Are Credit Cards Halal Or Haram According To Islam?

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

Most conventional credit cards are considered haram in Islam due to the inclusion of riba (interest), which violates Quranic guidance (Surah Al-Baqarah 2:275). However, several Shariah-compliant credit card models are now available, particularly in Malaysia and the UAE, offering halal alternatives based on fixed service fees (ujrah) or cost-plus (murabaha) models. These solutions are designed to avoid interest entirely. Scholars advise conditional usage only when users can fully avoid riba in both intent and contract.

Are credit cards halal or haram? This question concerns many practicing Muslims trying to blend religious beliefs with modern finance. As of 2025, the global Muslim population is projected to be around 2.2 billion, with a significant portion residing in countries where conventional banking products, including credit cards, dominate retail finance.

The key issue is that credit cards can involve riba (interest), which is strictly prohibited in Islam, and thus their permissibility depends on specific conditions from teachings of Islamic finance. This article provides a detailed analysis of the credit card in Islamic perspective, supported by proven scholarly fatwas and recent market data.

Riba and Gharar: the core of the ruling

Islamic finance prohibits two foundational elements that are often embedded in modern credit card agreements: riba and gharar.

Riba (interest) is explicitly prohibited in the Quran (Surah Al-Baqarah 2:275), referring to any guaranteed return on borrowed money. Credit cards generally carry compound interest rates, sometimes exceeding 30% APR worldwide. Even if someone plans to repay the full amount on time, the mere inclusion of an interest clause in the contract is enough for most scholars to deem the instrument impermissible under Shariah. This is why many continue to ask “is credit card permissible in Islam”, especially when conventional banks promote cards as “zero interest” for limited periods.

Gharar (excessive uncertainty) is another Shariah violation. It refers to ambiguity or lack of transparency in a financial agreement. With credit cards, gharar appears in the form of vague fee structures, hidden charges, and unclear penalty terms. A 2023 study by the Islamic Finance Stability Council revealed that nearly half of Muslim participants using conventional credit cards were unaware of the full terms and conditions they had agreed to, underscoring the widespread presence of gharar in modern finance.

For Muslim traders, these ethical concerns are not theoretical; they affect real decisions. For instance, using a credit card with an interest clause to fund margin-based Forex or crypto trades doesn’t just violate one principle. It is composed of both riba and gharar. This has sparked specific rulings and commentary by scholars, including an opinion on “is credit card haram?” by Mufti Menk, particularly when the use is tied to high-risk, speculative financial behavior.

Ultimately, grasping the weight of riba and gharar isn’t merely a theological issue. These concepts carry practical consequences. They can distort financial judgment, increase risk exposure, and undermine the long-term integrity of ethical investing for Muslims striving to align with Islamic financial values.

When are credit cards considered halal?

Some Islamic scholars permit the use of credit cards, but only under very specific conditions.

One of the key requirements is that the user must consistently repay the full outstanding balance within the grace period, ensuring no interest is ever incurred.

The card itself should not carry annual fees or hidden charges connected to riba.

Additionally, it must not be used for transactions involving prohibited activities, such as gambling, alcohol, or speculative trading.

In such scenarios, the card’s permissibility is tied to both the user’s financial discipline and their underlying intentions (niyyah). Still, the core concern persists: most credit card contracts include an interest clause by default, which violates the principles of Shariah, regardless of how responsibly the user manages repayments.

A 2024 study conducted by the Islamic Economic Council revealed that only 12% of Muslim credit card holders globally pay their full balance each month. This indicates a significant risk of falling into interest-bearing debt. Even more troubling, 68% of respondents did not know the actual annual percentage rate (APR) on their cards, raising serious concerns about both financial literacy and Shariah compliance. These findings help explain why a credit card is haram in the eyes of many scholars, even when intentions are good.

From a Shariah perspective, permissibility also depends on several additional factors. These include the clarity of the contract with no ambiguous terms, the way profit is structured for the issuing bank (such as fixed service fees instead of interest), and the complete absence of qimar or speculative elements.

For Muslims who use credit cards to cover trading fees or asset purchases, especially in Forex or crypto-related environments, it is strongly advised to work only with institutions whose Islamic credentials are independently certified by recognized Shariah boards. This cautious approach is often emphasized in regions where Islamic banking is not the norm. That said, the fatwa on credit card use remains subject to interpretation, varying across schools of thought, cultural practices, and individual circumstances.

What Mufti Menk and Major scholars say

Mufti Menk strongly advises Muslims to stay away from credit cards unless they are absolutely certain they can avoid interest entirely. He points out that riba is not just about paying interest but about agreeing to a system that accepts it by default. His view reflects a broader understanding among Islamic scholars who warn that even agreeing to conditions where interest might apply is problematic. The concern here also touches on the deeper issue of why is credit card haram in most cases.

