Is Spot Trading Halal Or Haram? A Detailed Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Spot trading is usually viewed as halal in Islam, provided it meets certain conditions such as immediate settlement, avoidance of interest (riba), and actual asset ownership. If any of these criteria are missing, the trade might be considered haram. Spot trading is halal or haram depending on how strictly these principles are followed.

Many Muslims remain uncertain about whether joining financial markets, particularly spot trading, fits within Islamic values. With the rise of crypto exchanges and online platforms, it’s become more important to clarify what is acceptable and what crosses the line. This article explains spot trading in practical terms and compares it with methods like futures or margin trading. It also outlines key rulings from Islamic scholars that help traders assess if spot trading is halal in Islam based on how the trade is structured and executed.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

What is spot trading and how does it work?

Spot trading means buying or selling an asset with immediate settlement. In this method, you purchase a financial asset such as a stock, currency, commodities, or cryptocurrency and receive it right away, usually on the same day. The term “spot” reflects this immediate nature of settlement, unlike futures or options where the delivery is postponed. To keep it halal as per laws of Islamic finance, payment and transfer of ownership should take place at the time of trade or within a short and agreed timeframe.

This form of trading exists across both traditional markets and digital platforms. Many scholars discuss the question “Is spot trading halal in Islam”, and the general consensus leans toward permissibility when there's no interest involved and ownership is clear. The absence of speculation or delayed settlement helps clarify the question of whether spot trading is halal or haram for those seeking Shariah compliance.

Islamic principles on trade and financial transactions

Islamic finance is based on fairness, openness, and strong moral values. All financial transactions must avoid riba (interest), gharar (excessive uncertainty), and maysir (gambling), as these are seen as unethical and damaging under Shariah.

The Qur'an explicitly states:

"But Allah has permitted trade and has forbidden interest." — Surah Al-Baqarah 2:275

Trade is highly regarded in Islam, as long as it’s done with honest terms and clear mutual understanding. The Prophet Muhammad (peace be upon him) was a trader himself, and the Quran contains many references encouraging honest and fair trade. The permissibility of a transaction depends on how it’s structured — not on trading itself.

When a trader is evaluating spot trading with a goal to know if it is halal, what matters most is whether the trade avoids delayed settlements, interest-based accounts, and unclear asset ownership. If those conditions are met, it generally fits within Shariah rules. Scholars discussing spot trading being halal or haram in Islam often point out that it’s the transaction’s details, and not the method, that make the difference.

Key differences between spot trading and other trading types

Spot trading vs futures trading

Futures trading means agreeing to buy or sell an asset at a set price on a future date. These deals usually involve delays and speculation, both of which are not acceptable in Islamic finance. They may also require borrowing or margin, which can bring interest into the transaction.

By contrast, spot trading happens right away. You pay and receive the asset immediately, without delay or profiting from the timing. This structure makes it more acceptable from a Shariah perspective.

Spot trading vs margin trading

Margin trading allows you to borrow money to place larger trades. This almost always includes paying interest (riba), which goes against Islamic teachings. It also increases exposure to risk and speculation.

With spot trading, you use only your own capital. There's no borrowing, so no interest is involved. That’s why it's a better fit for those following Islamic financial principles.

Spot trading vs options trading

Options contracts let traders buy or sell later, but this right comes with conditions that are often used for speculation. Since these contracts involve uncertainty and delay, they create ambiguity (gharar), which is not allowed in Islam. Further, binary options are also generally considered haram because they resemble gambling, and offer all-or-nothing outcomes based on price movements within a short time frame, without actual asset ownership or productive economic activity.

Spot trading works more simply. You pay the agreed price and take possession of the asset right away. This clarity makes it easier to follow Islamic rules on trade.

Other trading methods

CFD trading doesn’t involve real ownership of assets. Instead, it’s a contract based on price differences. Because CFDs often rely on leverage and speculation, they fall outside the boundaries of halal finance.

Similarly, real estate trading might seem completely halal at first glance, but not all property investments qualify. If real estate deals involve conventional mortgages or yield rental income from haram businesses, they could become non-compliant.

Day trading and scalping, which involve rapid, frequent trades based on short-term price changes, are often criticized for resembling speculation (maysir). While technically possible to perform in a halal way, both styles require extra caution.

Proprietary trading is another area where ethics depend on how the risk is shared between the firm and the trader. Many models involve leverage or unfair risk distribution, which can introduce gharar.

Copy trading and swing trading also require careful analysis. Copy trading may involve following traders who use haram strategies or leverage, while swing trading’s medium-term nature makes it more flexible, yet not automatically halal.

