What Is Niyyah In Islam: Meaning, Importance, and Its Role In Finance

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

What is niyyah in Islam? Niyyah refers to intention, the personal resolve that gives meaning to every action, whether it's in prayer or finance. A well-known hadith in Sahih Bukhari says, “Actions are judged by intentions.” In Islamic finance, niyyah plays a key role in helping people make choices that follow halal guidelines, like steering clear of interest (riba), gambling (maysir), or risky ambiguity (gharar). More than 70% of Muslim investors say their ethical screening begins with niyyah, influencing how they build their portfolios.

The Arabic word niyyah means “intention” and is central to how Muslims approach worship, values, and even money matters. It shapes how a person evaluates whether their actions are spiritually meaningful and morally sound. For investors and traders alike, carrying niyyah into financial life helps them stay true to their faith while building trust and acting with transparency. In this guide, we explain the concept of niyyah based on the teachings of Islamic finance.

Risk warning: All investments carry risk, including potential capital loss. Economic fluctuations and market changes affect returns, and 40-50% of investors underperform benchmarks. Diversification helps but does not eliminate risks. Invest wisely and consult professional financial advisors.

What does Niyyah mean?

Niyyah in Islam refers to the inner decision or personal intention to carry out an action purely for the sake of Allah. It isn’t spoken out loud but formed quietly in the heart. As mentioned in the well-known hadith found in both Sahih al-Bukhari and Muslim, the Prophet Muhammad said:

“Verily, actions are judged by intentions, and every person will be rewarded according to their intention.”

This hadith shows that the true worth of any act in Islam is not just about how it appears but the sincerity that drives it. For instance, if someone prays just to be seen by others, and not to connect with Allah, the act loses its spiritual value even if performed correctly.

Niyyah meaning in English is often translated as "intention", but within Islamic law and understanding, it holds much more weight. It gives purpose to one’s actions and plays a key role in whether those actions are accepted by Allah. Scholars like Imam al-Ghazali noted that niyyah is the heartbeat of every deed, if it's missing, even required duties may not hold their full reward.

So for those not clear on what niyyah is in Islam, it’s the guiding force that sets apart acts of worship from ordinary habits. It’s what turns sharing a meal into a gesture of love, work into devotion, and charity into lasting reward, all because of the intention behind them.

The power of niyyah lies in how it turns daily routines into meaningful spiritual acts. For example, a Muslim earning a halal income to support their family is not only putting in effort but being rewarded for a noble intention. This reflects how Islam brings spiritual purpose into daily life, touching even work, family, and community.

Scholars also speak of different types of niyyah:

Niyyah in worship (like before praying, fasting, or going for hajj).

Niyyah in daily actions (like eating, working, or marriage), which become virtuous when done with sincere purpose.

Niyyah in financial matters, guiding Muslims to keep transactions fair, honest, and aligned with ethics.

In the end, niyyah is the quiet motivation that makes acts of worship real and helps ordinary actions carry spiritual meaning. It’s that unseen intention that connects every step in life to faith, making sure even the smallest action has a thoughtful, God-conscious goal.

Why is Niyyah important?

Though Niyyah in English translates to "intention," that word barely scratches the surface. Niyyah isn't just a silent thought before prayer; it's a lens through which every act is spiritually filtered. For scholars like Imam al-Ghazali, niyyah determines whether an act is an act of worship or simply routine. For instance, washing hands in the morning is just hygiene, unless it's done with the conscious intention of following the Sunnah, in which case it becomes ibadah.

The real weight of niyyah appears when we talk about compound actions. Say a person gives money to charity. If the intent is to seek praise, then despite the outward goodness, the act may be spiritually void. But if the heart quietly intends only the pleasure of Allah, it could outweigh a thousand such donations. This shows the importance of niyyah in Islam isn't about ticking boxes but anchoring one's soul to sincerity. Scholars even debate whether niyyah transforms neutral acts like sleep or eating into worship when done with the right inner purpose.

So, what does niyyah mean beyond its simple definitions? It’s a declaration of purpose between you and your Creator, with no audience. Early Sufis viewed niyyah as a living state, one that had to be purified continuously, not once. That’s why they focused less on how something looked and more on how it was intended. It’s not about perfection, but clarity. A flawed deed with pure niyyah holds more value than a grand gesture fueled by ego.

