Halal Index Funds And ETFs: A Data-Driven Investment Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

In 2025, more than 30 halal ETFs and index funds are available across global markets, giving Muslim investors a Shariah-compliant way to access equity investments. Popular options like SPUS, HLAL, and AMAGX have shown returns ranging from 8.9% to 13.6%, with strong exposure to sectors such as technology, healthcare, and industrials. These funds generally follow guidelines set by AAOIFI or the Dow Jones Islamic Index and are reviewed every quarter to stay aligned with Islamic rules.

Halal index funds and ETFs give practicing Muslims a way to participate in the stock market without compromising their beliefs. These investment vehicles exclude companies involved in alcohol, gambling, pork products, or interest-based financial services. By following Shariah-compliant guidelines, these funds offer a responsible path to value-aligned financial growth. In this article, we explore key insights into top halal ETFs and halal index funds in 2025. Using the latest data, we highlight how these funds are screened, compare their recent performance, and explain what sets the best halal ETFs apart.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

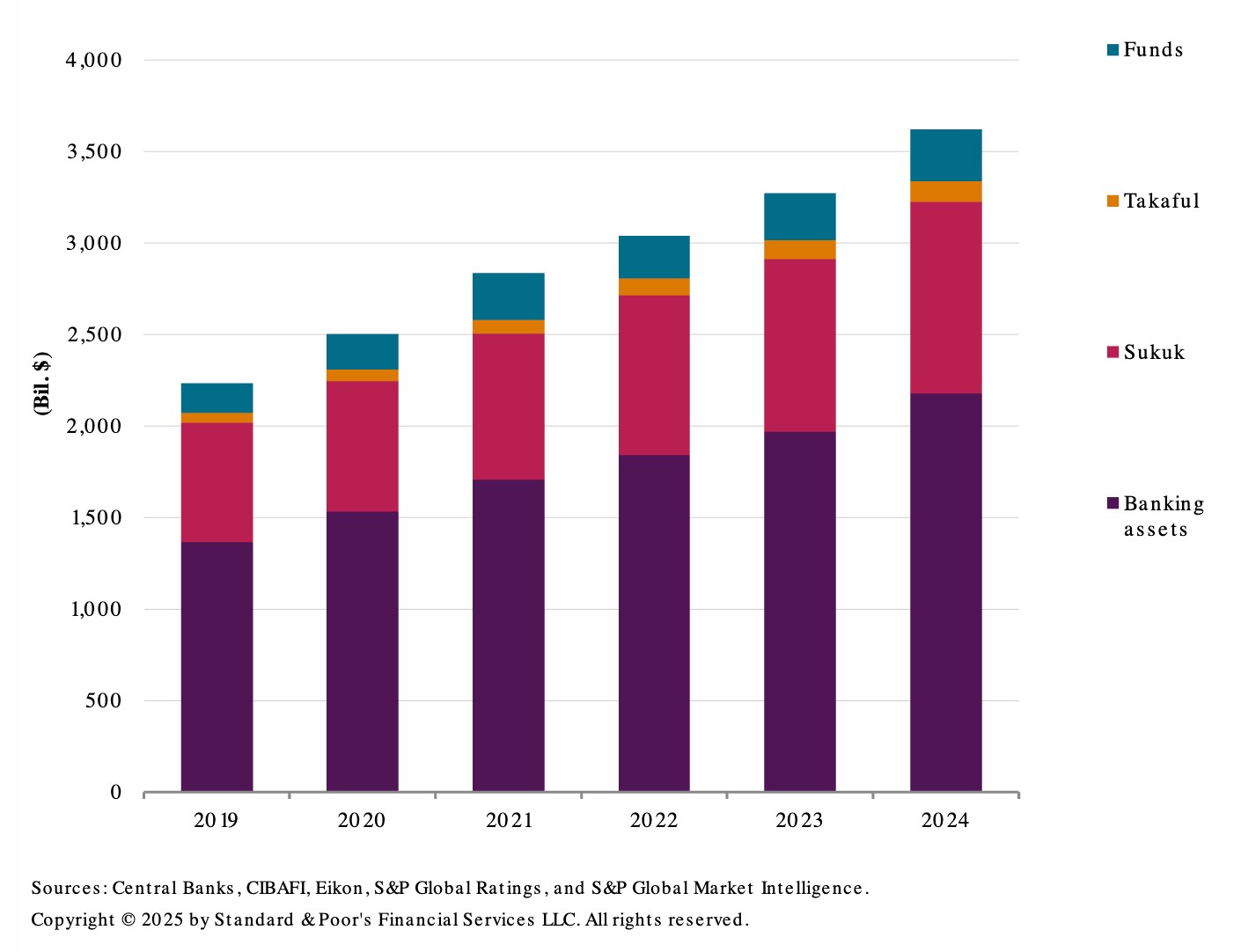

Market overview: Islamic finance market in 2025

The Islamic finance market continued its upward trajectory in 2025, reaching a total value exceeding $3.8 trillion, according to data from S&P Global Ratings. Banking assets remained the largest component, supported by steady growth in core markets. Sukuk (Islamic bonds) issuance also expanded significantly, reflecting strong investor appetite for Shariah-compliant instruments. The takaful (Islamic insurance) and funds segments, though smaller in scale, saw gradual increases, driven by greater institutional participation and retail demand. Overall, the market has grown consistently year-over-year since 2019, underscoring its resilience amid global financial uncertainty and rising interest in ethical finance. Although specific data on Shariah-compliant equity instruments remains limited, interest in this segment continues to grow steadily as investors seek the best halal ETFs to invest in.

What are halal index funds?

Halal index funds are built around strict principles that align with Islamic investing, such as avoidance of riba, maysir, and gharar. These funds track Shariah-compliant stock indices, ensuring that investors avoid exposure to industries considered haram, such as alcohol, gambling, pork products, stock lending, and conventional banking.