Finally, short selling is widely viewed as impermissible in Islamic finance, since it involves selling what you don’t own and profiting from a decline in value; actions that are speculative and lack real asset backing.

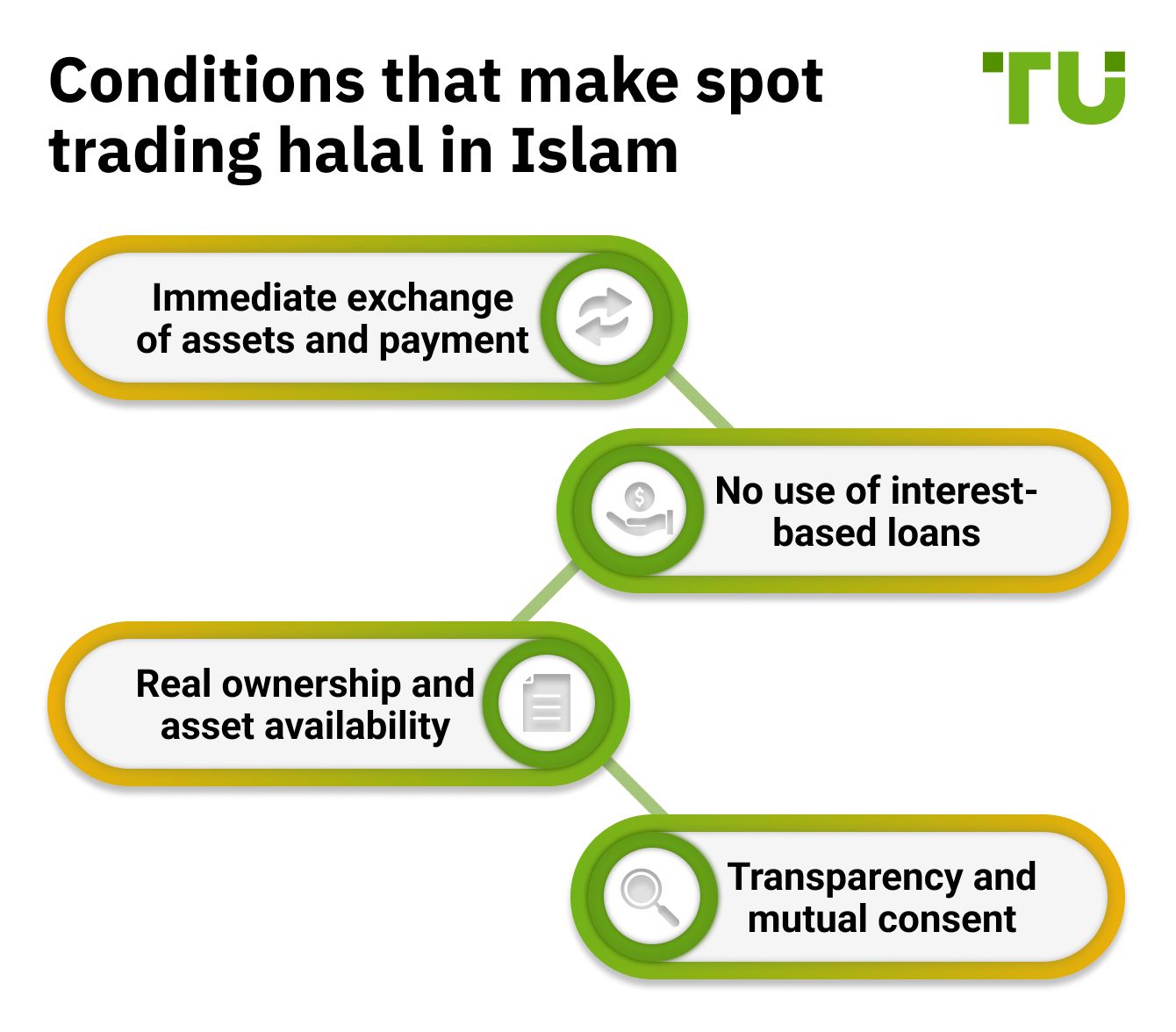

Conditions that make spot trading halal in Islam

Immediate exchange of assets and payment

One major rule of spot trading is that the exchange of both the asset and the payment should happen immediately or within a short, defined period (like T+2, as some scholars permit). If either the money or the asset is delayed, it brings in uncertainty. Quick settlement avoids such doubts and keeps the trade halal.

No use of interest-based loans

Many trading platforms offer margin accounts that charge interest. Using borrowed money with interest turns the trade into a haram one. But is spot trading halal in Islam when you use your own money without interest? Yes, spot trading with your own funds avoids this issue and stays within Islamic guidelines.