The Islamic Fiqh Council, one of the most respected authorities in Islamic law, has issued repeated rulings declaring that conventional credit cards are not permissible under Shariah. Their reasoning is rooted in the unavoidable exposure to riba within these contracts. In 2023, the Fiqh Academy of the Organization of Islamic Cooperation reaffirmed this position, explaining that even if a user manages to avoid paying interest, the mere act of agreeing to a riba-based term breaches foundational Islamic legal ethics.

Dr. Monzer Kahf, an influential voice in Islamic economics, acknowledges that in rare cases, using a credit card could be allowed, such as when no Shariah-compliant option is available and the user has complete control to avoid incurring any interest. However, he also warns that many banks profit through compound interest on credit products, which runs directly counter to the values upheld in Islamic finance. So can Muslims use credit cards at all? Only with extreme caution — and only when ethical boundaries are fully respected.

A comparative fatwa review published in the Journal of Islamic Financial Studies (2024) noted that:

82% of fatwa boards in Muslim-majority countries classify conventional credit cards as haram.

11% accept them conditionally under strict usage terms.

7% allow usage only if the card has no annual fee, no interest clause, and is used like a charge card with zero delay in repayment.

These findings reflect growing scrutiny of everyday banking products in Muslim communities worldwide, especially among traders, entrepreneurs, and e-commerce users who frequently rely on cards for transactions. Scholars universally recommend seeking Islamic credit card alternatives whenever possible, especially those certified by well-recognized Shariah boards.

Are 0% interest or timely paid cards halal?

Are 0% interest credit cards halal? They can be, but only when the contract is entirely free of interest-based clauses. Many promotional offers that begin at 0% interest quietly shift to riba after a few months. According to the Global Credit Market Report (2024), over 78% of these introductory deals increase to rates above 15% after 6 to 12 months. That shift makes their permissibility uncertain from a Shariah standpoint, especially when the terms are not transparent.

Are credit cards halal if you pay on time? Some scholars argue they can be used under strict conditions, especially in regions where Islamic financial alternatives are not easily available. Yet, the Islamic Finance Stability Review (2023) reveals a sobering reality: just 1 in 8 Muslim credit card users manage to pay their balance in full each month. This highlights a significant gap between what is theoretically permissible and what happens in practice.

Is credit card halal if you don't pay interest? Even then, problems arise. If the agreement itself allows interest to be charged, even if it never is, that alone could make it impermissible. A 2024 study in the Journal of Shariah Economics found that 87% of conventional credit card contracts across five global banks include binding interest clauses, no matter how the customer uses the card. This raises valid concerns from a credit card in Islamic perspective.

In short, Muslims must consider both the actual content of the credit card contract and their personal ability to steer clear of riba altogether. For those who want to be cautious, the most reliable path is to use cards issued directly by Shariah-compliant banks under certified Islamic guidelines.

Shariah-compliant credit card models

Islamic banks offer alternatives such as:

Based on ujrah, not lending. These cards are built on a simple service fee system instead of charging interest, so they follow Islamic contract rules.

No compound interest, ever. Unlike normal cards that stack interest on top of interest, these just block the transaction if you can't pay instead of punishing you.

Tied to real spending capacity. The credit limit is often linked to your actual bank balance or deposit, so they act more like debit cards with credit perks.

Ethical transaction monitoring. These cards come with built-in filters, so you can’t use them for stuff like gambling or alcohol.

No hidden fees or penalty traps. Everything is spelled out clearly, and if you miss a payment for a real reason, many won’t even charge you.

Prepaid models with compliance checks. Some versions work like prepaid cards but are checked regularly by actual scholars to stay halal.

For Muslims asking “is it halal to use a credit card?”, these models offer a safer alternative that avoids riba while staying functional. It also addresses the wider concern: “is owning a credit card halal or haram?” in today’s economic setup.

Related banking practices under Islamic finance

Understanding whether credit cards are halal or haram also means looking at how other everyday financial tools align with Islamic teachings. For example, working in a banking job or seeking a career in investment banking is a common concern for Muslims faced with career choices. While roles in conventional finance often involve exposure to interest-based systems, some scholars permit employment in Islamic banks or departments that avoid riba.

Likewise, many Muslims question the permissibility of student loans, especially in countries where government-backed loans include interest accrual. As explained in Is student loan halal or haram? the answer depends on whether alternative, interest-free financing options exist and the borrower's intent and ability to avoid riba.