How Niyyah shapes ethical behavior

A pure niyyah can turn routine actions into meaningful worship. The Prophet Muhammad said:

“Every deed is rewarded according to the intention behind it.”

(Sahih al-Bukhari, Book of Revelation)

In business, for example:

Signing a halal trade deal with the aim of offering fair value and earning trust shows a sincere intention.

A merchant avoiding riba (interest) because of faith, not just rules, acts with devotion.

An employer who hires to support someone’s livelihood, not just to increase profits, brings a moral dimension to that decision.

But when niyyah is missing, even good-looking actions may lose their deeper value. A trader who donates profits while dealing in haram may not be rewarded, as the source of those profits was impure. This idea emphasizes that niyyah’s meaning in Islam goes beyond appearances; it’s about staying true to spiritual principles.

Application beyond worship

In marriage, intentions shape whether one seeks connection, peace, or just social standing.

In education, learning to help others is more noble than chasing status or salary.

In investing, aiming to grow halal, productive ventures is meaningful, unlike chasing risky profits out of greed.

So, why is niyyah important? Because it shapes every action from the inside. It helps Muslims avoid acting for show, keeps their goals rooted in faith, and makes sure Shariah is not just followed on the surface, but also from within. So even though niyyah’s meaning in English is intention, but in Islam, it’s so much more: it’s the heart of every deed.

