Nifty 50 Shariah Index: Comprehensive Overview For Halal-Conscious Investors

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

The Nifty 50 Shariah Index comprises stocks that adhere to Islamic finance principles. It omits sectors such as banking, gambling, and alcohol, instead emphasizing industries like IT, consumer goods, and energy. The index undergoes monthly reviews and offers halal investment opportunities within India's large-cap market.

The Nifty 50 Shariah Index serves as a faith-aligned variant of India's primary equity benchmark, assisting investors in aligning their portfolios with principles of Islamic finance. It systematically excludes companies involved in activities deemed haram, such as conventional banking, gambling, alcohol, tobacco, and certain entertainment sectors. This approach ensures that investments remain within the bounds of Shariah law. For those interested in exploring the specific constituents, the Nifty 50 Shariah stocks list offers a well-compiled list of Shariah-compliant stocks in the Indian market.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

What is the Nifty 50 Shariah index?

The Nifty Shariah Index is built as a faith-based alternative to the widely followed Nifty 50 index, offering a Shariah-compliant equity benchmark for Muslim investors. While the original Nifty 50 lists India’s top 50 large-cap firms across sectors, the Shariah version filters out businesses that do not align with Islamic financial values, making it one of the best halal investment options. This helps address the growing interest in whether the Nifty 50 is halal or haram, providing a clearer path for those seeking ethical investing options.

Islam encourages commercial activity and entrepreneurship, as long as it is conducted within the boundaries of fairness, honesty, and justice By contrast, riba-based systems are condemned for fostering exploitation and unjust enrichment. Surah Al-Baqarah (2:275) declares:

“...But Allah has permitted trade and forbidden riba…”

To meet Shariah standards, the index follows a two-step screening framework.

Sector-based screening

In this step, companies are excluded if their primary business involves non-permissible (haram) sectors under Islamic principles. These include:

Interest-based banking and finance.

Insurance that operates on conventional interest models.

Alcohol production or distribution.

Pork-related food and processing.

Gambling and betting services.

Tobacco-related manufacturing.

Entertainment that includes adult content or music labels.

Only firms that generate little to no revenue from such sources are considered part of halal stocks in Nifty 50. Due to this approach, most penny stocks get filtered out as well.

Financial ratio screening

Even if a company operates in a sector deemed halal, it must also meet specific financial criteria. This ensures the company does not rely too heavily on interest-based debt or income. The key financial checks include:

A debt-to-equity ratio typically under 33%, though this can vary based on Shariah board standards.

Minimal holdings in interest-earning cash or liquid assets.

Low levels of receivables compared to total assets, to reduce exposure to interest-linked earnings.

This layered review ensures only businesses that meet both ethical and financial requirements are included in the Nifty Shariah Index, making it a reliable guide for those investing in line with Islamic values.

Composition and sectoral breakdown

The Nifty 50 Shariah Index comprises select companies from the broader Nifty 50 that adhere to Shariah compliance standards. The number of constituents may change with periodic rebalancing. According to the Nippon India ETF Nifty 50 Shariah BeES, current top holdings include Tata Consultancy Services (17.58%), Hindustan Unilever Ltd (10.36%), and Sun Pharmaceutical Industries Ltd (9.85%), reflecting a strong presence in IT, consumer goods, and healthcare sectors.

Top holdings by weight

The Nifty 50 Shariah Index, as tracked by the Nippon India ETF Nifty 50 Shariah BeES, reflects the weight of companies that meet Shariah compliance criteria.

Tata Consultancy Services Ltd. 17.58%

Hindustan Unilever Ltd. 10.36%

Sun Pharmaceutical Industries Ltd. 9.85%

HCL Technologies Ltd. 8.29%

UltraTech Cement Ltd. 6.75%

Trent Ltd. 5.73%

Asian Paints Ltd. 5.47%

Tech Mahindra Ltd. 4.75%

Oil & Natural Gas Corporation Ltd. 4.73%

Coal India Ltd. 4.36%

These top ten holdings make up approximately 77.87% of the total index weight, showing a heavy concentration in a few key Shariah-compliant stocks.

The index continues to favor sectors like IT, pharmaceuticals, and consumer goods, ensuring alignment with Islamic finance principles by excluding conventional financial institutions and companies involved in haram activities.

Investors seeking ethical exposure to India’s large-cap stocks may find the Nifty 50 Shariah Index a relevant option, though they should consider its concentrated structure and sector-specific bias.