Real ownership and asset availability

According to Islamic rules, you must own or control what you sell. Selling something that isn’t in your possession is not allowed. Spot trading usually involves real ownership, whether of stocks, crypto, or another asset, which ensures that the trade is valid.

Transparency and mutual consent

Trade in Islam must be based on clarity and agreement between both sides. Each party should fully understand what they’re agreeing to. Most modern spot trading platforms provide clear pricing and straightforward execution. As long as both parties agree with full understanding, the trade stays halal.

Common misconceptions about spot trading in Islamic finance

All types of trading are haram

Many people believe trading is always haram due to the risks or interest involved. But that’s not true. Islam allows trade but sets boundaries to keep it ethical. When done right, spot trading respects these limits. The issue is not trading itself, but how the trade is structured.

Cryptocurrency spot trading is always haram

Some assume that trading crypto is always wrong. In reality, it depends on the asset and how it’s traded. If it has real-world use and is traded on a spot basis, without leverage or margin, crypto spot trading can be halal.

Is spot trading haram in Islam when it involves speculative contracts? Yes. But when done transparently and without interest, scholars consider it permissible.

Immediate transfer isn’t necessary

There’s a view that once a deal is agreed upon, timing doesn’t matter. But Islam stresses the importance of prompt delivery. Delays introduce risk and uncertainty, which are not allowed. For a trade to qualify as halal, the exchange must happen without unnecessary delays.

If you wish to invest in financial assets (stock, crypto, etc), we suggest you do so through brokers that offer Islamic accounts. We have presented the top options below. You may compare and choose one for yourself:

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.79 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | Yes | 50 | 200 | No | 1.96 | Study review |

Spot trading as a halal strategy through real-asset pairing and risk layering

When it comes to whether spot trading is halal or haram, most people just check if it’s settled instantly. But there’s more to it. A smart move for beginners is to build trades around real, deliverable assets, like a gold-backed ETF or a currency that’s tied to physical reserves. If you trade things that actually exist and can be transferred right away, you stay within the bounds of Islamic rules. That’s what really matters, not just timing, but what’s behind the trade.

There’s also a helpful way to reduce risk without stepping into speculation. Try dividing your money into three parts: one part for active trading, one only for trades that meet strong halal criteria, and one just kept aside. This isn’t just about playing it safe, it helps you trade with a clear purpose and keeps your capital protected. That balance between staying active and being responsible is exactly what Islamic finance is about.

Conclusion

Spot trading can be halal in Islam if it aligns with key Shariah principles like immediate settlement, no interest, clear ownership, and mutual consent. It avoids many of the speculative and risky elements found in other trading types.

Muslims interested in trading should carefully evaluate the platform, transaction method, and underlying asset. With proper knowledge and ethical practices, spot trading offers a halal way to participate in financial markets.

FAQs

Can I spot trade during non-trading hours in Islam?

Yes, as long as the trade is processed in a way that ensures immediate settlement once the market reopens. The time of placing an order doesn't matter, what matters is when ownership and payment are executed. Delayed processing due to market closure doesn't make it haram if the intent and structure are still Shariah-compliant.

Is trading fiat currency for crypto in spot trading halal?

It can be, if both the fiat and crypto assets are legitimate and the exchange is completed instantly. Scholars differ slightly on crypto's permissibility, so make sure the cryptocurrency has utility, isn’t purely speculative, and is exchanged on a transparent spot basis, no delays, no hidden conditions.

Does automatic order execution impact the halal status?

No, automated systems are fine as long as the trade conditions meet Islamic requirements: real asset ownership, no riba, and timely settlement. Auto-execution just facilitates efficiency, it doesn't affect the ethical nature of the trade unless it leads to delays or speculative elements.

Is it halal to spot trade through a broker who charges a spread?

Yes, spreads are typically considered a fee for service and not riba, especially when they’re clearly disclosed. Just ensure the broker doesn’t engage in unethical practices like pooled trading, delayed settlements, or interest-based hidden charges. Full transparency matters in keeping the trade halal.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

CFD is a contract between an investor/trader and seller that demonstrates that the trader will need to pay the price difference between the current value of the asset and its value at the time of contract to the seller.

Day trading involves buying and selling financial assets within the same trading day, with the goal of profiting from short-term price fluctuations, and positions are typically not held overnight.

Copy trading is an investing tactic where traders replicate the trading strategies of more experienced traders, automatically mirroring their trades in their own accounts to potentially achieve similar results.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.