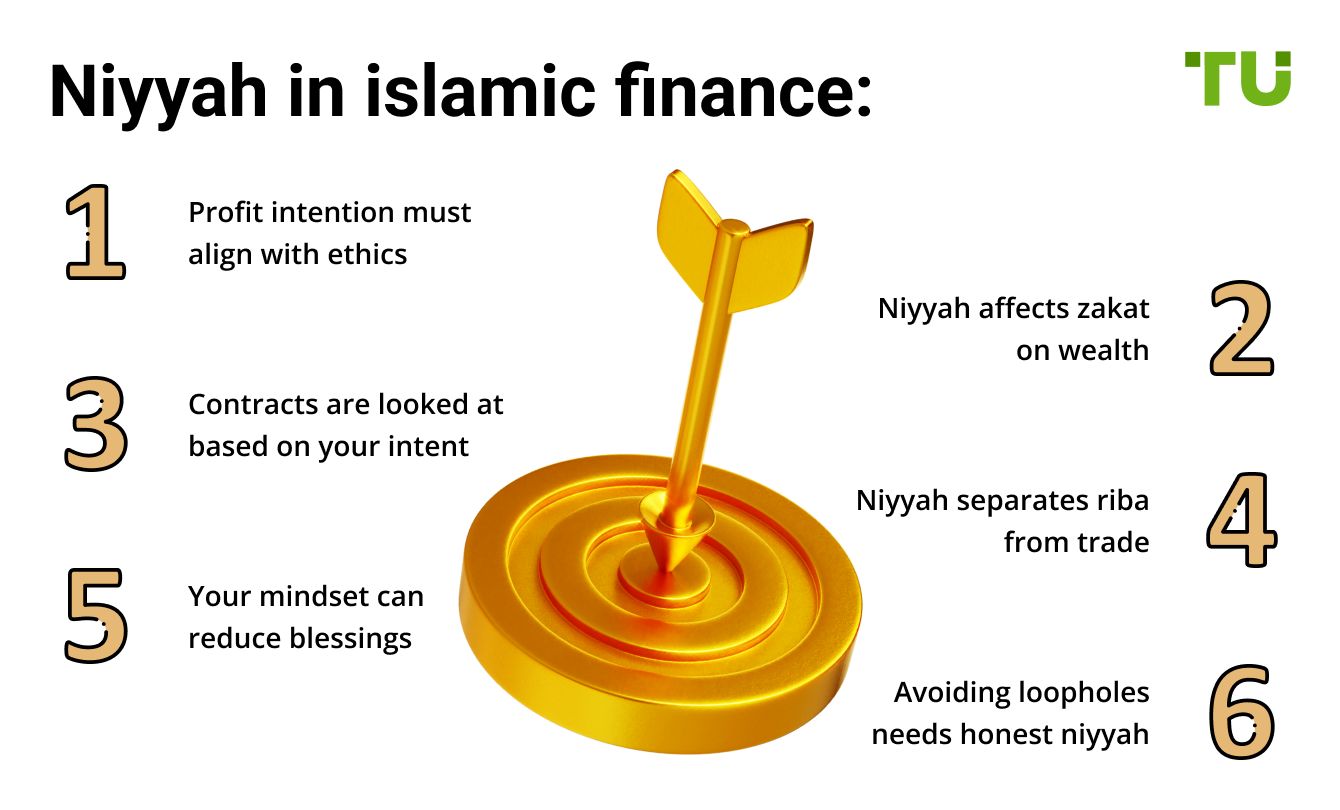

Niyyah in islamic finance

In Islamic finance, niyyah isn’t just about ethics, it shapes whether a transaction is even valid in the eyes of Shariah.

Profit intention must align with ethics. If your goal is only to make money without caring how, you're crossing into risky areas that niyyah is meant to keep you away from.

Niyyah affects zakat on wealth. If you’re saving money with the real purpose of investing in halal projects, it can change how, when, and which type of zakat applies to you.

Contracts are looked at based on your intent. A murabaha deal done just to avoid paying a loan, even if it looks okay on paper, is not accepted by many scholars.

Niyyah separates riba from trade. Some deals may seem fine, but if the goal is to copy how interest deals work, it goes against what Islamic finance is meant for.

Your mindset can reduce blessings. Even if everything checks out legally, not having a sincere intention in Islam for fairness and benefit can lower the spiritual value of your earnings.

Avoiding loopholes needs honest niyyah. Using Islamic rules to do something shady might pass legally, but if your niyyah isn’t right, you still violate the beliefs. This shows the importance of intention in Islam even in business practices.

How traders can apply Niyyah

A trader who starts their day with the intention to earn halal income, avoid harm, and fulfill a religious duty, elevates their entire workflow from mere commerce to spiritual effort. Modern Islamic traders face complex markets and various halal investment options. Still, the principle of niyyah provides a simple yet powerful guide:

| Activity | Aligned Niyyah Example |

|---|---|

| Stock trading | Investing in halal sectors to support ethical businesses |

| Forex trading | Using Islamic accounts to avoid interest-bearing swaps |

| Crypto trading | Choosing tokens with clear utility and halal certification |

While modern Islamic traders have access to a wide range of tools and markets, aligning each action with niyyah helps maintain integrity in decision-making. But intention alone isn’t enough if the structure of the trade involves riba (interest), gharar (excessive uncertainty) or maysir (speculation and gambling). These elements are common in conventional finance, especially in derivatives, margin trading, or high-risk crypto schemes. That’s why applying niyyah must go hand in hand with avoiding contracts or platforms that rely on unclear terms or chance-based gains. You can use brokers that offer Islamic accounts to stay clear of these issues. Some of the top options in the market are presented in the table below:

| Swap Free | Crypto | Stocks | Currency pairs | Min. deposit, $ | Regulation | TU overall score | Open an account | |

|---|---|---|---|---|---|---|---|---|

| Yes | Yes | Yes | 68 | No | FSC (BVI), ASIC, IIROC, FCA, CFTC, NFA | 6.79 | Open an account Your capital is at risk. |

|

| Yes | No | Yes | 50 | 200 | No | 1.95 | Study review | |

| Yes | Yes | Yes | 90 | No | ASIC, FCA, DFSA, BaFin, CMA, SCB, CySec | 7.17 | Open an account Your capital is at risk.

|

|

| Yes | Yes | Yes | 80 | 100 | CIMA, FCA, FSA (Japan), NFA, IIROC, ASIC, CFTC | 6.95 | Study review | |

| Yes | Yes | Yes | 60 | 100 | FCA, CySEC, MAS, ASIC, FMA, FSA (Seychelles) | 6.83 | Open an account Your capital is at risk. |

Institutional and scholarly views

Islamic scholars have long emphasized the importance of niyyah in shaping ethical behavior in economic matters.

Intention is obligatory in both worship and transactions. Imam Nawawi noted that intention is a necessary part of any act that involves worship or legal responsibility.