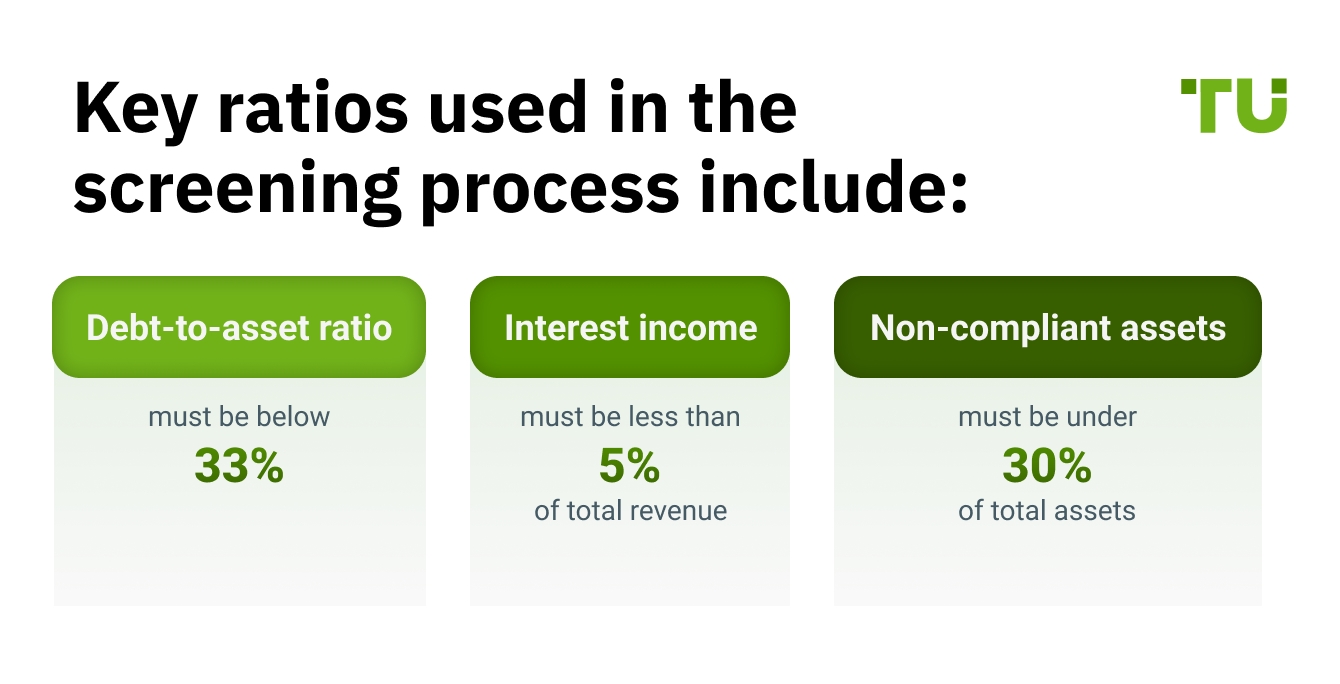

However, what sets these funds apart isn’t just the exclusion of certain sectors. They also apply rigorous financial screening, monitoring things like debt levels, non-compliant income sources, and adherence to the purification process. Even if a company operates in a permissible sector, it may still be excluded if it carries excessive interest-bearing debt or generates income from activities that conflict with Islamic finance principles.

Compliance criteria

Most halal index funds follow guidance from standards-setting bodies such as:

AAOIFI (Accounting and Auditing Organization for Islamic Financial Institutions).

Dow Jones Islamic Market Index Guidelines.

MSCI Islamic Index Methodology.

Debt-to-asset ratio: must be below 33%.

Interest income: must be less than 5% of total revenue.

Non-compliant assets: must be under 30% of total assets.

What are halal ETFs?

Halal ETFs are a category of exchange-traded funds created to comply with the principles of Islamic finance. Unlike traditional ETFs that may include companies involved in alcohol, gambling, or interest-based finance, the best performing halal ETFs exclude haram sectors and apply strict financial filters. These filters ensure that the companies selected do not generate significant income from interest or carry excessive debt, maintaining Shariah compliance.

What makes halal ETFs unique isn’t just the exclusion of prohibited sectors. It’s the thoughtful selection of smaller, high-growth companies that not only meet financial and ethical criteria but also reflect the values many Muslim investors choose to support. This blend of ethical investing and growth-oriented strategy offered by Shariah ETFs provides them with a distinct appeal within the broader Shariah ETF market.

ETF governance

