Halal Penny Stocks | Learn All About

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Halal penny stocks are low-cost shares in companies that meet Islamic finance rules of avoiding interest, gambling, and unethical sectors. They offer high growth potential but come with big risks like volatility and unclear compliance. Investors should screen carefully using financial ratios, business activities, and transparency checks. For those seeking ethical, affordable investing, halal penny stocks can be a fit, if approached with due diligence and a long-term Shariah mindset.

Halal penny stocks offer Muslim investors a unique opportunity to engage in ethical investing while accessing the high-growth potential of low-cap companies. With increasing interest in Shariah-compliant portfolios, these stocks have gained attention for their affordability and alignment with Islamic financial principles. However, not all low-cost stocks qualify as halal, making it essential to understand the underlying business model, debt levels, and income sources before making any decision.

In this article, we’ll explore what qualifies a penny stock as halal, provide a halal penny stocks list, and explain the Islamic investing rules that help ensure your investments remain aligned with your faith.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

Overview of potential halal-compliant penny stocks

Some affordable stocks might align with Shariah principles, considering their financial data and the industries they operate in. These companies operate in sectors generally considered permissible under Islamic finance, such as renewable energy, technology, and healthcare. Investors should personally verify Shariah compliance, either through financial analysis or by consulting a qualified advisor.

Heliogen Inc. (Ticker: HLGN). Operating in the renewable energy sector, Heliogen focuses on sustainable technology. As of April 2025, its stock price was approximately $0.80.

Ault Alliance Inc. (Ticker: AULT). A technology company, Ault Alliance's operations may align with Islamic investing guidelines. Its stock was trading around $0.21 in April 2025.

Ideanomics Inc. (Ticker: IDEX). Specializing in electric vehicle solutions, Ideanomics trades at roughly $0.10. While the sector is potentially compliant, further scrutiny of financials is advised to determine full eligibility.

vTv Therapeutics (Ticker: VTVT). Part of the healthcare industry, vTv Therapeutics has a market price near $0.90. Given the nature of its pharmaceutical work, there may be conditions for compliance depending on the specifics of its product lines and revenue sources.

| Stock Ticker | Company Name | Sector | Price (Approx.) | Shariah Compliant? |

|---|---|---|---|---|

| HLGN | HelioGen Inc. | Renewable Energy | $0.80 | Likely |

| DPRO | Ault Alliance Inc. | Technology | $0.21 | Likely |

| IDEX | Ideanomics Inc. | EV Solutions | $0.10 | Possibly |

| VTVT | vTv Therapeutics | Healthcare | $0.90 | Possibly |

What are halal penny stocks?

Halal penny stocks refer to shares priced relatively low, often below $5 each, that align with Islamic ethical standards. These standards rule out companies involved in riba (interest), maysir (gambling), and gharar (excessive uncertainty), ensuring investments stay within Shariah boundaries.

