Halal Stocks: A Guide To Shariah-Compliant Stock Investments

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The best halal stocks by region are:

North America. Top halal picks include ASML, TJX, and Visa for their strong returns and ethical compliance across tech, retail, and finance.

Europe. Leading names like Hermès, Infineon, and L’Oréal shine in luxury, semiconductors, and healthcare, all Shariah-aligned.

Middle East/Africa. Major players such as Saudi Aramco and Boubyan Bank lead the energy and Islamic finance sectors.

Asia-Pacific. Growth-driven options include TSMC, BYD, and Samsung, representing semiconductors, EVs, and consumer tech.

For many Muslim investors today, halal stocks represent a way to grow capital while staying true to religious values. As stock markets expand worldwide, the demand for investments that reflect Islamic values continues to rise. This guide looks at the foundations of halal stock list, offering practical insights on how to evaluate opportunities and where to begin building a portfolio that reflects both financial goals and faith. We also take a look at the best halal companies to invest in during 2025.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

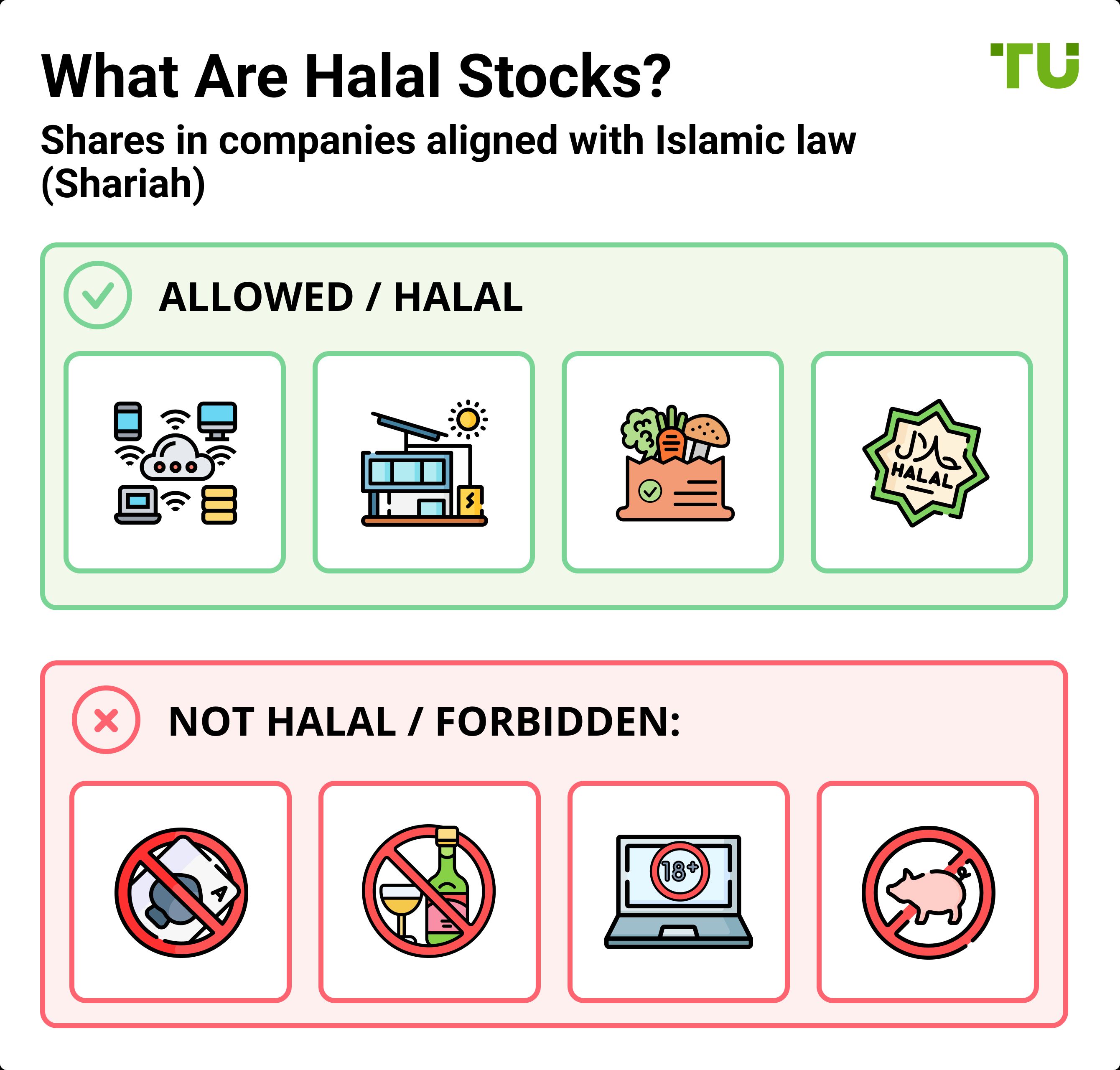

What are halal stocks?