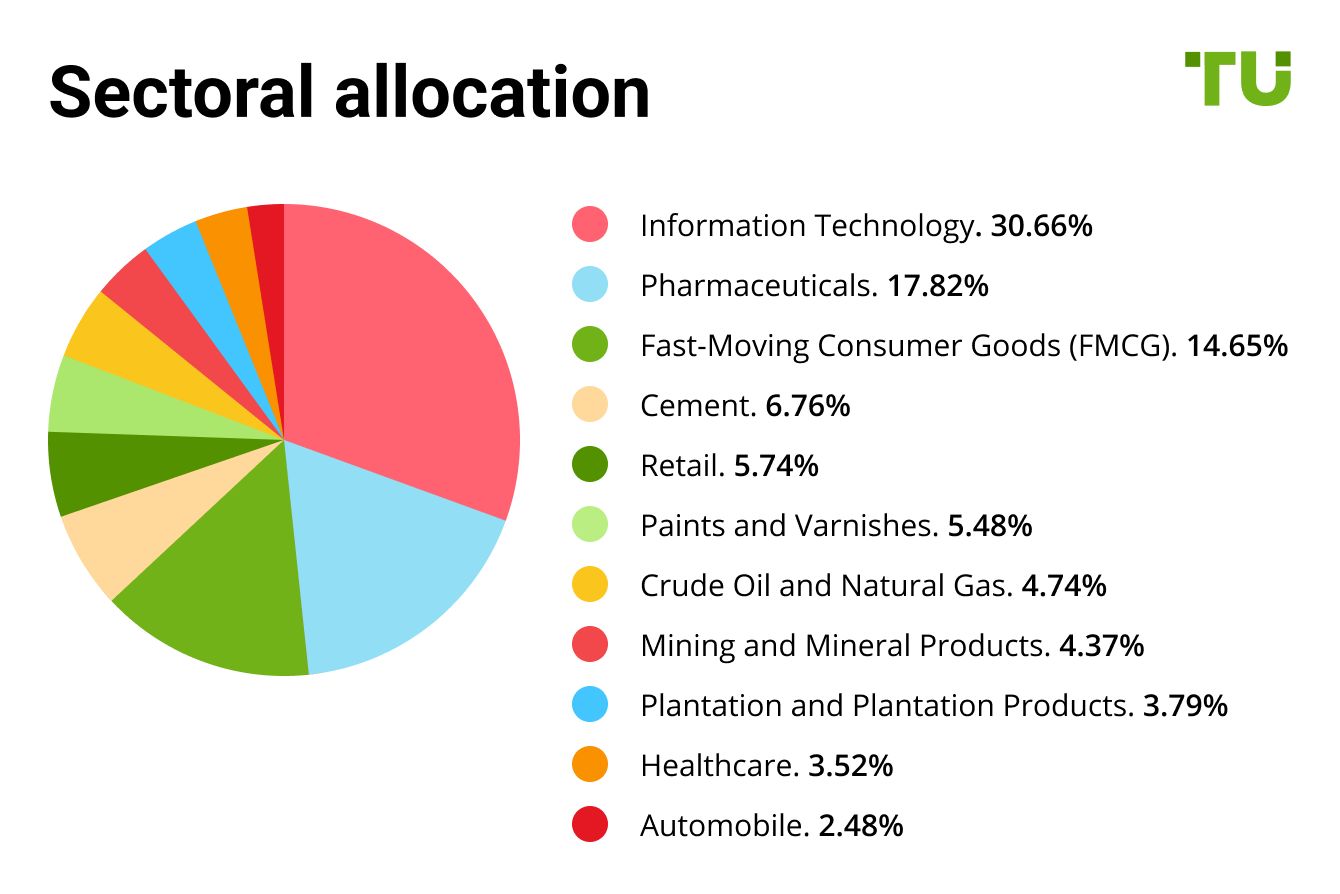

Sectoral allocation

Based on the portfolio of the Nippon India ETF Nifty 50 Shariah BeES, which tracks the Nifty 50 Shariah Index, the sectoral allocation is as follows:

This allocation emphasizes sectors that align with Shariah principles, focusing on industries like Information Technology, Pharmaceuticals, and FMCG, while excluding conventional financial services.

Is Nifty 50 halal or haram?

The standard Nifty 50 Index includes a broad mix of India’s top companies, many of which operate in sectors not considered permissible under Islamic finance principles, such as conventional banking, insurance, and certain entertainment industries. This raises the central question many observant investors ask: is Nifty 50 halal according to Shariah law?

Key fact: Around 20 to 30 percent of the Nifty 50’s total market capitalization has historically come from financial institutions. These entities are excluded from halal investment portfolios because their operations rely heavily on interest-based models, which are prohibited in Islamic finance.

Why the standard Nifty 50 is not fully halal

Companies in the regular Nifty 50 are generally not evaluated against core Islamic investment criteria, including:

Interest-based debt exposure.

Revenue derived from non-halal sources like alcohol, tobacco, and gambling.

Adherence to Islamic financial ratio standards.