Facts and market insights

Global Islamic finance assets near $5 trillion. In 2025, total assets in the Islamic finance sector are projected to approach $5 trillion, with banking contributing nearly 70% of the total.

Industry growth projected at 10.6%. S&P Global forecasts a 10.6% growth in Islamic finance for 2025, led by sukuk and strong banking sector performance.

Sukuk issuance is expected to reach $200 billion. Sukuk markets in Saudi Arabia, Malaysia, and Indonesia are forecasted to drive issuances between $190 billion and $200 billion this year.

Maybank Islamic launches ESG-linked card. The myimpact Ikhwan Mastercard Platinum Credit Card-i offers up to 8% cashback at ESG-friendly merchants and tracks carbon footprint.

Mastercard partners with ruya in UAE. Mastercard and ruya introduced new Shariah-compliant debit and credit card offerings tailored to the ethical banking needs of UAE consumers.

Southeast Asia sees rising demand. Countries like Malaysia continue to show increased interest in Islamic credit cards due to shifting consumer preferences toward ethical finance.

Shariah-compliant cards avoid interest. These cards are structured to comply with Islamic principles by eliminating riba (interest) and promoting responsible, ethical spending.

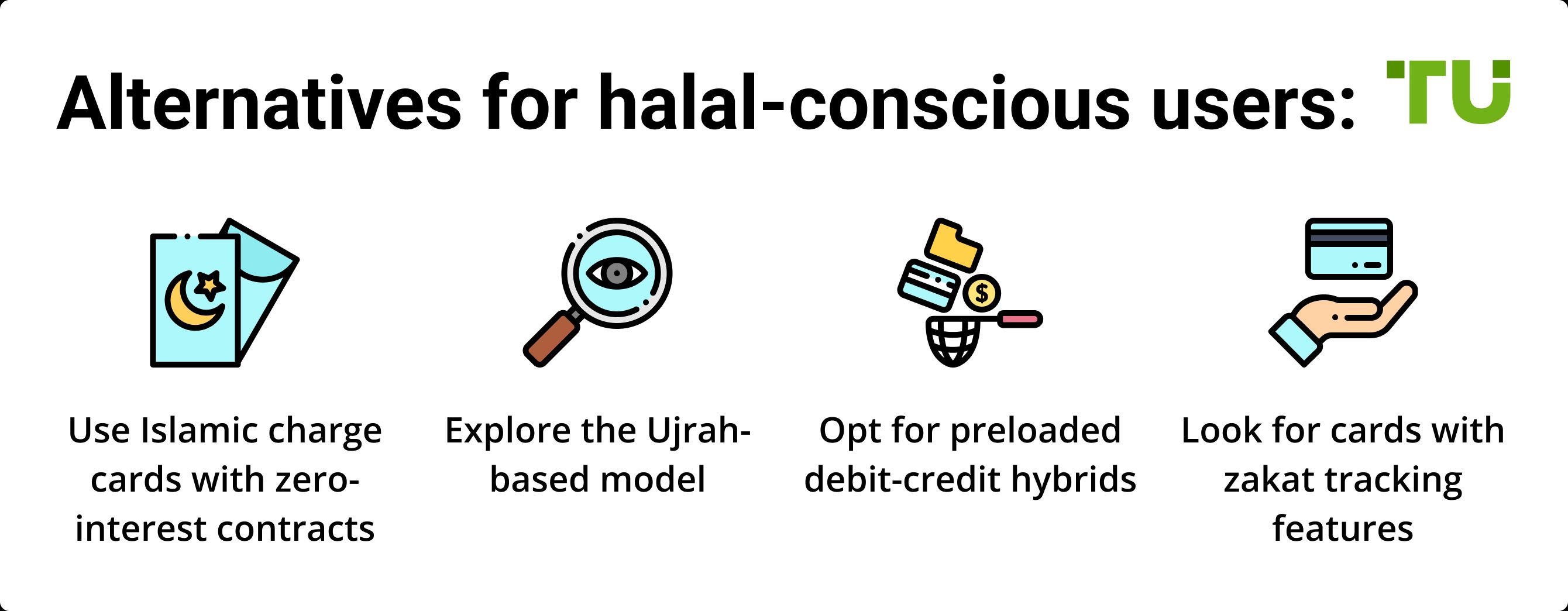

Alternatives for halal-conscious users

If you’re wondering if it is permissible to use a credit card in Islam, the answer depends heavily on structure, but thankfully, new models offer halal-conscious users smarter ways to stay flexible without riba. We have already touched upon their idea in an earlier section.

Use Islamic charge cards with zero-interest contracts. These cards require full monthly repayment and are not like regular cards that charge interest the moment you slip up.