Halal ETFs are typically reviewed every quarter by a Shariah Supervisory Board and often work with independent compliance firms like IdealRatings, Shariah Review Bureau, or Yasaar Ltd. These reviews help ensure the funds continue to meet Islamic investment principles and remain suitable for observant investors.

Verified 2025 performance: list of halal ETFs

The section below presents the latest data on performance, fee structures, and key attributes of the best Shariah ETFs, based on updates from Q4 2024 through Q1 2025. Each fund listed operates under strict Shariah supervision, providing a reliable and ethical path for equity investments, including those that intersect with halal Forex trading and Forex-related strategies. These funds continue to serve as a practical, transparent, and values-driven investment option for observant investors across various risk profiles.

| ETF Name | YTD Return (Q4 2024 – Q1 2025) | Expense Ratio | Holdings Count | Geographic Focus |

|---|---|---|---|---|

| SP Funds S&P 500 Sharia ETF (SPUS) | +13.23% | 0.45% | 224 | U.S. Large-Cap |

| Wahed FTSE USA Shariah ETF (HLAL) | +12.28% | 0.50% | 215 | U.S. Diversified |

| iShares MSCI World Islamic UCITS ETF (ISWD) | -9.38% | 0.30% | 330 | Global Developed |

| HSBC MSCI World Islamic ESG UCITS ETF (HIWS) | +11.5% | 0.30% | 300+ | Global Developed (ESG Focus) |

| Wahed Dow Jones Islamic World ETF (UMMA) | +10.8% | 0.65% | 100+ | Global ex-U.S. |

| iShares MSCI USA Islamic UCITS ETF (ISUS) | +9.9% | 0.50% | 200+ | U.S. Mid & Large-Cap |

| SP Funds Dow Jones Global Sukuk ETF (SPSK) | +3.2% | 0.65% | 50+ | Global Sukuk (Fixed Income) |

| SP Funds S&P Global REIT Sharia ETF (SPRE) | +7.4% | 0.69% | 60+ | Global Real Estate (REITs) |

| Franklin Global Sukuk ETF | +2.9% | 0.40% | 40+ | Global Sukuk |

| DWS MSCI Islamic World ETF | +8.6% | 0.35% | 250+ | Global Developed |

SP Funds S&P 500 Sharia ETF and Wahed FTSE USA ShariahETF are currently the best Shariah-compliant ETFs in the U.S., offering investors sector-weighted exposure to vetted large-cap companies.