For this reason, many scholars hold the view that Nifty 50 is halal or haram depending on how it is filtered, but investing directly in the unscreened version is not considered Shariah-compliant.

Nifty 50 Shariah: A halal-compliant alternative

To serve Muslim investors more effectively, the Nifty Shariah Index was developed as a compliant alternative to the primary benchmark. This version excludes all companies from prohibited sectors and undergoes monthly financial screenings to remain within the guidelines of Islamic investment.

34 out of the original 50 companies are included.

All firms meet sector and financial ratio filters and are approved by IdealRatings, a globally respected Shariah advisory organization that partners with NSE to maintain the index.

For those managing faith-based portfolios, tracking the Nifty 50 Shariah index stocks list offers an efficient way to stay aligned with Islamic values. Investors may also refer to the Nifty 50 Shariah share price to assess market movements through a halal lens. The debate around “is Nifty 50 halal” continues to evolve, but for now, this index remains a widely accepted benchmark for those seeking purity in equity investing.

Strategic takeaway for traders

A lot of traders overlook the little things that make the Nifty 50 Shariah, based on halal stocks, behave differently than the main index, but these are exactly where strategy lives.

Watch for sector rotation with ethical limits. Since banking, alcohol, and other excluded industries are filtered out, the index tends to lean more on sectors like tech, pharma, and FMCG. Use that pattern to spot when rotations begin.

Volume spikes tell a different story. Big trading spikes often come from halal-conscious institutions, not just hype, which makes the moves more meaningful and longer-lasting.

Earnings season hits differently. Without interest-heavy companies in the mix, stock movement depends more on real performance, like how well the company operates, not how well it manages debt.

Liquidity levels may lag at extremes. It’s generally easy to trade, but don’t expect the same trading ease as the main Nifty during volatile markets. Some stocks can feel sticky.

Use divergence from main Nifty as a sentiment signal. When this index moves differently than the Nifty 50, it shows investors are either avoiding risky sectors or shifting toward cleaner ones. This helps answer “is investing in Nifty 50 halal?” from a behavioral lens.

Top halal stocks in Nifty 50

The following companies are included in the Nifty 50 Shariah Index. Each has passed both sector-based and financial screening, making them compliant with Islamic investment principles. These stocks offer exposure to key growth sectors in the Indian economy while adhering to Shariah law.

| Stock | Sector | Why It Is Halal |

|---|---|---|

| Infosys Ltd | Information Technology | Main revenue from IT services, no involvement in haram activities like riba, alcohol, or gambling. Infosys has low debt levels, strong free cash flows, and a consistent dividend history, making it a popular choice among both halal and ESG investors. |

| Tata Consultancy Services Ltd (TCS) | Information Technology | Earns from IT consulting and software development, without prohibited operations. With a massive global client base, TCS generates predictable earnings and dividends. This makes it one of the best halal dividend stocks in the Indian market. |

| Hindustan Unilever Ltd | Consumer Goods | Produces food and hygiene products, no involvement in alcohol or pork production. |

| HCL Technologies Ltd | Information Technology | IT services and software development, no financial activities involving riba. |

| Sun Pharmaceutical Industries Ltd | Pharmaceuticals | Manufactures medicines, no involvement in prohibited industries. |

| Cipla Ltd | Pharmaceuticals | Produces pharmaceuticals, avoids sectors like alcohol or interest-based finance. |

| Dr. Reddy’s Laboratories Ltd | Pharmaceuticals | Generates revenue from pharmaceuticals, avoids haram financial practices. |

| Wipro Ltd | Information Technology | Primarily provides IT services and consulting, no interest-based operations. |

| Maruti Suzuki India Ltd | Automotive | Manufactures vehicles without involvement in prohibited business practices. |

| Divi’s Laboratories Ltd | Pharmaceuticals | Produces active pharmaceutical ingredients, no involvement in riba-based financial schemes. |

How to track and invest

Investors can monitor index performance on the NSE website, TradingView, or other reputed financial platforms. The Nifty 50 Shariah Index stocks list is published and updated monthly.

Investment options include:

PMS (Portfolio Management Services) specializing in Islamic finance.

Custom-built portfolios based on index constituents.

To learn about passive vehicles for Shariah investing, refer to:

And for investors interested in compliance issues such as lending:

Expanding with the Nifty 500 Shariah index

If you're exploring ethical investing in India, the Nifty 500 Shariah index provides a mix of compliance and diversification that suits faith-driven investors seeking broader exposure.

Understand the screening criteria. The index selects companies following Islamic guidelines, excluding those involved in activities like alcohol, gambling, and interest-based finance.

Sectoral weightage matters. Information Technology, Healthcare, and FMCG sectors lead the index, showing sectors more aligned with Islamic values and offering more resilience than many realize.