Halal stocks refer to shares in companies whose operations align with Islamic law, or Shariah. This means they must avoid involvement in activities forbidden under Islam, including:

Alcohol and gambling.

Products derived from pork.

Conventional forms of insurance.

Pornographic or explicit content.

“O you who have believed, indeed, intoxicants, gambling, [sacrificing on] stone alters, and divining arrows are but defilement from the work of Satan, so avoid it that you may be successful.”

— Surah Al-Ma’idah (5:90)

For a stock to qualify as halal, it must pass both ethical and financial screenings defined by Islamic principles. Ethical screening considers what the company actually does, while financial screening evaluates metrics such as debt levels (issue of bonds) and how much revenue comes from non-permissible sources.

What makes a stock shariah-compliant?

To qualify for listing as a Shariah-compliant stock, a company needs to meet specific financial screening criteria, including:

A debt-to-asset ratio that remains under 33%.

Interest-based income must stay below 5% of the company’s total revenue.

Liquidity levels and any non-permissible income must fall within acceptable thresholds.

Once a company satisfies these conditions, its stock may be classified as halal, aligning with the investment goals of Muslim investors who prioritize ethical financial choices.

How to find the best halal stocks to invest in

If you're starting out in halal investing, here are some things to keep in mind:

Focus on halal-friendly sectors that don’t rely on leverage. Companies in healthcare equipment, halal food production, or tech infrastructure often operate with clean balance sheets and don’t depend on debt to grow.

Look for cash-heavy businesses with low receivables. Under Shariah law, excess receivables tied to interest-based contracts can make a stock non-compliant. Companies like Apple or Pfizer maintain healthy cash flows with minimal reliance on debt collection. This would filter out most penny stocks.

Don’t just check the industry, check where the money comes from. A company can be in a “halal” sector like logistics but still earn passive income from interest-bearing deposits or investments.

Global halal ETFs can mask non-compliant holdings. Even Shariah-labeled ETFs and index funds often hold borderline stocks to boost returns, so read the actual holdings list before putting your trust in the label.

Use quarterly screening, not just annual reports. Shariah status can flip mid-year based on earnings breakdowns, so use platforms like Zoya or Islamicly that track compliance in real-time.

Screen for ethical conduct, not just religious filters. Some Shariah-compliant companies treat workers poorly or damage the environment. Islamic investing is as much about values as technical screening.

Best halal stocks by region

Best halal stocks in North America

For Muslim investors seeking Shariah-compliant and dividend paying opportunities in the U.S. and Canada, identifying halal stocks can feel overwhelming in a market dominated by interest-based finance and speculative industries. Fortunately, with proper screening, it’s possible to build a portfolio that aligns with Islamic principles while still tapping into leading sectors like technology, healthcare, and consumer goods. For those wondering what are halal stocks to invest in, below is a curated list of some of the best halal stocks in North America, chosen based on business activity, debt ratios, and income purity.

| Company | Ticker | Sector | Price (USD) | 5-year return | Market Cap (USD) |

|---|---|---|---|---|---|

| Abbott Laboratories | ABT | Healthcare | $126.22 | 40.00% | $218.91B |

| Visa Inc. | V | Financial services | $335.88 | 85.00% | $656.03B |

| Oracle Corporation | ORCL | Technology | $133.94 | 70.00% | $375.60B |

| TJX Companies, Inc. | TJX | Retail | $128.50 | 105.00% | $143.55B |

| Automatic Data Processing | ADP | Business services | $298.06 | 95.00% | $121.27B |

| ASML Holding N.V. | ASML | Semiconductors | $683.16 | 500.00% | $269.43B |

The halal investment universe in North America has grown steadily, with many ethically-aligned companies gaining attention among Shariah-compliant investors. These six firms represent a broad mix of sectors, from healthcare and retail to semiconductors and enterprise software, chosen not just for compliance but for consistent performance and resilience. None of these businesses operate in prohibited areas such as gambling, alcohol, or interest-based finance, making them suitable for halal investment portfolios.

What's notable is the way these stocks have managed to outperform broader benchmarks despite compliance filters. ASML leads in advanced chip-making systems, while TJX thrives through value-based retailing in varied economic conditions. Visa’s model is based on fee revenue, not lending, and ADP continues to scale through reliable payroll and HR solutions. These companies meet Shariah criteria and remain at the forefront of their sectors. For investors seeking financial returns without compromising on ethics, this group strikes a rare balance between performance and principle.