Verified 2025 performance: list of halal index funds

For investors seeking both long-term growth and Shariah compliance, best halal index funds serve as a reliable entry point into equity markets in 2025. These options are particularly appealing to individuals who prioritize religious values while aiming for consistent portfolio expansion. If you're trying to understand which index funds are halal in today’s landscape, the selections below offer a solid starting point.

The best Shariah-compliant index funds are highlighted below with their returns based on verified data from the first quarter of 2025, using the most recent disclosures available. Each one adheres to recognized Shariah screening methodologies and maintains transparency in how assets are allocated across sectors that align with Islamic principles.

| Fund Name | 1-Year Return | Net Assets | Sector Allocation |

|---|---|---|---|

| Iman Fund (IMANX) | -4.44% | $187.41M | Technology (39.28%), Industrials (13.08%), Healthcare (12.14%), Consumer Cyclical (11.30%) |

| Amana Growth Fund (AMAGX) | -4.02% | $5.08B | Technology (51.85%), Healthcare (17.25%), Industrials (10.24%), Consumer Cyclical (7.04%) |

| Amana Developing World Fund (AMDWX) | -2.78% | $37.23M | Technology (34.6%), Consumer Staples (19.1%), Materials (12.1%), Healthcare (8.8%) |

| HSBCIslamic Global Equity Index Fund | +14.37% | $7.3B | Technology (38.6%), Healthcare (12.96%), Industrials (11.2%), Consumer Cyclical (8.95%) |

| Schroder Islamic Global Equity Fund | +12.5% | $1.2B | Technology (39.82%), Consumer Cyclical (15.25%), Healthcare (12.26%), Industrials (10.26%) |

| RHB Global Shariah Equity Index Fund | +14.37% | $500M | Technology, Healthcare, Industrials |

| Foord-Hassen Shariah Equity Fund | +11.8% | $300M | Technology, Consumer Cyclical, Healthcare |

| KSE Meezan Index Fund (KMIF) | +9.2% | PKR 10B | Financials, Energy, Technology |

| Mackenzie Shariah Global Equity Fund | +13.5% | $250M | Technology, Healthcare, Consumer Cyclical |

| Sands Capital Global Shariah Fund | +15.0% | $400M | Technology, Consumer Cyclical, Healthcare |

Amana funds continue to be some of the most recognized halal mutual funds in North America. They are known for long-term capital growth, achieved through sector diversification and careful adherence to Shariah principles. For investors seeking exposure to ethically screened portfolios, Shariah compliant index funds like Amana offer a balanced approach that combines financial discipline with religious compliance.

Global availability of halal ETFs

Global halal ETFs. There are approximately 5 U.S.-listed Shariah-compliant ETFs and a handful of global ones.

Regional distribution. The United States hosts 5 halal ETFs. Europe, the Gulf Cooperation Council (GCC), and Asia (including Malaysia and Indonesia) each have a few such ETFs.

Active providers. Notable providers in the halal ETF space include Wahed Invest, SP Funds, Franklin Templeton, and BlackRock.

Halal small cap ETFs

In 2025, demand for the halal small cap ETFs remains strong among Muslim investors who seek ethical and Shariah-compliant exposure to equity markets. These funds are popular due to their accessibility, trading efficiency, and relatively low expense ratios. They offer diversified exposure to equities that align with Islamic principles, ensuring that investors remain within faith-based guidelines without sacrificing performance.

There has been growing demand for halal small cap ETFs as they are a better option relative to penny stocks. However, available options are still relatively few. As of now:

Three halal small cap ETFs are actively traded in various international markets.

The SP Funds S&P Small Cap Sharia ETF is expected to launch around mid-2025.

Halal small cap ETFs tend to experience greater return fluctuations, with one-year performance ranging from 9.1 percent to 14.4 percent based on sector distribution.

How to choose a halal ETF or index fund

If you’re new to halal investing, selecting one of the best Islamic ETFs requires more than simply choosing a fund that includes the word Islamic in its name.

Check the Shariah board behind the fund. A legit ETF should clearly state who approved it and how often they check to keep it in line with Islamic principles.