Review constituent companies. Top constituents include Indian Oil Corporation Ltd (7.31%), Varun Beverages Ltd (6.20%), and Bharat Petroleum Corporation Ltd (4.92%), a valuable starting point for anyone exploring the Nifty 500 Shariah stocks list.

Explore investment avenues. For those asking how to invest in Nifty 500 Shariah, the simplest route is through ETFs or mutual funds that track the index. This allows exposure without deep stock-by-stock screening.

Here are some of the top constituents of the Nifty 500 Shariah index along with their respective weightages:

Indian Oil Corporation Ltd. 7.31%

Varun Beverages Ltd. 6.20%

Bharat Petroleum Corporation Ltd. 4.92%

Britannia Industries Ltd. 4.83%

Shariah-compliant investing beyond Nifty: Global indices, ETFs, and fixed-income filters

While the Nifty 50 Shariah Index offers a localized halal benchmark, investors exploring global diversification often look toward compliant indices like the S&P 500 Shariah Index and Nasdaq 100 Shariah Index, both of which apply rigorous faith-based screening to leading US equities.

For those preferring structured exposure through funds, halal ETFs and index funds have emerged as a practical vehicle, offering ease of access to compliant assets without deep individual stock analysis.

On the fixed-income front, traditional instruments like bonds remain controversial, with ongoing debates around whether bonds are halal or haram, depending on their structure and underlying contract type.

Similarly, investors evaluating broader portfolios must consider how mutual funds align with Islamic principles, especially those with exposure to interest-generating debt or non-compliant sectors.

Another critical factor for halal-conscious investors is not just what you invest in, but how you invest. To stay compliant across different asset classes like equities, crypto, or Forex, it is essential to use a Shariah-compliant or Islamic trading account. To support your decision-making, we have reviewed and compared top brokers that offer Islamic accounts tailored for halal investing across global markets. You can explore their features and terms in the section below.

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.79 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | Yes | 50 | 200 | No | 1.96 | Study review |

Taken together, these resources help investors move beyond Indian equities and build diversified, Shariah-compliant strategies across geographies and asset classes. Also learn how to buy sukuk bonds in India and explore the best halal mutual funds in India that follow Shariah principles and offer ethical investment options for Muslim investors in our articles.

Liquidity filters and sectoral weighting matter in 2025

Most people new to Shariah investing stop at avoiding banks and sin stocks. But here's the deeper truth: the Nifty 50 Shariah Index quietly screens out stocks with poor liquidity. That’s a huge deal. Low-volume stocks often get hyped on social media or Telegram channels and then crash just as quickly. By sticking to names that trade consistently, the index helps you avoid those traps before you even get started. It’s not just about what’s halal, it’s also about what’s stable.

Now here’s something smart investors notice early. Since the index excludes banks, it naturally shifts more weight toward tech, healthcare, and consumer names. This isn't a glitch. It's a hidden edge. India in 2025 is all about digital expansion, AI-driven pharma, and a resilient middle class. The Shariah index leans into that wave without needing to time the market. If you ride this structure intentionally, you're not just following Shariah rules, you're riding long-term economic trends that are already gaining momentum.

Conclusion

The Nifty 50 Shariah Index and its broader counterpart, the Nifty 500 Shariah Index, present structured, transparent, and faith-compliant paths for ethical investing in India’s capital markets. With rigorous screening mechanisms, regular reviews, and a focus on sectors like technology, pharmaceuticals, and consumer goods, these indices enable Muslim investors, and any values-driven investor, to access high-quality equities while adhering to Islamic financial principles. While these indices exclude conventional banking and other non-permissible industries, they retain broad exposure to India’s economic growth engines.

FAQs

Can NRIs (Non-Resident Indians) invest in the Nifty 50 Shariah Index?

Yes, NRIs can invest in Indian Shariah-compliant stocks through NRE/NRO demat accounts. They can also access halal mutual funds or PMS options that track the Nifty 50 Shariah Index.

How do dividends work in Shariah-compliant stocks?

Dividends from halal stocks are generally permissible if the income sources are compliant. If there is a minor proportion from interest-based activities, purification (donating the non-halal portion) may be required.

What happens if a company in the index becomes non-compliant?

If a listed company breaches Shariah criteria during the monthly review, it is removed from the index. Investors using automated strategies or mutual funds tracking the index will see the portfolio rebalanced accordingly.

Are there any tax differences for investing in Shariah-compliant stocks in India?

No, Shariah-compliant stocks are treated the same as other equity investments under Indian tax laws. Capital gains and dividend taxation apply equally, regardless of religious compliance.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Diversification is an investment strategy that involves spreading investments across different asset classes, industries, and geographic regions to reduce overall risk.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.