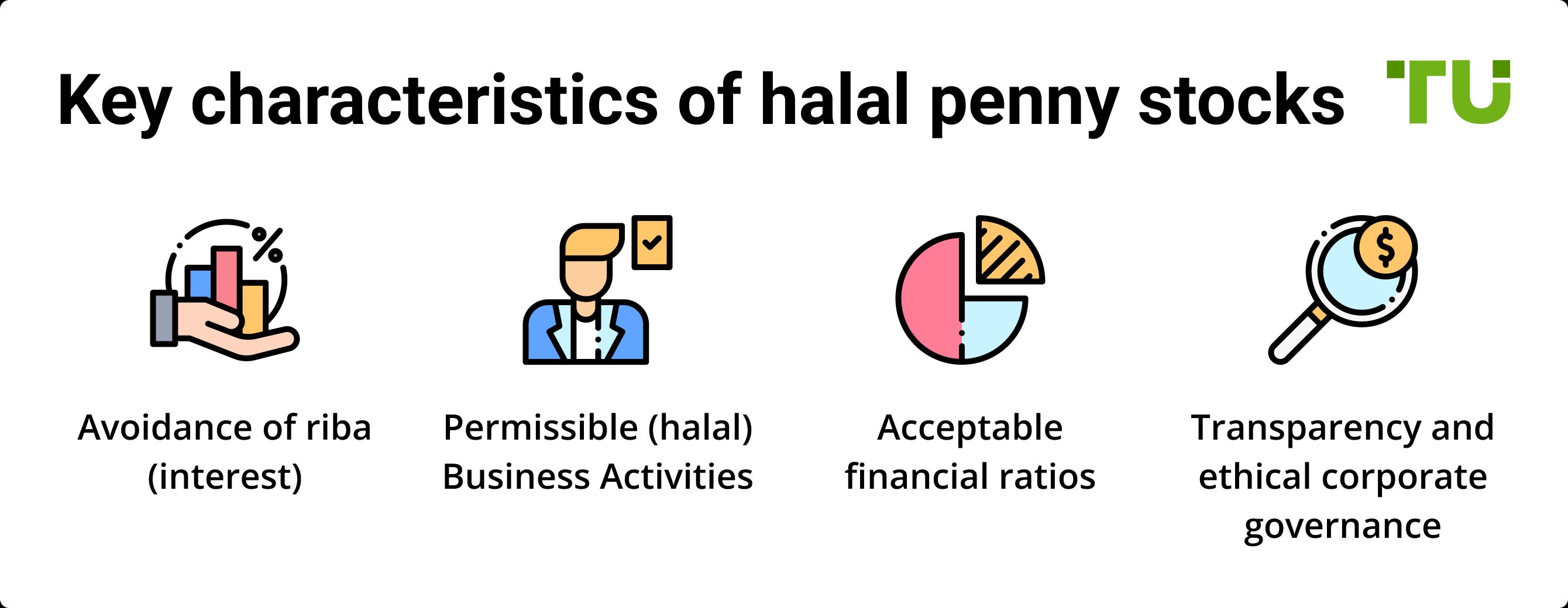

Key characteristics of halal penny stocks

For a penny stock to qualify as halal, the following conditions must be met:

Avoidance of riba (interest)

The business should not engage in interest-driven financial services or earn a notable portion of its revenue from interest-related investments. For example, companies that depend largely on returns from loans or fixed-income assets don’t fall under halal investments.

Permissible (halal) business activities

The main source of revenue must come from halal lines of work. Sectors like alcohol, tobacco, traditional banking and insurance, adult content, pork processing, and arms production are off-limits. In contrast, businesses in tech, healthcare, manufacturing, or other ethical sectors may qualify if they pass other filters.

Acceptable financial ratios

To ensure compliance, Islamic guidelines include financial ratio checks. A typical rule is that total debt should not go beyond one-third of a firm’s total assets. This helps limit dependency on loans that involve interest.

Transparency and ethical corporate governance

The company must operate with openness and fairness. Full financial disclosure, respect for shareholders and business partners, and ethical decision-making are essential. Signs of fraud, opacity, or mismanagement can disqualify a stock from being considered halal.

Criteria for identifying Shariah compliant penny stocks

To be Shariah compliant, a penny stock must pass the following screens:

Business activity screen

Firms engaged in industries such as alcohol, tobacco, conventional banking or insurance, adult media, pork-related goods, or arms manufacturing are deemed not permissible.

Financial ratio screen

The company’s total debt, when compared to its market value, must stay within an acceptable limit (generally under 33%).

Any income derived from interest-based sources should remain extremely limited or insignificant.

Receivables should not make up a disproportionate share of the overall assets.

Ethical conduct and transparency

Firms are expected to operate with integrity, avoiding deceptive practices, speculative behavior, and insider dealings; actions that conflict with the Shariah concept of gharar.

Risks of investing in penny stocks: halal concerns

Penny stocks are already risky due to low liquidity, lack of transparency, and limited regulatory oversight, but for Shariah-conscious investors, the risks go a step further. Many penny stocks operate in sectors that are not clearly compliant, such as biotech firms that engage in speculative R&D, fintech startups with interest-based models, or mining operations that lack environmental accountability (a principle deeply tied to Islamic stewardship or khalifah).

According to a 2024 screening report by Amanie Advisors, over 60% of publicly listed micro-cap stocks in Asia failed to meet Shariah standards due to either excessive debt or non-compliant income streams.

Another key risk is purification ambiguity. Even when a stock passes initial Shariah screening, its quarterly income mix often fluctuates, which makes real-time halal status hard to track. Most investors are unaware that AAOIFI guidelines require donation of impure income, but when there’s no clear breakdown from the company, especially common in smaller firms — this creates a blind spot.

A study by EthisX in 2023 found that fewer than 10% of penny stock investors using halal investing apps actually purified their dividends or knew how much to give away. This can lead to unknowingly holding impermissible earnings, putting both returns and spiritual accountability at risk.

Can penny stocks ever be fully halal?

Yes, but with strong conditions.

The stock must:

Pass all major Islamic financial screens.

Belong to a halal sector.

Avoid all forms of interest-based income, gambling, and speculation.

Be transparent with regular financial audits.

Keep in mind that even stock market investing in general can be debated among Islamic scholars.

