MicroStrategy chief suggests a complete shift in attitude toward Bitcoin investments

MicroStrategy chief suggests a complete shift in attitude toward Bitcoin investments

MicroStrategy chief suggests a complete shift in attitude toward Bitcoin investments

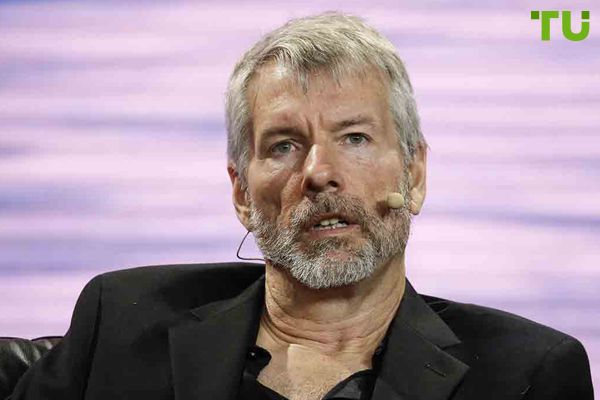

Michael Saylor, chairman of MicroStrategy, which has the majority of its assets invested in Bitcoin, believes that a different attitude toward mainstream cryptocurrency needs to be shaped.

Michael Saylor is skeptical of Bitcoin's function as a means of payment but sees it as a profitable investment.

He said that Bitcoin should not be treated as a currency but as a "billion-dollar building in cyberspace" that will last for a hundred years.

Saylor told CNBC that he has observed a fundamental misunderstanding due to the perception of Bitcoin as a currency, with the best use of Bitcoin being its ability to store capital for hundreds of years.

"It's wrong to think of Bitcoin as a currency; I would suggest treating it as a billion-dollar property right in cyberspace," Saylor said.

Michael Saylor doesn't believe in Bitcoin's function as a means of payment: "It's not like people are trying to buy a cup of coffee for part of their building on Fifth Avenue. Although all the rich people I know own real estate in London or New York, none of them use their buildings as a medium of exchange."

The MicroStrategy executive raised many controversial questions about cryptocurrencies related to their use as a means of payment. He believes that the US, China, and other countries are more likely to accept cryptocurrency if it is viewed as a digital asset.

"As a medium of exchange, Bitcoin is only worth $1 trillion, but as a means of storing assets, it's worth $100 trillion," Saylor said. According to him, Bitcoin as an asset for capital storage has a much higher price ceiling.

Interestingly, BlackRock CEO Larry Fink has previously said the same thing about Bitcoin. He believes that it is better used as a form of wealth storage than as an alternative to traditional currencies.

Commenting on the launch of spot Bitcoin ETFs, Saylor said that Bitcoin will simply overtake gold because it has all of its characteristics but is spared its drawbacks. "It outperforms other investments like gold, stocks, or real estate because it is digital, accessible, global, ethical, and useful to millions of businesses and billions of people," he said.

Loading...

"Bitcoin is the most recognized and trusted asset to invest in. It is the king of all commodities because there is no issuer that controls it."

Saylor also revealed that he didn't express any doubts or concerns when the price of Bitcoin dropped to $20,000 because he has complete confidence in the asset. "It's the greatest asset; there's no second best, so I didn't have any questions about it. We're just waiting for the rest of the world to realize how good it is."