Halal ETFs And Shariah-Compliant Index Funds In Pakistan

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

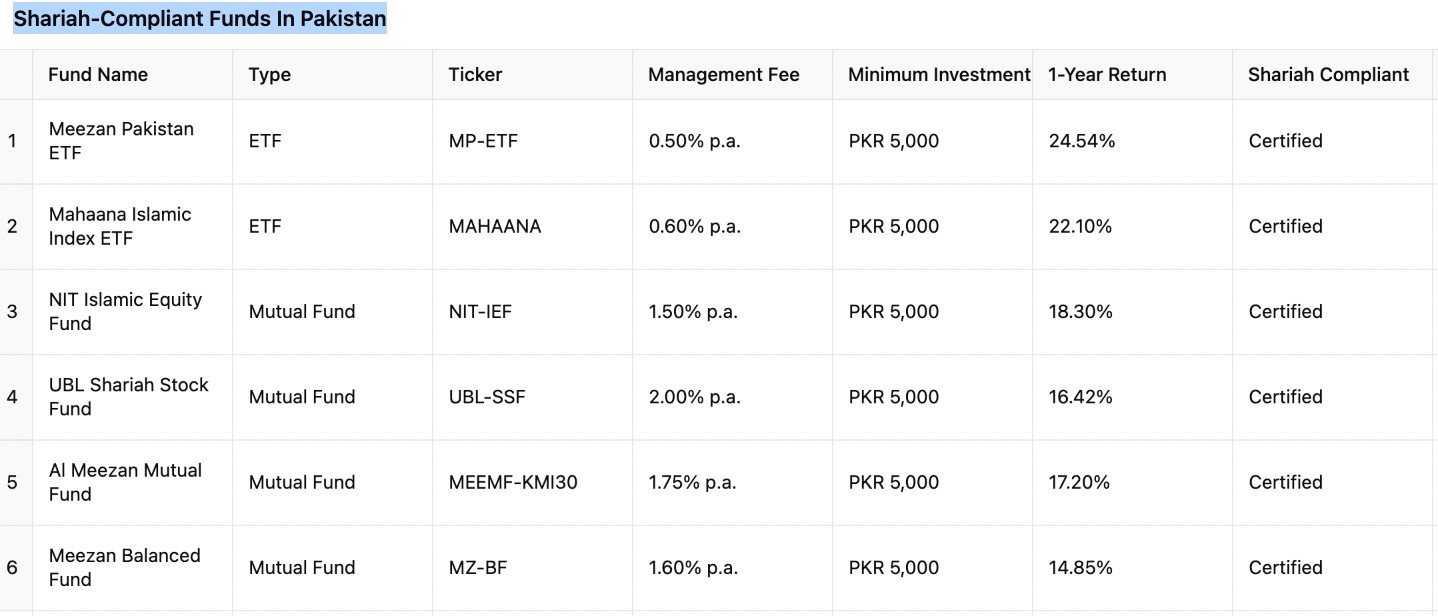

The top halal ETFs and index funds in Pakistan are:

Meezan Pakistan ETF (MP-ETF) – Pakistan’s first halal ETF with real-time Shariah screening and automatic purification of non-compliant income.

Mahaana Islamic Index ETF – a low-cost, passively managed ETF tracking a Shariah-compliant stock index, optimized for digital retail access.

NIT Islamic Equity Fund (Mutual Fund) – offers ETF-like diversification with stricter Islamic filters on interest and liquidity.

UBL Shariah Stock Fund (Mutual Fund) – screens out firms with high receivables; focuses on operational purity and financial strength.

Al Meezan Mutual Fund (KMI-30) (Mutual Fund) – tracks the KMI-30 index, with added governance and ethical oversight from a Shariah board.

Meezan Balanced Fund (Mutual Fund) – combines Shariah-compliant equities with Islamic Sukuk for a lower-risk, hybrid portfolio.

For Muslims looking to participate in the stock market without compromising on religious guidelines, one of the most practical routes is through a Shariah compliant ETF in Pakistan. These, along with halal index funds, give investors a chance to grow their savings while avoiding prohibited sectors. When choosing a platform to invest in a Islamic ETF in Pakistan, investors not only ensure ethical growth but also gain access to diversified portfolios that follow Islamic screening standards. This guide highlights some of the best halal ETFs and index funds currently available in the Pakistani financial landscape.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Halal index funds and islamic ETFs in Pakistan: Ethical, diversified investing in 2025

Halal index funds in Pakistan go a step further by constructing entire indexes around pre-approved Islamic assets. These are not just exclusions of alcohol or gambling sectors, but full-spectrum financial filters. The filters include debt ratios, liquidity screens, interest income limits, and even how much cash a company holds relative to its total assets.

