Bitcoin annual growth (CAGR) drops to record low 8%

Ethereum-to-Bitcoin (ETH/BTC) ratio has fallen to 0.022

Ethereum-to-Bitcoin (ETH/BTC) ratio has fallen to 0.022

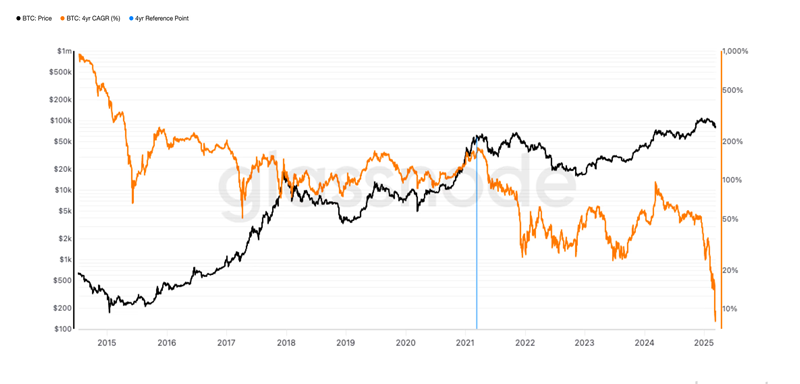

Bitcoin’s four-year compounded annual growth rate (CAGR) has fallen to a record low of 8%, according to Glassnode data, marking a significant shift in the asset’s performance as it matures.

The four-year period, chosen to align with Bitcoin’s halving cycle and typical bull/bear market fluctuations, highlights the diminishing volatility and returns of the cryptocurrenc, СoinDesk reported.

In March 2021, Bitcoin traded around $60,000, near the peak of the previous market cycle—a stark contrast to current growth dynamics.

Key takeaways

- Record low growth: Bitcoin’s four-year CAGR has dropped to 8%, its lowest since detailed tracking began.

- Market cycle alignment: The measurement period mirrors Bitcoin’s halving cycle, emphasizing long-term market trends.

- Investor caution: With returns diminishing as the asset matures, traders must adjust expectations in a less volatile environment.

Declining growth amid maturing market

Glassnode informs that Bitcoin continues to experience persistent selling pressure and exhibits increased volatility. Weak demand and liquidity constraints increase downside risks.

Loading...

According to Glassnode, Bitcoin's (BTC) four-year compounded growth has decreased to an all-time low of 8%.

BTC 4yr Compound Annual Growth Rate. Source: Glassnode.

The decline in Bitcoin’s growth rate reflects a broader trend of market maturation. As the cryptocurrency becomes more established, its dramatic price swings and explosive gains—common in its early years—are giving way to a more stable, albeit slower, growth trajectory. This evolution is expected as the market normalizes; the high volatility of past cycles has been tempered by increased institutional participation and improved liquidity.

In addition to Bitcoin’s performance, the Ethereum-to-Bitcoin (ETH/BTC) ratio has fallen to 0.022, the lowest level since 2020, while Ethereum’s own CAGR has entered negative territory at 6%.

These indicators suggest that while Bitcoin’s performance is stabilizing, other cryptocurrencies, notably Ethereum, are struggling to keep pace, possibly due to stagnant price levels below $2,000.

Prospects for cryptoassets

Market analysts warn that while the lower CAGR may signal a maturing market, it could also temper investor enthusiasm in the short term.

However, if Bitcoin can maintain its dominant position amid regulatory clarity and evolving market dynamics, its stability may attract a different class of investors seeking reduced volatility.

Read also: Bitcoin news about 4-month low imminent as panic-selling escalates.