

Here are some real examples of halal ETFs and index funds that enable Shariah-compliant SIPs, following strict Islamic investing guidelines and offering transparency in portfolio composition.

Tata Ethical Fund. This is one of the best halal mutual funds from India, investing only in companies that pass a religious compliance screen and avoid sectors like conventional banking, alcohol, tobacco, gambling, and arms manufacturing.

Wahed FTSE USA Shariah ETF. Managed by Wahed Invest, this halal index fund tracks the FTSE USA Shariah Index and includes tech giants like Apple and Microsoft while excluding companies that earn interest, deal in alcohol, or finance debt-heavy projects.

Amana Growth Fund (USA). Operated by Saturna Capital, it invests in US-based stocks that pass Shariah filters and places special emphasis on companies with low debt and strong balance sheets.

SP Funds S&P 500 Sharia Industry Exclusions ETF. This fund filters out S&P 500 companies engaged in non-halal sectors and only includes those with clean financial ratios and ethical operations, based on Shariah principles.

iShares MSCI World Islamic UCITS ETF. This global Shariah-compliant fund gives exposure to over 20 countries and filters based on sector screening, debt ratios, and revenue sources.

Benefits of investing in halal SIPs

Investing in halal SIPs isn’t just about avoiding the haram, it lets you grow capital without guilt.

Purification builds spiritual discipline. Halal SIPs have a system where non-halal earnings are donated, reminding you to keep your money clean in Allah’s eyes.

Screens out companies quietly slipping in haram revenue. Even so-called ethical funds may include alcohol or interest earnings, which Islamic SIPs avoid by regularly adjusting holdings.

Aligned with global Shariah boards. Many Shariah compliant SIPs are checked by well-known Islamic experts, so you don’t have to second-guess your decisions.

Helps answer the question of which SIP is halal. Newer platforms now give clear info on what’s inside your fund and what’s left out.

Strong performance without compromising faith. Some of the best halal SIPs have done better than regular ones by skipping risky and debt-heavy businesses.

Tailored for Muslim financial goals. These SIPs aim for long-term value and real-world impact, making them great for Muslims who want to invest right.

How to check if your SIP is halal

Verifying the halal status of a SIP requires several checks:

Fund documentation

Study the fund’s prospectus, fact sheet, and annual reports. Look for mentions of Shariah compliance.

Shariah certification

Confirm if the fund is certified by a recognized Shariah board (e.g., AAOIFI, Islamic Finance Advisory Board).

Screening tools

Use apps and tools like Islamicly, Zoya, Finvice, or IdealRatings that provide real-time Shariah assessments of mutual funds and stocks.

Expert consultation

Speak with scholars or certified Islamic financial advisors to validate your choice.

Platform due diligence

Invest via Islamic investment platforms such as Wahed, Amana Funds, or ShariaPortfolio which pre-screen SIP options for compliance.

Common misconceptions about SIPs and halal investing

SIPs are often misunderstood by Muslims new to investing, especially when trying to figure out whether they’re halal or not.

Many wonder, can Muslims invest in SIP. The method of investing isn’t the issue, it’s the companies you’re putting money into that decide if it’s allowed in Islam.

The term “SIP” is neutral. A Systematic Investment Plan is just a tool, like a monthly savings habit. What matters is what the fund holds inside, not the process itself.

Most SIPs include haram sectors. Regular funds often include interest-based banks, liquor companies, or gambling businesses, which are not allowed in Islam.

Some ask, is it halal to invest in SIP. If the fund meets Islamic finance rules, avoids debt-heavy firms, and cleans up any profits that might not be allowed, then yes, it can be halal.

People also ask, is SIP allowed in Islam. Islam allows investments that avoid interest, gambling, and unethical sectors. So yes, SIPs are allowed if they’re set up the right way.

A halal label isn’t always enough. Some so-called Islamic funds may still hold questionable stocks. Always check how they choose companies and which scholars are guiding it.

Beyond mutual funds, if you're aiming to grow your wealth while staying true to Islamic values, it's important to consider how your broader investment choices align with Shariah principles. One of the most reliable ways to do this is by using an Islamic account that supports halal investment options across markets like stocks, crypto, and Forex. We've reviewed the leading platforms that offer these Shariah-compliant accounts and outlined their key features to help you choose wisely. You can explore them below.

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.8 | Open an account Your capital is at risk. |

|

| Yes | No | Yes | 50 | 200 | No | 1.97 | Study review | |

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review |

Make SIPs halal by restructuring fund choices and rebalancing regularly

Many people think SIPs are off-limits in Islam because of the interest component, but there’s more nuance to it. If you pick each fund yourself and stick to Sharia-compliant options like ethical stocks or certain ETFs, you can still invest without breaking Islamic rules. You’re not forced to follow pre-set fund packages. Building your own SIP this way gives you the benefits of disciplined investing, while also aligning with your values.

Here’s something most people overlook: even if your investments start out halal, they might not stay that way. Company debt ratios and business activities can shift. That’s why it’s smart to check your portfolio every few months and swap anything that’s no longer compliant. Think of it like cleaning up your investments before they cross a line. It’s not just about being invested, it's about being intentional with every rupee you put in.

Conclusion

Systematic Investment Plans are a powerful tool for wealth accumulation. For Muslims, the key consideration is not the method itself, but the ethical nature of the investments made through it. By choosing Shariah-compliant mutual funds and using trustworthy tools and advisors, Muslim investors can confidently participate in the financial markets while upholding their faith. Halal SIPs represent a bridge between modern financial planning and traditional Islamic values.

FAQs

Can I automate halal investing like a regular SIP?

Yes, many global platforms like Wahed or ShariaPortfolio allow you to set up automated, recurring halal investments. You can choose your risk level and contribution amount, and they’ll handle compliance and portfolio rebalancing for you.

What happens if a company in my halal SIPs fund becomes non-compliant later?

If a holding becomes non-compliant, most Shariah-managed funds remove it during the next review. Any income earned from that stock is usually purified, donated to charity, so your returns stay ethically clean.

Are halal SIPs available in countries with limited Islamic finance infrastructure?

Yes. Even if your country lacks dedicated Islamic finance institutions, you can invest globally through online platforms that offer Shariah-compliant ETFs and mutual funds. Just ensure the platform is regulated and the fund has credible Shariah oversight.

Is it necessary to consult a scholar before starting a halal SIPs?

Not always. While scholars provide helpful guidance, many reliable funds today publish Shariah audits and compliance reports. If you're using a trusted halal platform and doing basic research, you can invest confidently without direct consultation.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.