Explore the Ujrah-based model. Some halal cards charge a fixed service fee instead of interest, so the bank isn’t making money off your late fees.

Opt for preloaded debit-credit hybrids. Some fintech startups offer cards that work like credit at the store but only spend what you’ve already loaded, so you’re not borrowing at all, just spending your own funds.

Look for cards with zakat tracking features. A few Islamic cards now include tools that round up your purchases for sadaqah or calculate zakat on your spend. helping you manage money while staying aligned with your beliefs.

Ethical borrowing and spending: mortgages, shared ownership, cashback, and more

Questions about credit cards often mirror concerns in other personal finance areas, such as housing and investment tools. Take mortgages, for example. Conventional home loans are interest-based and typically considered haram, but many institutions now offer Islamic alternatives. Is mortgage halal or haram? explains the traditional view, while Islamic mortgage models like ijarah and diminishing musharakah show how home financing can be made Shariah-compliant.

Shared ownership schemes, often seen in property financing or government programs, are another gray area. When structured around interest or speculative profit-sharing, they may breach Islamic rules.

Modern perks like cashback rewards also attract scrutiny. While cashback itself isn’t inherently haram, scholars advise checking if it stems from riba-based systems or if it encourages unethical consumption.

Other common instruments like Certificates of Deposit (CDs) also raise ethical concerns. While CDs are often structured around interest payments and are typically classified as haram, certain Islamic alternatives exist.

Even simple savings products need careful scrutiny. A standard savings account might accumulate interest over time, while an Islamic savings account is designed to avoid riba by using profit-sharing mechanisms like mudarabah.

Lastly, Individual Savings Accounts (ISAs), especially popular in the UK, are evaluated based on how and where your money is invested. If the fund includes haram sectors (like alcohol or gambling) or earns interest, it's not Shariah-compliant.

Another important concern is how you invest and how to invest in a halal way. It is recommended that you use an Islamic account, which is developed for being Shariah compliant, for halal investing in major markets like stocks, crypto, Forex, etc. We did some research and gathered key features of the top brokers offering such accounts. You can refer to it below:

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.79 | Open an account Your capital is at risk. |

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | No | Yes | 50 | 200 | No | 1.96 | Study review |

Agreeing to fallback interest and indirect riba funding makes most credit cards haram

When people talk about whether credit cards are halal, they usually focus on whether they pay the bill on time. But the bigger issue is buried in the fine print. If the bank’s contract includes a clause saying they’ll charge interest if you ever miss a payment, even once, that’s already a problem.

According to many scholars, just agreeing to that kind of setup makes the whole deal haram, regardless of how careful you are. That’s why some Muslims lean toward charge cards instead, which force you to pay everything off monthly and don’t have interest baked into the system at all.

Here’s something else that slips under the radar. Every time you use a credit card, the bank earns a cut from the merchant. You’re not paying interest, but the money still flows through a system that often feeds into interest-based loans and financing.

So even if your hands are clean, the profit made from your purchases may not be. That’s why some halal-conscious users prefer credit cards from Islamic banks, where the merchant fees support halal investments like sukuk or profit-sharing ventures. It’s not just about avoiding interest, it's about staying clear of anything that fuels it.

Conclusion

Are credit cards halal? In most conventional forms, they are not, due to the embedded risk and contractual stipulations involving riba (interest). Scholars emphasize that even unused interest clauses can invalidate permissibility under Islamic law.

Only about 12–15% of Muslims globally use fully Shariah-compliant credit cards. With over $46 billion now allocated to consumer Islamic finance, halal alternatives are expanding but remain underutilized. The safest practice is choosing certified Islamic credit cards and maintaining full repayment discipline. For traders and consumers alike, prioritizing contracts vetted by Shariah boards helps mitigate both financial and ethical risk.

Always review terms carefully and consult a qualified scholar or Islamic financial advisor before committing to any credit product.

FAQs

Is it halal to use a credit card for emergencies?

Only if no interest is involved and there's no better halal alternative.

Can Muslims use credit cards with rewards?

Only if the rewards do not derive from interest-based spending and the card itself is halal.

Is credit card halal if no interest is paid?

Even without paying interest, if the contract allows it, the permissibility is disputed.

What is the safest halal alternative to credit cards?

Islamic credit cards or debit/prepaid cards with no interest or haram terms.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

A broker is a legal entity or individual that performs as an intermediary when making trades in the financial markets. Private investors cannot trade without a broker, since only brokers can execute trades on the exchanges.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Trading involves the act of buying and selling financial assets like stocks, currencies, or commodities with the intention of profiting from market price fluctuations. Traders employ various strategies, analysis techniques, and risk management practices to make informed decisions and optimize their chances of success in the financial markets.