Unlike conventional ETFs that passively track an index and forget it, Islamic ETFs often re-adjust holdings based on real-time Shariah compliance audits. For example, a company might initially pass the screen but later breach debt or interest thresholds, requiring the fund to divest it promptly.

What’s rarely discussed is that some funds also apply qualitative filters, removing firms with unethical labor practices or poor ESG scores, even if they pass the financial filters. This results in a portfolio that is not only Islamically compliant but also socially conscious, making halal index funds and ETFs one of the best halal investment options in 2025.

Key features:

Shariah compliance. Investments are screened to ensure they meet Islamic ethical standards.

Diversification. Funds typically invest in a variety of sectors to spread risk.

Transparency. Regular audits and disclosures ensure adherence to Shariah principles.

These funds are ideal for investors seeking to align their financial goals with their faith.

Top Shariah-compliant ETFs in Pakistan

Halal investing in Pakistan has matured over the past decade, offering both Exchange-Traded Funds (ETFs) and mutual funds that comply with Islamic financial principles. While both structures offer exposure to Shariah-screened assets, they differ significantly in how they operate.

ETFs trade like stocks throughout the day, providing real-time pricing, better liquidity, and typically lower management fees. They are ideal for investors who want transparency and ease of entry and exit. In contrast, mutual funds are priced once daily and often actively managed, offering more flexibility in strategy but usually at slightly higher cost and with longer investment horizons.

Shariah-compliant ETFs in Pakistan

Pakistan currently offers two ETFs that are fully Shariah-compliant:

Meezan Pakistan ETF (MP-ETF). The country’s first halal ETF, MP-ETF offers real-time Shariah screening and includes a built-in purification process for any non-compliant income. It tracks a Shariah-compliant equity index and is suitable for investors seeking simplicity and transparency.

Mahaana Islamic Index ETF. A newer option that focuses on passive investing in a diversified basket of Shariah-compliant stocks. Mahaana’s approach emphasizes low fees, index tracking, and modern digital accessibility for retail investors.

Top shariah-compliant mutual funds in Pakistan

For those preferring active management or broader diversification beyond listed equities, Pakistan’s mutual fund market includes several robust Shariah-compliant options. These funds are ideal for long-term investors seeking a more curated portfolio that adapts to market conditions:

NIT Islamic Equity Fund. Though structured as a mutual fund, it mirrors the diversification and accessibility of an ETF while applying stricter Islamic screens on interest and liquidity.

UBL Shariah Stock Fund. Actively avoids companies with excessive receivables, emphasizing operational purity and financial soundness.

Al Meezan Mutual Fund (based on KMI-30). Tracks the KMI-30 index but adds another layer of oversight through its Shariah board, which evaluates governance and ethical practices alongside financial criteria.

Meezan Balanced Fund. A hybrid fund that mixes Shariah-compliant equities with Islamic Sukuk, offering lower volatility and appealing to more risk-averse investors.

For those interested in other halal investment options in Pakistan, our guides covers important details:

Halal stocks in Pakistan.

Halal mutual funds in Pakistan.

Sukuk bonds in Pakistan.

How do Shariah-compliant ETFs work in Pakistan?

Shariah-compliant ETFs in Pakistan are built using strict religious and financial screening rules that go beyond the basics. Here’s how they really work behind the scenes:

Debt levels are closely capped. Companies must keep their total debt under one-third of their market value to be included.

Cash-to-asset ratio is monitored. A firm cannot hold excessive idle cash, especially if it's in interest-bearing accounts.

Non-halal income is tolerated, but limited. Up to 5 percent of total revenue can come from haram sources like conventional banking, but it must be purified.

Purification is mandatory and enforced. Any income from non-permissible sources is donated to charity, and this process is tracked by Shariah boards.

Earnings must come from real assets. Companies that earn mostly from speculative trades or derivatives are excluded.

Ongoing audits keep funds compliant. Screening is not a one-time check but a continuous process, with updates at least every quarter.

Local benchmarks adjust global rules. Screening standards are customized for Pakistani companies and differ from international Shariah ETFs.

How to invest in Halal ETFs and index funds in Pakistan

Step 1: Open a brokerage account

To begin investing in exchange-traded funds, you’ll first need to open an account with a brokerage firm that is registered with the Pakistan Stock Exchange (PSX). Whether you’re interested in conventional options or exploring an Islamic ETF in Pakistan, the brokerage platform is your gateway to the market.