Alternative halal investment options

For Muslim investors seeking more stable alternatives to penny stocks, exploring options like stocks from the S&P 500, index funds, or ETFs can provide a more balanced, diversified approach. Many mutual funds and bonds do not meet Shariah standards due to interest income, but the market now offers a growing range of best halal ETFs and index funds that track ethical sectors and exclude prohibited industries. These instruments combine transparency, lower volatility, and easier long-term management, making them a smart addition to any halal investment portfolio. Apart from these generic alternatives, you may also consider unique ones such as:

Peer-to-peer halal lending is gaining traction. Lending platforms like Qardus (UK) or LaunchGood (US) let you fund ethical businesses using profit-sharing models instead of interest.

Agricultural microfunds offer asset-backed returns. Some halal funds invest in livestock or farmland, giving returns based on real trade cycles, not speculation or lending.

Shariah-compliant REITs focused on logistics. These real estate funds avoid retail and entertainment sectors and instead invest in halal-aligned warehouses or supply hubs.

Ethical gold leasing is making a comeback. Based on Islamic ijara contracts, some platforms let you lease your gold for rent, rather than selling it, keeping it compliant and income-generating.

Halal venture syndicates are now more accessible. Small investors can now co-invest in early-stage halal startups through Shariah-cleared syndicate platforms.

Takaful-linked investment plans. Some Islamic insurance providers offer investment-linked plans that grow your money while keeping it within a Takaful structure, ideal for retirement-minded investors.

Halal crowdfunding for green startups. Look for eco-focused businesses raising funds via halal crowdfunding, as this blends ethical impact with asset-backed growth.

If you choose to invest in financial assets (stocks, crypto, etc.), it’s best to use Islamic accounts to remain Shariah compliant. Below we have presented the top brokers offering such accounts. You may compare and choose one for yourself, if required:

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.79 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | Yes | 50 | 200 | No | 1.95 | Study review |

Filtering halal penny stocks using balance sheet asymmetry and IPO lock-up cycles

Most beginners screen halal penny stocks using industry filters and debt ratios — but that barely scratches the surface. A deeper strategy involves identifying companies that show balance sheet asymmetry, where liquid assets vastly outweigh short-term liabilities but still trade under ₹100 or $5.

Why does this matter? In Shariah investing, financial stability without interest-heavy obligations is key, and these asymmetries often flag overlooked halal plays — especially in biotech, logistics, or cloud service firms that use alternative funding methods like equity crowdfunding or sukuk-style arrangements.

Here’s something rarely talked about: IPO lock-up expiries in micro-cap halal companies can create undervaluation windows for a few days or weeks. Many investors ignore them because they focus on large caps, but when insiders are free to sell (post-lockup), temporary price dips occur — even in Shariah-compliant stocks. If you’ve already screened the business activity and ratios for halal compliance, this is the moment to act. Pair this with Form 10-Q deep dives to verify non-interest revenue sources, and you’re making a Shariah-aligned move with timing precision.

Conclusion

Halal penny stocks offer Muslim investors a chance to engage in the equity market while remaining true to Islamic values,but this path is not without its challenges. The low cost of entry can be appealing, yet the risks of volatility, limited transparency, and potential non-compliance with Shariah principles demand careful scrutiny. To invest responsibly, one must go beyond surface-level screening and continuously evaluate a company’s business activities, financial health, and ethical standards. With proper due diligence and guidance from Shariah advisors, halal penny stocks can be a valuable component of a faith-conscious investment strategy.

FAQs

Do halal penny stocks ever change compliance status over time?

Yes, and quite frequently. A stock that is halal today may become non-compliant next quarter due to rising interest income or changes in business activities. That’s why continuous monitoring and re-screening every earnings season is essential.

What should I do with dividends from a stock that partially violates Shariah principles?

If a small portion of the income from dividend stocks is from non-halal sources, you’re expected to purify your earnings by donating that exact portion to charity. But this requires knowing the breakdown — so check financial statements or seek a Shariah advisor.

Is using leverage or margin allowed when trading halal penny stocks?

No, using margin or borrowed funds typically involves interest, which violates Islamic finance rules. All halal investing, including penny stocks, should be done with your own capital to remain compliant.

Can I invest in halal penny stocks through a robo-advisor or app?

Yes, but with caution. Some platforms claim Shariah compliance but don’t disclose their screening process. Look for apps certified by a recognized Shariah board or those that allow manual screening filters.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

A Robo-Advisor is a digital platform using automated algorithms to provide investment advice and manage portfolios on behalf of clients, often with lower fees than traditional advisors.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.