Ethical depth separates valid contracts from hollow ones. Mufti Taqi Usmani has often explained that the importance of niyyah in Islam is in distinguishing a valid agreement from one that may meet legal standards but lacks ethical substance.

Judges consider intention in Shariah contract disputes. Recent discussions in Islamic finance news reflect how judges in Shariah-based legal systems take intention seriously when evaluating unclear or misleading contracts.

Institutions like Bank Syariah Indonesia (BSI) have adopted training on niyyah as part of their internal ethics programs, encouraging employees to act with sincerity, accountability, and a focus on mutual benefit.

Verified data and market findings (2024–2025)

A 2024 study on sukuk investment in Bangladesh found that 73% of surveyed investors cited "religious intent" as a major factor behind their portfolio choices.

In Indonesia, financial regulators and Islamic banks are now including "collective niyyah declarations" during product launches to align shareholder and client values.

Based on research from Reflexivity and iConsult, over 60% of Muslim Gen Z investors now include “intention filtering” in their due diligence, particularly for DeFi and crypto assets.

Use niyyah to purify profit goals and prevent moral loopholes in Islamic finance

In Islamic finance, niyyah goes beyond being a personal mindset, it can shape the way a business deal is formed. While many think it’s enough for a deal to follow Shariah rules on paper, the deeper question is why the deal is being made. If someone’s intention is to squeeze out short-term gains while avoiding real risk or social responsibility, that deal might be legal but spiritually empty. Bringing niyyah into your financial choices means checking your real goals, and whether they align with ethical, long-term benefit.

Here’s something most newcomers miss: experienced investors in Islamic finance often take a moment before closing a deal to reflect on their intention. They might write it down, talk it out, or simply ask themselves whether the outcome benefits more than just their wallet. Doing this helps them stay honest, build trust with Shariah advisors, and avoid deals that feel right but don't sit right. Starting this habit early sets you apart, not just as a good investor, but as someone others want to work with.

Conclusion

Niyyah is not only the gateway to religious acts, it is a cornerstone of ethical finance. For traders and investors operating under Shariah principles, maintaining the right niyyah ensures that every action is both profitable and spiritually fulfilling.

Whether entering a stock trade, launching a fintech product, or drafting a financing agreement, the question remains: What is your intention? In Islam, that single answer defines not just success in this life, but in the Hereafter.

FAQs

Can a Muslim trader set niyyah before every transaction?

Yes, setting niyyah before financial transactions helps align decisions with Islamic ethics and ensures the trade is halal in both intent and action.

Does niyyah affect the permissibility of crypto investments?

Yes, niyyah influences the selection of crypto projects. Traders with proper niyyah avoid interest-based and speculative tokens.

How does niyyah help in avoiding gharar in contracts?

Niyyah ensures clarity and sincerity in contract formation, which helps reduce uncertainty and deception (gharar) in Islamic financial agreements.

Can niyyah impact investor risk strategy in Islamic finance?

Yes, investors who set a niyyah to avoid harm often choose risk-sharing models like mudarabah or sukuk over high-risk speculation.

Related Articles

Team that worked on the article

Alamin Morshed is a contributor at Traders Union. He specializes in writing articles for businesses that want to improve their Google search rankings to compete with their competition. With expertise in search engine optimization (SEO) and content marketing, he ensures his work is both informative and impactful.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Cryptocurrency is a type of digital or virtual currency that relies on cryptography for security. Unlike traditional currencies issued by governments (fiat currencies), cryptocurrencies operate on decentralized networks, typically based on blockchain technology.

Forex trading, short for foreign exchange trading, is the practice of buying and selling currencies in the global foreign exchange market with the aim of profiting from fluctuations in exchange rates. Traders speculate on whether one currency will rise or fall in value relative to another currency and make trading decisions accordingly. However, beware that trading carries risks, and you can lose your whole capital.

An investor is an individual, who invests money in an asset with the expectation that its value would appreciate in the future. The asset can be anything, including a bond, debenture, mutual fund, equity, gold, silver, exchange-traded funds (ETFs), and real-estate property.

Crypto trading involves the buying and selling of cryptocurrencies, such as Bitcoin, Ethereum, or other digital assets, with the aim of making a profit from price fluctuations.

Index in trading is the measure of the performance of a group of stocks, which can include the assets and securities in it.