Step 2: Choose a shariah-compliant fund

Next, take the time to research funds that align with both your financial goals and ethical beliefs. If you're seeking investments that avoid interest-based or non-permissible sectors, look into a Shariah compliant ETF in Pakistan. Factors like past performance, fund structure, management costs, and certification status should all guide your decision.

Step 3: Place an order

After choosing a suitable fund and completing your account setup, you can proceed to buy units of your selected ETF. This is done through your broker’s online trading platform, where you’ll have access to both conventional and Islamic investment options.

Step 4: Monitor your investment

Once your investment is active, it’s important to track its progress regularly. Make sure the fund continues to perform in line with your financial targets while staying consistent with your values, especially if you've opted for an ethical or Shariah-compliant fund.

Benefits and risks of investing in Shariah-compliant funds

- Pros

- Cons

Avoids hidden balance sheet risks. These funds screen out companies with excessive debt or interest income, reducing exposure to leverage-related crashes.

Ethical screening has real-world value. Firms with unethical practices, like labor exploitation or weapon manufacturing, are excluded, often shielding investors from reputational risk.

Shariah audits create built-in oversight. Regular reviews by Islamic scholars add a layer of compliance checking that even some conventional funds lack.

Stability in volatile markets. Due to conservative asset selection and ethical limits, Shariah funds tend to avoid bubbles caused by hype-driven stocks.

Misses out on high-growth sectors. Many tech and financial giants are excluded due to non-compliant revenue models, limiting potential returns.

Shariah definitions can vary. What qualifies as compliant in Malaysia may not pass the test in the Gulf, leading to confusion across platforms.

Limited product variety in emerging markets. In countries like Pakistan or Bangladesh, investor choice in sectors like healthcare or clean tech is often narrow.

Higher review and admin costs. Continuous Shariah screening and board oversight sometimes result in slightly higher fund management fees.

If you're interested in looking beyond halal ETFs and index funds in Pakistan, there’s a wider world of Shariah-compliant investment options available globally. From equities and commodities to Forex and digital assets, many platforms now offer dedicated Islamic accounts that follow the principles of interest-free, ethical investing. These options are designed to help you stay true to your financial values while exploring diverse markets. If that sounds like your next step, explore the list of halal-aligned global platforms below and choose one that fits your approach.

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.79 | Open an account Your capital is at risk. |

|

| Yes | No | Yes | 50 | 200 | No | 1.95 | Study review | |

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

Track hidden halal ETF costs and use sector purity to boost returns in Pakistan

Most people stop at checking if a fund says “Shariah-compliant,” but that’s just the first step. If you really want to invest the halal way, go deeper. Some funds include companies that barely pass the basic screening, they might carry more debt or earn from grey-area businesses. Instead, look for funds that follow tighter rules, sometimes going beyond the usual Shariah index. It’s not just about investing ethically, it’s about being extra sure that every rupee is aligned with your values.

Another thing beginners often miss is how much money gets quietly taken out of your returns to clean up impure earnings. Some ETFs don’t clearly show the costs involved in purifying dividends, and that can eat into your profits. The smarter move? Stick to funds that explain these costs upfront or avoid dodgy stocks in the first place. That way, your money stays clean and your gains stay stronger, without any surprises along the way.

Conclusion

Investing in Halal ETFs and Shariah-compliant index funds in Pakistan provides an opportunity to grow wealth while adhering to Islamic investing principles. By carefully selecting funds, understanding their structures, and staying informed, investors can make ethical and profitable investment decisions.

FAQs

Do Halal ETFs in Pakistan distribute dividends, and are they purified?

Yes, many Halal ETFs distribute dividends, but any earnings from non-compliant sources are purified before payout. This means a portion may be donated to charity to maintain Shariah compliance. Always check the fund’s purification policy for transparency.

Can non-Muslims invest in Shariah-compliant funds in Pakistan?

Absolutely. These funds are open to everyone, regardless of religion. Many non-Muslim investors choose them for their ethical screening, low leverage exposure, and socially responsible practices.

What happens if a stock in the ETF becomes non-compliant later?

If a stock no longer meets Shariah criteria, the ETF is required to remove it during the next rebalancing period. Some funds even divest immediately and redirect gains through purification.

Is it possible to automate investments in Halal ETFs through SIPs?

Yes, several platforms in Pakistan allow systematic investment plans (SIPs) into Shariah-compliant funds. This helps investors build wealth gradually while sticking to ethical guidelines with convenience.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).