Look beyond exclusion and study the business models. Some companies pass the screen but still earn income in questionable ways, like leasing property to conventional banks.

Review the purification methodology. If ETF or index fund doesn’t tell you how much dividend to purify, you’re left guessing whether your profits are truly halal.

Scan sector weightings, not just the top 10 holdings. A halal fund could be overloaded in tech or real estate, which affects how it behaves when the market shifts.

Dig into the financial ratios. Check how strict the fund is about limiting interest-based income and debt. This shows whether it follows real Shariah standards or just meets the minimum.

Check how often the fund is rebalanced. Funds that adjust quarterly or semi-annually stay more compliant than those that update only once a year.

See how the fund handles sukuk and cash. If it holds a lot of cash or sukuk, make sure the structure matches both your risk tolerance and Islamic goals.

If you wish to invest in index funds and ETFs, we suggest you do so through brokers that offer Islamic accounts. We have presented the top options below. You may compare and choose one for yourself:

| Swap Free | Indices | Stocks | ETFs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | Yes | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | Yes | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | No | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.79 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | Yes | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | Yes | No | No | 10 | No | 1.96 | Open an account Your capital is at risk.

|

Risks and warnings

Technology concentration. Most halal funds are tech-heavy, increasing vulnerability during sector corrections.

No exposure to financials. Excludes banks and insurers, limiting portfolio diversification.

Cyclicality in industrials and energy. Performance may fluctuate with commodity prices and global economic trends.

Emerging market risk. Some funds include volatile regions with political and currency instability.

Shariah compliance shifts. Companies may fall out of compliance between quarterly rebalancing cycles.

Low liquidity in niche ETFs. Smaller funds may have wide bid-ask spreads and limited daily volume.

Regional insights on halal investing

The availability of Shariah-compliant investment options, including ETFs and Shariah law index funds, varies across regions due to differences in regulation, market access, and investor demand. To help you navigate these options, we’ve compiled a comprehensive list of halal index funds tailored to specific countries.

Whether you're based in India, the UK, Pakistan, the USA, Canada, Malaysia, or Singapore, our region-wise guides offer detailed fund overviews, access platforms, and key regulatory insights. Each guide is designed to help local investors identify suitable choices aligned with Shariah principles, making informed investment decisions easier and more accessible.

Halal ETFs with low debt rotation and frontier market tilt offer growth edges

When choosing halal ETFs or index funds in 2025, beginners often miss one key detail: how often the fund checks for companies crossing Shariah limits. Some ETFs only screen for debt and interest once every quarter, while others do it monthly. That difference can be a big deal. If the market moves quickly and a company’s debt levels rise, a less frequently updated ETF might still hold it. But a fund that checks more often can drop non-compliant stocks faster, keeping your portfolio cleaner and closer to halal principles even in fast-changing markets.

Here’s something else many overlook. Most people stick to US or Gulf-based halal funds, but some of the most promising halal ETFs right now are in frontier markets — places like Nigeria, Malaysia, or Kazakhstan. These often include smaller companies that don’t move in sync with big global markets and can offer stronger growth during uncertain times. They’re a bit harder to access and not as heavily traded, but the sectors they cover, like agriculture, logistics, and halal travel, can give you an edge if you're looking beyond the obvious. Look at funds that explain how each sector handles zakat and halal screening. That’s where the smart choices start to show.

Conclusion

In 2025, investors have access to a growing and regulated selection of halal ETFs and index funds. These instruments offer ethical exposure to equity markets while remaining compliant with Islamic financial principles.

With over 30 active halal funds, global availability, and continued innovation (e.g., sector-based indexes and small-cap coverage), Muslim investors can now build portfolios that meet both financial and religious goals.

FAQs

Do halal ETFs pay dividends?

Yes. Dividends are either purified before distribution or disclosed for investor purification as per Shariah standards.

How often are best islamic index funds rebalanced?

Most halal ETFs and index funds are rebalanced quarterly, with compliance screening updated during each cycle.

Are halal ETFs suitable for short-term investing?

While muslim ETFs are generally designed for long-term growth, they can also be used for short-term strategies depending on market conditions and liquidity.

Do halal index funds include ESG screening?

Some muslim index funds also apply ESG filters, but not all. Investors seeking dual ethical screens should verify each fund’s inclusion criteria.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.