Best halal stocks in Europe

Europe offers a growing range of investment opportunities for Muslims seeking to align their portfolios with Islamic values. The table below highlights some of the top islamic stocks to invest in Europe, screened for Shariah compliance in both business activity and financial structure.

| Company | Ticker | Country | Sector | Price (EUR) | 5-Year Return | Market Cap (EUR) |

|---|---|---|---|---|---|---|

| Hermès International SCA | RMS | France | Luxury Goods | €2,000.00 | 150% | €270.89B |

| L’Oréal S.A. | OR | France | Consumer goods | €450.00 | 95% | €182.63B |

| Sanofi S.A. | SAN | France | Healthcare | €95.00 | 60% | €125.40B |

| Siemens Healthineers AG | SHL.DE | Germany | Medical devices | €60.00 | 80% | €55.56B |

| Infineon Technologies AG | IFX.DE | Germany | Semiconductors | €40.00 | 110% | €38.81B |

| ASML Holding N.V. | ASML | Netherlands | Semiconductors | €1,000.00 | 50% | €269.43B |

Europe’s halal equity market has grown considerably, offering several compliant investment options across a range of industries. French giants such as Hermès and L’Oréal reflect the strength and expansion of luxury and consumer sectors. Sanofi continues to advance healthcare access through pharmaceuticals and vaccines, reinforcing the industry’s stable returns.

Germany stands out with innovation in medical technology and semiconductors, led by Siemens Healthineers and Infineon Technologies. Meanwhile, ASML in the Netherlands is essential to global chip production. Each of these firms follows Shariah investment rules while maintaining robust financial profiles and clear competitive advantages.

Best halal stocks in Middle East/Africa

Here are some of the best islamic stocks to invest in the Middle East and Africa, selected for their strong performance and compliance with Shariah principles.

| Company | Ticker | Sector | Price (USD) | 5-Year Return | Market Cap (USD) |

|---|---|---|---|---|---|

| Saudi Aramco | 2222.SR | Energy | $8.50 | 30% | $1.9T |

| Boubyan Bank | BOUBYAN | Islamic banking | $3.20 | 65% | $8.5B |

| MTN Group | MTN.JO | Telecommunications | $12.75 | 55% | $22B |

| SABIC | 2010.SR | Chemicals | $25.00 | 40% | $75B |

| Dangote Cement | DANGCEM.LG | Materials | $10.50 | 35% | $20B |

| Etisalat Group | ETISALAT.AD | Telecommunications | $6.80 | 50% | $35B |

The Middle East and Africa offer a dynamic opportunity set for halal investors, with halal stock market companies across sectors such as oil, Islamic banking, chemicals, and telecom. Saudi Aramco continues to dominate the energy landscape while maintaining Shariah compliance through its debt-averse operations. Boubyan Bank, based in Kuwait, reflects the growth and reliability of the Islamic finance sector.

Telecom leaders MTN Group and Etisalat have benefitted from rising mobile and internet use across the region. Meanwhile, SABIC and Dangote Cement drive regional development in chemicals and infrastructure. These firms not only follow halal guidelines but also contribute meaningfully to regional economic expansion.

Best halal stocks in Asia/Pacific

Below are some of the leading halal stocks in the Asia-Pacific region, chosen for their growth potential and adherence to Islamic investment guidelines — an essential part of any well-researched share market halal company list.

| Company | Ticker | Sector | Price (USD) | 5-Year Return | Market Cap (USD) |

|---|---|---|---|---|---|

| Taiwan Semiconductor Manufacturing Co. | TSM | Semiconductors | $130.00 | 200% | $600B |

| Samsung Electronics Co., Ltd. | 005930.KS | Technology | $75.00 | 150% | $500B |

| Infosys Limited | INFY | IT Services | $20.00 | 100% | $85B |

| BHP Group Limited | BHP | Materials | $50.00 | 80% | $220B |

| BYD Company Limited | 1211.HK | Automotive | $30.00 | 250% | $100B |

| Reliance Industries Limited | RELIANCE .NS | Conglomerate | $30.00 | 120% | $200B |

The Asia-Pacific region offers a diverse array of Shariah-compliant investment opportunities across various sectors. Taiwan Semiconductor Manufacturing Co. (TSMC) stands as a global leader in semiconductor manufacturing, supplying chips to major technology firms worldwide. Samsung Electronics continues to innovate in consumer electronics and semiconductor technology, maintaining a strong market presence.

Infosys Limited represents the robust IT services sector in India, delivering consistent growth through digital transformation services. BHP Group, a leading mining company, benefits from the global demand for natural resources. BYD Company, a Chinese automotive manufacturer, has seen significant growth due to its focus on electric vehicles. Reliance Industries, a major Indian conglomerate, has diversified interests ranging from energy to telecommunications, contributing to its substantial market capitalization.

These organizations meet the strict financial and ethical criteria of Islamic investing while also showcasing consistent growth and operational resilience. For those seeking to align values with returns, these firms represent standout halal companies to invest in across Asia-Pacific’s fast-evolving economic landscape. Discover the top halal stocks in Singapore, featuring Shariah-compliant companies ideal for ethical investing.

Where to find a list of shariah compliant stocks

If you're trying to build a halal stock portfolio, don’t just rely on what looks ethical. Use these specialized sources and tools to find shariah compliant stocks list:

FTSE Shariah Index Series is a great global starting point. These indexes filter out companies based on interest income, debt ratios, and non-compliant revenue. FTSE Bursa Malaysia Hijrah Shariah Index fund is a solid example for Southeast Asian stocks.

S&P Shariah Indices offer regional precision. From the S&P 500 Shariah to the S&P Pan Arab Shariah, these indexes give you access to compliant stocks in both developed and emerging markets without doing all the math yourself.

Zoya and Islamicly apps go beyond lists. These tools don't just tell you what’s halal, they alert you when a company becomes non-compliant, break down income sources, and even help you calculate purification amounts.

Dow Jones Islamic Market Indices track big names you wouldn’t expect. You’ll find stocks like Adobe or Nvidia in their list, but only after they pass through strict Shariah filters on debt, interest, and core operations.

Tadawul’s Saudi Exchange maintains its own Shariah list. It’s often overlooked, but their monthly screening includes insider insights on domestic compliance, great for investors focusing on Gulf markets.

SEBI-recognized indices like Nifty50 Shariah are useful for Indian investors. While the Indian stock market doesn’t have widespread Shariah screening, this index gives a filtered snapshot of the country’s top compliant companies.

Check asset managers who offer Islamic funds. Institutions like Wahed, Saturna, and Franklin Templeton publish their fund holdings, reverse-engineer them to find compliant stocks backed by professional due diligence.

Filtering halal stocks with debt cycle traps and revenue purifiers

If you're just starting out with halal investing, here’s a rare insight: don’t just screen for debt ratios and sector exclusions go deeper into the debt cycle traps. Many companies briefly dip below the 33% debt threshold to pass Shariah screenings during quarterly reports, only to spike debt levels days later. This “window dressing” can trick automated screeners. The solution?

Track rolling 12-month leverage trends using tools like EDGAR filings or Indian equivalents, and look at how often a company repays debt with actual cash flow instead of refinancing. This gives you a more ethical, and more stable pick.

Also, for stocks that fall into the grey zone due to mixed revenues (halal + haram), don’t rule them out too fast. You can purify the impermissible income portion yourself by donating that exact percentage of dividends to charity. What most beginners miss is that this purification method isn’t random, it’s calculated using the income statement.

Look for annual reports that break down “other income” or non-core business revenue. If 5% of the revenue is non-compliant, purify 5% of your earnings. This approach lets you access high-performing companies without compromising on your values.

Conclusion

Whether you're a seasoned investor or just starting out, choosing halal stocks allows you to grow your wealth while staying true to your faith. By focusing on Shariah compliant stocks, avoiding interest and speculative assets, and using reliable halal stock screeners, you can make ethically sound decisions in the stock market. With growing global interest, the Islamic stock market is becoming more accessible than ever, empowering Muslims to invest with purpose and confidence.

FAQs

Can I invest in halal stocks through a regular brokerage account?

Yes, you can — but you’ll need to do the extra work. Most standard brokerages don’t filter for Shariah compliance, so you’ll have to screen each stock manually or use a Shariah-compliant portfolio tracker in parallel. This is especially relevant for those exploring the halal stock market or looking for halal shares to buy within a conventional platform.

Do halal stocks perform worse than conventional stocks?

Not necessarily. Many halal stocks to buy come from cash-rich, low-debt sectors like technology, healthcare, or industrials — areas that often demonstrate strong fundamentals. The key in the Islamic share market is not about limiting your potential returns, but about intelligent screening and avoiding high-risk, interest-based models. In fact, some of the best halal stocks to buy outperform their conventional counterparts in stability and consistency.

Can non-Muslims invest in halal stocks too?

Absolutely. Halal stocks are essentially ethically filtered investments — with low leverage, clean income sources, and no exposure to industries like alcohol, gambling, or weapons. Many socially responsible non-Muslim investors turn to the Muslim stock market as a form of values-aligned investing that also reduces financial risk.

Which stocks are halal to invest in?

Many beginners ask: “Which stocks are halal to buy?” The answer depends on the business model and financial ratios of each company. The best approach is to use verified halal screeners, Islamic ETFs, or consult with a specialist in the halal share market. For those actively investing, exploring tools designed for the Islamic share market helps build a portfolio that’s not only profitable — but also ethically sound.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

Forex leverage is a tool enabling traders to control larger positions with a relatively small amount of capital, amplifying potential profits and losses based on the chosen leverage ratio.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Xetra is a German Stock Exchange trading system that the Frankfurt Stock Exchange operates. Deutsche Börse is the parent company of the Frankfurt Stock Exchange.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.